Learn More at www.ceek.com and www.firstblock.ai

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We reviewed the top news, stats, and reports in the digital asset ecosystem for our 340k weekly subscribers. This week, Bitcoin hit a new all-time high above $126,000 as Coinbase Institutional called October “tactically bullish”; the SEC allowed advisers to use state-chartered trusts as crypto custodians; and Grayscale became the first U.S. issuer to add staking to its Ethereum ETFs. Galaxy Digital launched GalaxyOne, combining crypto, stocks, and yield products for U.S. users, while a California court ruled Bored Ape NFTs are not securities. On the fundraising front, a bitcoin life insurance firm backed by Sam Altman raised $82M, Bee Maps raised $32M led by Pantera Capital, and Lava closed a $17.5M Series A extension.

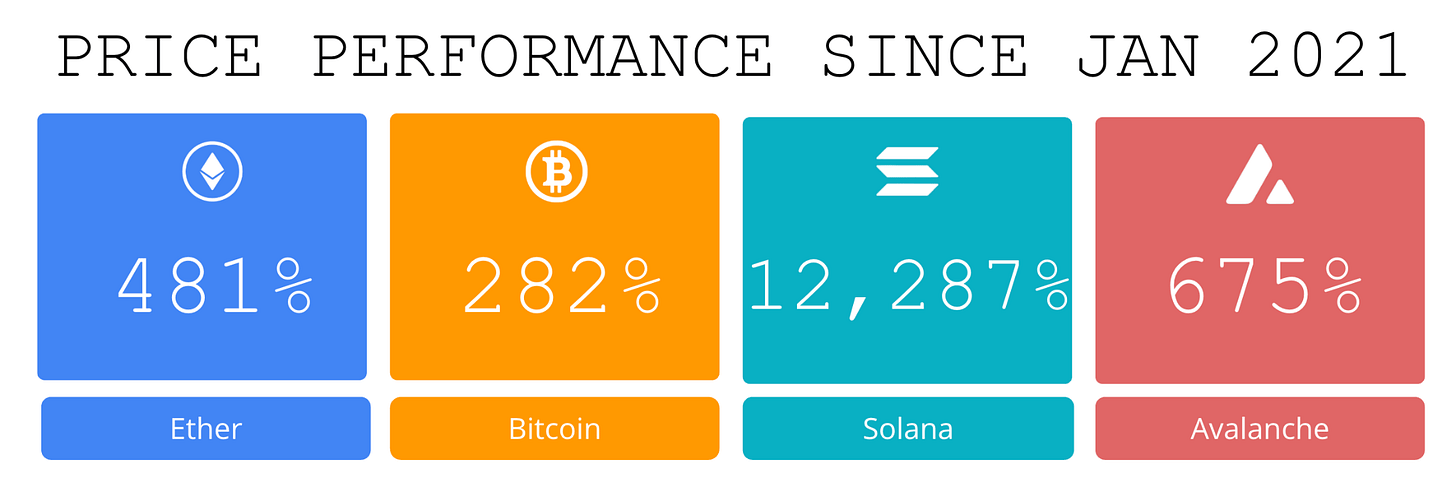

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Tap into the $8.5T Generative AI Economy with CEEK, the AI-powered platform securing content as digital assets on the Blockchain. Trusted by Meta, Universal Music, and Microsoft, CEEK enables users with Agentic AI tools to create, monetize and scale content and expertise. CEEK is the Web3 Monetization OS for the new economy. 👉 Learn more at www.ceek.com

First Block’s vision is clear: a world where every stock, bond, fund, and real asset can be tokenized, traded, and settled in real time. By merging the discipline of Wall Street with the innovation of blockchain, First Block is creating the infrastructure for liquid, compliant, and borderless capital markets. Learn more at www.firstblock.ai

Become a Coinstack Sponsor

To reach our weekly audience of 340,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🥳 BTC Sets New ATH Above $126,000 as Analysts Expect ‘Tactically Bullish’ October: Analysts at Coinbase Institutional wrote in a market update that their October outlook remains “tactically bullish,”.

