Issue summary: In this issue, we take a deep dive into Celo, the fast growing DeFi blockchain on a mission to provide mobile financial services to the world. We also summarize the most important crypto news, stats, and reports.

In This Week’s Issue:

Celo Deep Dive: The 4th Fastest Growing DeFi Blockchain By Mike Gavela & Ryan Allis

This Week in Crypto…

🗞️ Top Weekly News

💵 Weekly Fundraises

📊 Key Stats

📝 Report Highlights

🎧 Best Podcasts

📈 Top 10 Performers

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

🏦 Celo: The 4th Fastest Growing DeFi Blockchain

About the Authors: Mike Gavela is an analyst at Coinstack and Ryan Allis is a Managing Partner at HeartRithm, a crypto quant fund, and the founder and publisher of Coinstack.

A Deep Dive Into Celo - The Mobile-First DeFi Blockchain

Celo is a mobile-first blockchain focused on making financial services accessible to anyone globally with a mobile phone. Celo is growing very quickly and is currently the 4th fastest growing blockchain in DeFi. It has grown its TVL by 157% since August 1 from $339M to $870M today. You can see below Celo is currently outperforming Terra, Ethereum, Binance, HECO, and Polygon among major blockchains with at least $800M in TVL.

Since August 1, only Avalanche, Fantom, and Solana have grown faster than Celo among major blockchains with more than $800M in total value locked in DeFi applications.

Their token, CELO, is also up by 92% in the last 90 days and now trades around $5 per token with a market cap of $1.7B — much less than Terra (LUNA) market cap of $18B, potentially indicating an investment opportunity worth exploring.

The Top Celo Dapps

Celo’s Dapps like Symmetric, Moola Market, and Mobius Money have been growing exceptionally quickly since August 1st.

Celo is a fork of the Ethereum blockchain making it in an L1 blockchain that is fully compatible with Ethereum tooling. Furthermore, with its Ethereum Virtual Machine (EVM), you can run smart contracts built in solidity for Ethereum unmodified. It uses Proof of Stake consensus and has five-second transaction finality. Celo currently offers 1000 TPS with a goal of reaching 140k TPS thanks to their recently announced collaboration with Mysten Labs.

A Goal to Bank The Unbanked

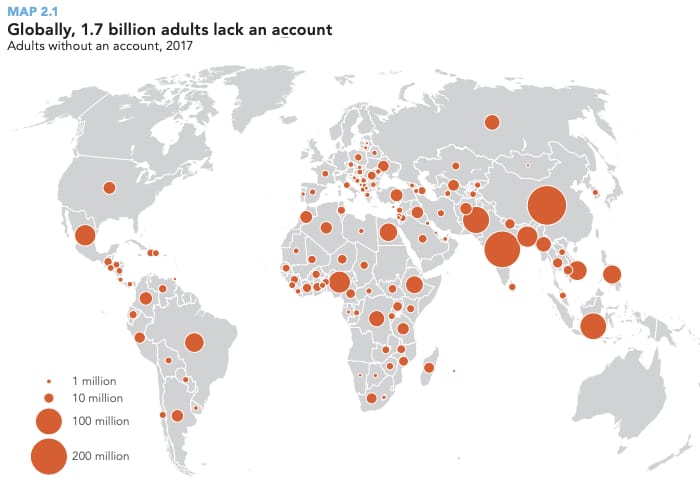

The World Bank Group looks at financial inclusion across three dimensions - access, usage, and quality of financial services. Over the last decade, the unbanked population fell by 35%, primarily boosted by the increase in mobile money accounts.

While globally 1.7 billion adults remain unbanked, fintech is helping make financial services more accessible. Today we have Celo, an L1 blockchain that leverages mobile money accounts to bring essential financial services to all parts of the globe regardless of their internet connection. Celo's core mission is to create a better financial system that creates the conditions for prosperity for all. In this deep dive, we dig into the background, values of the Celo founders, the tech, and the projects currently being built.

Founder’s Background

Rene Reinsberg, the founder of Celo, grew up in East Germany, recalling the fall of the Berlin Wall when he was a child. His family had a shoe store, and growing up he watched his parents struggle to figure out this new market economy which sparked his initial interest in Economics. During his high school years, he was fascinated to learn more and understand markets — especially loving the supply and demand dynamics that make up an economy. This fascination led him to be more involved with the store as he ended up developing a CRM and point of sale system to help his family better manage their stores. Rene credits this experience as his gateway into entrepreneurship at an early age while still in high school.

Rene joined Morgan Stanley in London out of college, where he worked in capital markets for the next couple of years. He was fascinated by the models and developing financial products on the structuring desk. He describes the experience as “being in a mini-startup inside a massive corporation.” He had fun in his role, given his fascination for economics, but it left him feeling a lack of purpose, being that he wasn’t serving people directly like he was in his tiny startup in high school. Rene decided then to leave Morgan Stanley and move to Latin America, where he worked as a consultant for various organizations, including the World Bank in Venezuela.

