Learn More at www.rootstock.io and www.amphibiancapital.com and www.token.cryptocasino.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 275k weekly subscribers. This week, BTC crashed to $63k on South Korean exchanges after the country enacted martial law, Celsius announced a $127M distribution to creditors, WisdomTree files for spot XRP ETF and big new venture rounds for usdx.money ($45M) and Avant ($6.5M).

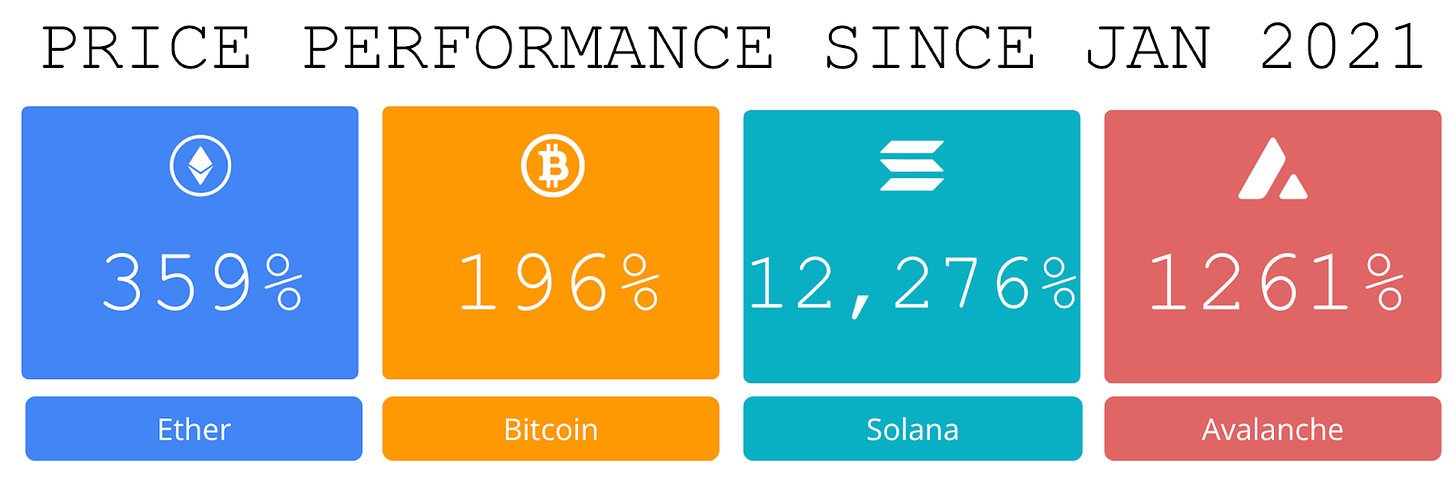

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 60%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Amphibian Capital, managing $110M+ AUM, is a fund of the world's leading hedge funds. +14.92% net YTD approx with their USD fund, +11.00% net BTC on BTC YTD (90.93% in USD terms), and +14.39% net ETH on ETH YTD (33.01% in USD terms) through 10/31. They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com. Approximate estimates through 10/31/24

CryptoCasino.com is a leading GameFi project featuring an online and Telegram casino. Launched by a team of iGaming industry experts that turned RakeTheRake.com into the world's largest poker affiliate, the platform is designed to capture the next generation of online bettors. Learn more at token.cryptocasino.com

Become a Coinstack Sponsor

To reach our weekly audience of 275,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

CryptoCasino.com Brings Web3 Betting to Telegram

With the crypto betting landscape exploding from $50 million to over $250 million from 2019 to 2024, a group of experienced iGaming executives are getting involved.

Backed by the premium domain CryptoCasino.com, the group that turned RakeTheRake.com into the world’s largest poker affiliate are now bringing blockchain betting to Web3 and Telegram.

With partnerships from some of the biggest players in both the betting and crypto world, CryptoCasino.com launched on November 19.

Featuring a Telegram mini-app that allows the over 1 billion users of crypto’s favorite social platform to instantly connect and bet, the project aims to deliver the experience that next-gen bettors are looking for.

Web3 Betting Backed by a Big Domain

There are essentially two elements to the CryptoCasino project.

First, the online CryptoCasino.com includes everything expected in a crypto betting site. With Web2 signup via email and Web3 wallet connectivity supporting wallets ranging from MetaMask to Trust Wallet, the platform leverages the blockchain for seamless deposits and withdrawals.

