Issue Summary: This week we share top predictions for crypto in 2022 and cover the top news and reports of the week in the digital asset market.

In This Week’s Issue:

2022 Predictions for Crypto By Nick Sullivan of HeartRithm

Our Sponsors: FTX, HeartRithm, Celo, and Hive Digital

This Week in Crypto by Mike Gavela

🗞️ Top Weekly News

💵 Weekly Fundraises

📊 Key Stats

📝 Report Highlights

🎧 Best Crypto Podcasts

📈 Top 10 Performers

👀 NFTs of the Week: $2 NFT LuvMonsters 👀

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

2022 Predictions for Crypto

By Nick Sullivan, CEO of HeartRithm, a crypto quant fund focusing on DeFi yield farming, margin lending, and algorithmic trading — with a big social impact mission.

It’s a brand new year in the world of digital assets. Here are my top crypto predictions for 2022.

DeFi Passes $1T TVL: The TVL (Total Value Locked) in DeFi will exceed $1 trillion dollars, up from $250B today, as we participate in the largest transfer of wealth in the history of humanity - money moving from traditional finance to decentralized finance.

BTC Becomes Less Dominant: Bitcoin dominance will fall below 20% (it already fell from 72% to 40% in 2021). The question is no longer Bitcoin or Ethereum, but Bitcoin vs multiple other chains. Chain bridges and adapters will be the coolest blockchain advancement technology of 2022, enabling seamless collaboration between chains.

Web 3 is Largest VC Investment Sector: The largest sector of venture capital funding in 2022 will be Web3 (which is the fancy name for blockchain meets web).

Crypto Hedge Fund Growth: Our company HeartRithm will become one of the top 10 crypto quant funds by AUM in the world, with its social impact mission attracting top talent and aligned capital, with returns on track to generate millions of dollars a year towards social impact philanthropic projects.

Eth2 Issues: Ethereum 2.0 will roll out, but with some major hiccups. It turns out it’s pretty hard to swap out the engines on a moving plane. Ethereum holds its spot as the healthiest developer community in crypto, and ETH compatible chains still dominate DeFi.

NFTs for Gaming and VR: NFTs will have lost their euphoric luster with the use case of unique images/media, but have found their real use cases beyond pixel scarcity. My picks include…

Gaming - a major gaming studio will put gameplay assets on the blockchain and we will see gaming millionaires like we see twitch streamer millionaires today.

Virtual Reality meets NFTs for online galleries to display assets (hat tip to Will O'Brien and nftoasis.co — although he might be on my 2023-2025 lists)

The Tokenization of Everything: The excitement NFTs created has kicked off the movement that I’ve been calling “tokenize all-the-things” (TATT), where we are starting to re-imagine the world when all assets (including mortgages, stocks, IRAs, art, bank account balances, future earnings, etc.) are all tradable, lendable, and collateralized on the blockchain. This new liquidity around assets is democratizing finance and chipping away at the socio-economic inequality problem. We are not there yet, as it is a multi-decade vision — however, multiple startups have been funded in this TATT ecosystem, but face serious headwinds from TradFi and government incumbents.

DAOs Break Through: DAOs, or Decentralized Autonomous Organizations, will re-imagine what it looks like to manage projects. Instead of corporate governance, we will see breakthrough platforms for *community* governance, and we will see a major organization become a legally recognized DAO. BurningMan.org?

More Hacks: Over $1B will be lost in smart contract hacks/exploits/rug pulls in 2022, triggering talks in US congress for more regulation. Nothing will actually happen, because regulatory bodies can’t keep up with the speed of innovation.

No Crypto Winter: Going against the grain: There will be no crypto winter in 2022. I know a lot of people, like myself, who survived the crypto winters of 2014 and 2018. People like to see patterns, even when they don’t exist. This false pattern matching and paranoia has led to lots of predictions of a 2022 crypto winter. I don’t buy it. Crypto is different now than it was 4 and 8 years ago, and crypto is anything but predictable. Crypto has so much more institutional capital than it did four years ago - they are viewing Bitcoin as digital gold, and these institutions are hungry to buy the dips.

An Algo Stablecoin Winner: And finally, someone will have figured out how to do an algorithmic stablecoin right. It keeps its peg reliably, without being asset-backed by a fiat currency. It earns interest for holders. It’s outside the purview of US regulatory bodies. It works as a store of value and a medium of exchange - an honest digital currency run by the internet.

These predictions are of course not financial advice, but hopefully they will help as a guide as you explore your 2022 crypto strategy.

