Learn More at www.crowdcreate.us and www.sdm.co and www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 330k weekly subscribers. This week BTC hit a new all time high at $122k, Bitcoin ETFs saw a record $1.2B inflows, and big new rounds from Pump.fun ($600M) and Upex ($200M) came in.

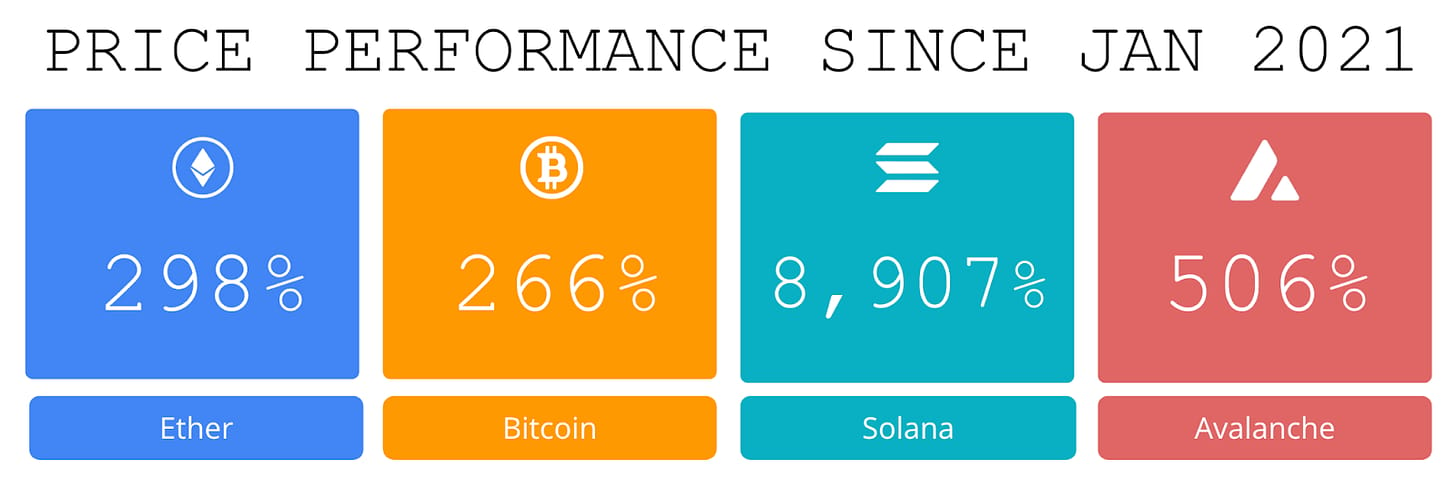

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Looking to scale your brand and drive real engagement? Crowdcreate is a top-rated marketing agency specializing in marketing strategy, influencer marketing, PR, outreach, crowdfunding, social media management, and investor marketing. With 700+ successful projects—including Sandbox, KuCoin, BitMex, and Star Atlas—we’ve helped raise over $250 million and supported startups and Fortune 500 companies with data-driven strategies. Learn more: crowdcreate.us

Secure Digital Markets (SDM) is a full-service crypto dealer offering spot trading, derivatives, and collateralized lending. We serve HNWIs, institutions, miners, protocols, and OTC desks, providing deep liquidity across 40+ assets with T0–T+1 settlement. Clients can borrow up to $250M at 7.5%–10.5% with 65% LTV on select top 50 assets. Our U.S.-based derivatives desk offers TRS, NDFs, options, and structured products designed for hedging, yield generation, or directional strategies.

Learn more: www.sdm.co

Contact: [email protected]

Get out Free Q2 Treasury Report: https://research.sdm.co/source2

Award-winning Amphibian Capital, managing $145MM+ AUM, is a fund of the world's leading hedge funds. +20.4% net 2024 approx with their USD fund, +14.1% net BTC on BTC in 2024 (*+152% in USD terms), and +17.3% net ETH on ETH in 2024 (+71.2% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com.

Become a Coinstack Sponsor

To reach our weekly audience of 330,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

Bitcoin's Role Is Expanding Across Capital Markets

Bitcoin’s role in global markets continues to shift—and Q2 2025 marked a significant acceleration point.

While headlines in the equities markets focused on geopolitical volatility and rate policy, the elephant in every crypto room has been Bitcoin’s emergence on corporate balance sheets. With over 140 public companies buying over $90 billion of BTC, Bitcoin is no longer a speculative asset. It’s becoming a cornerstone to modern treasury management strategies.

In SDM’s Q2 2025 Market Report, we outline the structural changes reshaping crypto markets—from treasury allocation and ETF pressure to derivatives growth and regulatory clarity. The report is a data-driven look at how institutions are positioning for what’s next.

