Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This week the California DMV integrates Avalanche, the Ethereum ETFs saw $152M in net outflows, the SEC approved Grayscale’s Bitcoin Mini Trust, and big new venture rounds came in for aPriori ($10M) and Mezo ($7.5M).

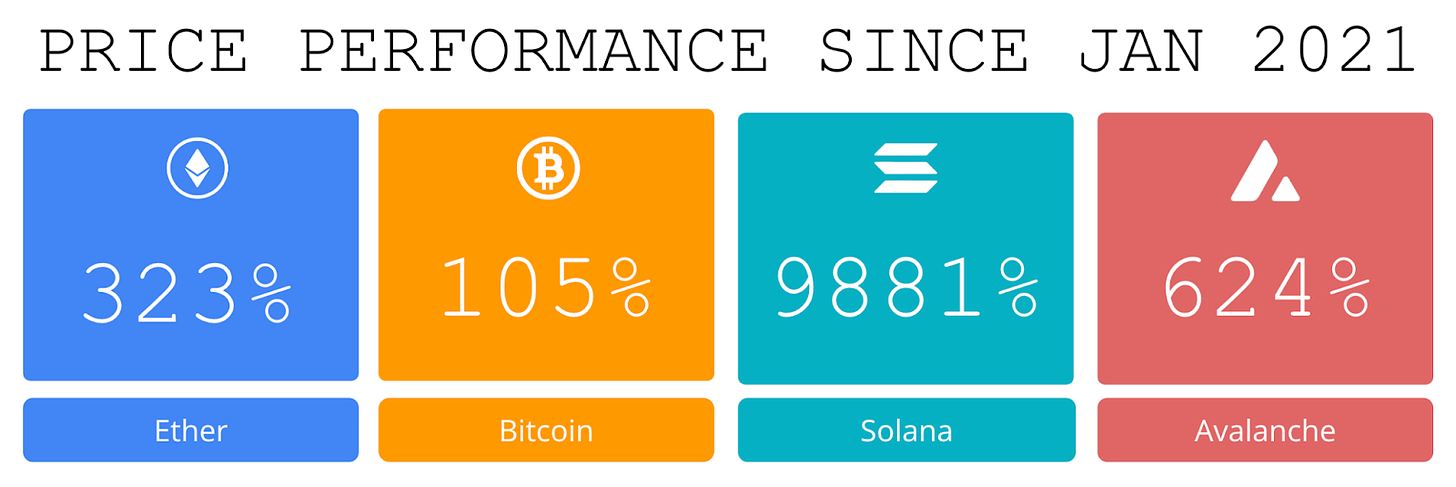

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Amphibian Capital, managing $75M+ AUM, is a fund of the world's leading hedge funds. +11.99% net YTD with their USD fund, +10.53% net YTD in their ETH fund (64.4% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

