Learn More at www.hypelab.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k+ weekly subscribers. This week Coinbase's Base Layer 2 shattered transaction records, a US lawmaker proposed joint CFTC-SEC committee, the SEC ‘regretted confusion’ it may have invited, and big new venture rounds came in for Permissionless Labs ($10M) and LogX ($10.1M).

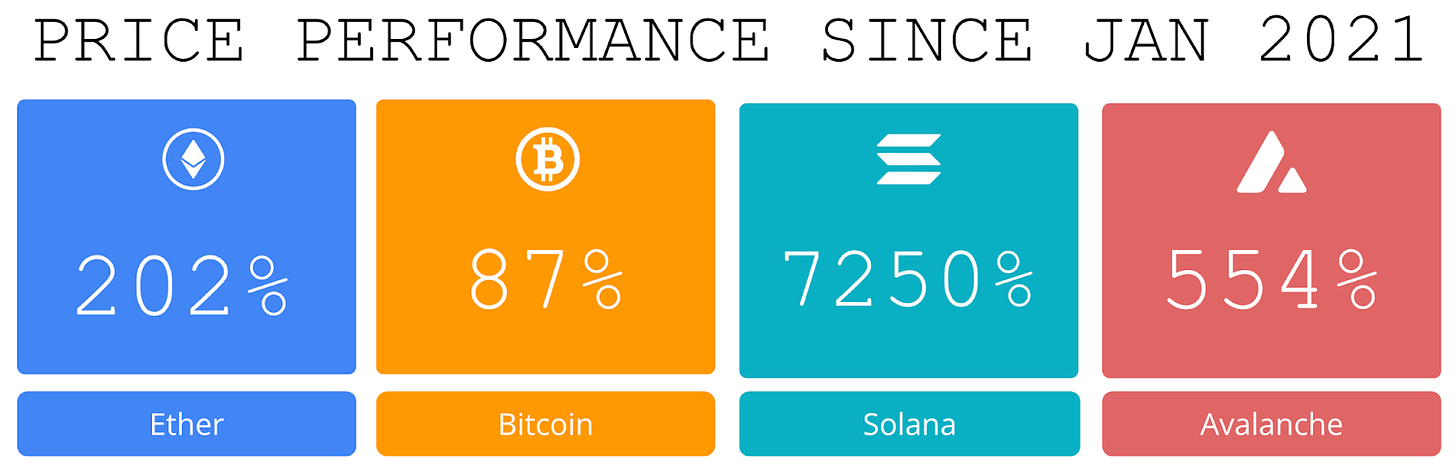

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

HypeLab is the premier web3 advertising network, building ‘Google ads for web3’. With HypeLab, you run ads to real crypto users on high-quality publishers like Chainlist, Coingecko, Quickswap, and hundreds more. Advertisers like Metamask, Uniswap, and Paypal use HypeLab to super-charge their web3 growth.

