Learn More at www.rootstock.io and www.amphibiancapital.com and www.token.cryptocasino.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem. This week, Brazil contemplated a strategic Bitcoin reserve, Solana’s monthly DEX volume surpassed $100B, US spot bitcoin ETFs top $30B and big new venture rounds for World Liberty Financial ($30M) and KGeN ($10M).

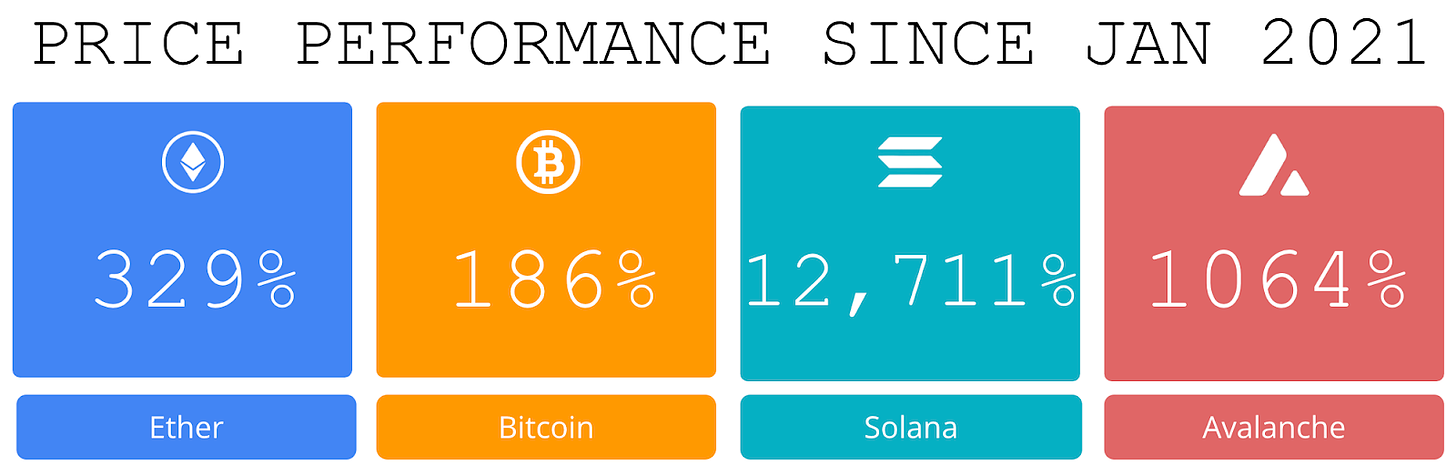

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 60%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Amphibian Capital, managing $110M+ AUM, is a fund of the world's leading hedge funds. +14.92% net YTD approx with their USD fund, +11.00% net BTC on BTC YTD (90.93% in USD terms), and +14.39% net ETH on ETH YTD (33.01% in USD terms) through 10/31. They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com. Approximate estimates through 10/31/24

CryptoCasino.com is a leading GameFi project featuring an online and Telegram casino. Launched by a team of iGaming industry experts that turned RakeTheRake.com into the world's largest poker affiliate, the platform is designed to capture the next generation of online bettors. Learn more at token.cryptocasino.com

Become a Coinstack Sponsor

To reach our weekly audience of 270,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

