Learn More at www.rootstock.io and www.crowdcreate.us

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 315k weekly subscribers. This week an AWS outage took out major exchanges, spot BTC ETFs saw six days of outflows, the SEC dropped claims against Helium, and Meanwhile ($40M), a Bitcoin life insurance fund raised a big venture round.

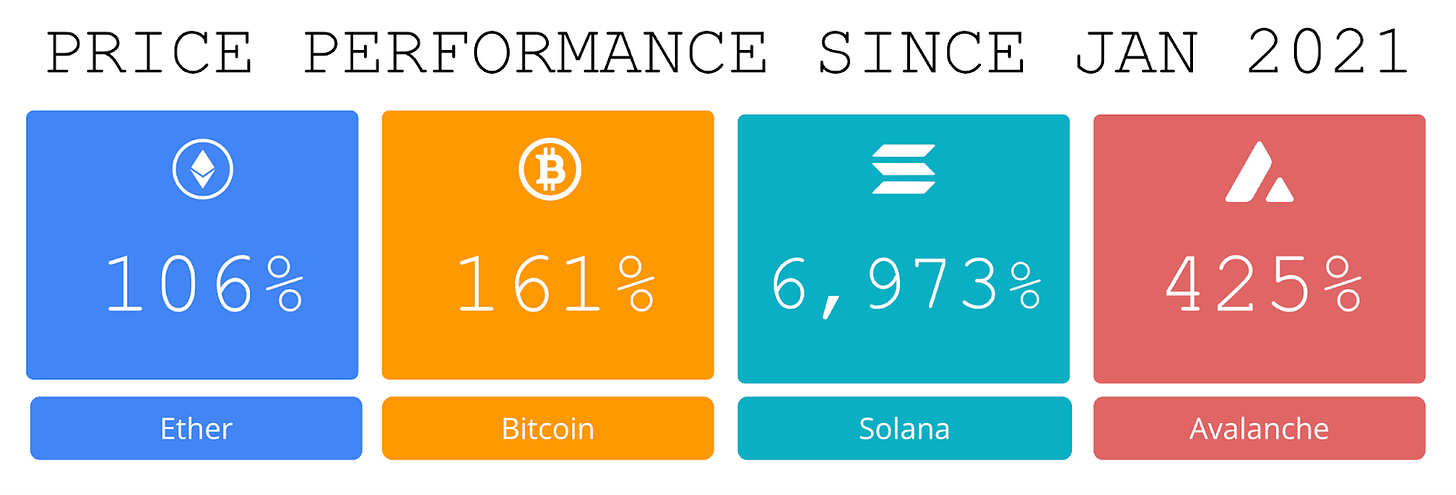

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2025 Coinstack Sponsors…

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 60%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Looking to scale your brand and drive real engagement? Crowdcreate is a top-rated marketing agency specializing in marketing strategy, influencer marketing, PR, outreach, crowdfunding, social media management, and investor marketing. With 700+ successful projects—including Sandbox, KuCoin, BitMex, and Star Atlas—we’ve helped raise over $250 million and supported startups and Fortune 500 companies with data-driven strategies. Learn more: crowdcreate.us

Become a Coinstack Sponsor

To reach our weekly audience of 315,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.a C