Key Signals from Q2:

$91B in corporate BTC holdings. Public companies added 243,000+ BTC in the first half of the year—outpacing ETFs in net accumulation.

Spot ETFs are tightening supply. With ~900 BTC mined per day, ETF inflows are absorbing new issuance at nearly six times the pace.

Altcoins bifurcate. Assets like ETH, SOL, and XRP attracted capital on the back of regulatory clarity and utility. Meanwhile, hype-driven names saw outflows.

BTC options volume reached $60B. Derivatives are no longer a niche—they’re a core part of institutional strategy for risk management and yield structuring.

Global regulatory progress accelerated. From the U.S. GENIUS Act to MiCA in the EU and sandbox initiatives in the UK, frameworks are falling into place.

The current cycle marks a clear departure from crypto’s earlier phases. Bitcoin has moved beyond its role as a speculative hedge—it’s now a strategic reserve embedded in institutional frameworks. Capital isn’t just flowing into BTC; entire financial strategies are being structured around it.

📥 Download the full Q2 report from Secure Digital Markets to dive deeper into market shifts, portfolio strategy, and emerging trade ideas.

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 Bitcoin sees fresh all-time highs: The price of Bitcoin hit a new all-time high according to crypto exchange Coinbase, which showed a new peak of about $122,900.

📈 Bitcoin ETFs see record $1.2B inflow as market hits all-time high in dollars: US-based spot Bitcoin ETFs saw a dramatic uptick in investor activity as the top crypto price reached a new all-time high.

⚖️ Trial starts for Tornado Cash developer Roman Storm in New York: The criminal trial of Tornado Cash co-founder and developer Roman Storm began Monday in federal court in Manhattan, where jurors will weigh whether he knowingly helped launder more than $1 billion in cryptocurrency linked to cybercriminals, including North Korea’s Lazarus Group.

⚖️ Federal Reserve, FDIC and OCC clarify rules for banks holding crypto for customers in joint statement: U.S. federal banking agencies released a joint statement setting out how existing rules apply to banks holding crypto on customers' behalf, marking the latest move by regulators to clarify how banks can engage with the burgeoning industry.

⚖️ Grayscale confidentially files draft IPO paperwork with US SEC:Crypto asset manager Grayscale Investments has confidentially submitted a draft registration statement for an initial public offering to the U.S. Securities and Exchange Commission, according to a Monday announcement.

💬 Tweet of the Week

Source: @Breedlove22

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. In less than 2 months, SBET (SharpLink Gaming) has become the largest ETH treasury on the planet, amassing over 280,000 $ETH (~$836M) and surpassing Ethereum Foundation. In June alone, SharpLink increased their ETH holdings by a staggering 59%.

Meanwhile, the underlying SBET stock is up 90% month-over-month and 365% since the treasury strategy launched in May.

Source: @DavidShuttleworth

2. Open interest on PUMP futures jumped 275% over the weekend, surpassing $690M, and is now the 13th highest across all digital assets, just behind AAVE ($729M) and LINK ($742M).

Source: @DavidShuttleworth

3. Historic week for BTC ETFs. For the first time ever, Bitcoin ETFs had back-to-back days with over $1B in net inflows:

Thursday, July 10th: $1.17B

Friday, July 11th: $1.03B

Notably, BlackRock's IBIT accounted for 84% ($1.85B) of all inflows during this period. This pushes BlackRock's total Bitcoin holdings to roughly 706,000 BTC, which represents more than 3.3 % of the total circulating supply.

Overall, more than $2.72B poured into BTC ETFs this week, the most since May and the third largest of 2025. It also marks the 5th consecutive week of positive inflows.

Source: @DavidShuttleworth

4. Avalanche Dominates Across RWA Tokenization $192.8M, subnet scalability 14M+ daily transactions, and cost efficiency near-zero gas fees.

Source: @OurNetwork

5. Sui Ecosystem Hits $1.8B TVL, Led by Lending Protocols and Growing Stablecoin Demand

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

On a week where BTC has hit an all-time high above $118,000, welcome to OurNetwork’s latest. Below we have coverage from six stellar analysts covering six major Layer 1s.

Leading off is Tanay on Ethereum, which hit its highest transaction mark since 2021. yasmin dug into Avalanche's momentum in the RWA space. Biff covered Sui's explosive stablecoin growth. Haley chronicled Aptos’ own RWA expansion, while Seoul Data Labs examined Plasma, the highly anticipated stablecoin-focused chain. Syed wrapped up with Sei's gaming sector traction.

