With Bitcoin up 19% this week and ETH up 25%, it’s fair to say the bulls are back. What should we expect for the rest of 2021?

Inside This Issue:

Our Latest Market Forecast - The Bulls Are Back

The Weekly Crypto Recap…

🗞️ Top Weekly Crypto News

💵 Weekly Crypto Fundraises

📈 Top 10 Weekly Performers (ICP, AXS, RVN, HOT)

🎧 Best Podcasts This Week

📊 Key Stats of the Week

📝 Crypto Report Highlights

Weekly Article: Axie Infinity’s Economic Engine

The Coinstack Alpha Fund - Up 19% in Last Week

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Wednesday Crypto Community Calls

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

OUR LATEST MARKET FORECAST:

Bitcoin has broken out of its $29k to $42k price band earlier than expected, headed toward the expected double peak in which expect to see new all-time Highs in 2021. We expect to see a breakout toward new all-time highs by Fall 2021, reaching $80k+ BTC and $6k+ ETH by the end of 2021. Below is our forecast for 2021 and how it compares to a similar double peak in 2013.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week...

⚖️ Senate Passes $1.2 Trillion Infrastructure Bill, Crypto Tax Debate Heads to House - The Senate passed its infrastructure bill Tuesday morning, clearing the way for a $1.2 trillion infusion into the nation’s public works. Senators proposed a few competing amendments to the bill, none of which managed to garner the support required for adoption. The infrastructure package now heads to the House of Representatives, where it’s set to be reviewed this Fall. (Source)

🕵️ $611M Stolen Poly Network in Massive Cross-Chain Hack - Marking the largest DeFi hack in history, the cross-chain protocol Poly Network was hacked with over $600M worth of assets stolen. The Block’s Igor Igamberdiev suggests the hackers exploited a cryptography issue within Poly Network’s code. (Source)

💳 Venmo Allowing Credit Card Holders To Automatically Buy Crypto With Their Cash Back - Venmo (a subsidiary of Paypal) launches a new crypto cashback tool for it’s credit card users. Darrell Esch, SVP and GM of Venmo, said the tool offers “a new way to start exploring the world of crypto” for users of the payments app. (Source)

⚡ Institutional Investors Return to Bitcoin Despite US Crypto Tax Plans - Coined as, “Bitcoin’s Defiant Rally'' by The Breakdown’s Nathaniel Whittemore. Institutions continue pumping the price despite the US’s Infrastructure Bill being passed by the senate. Joel Kruger from LMAX Digital explains, “Investors are looking to the positives around regulation rather than the negative.” (Source)

💰 USDC Builder Circle Discloses Its Plan to Become National Crypto Bank - On Friday Circle completed filling it’s S4 form stating their plans to pursue the strategy to work as a full-time reserve national bank to decrease their dependence on third parties associations. (Source)

🤑 Senator Who Opposed Crypto Amendment is Backed by Bankers - Senator Richard Shelby, an 87-year-old Republican from Alabama is credited to single-handedly block the crypto amendment. Messari’s founder Ryan Selkis believes the move was driven to place his staff in high-paying Wall Street jobs given that his list of donor’s includes Lockheed Martin, Boeing, as well as major finance players like Citadel and MetLife. (Source)

🇨🇳 China's Digital Yuan vs Bitcoin - Out of all major economies, China has advanced the furthest towards a fully-fledged CBDC with its digital yuan,as reported by Decrypt. Making it the closest country to creating a fully-fledged central bank digital currency. (Source)

🍿 AMC To Begin Accepting Bitcoin - America’s largest theater chain will begin accepting Bitcoin payments for tickets and concessions by the end of the year, the company’s CEO, Adam Aron, said on a second-quarter earnings call Monday. (Source)

📈 DraftKings Launches NFT Marketplace with Tom Brady - Tom Brady’s NFT marketplace, Autograph.io, will provide content for DraftKings Marketplace's with a collection that will include Wayne Gretzky, Tony Hawk, and Derek Jeter. (Source)

😡 Ted Cruz’s Speech on Crypto Goes Viral, Accuses Senators of ‘Ignorance’ on issue -Senator Ted Cruz went viral on Monday after giving a speech on the Senate floor essentially telling his colleagues that most of them could not tell the difference between a Bitcoin and an old New York City subway token, "Let’s recognize that if we gathered all 100 senators in this chamber and asked them to stand up and articulate two sentences defining what in the hell a cryptocurrency is, that you would not get greater than five who could answer that question," he said. (Source)

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📈 Top 10 Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100. We share the top performers in order to give you research ideas for what you may want to look into further.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100

🎧 Top Crypto Podcasts of This Week

Here are the crypto podcasts that are worth listening to this week...