Although Rene scratched his itch to make a direct impact on the lives of others, the entrepreneur inside him wanted something more, so he began his education at MIT to get back into startups. At MIT he founded a company called Loku which helped small businesses manage their online presence. After selling Loku to GoDaddy, Rene set his sights on the crypto markets.

In an interview with Real Vision, Rene reveals his purpose for “empowering the small guy,” which is the driver of his entrepreneurial ventures.

“We sold Loku to GoDaddy in 2013. And I was there for a few years leading new products through the IPO. And when it was time to go back to the drawing board with my Loku co-founder, Merrick, and one of our first advisors, Sep Kumvar, we kind of looked at what had happened with crypto, with Bitcoin, Ethereum particularly, and the probability of these digital assets. And it was really appealing, because it felt like this was a massive technological shift, and, again, something that could be used to actually help the small guy, and empower those who are largely excluded from the financial system, and to level the playing field. So that got us really excited. So we started tinkering on a few different ideas that then ultimately led to what now is Celo.”

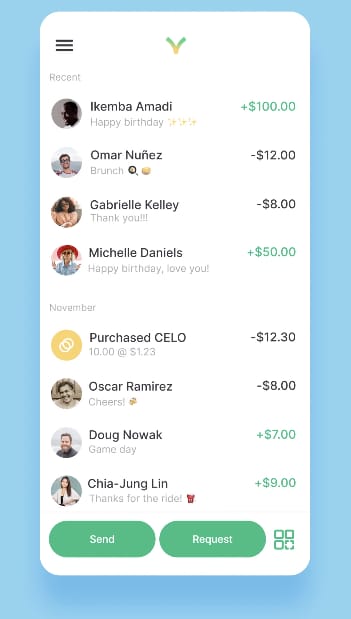

Valora: Venmo for the World

Valora is a mobile peer-to-peer payments and remittance app built on the Celo platform. Valora now has 53,000 monthly active users in over 100 countries and is rapidly growing. It was launched in February 2021, after four years in the making, and raised $20M in a Series A round led by a16z back in July.

Valora came initially within cLabs, and has spun out into its own separate entity. Valora is essentially the Metamask of the Celo blockchain. The difference is that Valora aims to achieve mainstream global success by giving users an easy to access, easy-to-understand, and easy-to-grow crypto wallet blurring the lines of Web 2 and Web 3 for mobile users.

Celo’s Bigger Purpose: DeFi For the People

Celo is an Esperanto word for Purpose. Celo's core mission is to build a better financial system that creates the conditions for prosperity for everyone. In the eyes of founder Rene Reinsberg, this means creating a new financial system that not only runs on mobile phones but is also easily accessible on those phones. The reason is that a large majority of those who are unbanked currently reside in 3rd world countries where feature phones are still often used.

Moreover, for those who do have a smartphone, it is usually not the latest iPhone on a 5G network, it is usually a legacy android device with a spotty internet connection. This is why companies with SMS interfaces such as MPESA have dominated the mobile money market in these regions. Even those with the latest smartphones in Africa often opt into using SMS phone interfaces instead of costly data services.

In order to truly bank the unbanked of the world, all financial products and services need to be offered, not just remittance. This is why some of the core designs of the Celo protocol revolve around making blockchains run on even the oldest of Android smartphones. With Celo, people who do not have a fast internet connection or computer to run a node can now participate in these networks, bringing BTC and ETH to over 6B mobile phone users worldwide.

Celo: How A Mobile-First Blockchain Works

Celo is a mobile-first blockchain that ties your phone number as your unique identifier or public key. The advantage to the average daily user is that Celo eliminates the inherent need to know someone’s public key in order to transfer funds or interact with smart contracts on the blockchain. Gone are the days of copy-pasting 40 characters plus strings of text starting in 0x.

With Celo, anyone with a mobile device can register for an account using their phone number. Users can then send and receive funds using their phone in the same way they use Paypal, Square Cash, or even Venmo. The difference here is that with Celo you don’t need a strong internet connection to make payments. Celo users can use the same feature phones from 2002 that they use today and interact with the blockchain using the most minimal amount of data. In an interview with Dr. Markus Franke, Celo’s head of European operations, Franke explains why Celo is mobile-first.

“Celo is mobile-first because per transaction, much less data is necessary to do a transaction. So you don't have to download a whole block to your router or light client being your mobile phone. You only have to download a hash of the block header. And this makes basically the amount of data that you as a mobile phone user would need for a transaction 700 to 800,000 times less than on other blockchains. So basically, this technological advancement enables payments for sure on 5G, but already on 4G, 3G, and even slower networks.

Because the amount of data you need for a transaction is much less. On the other hand, of course, there are applications on top of this blockchain that of course also need that extra data. And therefore, I think, like this rollout of 5g, of course, is beneficial to this movement to this mobile-first movement in crypto, and will bring adoption of these types of currencies and also of this technology to a much broader audience.”

Celo supports a lightweight identity protocol that makes it easy to prove that you have access to a mobile number through a decentralized method of sending SMS, and it maintains that mapping securely and privately. This means that you can use that mapping to send and receive payments to users just using their phone number. Moreover, you can actually receive payments before even starting to use Celo.

