Learn More at www.amphibiancapital.com and playupland.com/start and www.crowdcreate.us

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 300k weekly subscribers. This week Bybit puts back the value of the stolen ETH, the SEC ends the Robinhood investigation, the SEC reaches an agreement to dismiss Coinbase lawsuit and big venture news for Ethena ($100M) and Mansa ($10M).

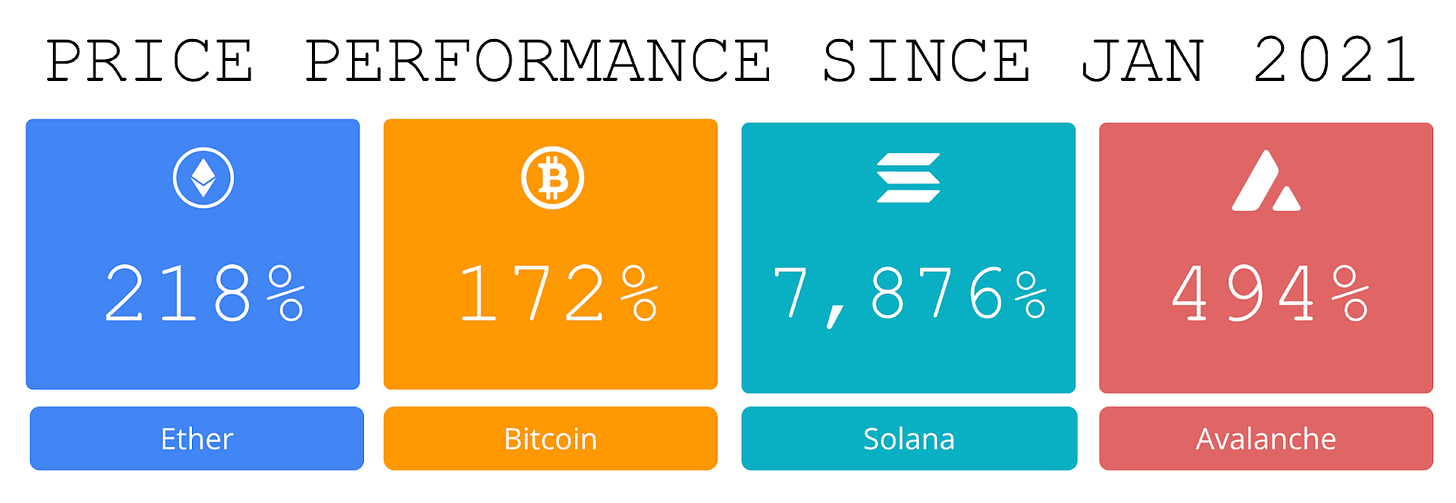

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2025 Coinstack Sponsors…

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 60%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Upland is the leading web3 gaming ecosystem mapped to the real world. The platform has minted over 8 million NFTs, players have earned over US$16 million and over 110 million $SPARKLET tokens. The company recently launched the first-ever casual game on X called XStacks. To play and learn more, visit www.upland.me

Looking to scale your brand and drive real engagement? Crowdcreate is a top-rated marketing agency specializing in marketing strategy, influencer marketing, PR, outreach, crowdfunding, social media management, and investor marketing. With 700+ successful projects—including Sandbox, KuCoin, BitMex, and Star Atlas—we’ve helped raise over $250 million and supported startups and Fortune 500 companies with data-driven strategies. Learn more: crowdcreate.us

Become a Coinstack Sponsor

To reach our weekly audience of 300,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

Upland has quietly become one of Web3's most compelling success stories, creating a platform that actually delivers on the promise of digital ownership with real-world connections.

Launched in 2020, this blockchain-based platform (often described as "Roblox for grown-ups") allows players to purchase, develop, and trade virtual properties mapped to real-world addresses. But Upland goes beyond simple property ownership, offering diverse gameplay including digital entrepreneurship, car racing, treasure hunting, and the ability to create and mint digital assets sold through player-owned "Metaventures."

What makes Upland particularly noteworthy in the crypto-gaming space is its dual-currency economy. The platform operates with UPX as its native in-app currency, while its utility token $SPARKLET (launched in-app in 2021 and listed on external exchanges in July 2024) powers the broader ecosystem. With over 150,000 holders, $SPARKLET serves as the backbone for Upland's open economy, content creation, and ecosystem expansion.

