Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This week Caroline Ellison was sentenced to two years, the SEC greenlighted trading options, a judge dismissed the Consensys lawsuit, and big new venture rounds came in for Celestia ($100M) and TON ($30M).

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

HypeLab is the premier web3 advertising network, building ‘Google ads for web3’. With HypeLab, you run ads to real crypto users on high-quality publishers like Chainlist, Coingecko, Quickswap, and hundreds more. Advertisers like Metamask, Uniswap, and Paypal use HypeLab to super-charge their web3 growth.

Become a Coinstack Sponsor

To reach our weekly audience of 260,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

👨⚖️ Caroline Ellison Sentenced to Two Years in Prison for Her Role in FTX Fraud: Ellison will also have to forfeit about $11 billion dollars, a federal judge ruled Tuesday.

⚖️ SEC greenlights listing and trading options for BlackRock's spot bitcoin ETF: The U.S. Securities and Exchange Commission has approved BlackRock's proposal to list and trade options for its spot bitcoin exchange-traded fund.

🏛 Judge dismisses Consensys lawsuit against SEC over MetaMask and Ethereum claims:A U.S. district judge has dismissed a case brought against the Securities and Exchange Commission by blockchain and web3 development company Consensys Software Inc.

🚀 Circle is launching USDC on Sui, marking its 15th network integration:This will be Circle’s fifteenth blockchain integration since launching USDC through a joint partnership with Coinbase in 2018. The token is the sixth-largest cryptocurrency, with a market capitalization and circulating supply of $35 billion.

⚖️ OpenSea NFT Marketplace Hit With Class Action Suit Over Alleged Securities Sales:The Moskowitz Law Firm filed another class-action lawsuit against a crypto firm Thursday, this time alleging that OpenSea’s customers were sold NFTs as unregistered securities.

💬 Tweet of the Week

Source: @intocryptoverse

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Over the last three weeks, net inflows of more than 545,000 ETH ($1.4B) occurred on exchanges. This pushed ETH exchange balances to their highest levels since July. Interestingly, this came ahead of the Fed signaling a rate cut towards the beginning of the month and as ETH ETFs continue to struggle to gain traction.

Source: @DavidShuttleworth

2. Over the last week, total USDT circulating supply on TON increased by 41% and surpassed $1B for the first time ever. So in less than 6 months, TON was able to attract more than $1B of native USDT liquidity on the network since TON Foundation integrated Tether.io back in April.

Meanwhile, weekly active users on the network have steadily grown to over 5M during this time and have increased by 56% since the beginning of September.

Source: @DavidShuttleworth

3. Fed cuts rates by 50 basis-points. Macro leads, crypto follows.

This is also an official notice to all stablecoin issuers that have had the luxury of simply kicking back and enjoying significantly high yields from parking deposits in short-term US treasuries and bonds to drive revenue. Those days are coming to an end, time to innovate.