The escrow contract allows you to send payments to a contract and associate them with the recipient’s phone number and redeem them if they are reclaimed if they go unredeemed. This approach does not compromise the user’s privacy since a hash plus a pseudorandom pepper of the phone number is stored on the blockchain without the need to share the actual phone number. The Celo public address allows the user to attach multiple phone numbers to the same address, change associated numbers, and/or revoke them at any time.

Companies like Kotani Pay leverage Celo’s lightweight identity protocol along with their tech stack to allow companies to connect with users on mobile phone interfaces. Kotani Pay users can use their feature phones to key in a code and create a blockchain account using SMS interfaces. Their assets are stored and encrypted on a blockchain just like any other L1. Use cases such as universal basic income for refugees to lending for small and medium enterprises in Kenya, to people just accessing crypto for the first time for savings, and money remittance is now all possible by using Celo’s lightweight identity protocol.

Celo’s Tokenomics

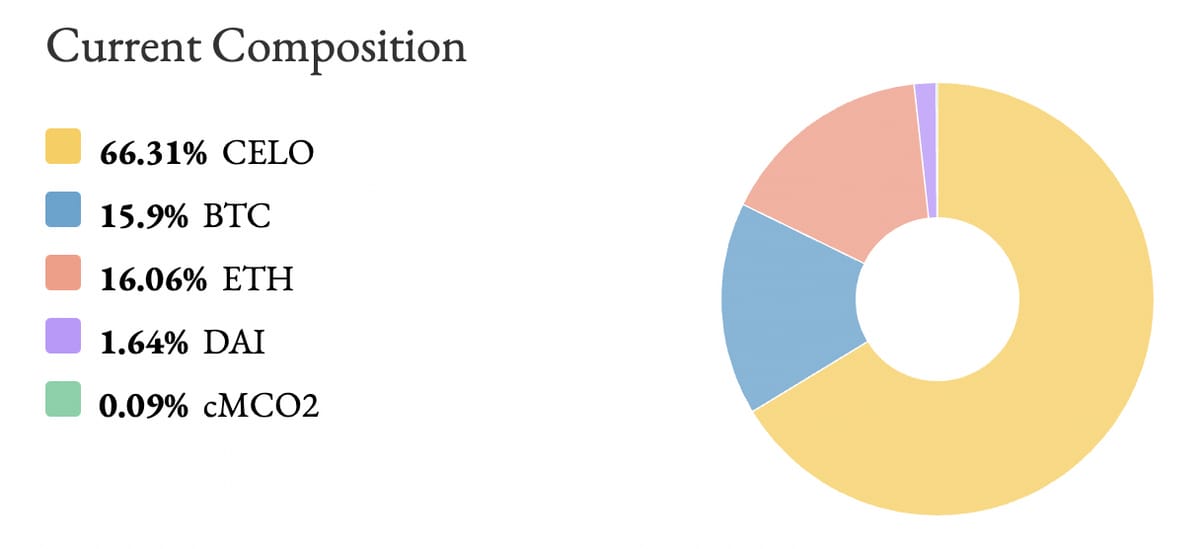

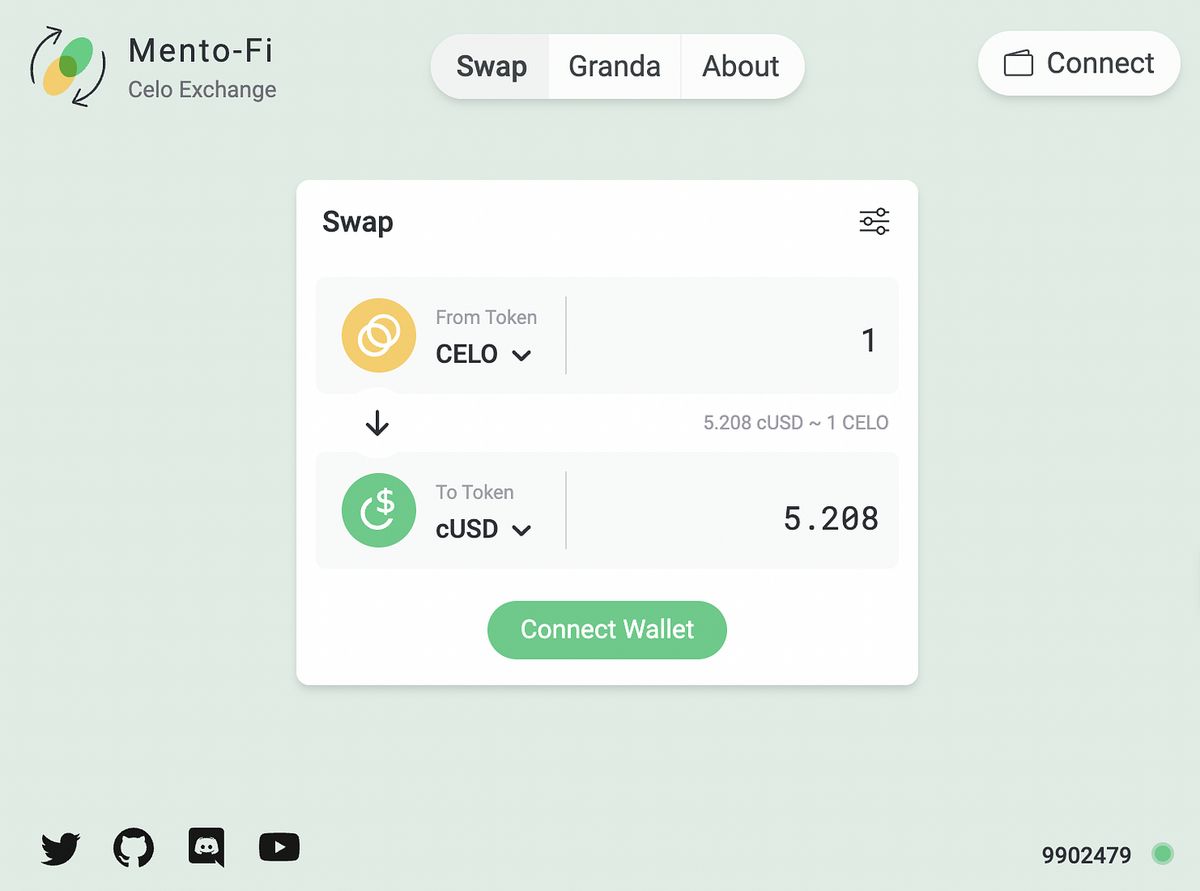

Celo’s native token, CELO, is used to support the growth and development of the Celo blockchain and ecosystem. Anyone who holds Celo is empowered to vote on governance proposals that direct how the core technology operates. Proof-of-Stake, validators must stake Celo as a signal of participation in confirming transactions on the blockchain, thus earning Celo Dollars (cUSD) as a reward. Celo’s stablecoins, cUSD and cEUR, are maintained using a two-pronged approach. The first is keeping an over-collateralized reserve of assets within the CeloReserve. The second is Mento, which is a one-to-one stability mechanism that utilizes Celo’s native token.

Celo’s native token is used as a stabilizer within the CeloReserve to ensure the healthy velocity of stablecoins that circulate and transact on Celo. The Celo reserve is a diversified portfolio of crypto assets supporting the ability of the Celo protocol to expand and contract the supply of Celo stable assets, in-line with user demand.

Celo leverages a basket of diversified cryptocurrencies held as reserves to support the peg of its stablecoin family. The current composition of the reserve is determined by governance voting. This stability mechanism can thus be defined as a hybrid crypto-collateralization / seigniorage-style model. At the time of writing, the reserve is currently 5.45x the outstanding supply of its stable coins.

