Learn More at www.rootstock.io and www.kuladao.io and www.crowdcreate.us

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 320k weekly subscribers. This week Bitcoin transaction fees hit 2025 highs, spot Bitcoin ETFs hit $109 billion in AUM, the SEC delays decision on Bitwise and 21Shares Solana ETF applications, and new venture rounds close from KYD Labs ($7M) and XP ($6.2M).

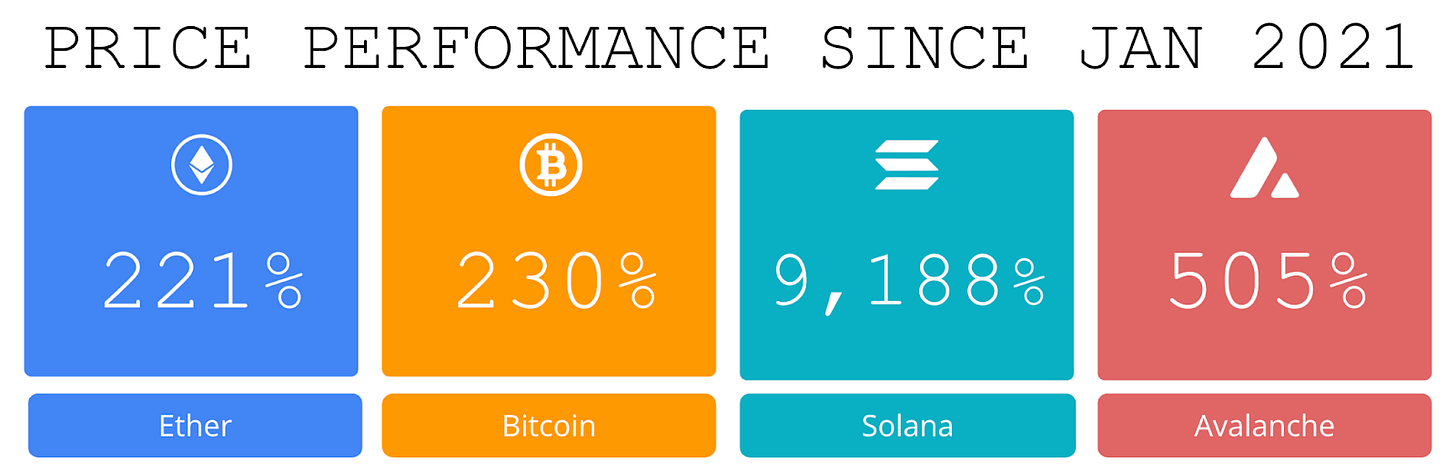

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 60%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Kula is a decentralised impact investment firm that transforms overlooked assets into shared prosperity and thriving communities by re-shaping how value and opportunity are recognised worldwide. By tokenising real-world assets, we provide opportunity, transparency, and financial sovereignty to historically excluded communities. Our model aligns economic growth with sustainable development, ensuring that wealth is not extracted but reinvested into the communities that generate it.

Looking to scale your brand and drive real engagement? Crowdcreate is a top-rated marketing agency specializing in marketing strategy, influencer marketing, PR, outreach, crowdfunding, social media management, and investor marketing. With 700+ successful projects—including Sandbox, KuCoin, BitMex, and Star Atlas—we’ve helped raise over $250 million and supported startups and Fortune 500 companies with data-driven strategies. Learn more: crowdcreate.us

Become a Coinstack Sponsor

To reach our weekly audience of 320,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