The numbers speak to Upland's success in a space where many projects have struggled to maintain engagement:

- 4 million accounts

- Over 8 million NFTs minted

- $10 million in monthly secondary market trading volume

- Players have earned over $16 million and over 110 million SPARKLET tokens

Unlike many Web3 projects that exist primarily as speculative investments, Upland has focused on building genuine utility and partnerships. Global brands including FIFA, the NFL Players Association, and UNICEF have used the platform to engage fans and audiences in innovative ways. This focus on real-world connections has helped Upland avoid the "empty metaverse" problem that has plagued similar projects.

For developers, Upland offers a robust infrastructure that enables seamless integration of Web2 and Web3 applications while leveraging the platform's existing economy. This has created a thriving ecosystem where third-party creators can build on top of Upland's foundation.

The platform recently expanded its reach with the launch of XStacks, the first-ever casual game on X (formerly Twitter), potentially introducing blockchain gaming to entirely new audiences.

What's particularly interesting about Upland's approach is how it balances blockchain technology with accessibility. The platform offers property rights secured via blockchain while maintaining a simplified Web2-like user experience with fiat on/off ramps, removing many of the barriers to entry that have limited adoption of other Web3 platforms.

As the metaverse concept continues to evolve following the initial hype cycle, Upland represents a model worth watching—one that focuses on building genuine utility, fostering community ownership, and creating meaningful connections between digital assets and the physical world.

To explore Upland's virtual real estate market, its tokens, and growing ecosystem, visit www.upland.me and follow the company on X.

