Learn More at www.hypelab.com and www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 270k weekly subscribers. This week, Bitcoin reached $93k, Justin Drake proposed Beam Chain, BlackRock’s iShares Bitcoin Trust (IBIT) logged its largest daily trading volume and big new venture rounds came in for Pond ($7.5M) and Brevis Network ($7.5M).

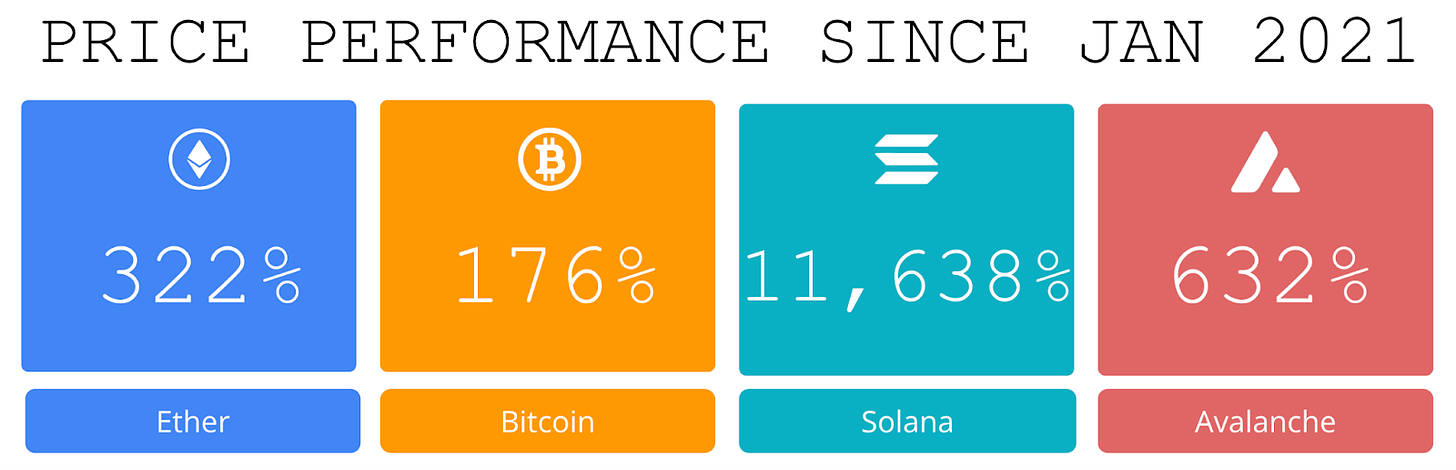

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

HypeLab is the premier web3 advertising network, building ‘Google ads for web3’. With HypeLab, you run ads to real crypto users on high-quality publishers like Chainlist, Coingecko, Quickswap, and hundreds more. Advertisers like Metamask, Uniswap, and Paypal use HypeLab to super-charge their web3 growth.

Amphibian Capital, managing $110M+ AUM, is a fund of the world's leading hedge funds. +14.92% net YTD approx with their USD fund, +11.00% net BTC on BTC YTD (90.93% in USD terms), and +14.39% net ETH on ETH YTD (33.01% in USD terms) through 10/31. They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com. Approximate estimates through 10/31/24

Become a Coinstack Sponsor

To reach our weekly audience of 270,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

