Learn More at www.hypelab.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 270k weekly subscribers. BTC rallied to $68k, Uniswap Labs unveiled Unichain, OKX launched the first crypto derivatives in UAE and big new venture rounds for Blockstream ($210M) and Solv Protocol ($22M).

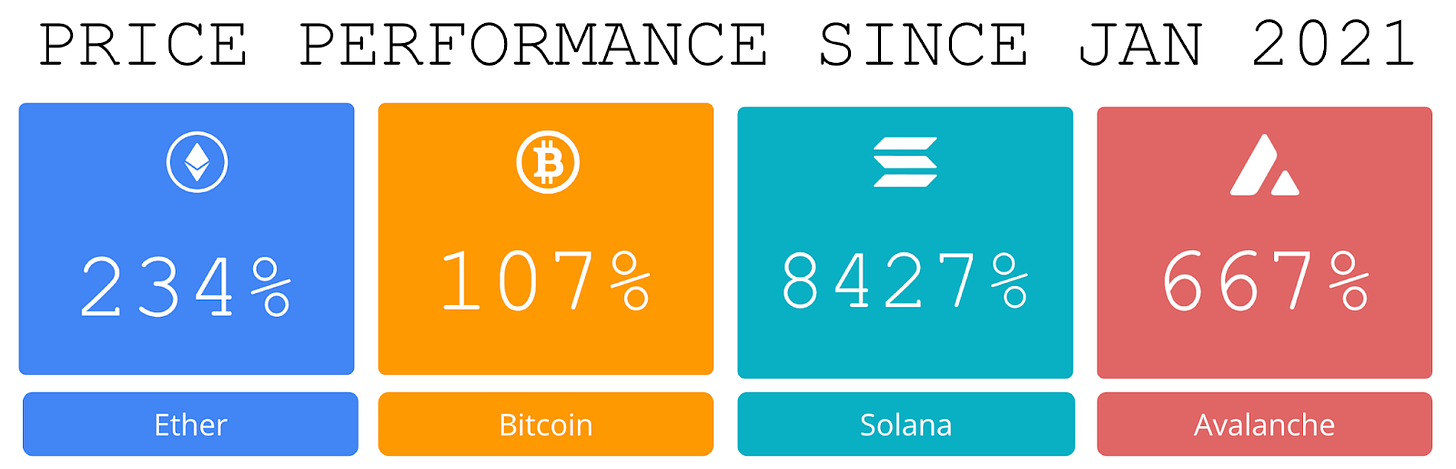

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

HypeLab is the premier web3 advertising network, building ‘Google ads for web3’. With HypeLab, you run ads to real crypto users on high-quality publishers like Chainlist, Coingecko, Quickswap, and hundreds more. Advertisers like Metamask, Uniswap, and Paypal use HypeLab to super-charge their web3 growth.

Become a Coinstack Sponsor

To reach our weekly audience of 270,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ Bitcoin traders brace for all time new highs after BTC rally to $68K: Bitcoin price is on track to register its highest daily close since July 31 after reaching a new intra-day high at $67,953. The rally chalked in a new higher high (HH3) with respect to its previous local top of $66,450 from Sep. 27.

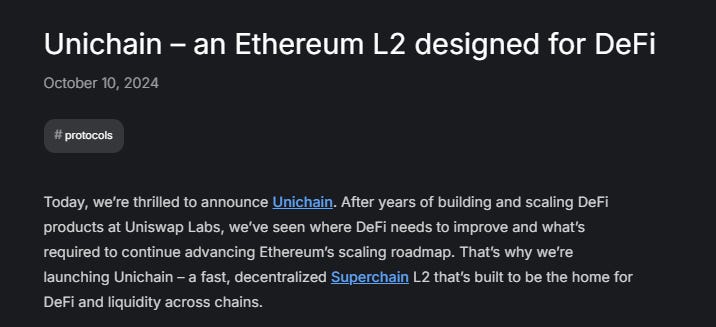

🚀 Uniswap Labs unveils Unichain, the first Ethereum Layer 2 to integrate Flashbot's Rollup Boost solution:Uniswap Labs unveiled a testnet for its forthcoming Ethereum scaling solution Unichain on Thursday — joining the growing ranks of firms looking to build custom Layer 2s — according to a press release.

