Learn More at https://wiselending.com/

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 150k weekly subscribers. This week we cover BlackRock’s spot Bitcoin ETF now being listed on a Nasdaq trade clearing firm, the FTX general counsel quitting, Joe Lubin facing a lawsuit over Consensys stock value, and big new venture rounds for Blockaid ($27M) and SynFutures ($22M).

Bitcoin finally turns positive since we began writing Coinstack

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Join our Daily Crypto News Roundup

We’re launching a new daily edition Coinstack that covers all the day’s news. If you’d like to join our daily edition, subscribe here.

Become a Coinstack Sponsor

To reach our weekly audience of 150,000 crypto insiders and daily audience of 50,000 subscribers, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

Thanks to Our 2023 Coinstack Sponsors…

Wise Lending is a fully decentralized liquidity market that allows users to supply crypto assets and start earning a variable APY from borrowers. Wise Lending has merged lending platform technology with yield aggregator technology to create higher APY opportunities for borrowers, which ultimately raises the interest paid to lenders across the platform.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

BlackRock’s Spot Bitcoin ETF Now Listed on Nasdaq Trade Clearing Firm: Exchange-traded fund analyst Eric Balchunas said the addition was “all part of the process” of a crypto ETF being listed and traded and a positive sign for SEC approval.

💸 Bitcoin is Surging Again - Bitcoin is rocketing higher this week, topping $35,000 for the first time since May 2022. It’s up 20% over the past five days. The famously volatile cryptocurrency has more than doubled in value this year as investors grow excited about the prospect of being able to buy bitcoin funds that trade on good old-fashioned stock exchanges

⚖️ Inside SBF's Trial: FTX General Counsel Quit after he learned of massive hole in balance sheet: The third week of Sam Bankman-Fried's criminal trial ended with the testimony of FTX's former general counsel, Can Sun, who came all the way from Japan to testify. Sun testified under a no-prosecution agreement he signed with the Department of Justice on Oct. 17, just days before his testimony, he said. Formerly an attorney at Fenwick and West, Sun joined FTX in August 2021.

⚖️ Ethereum co-founder Joseph Lubin faces lawsuit over Consensys stock value:Ethereum co-founder Joseph Lubin is facing a lawsuit from more than two dozen former Consensys employees, accusing him, Consensys and other parties of maneuvering valuable assets out of its Swiss holding company. The complaint was filed in New York state court on Thursday. It claims assets — including its web3 wallet MetaMask, partly developed by some of the plaintiffs — were transferred out of Consensys AG, leaving them with worthless shares.

⚖️ US Court confirms Grayscale ruling, says SEC must re-review bid for spot bitcoin ETF: The U.S. Court of Appeals for the D.C. Circuit issued a formal mandate to assert its August ruling that the Securities and Exchange Commission needs to reconsider the bid from Grayscale Investments to convert its flagship GBTC fund into a spot bitcoin ETF.