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

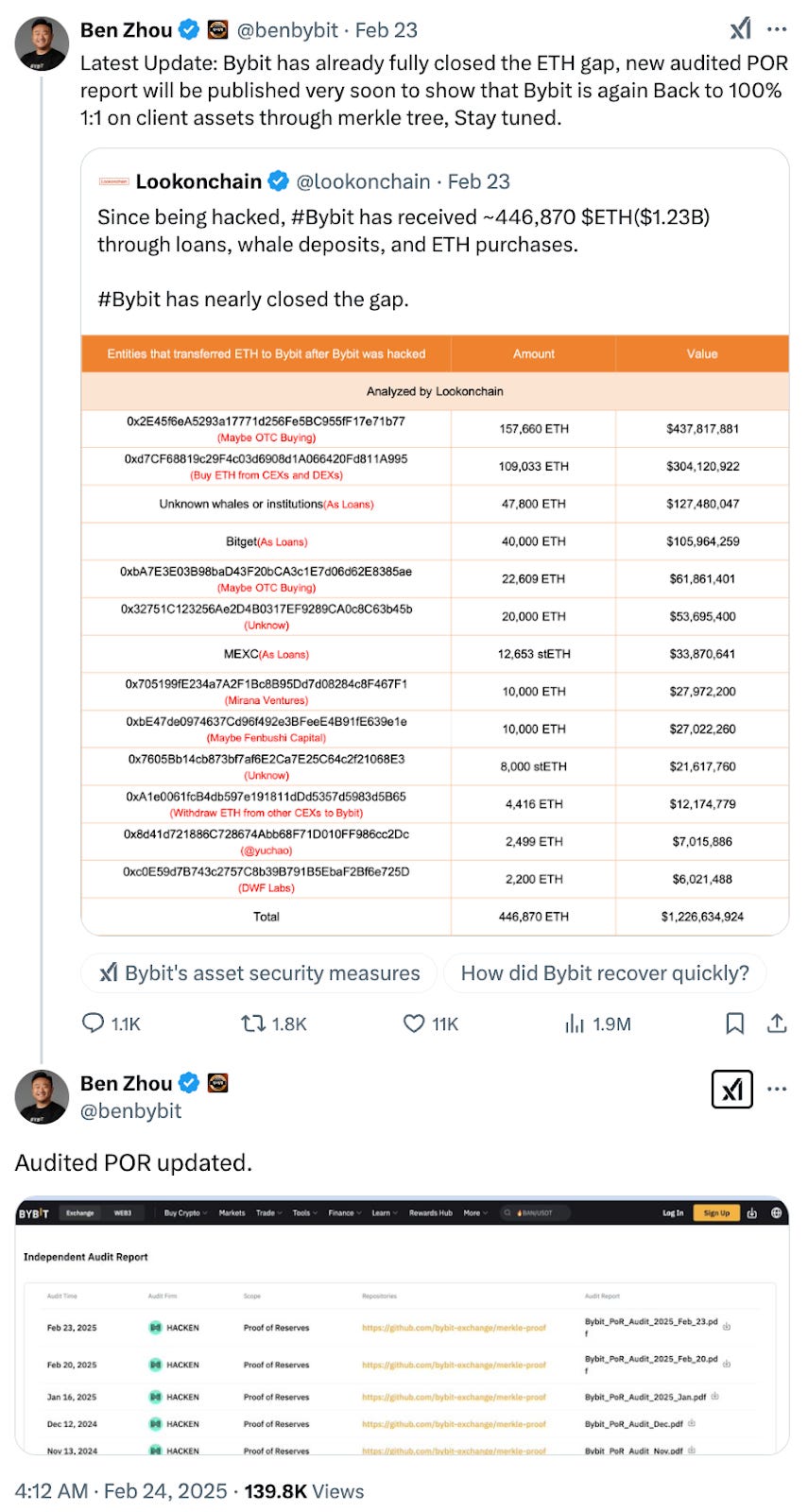

🎉 Bybit Said it Closed $1.5B Gap Left After Largest Crypto Exploit in History: According to Lookonchain data, Bybit replaced most of the stolen funds through loans from other crypto exchanges, whale deposits, and additional ETH purchases.

⚖️ SEC ends investigation into Robinhood as new leadership halts aggressive crypto enforcement: Robinhood Crypto is no longer under investigation by the SEC. The agency closed its inquiry on Feb. 21, opting not to pursue any enforcement action.

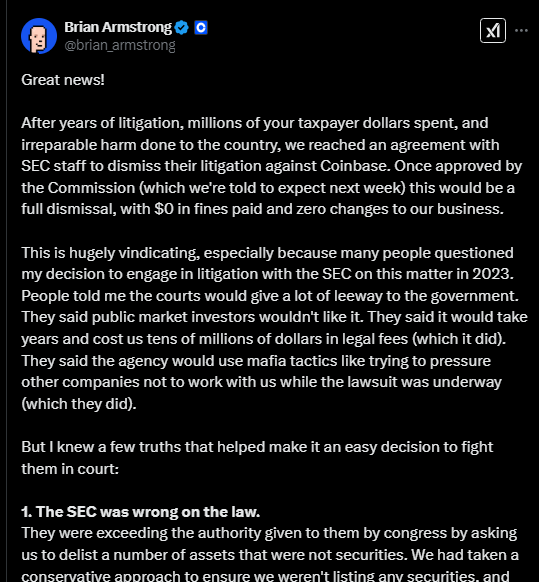

🏛️ Coinbase, SEC Reach Agreement to Dismiss Lawsuit: The Securities and Exchange Commission asked for a 28-day extension in response to Coinbase's appeal, a part of a long legal battle between the agency and crypto exchange centered on how to classify digital assets.