Beyond having the backing of the reserve, Celo’s family of stablecoins are also maintained by Mento, a stability algorithm and AMM. Mento allows user demand to determine the supply of Celo stable assets by enabling users to create, for example, a new Celo Dollar by sending 1 US Dollar worth of CELO to the reserve or to burn a Celo Dollar by redeeming it for 1 US Dollar worth of CELO. This mechanism creates incentives for market participants to maintain the peg for Celo Dollars (cUSD) or Celo Euros (cEUR) by taking profits whenever deviations from the peg occur.

When demand for the cUSD rises and the market price is above the peg, users can profit by buying 1 US Dollar worth of CELO on the market, exchanging it with the protocol for 1 cUSD, and selling that cUSD for the market price. Similarly, when demand for cEUR falls and the market price is below the peg, users can profit by purchasing cEUR at the market price, exchanging it with the protocol for 1 cEUR worth of CELO, and selling the CELO to the market.

Celo’s Alliance for Prosperity - How Facebook’s Libra Turned Into Inspiration for Celo

In 2019, Facebook attempted to enter the blockchain space by announcing their own blockchain called Libra, a closed and permissioned blockchain similar to Binance in that only a few trusted entities can keep track of the ledger. Libra was a stablecoin on a mission to become the native currency of Facebook platform and create frictionless global payments in the same way Celo chose to. Celo felt that in order to have financial inclusion and prosperity the underlying should be permissionless. In response to Libra, Celo announced the Alliance for Prosperity, an association of companies on a mission to create prosperity for all through the development and growth of the Celo ecosystem. Members of the alliance gain support on their projects as well as network and mentorship. The Libra Association took a major hit when some of the biggest names in Facebook’s embattled Libra Association (PayPal, Visa, Mastercard, Stripe, and eBay) left. Voicing concerns about their reputation being tainted, these major backers claimed that Facebook had exaggerated the openness of regulators to the Libra project. Today, the Alliance for Prosperity has grown to over 155 organizations, including T-Mobile’s parent company Deutsche Telekom who also made a strategic purchase into the Celo network earlier this year.