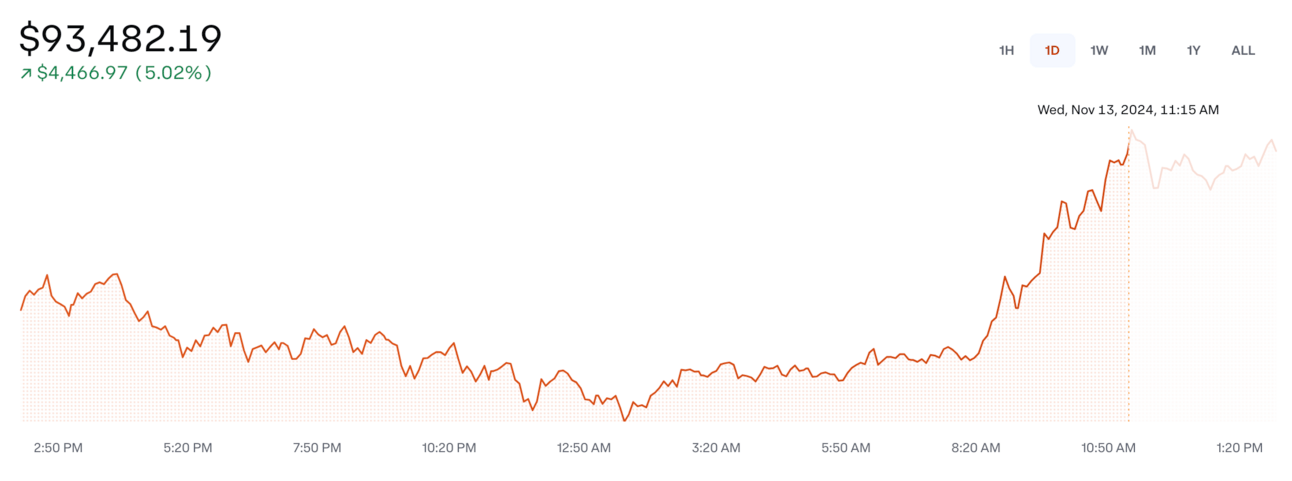

🚀 Bitcoin Surges to New Record Over $93K as Strong U.S. Demand Crushes Resistance Level: Bitcoin blasted through the $90,000 resistance level early in the U.S. trading day and then quickly pushed even higher to top $93,000. The move came as U.S. markets opened for trade, suggesting strong demand from American investors.