👨⚖️ SEC opens the door for investment advisers to use state trusts as crypto custodians: In something of a major reversal, the U.S. Securities and Exchange Commission has issued a no-action letter saying that investment advisers can use state-chartered trust companies as qualified custodians for crypto assets, according to a letter on Tuesday.

🚀Grayscale Ethereum ETFs Are First in US to Add Staking: Grayscale has introduced this functionality to its Ethereum Trust ETF (ETHE), the second-largest such fund on Wall Street with assets of $4.82 billion, as well as its Ethereum Mini Trust ETF (ETH).

🏦Galaxy launches GalaxyOne platform offering crypto, stocks, and 8% yields to US users: Galaxy Digital on Monday rolled out GalaxyOne, a new consumer platform and app that combines a 4% cash account, crypto custody and trading, and zero-commission trading on U.S. equities and ETFs.

⚖️Bored Ape NFTs Are Not Securities, Court Rules in Landmark Decision:A federal judge in California has tossed out a class-action lawsuit against Yuga Labs, creator of the once-dominant Bored Ape Yacht Club NFT collection, ruling that the digital collectibles cannot be considered securities.

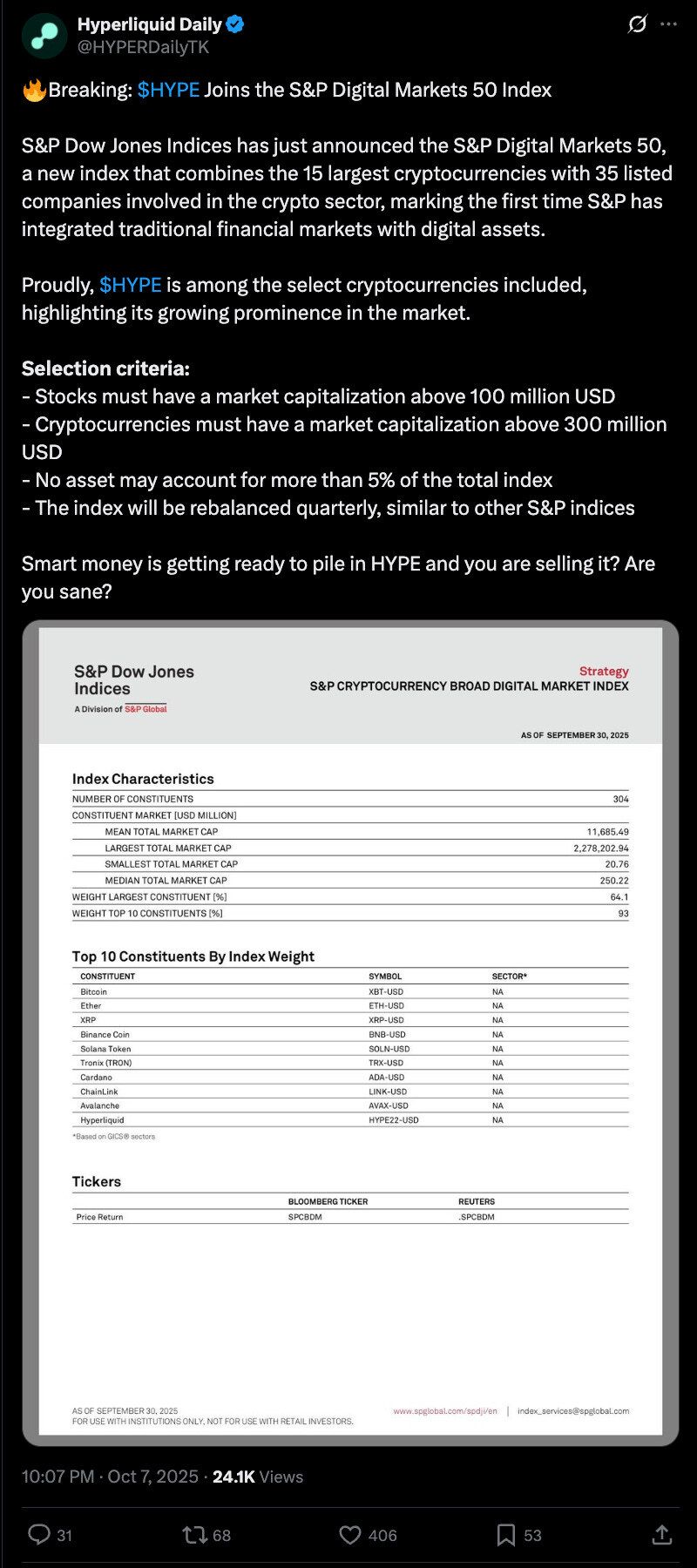

💬 Tweet of the Week

Source: @HYPERDailyTK

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

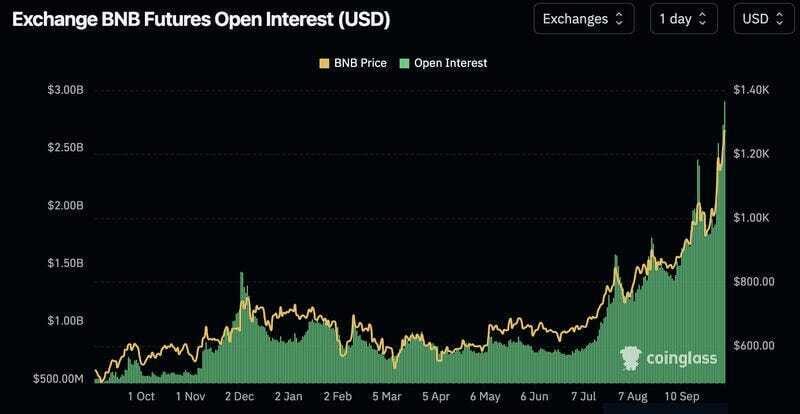

1. Open interest on BNB has swelled to an all-time high of $2.9B, more than doubling month-over-month. Meanwhile, the price of the underlying BNB has increased 46%.

Source: @DavidShuttleworth

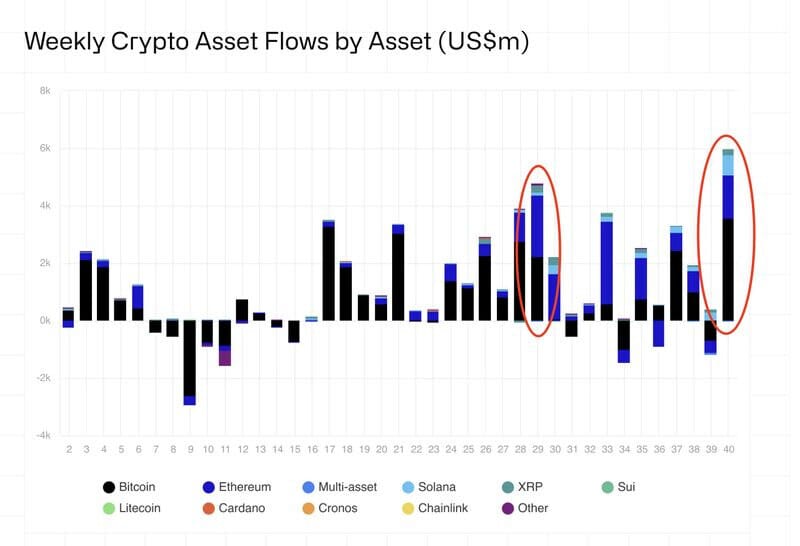

2. Nearly $6B flowed into digital assets last week, shattering the previous record set in July ($4.4B).

One particularly interesting movement is that during the record-setting week in July, inflows were relatively balanced between BTC ($2.2B) and ETH ($2.12B). This time, however, BTC dominated with a staggering $3.55B of inflows compared to ETH’s $1.48B.