🚀 OKX Launches First Crypto Derivatives In UAE Alongside Local Exchange:OKX, one of the world’s largest cryptocurrency exchanges, is the latest digital asset firm to enter the Middle East and Northern Africa (MENA) region.On Oct. 10, OKX announced the launch of a new exchange regulated by the Virtual Assets Regulatory Authority (VARA) of the United Arab Emirates (UAE) to offer regulated spot and derivatives markets for digital assets.

🛠️ Ethereum cofounder Vitalik Buterin outlines possible areas of improvement for the protocol:Though Vitalik Buterin believes Ethereum’s proof-of-stake implementation has “performed remarkably well” in terms of stability, performance, and avoidance of centralization risks, he outlined what can still be improved in its technical design in a post on his personal website.

🚀 Optimism rolls out fifth airdrop, allocates 10.3 million OP tokens to 54,000 Superchain users:Layer 2 network Optimism rolled out its fifth airdrop, distributing 10.3 million tokens (worth about $16 million) to 54,700 user addresses. The airdrop specifically rewarded users interacting with Superchain, an ecosystem of blockchains developed with the OP Stack.

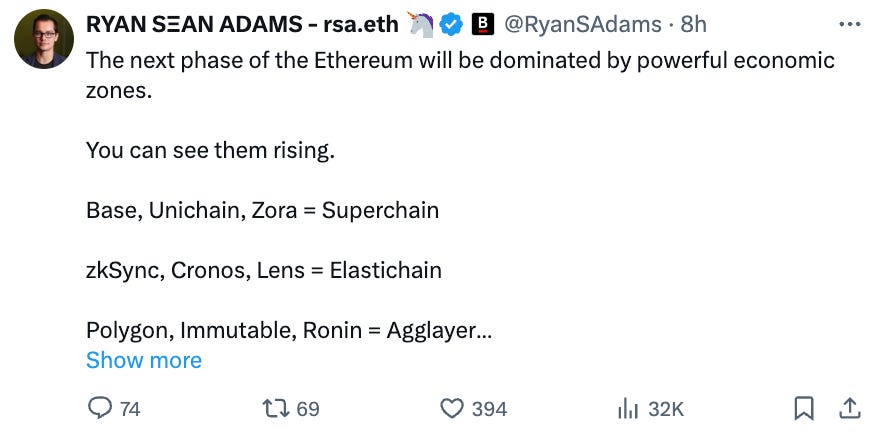

💬 Tweet of the Week

Source: @RyanSAdams

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

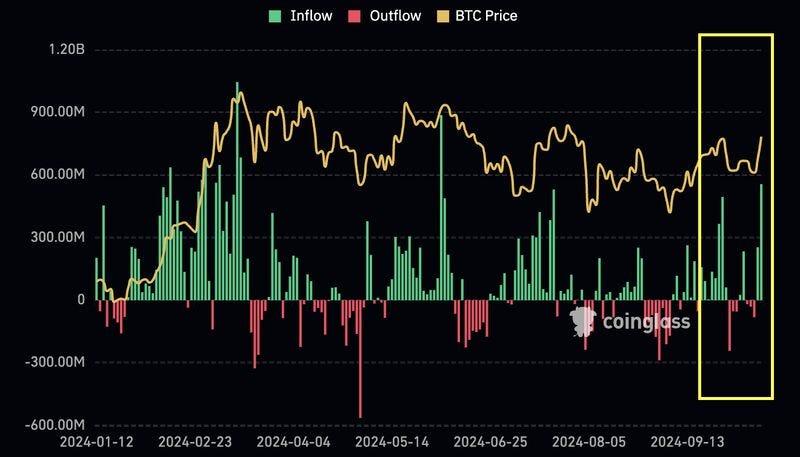

1. Yesterday over $555M Bitcoin ETF net inflows occurred, the most daily volume since the first week of June. During this time, BTC increased by 7% while trading volumes are now up 17% on the day.