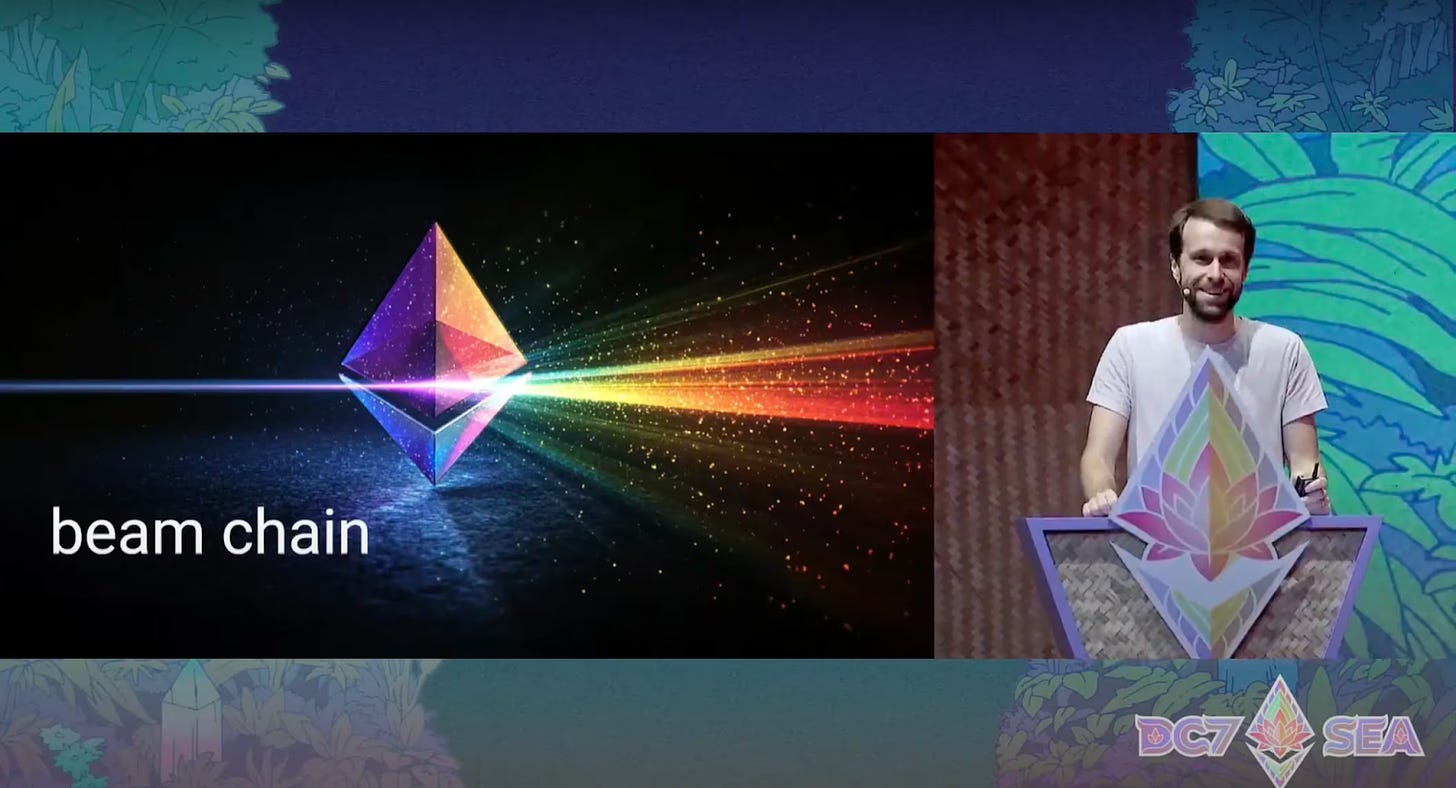

🛸 Justin Drake Proposes Beam Chain Overhaul For Ethereum: The proposed Beam Chain overhaul would upgrade Ethereum's staking and block production mechanism, and modernize its cryptography.

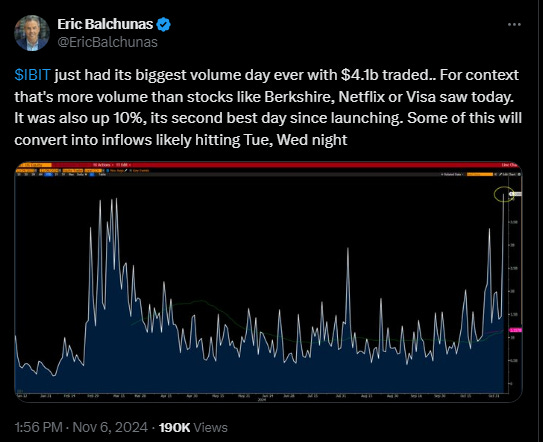

🚀 BlackRock’s spot bitcoin ETF sees record-breaking $4 billion traded on Election Day: BlackRock’s iShares Bitcoin Trust (IBIT) logged its largest daily trading volume on Wednesday, U.S. presidential election day, which saw pro-crypto Republican candidate Donald Trump reclaim the White House.

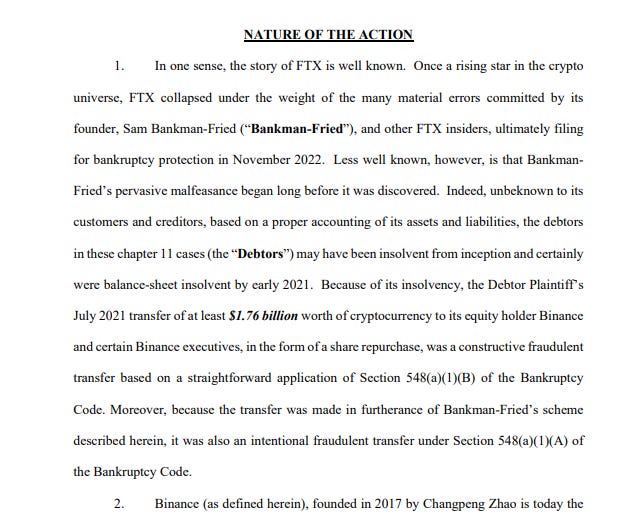

⚖️ FTX files $1.7 billion lawsuit against Binance and founder Changpeng Zhao:FTX filed a lawsuit against Binance and its co-founder Changpeng Zhao, aiming to recoup $1.76 billion from the world’s largest exchange as it claimed the money was fraudulently transferred.