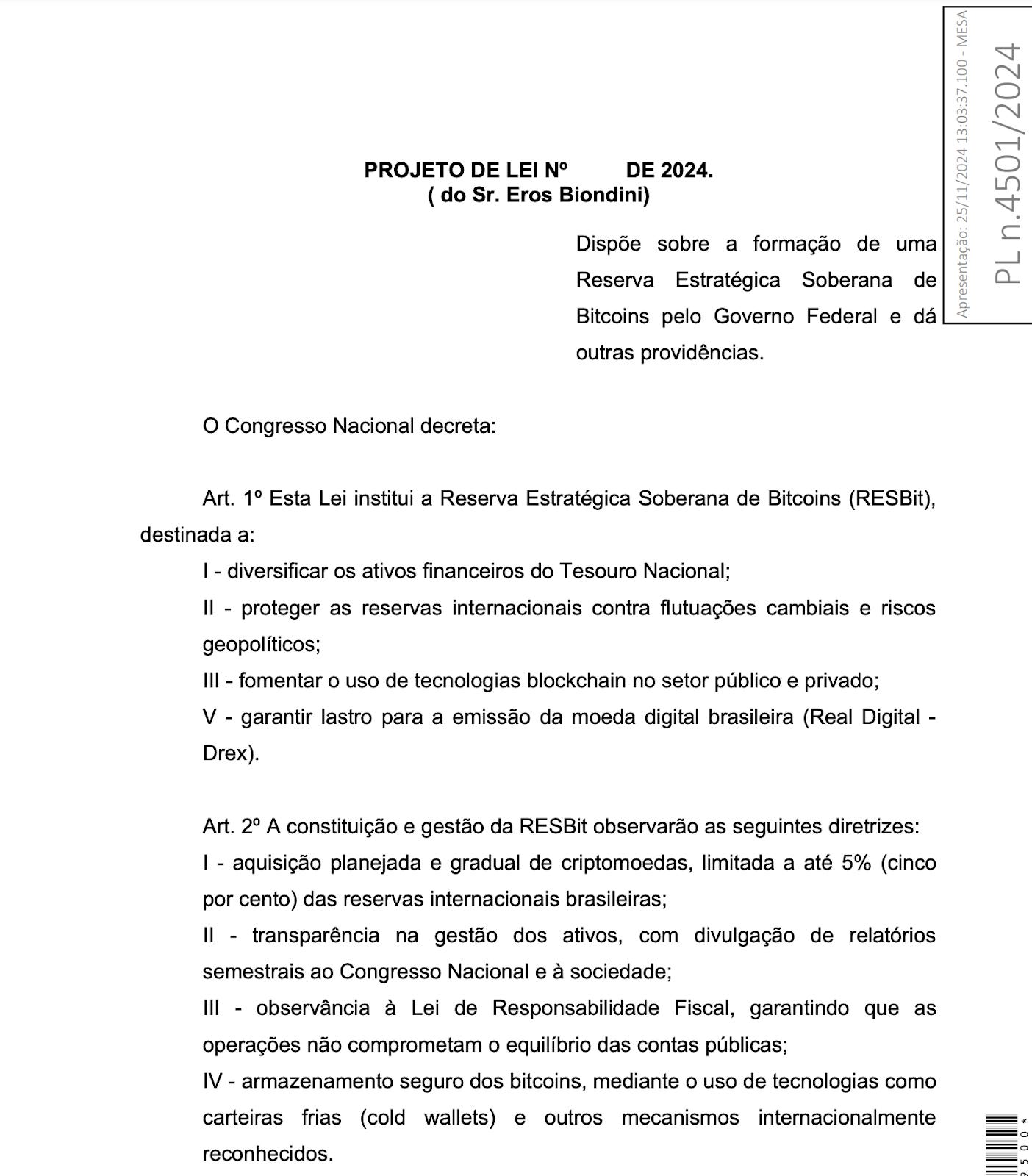

⚖️ Brazil’s Congress Introduces Bill To Create Strategic Bitcoin Reserve: Member of Brazil’s Chamber of Deputies Eros Biondini has introduced a bill to create a Strategic Bitcoin Reserve. As highlighted in the bill, Bidoni proposes that the country allocate up to 5% of international reserves to buy Bitcoin and diversify its national assets. This captures a growing trend among nation-states to invest in the first truly global reserve currency, that isn’t based