Partnerships with the biggest online gaming studios such as Pragmatic Play and Evolution Gaming mean that the casino is packed with over 7,000 of the most popular games, while an integration with award-winning sportsbook provider BetBy offers a premium sports betting product.

Players are able to deposit in over 20 cryptocurrencies ranging from bitcoin to memecoins such as PEPE and DOGE via Web3 transaction or wallet transfer.

Innovative Telegram Casino

Where CryptoCasino really grabs the attention of the new wave of crypto bettors is through its Telegram casino mini-app.

Understanding that community is a major component of the crypto world, the team has launched their casino through a direct integration with Telegram.

This app allows anyone to open the CryptoCasino bot within Telegram for a one-click registration using their TG credentials, drastically reducing friction for onboarding players and increasing player acquisition.

Players can enjoy all the casino and sports betting action right from the fully licensed CryptoCasino platform without having to exit from their Telegram app, marking a revolution in social crypto betting.

Backed by the $CASINO Token

To add an element of GameFi to the project, CryptoCasino.com has launched their own token called CASINO.

The team will use 50% of the net profits of the online and Telegram casinos to buyback & burn the CASINO token from the open market, making it deflationary. This mechanism will run until the total amount of capital raised in the CASINO presale has been bought-back and burned.

Holders can also stake the CASINO tokens for up to 10% APY rewards, while players can use the CASINO tokens to bet on the platform, while receiving exclusive bonuses for playing with the native cryptocurrency.

Learn More:

You can learn more about CryptoCasino by viewing the project page at Token.CryptoCasino.com

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 Celsius to distribute $127 million to creditors in second bankruptcy payout: According to a court filing submitted Wednesday, Celsius, the defunct crypto lender, is distributing $127 million to eligible creditors in a second payout from its bankruptcy proceedings.

⚖️ Bitcoin crashes to $62,000 on Upbit after South Korea enacts emergency martial law: Bitcoin plunged over 30% on Upbit following South Korea's martial law declaration. Bitcoin has since recovered above $89,000 on Upbit, creating a $4,000 arbitrage gap compared to global markets. The flagship digital asset dropped from $96,000 to $93,600 on global exchanges following the announcement.

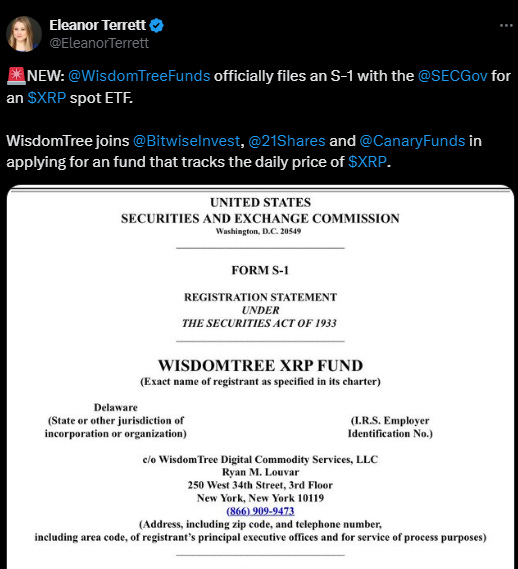

⚖️ WisdomTree joins race for spot XRP ETF as 4th filing amid impending SEC leadership change: Spot Bitcoin ETF issuer WisdomTree has filed a Form S-1 registration statement with the Securities and Exchange Commission (SEC) to launch a spot XRP exchange-traded fund (ETF).

🚀MetaMask integrates Venmo to enhance fiat-to-crypto onramp options: MetaMask added a fiat on-ramp feature through Venmo, allowing US users to buy crypto using the payment app, according to a Nov. 27 announcement.

⚖️Hong Kong to Waive Tax on Crypto Gains for Sophisticated Investors: Hong Kong is preparing to exempt investment gains from crypto and other assets for sophisticated investors, aiming to enhance the region’s appeal as a wealth management hub.

