Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 230k weekly subscribers. This week, iShares volume surpasses $1B, Binance to pay $4.3B in federal case, Ronin wallets hacked for $9.5M, and big new venture round for Eigen Labs ($100M) and Avail ($27M).

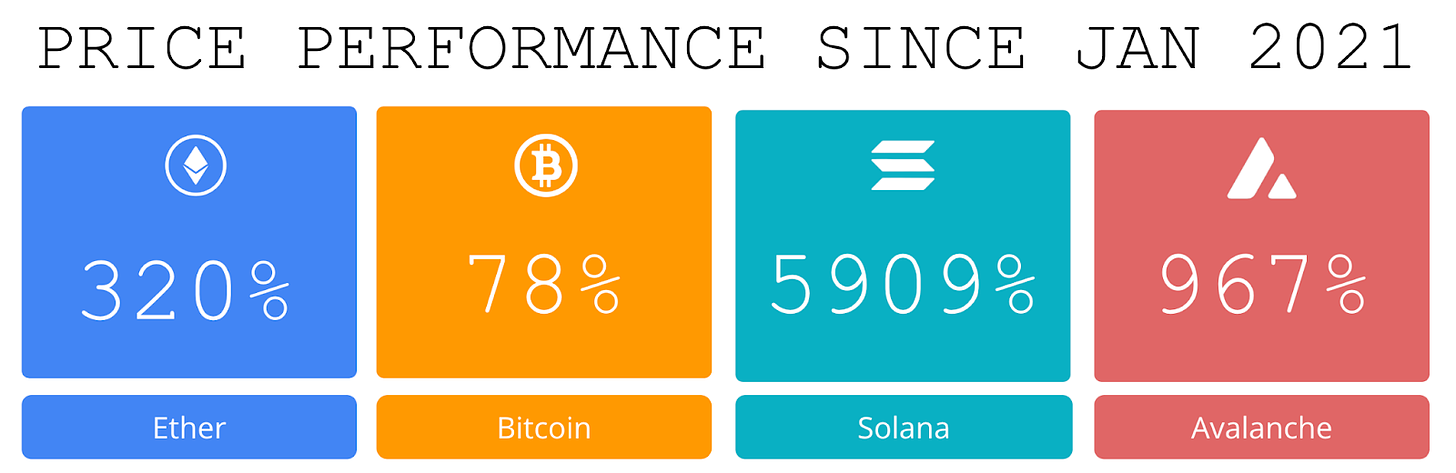

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2023 Coinstack Sponsors…

Amphibian Capital is a market/delta neutral fund of the world's leading crypto funds, returning approximately 14.43% net for '23, 195%+ net (pro-forma) since '19 and aim to deeply mitigate downside. Amphibian offers BTC, ETH and USD share classes. Deck here: www.amphibiancapital.com

Become a Coinstack Sponsor

To reach our weekly audience of 260,000 crypto insiders and daily audience of 60,000 subscribers, view our sponsor deck and schedule a call to discuss sponsoring Coinstack. We’re filling up our 2024 sponsor slots now.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 BlackRock Bitcoin ETF Trading Volume Surpasses $1B for Second Day In a Row: BlackRock’s bitcoin ETF saw $1 billion worth of trade volume with roughly two hours left in the trading day. The iShares Bitcoin Trust (IBIT) had traded nearly 32 million shares — worth roughly $1.04 billion.

🎭 Binance Must Pay $4.3 Billion In Federal Case as CZ Awaits Sentencing: A federal judge accepted a guilty plea from cryptocurrency exchange Binance along with $4.3 billion in fines and penalties to settle its case—the largest such assessment in the history of federal financial prosecutions.

⚖️ ‘Axie Infinity’ Founder’s Ronin Wallets Hacked for $9.5 Million in Ethereum:All told, about 3,250 ETH ($9.5 million) was pilfered from Ronin network wallets and sent through the network’s bridge to three separate Ethereum wallets, according to tweets from security firms PeckShield and Webacy.