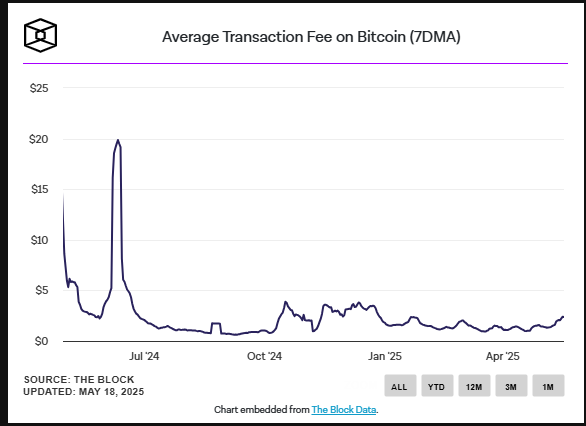

⚖️ Bitcoin transaction fees hit 2025 highs as BTC price challenges recent $109,000 top: The price of bitcoin hit $109,700 today. BTC dipped shortly after, and currently trades around $107k. Transaction fees also hit a 2025 high, signaling growing demand for blockspace. The US Senate’s advancement of the bipartisan GENIUS Act, focusing on stablecoin regulation, has bolstered market sentiment.

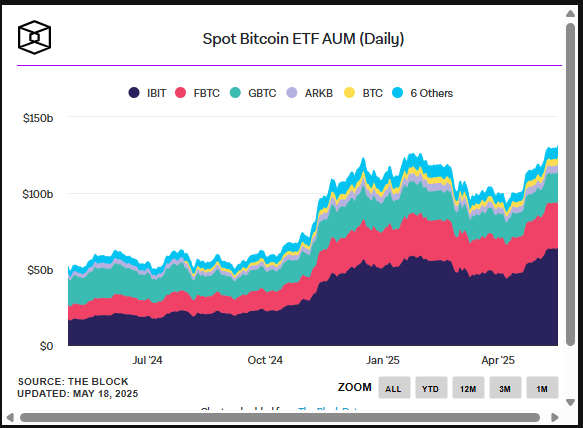

⚖️ Spot Bitcoin ETFs hit $109 billion AUM as institutional adoption accelerates globally: Assets under management (AUM) in spot bitcoin exchange-traded funds (ETFs) have reached a record $109 billion, underscoring the growing role these vehicles play in expanding institutional access to digital assets.

⚖️ SEC delays decision on Bitwise, 21Shares Solana ETF applications, opens public consultation: The US Securities and Exchange Commission (SEC) extended its review of two high-profile proposals for spot Solana (SOL) exchange-traded funds, signaling further delays in the approval process for crypto-linked investment products. The agency said it would begin a new round of proceedings to assess whether the ETF proposals from asset managers Bitwise and 21Shares comply with key provisions of the Securities Exchange Act.

🚀FTX creditors poised to receive $5B by May 30 in latest distribution round:FTX Recovery Trust will begin distributing over $5 billion to creditors on May 30 as part of the company’s Chapter 11 Plan of Reorganization, according to a May 15 statement issued by the Trust.Holders of allowed claims in both Convenience and Non-Convenience Classes who have completed the required pre-distribution steps will receive the funds.

⚖️ TON-based NFT marketplace MRKT launches as a Telegram mini app: MRKT, a new TON-based NFT marketplace, has launched inside Telegram as a native mini app. It lets users buy, sell, and trade digital collectibles such as gifts and stickers directly within Telegram chats.

💬 Tweet of the Week (Bullish)

Source: @santimentfeed

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. As Bitcoin approaches a new all-time high, BTC liquidity on exchanges has hit record lows. Total reserves across exchanges are down 20% since November and 12% YTD to just 2.4M BTC, and continue to trend downward.

Meanwhile, BTC ETF inflows have surpassed $3.3B this month with 11 days to go, futures open interest is nearing a record $72B, and MicroStrategy (now Strategy) just bought another 7,390 BTC ($775M).

Buckle up.

Source: @DavidShuttleworth

2. A big milestone for Sui Foundation this week: total circulating supply of stablecoins on the network just surpassed $1B for the first time, growing by $657M (177%) since January.

Meanwhile, native Circle USDC on Sui has grown to $738M, a 7x jump from $100M in November.

Source: @DavidShuttleworth

3. Total stablecoin liquidity on Hyperliquid has just surpassed $3B for the first time and has now grown by 53% ($1.06B) since April. Virtually all it is $USDC.