This is easily BTC’s largest inflow ever and 67% more than July’s peak.

One under-indexed angle is that SOL also set a new record with over $706M of inflows — and this comes with several key ETFs still on the horizon.

Source: @DavidShuttleworth

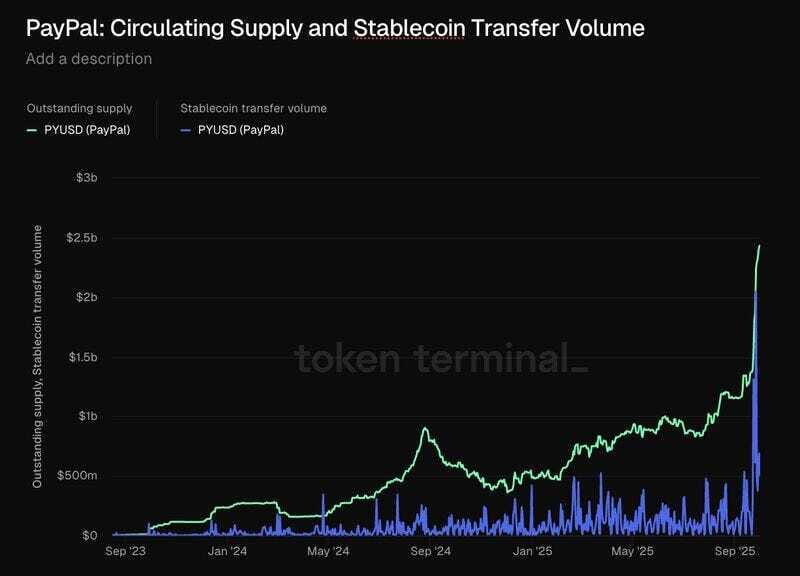

3. Quietly, PayPal PYUSD circulating supply has surged 113% month-over-month to reach a record $2.54B. The stablecoin now settles more than $6B in weekly transfers.

PayPal’s recent integration with Spark has helped drive this growth, as the protocol already manages $485M of PYUSD deposits and $237M of active loans.

Interestingly, supply more than doubled on both Ethereum ($1.84B) and Solana ($624M) since September.

Source: @DavidShuttleworth

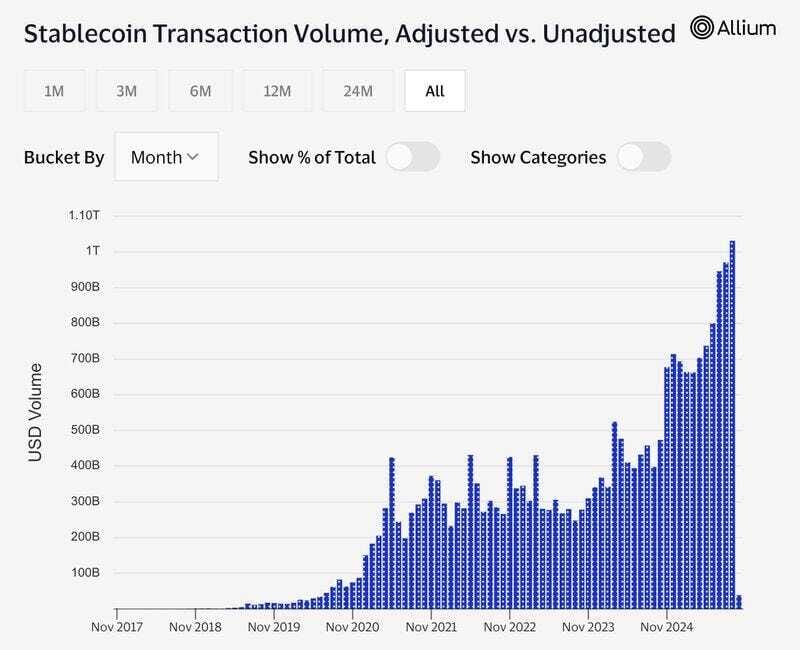

4. Amidst all the new yield, UX, and distribution improvements, one thing has gone largely unnoticed: the sheer volume of real economic activity stablecoins now process. In September, stablecoins settled over $1 trillion of organic transaction volume—the first time ever.