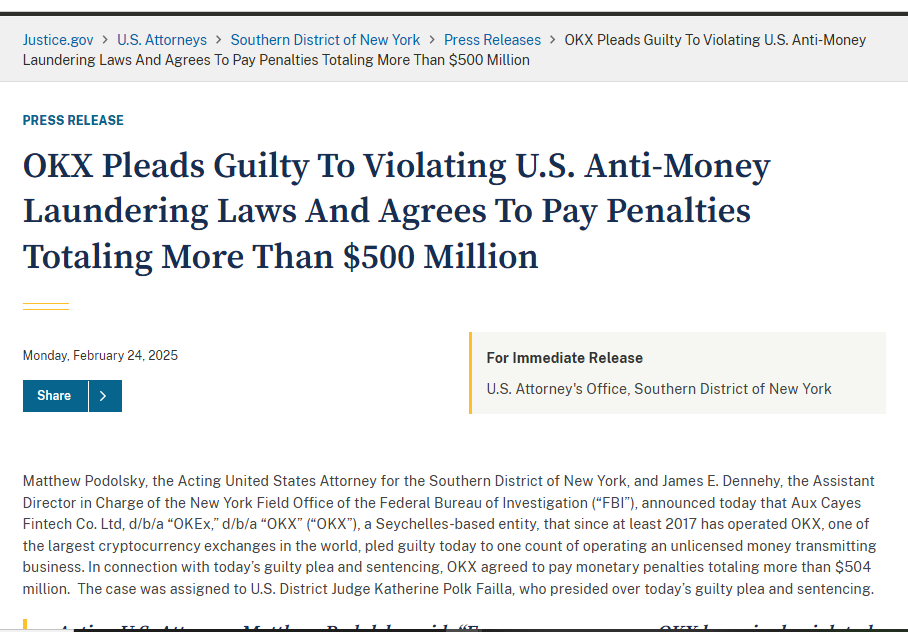

⚖️ OKX Pleads Guilty, Pays $500 Million for Illegally Serving US Customers: Cryptocurrency exchange OKX's Aux Cayes FinTech Co. Ltd affiliate has settled with the U.S. Department of Justice, and has agreed to pay over $500 million worth of penalties after pleading guilty to serving U.S. customers without a money transmitter license and not following anti-money laundering laws.

🚀 US spot Bitcoin ETFs surpass $750 billion in cumulative trading volume, led by BlackRock's IBIT: U.S. spot Bitcoin exchange-traded funds have surpassed $750 billion in cumulative trading volume — just over a year after their debut in January 2024.

💬 Tweet of the Week

Source: @JakeGagain

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

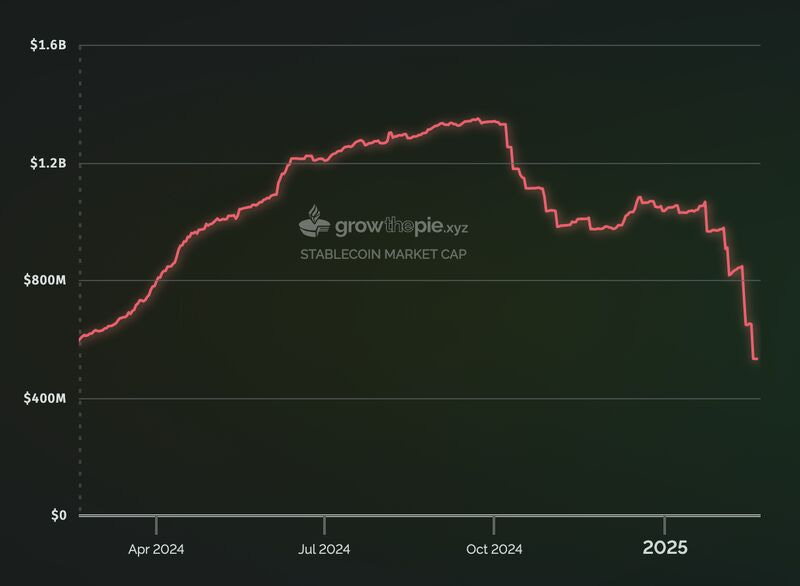

1. Interestingly, total circulating supply of stablecoins on Optimism is down 50% on the month, dropping from nearly $1.1B at the beginning of February to now just $531M. Much of this has been driven by USDT outflows, which have surpassed $550M (-68%) this month.

This is the lowest level of stablecoin liquidity on the network since January 2023.