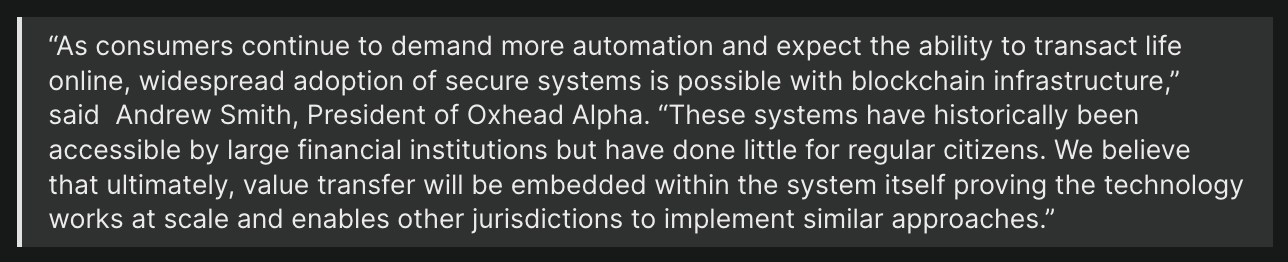

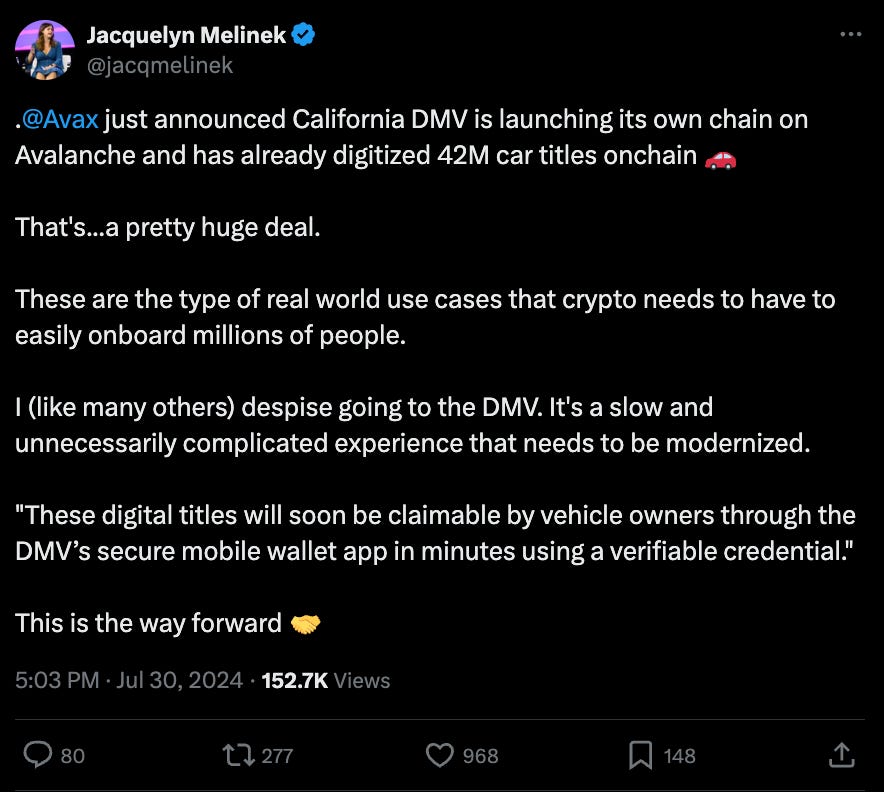

🚗 California DMV Puts 42M Car Titles on the Avalanche Network in Digitization Push: Developed by Oxhead Alpha, the system will let users transfer vehicle titles in minutes and without going to an office versus the two week time frame in the traditional system.

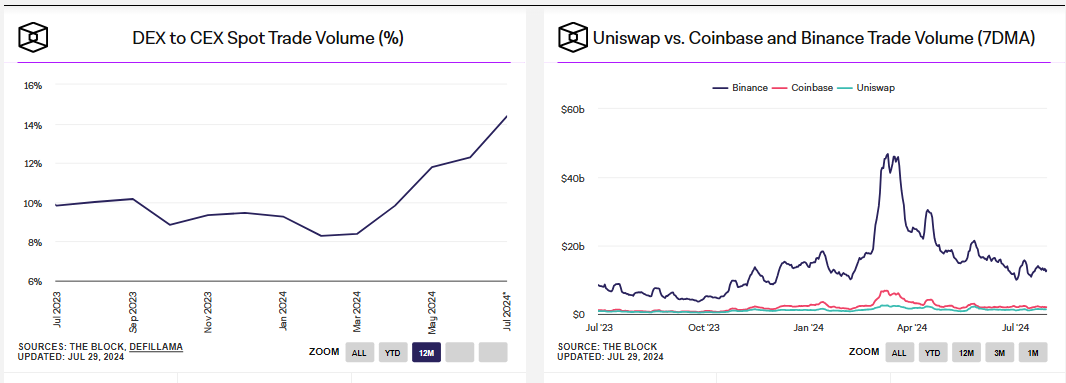

🚀 DEX market share surges to record high, outpacing centralized exchanges:The market share of decentralized exchanges (DEXs) compared to centralized exchanges (CEXs) has hit an all-time high.

🚀 US spot Ethereum ETFs see $152 million in net outflows on third day: The nine U.S. spot Ethereum exchange-traded funds recorded $152.3 million in net outflows on Thursday, their third day of trading, extending the outflows from the previous day.

⚖️ SEC Approves Grayscale Bitcoin Mini Trust to Trade on NYSE Arca:The U.S. Securities and Exchange Commission (SEC) has approved the New York Stock Exchange (NYSE) Arca’s request to list shares of Grayscale’s Bitcoin Mini Trust.

🚀 Long-Awaited ‘Illuvium’ Ethereum Games Launch on Epic Store: The developer of the Illuvium blockchain gaming franchise released three interconnected sci-fi fantasy games onto the Epic Games Store on Thursday. After a series of betas, Illuvium is branding this as the “official game launch,” following a play-to-airdrop campaign.