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

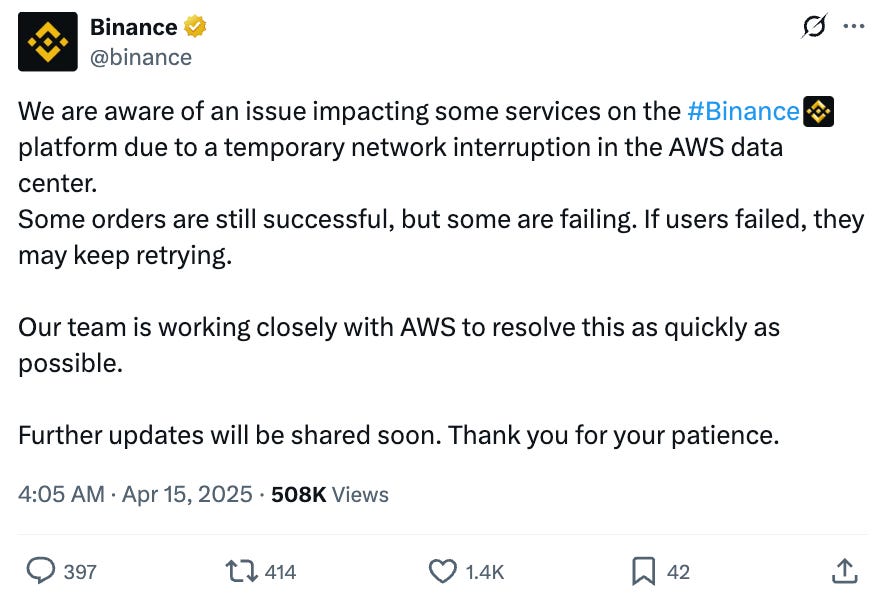

🌐 Binance, KuCoin, and Other Crypto Firms Hit by Amazon Web Service Issue: Binance and KuCoin temporarily suspended withdrawals due to issues with their data center provider, Amazon Web Services (AWS).

📉 Spot bitcoin ETFs see sixth straight day of outflows as tariff tensions fuel flight to safe havens: Spot bitcoin exchange-traded funds in the U.S. saw their sixth consecutive day of total net outflows on Thursday, as investors moved away from risk assets amid ongoing tariff tensions.

⚖️ SEC drops unregistered securities claims against Nova Labs, Helium says: Nova Labs, the creator of the Helium Network, said the U.S. Securities and Exchange Commission has dropped its claims that the firm sold unregistered securities.

🚀 Kraken unveils phased rollout for US stocks and ETF trading, shares plans for UK and European expansion: San Francisco-based crypto exchange Kraken has added U.S. equities trading to its mobile and web platforms in a step forward for its offerings. The move will allow U.S. customers to manage crypto, stocks and Wall Street funds from a single account, similar to brokerages like Robinhood.

⚖️ OpenSea Asks SEC for Clarity on NFT Marketplace Rules: NFT marketplace OpenSea is asking U.S. regulators to clarify that it and platforms like it should not be treated as securities exchanges or brokers. The request comes just months after the Securities and Exchange Commission (SEC) dropped a probe into the company’s alleged violation of federal securities laws.

💬 Tweet of the Week

Source: @rushimanche

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

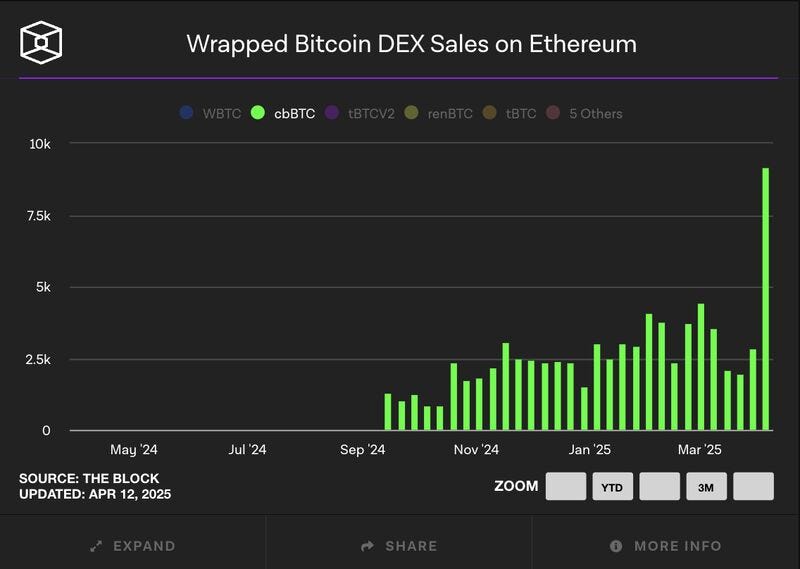

1. Interestingly Coinbase cbBTC experienced its highest weekly DEX volume ever, with over $780M in total volume this week (up 222% week-over-week).