For perspective, Hyperliquid now ranks as the 5th largest chain by total USDC in circulation, rapidly closing the gap on Base ($3.7B).

Over the same period, total open interest on the protocol has doubled, reaching nearly $6B.

Source: @DavidShuttleworth

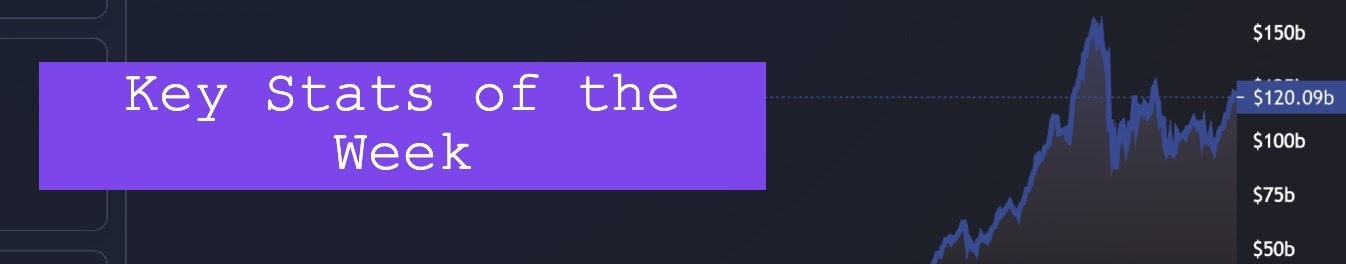

4. 📈 Since Peaking in January, Solana Stablecoin Supply has Dipped as Peer-to-Peer Volume Keeps Up, Showing Faster Coin Velocity and a Healthy DeFi Ecosystem