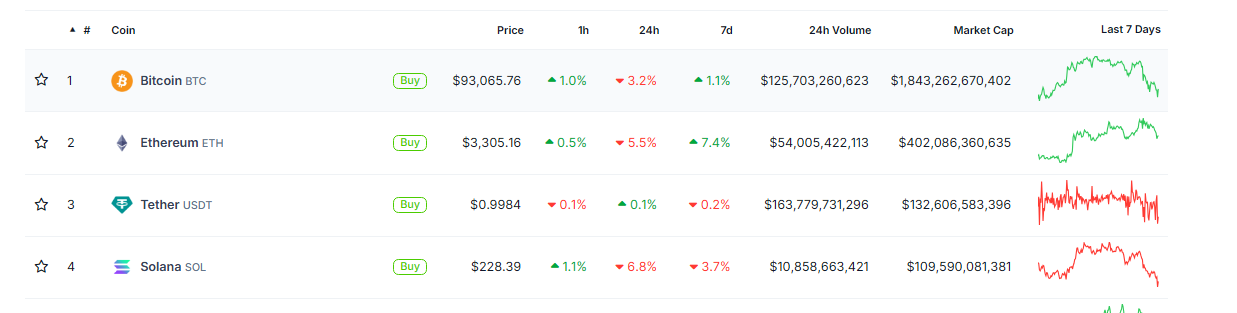

🚀 Solana’s monthly DEX volume surpasses $100 billion for the first time: According to DefiLlama data, the network had a total of $109.8 billion in DEX trade volume so far in November. This is nearly double Ethereum mainnet's monthly DEX volume of $55 billion and represents a significant increase of over 100% compared to October's trading volume of $52.5 billion.

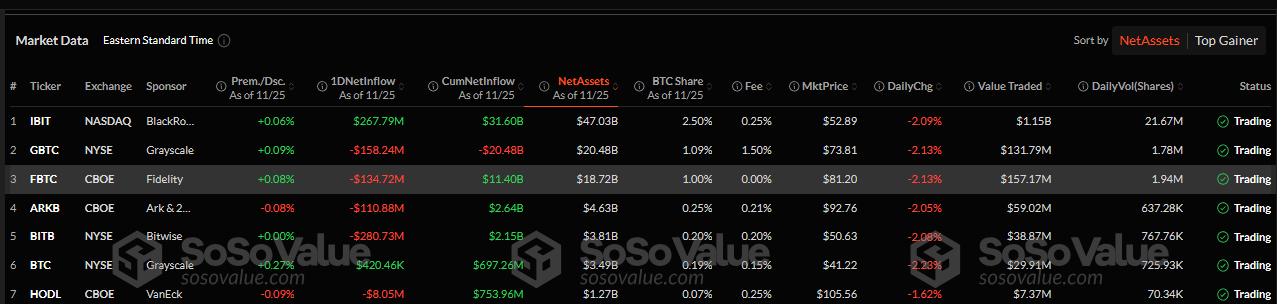

🚀 US spot bitcoin ETFs top $30 billion in cumulative inflows as BTC nears $100,000: The bitcoin ETFs have seen elevated amounts of trade volume and net inflows amid bullish market sentiment following the re-election of former president Donald Trump. The funds saw their total net asset value surpass the $100 billion milestone on Wednesday.

⚖️ Ethereum Touches $3,500, Reaching Four-Month High: The price of Ethereum (ETH) hit $3,500 Monday morning, the highest the cryptocurrency has seen for four months since surpassing $3,500 on July 21.

🤝 Trump Crypto Project Gets $30 Million Investment From Sun: The founder of the Tron blockchain, Justin Sun, has become the largest investor in Donald Trump’s crypto project, World Liberty Financial, after buying $30 million worth of its tokens.