Source: @DavidShuttleworth

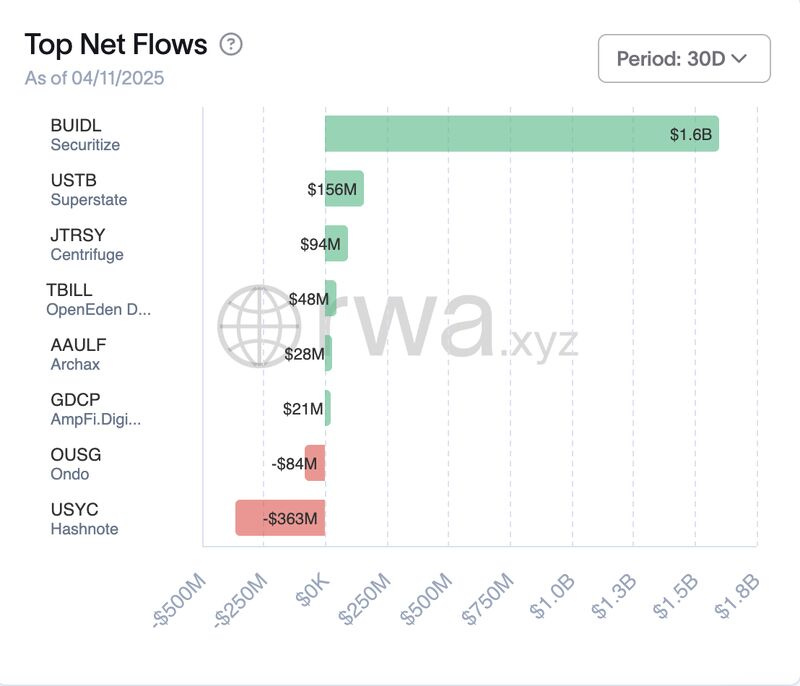

2. Markets are down, but RWAs are up. Inflows over the past 30 days:

BlackRock Securitize BUIDL: $1.6B (up 189%)

Superstate: $156M (up 28%)

Centrifuge: $94M (up 290%)

BlackRock's BUIDL now represents 41% of the entire onchain U.S. Treasuries market with $2.32B AUM, followed by Ondo (17%) and Franklin Templeton (12%).

Source: @DavidShuttleworth

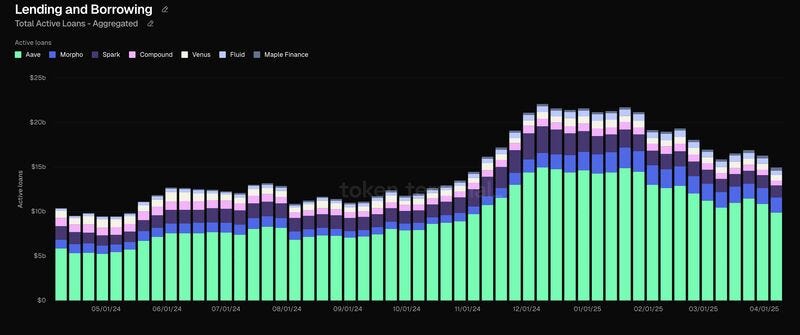

3. The state of the current lending and borrowing market:

🏦 major lending protocols including Aave, Morpho, and Compoud currently service $15B in loans throughout the space

💳 aggregate active loans are down 29% YTD, but are still up 11% from their pre-election levels in November

💵 $38.4B of aggregate liquidity available, up 11% since November, representing a 39% utilization rate.