Source: @DavidShuttleworth

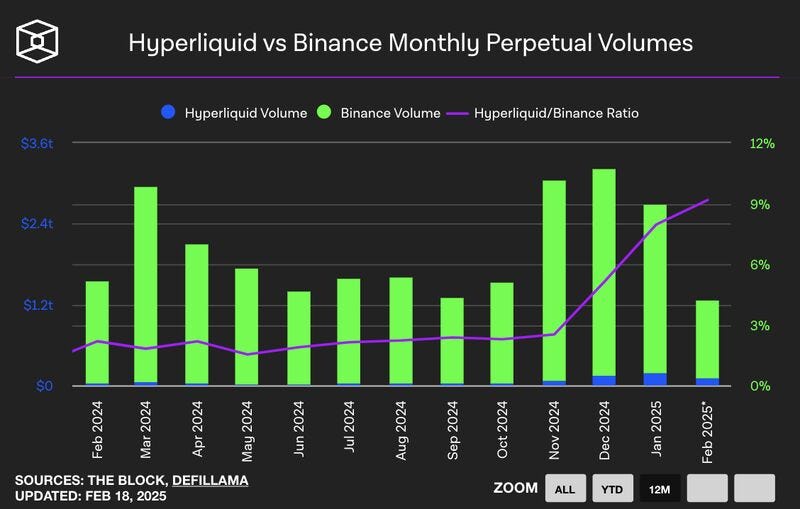

2. With the arrival of HyperEVM today, it's interesting to see how much progress Hyperliquid has made in a very short space of time. Since November, total monthly perp volume on the protocol has grown by 164% and closed out January with a staggering $198B in volume. Overall, Hyperliquid now represents about 9% of Binance's monthly perp volume, which is virtually unheard of for a decentralized application.