👨⚖️ Bhutan’s Bitcoin stash hits $1 billion as speculation around nation state adoption intensifies: Bhutan’s Bitcoin reserves have quietly swelled to over $1 billion, positioning the small Himalayan kingdom as a unique player in the world of sovereign wealth.

💬 Tweet of the Week

Source: @RasterlyRock

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

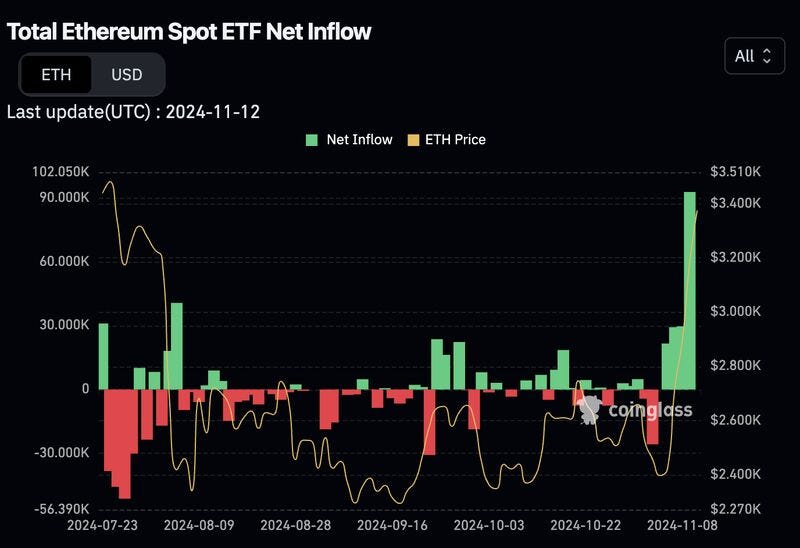

1. Yesterday there were over $295M of inflows into ETH ETFs, the highest daily volume ever. This is still relatively modest compared to BTC, but it's nearly triple the previous highs ($107M). Fidelity Investments had its best day so far ($115.5M) followed by BlackRock ($101M).

Source: @DavidShuttleworth

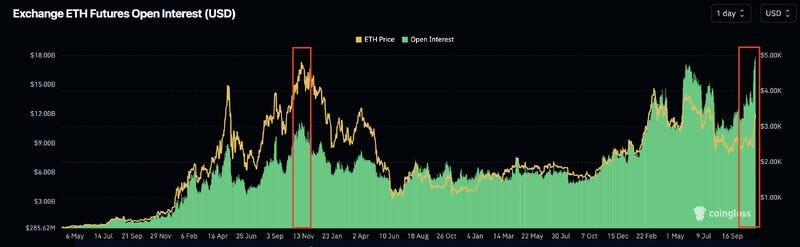

2. Despite being roughly 46% away from its all-time high, ETH futures open interest has surged to record levels and now stand at a staggering $17.9B (up $4.9B in one week). To put this into perspective, futures open interest were just $10.9B when the price of ETH was at its peak in November 2021.