Prices are up and time is short. Let’s get into it.

– ON Editorial Team

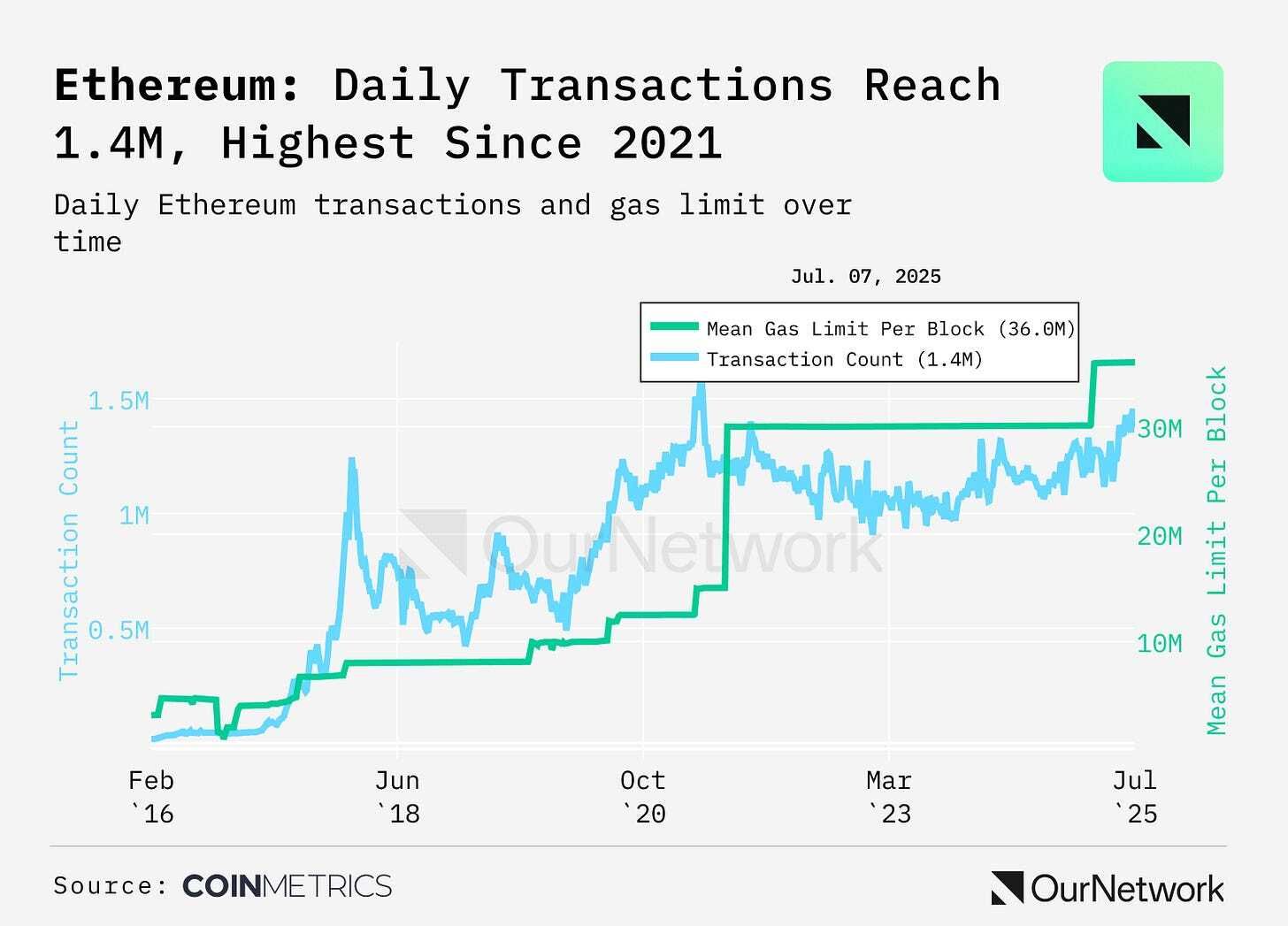

📈 Ethereum Mainnet Transactions Hit a 3-Year High of 1.4M as Stablecoin Transfer Volumes Average a Record $30B

Ethereum has sustained its dominance as a hub for stablecoins, with 55% of total supply, or nearly $140B residing on Ethereum mainnet. Another $10.5B are also natively issued on Ethereum Layer 2s (L2s), fueling their use across rollups like Arbitrum, Base and Optimism. The 30-day average adjusted transaction volume across Ethereum stablecoins reached a record-high of $31B in April. As stablecoin issuance and economic activity rise, they can create a feedback loop for ETH demand and utility.