Source: @DavidShuttleworth

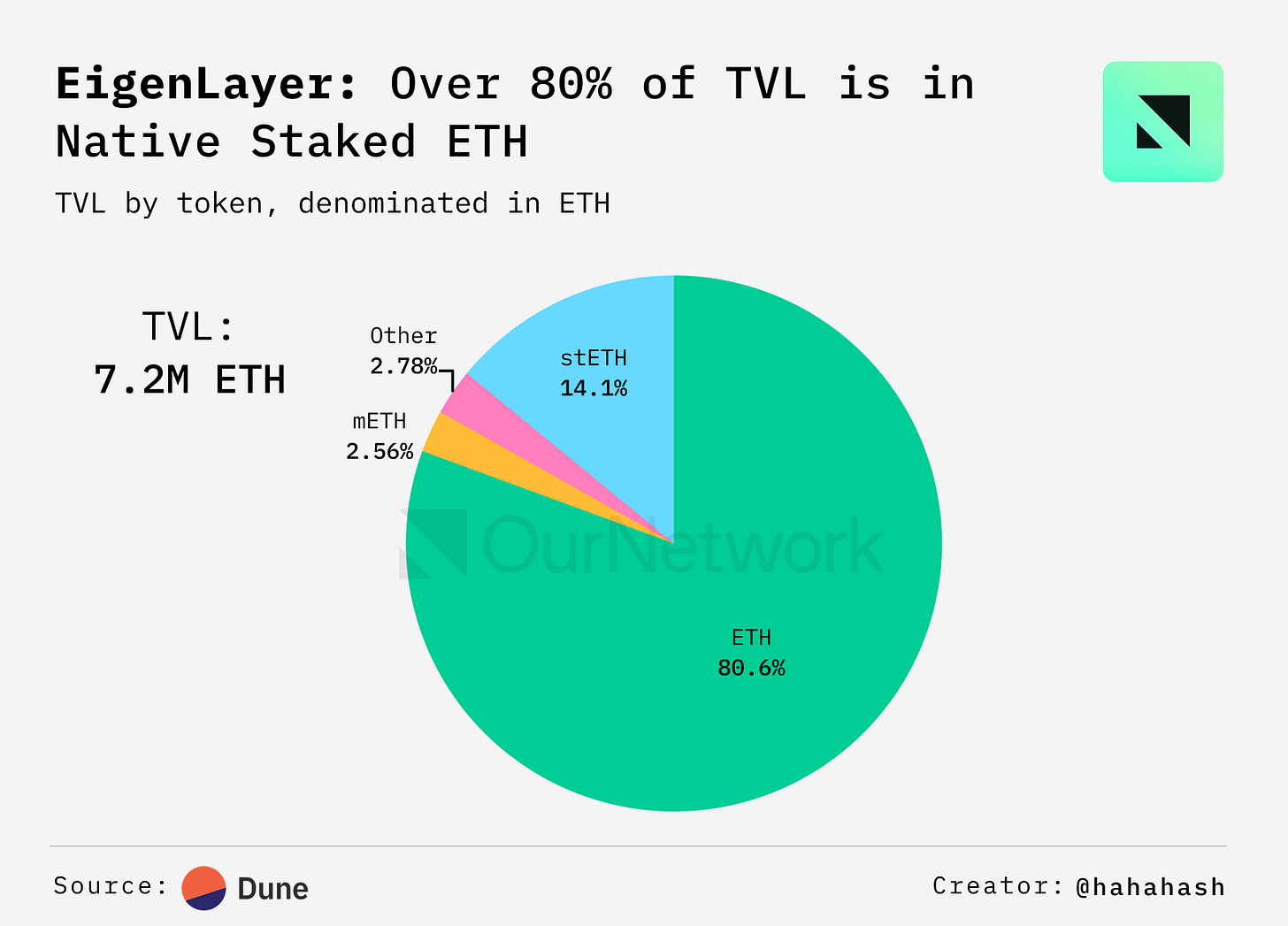

3. After a surge in deposits between February and April 2024, total value locked (TVL) for Eigenlayer, the leading restaking protocol, has seen steady growth. TVL now exceeds 7.2M ETH —roughly $20B at the time of writing. Of that amount, 80.6% is native staked ETH, 14% is Lido’s stETH, while more than ten other variations of liquid staking tokens (LSTs) make up the rest. The protocol has just under 137,000 unique depositors.

