Learn More at www.amphibiancapital.com and www.rootstock.io and www.sdm.financial

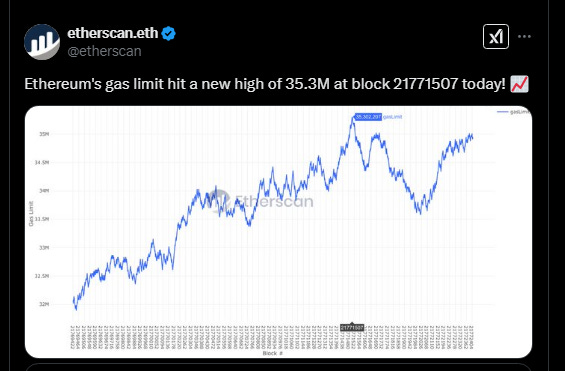

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 300k weekly subscribers. This week, “crypto czar” David Sacks outlined the administration’s pro-crypto agenda, Ethereum implemented first gas limit increase, SEC Fast-Tracked Bitwise's Bitcoin-Ethereum ETF and big venture news for Cipher Mining ($50M) and Irreducible ($24M).

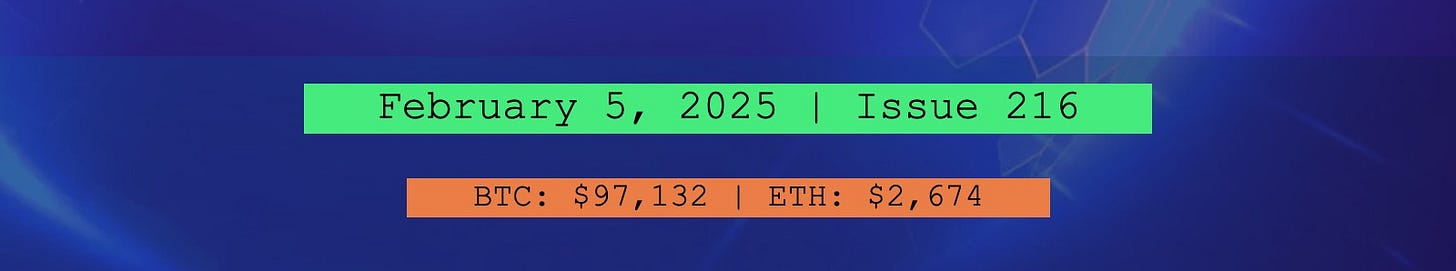

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2025 Coinstack Sponsors…

Amphibian Capital, managing $140MM+ AUM, is a fund of the world's leading hedge funds. +20.50% net YTD approx with their USD fund, +14.38% net BTC on BTC YTD (*+152.85 in USD terms), and +17.80% net ETH on ETH YTD (+71.97% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com. *Approximate estimates through 2/4/25

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 60%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

SDM Financial is a US derivative dealer, building custom options strategies for funds, family offices, miners & HNW investors. Specializing in derivatives on altcoins, exotics, and illiquid assets, we craft strategies to hedge portfolios, boost returns, and capture market opportunities. Elevate your investment strategy today with unparalleled market expertise. Learn more

Become a Coinstack Sponsor

To reach our weekly audience of 300,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