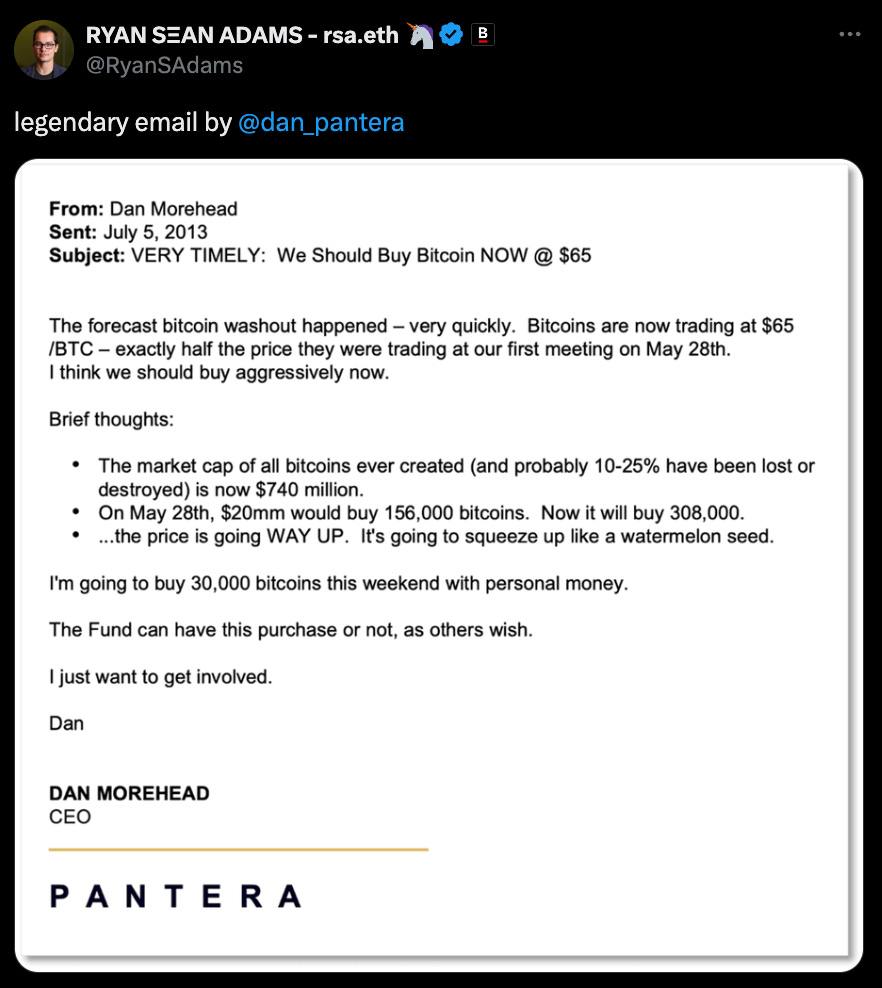

💬 Tweet of the Week

Source: @RyanSAdams

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

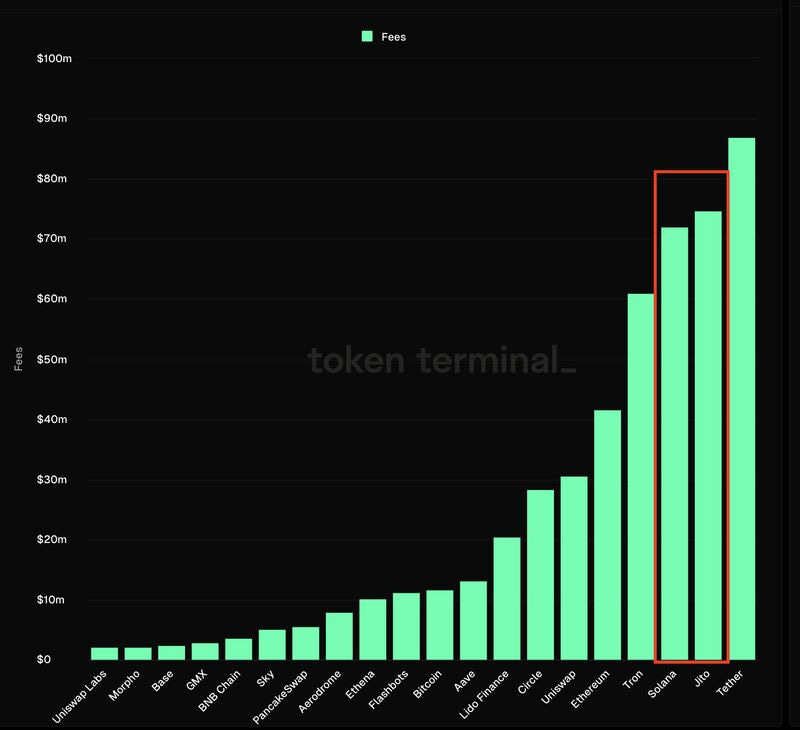

1. No one generated more fees this past week than Solana and Jito other than Tether. Over the past 7 days, Solana experienced historic levels of demand, handling over 54M daily transactions and $7.1B in daily DEX volume. During this time, the network earned $72M in fees. Jito was a huge benefactor of this activity and was able to generate more than $74.6M in fees.

To put this into perspective, total weekly fees on Solana never surpassed $26M prior to November, and only reached $20M three times in the history of the network.