Since the Fed cut rates on September 18th, total BTC ETF inflows have surpassed $1.98B and BTC has moved from $58K to over $67K, its highest levels since July.

Source: @DavidShuttleworth

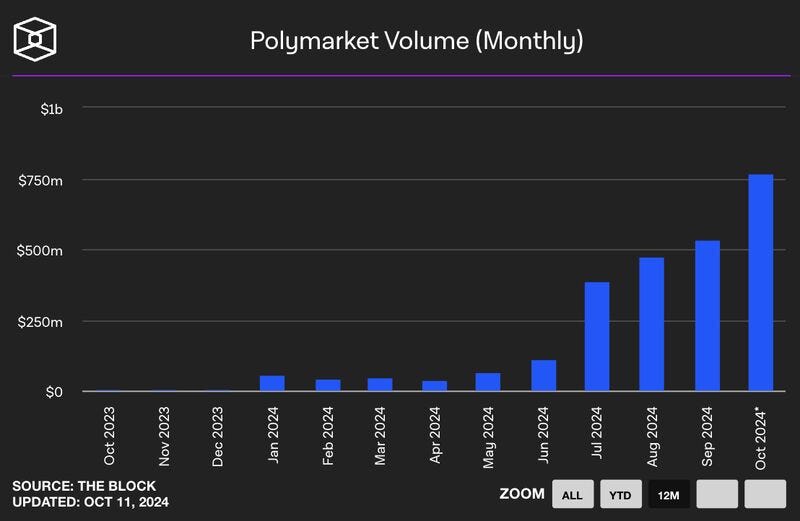

2. And there we have it, monthly volume on Polymarket for October flipped the entire volume in September by more than 43% and is at $766M less than 2 weeks into the month.

To no surprise, the presidential election outcome leads the way with $571M (compared with $189M last month), followed by the popular vote winner ($40M), and the identity of Satoshi on HBO's Bitcoin documentary ($20M).

Source: @DavidShuttleworth

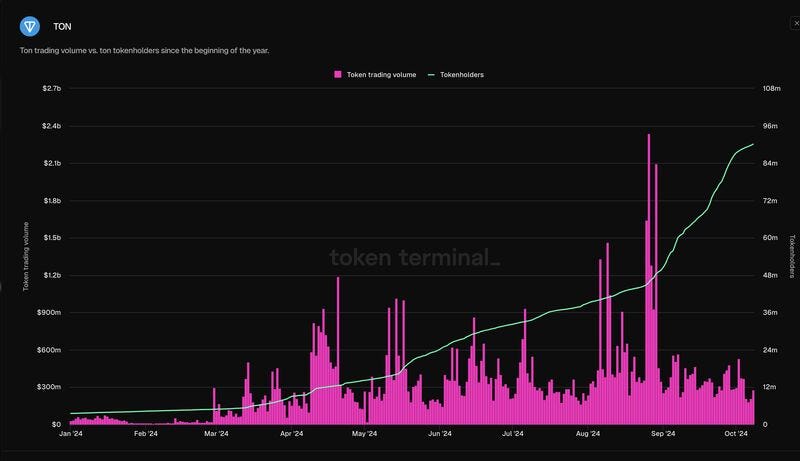

3. Token holder distribution of TON has grown by 2400% this year, as the total number of TON holders now stands at 90M. To put this into perspective, OP and ARB have about 1.2M and 1.4M holders, respectively, while ETH has about 220M.