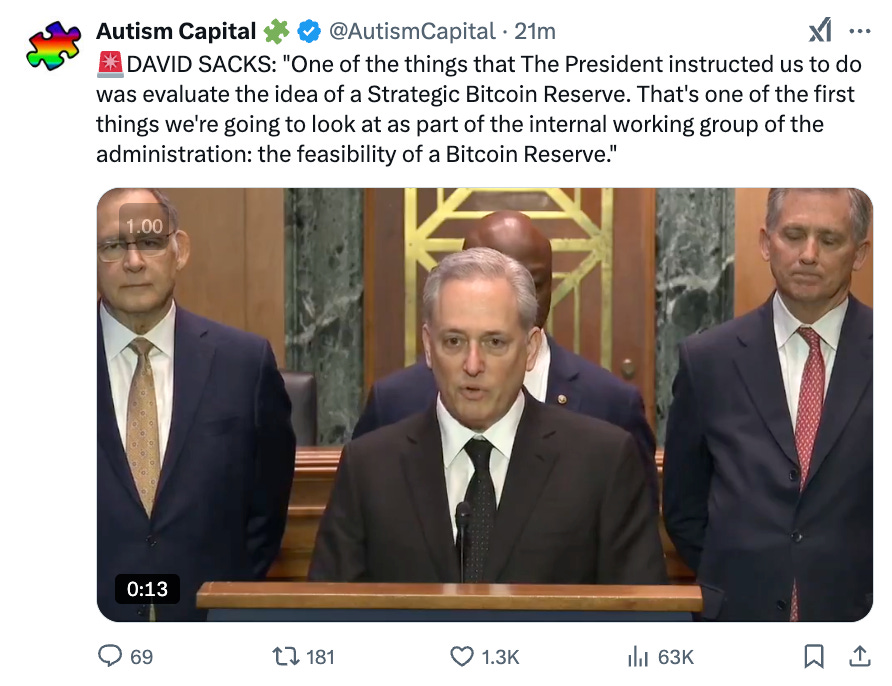

🚀 Bitcoin could be part of US sovereign wealth fund plan, says Trump's crypto czar: President Trump’s newly appointed “crypto czar” David Sacks outlined the administration’s pro-crypto agenda and confirmed that evaluating a strategic bitcoin reserve is a top priority.

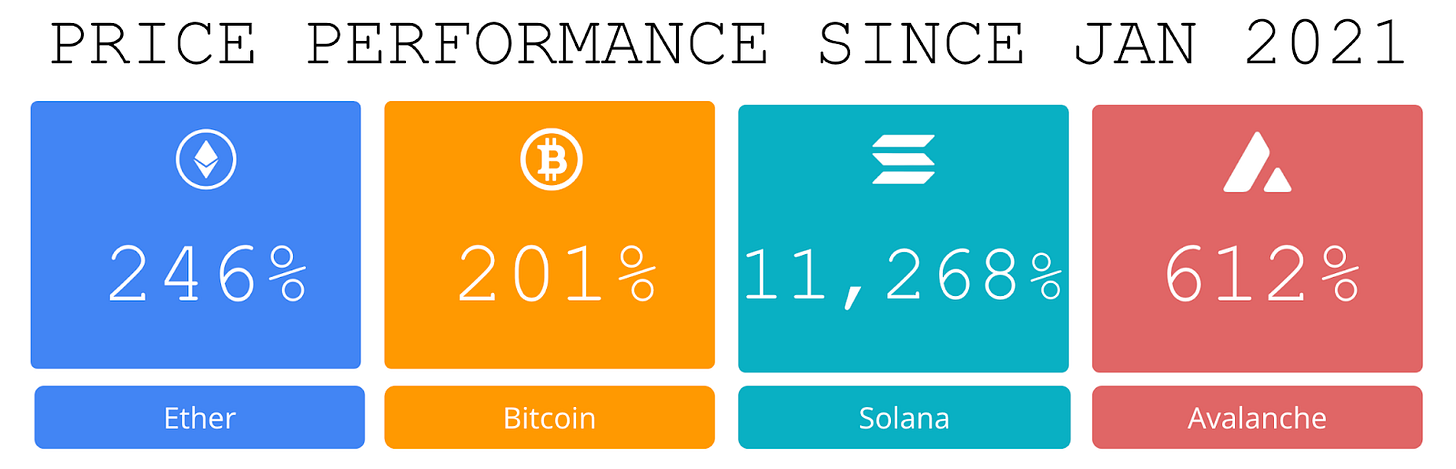

📈 Ethereum implements first gas limit increase since the Merge: Ethereum has raised its network gas limit, marking the first adjustment since transitioning to a proof-of-stake (PoS) consensus model in 2022.On Feb. 4, Etherscan, Ethereum’s blockchain explorer, confirmed that the gas limit reached a record 35.3 million at block 21771507.

⚖️ SEC Fast-Tracks Bitwise's Bitcoin-Ethereum ETF, Signaling Broader Crypto Acceptance: On Thursday, the U.S. Securities and Exchange Commission expedited approval for the Bitwise Bitcoin and Ethereum ETF, allowing it to be listed and traded on NYSE Arca.

🚀 Grayscale launches trust for institutional access to Dogecoin: Grayscale Investments announced the launch of the Grayscale Dogecoin Trust on Jan. 30, marking a significant milestone in institutional access to Dogecoin, the crypto initially created as a joke but now valued at billions.The new single-asset fund offers accredited investors exposure to Dogecoin (DOGE) through a traditional security format, eliminating the complexities of directly purchasing, storing, and securing digital assets.

🚀 Berachain mainnet set to launch in two days, foundation says: The much-anticipated Layer 1 Berachain is set to launch its mainnet in two days' time, according to the Berachain Foundation.“Berachain's mainnet will launch on February 6th, 2025,” the Berachain Foundation posted to X on Tuesday. “TGE will occur at the same time as mainnet launch. Tokenomics and checker tomorrow.”