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

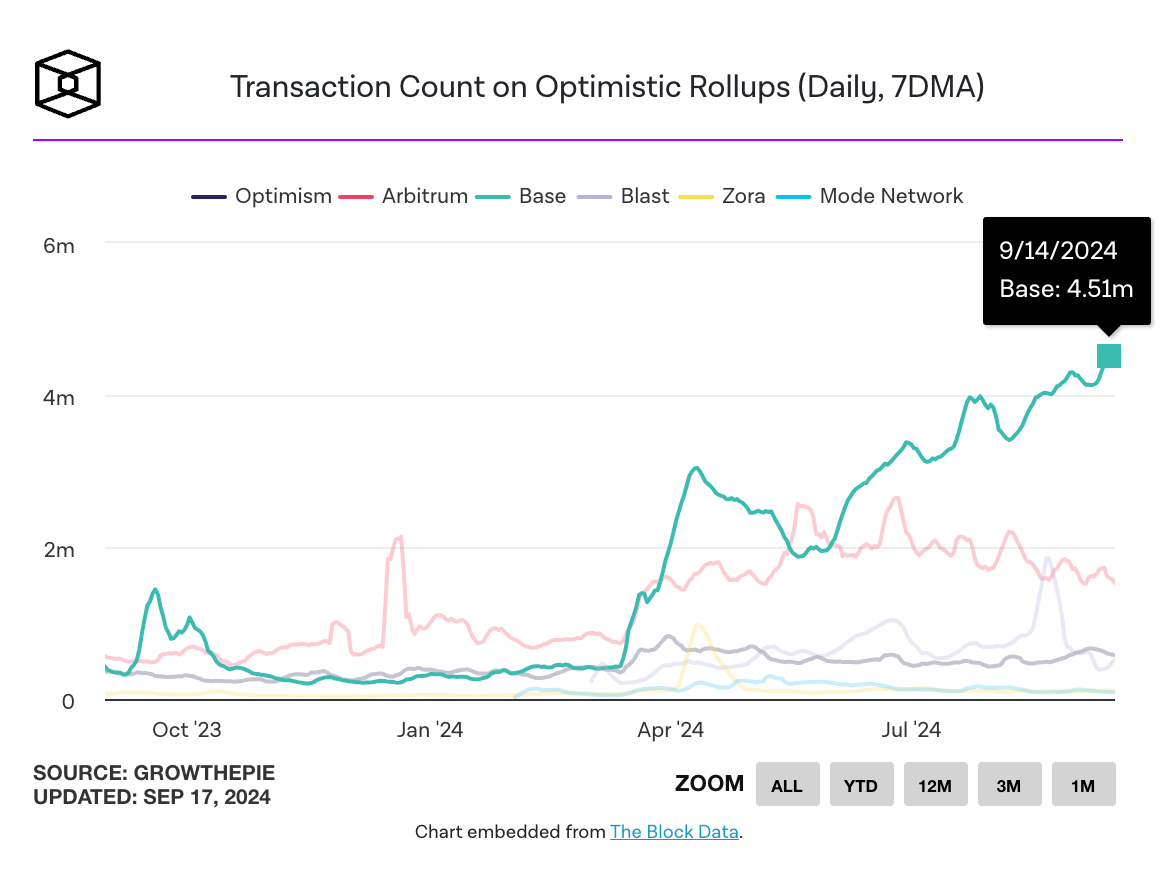

🚀 Coinbase's Base Layer 2 shatters transaction records with over 4.5 million in a single day: This milestone cements Base’s position as the leading Layer 2, showcasing its growing popularity and robust ecosystem.

📜 US lawmaker proposes joint CFTC-SEC committee to unify digital asset regulations: Congressman John Rose has proposed a new bill to streamline digital asset regulations by creating a Joint Advisory Committee co-managed by the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).

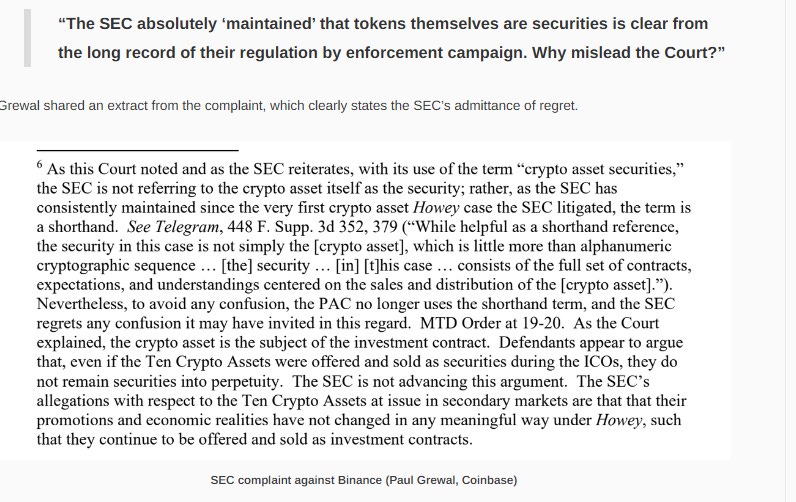

⚖️ The SEC ‘regrets confusion’ it may have invited stating some tokens are securities:The amendment, approved this morning, includes a motion under Federal Rule of Civil Procedure 15(a)(2), accompanied by a memorandum explaining the reasons for the changes, a proposed amended complaint, and a redline version highlighting the alterations.

🎉 Blockchain gaming sets new record with 4.2 million daily active users in August:The web3 gaming industry saw a 5% increase in daily unique active wallets (dUAW) last month despite falling to second place in terms of the most active crypto sector amid the AI boom.