Source: @DavidShuttleworth

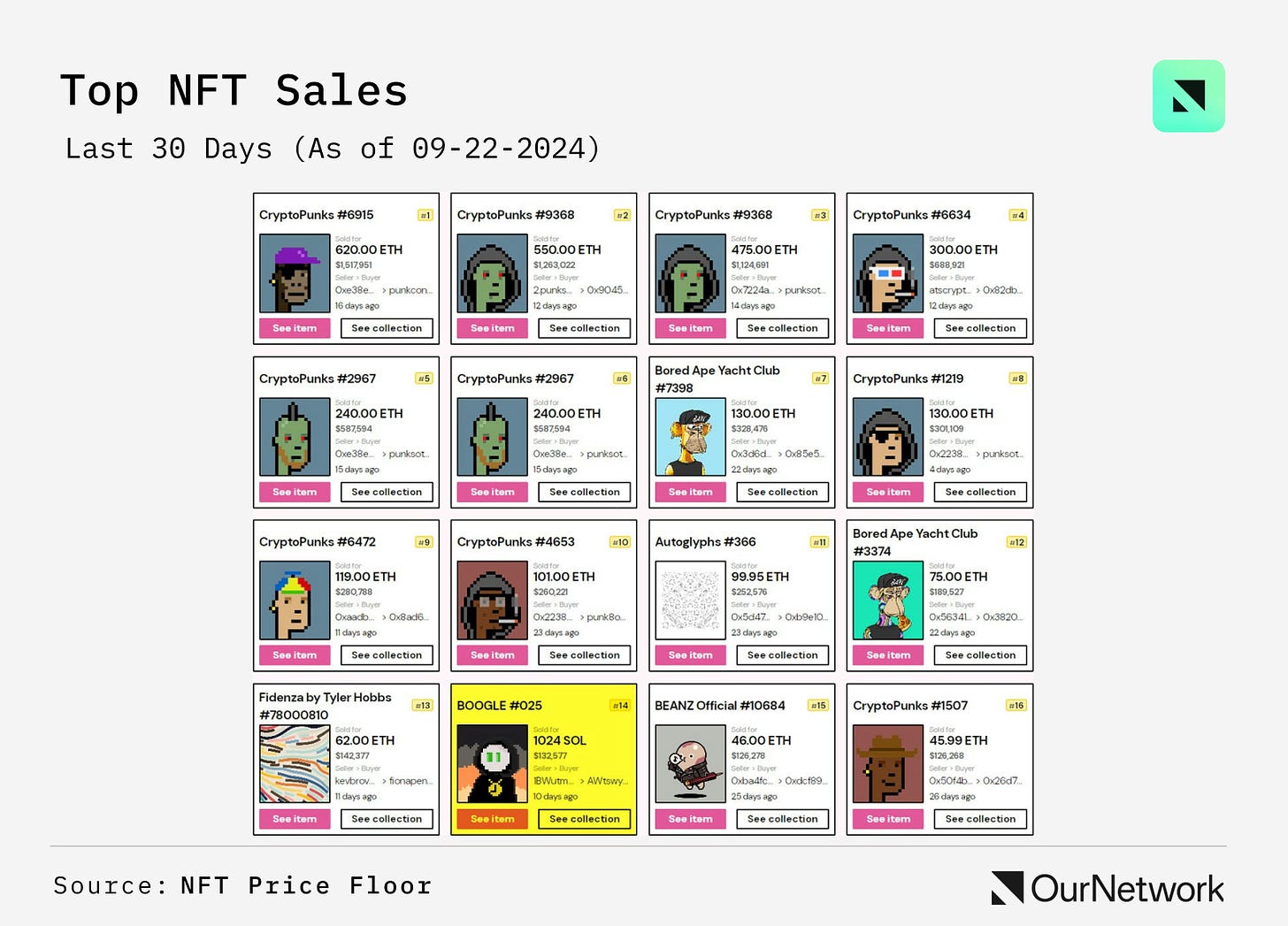

4. With 97% of the Sales, the High-End NFT Market is still Ethereum Territory

Source: @OurNetwork

5. Mad Lads Price Peaked at $29.4k in March, 38% of Holders are Solana Veterans who also Hold Claynosaurz.

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Clearing Intents

There are dozens of active L1 blockchains and with the advent of rollup services, the number of L2 chains has exploded. Reducing the tradeoffs of moving crypto across chains unlocks value for all chains, improves user experience, and creates tighter spreads for users. These are all features dearly needed to grow the users, apps, and protocols built on top of these blockchains. Bridges are the ways in which users can move assets and liquidity across chains. This is vital to price stability on-chain and more importantly, competitive price spreads for consumers. Current crypto bridges face a trilemma between being fast, cheap, and permissionless.

The three types of bridges:

Custodial Bridge: Using a CEX like Coinbase or Binance to bridge is instant and cheap, but not permissionless.

Permissionless Bridge: Hyperlane, Portal, Hop, or LayerZero are somewhat fast, but not cheap. They can be permissionless, in which liquidity providers take a fee, or depend on trusted minters to create wrapped canonical assets (which are not trustless and unnecessarily creates more assets).

Intent Bridge: Current solutions are permissionless, but are often slow and not significantly cheaper than permissionless bridges because of rebalancing. They also are limited to high volume tokens.

Intent bridges have the possibility of solving the trilemma, but face issues of liquidity fragmentation, lack of standardization, and rebalancing costs.

Everclear’s Clearing layer is designed to fix all these and dramatically reduce the friction of moving between chains, lower costs for app builders and users, and simplify the user experience for developers and users.

