Social Links: Twitter | Telegram | Newsletter

Learn More at www.blackinktech.io and www.icointechnology.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 170k weekly subscribers. This week, we cover Celsius’ recovery plan, Terraform Labs acquiring a cross-chain data provider, Hodlnaut starting liquidation, and huge new venture rounds for Blockchain.com ($110M) and Finality ($95M).

Price Performance of the L1 tokens since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Join our Daily Crypto News Roundup

We’re launching a new daily edition Coinstack that covers all the day’s news. If you’d like to join our daily edition, subscribe here.

Thanks to Our Coinstack Sponsors…

ChainIT by Black Ink Technologies is a Web3 trailblazer, ensuring data integrity and seamless user experiences. Its multi-patented technology forges a connected digital equivalent token for physical assets and entities, capturing essential 'Where, When, Who, What' attribute details. This platform guarantees transparency and authenticity, providing instant verification to eliminate fraud through validated truth.

Headquartered in Silicon Valley, iCoin Technology is a pioneer of a new class of hardware wallets for the digital economy, blending consumer-grade ease-of-use with industrial-strength air-gap security. Our wallet makes self-custody less intimidating and maybe a little fun!

Become a Coinstack Sponsor

To reach our weekly audience of 170,000 crypto insiders and daily audience of 55,000 subscribers, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ Celsius cleared to exit bankruptcy and enact recovery plan: Failed crypto lender Celsius Network won bankruptcy court approval of its plan to transform into a creditor-owned Bitcoin mining firm as part of a broader proposal to repay customers whose accounts have been frozen for more than a year.

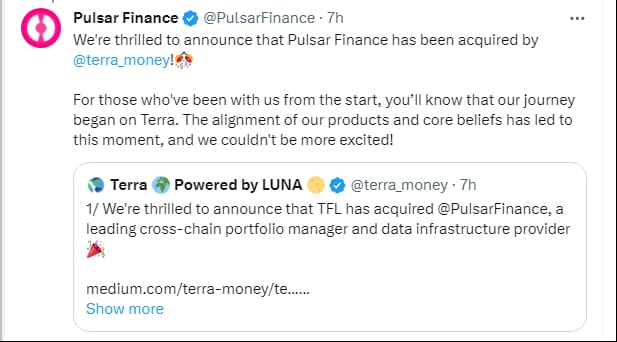

🤝 Terraform Labs acquires cross-chain data provider as it pursues post-Kwon plans: Terraform Labs, leading developer of the Terra blockchain, today announced the acquisition of Pulsar Finance, a cross-chain portfolio management and analytics startup.

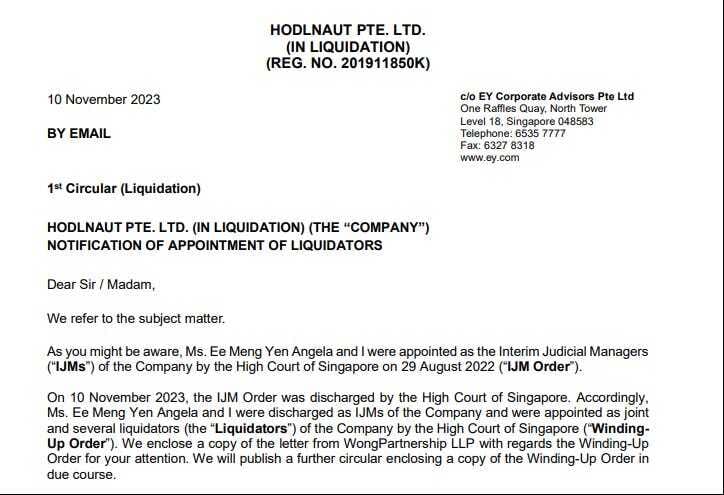

⚖️Distressed crypto lender Hodlnaut starts liquidation in Singapore: Hodlnaut, a Singapore-based crypto lending firm, will be liquidated by its previously appointed judicial managers, according to a document published by auditing firm EY.

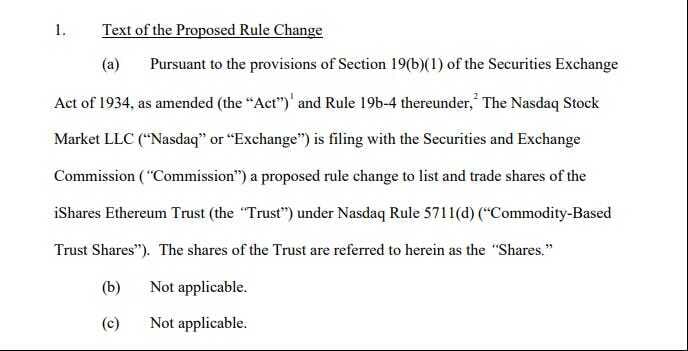

⚖️ Nasdaq files for BlackRock's proposed iShares Ethereum Trust ETF: BlackRock, the world's largest asset manager, is confirmed to be working on a spot ether ETF, according to a 19b-4 filing made on Thursday afternoon.