🥳 Ethereum Layer 2 Atlas Launches Private Testnet:Atlas, a Layer 2 blockchain developed by Ellipsis Labs, has launched its private testnet.The chain features a custom implementation of the Solana virtual machine (SVM) and settles to Ethereum mainnet “to access Ethereum’s assets in a trust-minimized fashion, and to benefit from Ethereum’s security and censorship-resistance”.

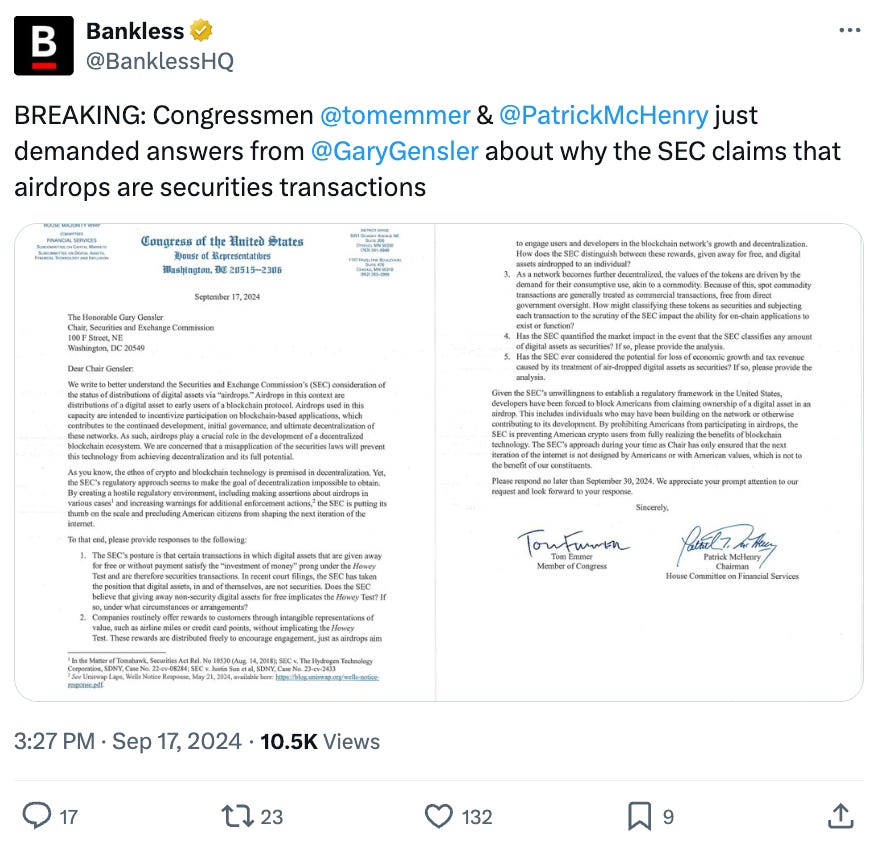

💬 Tweet of the Week

Source: @BanklessHQ

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. After growing to more than $1B towards the end of August, PYUSD's circulating supply has decreased by 28% over the last 3 weeks and now stands at $732M. More interestingly, however, is that most of these outflows occurred on Solana as $263M PYUSD left the ecosystem. This represents 91% of all PYUSD outflows during this time.

Much of this is driven by incentives for using PYUSD within Solana DeFi falling to 8-9% after being 15%+.

Source: @DavidShuttleworth

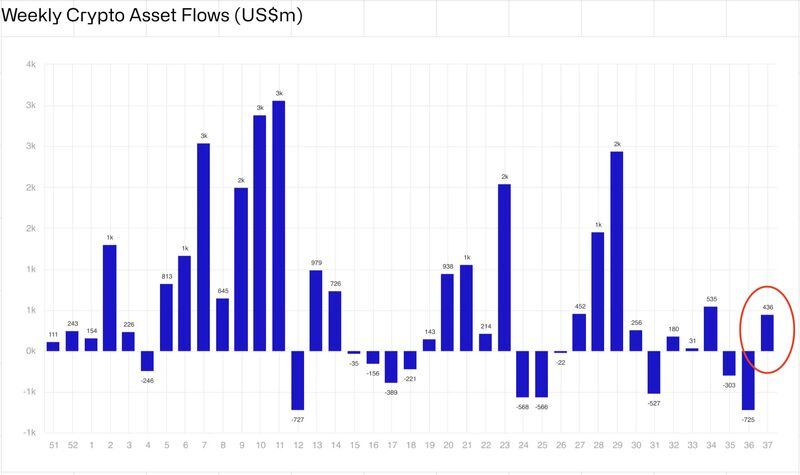

2. Heading into the week we saw some minor relief in terms of institutional demand, with $436M of inflows after $1.2B in total outflows the prior two weeks. Bitcoin once again was the leader here with $436M of inflows followed by Solana ($3.8M), while Ethereum had slight outflows of $19M, pushing its monthly total to -$117M.