Source: @DavidShuttleworth

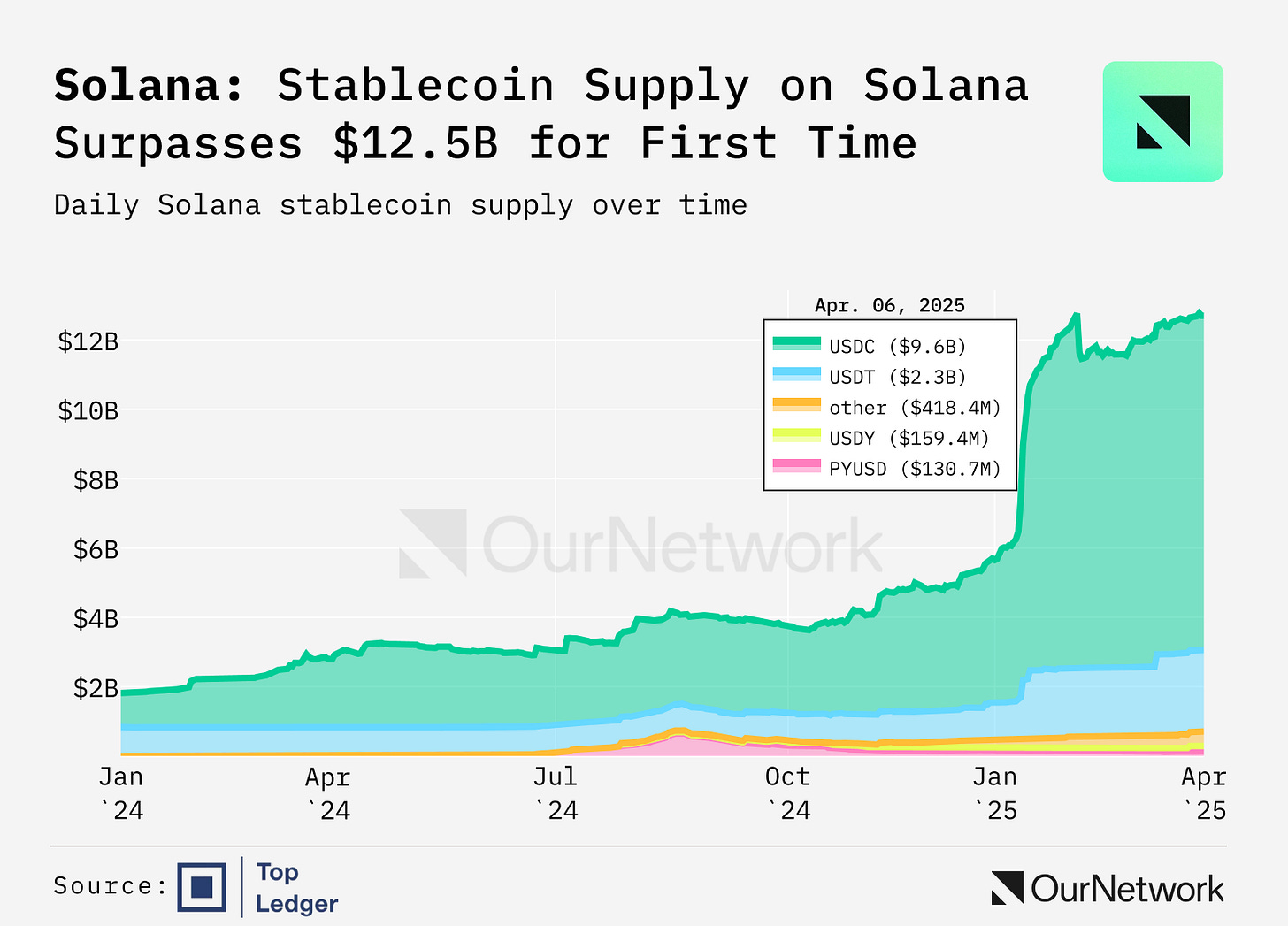

4. USDC on Solana Did More Than $150B USD in DEX Volumes in January 2025

Source: @OurNetwork

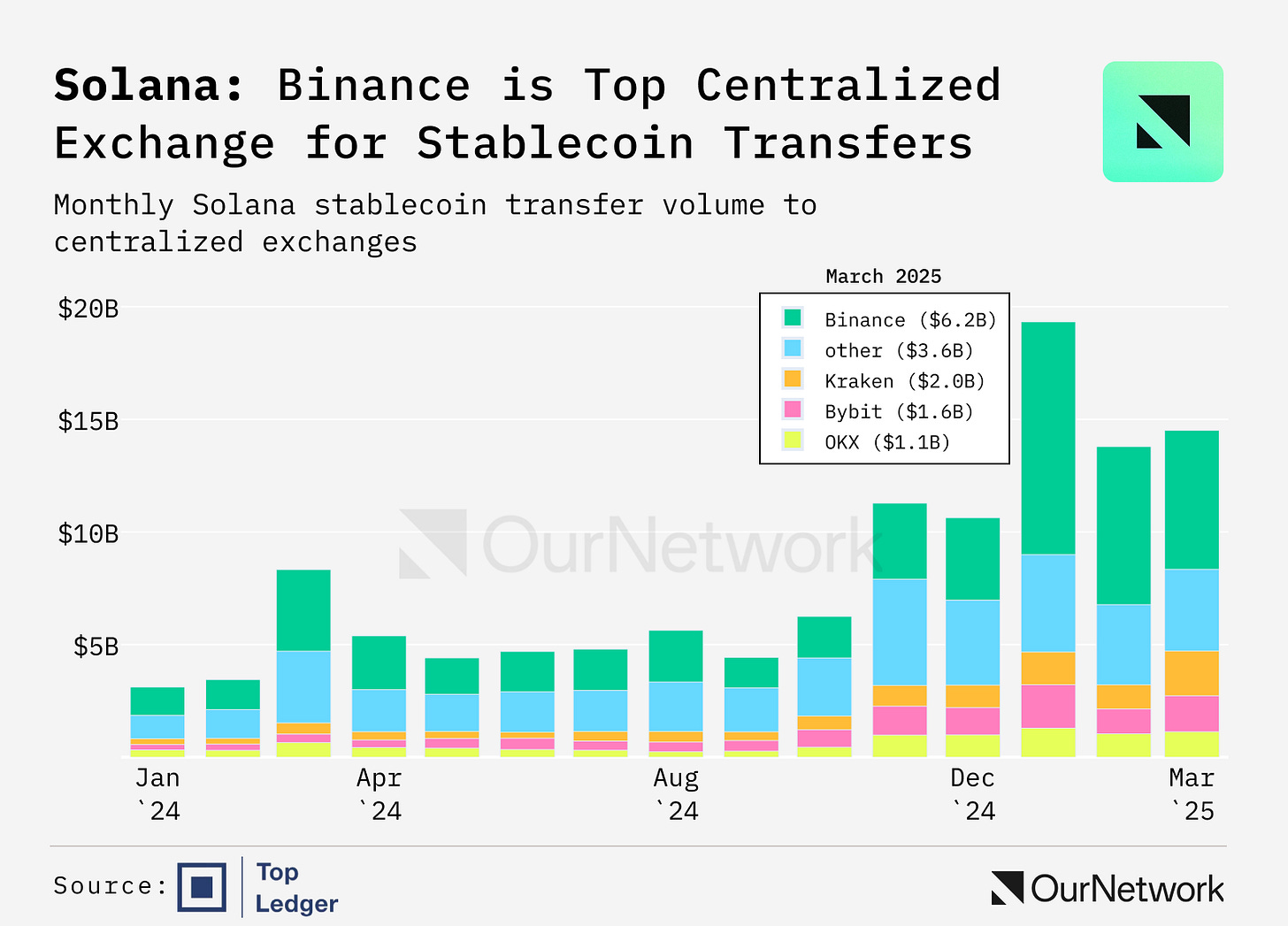

5. Transferring to centralized exchanges (CEXs) is generally considered a predicate to trading activity which then translates to price volatility. Transfers from CEXs are generally considered an activity to park a given token which translates to reduced trade and thereby volatility. For Solana, Binance is the CEX of choice for stablecoin transfers.

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Digital assets have not been immune to the fear gripping global markets as the U.S. proposed tariffs last week — the overall crypto market cap is down 6.3% in the past week, according to CoinGecko. Many individual tokens are down double digit percentage points in that time frame.

Despite this, overall usage remains solid, according to the analysis below from OurNetwork contributors, Peter, the Top Ledger team, and Yasmin. As traders and investors grapple with shifting economic conditions, let's dig into the onchain latest for four of crypto's most impactful Layer 1s.