Source: @OurNetwork

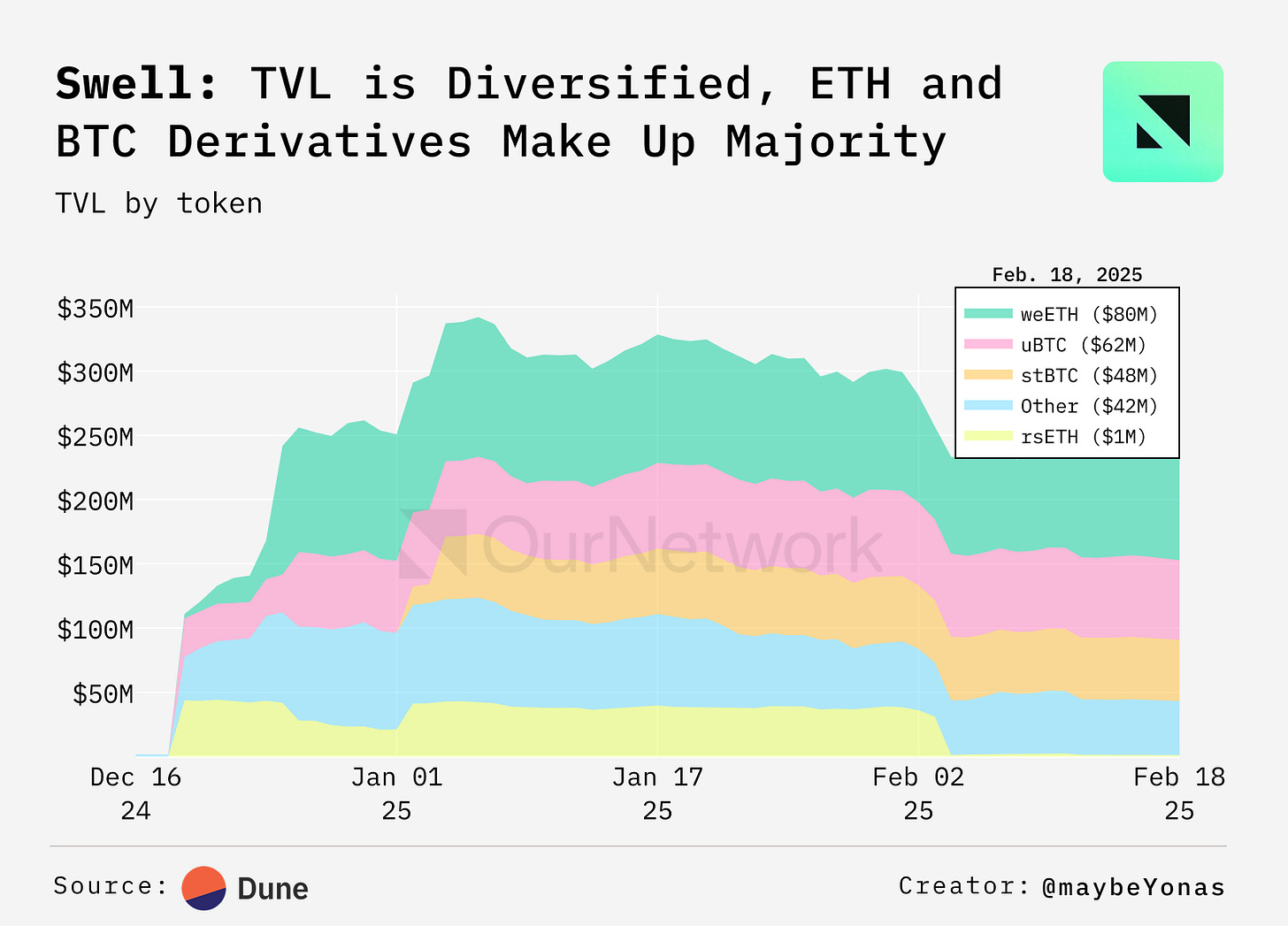

4. Swellchain is the Layer 2 (L2) network for Swell, a non-custodial LST and liquid restaking token (LRT) provider with over $800M in TVL across all products. Swellchain itself operates as a restaking-focused Layer 2 network built on the OP Stack alongside other L2s like Base, Optimism, and Unichain. Swellchain has attracted top protocols such as Euler, the lending protocol, Ambient, the trading protocol, and soon Velodrome, the decentralized exchange (DEX), to deploy on their chain. This has allowed the chain's $230M of TVL to be productively utilized and spark economic activity on the network.