Building Dapps on Celo

If you’re a developer, it’s a good time to explore building new Dapps on the Celo blockchain. Celo supports a lightweight identity protocol that makes it easy to prove that you have access to a mobile number through a decentralized method of sending SMS and it maintains that mapping securely and privately. This means that you can use that mapping to send and receive payments to users just using their phone number. This allows Dapp developers to build elegant, user-friendly experiences on mobile with users only needing a phone number to create and login to their wallets. Dapp users pay transaction fees <$0.01 using Celo’s native token. The ecosystem has only just begun to bloom with Celo’s hackathon underway rewarding developers who are building the future of Mobile DeFi.

The Top Celo Dapps by TVL

Here are the top 5 projects we are watching that are a part of Celo’s ecosystem.

#1) SushiSwap

A fully decentralized protocol for automated liquidity provision now supporting Celo’s chain.

Symbol: SUSHI Price: $9.65FDMC: $2.41BTVL: $101M

#2) Moola Market

Moola Market is a DeFi lending platform that allows loans to anyone. It supports CELO, cUSD (Celo Dollar) and cEUR (Celo Euro).

Symbol: MOOPrice: $0.45FDMC: $45MTVL: $66M

#3) Ubeswap

Ubeswap is the leading DEX on Celo network.

Symbol: UBEPrice: $0.54FDMC: $54MTVL: $47M

#4) Mobius Money

A cross-chain stableswap protocol built on Celo.

Symbol: MOBIPrice: $0.06FDMC: $60MTVL: $31M

#5) Beefy Finance

Beefy Finance is a Decentralized, Multi-Chain Yield Optimizer platform that allows its users to earn compound interest on their crypto holdings, now supporting Celo.

Symbol: BIFIPrice: $1,281FDMC: $102MTVL: $12M

Conclusion

Celo’s founder, Rene Reinsberg, is on a mission to bank the 1.7B unbanked by giving them access to blockchain technology that can be accessed using a Nokia from 2002. Since its inception, Celo has raised capital from prominent investors such as a16z, Polychain capital, and Deutsche Telekom (T-Mobile’s parent company).

Today, Celo continues to support its developers with hackathons and is currently accepting applications for its "Celo's Make Crypto Mobile Hackathon" with $2.5M in prizes, funding, and support. If you are in the market for a new job at a purpose driven crypto company Celo is currently hiring roles in all departments.

Overall, we recommend considering adding CELO to your digital asset investment portfolio.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to your favorite section…. This Week in Crypto. We give you everything you need to know in one scannable format. Here are the top 10 crypto news stories of the week...

⚡ President Biden Signs Infrastructure Bill Containing Crypto Broker Reporting Requirement Into Law - Sen. Cynthia Lummis and others are now attempting to narrow the scope of the law’s crypto broker clause with a separate bill. (Source)

😮 Ted Cruz Seeks Repeal of Biden Infrastructure Bill’s Crypto Broker Definition - Texas Senator Ted Cruz is seeking to strip language defining a crypto "broker" from the multibillion-dollar infrastructure package that was just signed into law. (Source)

🏧 Barbados To Establish a Virtual Embassy Within Ethereum Dapp Decentraland - The Caribbean nation is primed to become the first sovereign nation with an embassy in the metaverse. (Source)

💰 Scalability Comes to Bitcoin As Taproot Upgrade Goes Live - After years of waiting, Bitcoin’s Taproot upgrade is now live and its implementation could bring DeFi to the blockchain at last. (Source)

🤑 Twitter Forms New Crypto Team To Incorporate Decentralized Tech Into the Platform - The social media firm Twitter is building out a new crypto team to add crypto, blockchain, and decentralized technology into the popular social media platform. (Source)

🏦 Coinbase Is Looking at Support for Third-Party DeFi Apps on Its Platform, Says CFO - New comments from the publicly traded crypto exchange's CFO suggest that the company sees a broader scope. (Source)

🇺🇸 Wall Street Regulator Rejects VanEck’s Bitcoin-Backed ETF - SEC dissatisfied with the plan to prevent ‘fraudulent and manipulative acts’ from reaching regulated markets (Source)

🎆 China Expels Party Official for Supporting Crypto Mining Firm - To demonstrate its continued hostility towards the crypto industry, China has relieved one of its top officials for supporting crypto mining. (Source)

📈 DeFi Project ParaSwap Launches Airdrop of Native Cryptocurrency to Early Adopters - Decentralized exchange aggregator ParaSwap announced today the launch of the DeFi platform’s native cryptocurrency called PSP. (Source)

💳 European Commission Urges Members To Agree on Crypto Regulations - The commission is hoping to finalize its proposed regulatory sandbox for financial products based on distributed ledger technology by the end of the year. (Source)

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. OpenSea Now Accounts for 10% of Total ETH Burnt Since EIP-1559