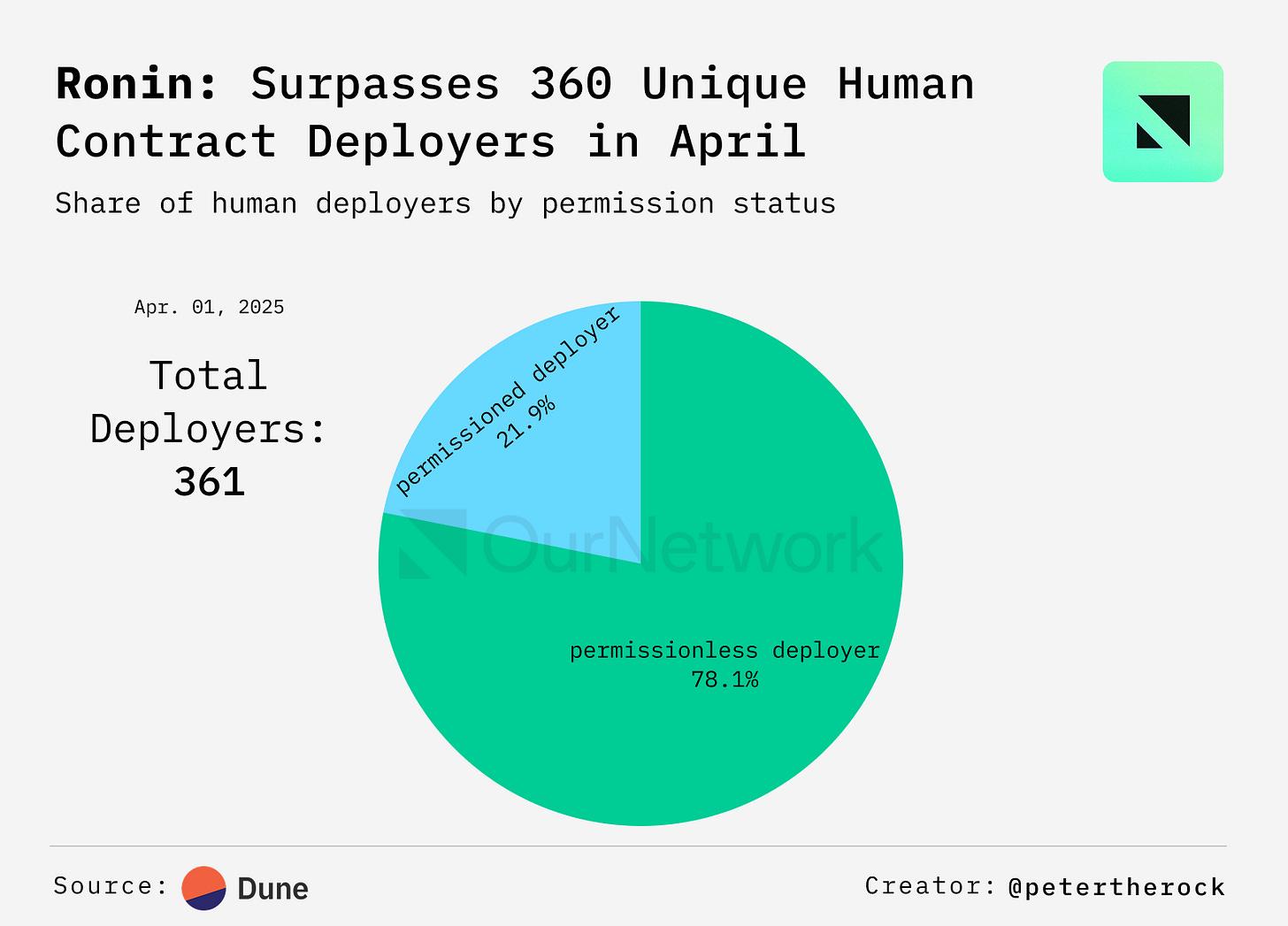

📈 Ronin Goes Permissionless in February and Has 1,733 Contracts Deployed by 275 Devs So Far

In February 2025, Ronin — a gaming-focused blockchain — went permissionless, enabling developers to deploy games, DeFi protocols, and other dapps without needing approval from the Sky Mavis team, the blockchain's original creators. In just 1.5 months, contract deployments surged by 77%, developer participation grew by 29%, and the rate of new developers joining rose by 64%. This momentum led to 1,733 contracts deployed by 275 developers — and more importantly, a broader range of consumer apps for Ronin’s ~500k daily users beyond games.