Source: @OurNetwork

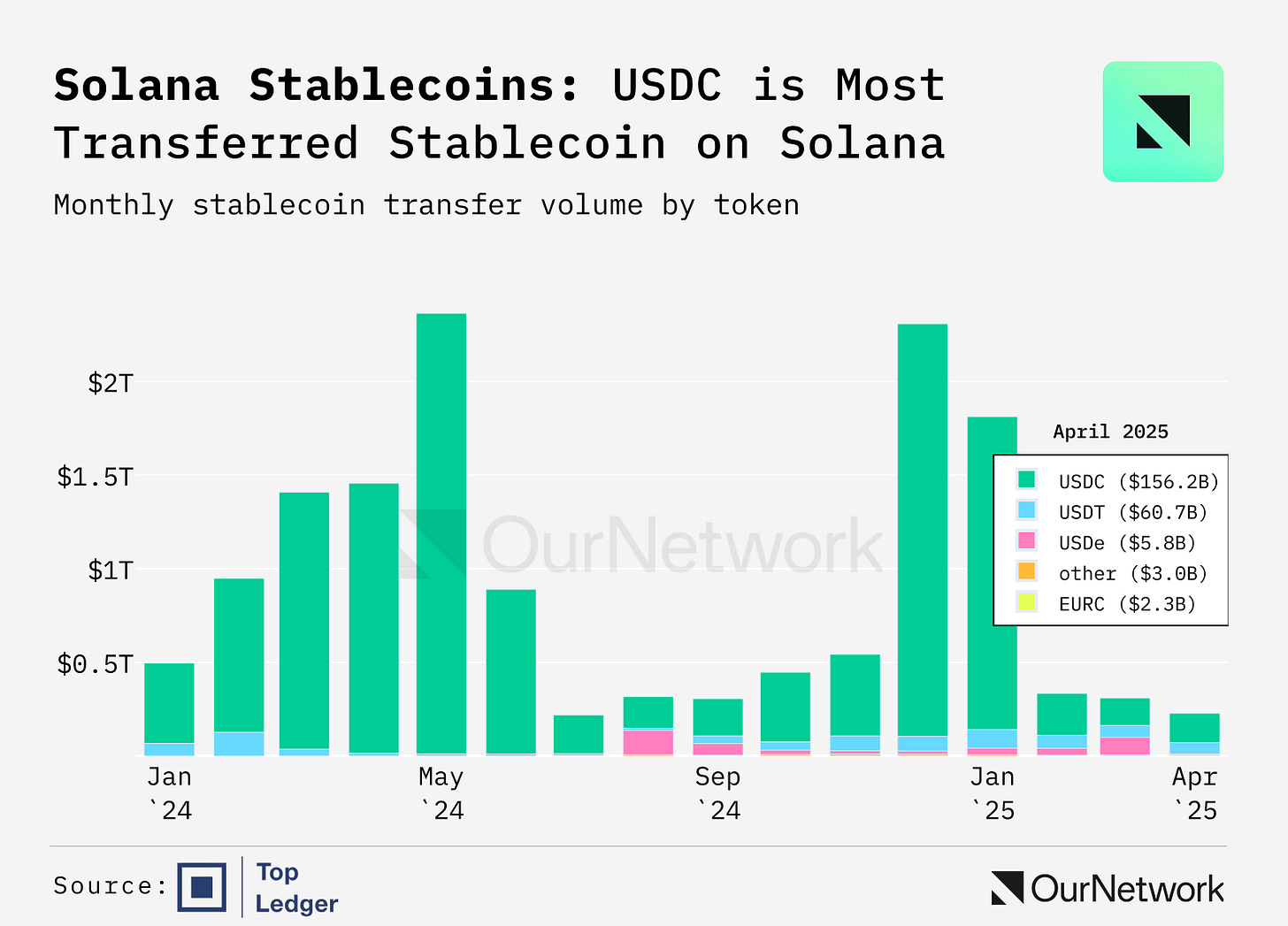

5. Since 2025, account abstraction-enabled wallets have processed over $2.4B in stablecoins across 4.46M transactions. These smart wallets simplify UX with gasless transactions, passkeys, and recovery modules. Base leads with over $1B in volume and the most active wallets, while Polygon had the highest transaction count (193k), indicating strong microtransaction or app-driven activity.

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Welcome to the second installment of OurNetwork’s two-part series on stablecoins. In the first, we covered behemoths like USDT and USDS, as well as the up-and-coming EURe, which is pegged to the euro.

Below, we have coverage of another deca-billion dollar giant, USDC, as well as updates on Ethena's dual stable offerings — USDe and USDtb. OurNetwork analysts also chipped in to cover the state of stablecoins on Solana, provide an infrastructure update —account abstraction is coming—, and to report on USR, an emerging $250M-plus dollar-pegged asset with delta-neutral backing.

If it wasn't clear already, at this point it's evident that stablecoins are here to stay. Tether notched an operating profit of over $1B in Q1 2025. USDC's issuer Circle, filed to go public. And even the World Economic Forum has estimated that, at $27.6T, stablecoins' volume surpassed Visa and Mastercard's combined volume in 2024.

Let's get into it.