Notably, however, BTC and ETH ETF weekly trading volumes were down by 44% from their average, standing at just $8B.

Source: @DavidShuttleworth

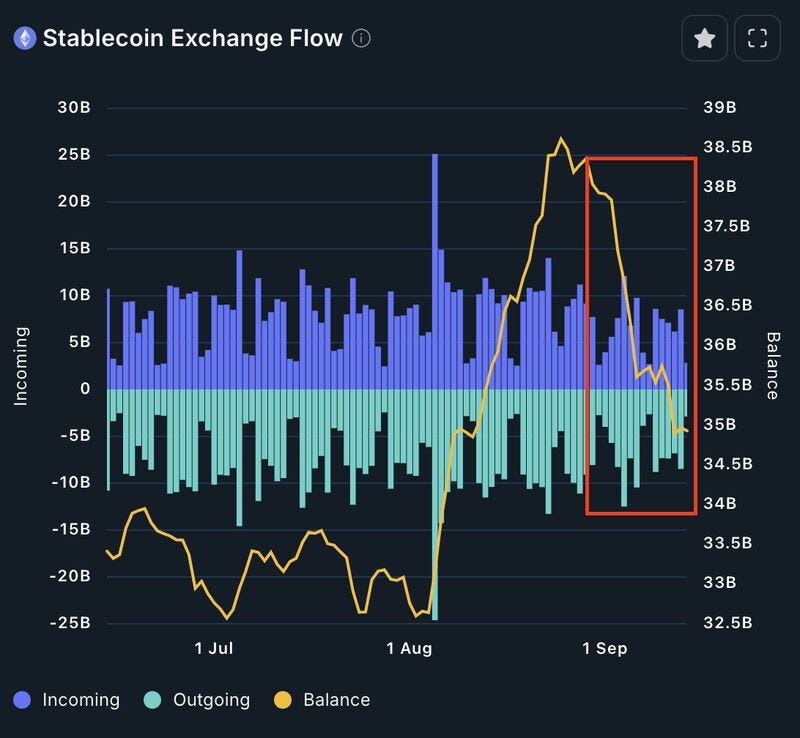

3. An interesting aspect in the realm of stablecoins right now is that despite total circulating supply growing steadily month-over-month and through September, the total balance of Ethereum-based stablecoins on centralized exchanges is down 8% since the start of the month. Collectively, exchanges have seen more than $3.1B of stablecoin liquidity on Ethereum exit their platforms within the last two weeks.

One takeaway here is that it could signal that users are putting their stables to work in ways other than just simply traditional CEX trading activities.