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

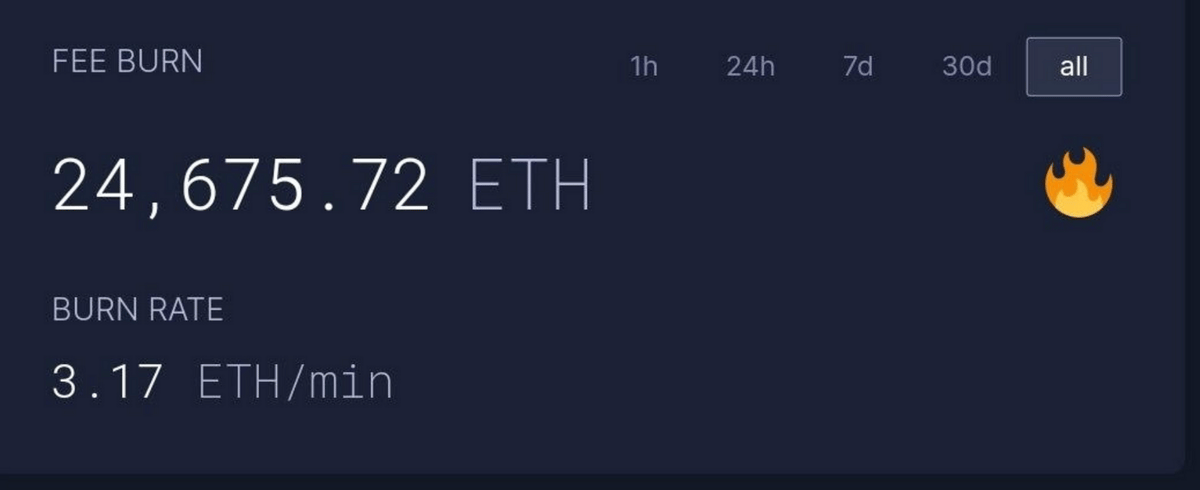

1. EIP-1559 burns 25k ETH (~$76M USD) Ethereum in less than a week.

2. Ethereum gets to $3200+ after a 3 week climb where we saw a positive green candle 19 of 21 days.

3. DeFi Gross Value Locked (GVL) has now reached $100B across all chains according to DeBank. DeFi Llama reports a higher figure of $138B.

4. Ethereum is now averaging over $15M per day in revenues, 30x Bitcoin.

5. Ethereum is now settling over $22.7B per day in value, over 3x Bitcoin.

6. Bitcoin’s 14 Day Relative Strength Index breaking out of a downtrend that kicked off in early Q1.

7. Fundstrat gives a buy signal with BTC crossing the 200D Moving Average. Historically following this signal has given a return of +193% within 6 Months of crossing (note that average returns go down with each cycle)

8. Uniswap leads DEX volume processing $2.5B a day in trades commanding over 30% market share in the AMM space

Q2 2021 Ethereum Trading Volume Exceeded Bitcoin for the First Time

📝 Highlights from The Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…1. U.S. Dollar Dominating Stablecoin Market

Mike McGlone, BI Senior Commodity Strategist believes that China continues to push against cryptocurrencies due to free market capitalism being inherently on the rise from US dollar backed digital assets. When sorting trade volume via Coinmarketcap the top five traded cryptos are all digital dollars. Meaning on a global scale, the countries that are, “ antagonistic to the greenback”. Have no trading presence via digital tokens and risk getting left behind as the industry continues to trade based on US dollar proxies.

2. Regulatory Oversight Threaten Stablecoins

Delphi Digital’s Jeremy Ong and Jayden Andrew publish this week’s Delphi Weekly with a focus on the current Infrastructure Bill and its effects on Stablecoins. Decentralised stablecoins such MakerDAO’s DAI is at risk given that >60% of Maker’s vault assets are made of USDC. Although DAI is a decentralised stablecoin, the rise in the share of USDC inside of MakerDAO’s vaults means DAI is not out of regulators’ reach.