💬 Tweet of the Week

Source: @AutismCapital

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. We close out the week with Solana continuing to experience some of the strongest demand in the space. Overall, Jito led the way with $122M in fees generated, followed by Solana ($116M). Both of which outpaced Tether and its $140B in reserves generating interest income.

Source: @DavidShuttleworth

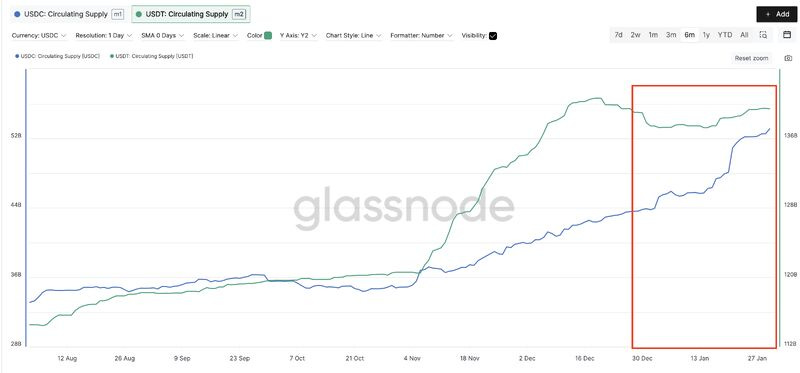

2. One thing that has largely gone unnoticed is that Circle USDC growth has outpaced USDT by 300% so far in 2025. Since January 1st, USDC added roughly $10B to circulating supply, while USDT added $2.5B. Perhaps just as interestingly, $5.3B (53%) of all new USDC in circulation in 2025 was issued on Solana.

Solana now represents 17% of all USDC in circulation.