💬 Tweet of the Week

Source: @jacqmelinek

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Last week, we saw a relatively low level of institutional inflows, despite the launch of spot ETH ETFs. Overall, just $245M entered the space compared with $1.35B the previous week. BTC ETFs led the way with $519M of inflows, but much of this was offset by $285M of outflows from ETH ETFs.

Source: @DavidShuttleworth

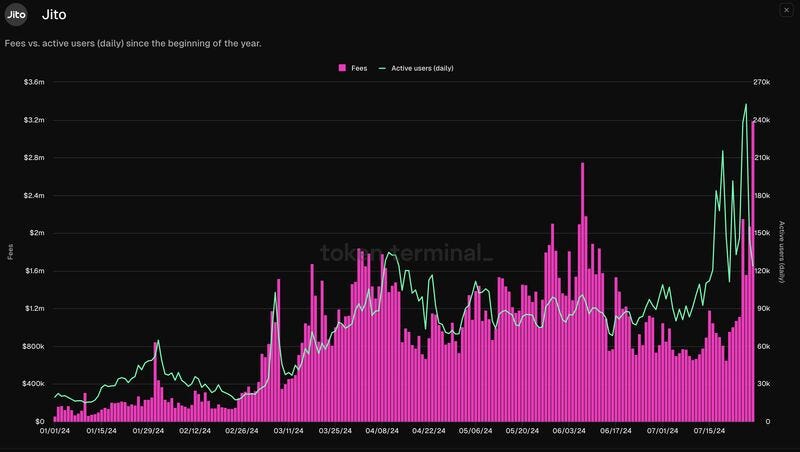

2. Over the past week, Jito has gained considerable traction and has now set an all-time record in terms of daily fees (total validator tips paid), users, and revenue (share of tips that go to the protocol). The platform recently served over 252,500 daily users and generated $3.19M in daily fees along with $160k in daily revenue. Perhaps just as importantly, Jito is currently responsible for over $2.2B of staked assets, also an all-time high.

Source: @DavidShuttleworth

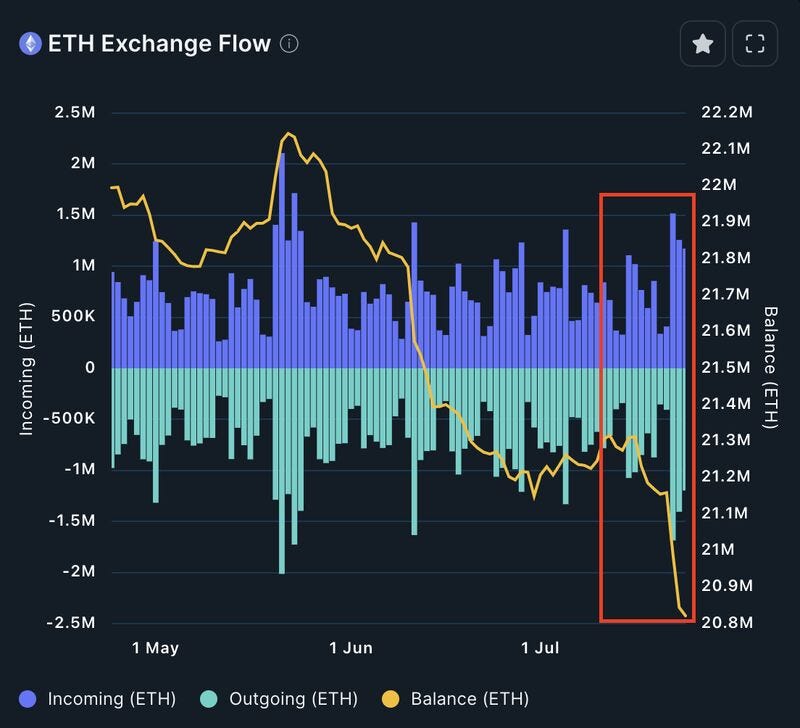

3. Amidst the launch of spot ETH ETF products, ETH liquidity on exchanges continues to trend downward and is now at a new yearly low of 20.8M ETH. This past week alone, over 491,000 ETH ($1.7B) was taken off of exchanges.