This filters for high-frequency trading, bot activity, and intra-exchange volume, making it a cleaner signal of adoption. That’s more than 2.5x the average monthly volume year-to-date.

Stablecoins aren’t just rails for crypto anymore, they’re quickly becoming a real settlement layer for global dollars. And we’re just getting started.

Source: @OurNetwork

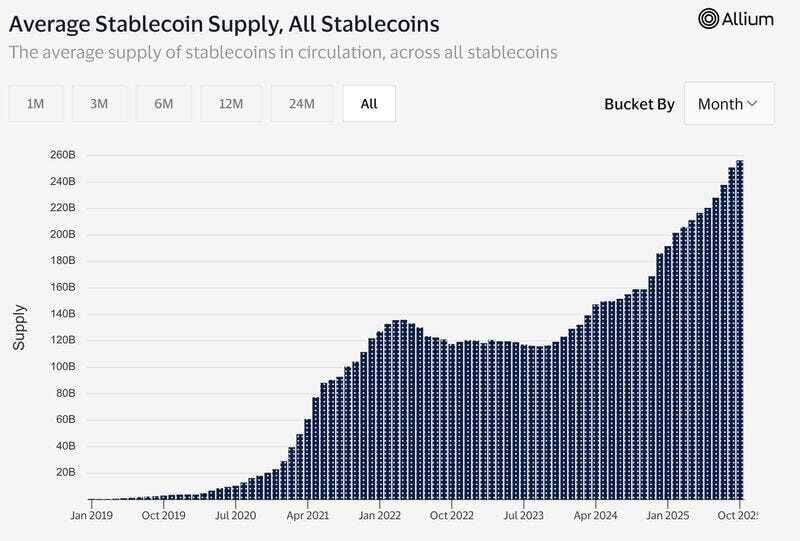

5. Fiat-backed stablecoin supply grew by 8% ($18.5B) in September to $256B, setting a new all-time high for the 12th consecutive month.

Ethereum led the space with $13.5B of new issuance, while Solana added $2B—both hitting new records. Ethereum now accounts for 57% of all fiat-backed stablecoins, its highest dominance since December 2024.

Programmable finance marches forward.

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Welcome to OurNetwork’s latest. In this issue we’re exploring the onchain latest in terms of where users are capturing yield.

Thank you to Tyler W, Alex, Kmets, and Yasmin for contributing.