💬 Tweet of the Week

Source: @iamjosephyoung

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

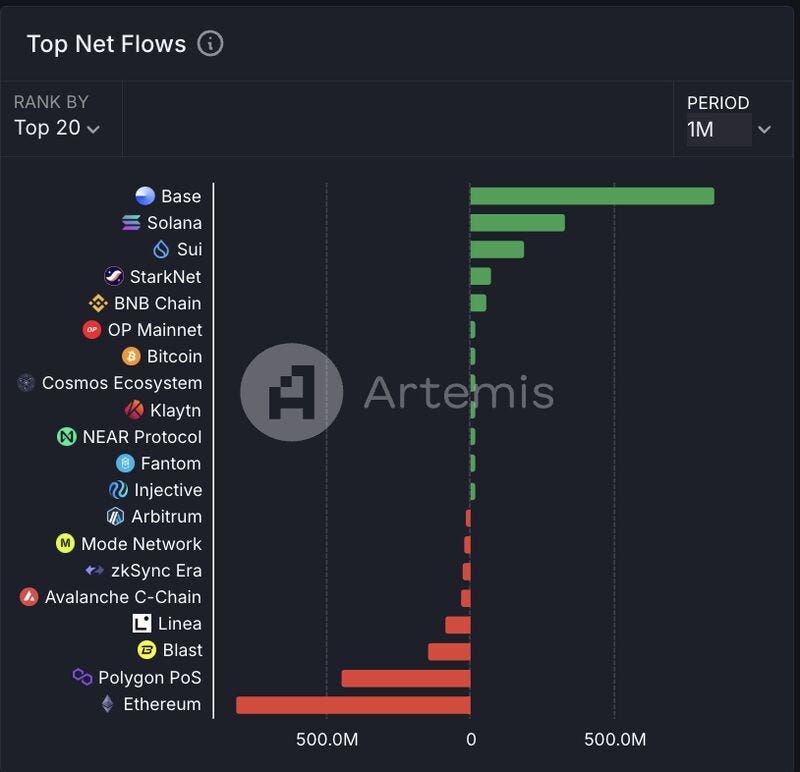

1. Over the past month, no ecosystem has had more capital inflows than Coinbase Base. In total, more than $848M poured in through November. Many applications on the network benefitted substantially from these inflows and experienced considerable gains in TVL, including Aave (116%), Uniswap (96%), Morpho (66%), Moonwell (39%), and Aerodrome (33%).

Source: @DavidShuttleworth

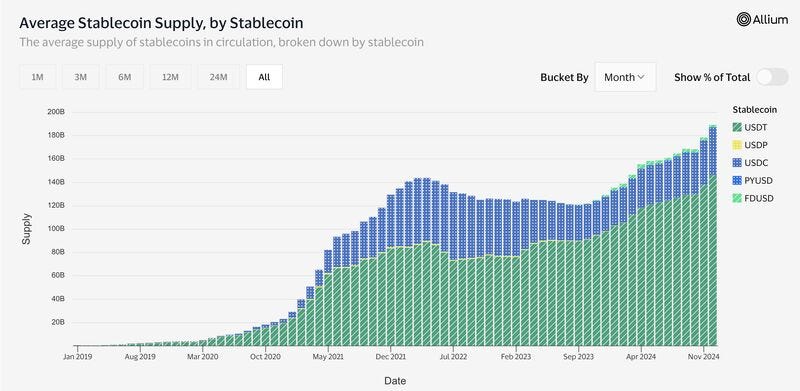

2. Total fiat-backed stablecoins in circulation surged to yet another all-time high in November, reaching a staggering $189.2B. Overall, the average circulating supply increased 6% month-over-month and 46.5% ($60B) YTD.

Tether.io continues to dominate the market, with over $146B USDT in circulation, followed by Circle USDC ($40.4B) and First Digital FDUSD ($2B).

In terms of yearly growth, all three of these stablecoins have experienced significant growth, with USDT increasing by 50%, USDC by 34%, and FDUSD by 37%.