🎭 Justin Sun-Owned Exchange Poloniex Hacked for At Least $126 Million: Poloniex, a crypto exchange owned by Tron founder Justin Sun, has seen more than $126 million worth of crypto assets exit one of its wallets as the result of a "hack incident."

💬 Tweet of the Week

Source: @dunleavy89

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

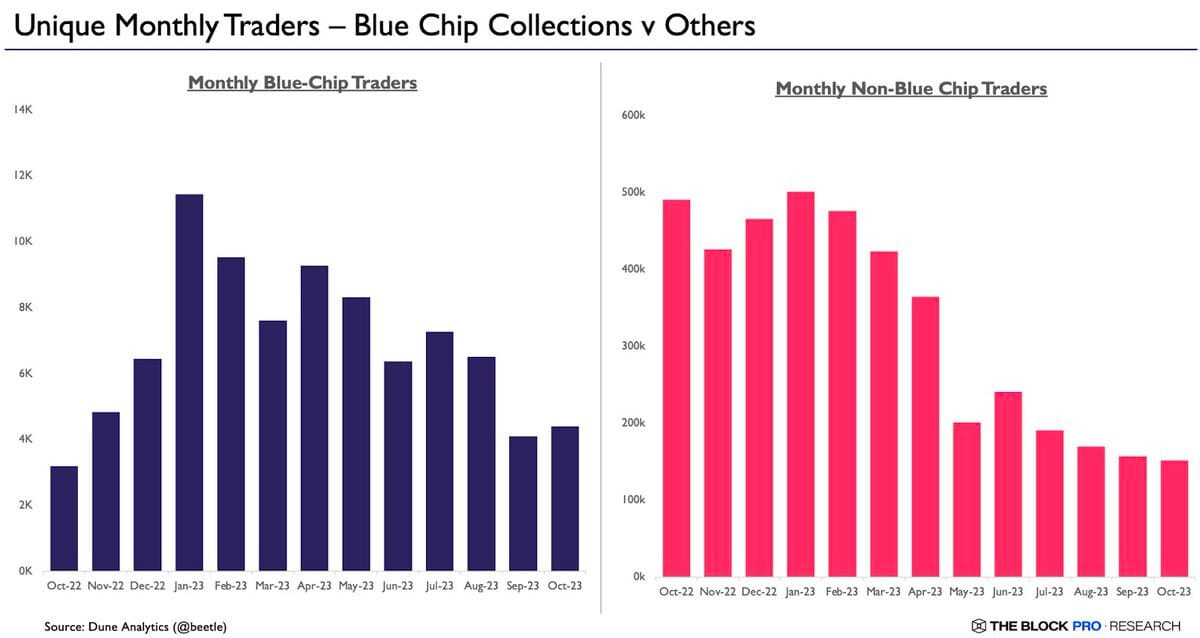

1. Ethereum's blue-chip NFTs saw an unexpected 17% spike in trading volume MoM, hitting $165M in Oct from $140M in Sep. Bored Ape Yacht Club led the pack with $71M in secondary sales.

Source: @TheBlockPro__

2. Despite the market's overall decline, the number of unique traders in blue-chip NFTs rose by 8% in October, indicating a flight to quality within the NFT market.