💬 Tweet of the Week

Source: @AutismCapital

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

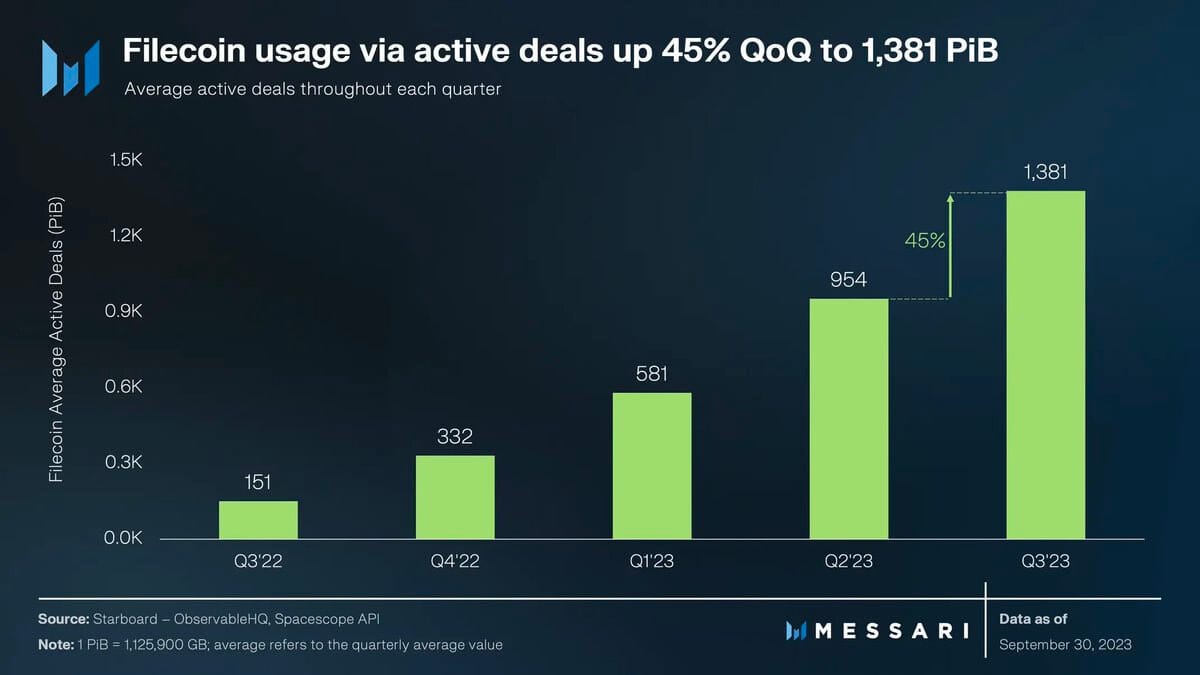

1. Filecoin’s storage market continues to grow. Active deals increased QoQ and YoY and as capacity decreased, utilization grew to almost 13%.

Source: @MessariCrypto

2. Over $102M in Bitcoin short liquidations occurred within the last 24 hours.

Source: @DavidShuttleworth

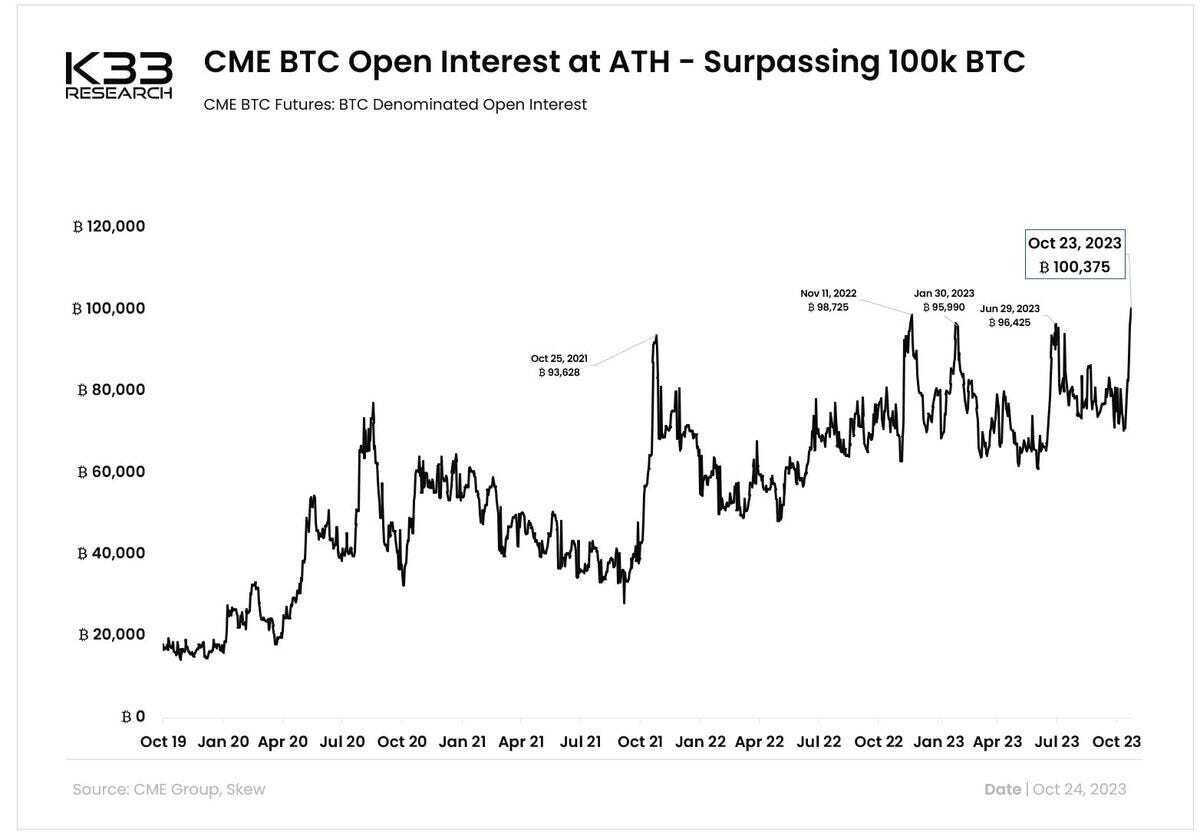

3. CME BTC futures OI has breached 100k BTC for the first time ever.

Source: @VetleLunde

4. CME's market share has pushed to a new all-time high of 25%, rapidly approaching Binance (Perps + Futures)

Source: @VetleLunde

5. CME has a market share of a gargantuan 80% within traditional expiry futures.

Source: @VetleLunde

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Muhammad Yusuf is an analyst for Delphi Digital and is the founder of Distributed Research. This is an excerpt from the full article, which you can find here.