3. Energy Intensive Blockchains Are Declining as % of Market Cap

Dan Moorhead, Pantera Capital’s Managing Partner, writes this month’s investor letter tackling ESG (Environmental, Social, and Governance) when it comes to Bitcoin. Dan’s biggest point is that a Bitcoin miner’s only real competitive advantage is sourcing the cheapest form of energy possible which gives them incentive to use renewable forms of energy.

4. Covid Delta Variant May Be Pumping Crypto Markets Via Expectation for Slower Fed Tampering

FSInsight, an independent research firm co-founded by Tommy Lee, the former Chief Equity Strategist at global investment bank JPMorgan, sees the recent Covid delta variant scare as a driver of further liquidity in the markets which may result in crypto markets to continue climbing this Fall.

“The Delta scare is leading to improved vaccination rates as States that were lagging have rallied to increase the number of citizens vaccinated, and according to data presented by Fundstrat, there is reason to believe that cases will peak in August. To us, the recent Delta scare is just enough uncertainty for the Fed to forego any rate hikes, and to continue bond purchases through the fall. An easy money environment is ideal for crypto as a higher money supply and a weaker dollar have historically been macro tailwinds for the asset class.”

5. Willy Woo’s New Metric Signals Bullish#forecast 024: The Buyers Bazaar, Aug 1, 2021

A very well known on-chain analyst, Willy Woo, has published a new buy/sell heatmap in his latest report, indicating that it is time to buy based on the buying behavior of long-term term holders.

📰 Axie Infinity’s Economic Engine By Liam Berryman

Publisher’s Note: The below is a guest article from Coinstack member Liam Berryman. You can read the full article here.

This analysis is primarily focused on answering two questions about Axie Infinity and assessing tokenomics / valuation; it does not provide an investment recommendation.

The article is split into Core Questions, Tokenomics, and AXS Price Action.

Core Questions

What makes Axie Infinity special?

Note: special means interesting, better than usual, etc. It does not mean 100% unique. Axie Infinity has done a great job integrating elements that have been used in other gaming protocols to build an elegant economic system.

What risks may exist for a holder of AXS?

Why is Axie Infinity special?

Separation of Currency and Equity: Axie Infinity has separated the currency system (Smooth Love Potion, SLP) from the equity system (AXS, Axies, Land) in the game. This incentivizes players to both regularly spend the currency they have earned and hold the equity they have accumulated. This addresses the problem that many L1 or single-token protocols have, where speculation about future price appreciation hampers spending or using tokens in the present day.

Due to players earning in SLP and then cashing out to ETH or USD, there is theoretically a balanced inflow and outflow from SLP with no mechanisms to lock value in the token. In this manner SLP acts as a ‘currency’ with some degree of projected stability. Despite these mechanisms and a net inflation in the supply of SLP (see graph below), SLP has still appreciated in price significantly due to a surge in demand to play the game over the past months. However, in the long run SLP price appreciation should not be as strong as appreciation of the other “equity” incentives such as AXS.

Accessible Wealth Building: Axie Infinity is a virtual land game competitive with Decentraland, Enjin, etc, but in addition has in-game mechanics that allow users to actively play to earn and build wealth as opposed to only benefiting from appreciation of assets (which is by definition more difficult to access if starting with little capital). In this way, Axie Infinity could serve as a wealth building on ramp to the broader cryptocurrency industry for millions of people.

Axie players have the ability to benefit economically from earning SLP, holding / staking AXS, holding / trading / breeding Axies, and holding Land in Lunacia. This multi-asset approach locks people into the game and provides an incentive to reinvest earnings into the game to hold more assets

See also Income Generating Assets, which provides an on ramp for players that can’t afford the initial fee to buy several Axies

Rebalancing Mechanisms: Axie Infinity has established a pseudo central bank that can adjust the “interest rate” (breeding cost, as one example) to increase or decrease breeding demand and other variables at will based on measurable stock and flow. Additionally, built in inflationary and deflationary mechanisms (collectively, “rebalancing” mechanisms) mean that supply of Axies remains balanced.

Income Generating Assets: Axie Infinity has established a scholars program where existing players can lend their Axies to new players in exchange for a split of SLP (revenue) earned from playing with the lent Axie. This turns every Axie into an income generating asset provided there are enough new players that can’t afford or don’t want to pay the buy in for 3 initial Axies.