Source: @DavidShuttleworth

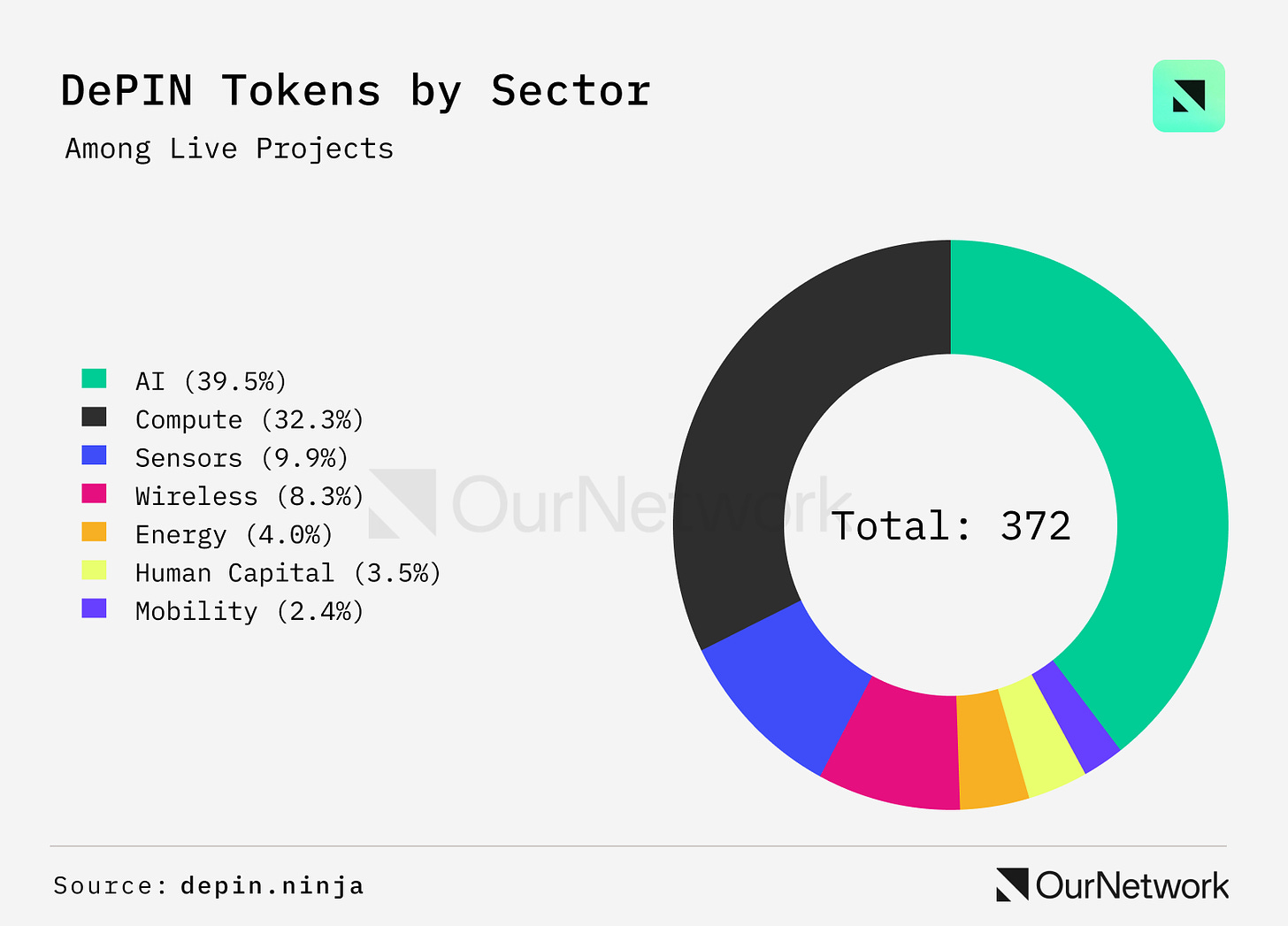

4. DePIN, decentralized physical infrastructure networks, is one of the fastest growing sectors in crypto, aiming to displace CAPEX-heavy industries like cloud computing, telecommunications, and renewable energy. Of 370+ live DePIN tokens, 75% focus on virtual services (AI/compute) and the other 25% provide physical services (wireless/energy/sensors); 75% of DePIN tokens launched on an EVM chain, with most of the rest launching on Solana, Cosmos, or their own native L1.