⚖️ Reddit Files to Go Public, Says It Invested in Bitcoin and Ethereum: Social community platform Reddit has added Bitcoin (BTC) and Ethereum (ETH) to its balance sheet as it attempts to go public, a Thursday filing with the Securities and Exchange Commission shows.

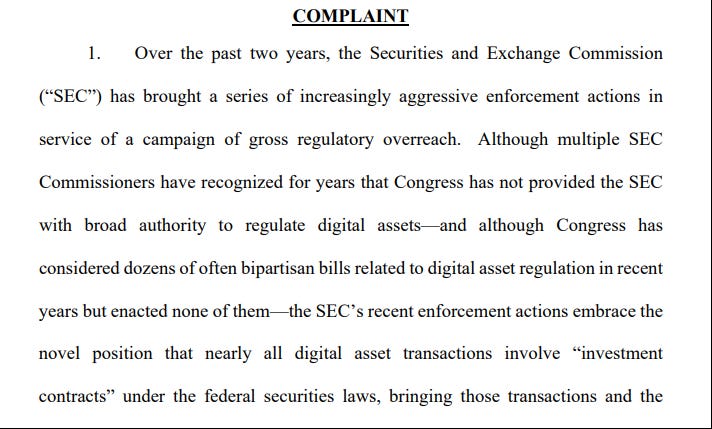

🚀 Coinbase, a16z Take SEC to Court Over 'Unlawful' Crypto Overreach: A consortium of crypto industry juggernauts is suing the U.S. Securities and Exchange Commission (SEC) in Texas, in response to years of what it calls “erroneous SEC enforcement actions.”

Coinstack Daily

We’re launching a new daily edition Coinstack that covers all the day’s news and funding announcements. If you’d like to join our daily edition, subscribe here.

💬 Tweet of the Week

Source: @EricBalchunas

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. In just 5 days after launching, Ethena Labs' USDe (an Ethereum-based synthetic dollar stablecoin) has amassed a circulating supply of over $425M. This makes it the 8th largest stablecoin in circulation, leaping right past PayPal's PYUSD.

Source: @DavidShuttleworth

2. Yesterday Consensys zkEVM Linea handled over 1.05M daily transactions, the second most in its history (1.29M) and nearly as many as Ethereum mainnet (1.1M) had on the same day.

Source: @DavidShuttleworth

3. We've now reached four consecutive weeks of institutional inflows of at least $550M, bringing the YTD total to $5.7B and driven almost entirely by Bitcoin.

Source: @DavidShuttleworth

4. AI, ETF, and GameFi have been the top 3 narratives for the past few weeks according to Kaito

Source: @KaronPangestu

5. Bitcoin MVRV Z-Score is now scoring +2 for the first time this bull cycle.

Source: @PhilipSwift

6. Top Moving Coins From the Top 100

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Ondo Finance Leads the Market in Real World Assets, Bringing DeFi and TradFi Together

Overview

Ondo Finance marries real world assets, including US Treasuries and other securities, with the transparency, accessibility, and interoperability of decentralized finance (DeFi) through the tokenization of assets and development of DeFi protocols.

Ondo works with institutional-grade asset managers and service providers such as BlackRock and Morgan Stanley.

Ondo’s product line offers accessibility to a broad array of investor types.

Unlocking New Horizons with Ondo

In 2023, the landscape of decentralized finance and the management of tokenized assets saw significant evolution, with industry leaders such as Larry Fink of BlackRock highlighting the crucial role of tokenizing assets in reshaping the financial industry. We believe that certain assets represented as tokens that move on blockchain-based rails can offer many benefits, including enhanced liquidity, democratized ownership, better security and transparency, and lower cost compared to legacy systems. The tokenized US treasury market has grown to over $850M, with Ondo Finance at the forefront. The total value of tokenized treasuries is up 7.4x since the start of 2023.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com