Source: @TheBlockPro__

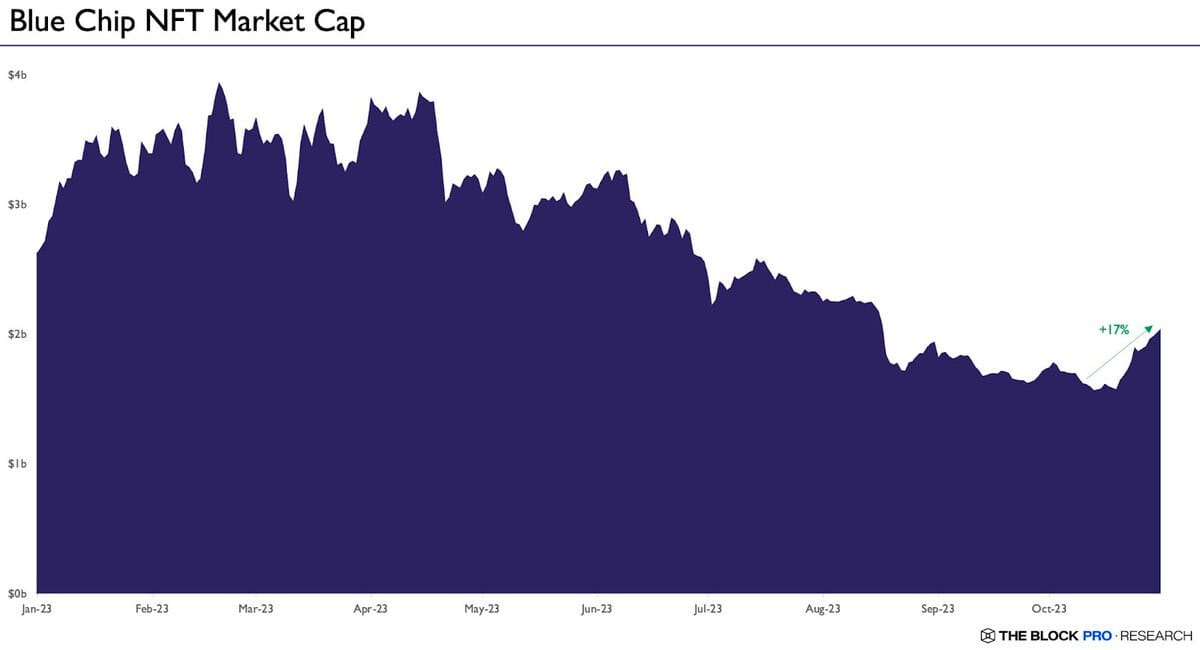

3. Blue-chip NFT collections saw an 18% MoM surge in market cap, jumping from $1.72B to $2.03B, Sept to Oct. Captainz NFT collection took the lead, surpassing Bored Ape Yacht Club as the top earner.

Source: @TheBlockPro__

4. Blue-chip NFTs’ total outstanding debt remains substantial, indicative of an ongoing shift towards treating NFTs as traditional financial assets, with DeGods and Milady Maker being the most leveraged collections.

Source: @TheBlockPro__

5. After looking dead in the water, friend.tech (FT) activity revived from the dead over the last week. Impressively, the friend.tech app saw more volume than the entire Ethereum NFT market.

Source: @alpha_pls

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Key Takeaways:

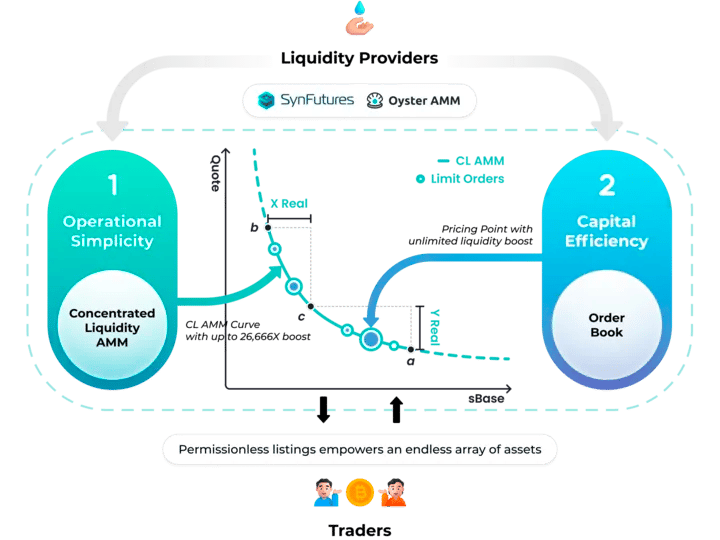

SynFutures is a perp DEX that creates an open and trustless derivatives market by enabling permissionless trading on any asset with a price feed. The latest iteration of the protocol represents a significant milestone in the DeFi space.

The new version of the protocol features Oyster AMM, an innovative automated market maker model aimed at delivering the highest capital efficiency of any derivatives DEX.

Oyster AMM combines the strengths of onchain order book and AMM models while allowing 30-second arbitrary asset listings of perps and futures with only a single token; it enables a significant “capital efficiency boost” and broadens SynFutures’ audience of traders and liquidity providers.

Introduction

SynFutures is a perp DEX that employs a business model reminiscent of Amazon, democratizing the derivatives market and supporting an endless array of longtail assets. This approach grants users the power to effortlessly engage in asset trading and list customized futures and perps contracts in a matter of seconds. By cultivating a free market and maximizing the variety of tradable assets, SynFutures is lowering the barrier to entry and creating a more equitable derivatives market. Anyone can list and trade anything, anytime.

Since launching in 2021, SynFutures has emerged as a leading perp DEX, processing over $21 billion in volume with nearly 100,000 traders and 270 trading pairs listed to date. The protocol is backed by Pantera Capital, Susquehanna International Group (SIG), Polychain Capital, Standard Crypto, Dragonfly Capital, Framework Ventures, and HashKey Capital, among others.

Oyster Automated Market Maker (AMM)

While V2 marked a significant milestone in the project's evolution, V3 signifies a substantial leap in the overarching product roadmap. At the core of this transformation lies Oyster AMM, a refined automated market maker model designed to build upon the foundations established by its predecessors.

Oyster AMM is designed to harmoniously blend the simplicity of automated market making with the efficiency of order book models, creating a seamless experience for newcomers and seasoned professionals.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and digital paid advertising services. If you want to expand your organic presence and paid leads from Google and Facebook and LinkedIn, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.blackinktech.io and www.icointechnology.com