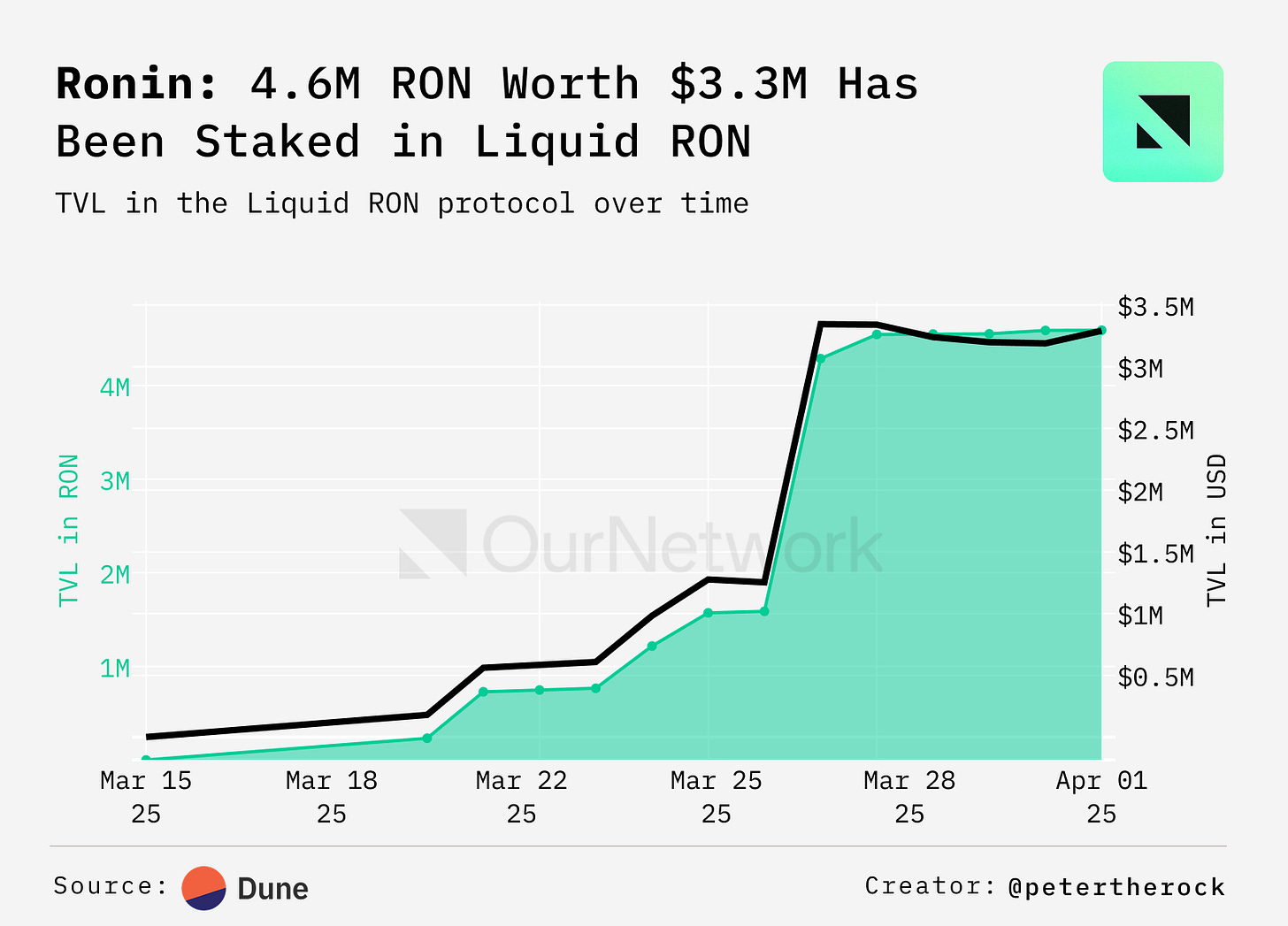

Liquid RON (LRON) is a tokenized version of staked RON, unlocking further use cases for staked RON like DeFi apps. So far, 1,164 users have staked 4.59M RON, worth roughly $3.3M at the time of writing. Of those stakers, 40% fully converted to LRON, 10% are first-time stakers, and 50% hold a mix of staked RON and LRON.