Source: @DavidShuttleworth

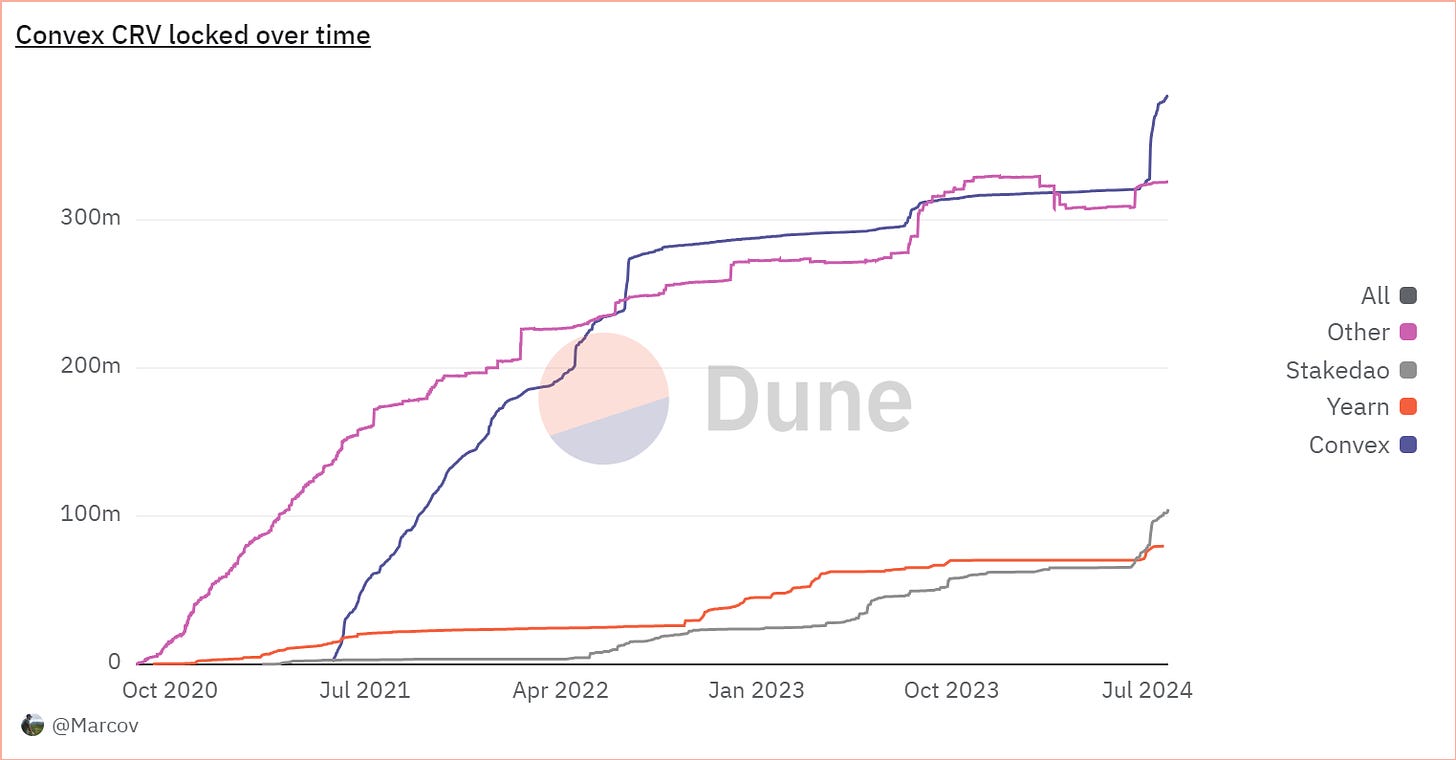

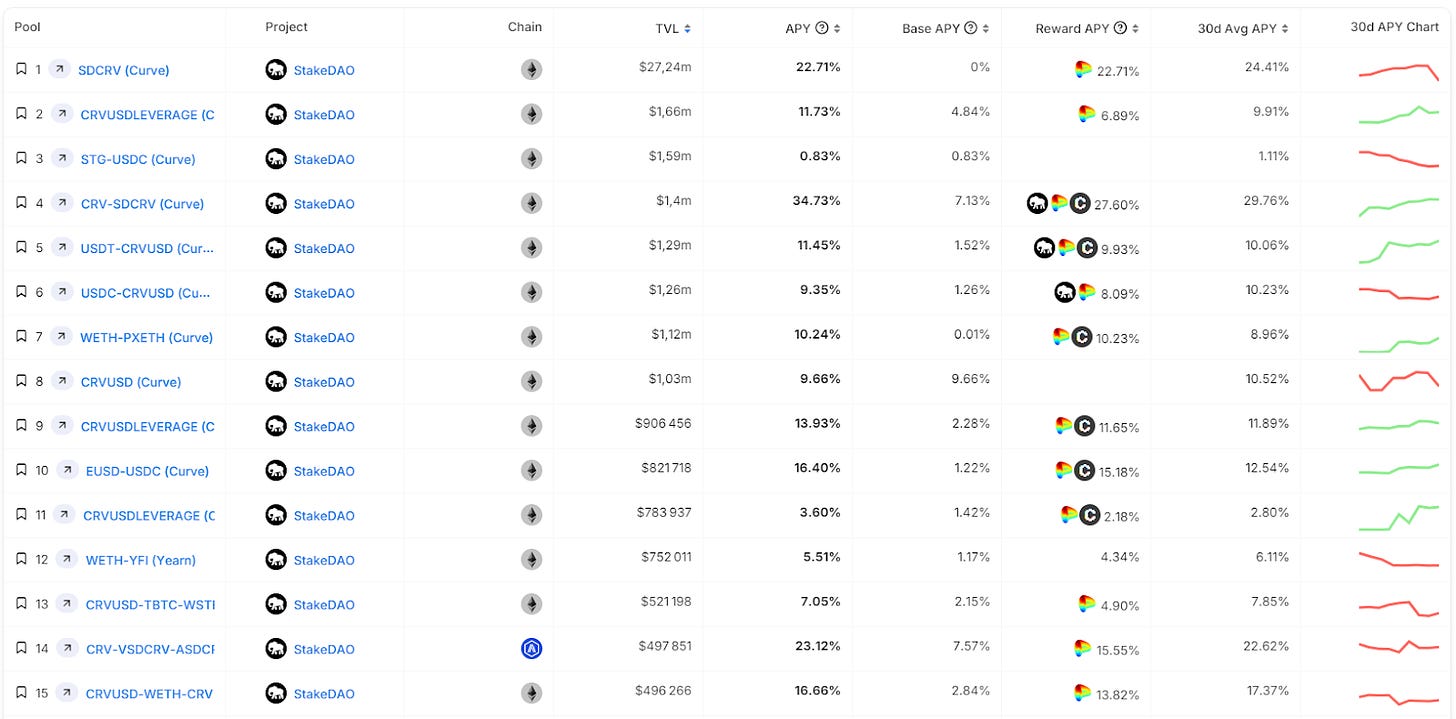

4. Convex locked CRV reaches 385M in July (+17.5%)

5.Stake DAO crosses 100M CRV locked

Source: @OurNetwork

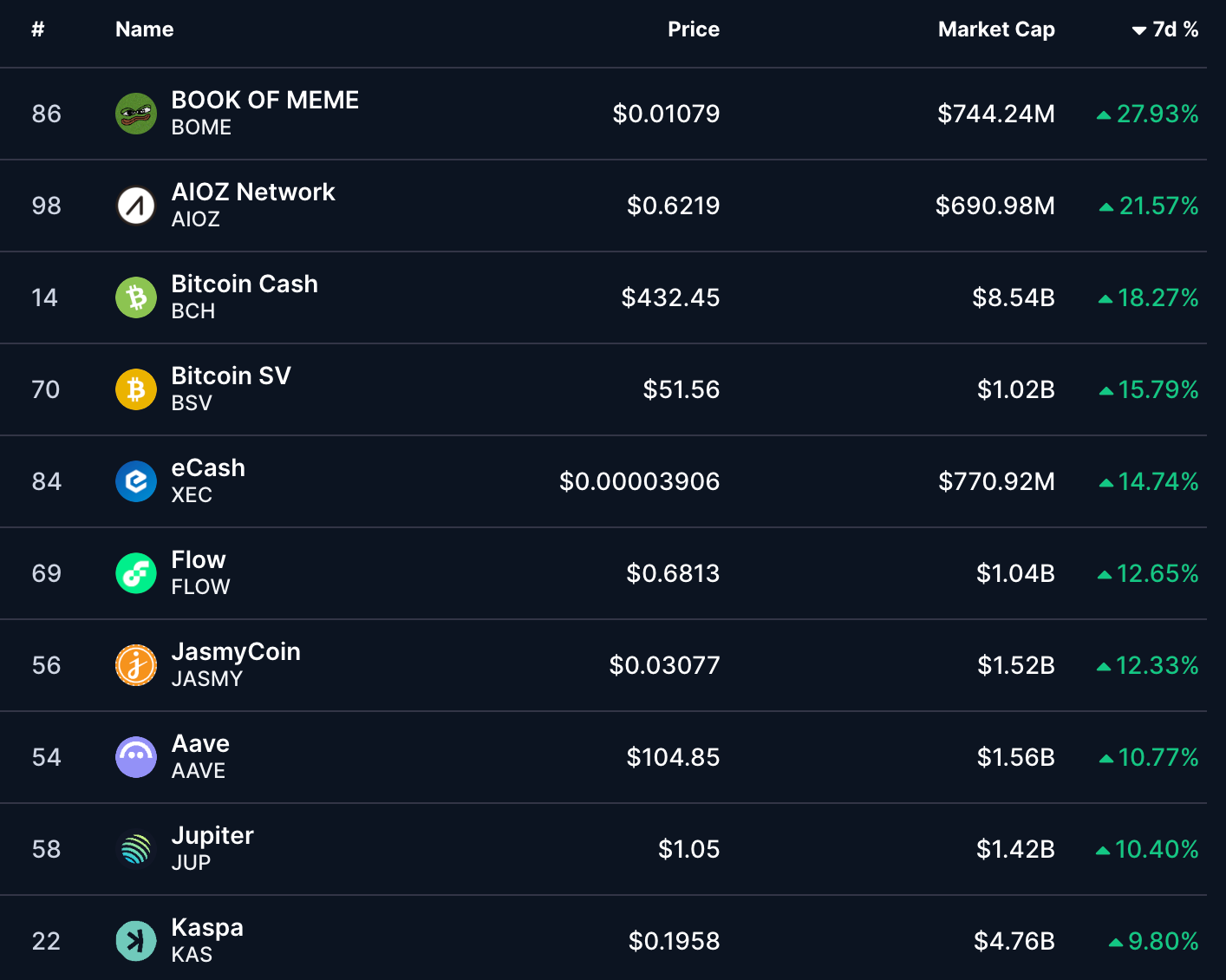

6. Top Moving Coins From the Top 100

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

“Navigating the Crypto Landscape” Panel

In May, I was fortunate to share the (virtual) stage with Haseeb Qureshi (Dragonfly Capital), Jason Choi (Tangent), and Jason Kam (Folius Ventures) for the "Navigating the Crypto Landscape" panel at the REDeFiNE TOMORROW 2024 summit.

In a conversation moderated by CJ Fong from GSR, I covered some of the most interesting trends that we’re observing at Pantera.

CJ Fong: Hello, everybody. Welcome. The panel I have before me, and it's an honor to moderate this panel, includes four giants of the space, the most prominent figures you'll come across. Today's topic, however broad, is called “Navigating the Crypto Space.” We're going to look to these crypto VCs and founders to find out their thoughts on the space—where we've come from, where we are now, and where we're going from here.