Source: @DavidShuttleworth

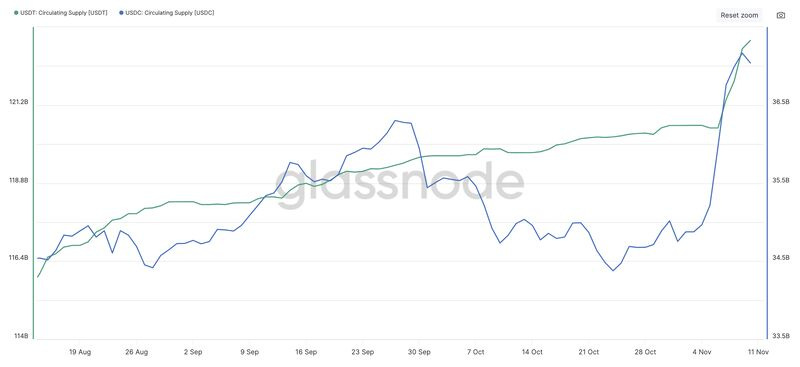

3. Stablecoin dynamics have been incredible to monitor post-election. Total circulating supply of Circle USDC increased by $1.93B (5.5%) this past week. In terms of ecosystems, the majority of this growth occurred on Ethereum ($1.82B), but interestingly USDC grew by 14% on Solana ($353M).

Meanwhile Tether.io USDT added another $2.7B (2.2%) to its circulating supply, growing by 23% on SUI, 22% on NEAR, 17% on TON, and 8% on Ethereum.