– ON Editorial Team

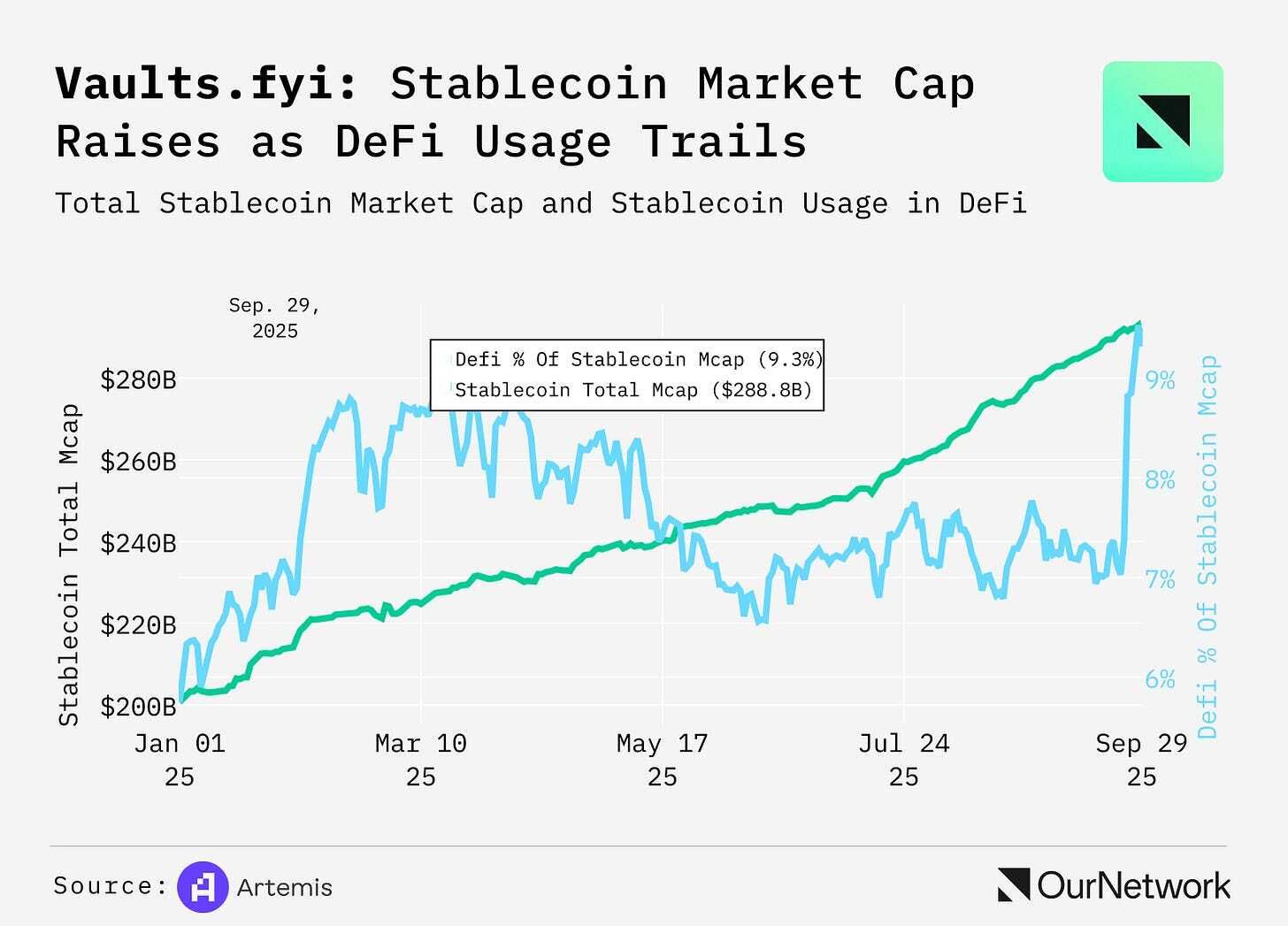

📈 While Stablecoin Market Cap Approaches $300B, Most Stablecoins Sit Idle. Yield Remains a Compelling Driver to Bring Capital Onchain.

The total market cap of stablecoins has grown throughout 2025, steadily climbing towards $300 billion. Despite this massive and growing pool of onchain liquidity, less than 10% of stablecoins are currently engaged in DeFi protocols to earn yield. At vaults.fyi, we expect the growth of stablecoins inside DeFi to accelerate. This year major exchanges and wallets have already made yield core to their products, with simplified DeFi-powered yield offerings on the backend.