Source: @OurNetwork

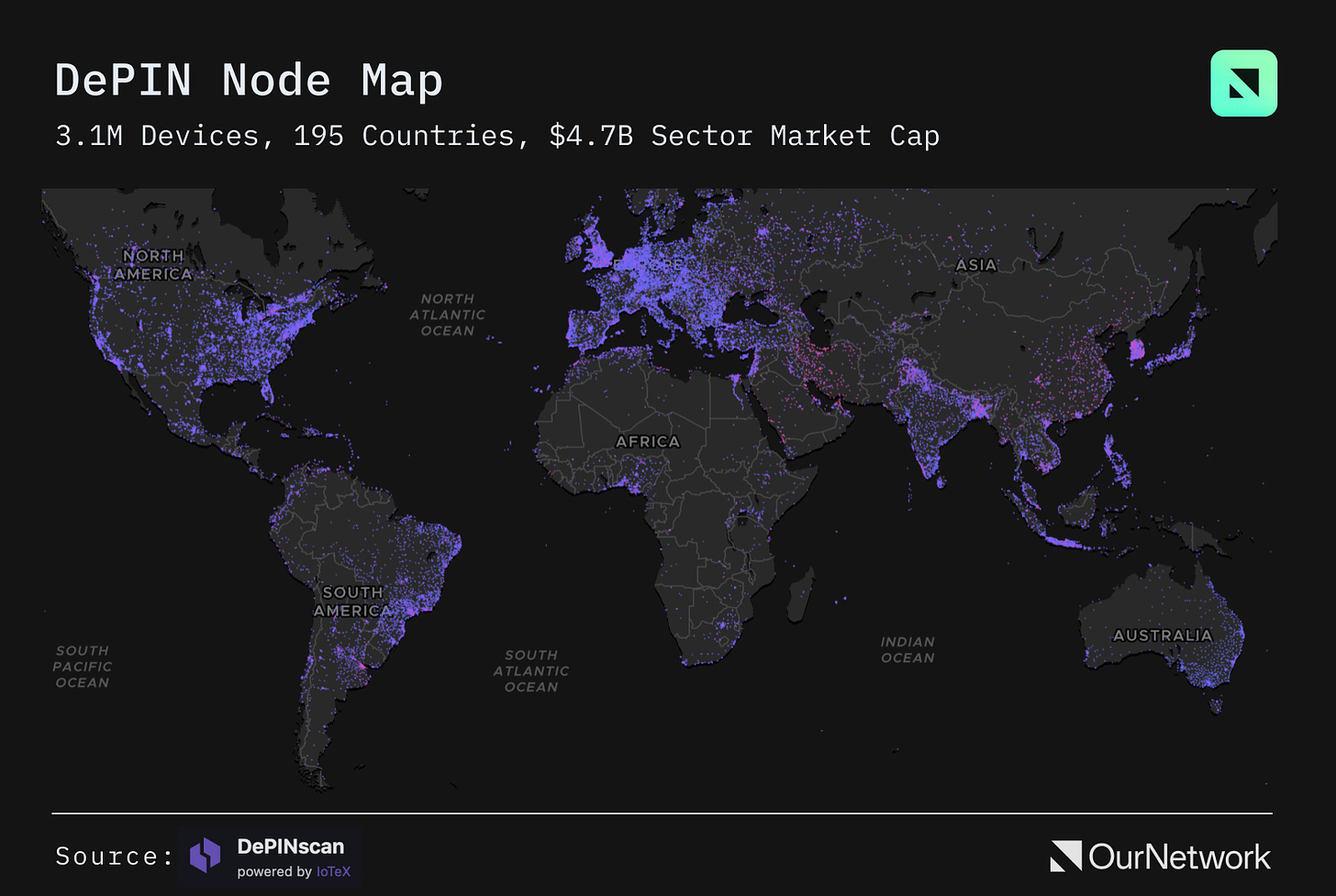

5. DePINScan tracks >3M active DePIN nodes globally. Networks with significant scale are gravitating towards high-throughput blockchains: of the ten DePINs with >100k active nodes, seven are building in the Solana ecosystem (Helium, Natix, Hivemapper, Grass, Dawn, Uprock, and Roam).

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Present Focus

Over the past few years, two new holistic problems in AI development have emerged:

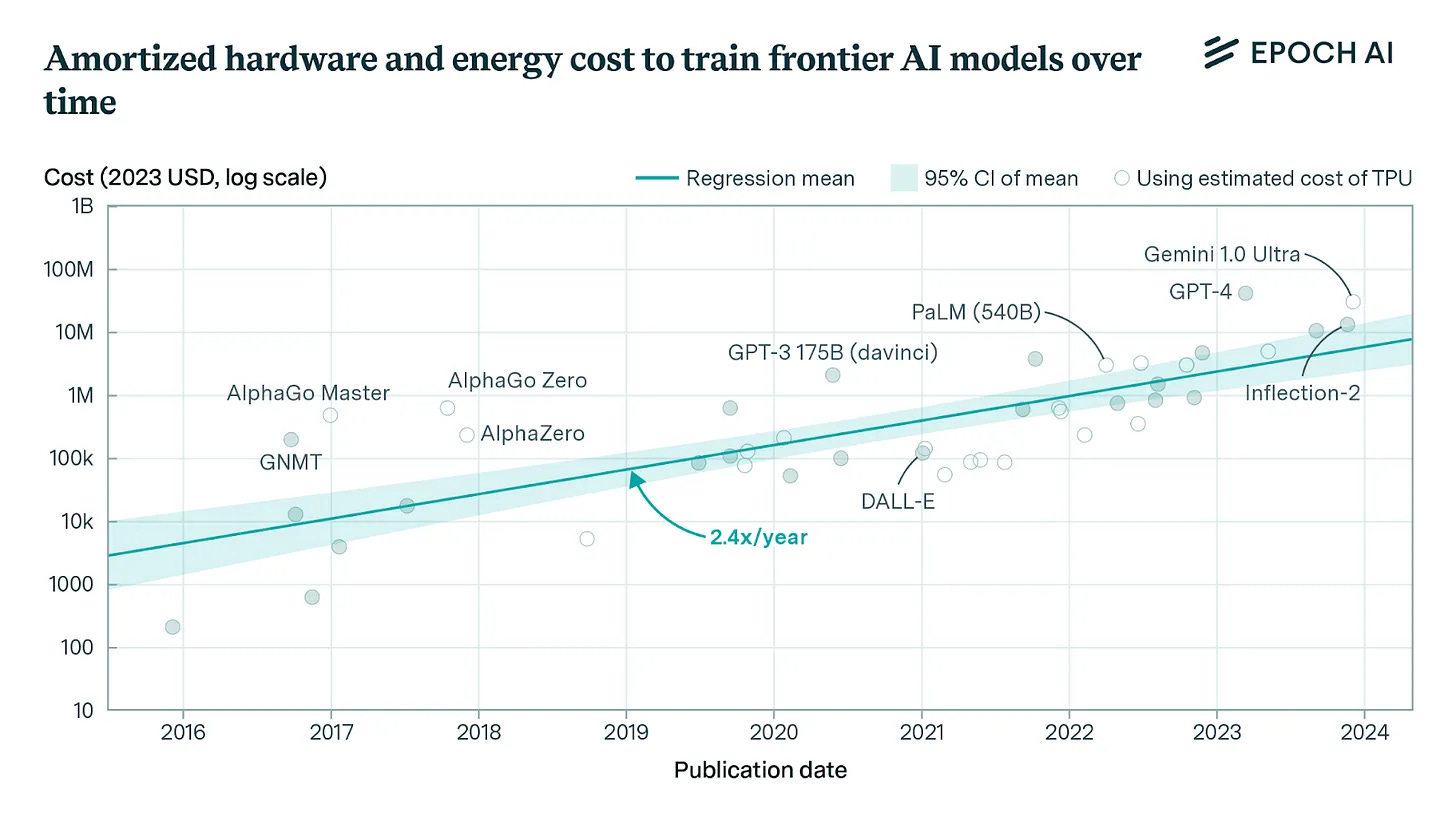

Resource management: AI development is not cost-scalable

Incentive alignment: AI is made for people, but its development and rewards are decided in boardrooms

Firstly, AI models do more and more computations (FLOPS) and have higher and higher training costs. OpenAI is on track to lose $5 billion this year due to high costs. AI companies have so much additional baggage: sales teams, legal departments, HR, distribution, purchasing, and more. How about designing infrastructure that trustlessly distributes models in a monetizable and ownable way, so that researchers can focus on building models, not on extraneous tasks?

Compute Trends Across Three Eras of Machine Learning

Amortized hardware and energy cost to train frontier AI models over time

Secondly, decision-making is decided from the top down. The decision on the metrics to follow, market to target, data to gather, and modality to include are decided by internal hierarchy. Centralized decisions are made to benefit shareholders, not end users. Instead of predicting the use cases, why not let the users have a say in what they find valuable?

Companies have identified the symptoms and tried addressing them by defining their niche. Mixtral champions collaboration by being open source, Cohere focuses on B2B integrations, Akash network decentralizes compute resources, Bittensor uses decentralization to reward model performance, and OpenAI is centralized, multimodal, and pioneered the use of an API to serve users. But none have looked at the holistic issues.

A Sentient Future

Tackling these two problems requires a fundamental rethink of how companies design, make, and distribute AI. We believe Sentient is the only company that has understood the necessary scale of change, reinventing AI from the ground up to address these overarching challenges. The Sentient team calls this OML, which stands for open (models available to be made and used by anyone), monetizable (model owners can sign off on model use), and loyal (controlled by the commons/DAO).

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.hypelab.com