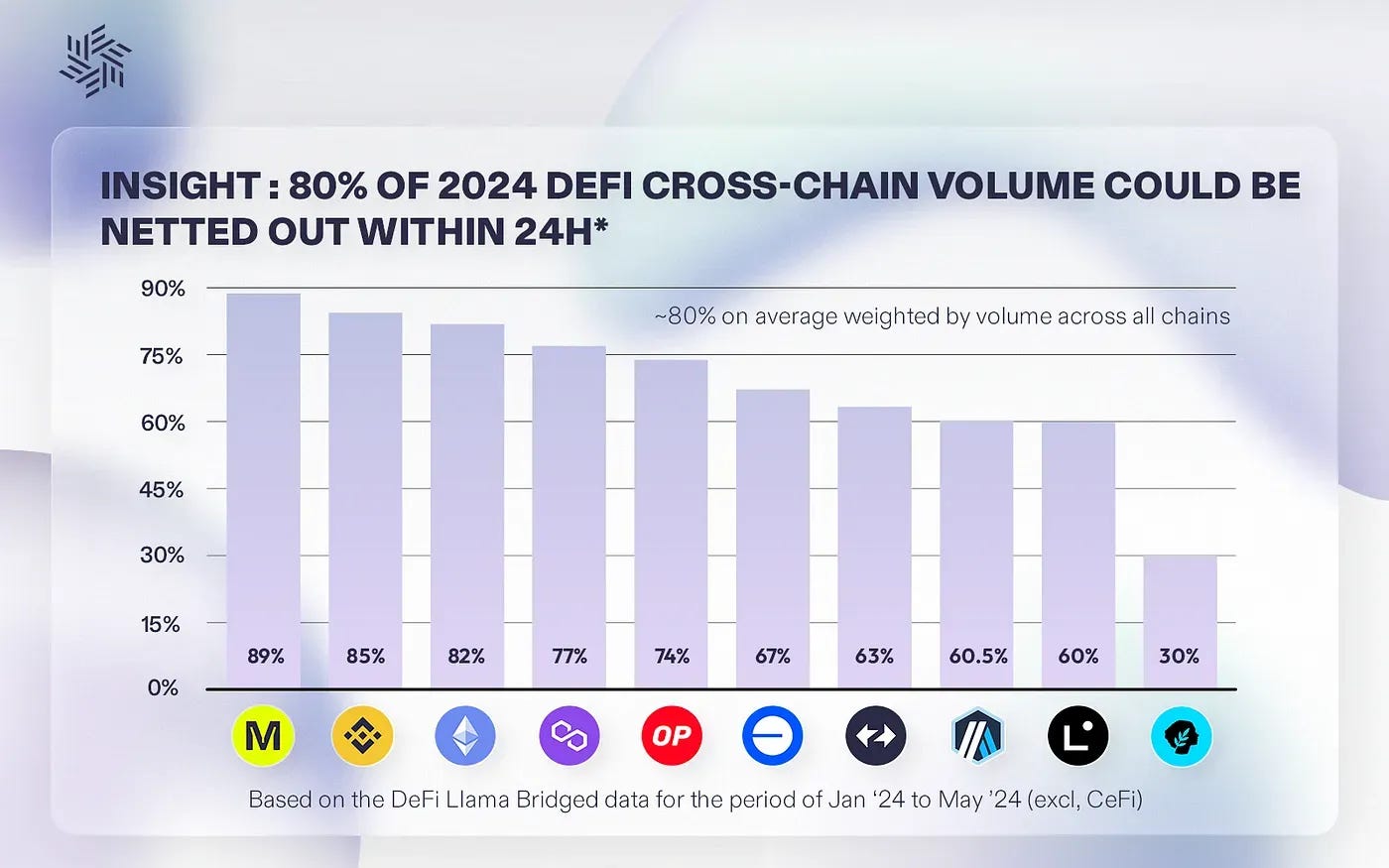

Intended Consequence

Intent bridges take advantage of the insight that 80% of cross-chain volume is “netted” within 24hrs, meaning that across all chains, for every dollar that leaves a chain, 80 cents returns within 24hrs. There is always volume going in and out of chains, but for 80% of it, the net volume ends back where it started.

Intent protocols take advantage of netting by swapping liquidity on each chain rather than bridging. For example, if a protocol like UniswapX has one user swapping $100 from Arbitrum to Polygon and another swapping $100 from Polygon to Arbitrum, UniswapX would instead just allow the two users to natively transfer the tokens to each other, which is magnitudes cheaper than bridging traditionally.

The core problem that Everclear solves is that this perfect match rarely happens. When it does not, the protocol has to “rebalance” by moving the residual the slow way through traditional custodial or permissionless bridges. This is slow, complicated, and expensive.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.