– ON Editorial Team

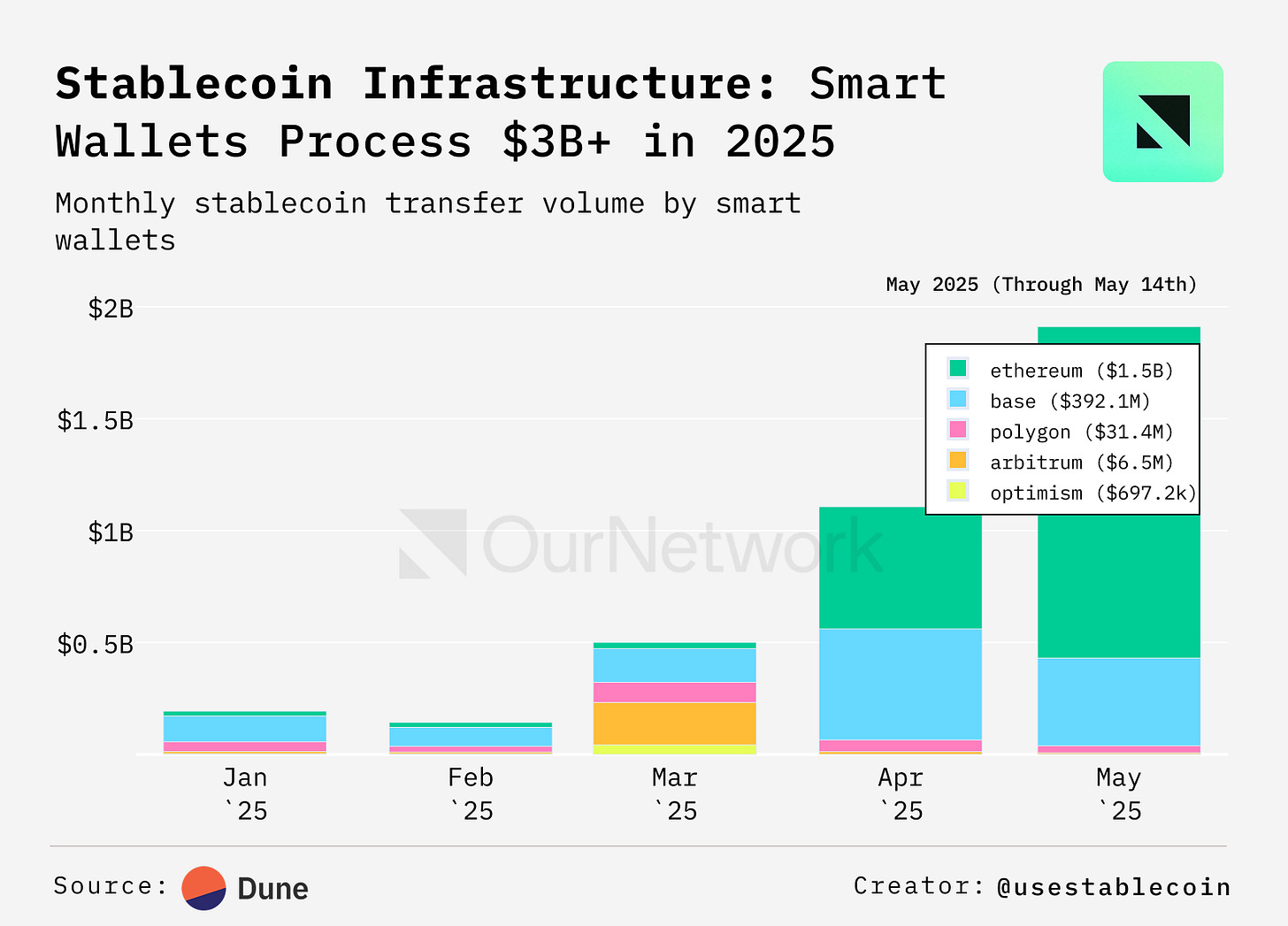

📈 Stablecoins' Market Cap Surges Past $232B, Gaining 15% Year-to-Date in 2025

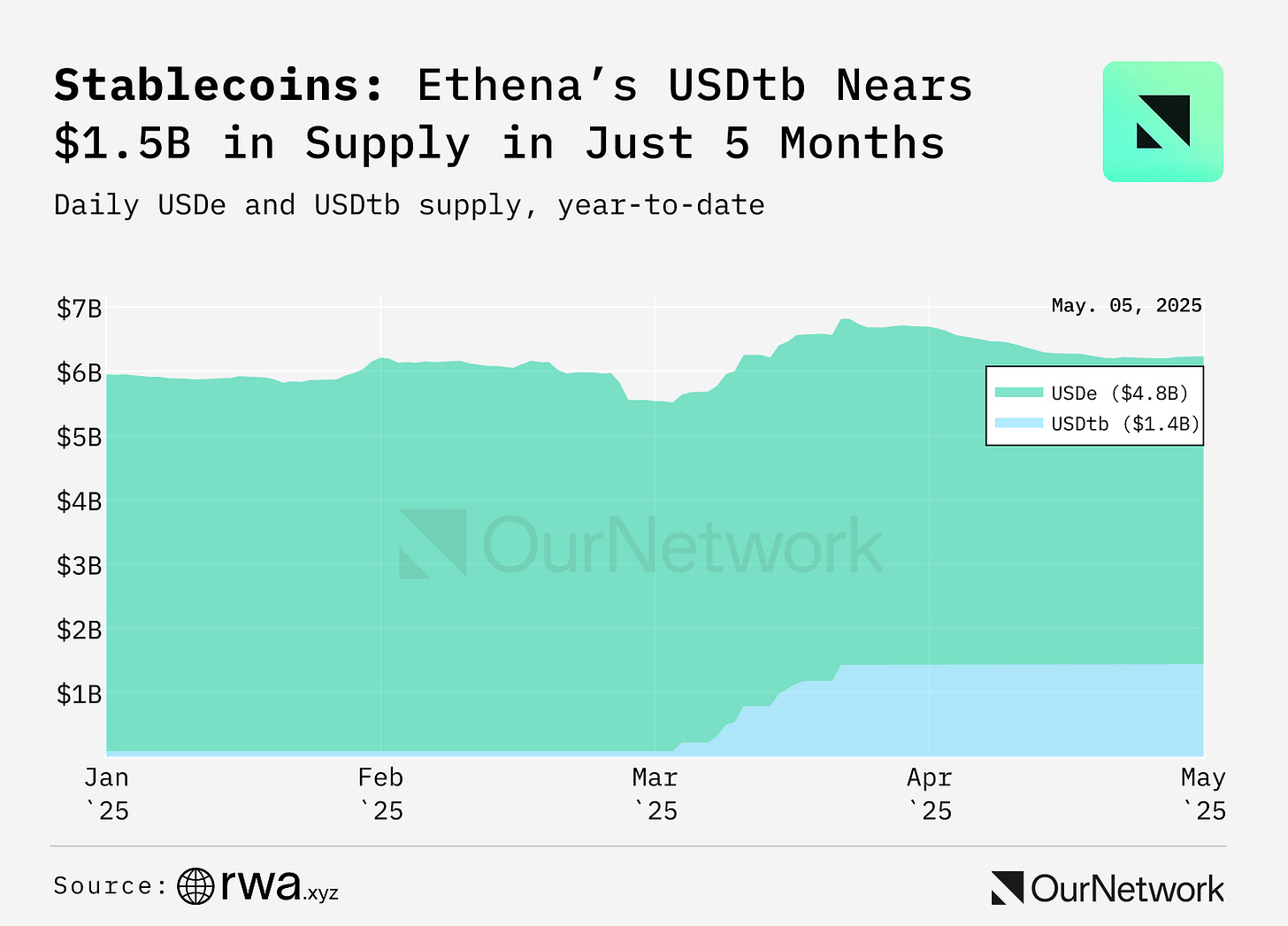

The stablecoin market grew by $30B in 2025 to reach $232B. USDT and USDC still dominate with 89% combined share, but USDT dropped from 68% to 62% due to MiCA-related delistings, while USDC rose to 26%. Sky's USDS and USDtb, issued by Ethena and backed by U.S. treasuries —primarily BlackRock's BUIDL fund— led growth among yield-bearing stables, adding over $4B. USDtb exploded from $89M to $1.4B, reflecting its expanding role in Ethena’s ecosystem as a safer alternative during volatile market conditions.