Breakaway Position in crypto-based gaming and Play to Earn: Of Play to Earn crypto games, Axie Infinity appears to have an overwhelming lead and network effects will continue to draw more users in at an accelerating rate. Additionally, in the Play to Earn category (as opposed to Play to Win and other variants) already emerging in the traditional gaming industry, Axie Infinity appears to have the strongest lead.

Daily Active Users have exceeded 1,000,000 as of August 6th, 2021

Axie Infinity is the first NFT game ever to cross $1B of transactions (sales) with more than 300,000 players actively trading

What are the risks?

Daily active users, the metric many AXS speculators are relying on, are currently self-reported by Axie Infinity.

The treasury distribution (token earnings) schedule put forward by Delphi Digital (the company that designed the tokenomics for AXS on behalf of Axie Infinity) is a recommendation and can be changed at the discretion of the project team. This means that future yield on staked AXS could vary widely from the current projection (see Tokenomics).

Significant loss of DAUs and particularly new DAUs will cause downwards pressure across the game which can be temporarily averted by adjusting breeding rates and other relevant in-game operating costs, but (similar to interest rate adjustments) can only do so much. Thus, a swift decline in player interest could lead to a vicious cycle and a negative compounding effect on AXS price.

The project team has central control over critical factors that act as checks and balances on in-game economics. An adjustment error, particularly as game economics become more complex, could significantly impact gameplay and token prices.

Axie’s core team will retain voting control over AXS until at least 2023 and there are no plans to accelerate creation of a true DAO to govern the game or underlying smart contracts.

Sky Mavis is planning on turning the Ronin chain into a full Ethereum sidechain with its own token, so that other games like Axie Infinity can be designed on top of it. Congestion, price instability, and other scaling issues could adversely impact Axie Infinity gameplay and therefore AXS price

Security of the Ronin chain is unclear at this point in time and accessibility (to pull relevant data, for example) is lower than Ethereum

Additional notes:

Axie Infinity is a crypto native game built by Sky Mavis. Sky Mavis is venture backed, with investors including Mark Cuban. The company has raised $9M in two investment rounds, which would suggest the majority of the company is still owned by the founding team.

I found no evidence that revenue, treasury, or user metrics have been faked. However, I was unable to audit the Ronin chain directly (other than viewing the contract pasted herein that shows the current Treasury balance).

Publisher’s Note: The above is a guest article from Coinstack member Liam Berryman. You can read the full article here.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 2,414 plays and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.Here are the episodes we’ve released so far...

You can listen and subscribe on:

Thanks for sharing the link with your friends.

📈 Our Top 30: A Long-Term Crypto Portfolio

If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be absolutely sure to include our top 5: ETH, DOT, KSM, SOL, & NEXO. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short-term.

📈 The Coinstack Alpha Fund

In April 2021 we launched The Coinstack Alpha Fund, which is an on-chain fund on top of the Enzyme platform.

The fund is up 19% in the last week and 32% in the last month, driven by a resurgence in Ethereum, Polkadot, and Defi investments.

There is no minimum investment, although there is a gas fee you pay to Ethereum network to invest -- which has been around $50-$100 recently.

We are now up to $245k from 31 depositors in the Coinstack Alpha Fund. Enzyme allows deposits with both USDT or ETH. We charge a 2% management fee annually plus 20% of profits. Withdrawals are allowed at any time, although we recommend a 5-10 year hold period for optimal returns.

You can invest directly via your Metamask, Argent, TrustWallet, or any wallet that works with WalletConnect. We don’t hold your funds, Enzyme does. We simply invest them on your behalf. You can learn more about Enzyme here.

And if you’d like, you can invest here in the Coinstack Alpha Fund.

Our current portfolio allocation in our fund is:

📞 Join Our Wednesday Crypto Community Zoom Calls

Most Wednesdays Coinstack Founder and Publisher Ryan Allis does a live 30 minute Crypto Advice Zoom call at 12PM PT / 3PM ET / 8pm GMT. All investors in our Coinstack Alpha Fund on Enzyme are invited to join and ask questions and share learnings with each other. After you invest, just reach out to Ryan Allis on Telegram (or reply to this email) to get added to the weekly call invite.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published weekly. Published and written by Ryan Allis. Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

BitClout at Bitclout.com/u/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.