Source: @DavidShuttleworth

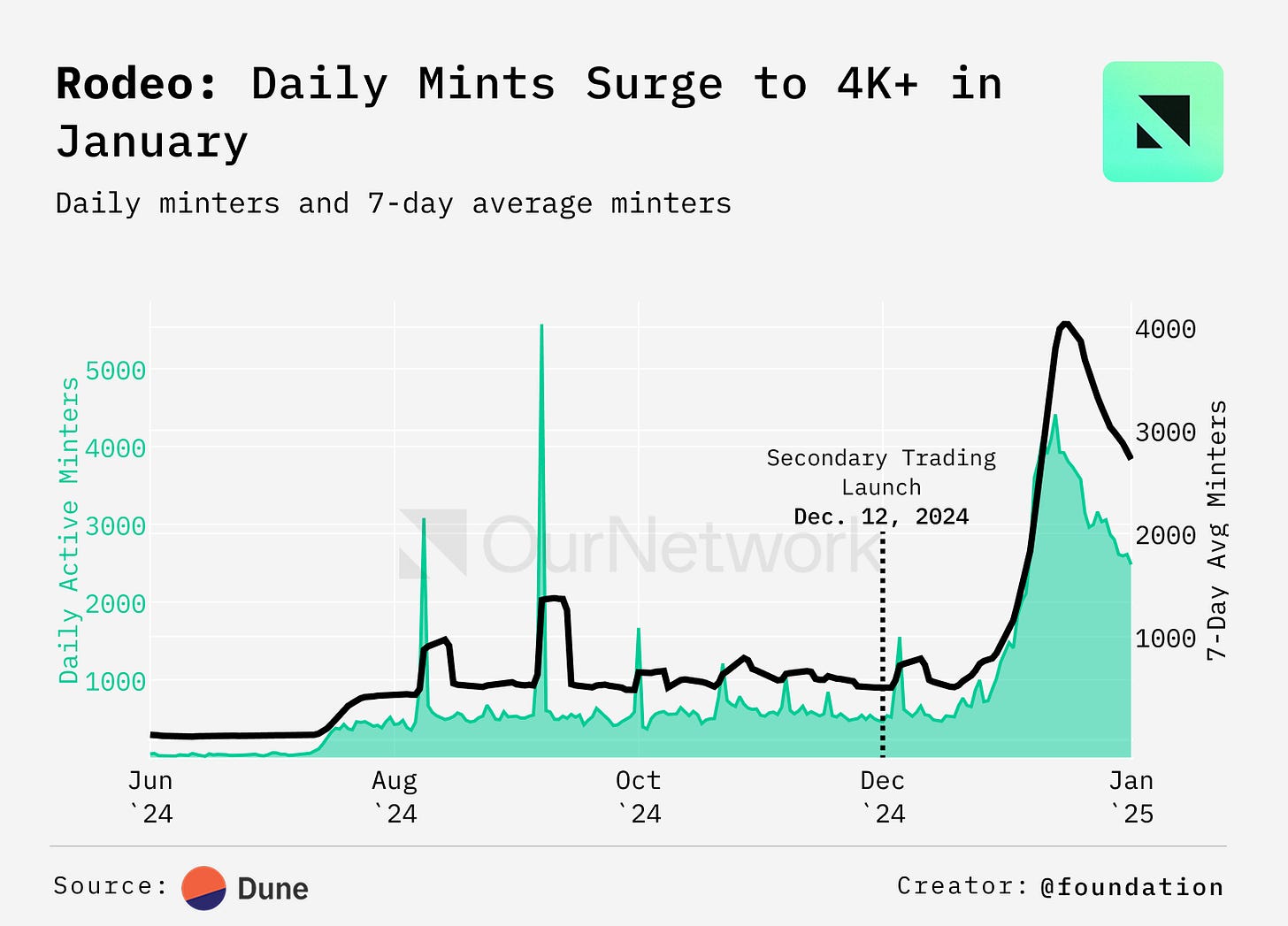

3. Mints and Posts on Rodeo Trend Upwards after Secondary Trading Goes Live

Source: @DavidShuttleworth

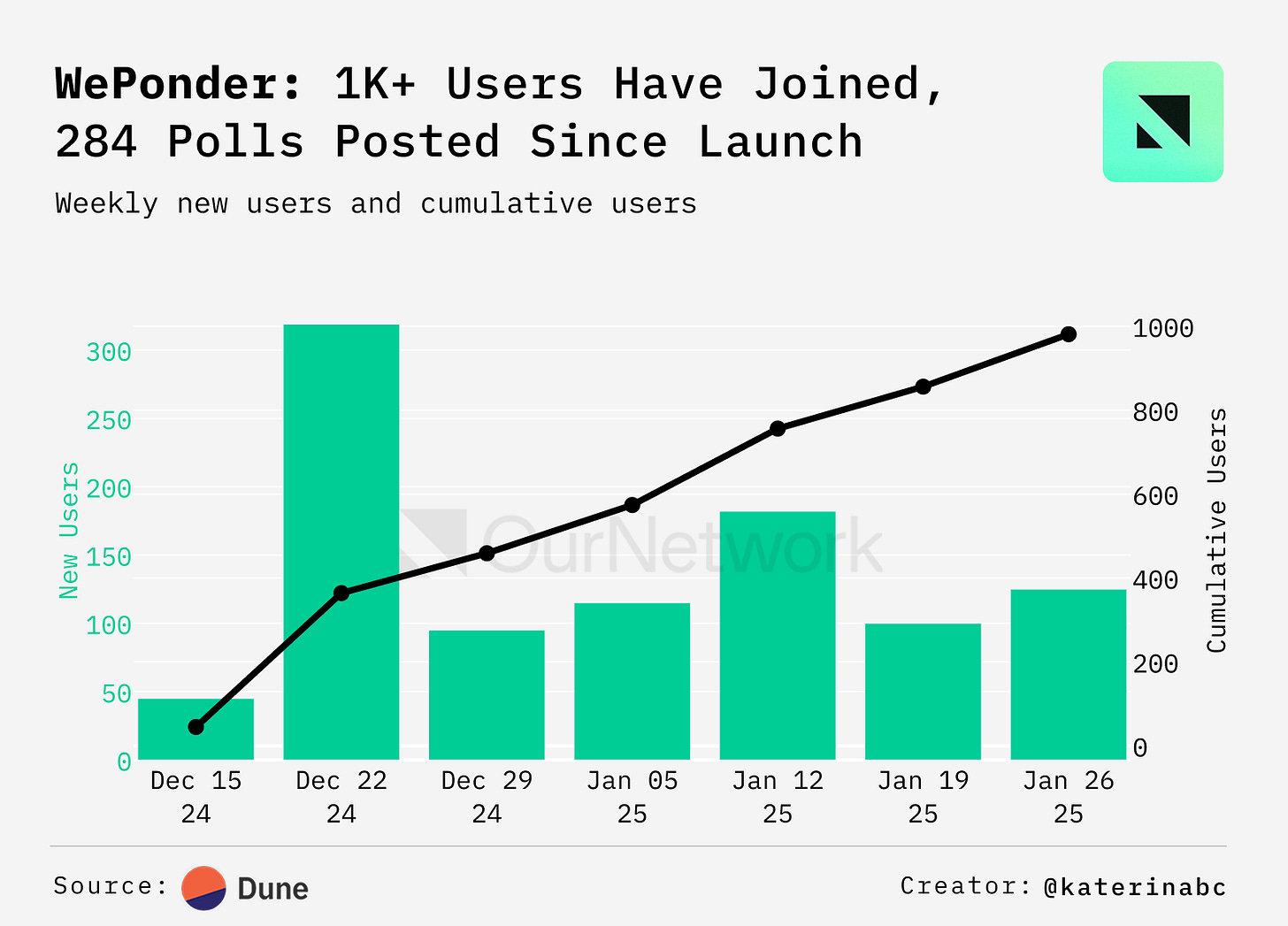

4. WePonder Achieves 8.51% in Engagement by Asking the Right Questions

Source: @OurNetwork

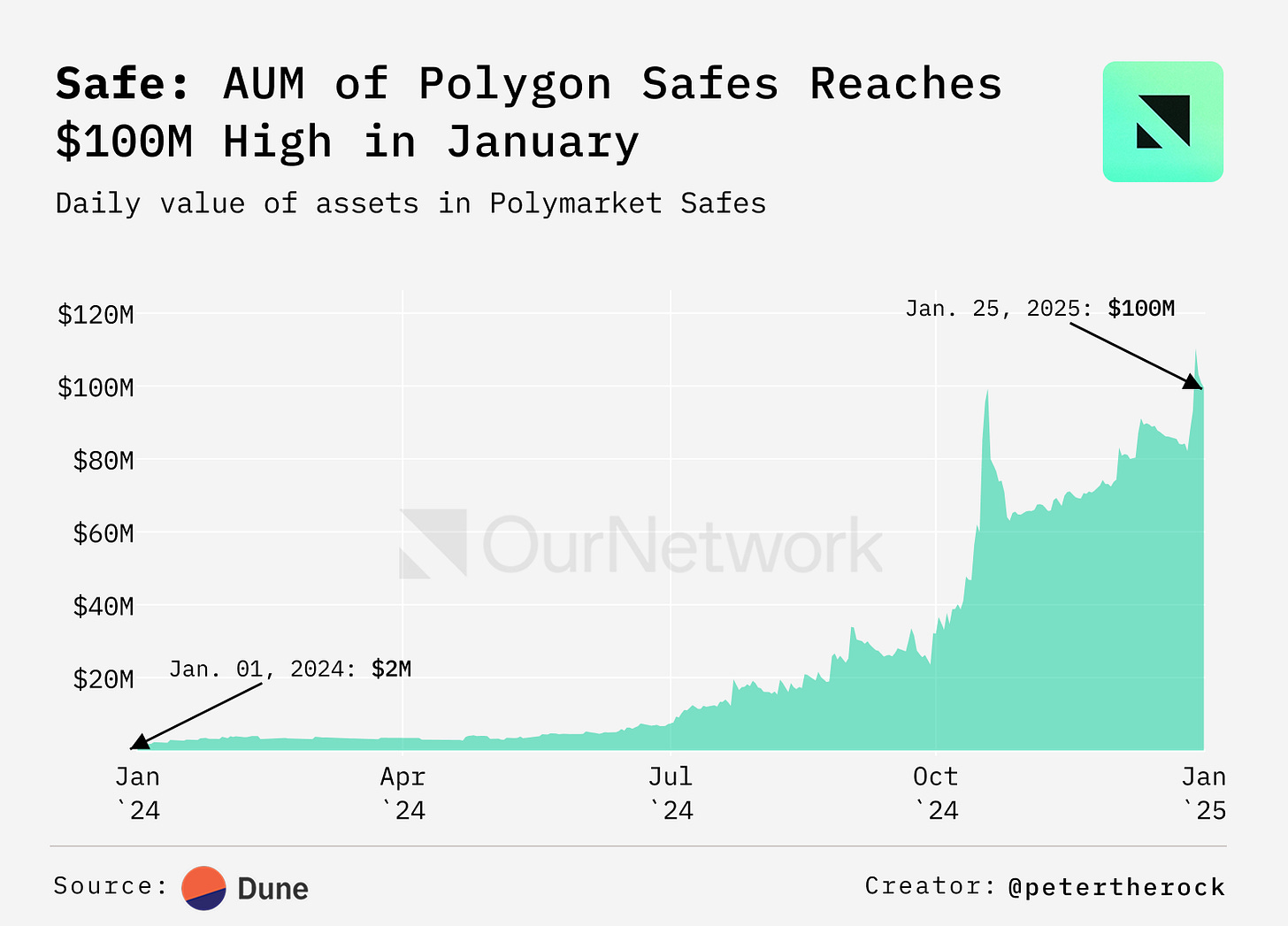

5. Safe Processes Billions of Dollars for Polymarket and World Liberty Financial

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is made possible by a community of contributors who actively participate at the forefront of this emerging data landscape. This is an excerpt from the full article, which you can find here.