Source: @DavidShuttleworth

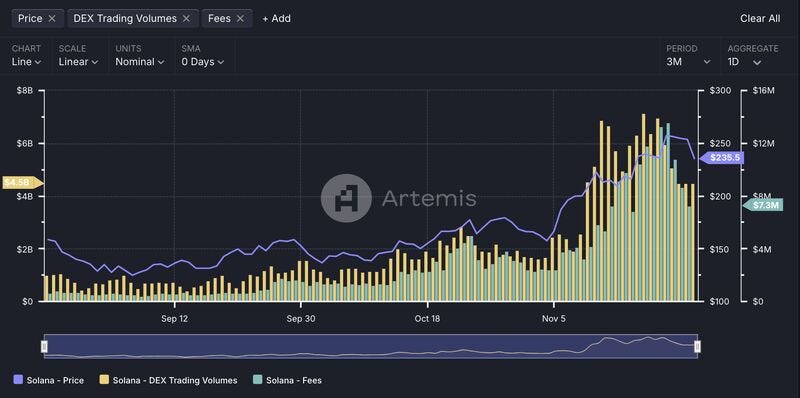

2. DEX activity on Solana has been an incredible driver for network fees, and if we map this to SOL price we get a pretty interesting picture, especially over the last month.

Since November 1st, daily DEX trading volume grew by 164%. During this time, daily fees on the network grew by 204%, while the price of the underlying SOL increased by 53%. As trading volume declined by 25% over the weekend, network fees have declined by 44%, while SOL is down 10%.

Source: @DavidShuttleworth

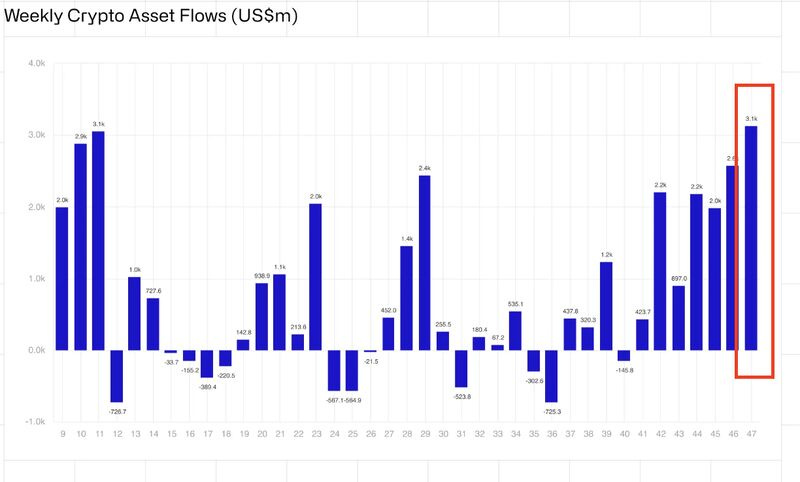

3. We head into the week coming off the largest volume of institutional inflows into digital assets ever, as more than $3.13B poured into the space. To no surprise, BTC led the way and accounted for a record-setting $3B of these inflows. Overall this pushes total inflows to $15B since the Fed cut rates in mid-September and $7.7B since election day earlier in the month.