I'd be happy if half of these come true. Let’s have a great 2022!

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

HeartRithm is a crypto quant fund that invests in DeFi, margin lending, and algorithmic trading to generate monthly yield for institutional allocators and qualified clients in a market-neutral manner, without a single down month for their strategies since starting in 2017. They also have a major social impact mission and are building a regenerative engine for funding philanthropic efforts. Learn more at www.heartrithm.com.

Celo, the mobile-first blockchain that makes financial tools accessible to anyone with a mobile phone number, is a proud sponsor of Coinstack. Connect, transact, and store your crypto assets on the Celo blockchain using only an SMS interface. Learn more about Celo at www.celo.org.

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies to drive organic and paid traffic. If you want to expand your presence and leads from Google and Facebook, hire Hive Digital at www.hivedigital.com.

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week...

⚡ Aave's Newest Market: Real-World Assets - Aave users can now earn yield by helping small businesses tap liquidity from the frothy crypto markets thanks to a new partnership with Centrifuge. (Source)

😮 Thailand’s Central Bank Reschedules CBDC Pilot Project to Late 2022 - Thailand has rescheduled the trial date for its national digital currency from Q2 2022 to a later date. (Source)

🏧 ProShares Files for Metaverse ETF - ETF will track the Solactive Metaverse Theme Index (SOMETAV) and hold Apple, Meta, Unity and Nvidia as its heaviest weightings. (Source)

💰 Mexico Confirms Plans To Roll Out CBDCs in 2024 - The plans for a CBDC follow the recent statement by Mexico's President Andrés Manuel López Obrador that Mexico is unlikely to follow El Salvador's footsteps and use cryptocurrencies like Bitcoin (BTC) as legal currency, at least not yet. (Source)

🤑 Shanghai Doubles Down on the Metaverse by Including It in Development Plan - A Shanghai city department released Thursday its five-year development plan, which included encouraging metaverse use in public services, business offices, and other areas. (Source)

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Over 90% of NFT Volume Was Settled on Ethereum in 2021

2. Cardano Showed the Most Developer Activity on GitHub in 2021

3. Fantom’s Price Surged +115% in Just Under Two Weeks, While Fantom’s Active Addresses Have Spiked to Levels Not Seen Since Late November

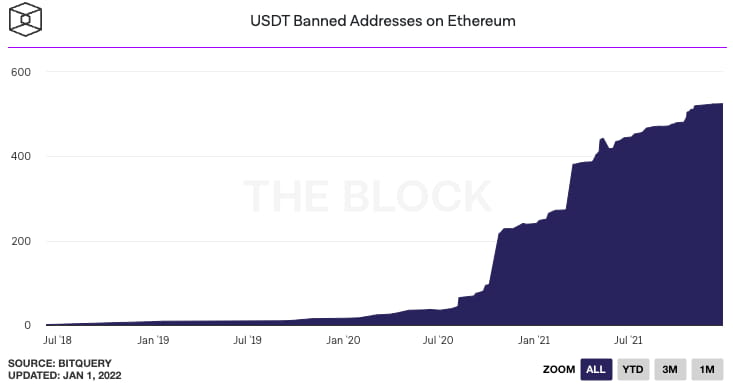

4. Stablecoin issuer Tether froze over $1 million worth of USDT last week

5. Bored Ape Yacht Club Crosses $1 Billion in Total Sales in Less Than a Year

📝 Highlights From Crypto Reports

Here are the top highlights from the best crypto research reports this week…

The Chainalysis 2021 NFT Market Report

Chainalysis provides blockchain data, software, services, and research to government agencies, exchanges, financial institutions, and insurance and cybersecurity companies in over 60 countries. This week, we review Chainalysis’s latest report on the NFT market based on their on-chain research and analysis.

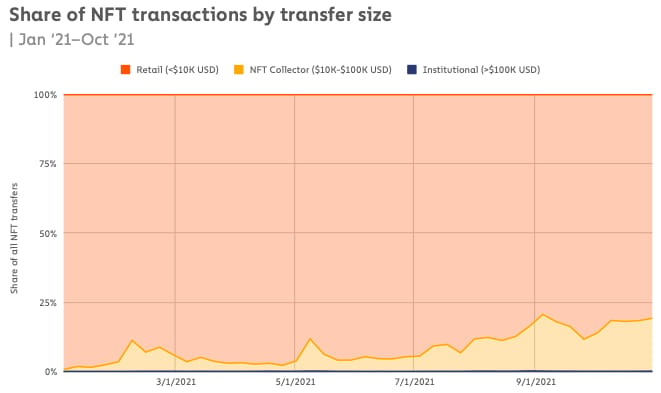

1. The Vast Majority of NFT Transactions Are at the Retail Level (<$10K USD)

"However, as we see above, larger NFT transactions are becoming more and more common. As of the week of October 31, 2021, NFT collector-sized transactions, meaning those between $10,000 and $100,000 worth of cryptocurrency, have risen to account for 19% of all NFT transactions, compared to just 6% at the beginning of March. With an average number of just under 500 per week, institutional-sized transactions account for well under 1% of all transfers."