Source: @DavidShuttleworth

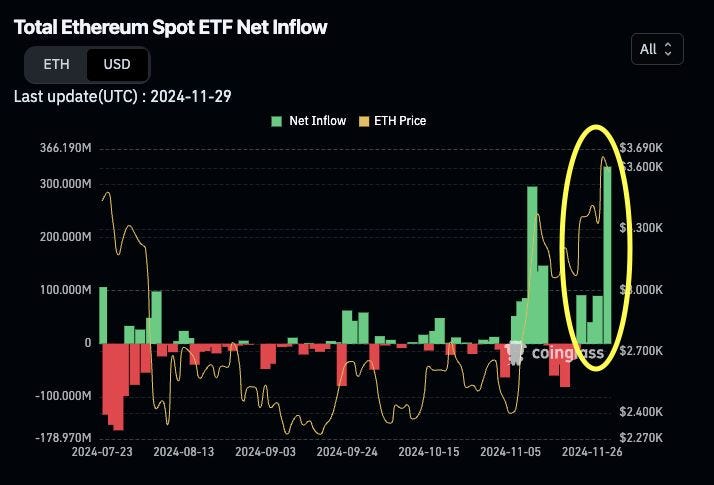

3. Lots of CHIT CHAT about "AI agents" this week, meanwhile $ETH ETFs quietly had their largest daily inflow volume ever with $333M on Friday, marking the 5th consecutive day of positive net flows. BlackRock ETHA led the way with $250M and has now amassed over $2.1B AUM.

During this time, the underlying ETH increased by 11% and experienced some of its strongest weekly spot demand pressure since May.

