Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This week, BlackRock overtakes Grayscale’s GBTC, Solana’s network restarts, Celsius Network starts $3 billion payout, and big new venture round for Oobit ($25M) and Nibiru Chain ($12M).

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2023 Coinstack Sponsors…

Amphibian Capital is a market/delta neutral fund of the world's leading crypto funds, returning approximately 14.43% net for '23, 195%+ net (pro-forma) since '19 and aim to deeply mitigate downside. Amphibian offers BTC, ETH and USD share classes. Deck here: www.amphibiancapital.com

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders and daily audience of 60,000 subscribers, view our sponsor deck and schedule a call to discuss sponsoring Coinstack. We’re filling up our 2024 sponsor slots now.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 BlackRock’s spot bitcoin ETF overtakes Grayscale’s GBTC in daily volume: After Grayscale’s converted product dominated spot bitcoin exchange-traded fund daily volumes for 14 days, BlackRock’s IBIT overtook GBTC for the first time on Thursday.

🛑 Solana network restarts after outage that lasted five hours: The Layer 1 network Solana has restarted after going dark around five hours earlier. "Block production on Solana mainnet beta resumed at 14:57 UTC (9:47 a.m. ET), following a successful upgrade to v1.17.20 and a restart of the cluster by validator operators.

⚖️ Celsius Network starts $3 billion payout after emerging from Chapter 11 bankruptcy: Celsius Network has started to distribute $3 billion worth of cryptocurrency and fiat to its creditors after officially resolving its Chapter 11 bankruptcy, 18 months after it paused user withdrawals, the company said on Wednesday.

⚖️ Judge orders Ripple to hand over financial documents after request from SEC: The regulator sued Ripple more than three years ago over what it said were unregistered sales of XRP. Last year, Southern District Court of New York Judge Analisa Torres ruled that sales of XRP to institutional investors were unlawful securities sales, but "blind bid" sales to retail were not.

⬆️ EigenLayer TVL soars after deposit cap removed: Following its decision to temporarily remove total value locked (TVL) caps for all tokens, restaking protocol EigenLayer has seen deposits on its network soar. According to information available on DeFiLlama, EigenLayer’s TVL almost doubled in the past 24 hours, from $2.16 billion to $3.84 billion at the time of writing.

Coinstack Daily

We have a new daily edition Coinstack that covers all the day’s news and funding announcements. We have 60,000 subscribers so far. If you’d like to join our daily edition, subscribe here.