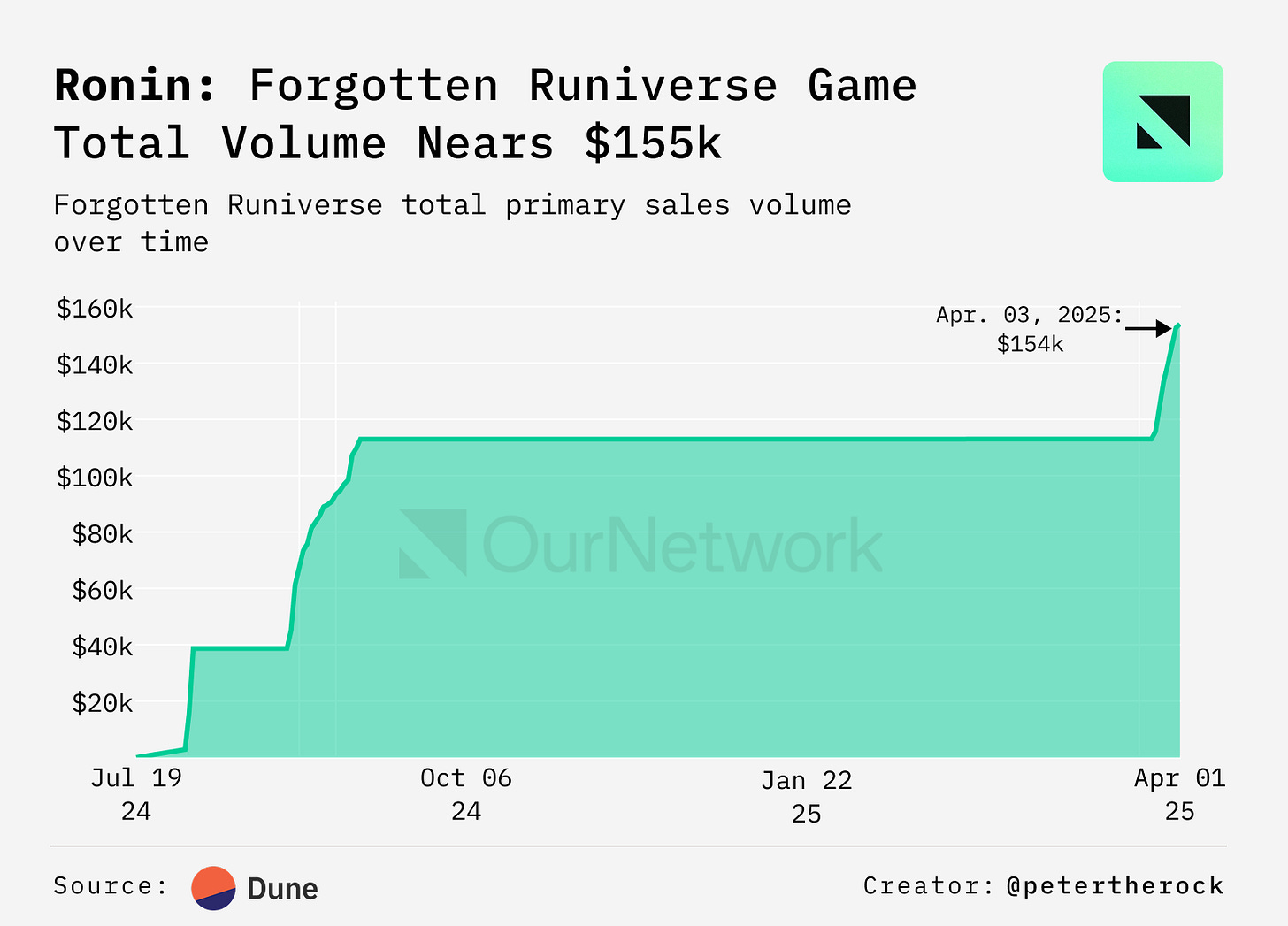

Forgotten Runiverse is a pixel-art fantasy game with a vast open world, player-driven economy, and engaging gameplay. It has generated over $153k in primary sales through events and package purchases, and players have spent 55.85k RON on secondary market items.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.rootstock.io and www.crowdcreate.us