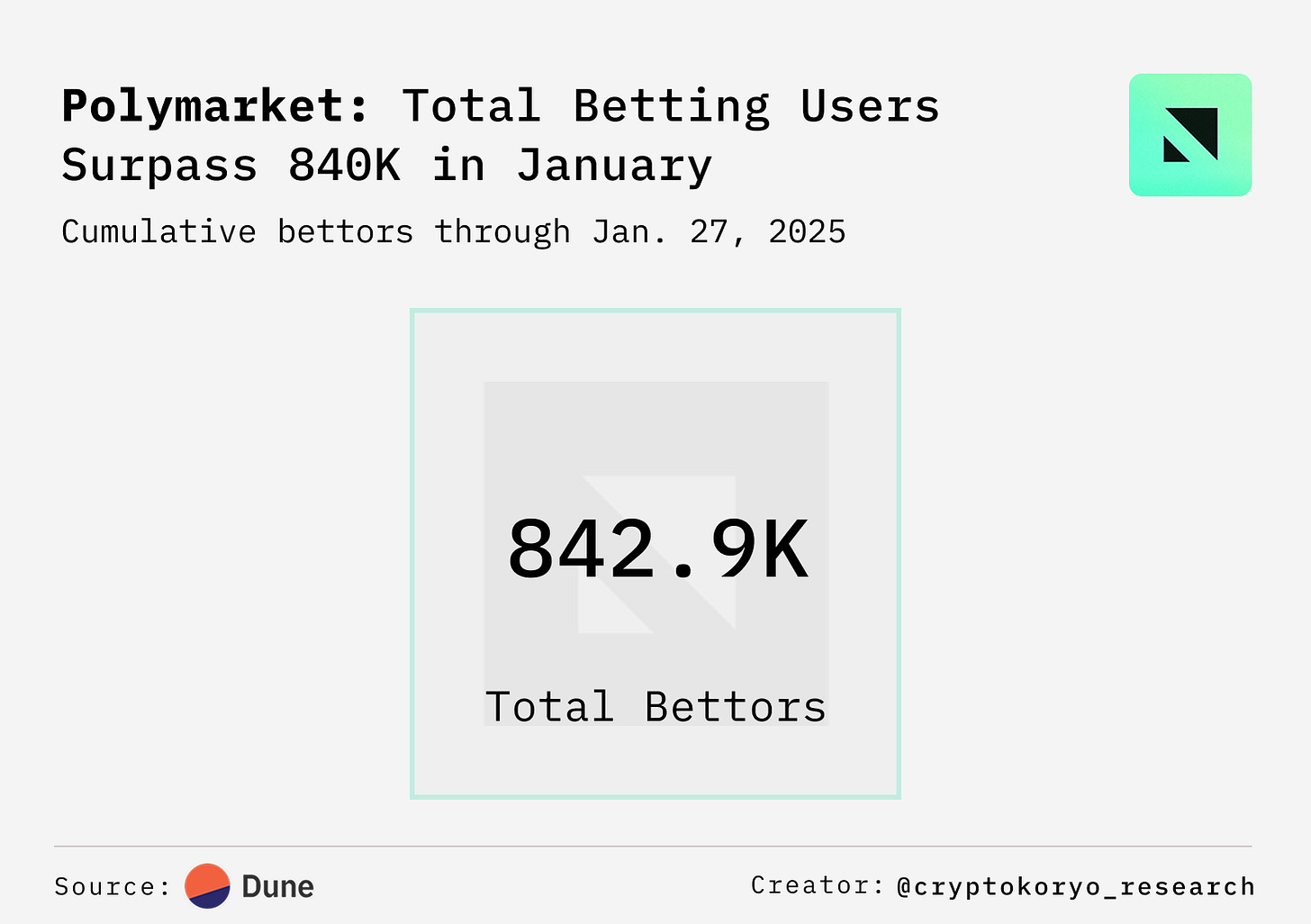

Polymarket 🔮

📈 Polymarket Surpasses $10B in Lifetime Betting Volume

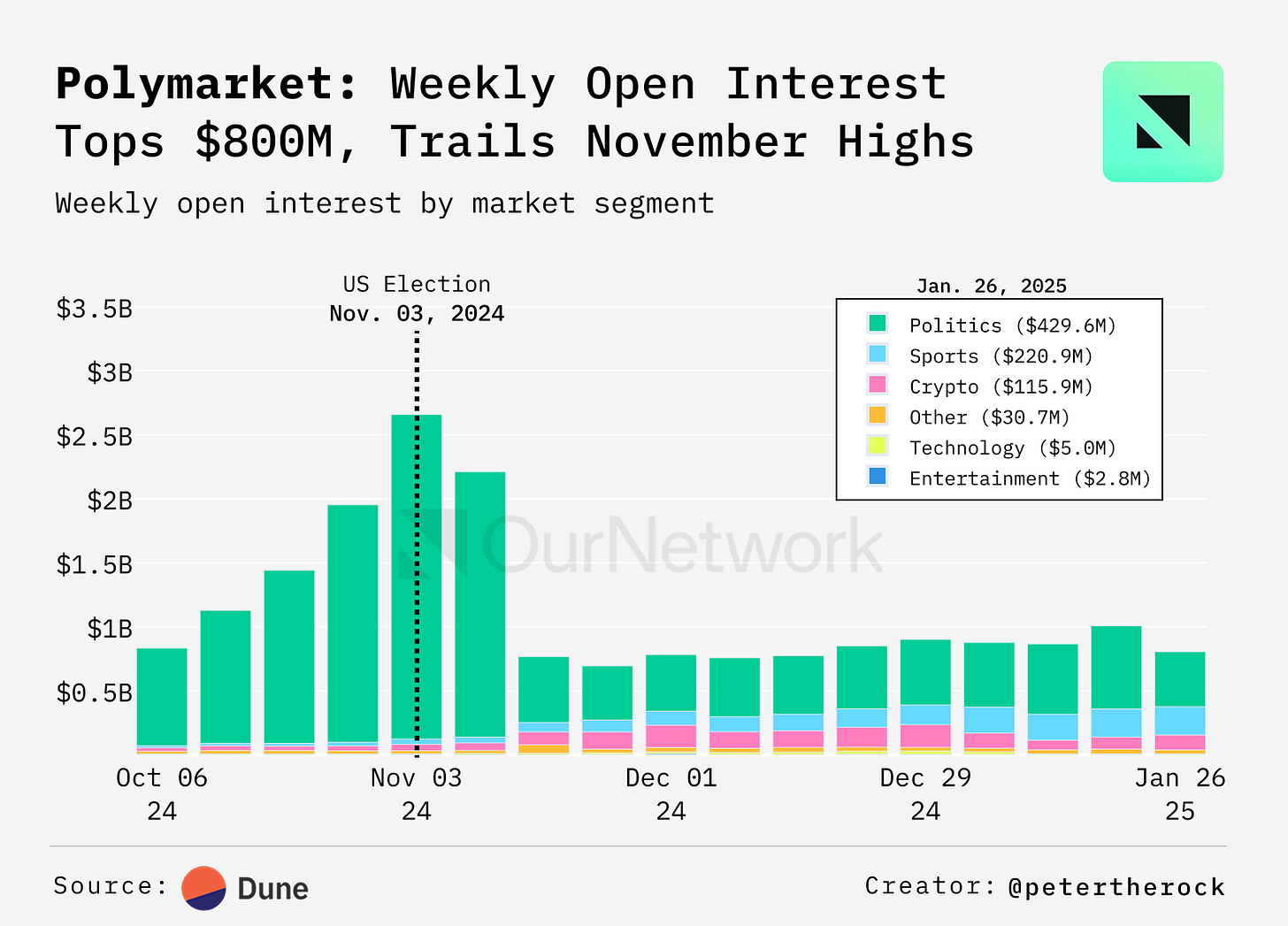

Polymarket, a decentralized predictions market on Polygon, has surpassed $10.2B in lifetime betting volume since 2020, with 71.4M bets placed by over 842K traders. The platform's open interest dropped 65% to $198M from $569M 7 days after the US election. However, Polymarket's open interest since rebounded to $438M as of Jan. 21, recovering 77% of its all-time high reached during the election period.