Source: @OurNetwork

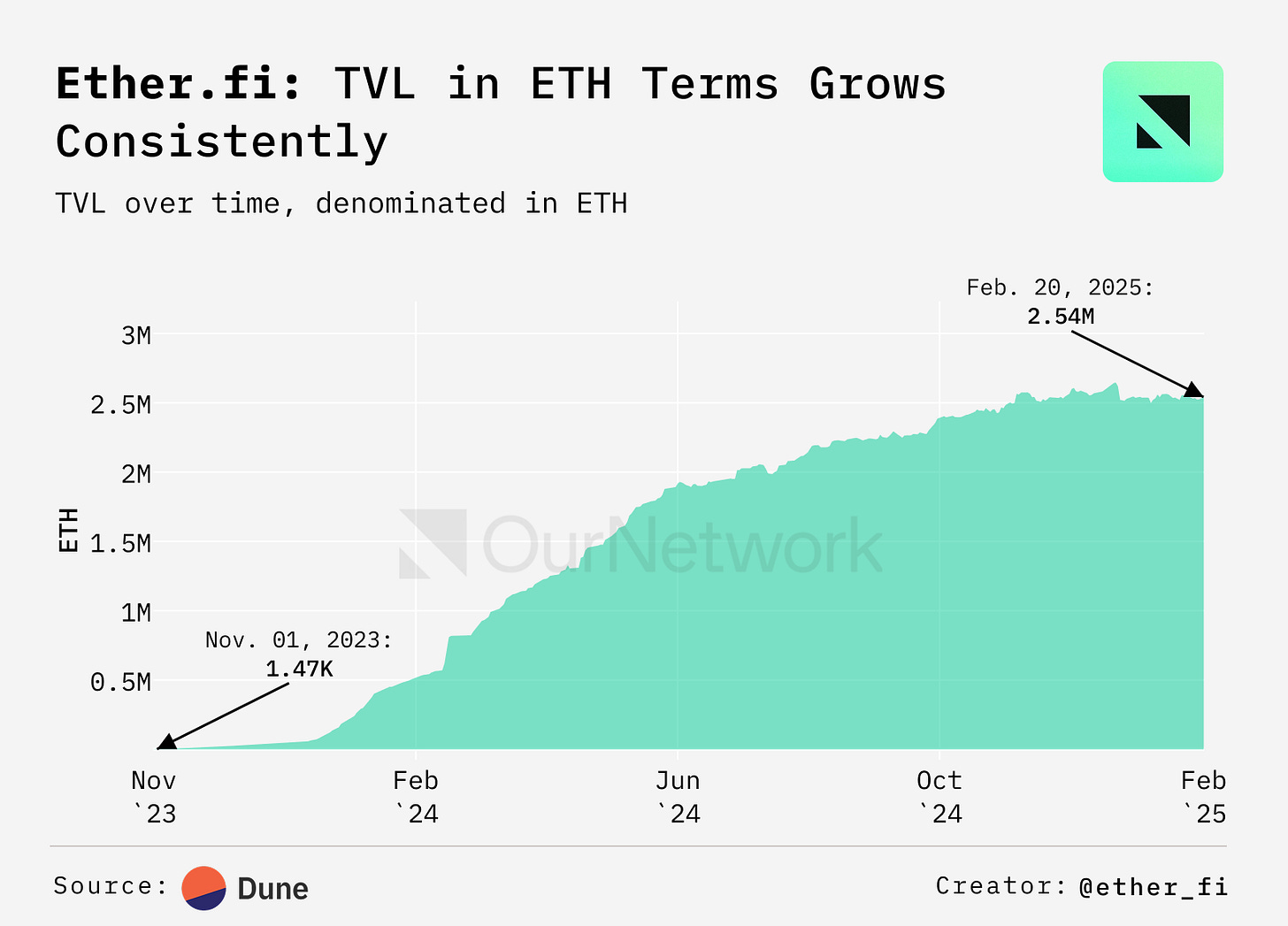

5. Ether.fi is a non-custodial staking protocol whose key offering, eETH, is integrated with Eigenlayer to offer restaking rewards. The protocol reached 2.54M ETH in TVL, according to Dune Analytics. Deposits into Ether.fi are routed into different protocols — key among those is Eigenlayer, where Ether.fi's deposits constitute over 40% of the protocol's TVL. Ether.fi's deposits are also over 40% of Symbiotic's TVL, showing Ether.fi's impact in the restaking space.

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Introduction

The Ondo Summit 2025, held on February 6, 2025, in New York City, marked a significant milestone in the integration of traditional finance with blockchain technology. The event featured a star-studded guests list including but not limited to:

Asset Managers:

Goldman Sachs

Franklin Templeton

BlackRock

Fidelity Investments

BNY Mellon

Blockchain and DeFi Leaders:

David Schwartz (Chief Technology Officer, Ripple)

Sergey Nazarov (Co-founder, Chainlink)

Mary-Catherine Lader (Chief Operating Officer, Uniswap)

Konstantin Richter (CEO, Blockdaemon)

Regulatory Officials:

Caroline D. Pham (Acting Chairman, Commodity Futures Trading Commission)

Summer K. Mersinger (Commissioner, Commodity Futures Trading Commission)

J. Christopher Giancarlo (Former Chairman, Commodity Futures Trading Commission)

Industry Experts:

Dan Morehead (Founder, Pantera Capital)

Mike Novogratz (CEO, Galaxy Digital)

Patrick McHenry (Former Chair, House Financial Services Committee)

This was perhaps the first time where blockchain leaders, regulatory officials, and traditional asset managers came together to talk about the steps required to integrate blockchain technology with traditional finance rather than metaplanning.

This has been a long time coming.

The full summit is available on Youtube here.

What made me the most excited was the pragmatism during the conversations. Some quotes that Sandy Kaul from Franklin Templeton that displays this thoughtfulness are:

“Don't underestimate how difficult it is going to be to move from an account based system to a wallet based system… there is no such thing as a real portfolio; a portfolio is a virtual construct of different accounts and therefore the idea that I could commingle assets and use assets interoperable is completely foreign to anyone coming from a traditional background.”

“The system [the regulators] came up with [in the 1970’s] started to have Central counterparties [and] Central depositories. We started to have clearing organizations acting as buyer to every seller and seller to every buyer, we started netting portfolio positions, we started doing book order entry and ownership. We have to unwind that whole system to make this new system work.”

Dan Morehead, the Founder of Pantera Capital also mentioned the changing political zeitgeist:

“There used to be this huge group of people in Congress that were anti-crypto… In the 58 contested elections where pro-crypto PACs competed, 54 of the anti-crypto people left Congress. Nobody’s going to say anything bad about crypto in Congress again.”

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com and playupland.com/start and www.crowdcreate.us