Source: @DavidShuttleworth

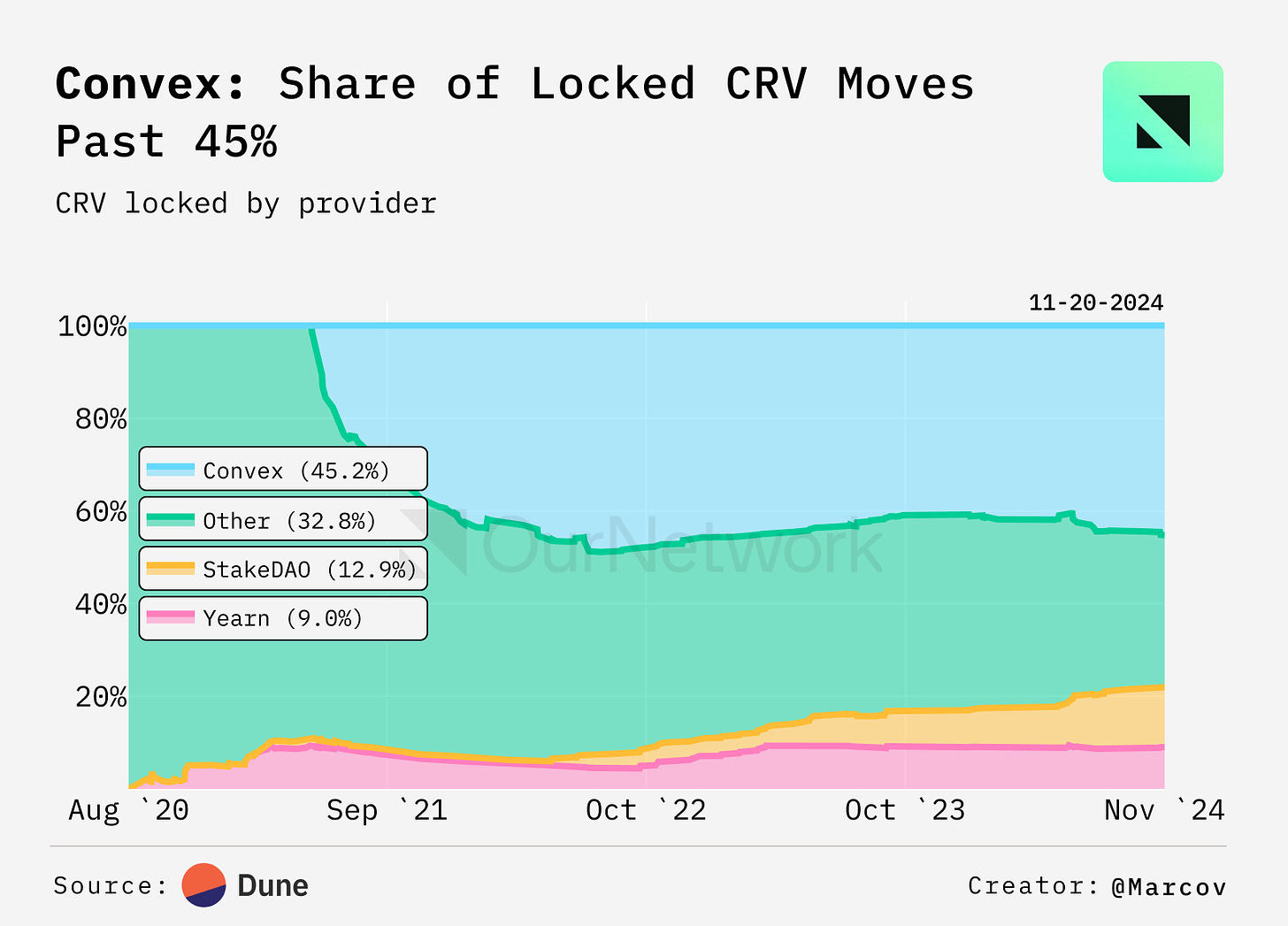

4. Convex Finance's veCRV Market Share Moves Past 45%

Source: @OurNetwork

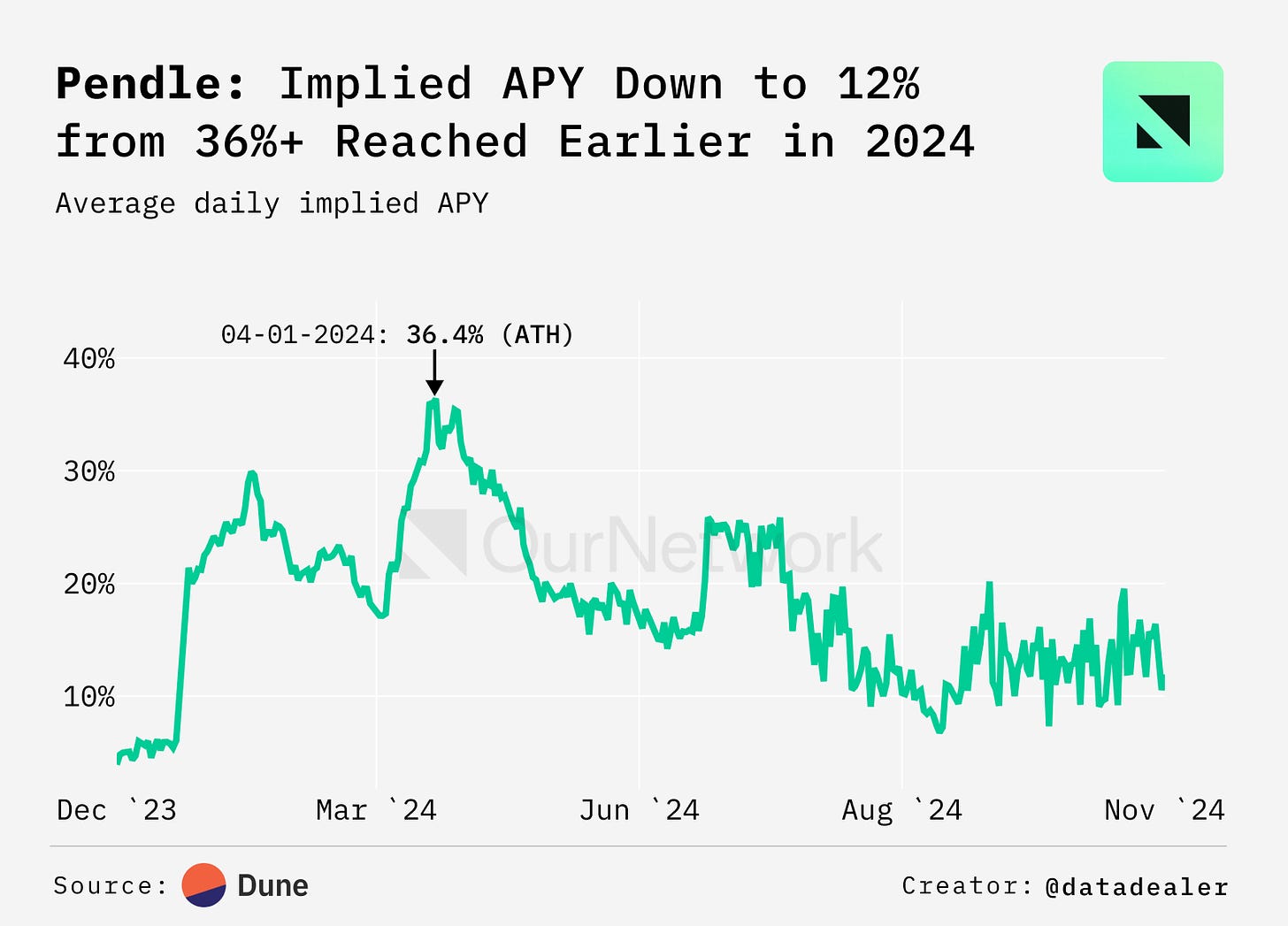

5. Implied APY has Fallen to 12% from the 36% Reached Earlier in 2024

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: 1995 Digital Asset Research, serves actionable insights, market research, and Web 3 Tech Tutorials for informed investing. This is an excerpt from the full article, which you can find here.

Introduction

Today, I feel the need to remind people of how the cycle actually works. The amount of people asking me about "whats going on with eth?" today alone is ridiculous. We published this report not even a month ago and nothing has changed. We were one of, if not the only, cycle analysts that repeatedly told you that the BTC cycle was right on track from a time perspective regardless of how high price went early on. Many people cannot say that. Most people were calling for a left or right or north or south translated cycle whatever you want to call it. Today, I am telling you that ETH will stage a rally the likes of which it has never seen starting in December. 16k ETH? 20k? This time is not different. - Digital Asset Research.

Today we do a quick dive into the current state of Ethereum (ETH) amidst the bull run, explaining why ETH has been undervalued despite being structurally sound. We also explore Bitcoin dominance, the altcoin cycle, and historical trends, pointing to a probable start for ETH’s next big rally.

We show key technical indicators signaling ETH’s potential for a major upward move, with similar previous setups resulting in a 170% markup in price.

This could bring ETH close to $6,000 sometime around January. With Ethereum sentiment at an extreme negative it still maintains key support levels, and remains a strong signal for the upcoming alt season.

Finally, one last chart I should have put in the video for your consideration. From a time range perspective, 26 weeks top to bottom on both time frames. History rhymes.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.rootstock.io and www.amphibiancapital.com and www.token.cryptocasino.com