2. BTC’s 90-Day Rolling Correlation With S&P 500 (SPY) Is Increasing and Now Above 0.3

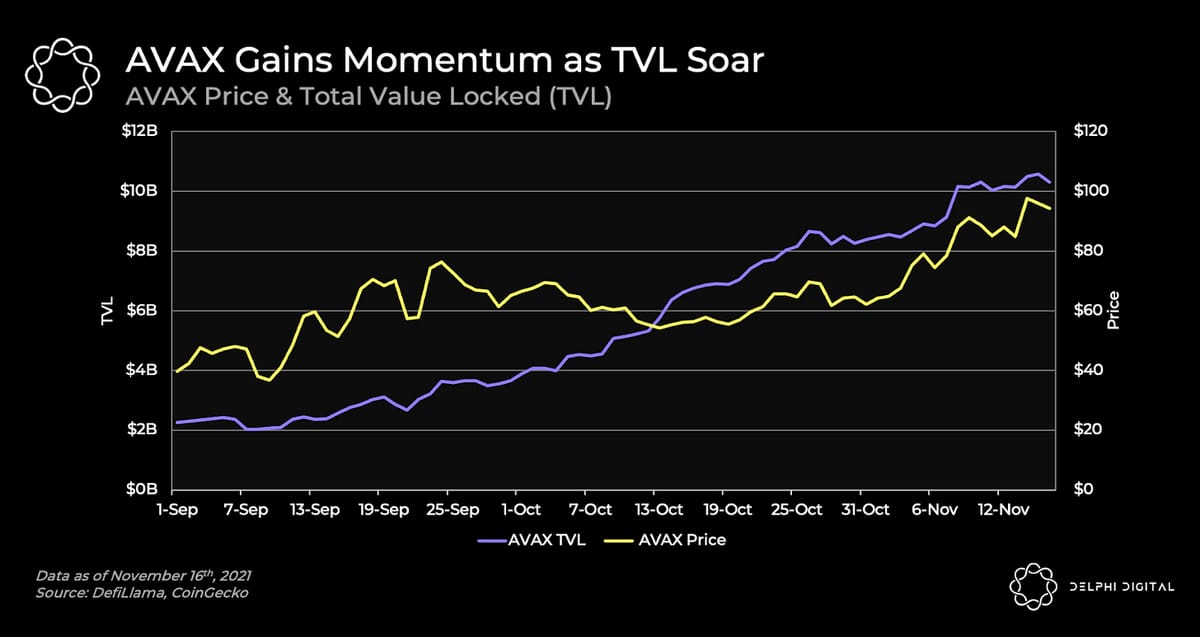

3. AVAX’s TVL Increases 5x Since Sept Now Crossing $10B

4. Alameda and Cumberland Received at Least $60.3 Billion in USDT From Tether Treasuries Outflows Equal to 55% of All Outbound Volume