Source: @DavidShuttleworth

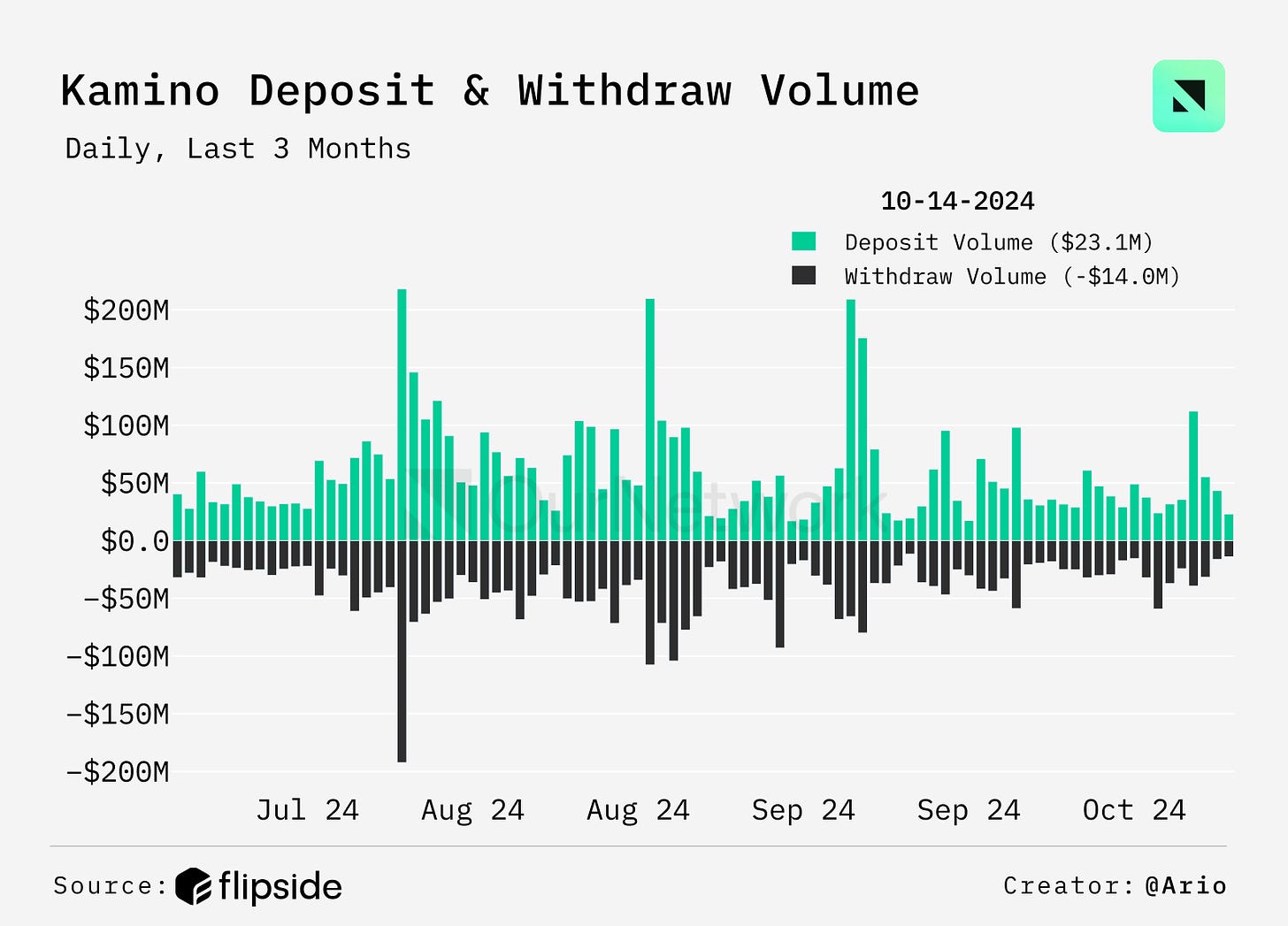

4. $1.74B Net Supply Over the Past 90 Days

Source: @OurNetwork

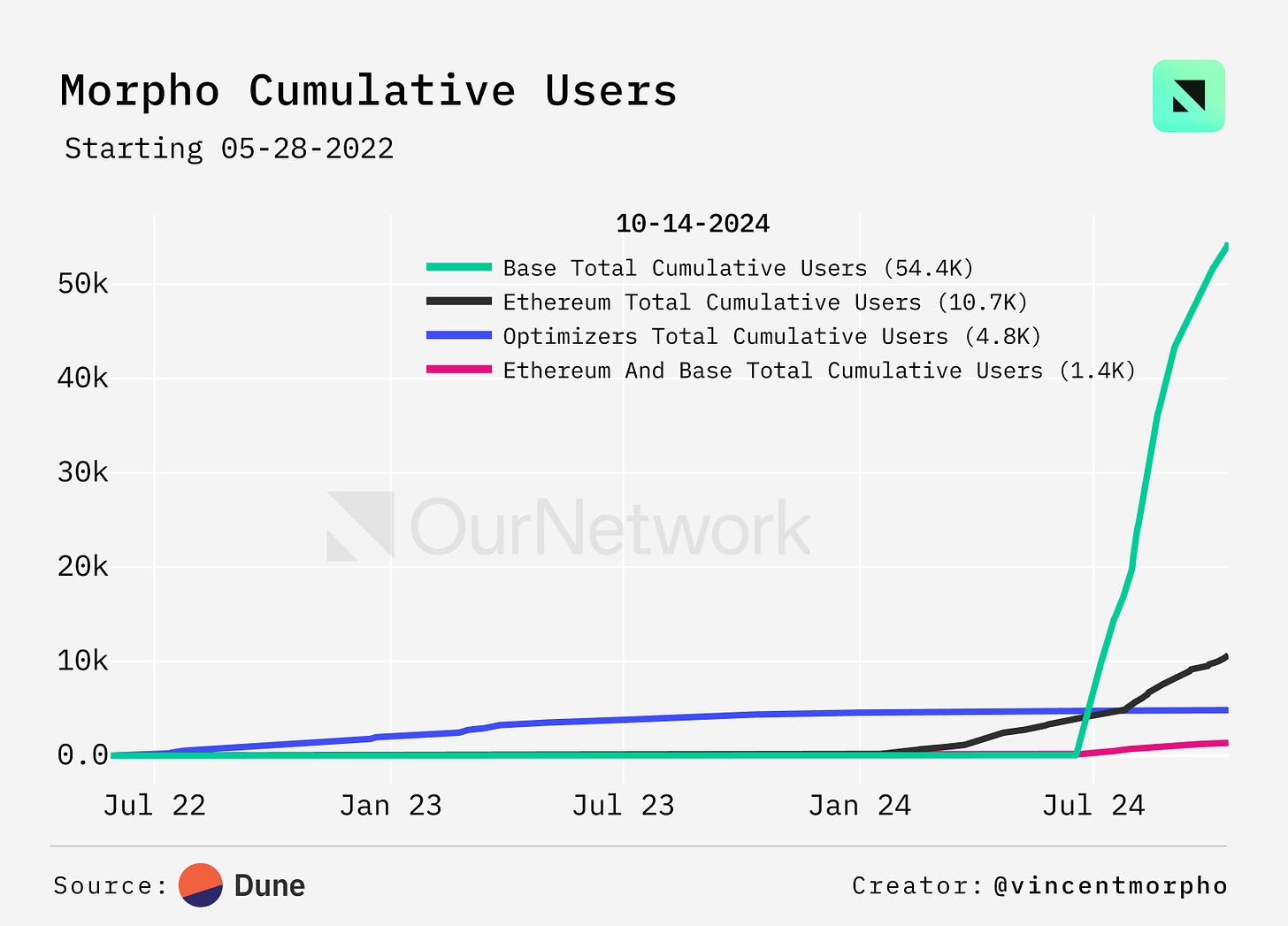

5. Morpho Crosses $1.6B+ in Deposits, 68k+ users

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: 1995 Digital Asset Research, serves actionable insights, market research, and Web 3 Tech Tutorials for informed investing. This is an excerpt from the full article, which you can find here.

Introduction

This week should be a critical tipping point with the crypto market on the precipice of a major expansion. In many respects we are already seeing very substantial gains in our portfolios since aggressively buying at our signal from the August lows. However, if we continue at the current rate we are likely about to experience the most significant rise in crypto history.