Dune - @cryptokoryo_research

Dune - @petertherock

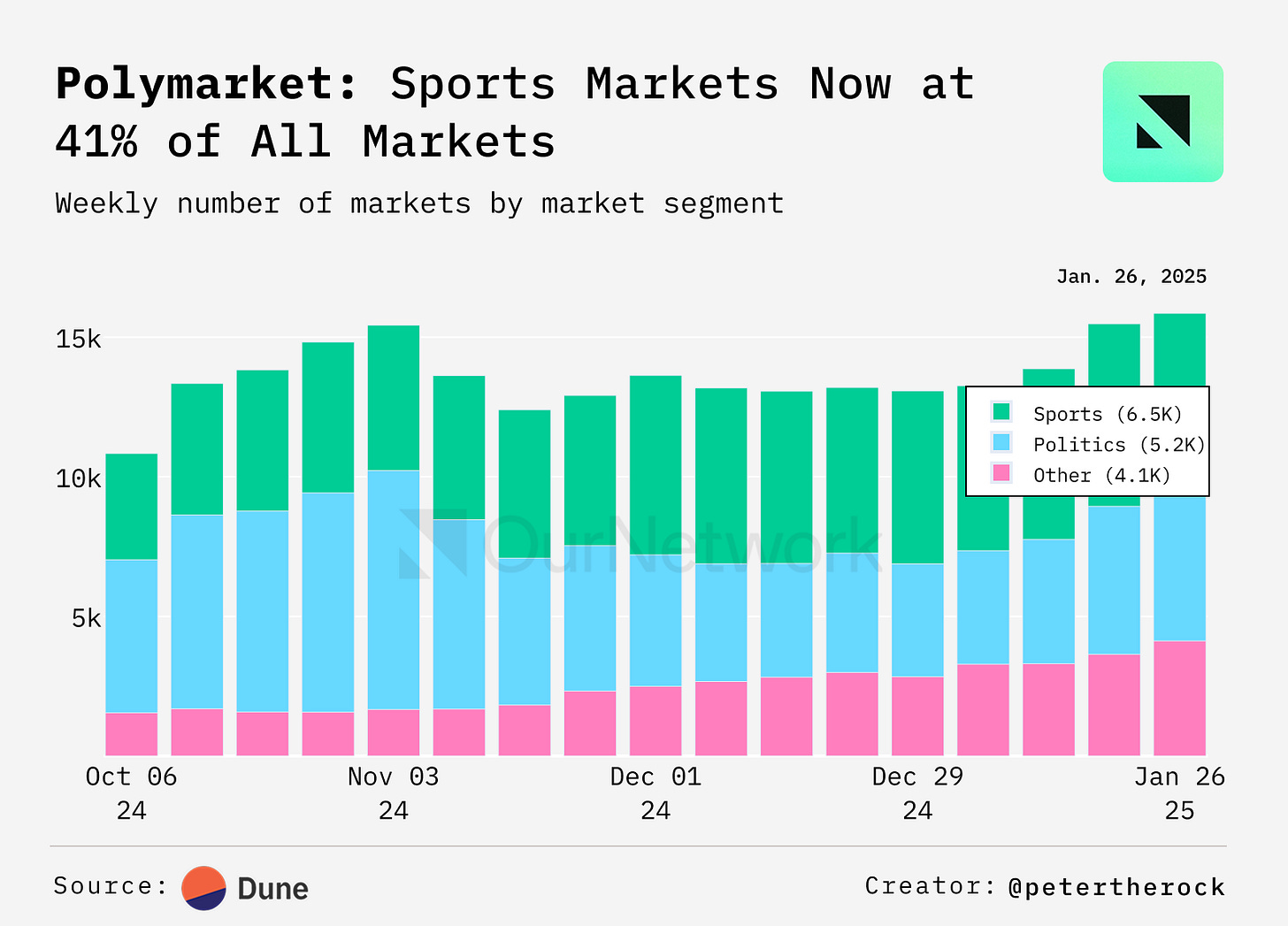

Post-US election, Polymarket activity is rebounding. As of Jan. 27, 2025, $100M in markets were open across 2.11K total markets — this matches levels hit on Nov. 6, 2024, which was an all-time high. Political markets dropped by 20% — sports are now the leading category at 41%, followed by politics at 33%, and crypto at 7%.

Dune - @petertherock

Dune - @petertherock

Thought leaders with strong followings like @theallinpod are driving creator markets on Polymarket through their ideas and discussions. Before inauguration day, "creator markets" held $13M in open positions, accounting for 8% of all open positions, highlighting their growing visibility and impact.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com and www.rootstock.io and www.sdm.financial