Source: @DavidShuttleworth

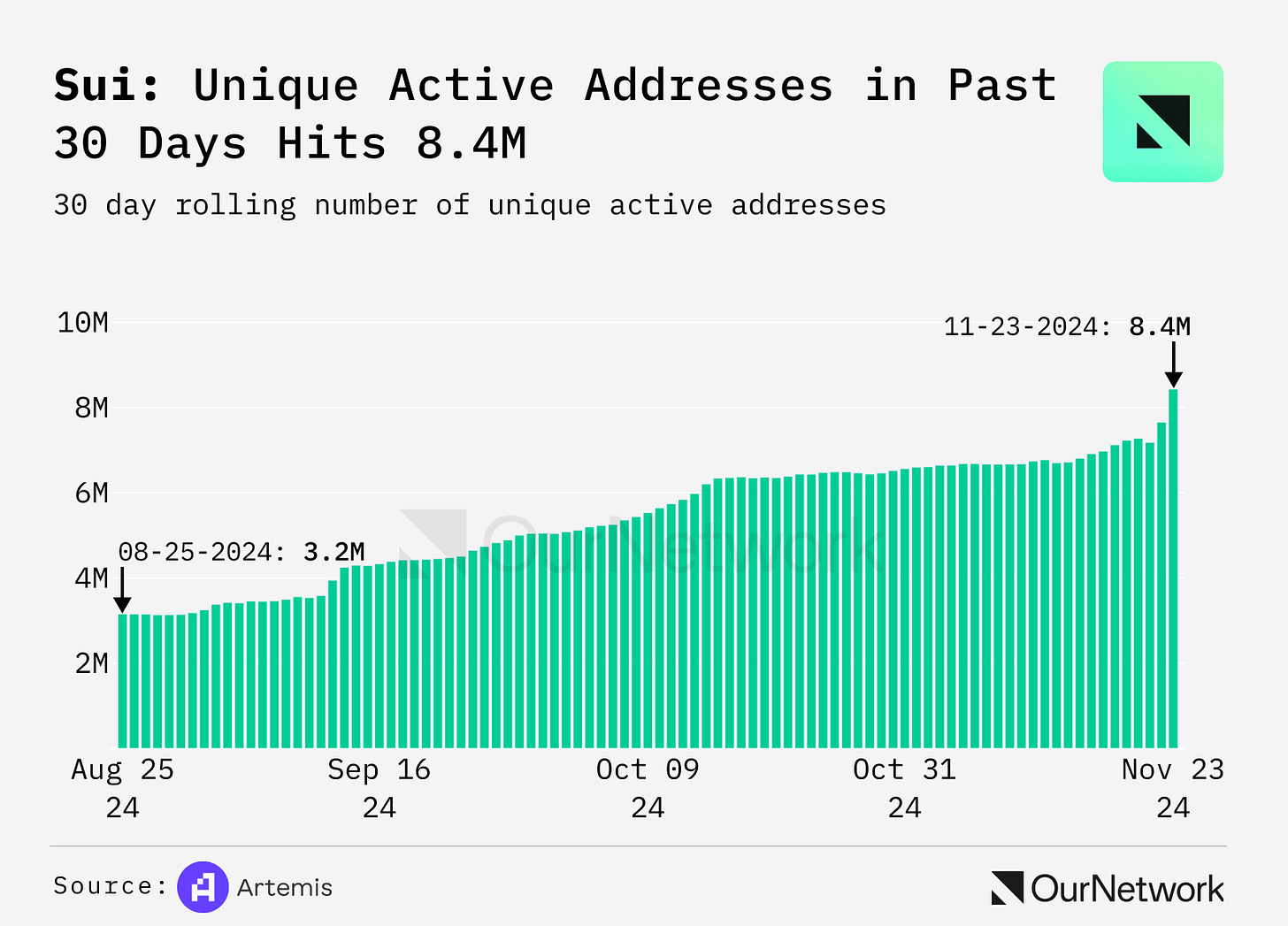

4. Sui Grows Across Active Addresses, New Wallets and Total Value Locked

Source: @OurNetwork

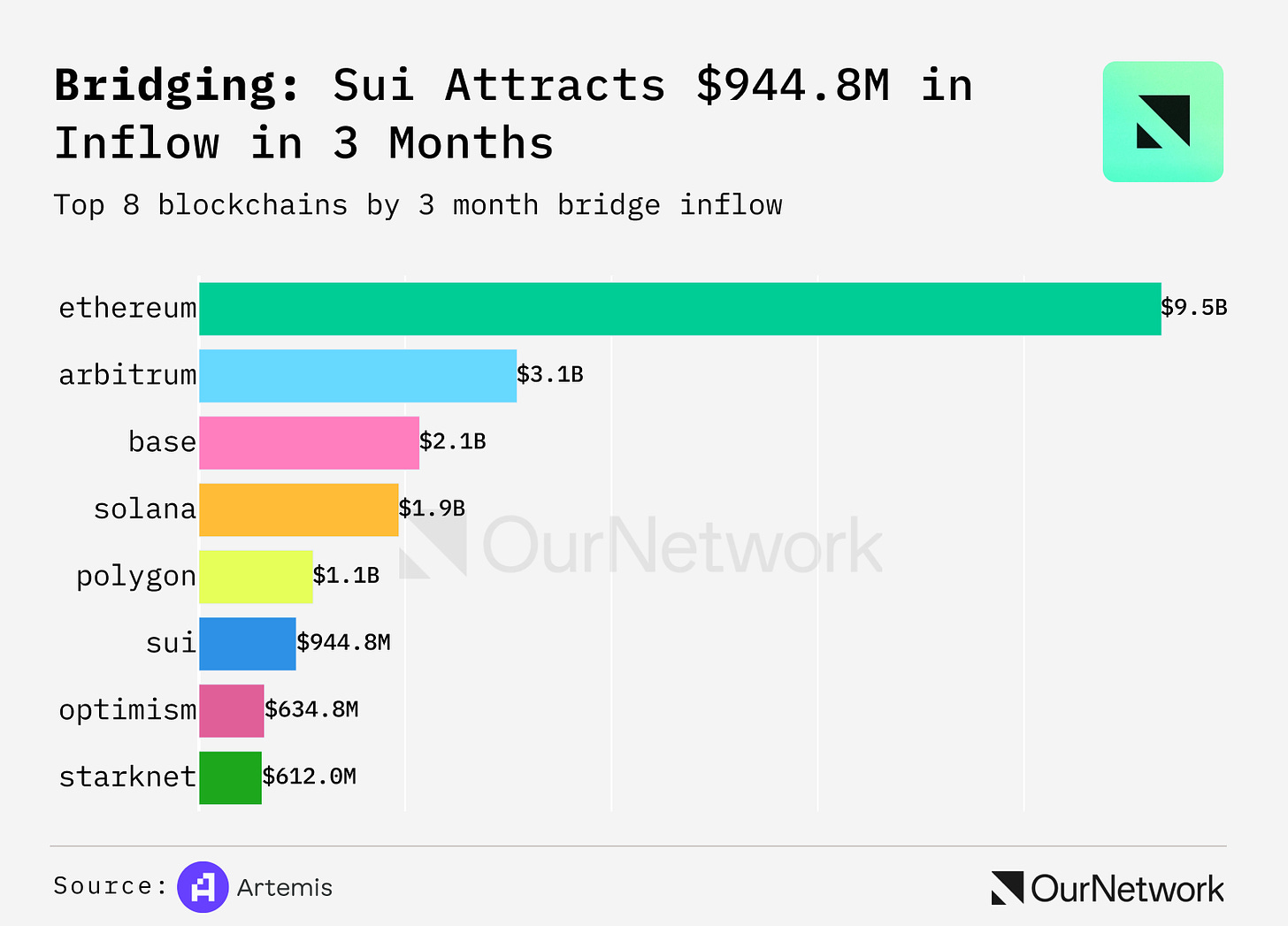

5. Users Have Bridged Nearly $1B to Sui in the Last 3 Months

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Authors: Kimberly Liang, Gunkan, and Austin Weiler are all research analysts for Messari, a crypto research firm that provides market intelligence products to help professionals navigate the crypto industry with confidence, combining deep analysis, data, news, and tools.