Mixers, Pools, and Everything in Between

Blockchains were initially designed to be fully transparent. While it promotes accountability, it is a double-edged sword. If you received a salary payment on-chain, anyone with your wallet address could see how much you were paid over the years and how much you would be paid in the future.

DEXs (Decentralized Exchanges) and wallets are subject to be tracked by wallet tracking and copy trading platforms which take it even further by allowing anons to snipe well-performing traders, complicating their trading strategies. Large orders also risk being front-run by searchers in public mempools.

Before we get into dark pools, let’s distinguish between mixers and dark pools. Mixers are a subset of dark pools. Mixers like Tornado Cash mix tokens to break links between wallets and assets to make it difficult to trace the source of funds. Dark pools, on the other hand, not only break links between wallets and tokens but also help users trade amongst each other without revealing any information about the other parties.

Now that we've looked into the origins and motivations behind traditional dark pools and distinguished a mixer from a dark pool, let’s dive into blockchain-based dark pools that instill privacy in their base-level architecture with Balance models and PETs (Privacy Enhancing Technologies) such as Zero Knowledge, MPC and FHE.

Mixers, Pools, and Everything in Between

Balance Models

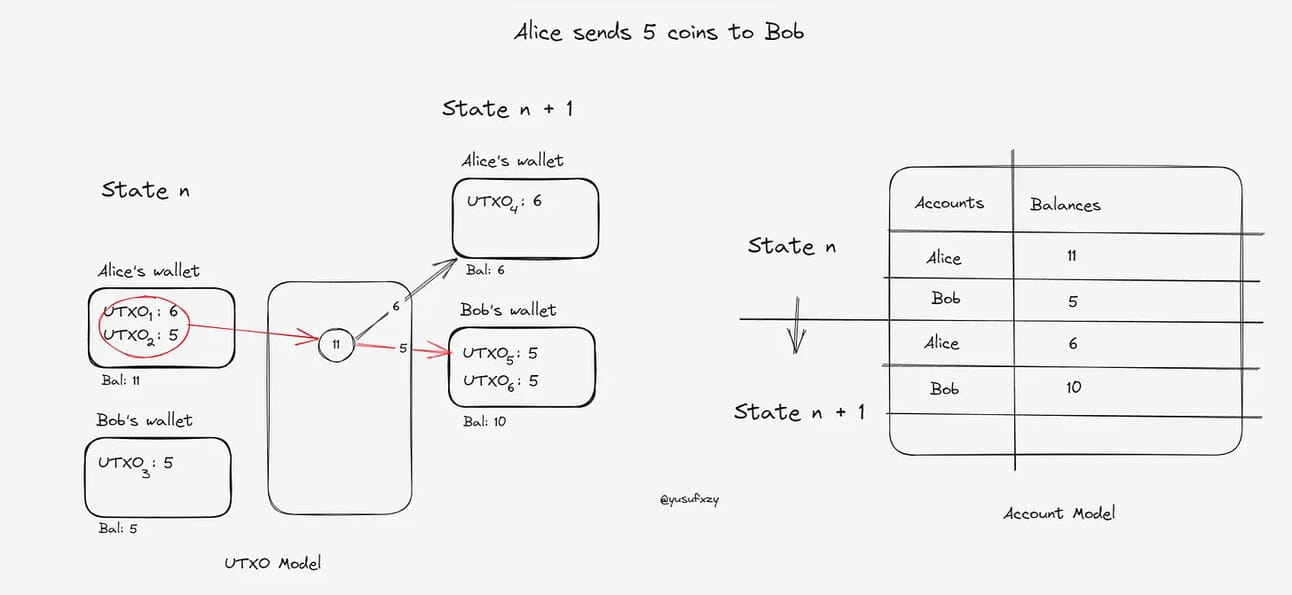

Blockchains are state machines. The state is composed of accounts and transactions. As accounts transact, with every state transition, a new set of updates is added to the chain. The balances of the accounts are also updated. Balance Models are different ways in which a blockchain tracks and manages user account balances. Blockchains such as Ethereum, Solana, and Polygon utilize the Account model and Blockchains such as Bitcoin, Zcash, and Monero use the UTXO model. These models differ in how they manage and present the state of a blockchain.

The Account model, similar to a bank account, shows the current state as a set of addresses and their balances. Whenever you make a payment, you send the exact amount, no change is left over on either side, and no new balances are created. But the UTXO (Unspent Transaction Output) model isn’t as straightforward. When you make a payment, your entire balance is transferred, burning your existing balance. The remainder of what you own is added to a new balance. The UTXO model shows the current state as a graph of all the spent and unspent outputs of transactions.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at https://wiselending.com/