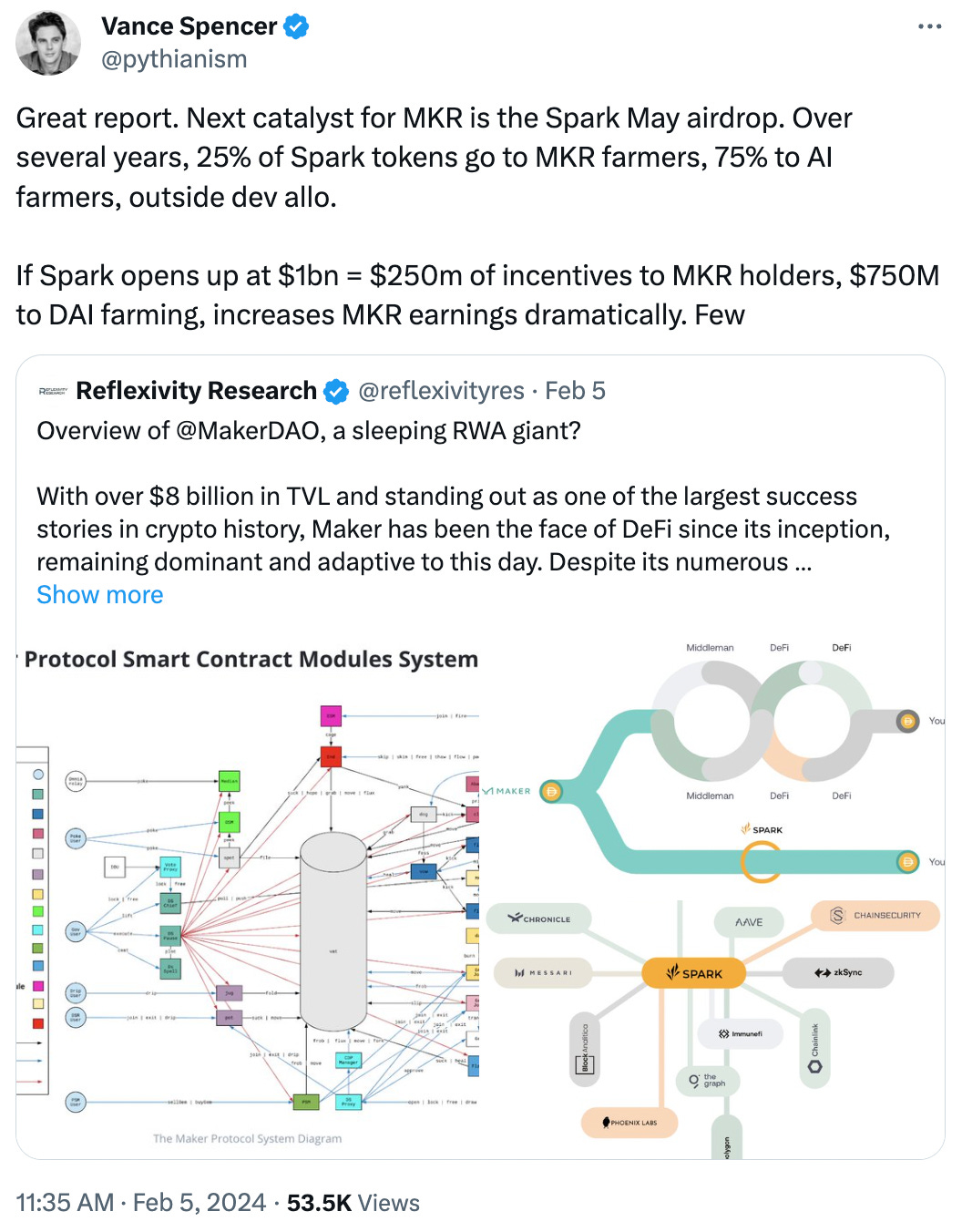

💬 Tweet of the Week

Source: @pythianism

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Uniswap — A decentralized exchange with no employees and no offices — processed $465 billion in trading volume in 2023

Source: @MarkSugden

2. Tether dominates over 75% of the $120B+ stablecoin market and has become pivotal in connecting traditional and digital finance, especially in emerging markets

Source: @KaronPangestu

3. DAI processed more than 50% of all stablecoin volume for the past two weeks and has been the dominant stablecoin in terms of transaction volume since late 2023.

Source: @intotheblock

4. As EigenLayer continues to build and caps on ETH deposits are lifted, the liquid restaking landscape has gained considerable momentum and now accounts for over 830,000 ETH ($1.96B). To put this into perspective, Solana's entire total value locked is $1.66B.

Source: @DavidShuttleworth

5. Cycle comparison: 75 days until the Halving.

Source: @therationalroot

6. Top Moving Coins From the Top 100

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

We fingerprinted 485 million code commits across 818k open-source repositories to create this year's Developer Report

Why measure developers: Developers are a leading indicator of value creation.

Developers build apps that deliver value to users. Killer apps attract customers. New customers bring more developers.

Because crypto is significantly open source, we have an unprecedented ability to measure this developer-value creation flywheel in an emerging industry.

Executive Summary

While developers overall are down 24%, the most valuable segment of developers (2+ year tenure who contribute the most code) continues to steadily grow.

While developers overall are down 24%, the most valuable segment of developers (2+ year tenure who contribute the most code) continues to steadily grow.

Developers who have been in crypto for 2+ years are at an all-time high after growing at 52% annualized for the past 5 years.

Developers who have been in crypto for more than 1 year grew 16% YoY and are 63% of all monthly active developers.

In contrast, Newcomers who have been in crypto for less than 12 months dropped -52% YoY.

Overall developer number losses can be attributed to a record number of new developers who joined in 2022 and churned.

Crypto is now clearly Multi-chain.

30% of developers support more than one chain, up 10x from 3% in 2015.

Developers who support 3+ chains grew to 17% of all developers in 2023, an all-time high.

Growth in developers is not correlated across projects. Some projects gained developers while others lost them. Developers are voting with their feet on which projects they believe provide real utility.

Crypto is global. The US continues to lose developer share.

72% of developers are outside of North America.

The US has lost -14% developer share since 2018 and is now only 26% of crypto developers.

South Asia, Latin America, Eastern Europe, Western Africa, and Southern Europe collectively grew developer share by +20% since 2018.

Tracking the Crypto Developer Community is an Open-Source Effort

Finding, tracking, and mapping these crypto repositories is a community effort. Thank you to the 500+ contributors who added repositories to the Crypto Ecosystems Github since 2019. If you are working in open-source crypto, please help the community by adding your repo to the mapping.h

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com