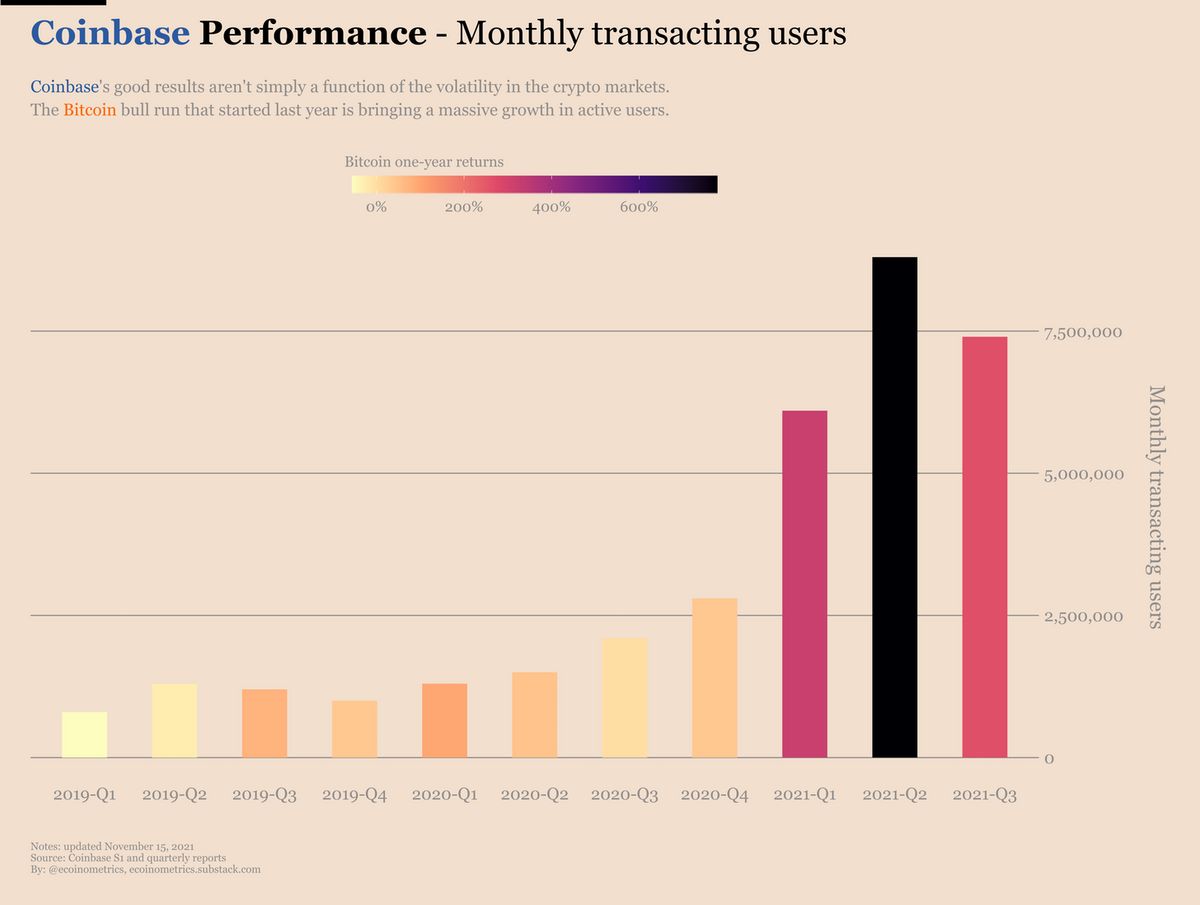

5. Coinbase’s Q3 Quarterly Report Showing Retail Demand Remains High Compared to Previous Quarters

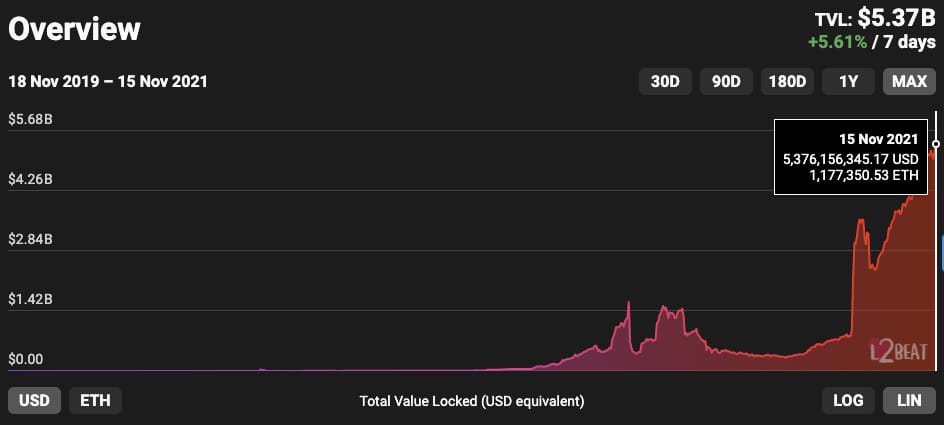

6. L2s Reached a New TVL ATH of $5.3B

📝 Highlights from Crypto Reports

Here are the top highlights from the best crypto research reports this week…

1. ETH Avg Fees Rose to an ATH of $36.04 in Oct

Crypto Compare, a cryptocurrency market data provider, releases their first Digital Asset Report providing readers with a summarised analysis of the latest movements in the cryptocurrency markets.

"Fees spent on the Ethereum network continued to rise in October and reached another monthly all-time high of $1.4bn, a 26.5% growth from September. Average fee per transaction rose to an all-time high of $36.04. Ethereum’s hashrate and mining difficulty trended upwards in October, closing the month at 735 TH/s and 10.1P respectively (10.1% and 10.4% increase from September)."

2. Investor Sentiment Remains Bullish Despite Market Dip

The team at Glassnode Insights published their latest weekly report highlighting that although the market took a dip over the week, we are still in a bull market.

“Next is the battle tested MVRV Z-Score metric. Using statistical normalisation, this metric measures how many standard deviations the spot price is away from the realised price.

Another way to think about this metric is that very high values mean the market is holding large unrealised profits, and thus the incentive to sell is at a maximum. Conversely, bottoms can be found when the market is heavily underwater and investor capitulation is most likely underway. The current market is around 'half-way', after cooling off dramatically following the peak in April.”

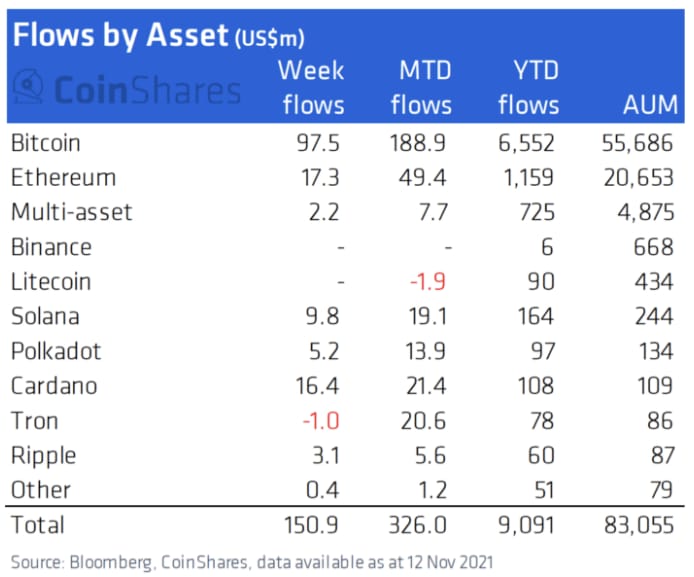

3. Bitcoin Leads Institutional Inflows

CoinShares, Nov 15, 2021The CoinShares Group is an investment fund that launched the world’s first regulated bitcoin investment fund in 2014. In their latest research, the team outlines which assets are getting the most inflows from institutional investors.