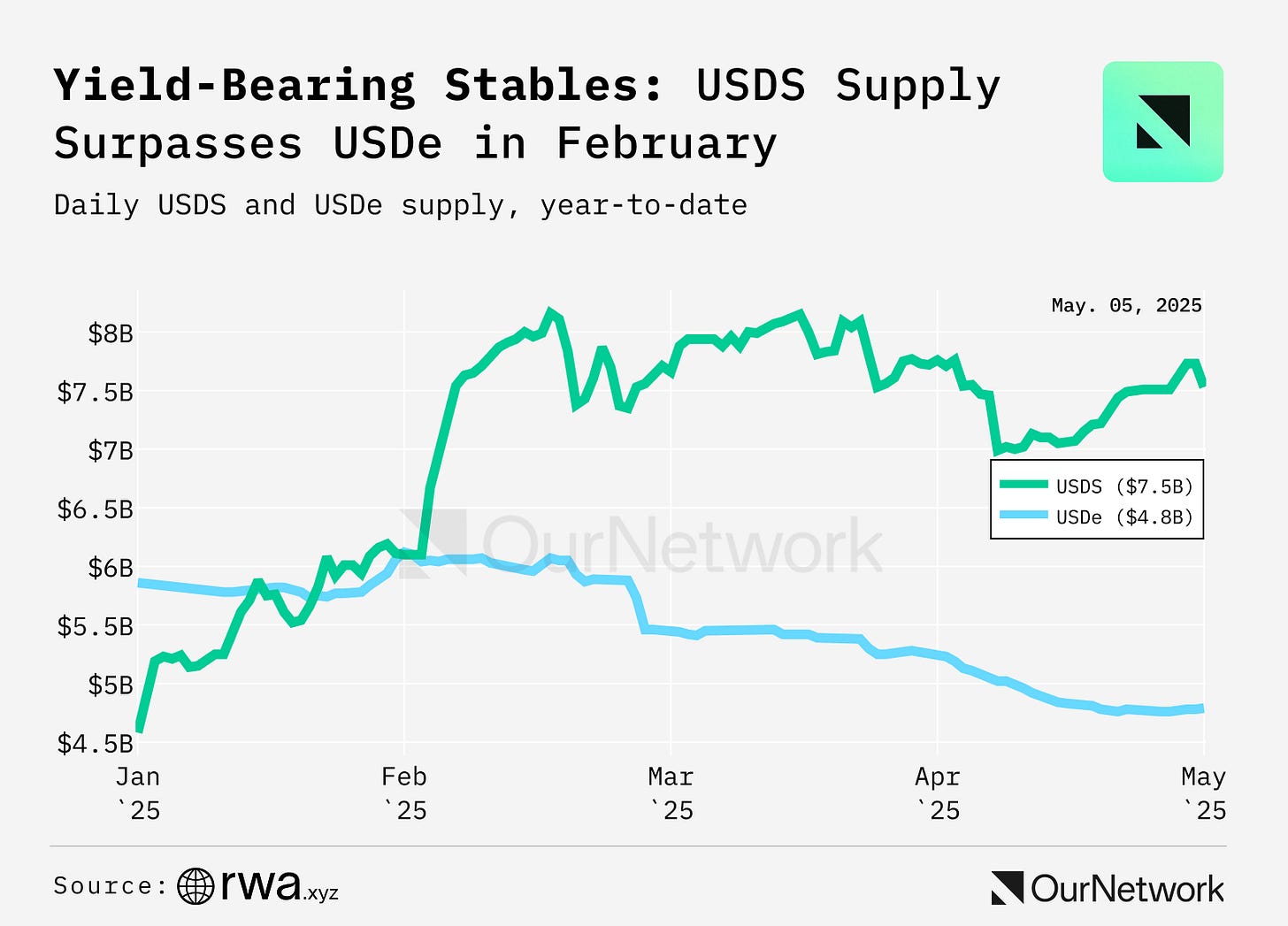

Sky’s USDS surpassed Ethena’s USDe in supply in February. As market conditions worsened and staked USDe yields tumbled from the high teens to low single digits, it fell by over $1B. Meanwhile, USDS grew nearly $3B, driven by demand for its more stable, predictable returns.

While both assets are issued by Ethena, USDtb is backed by BlackRock’s BUIDL and offers a safer alternative to USDe. When perpetuals funding turned negative, Ethena closed delta-neutral positions and shifted assets to USDtb. USDe supply fell 18% while USDtb surged 1,510%.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.rootstock.io and www.kuladao.io and www.crowdcreate.us