Source: @DavidShuttleworth

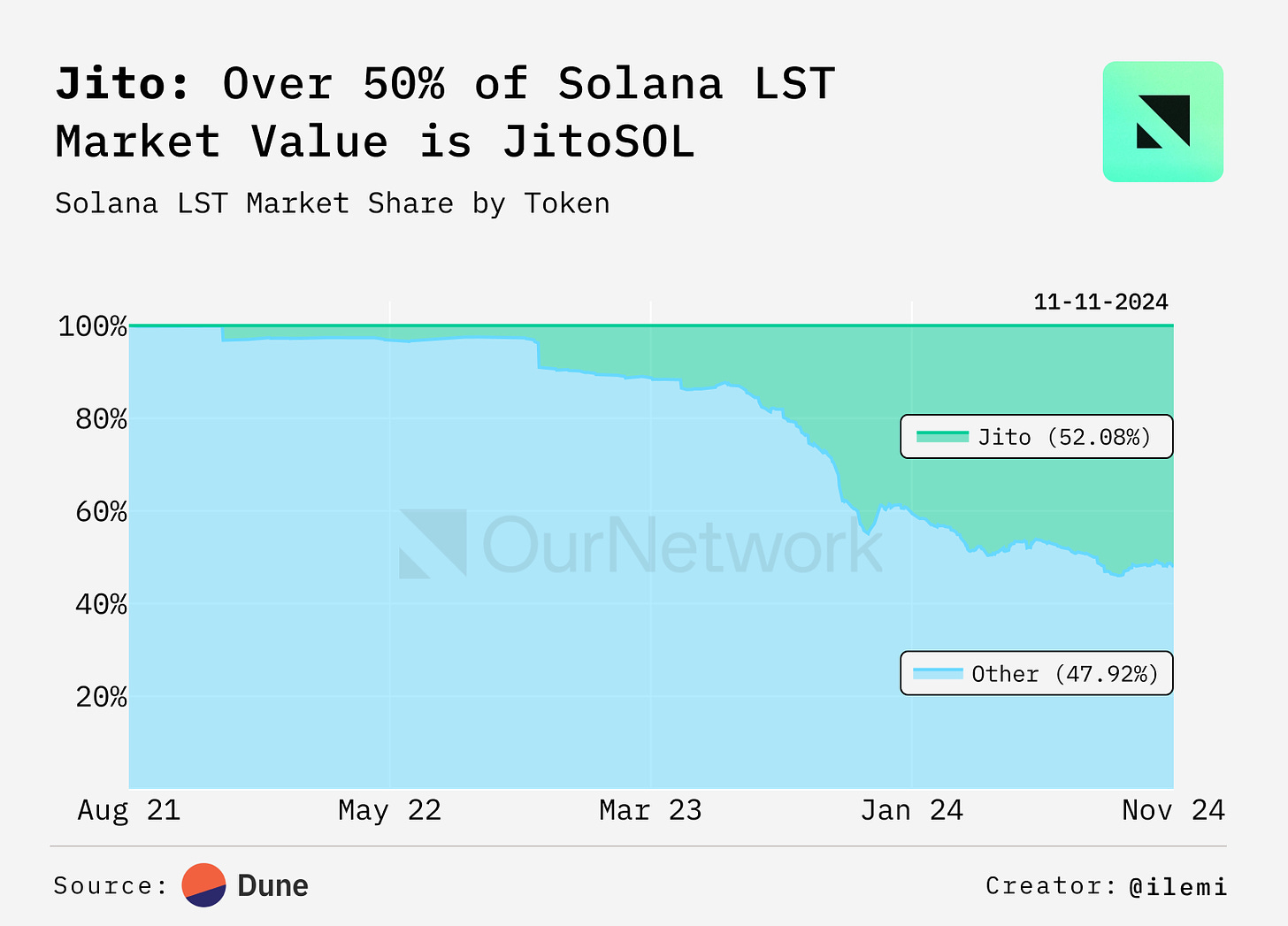

4. Solana Remains the Highest-Upside Liquid Staking Token Ecosystem With Just ~7% Liquid Stake Rate

Source: @OurNetwork

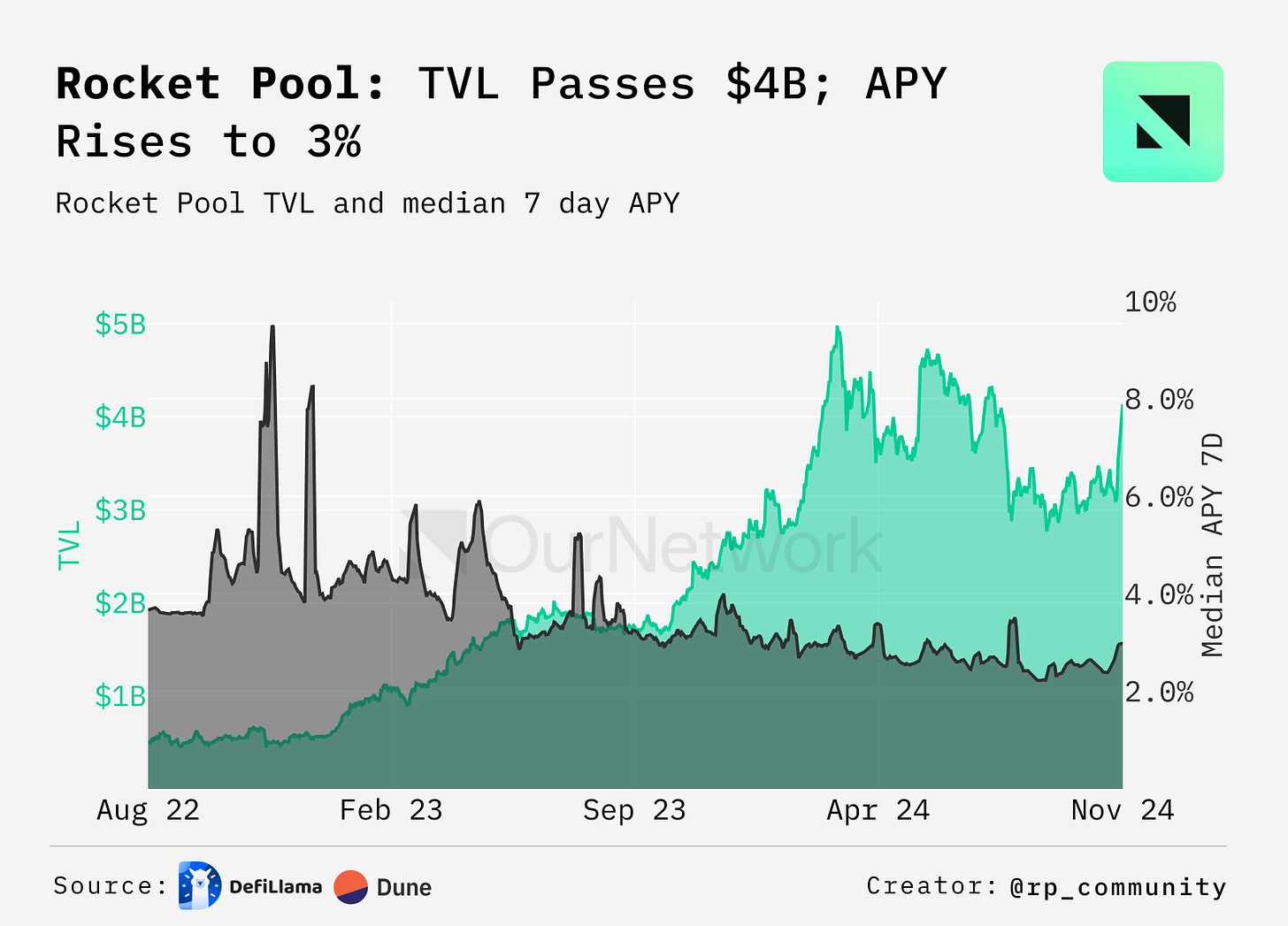

5. Rocket Pool Staked ETH Inflow Peaks at 12.5K Daily; Double the Previous YTD High

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Introduction

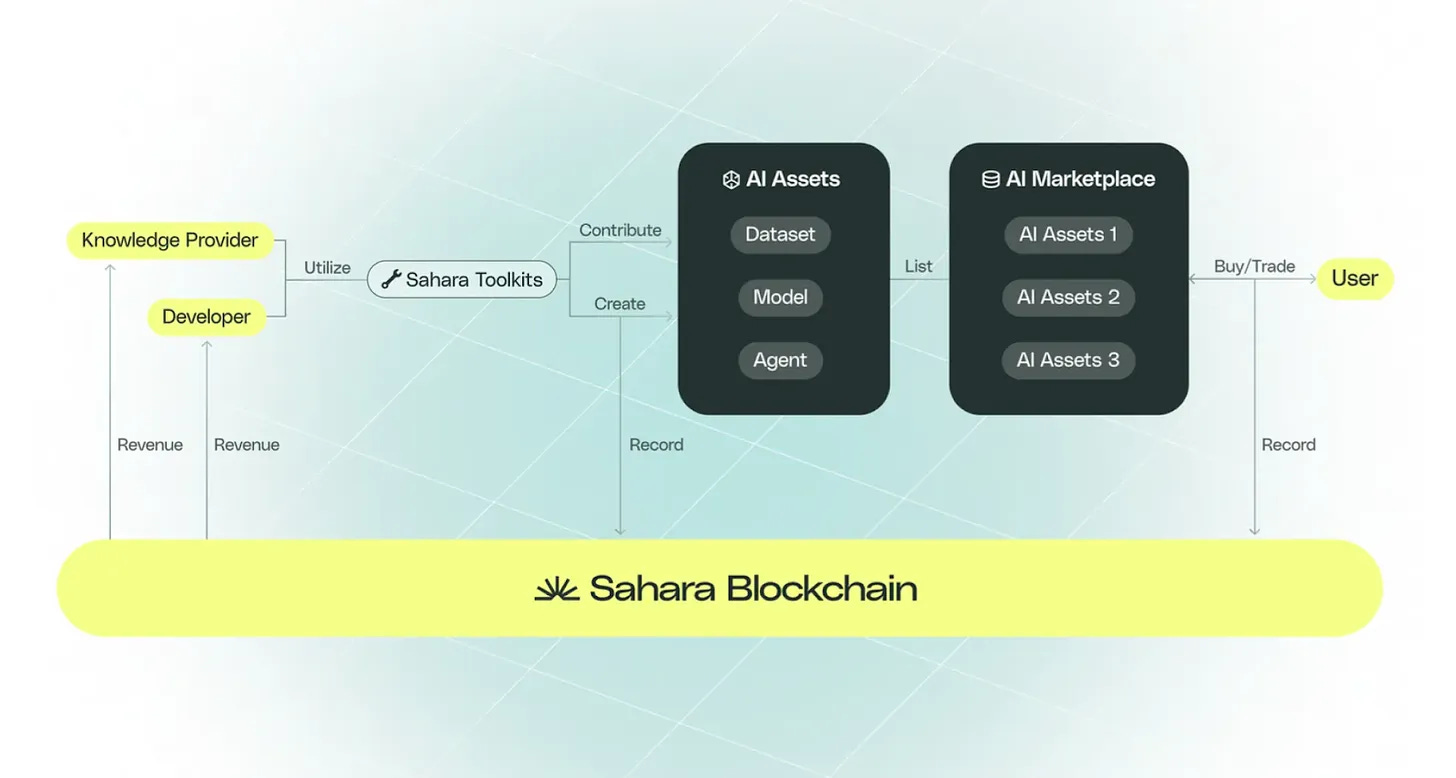

Sahara AI’s mission is to create a more open, equitable, and collaborative AI economy that is as easy as possible to participate in. By leveraging blockchain, Sahara ensures that all contributors (data contributors, labelers, model developers, etc) are fairly compensated, data and models maintain sovereignty, and AI assets can securely and permissions be created, shared, and traded.

Current AI Stack

The current AI stack has more or less settled into the following distinct layers:

Data collection and Labeling

Data is gathered from various sources (e.g. web scraping, public datasets, user-generated data) and must comply with licensing requirements to avoid legal issues. Data is labeled based on the task at hand (e.g. classification, object recognition).

Model Training and serving

Data is fed into the model, which adjusts its internal parameters (weights) to minimize errors. This is computationally expensive and time-consuming.

AI agent creation and deployment