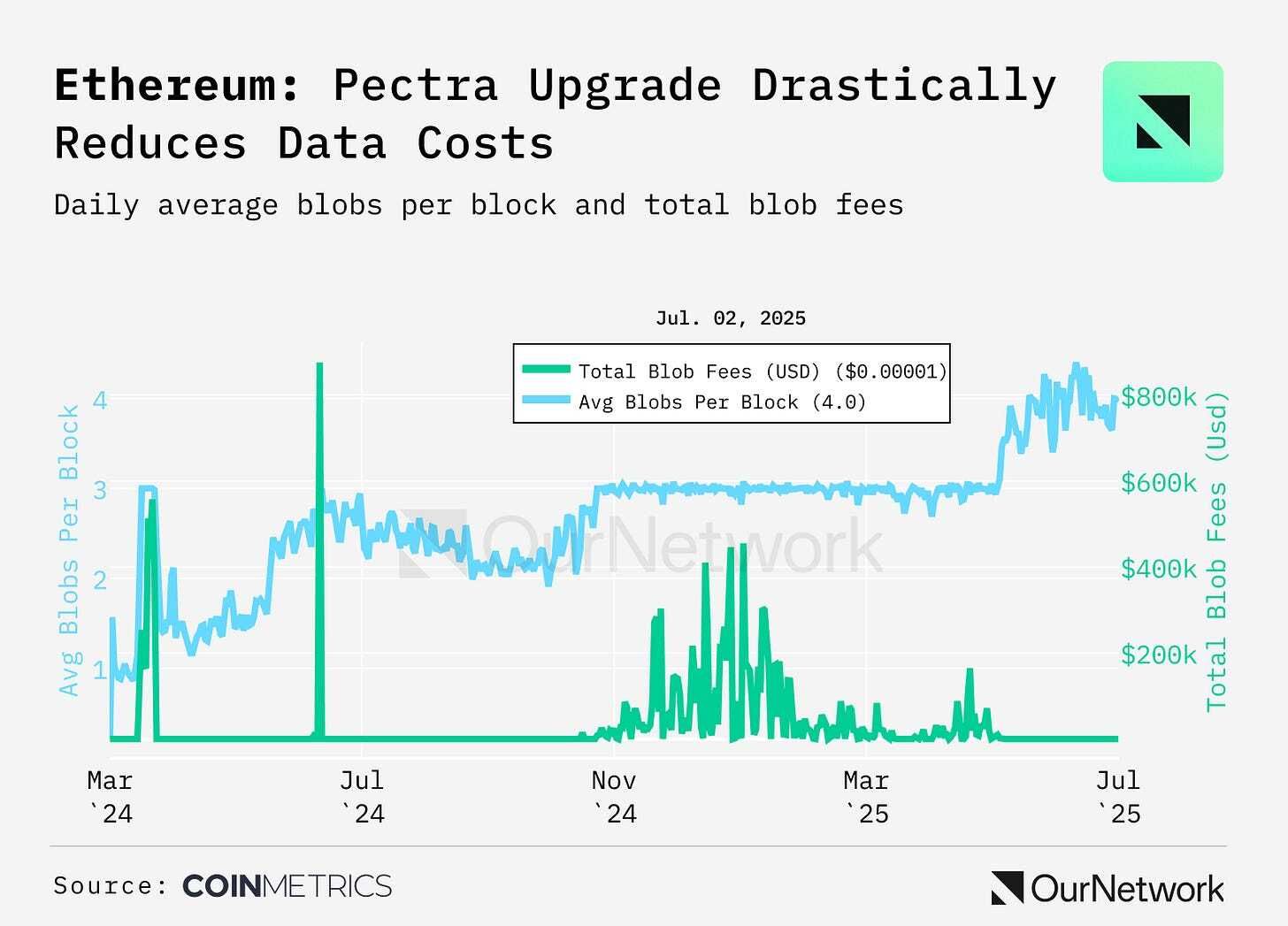

The Pectra upgrade went live in May, enhancing Ethereum’s staking efficiency and L2 scalability. 35.5M ETH, or 29.4% of supply, is now staked. EIP-7691 raised the blob target from 3 to 6, doubling blob capacity. This has reduced data costs, and enabled greater rollup transaction throughput and adoption.

Blobs posted daily rose from ~21,300 to ~28,000 (~4 per block) after Pectra, but underused space keeps blob fees minimal at ~$0.000009. The base layer is scaling in parallel. Transactions on mainnet reached 1.4M, the highest level since November 2021, supported by recent block gas limit increases.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.crowdcreate.us and www.sdm.co and www.amphibiancapital.com