My name is CJ Fong. I'm with GSR, and I run the sales teams for APAC and ANZ. I'd love for each of the panelists here to please introduce yourselves and your funds. What I'd also love to hear is what you feel is a differentiating factor when it comes to your respective funds in terms of your approach. And, on a more personal note, I'd love to know how long you've been in crypto and how you actually got into space.

Paul Veradittakit: My name is Paul Veradittakit, and I'm the Managing Partner at Pantera Capital. Pantera Capital is one of the first institutional investors in crypto and blockchain. We manage about $5.5 billion, investing in both equity and tokens at early and later stages, including pre-TGE rounds.

Pantera was founded by Dan Morehead, who used to be the CFO and head of global macro trading at Tiger Management. He comes from the traditional global macro side of things. We've been investing in crypto since 2013 and launched the Bitcoin Fund that same year. Dan initially faced challenges buying a few million dollars of Bitcoin on Coinbase due to daily limits, which Olaf Carlson-Wee, then in customer support at Coinbase, helped resolve. This was back when Bitcoin was about $50. We now have over 200 investments worldwide.

My career has mostly been in venture capital, starting on the startup side with business development, followed by economic consulting, and then VC focused on mobile apps and infrastructure. I've been managing investments for Pantera for the last 10 years.

Regarding differentiation, when we started in 2014, there wasn't much of a platform in crypto; it was traditional VC activities like business development. Over time, we developed a platform to address the needs of crypto companies, including hiring, economic research, governance, and regulations. Pantera stands out with its cross-border global activities. We also have a long-short hedge fund, unlike many who only do privates, and a special opportunities fund targeting secondary markets during bear markets.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com