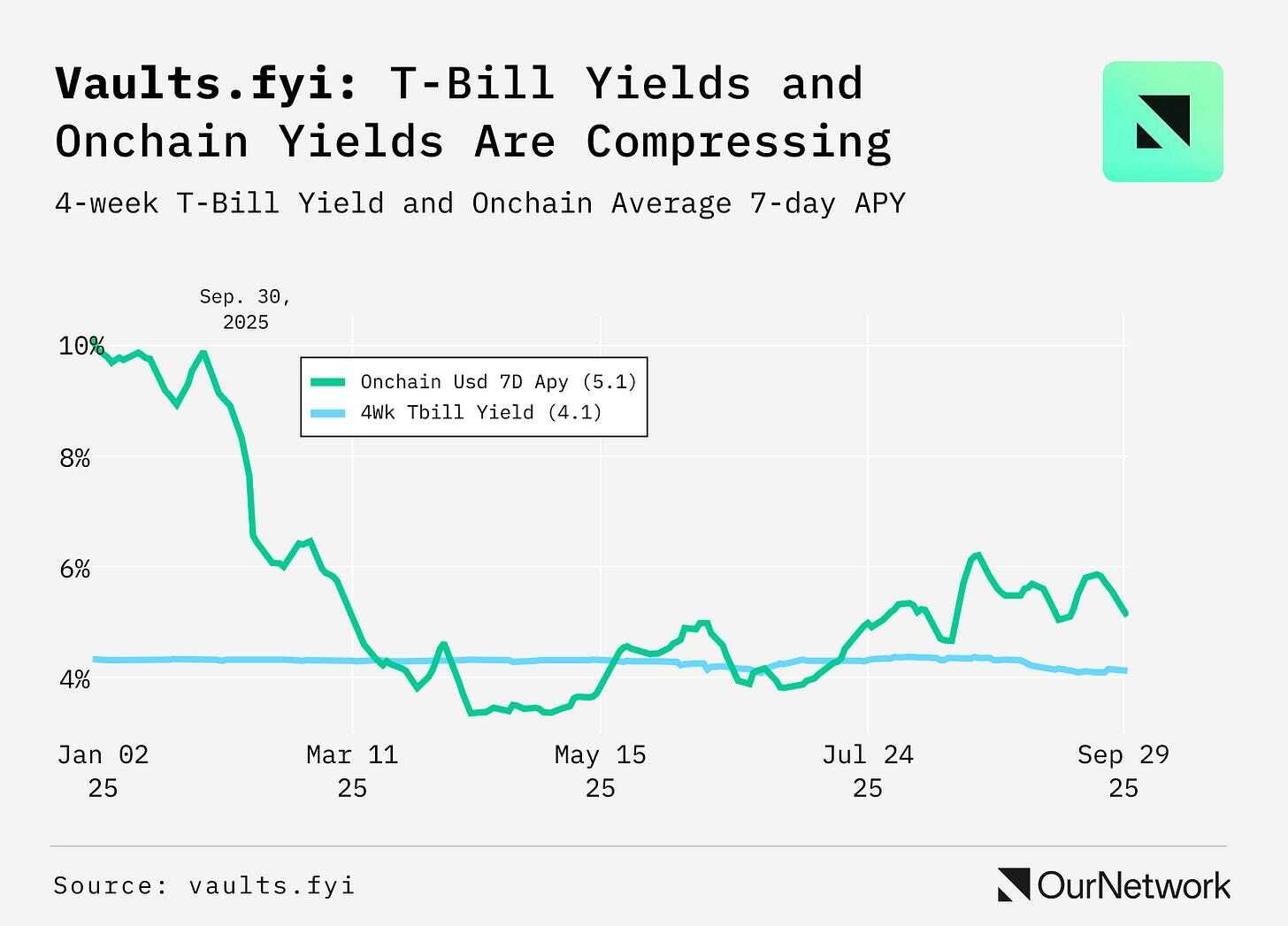

After onchain rates started 2025 at a significant premium over T-bills, this spread compressed, and even briefly turned negative. This trend signals a maturing market where the “crypto-native” risk premium has diminished, with onchain yields now stabilizing at ~100 bps above T-bills.

While onchain rates have compressed, opportunities are still available for active farmers. Vaults.fyi data currently shows several major stablecoin vaults with $100M-plus TVL returning 7d average yields of over 10% APY.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.ceek.com and www.firstblock.ai