User experience of creating an AI agent typically involves using tools like TensorFlow, requiring technical expertise.

Compute resources

Model Training requires expensive processing.

Each layer has seen intense competition and diversification, with a category of execution that has largely proven to be the most effective on each. For example, data collection is best done with large, public datasets (like books) and fine tuned with specialized data (research papers). Model training is best done on specialized hardware, AI agents should be easily made with plug-and-play resources to build a developer community, and compute resources should be distributed in order to accurately reward those who provide compute resources. Integrating these pieces will lead to better AI models and a stronger community.

Web2 companies are trying to do this, but face severe limitations because of their centralized design. From both a corporate and technical perspective, these firms are designed to limit access and silo different parts of the stack, leading to different security standards, database designs, backend integrations, and monetization strategies. In effect, poorly designed to face the shifting paradigm of the AI economy.

For example, OpenAI has built a very powerful foundational model and has begun embracing community builders with its permissionless GPT wrapper marketplace, but only allows surface-level prompt customization rather than a rewiring of the underlying model. The company purchases all its computing resources using investors’ money and is on track to end this year with a $5 billion loss.

Collaborative AI Economy

Sahara’s platform serves as a one-stop shop for all AI development needs throughout the entire AI lifecycle: from data collection and labeling, to model training and serving, AI agent creation and deployment, multi-agent communication, AI asset trading, and crowdsourcing of AI resources. By democratizing the AI development process and lowering barriers to entry found in existing systems, Sahara AI provides equal access for individuals, businesses and communities to co-build the future of AI.

The figure above presents an overview of this user journey, illustrating how AI assets move from creation to utilization and user engagement within the Sahara AI ecosystem. Notably, all transactions within the platform are immutable and traceable, with ownership protected and the origins of assets recorded. This supports a transparent and fair revenue-sharing model, ensuring that both developers and data providers receive appropriate compensation for their valuable contributions whenever revenue is generated.

Sahara’s goal is to make it easy to participate in this AI economy. The steps developers and users take are:

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.hypelab.com and www.amphibiancapital.com