Key Insights

Rootstock is a Bitcoin sidechain launched in January 2018 designed to bring more expressive programmability to the Bitcoin network without compromising its security.

Rootstock uses merged mining for consensus, and its transactions are facilitated by RBTC, a bridged version of BTC.

The Rootstock ecosystem supports a variety of decentralized financial services, including lending, borrowing, trading, data tools, and stablecoins, with significant contributions from projects like Money On Chain and Sovryn.

Rootstock’s TVL has seen significant growth, growing over 107% over a year($77.0M to $160.3M).

RootstockLabs has partnered with Fairgate to create BitVMX, an altered version of BitVM aiming to build a trust-minimized bridge between the Bitcoin mainchain and Rootstock sidechain using ZK proofs.

Introduction

Bitcoin is the largest cryptocurrency by market cap, but it does not support arbitrary programmability. Rootstock is a Bitcoin sidechain that addresses users’ desire for additional programmability by running an EVM-compatible sidechain in parallel to the Bitcoin mainchain. Rootstock uses merged mining as a consensus mechanism and RBTC as a fee token.

Often referred to as “digital gold,” Bitcoin's narrative has been built around its robustness, security, and role as a store of value. To prioritize the safety of peer-to-peer payments, Bitcoin was intentionally created with extremely limited programmability to avoid introducing bugs and reduce network congestion. Its programming language, Bitcoin Script, is non-Turing complete, leaving developers who seek to build more complex applications to choose other blockchains that offer greater flexibility and functionality.

However, with the introduction of the Ordinal Theory in 2022 and BitVM in 2023, there has been a renewed interest in programmability within the Bitcoin ecosystem, highlighted by the launch of Ordinals (inscriptions like NFTs and digital artifacts) and discussions about the potential of soft forks. Yet, the goal of increased programmability is not new; Bitcoin layer solutions like the Rootstock (RSK) protocol have been striving to achieve this since the launch of Ethereum. As the community debates enhanced smart contract functionality, Rootstock stands out by offering improved scalability and faster transactions for Bitcoin since 2018. Like many upcoming layers, it is expected to adapt to BitVM, further innovating its offerings in the evolving Bitcoin ecosystem.

Background

Rootstock is a permissionless Bitcoin sidechain launched on mainnet in January 2018 with the intention of bringing smart contract functionality to the Bitcoin network without compromising the security of the Bitcoin mainchain. It does not have its own unique native gas token, opting instead to run on “Smart Bitcoins” (RBTC) which maintain a two-way peg to Bitcoin itself.

A group of Argentinian engineers and entrepreneurs first conceived Rootstock in 2014 and published the whitepaper in November 2015.

In 2016, members of Rootstock’s core team formed RSKLabs to support the network’s growth. In November 2018, IOVLabs (later rebranded to RootstockLabs) acquired the assets and IP of RSKLabs. Today, RootstockLabs remains one of the core contributors to the Rootstock network and the RIF economy.

Before its acquisition, RSKLabs received $4.5 million in funding. In 2016, it raised $1.0 million in a seed round led by Bitmain Technology, with investors including Digital Currency Group and Coinsilium. In 2017, RSKLabs secured an additional $3.5 million in a Pre-Series A round.

Sergio Lerner, RootstockLabs’ Chief Scientist and Co-founder, has a long history in crypto. In 2013, he created QixCoin, a PoW Turing-complete cryptocurrency, contributed to Ethereum’s mining algorithm, and worked as the fourth full-time Bitcoin core developer for the Bitcoin Foundation. The current RootstockLabs executive team also includes Chairman and Co-founder Diego Gutierrez, CEO Daniel Fogg, CFO Matthias Rosenthal, CPO Tim Paymans, and CTO Henrik Jondell.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.rootstock.io and www.amphibiancapital.com and www.token.cryptocasino.com