“Digital asset investment products saw inflows totaling US $151m last week, the 13th consecutive week of inflows, bringing year-to-date inflows to a record US$9bn. Intra-week prices rises also saw total assets under management (AuM) reach record highs of nearly US$87bn, but closing the week at US$83bn.

Bitcoin saw the majority of inflows totaling US$98m, pushing AuM to a record US$56bn, with inflows of US$6.5bn this year. This is despite its dominance (relative performance) versus altcoins waning over the week.

Ethereum also saw continued inflows totaling US$17m, with total AuM pushing past US$21bn for the first time.”

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

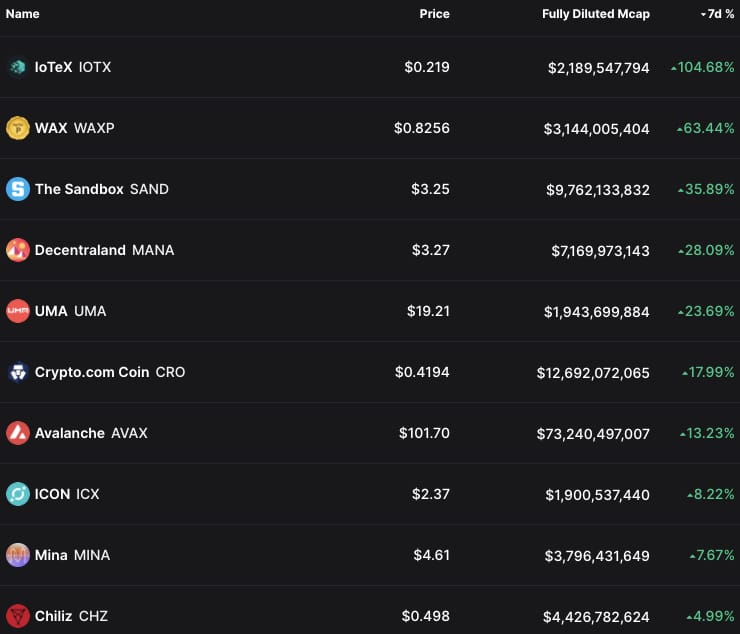

📈 Top Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap. Some of our favorites like SAND, MANA, and AVAX had an especially great week.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Kadena is an L1, Loopring is a zkRollup, Sandbox and Decentraland is a metaverse.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 10,827 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

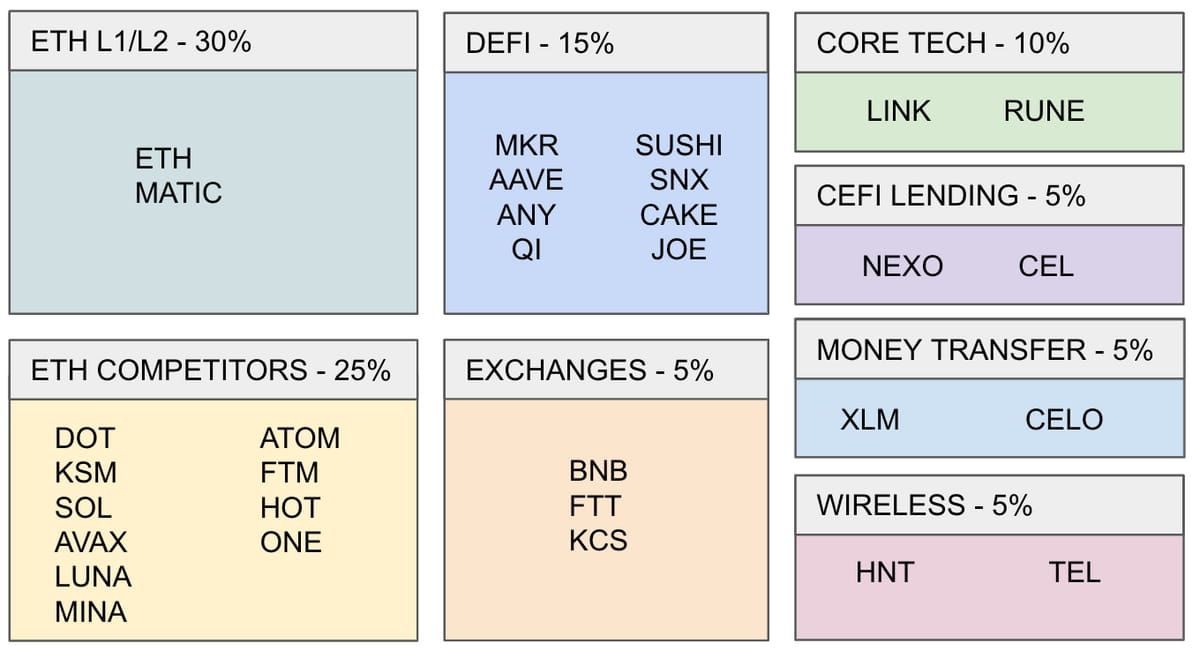

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, DOT, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.