2. OpenSea Data Shows That Users Who Flip NFTs Make a Profit on 65.1% of Resales

“Flipping NFTs with a prior sales history, on the other hand, has a much higher success rate than reselling NFTs bought during minting. NFT flipping activity is quite concentrated. Over 2,000 individual NFT collections on OpenSea have had a secondary sale, but just 250 collections account for 80% of those secondary sales.”

3. The Top 5% of NFT Flippers on Average Pay 2.2 ETH for the NFTs They Later Resell, More Than Double the Average Purchase Price

"Overall though, the data shows that deploying capital isn’t enough on its own to be a successful NFT investor. While high purchase prices appear to correlate with success for the top NFT collectors, this strategy is catastrophic for the least successful collectors in Group 5, whose losses are compounded by the fact that they’re spending large amounts on their initial purchases. Group 1 appears to use better judgment on where to deploy capital and more consistently spots NFTs that will rise in value."

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap. Some of our favorites like ATOM, FTM, and YFI had an especially great week.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Near, Fantom, and Harmony are L1s, Curve is an exchange liquidity pool.

🎨 NFTs of the Week: $2 LuvMonster NFTs

In our last issue, Mrs. Bubble launched the Happy Dragon LuvMonster NFT on OpenSea. It sold out 10 copies within three hours. Its trading price then went from 0.005 ETH (~$2) to 0.05 ETH (~$200) in the aftermarket. That’s NFTs these days!

We’re keeping the initial prices low to build community and to allow for price appreciation in the resale market for collectors.Coinstack has partnered with NFT artist Mrs. Luv Bubble on her new collection of LuvMonsters. Our goal is to build LuvMonsters into a major new crypto NFT collectible in 2022, and then build a line of stuffed animals based on them (think Beenie Babies for the NFT generation)…

🐵 Two New LuvMonster NFTs - $2 Each

This week we’re dropping two new LuvMonster NFTs that you can collect for $2 each…

Yep, Mrs Luv Bubble is keeping the ridiculously low price of just $2 each for the first 10 owners in order to build community, so get them as soon as you can. She’s having a joy sale!

These beauties are minted on Polygon on OpenSea, making them gas-free for you.

We’re following the same initial strategy as Beeple — sell them initially at a low cost for the first couple months to build community and supporters, and then increase the price over time as our base of raving fans expands.

Here there are… you can get them now on OpenSea using your Metamask wallet for just 0.0005 ETH (~$2)…

Our 41st LuvMonster - Mickipoo is 33% Bee, 33% Poodle and 33% Cat in the hat. His dad was very old but very cool, with his green eggs and ham and adventures teaching Mickipoo the power of rhyme and story. While his mamma was part Bee and Poodle, she had infinite unique dance moves and the sweetest dance moves. You can find him prancing down streets and while rhyming his favorite love stories into being. Also single ladies, so if anyone is looking he can be found on Poddletinder for dates! You can buy him now on OpenSea for just $2 to add to or start your NFT collection.

🎨 NFT Magic: LuvMonsters by Mrs. Bubble

Artist statement by Mrs. Bubble, creator of LuvMonsters…

We are pumped to be creating a magical world of LuvMonsters whom are all unique expressions of creation and live in a mystical, magical vibrational world where they navigate life based on their feelings!

This our first project, a gift to the crypto community, who has family, or loves to be happy, or loves to find cool things to invest in, and are starting to believe in a better world... A world that is prosperous for all, a world that is happy, connected and free to be themselves while being supported by the love of community, family and friends.

Yes, art plays a unique role in our lives to give us hope, new image of what life could be, a reflection of our inner ideal or challenge. We hope to create something iconic in your life that plays that simple and playful roll to remind you that a magical world, a beautiful unique world that is thriving is possible. Remember, a glimmer of hope is really all we need to get the momentum going.

- Mrs. Luv Bubble, your favorite NFT artist

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 14,413 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, DOT, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/luvmonsters

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.