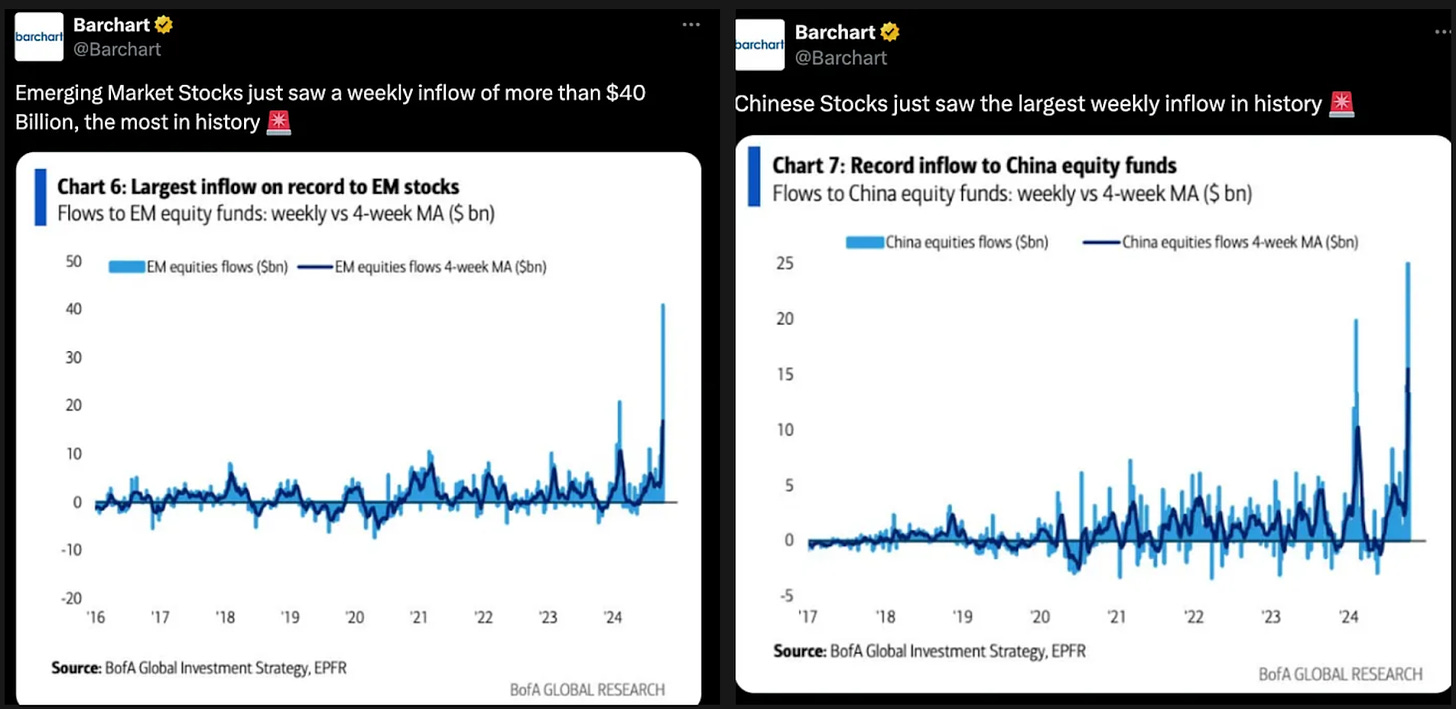

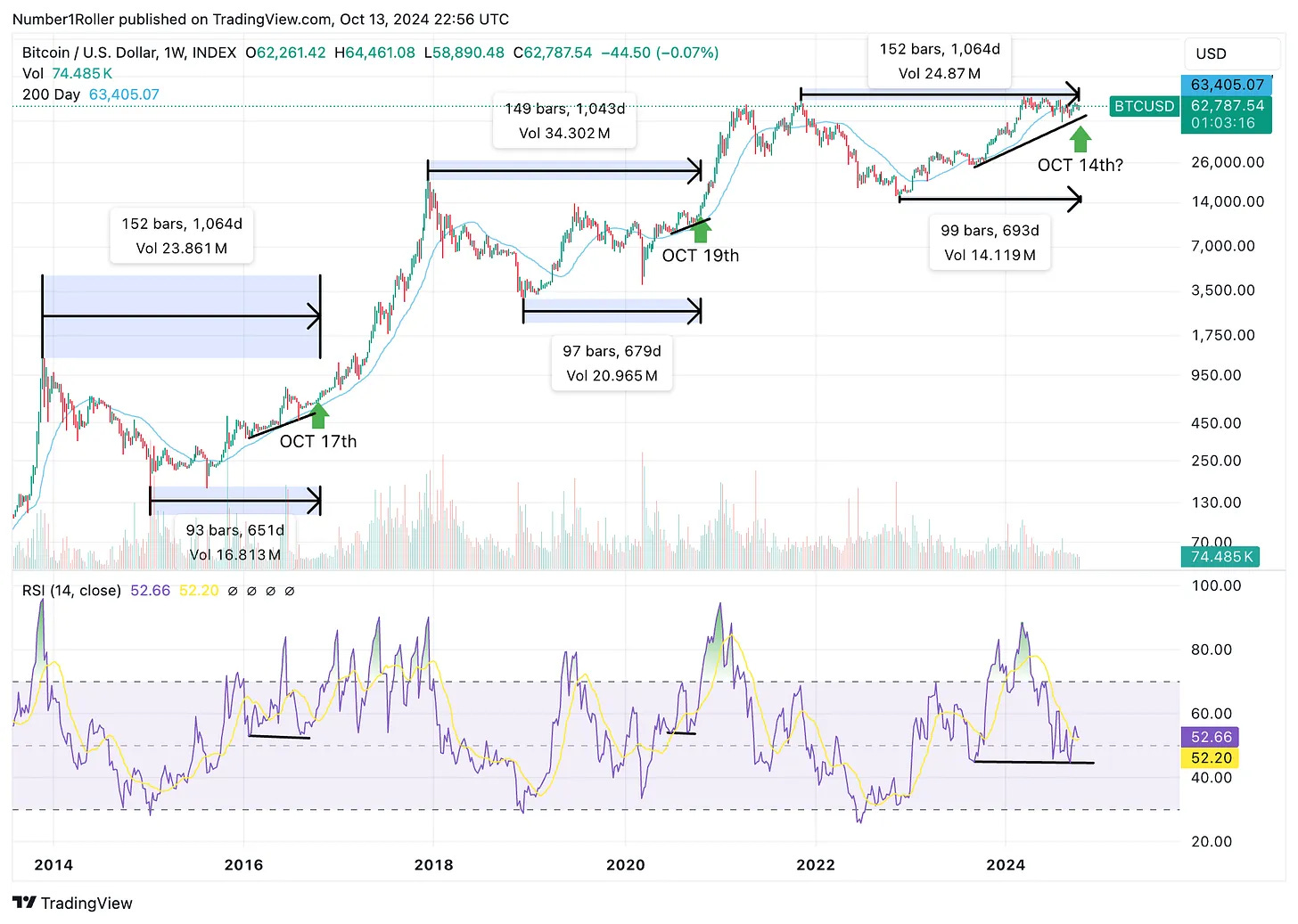

If you have been paying attention, records have been getting smashed all across different asset classes, global liquidity is rapidly rising with China joining the party in a big way, companies are reporting record earnings, mergers and acquisitions are making historic deals and above all TIME is giving us the signal.

The crypto market will not remain immune to these conditions for much longer and the time to own assets is now.

Today, we’re going to show you why we are sitting right in the sweet spot before takeoff and why you will not get another chance to buy once this train leaves the station.

First a simple look at the Bitcoin cycle.

As you can see the sweet spot for the last three cycles has fallen between roughly 93 weeks from the bottom and 152 weeks from the previous top. This is a very simple overview but theres really no need to complicate it.We showed you two weeks ago how the structure of the market was changing due to time. We also showed you the striking similarities between today’s price action and the price action we had exactly a year ago.

Additionally, we can see the tendency of BTC to start its move in the second half of October particularly in the week which we are now entering. Lastly, we have one of our most powerful RSI signals showing a very high time frame bullish reversal.

Remember, sentiment was that September = bad and it turned out September was good. Then it was, October = good but so far it has been lackluster. Something we warned about…until now. As of the lows last week, sentiment reset to where the predominating emotion is fear and uncertainty. We also have general trend interest in BTC hitting a four year low. This all corresponds to the same setup we had a year ago.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.hypelab.com