2025 marked a pivotal year for the cryptocurrency industry. The United States saw its first administration openly embrace digital assets, passing landmark legislation including the GENIUS Act for stablecoins and formalizing a Strategic Bitcoin Reserve.

For the first time, institutions had the clarity to treat Bitcoin as a standard reserve asset.

Yet while Washington delivered, markets struggled to deliver. Bitcoin peaked in late October and the long-promised alt cycle never materialized. Gold, silver, and commodities surged to new highs. The S&P 500 and Russell 2000 pushed to all-time highs while the Nasdaq showed weakness in the 4th quarter. Bitcoin’s narrative as a hedge against inflation faced its toughest test yet. All while tariff pressures created volatility across all markets.

Even as liquidity tightened and market valuations faced a steep correction, the ecosystem reached several critical maturation points including:

Stablecoins hit the $10 trillion annual transaction mark 4.8x faster than Visa

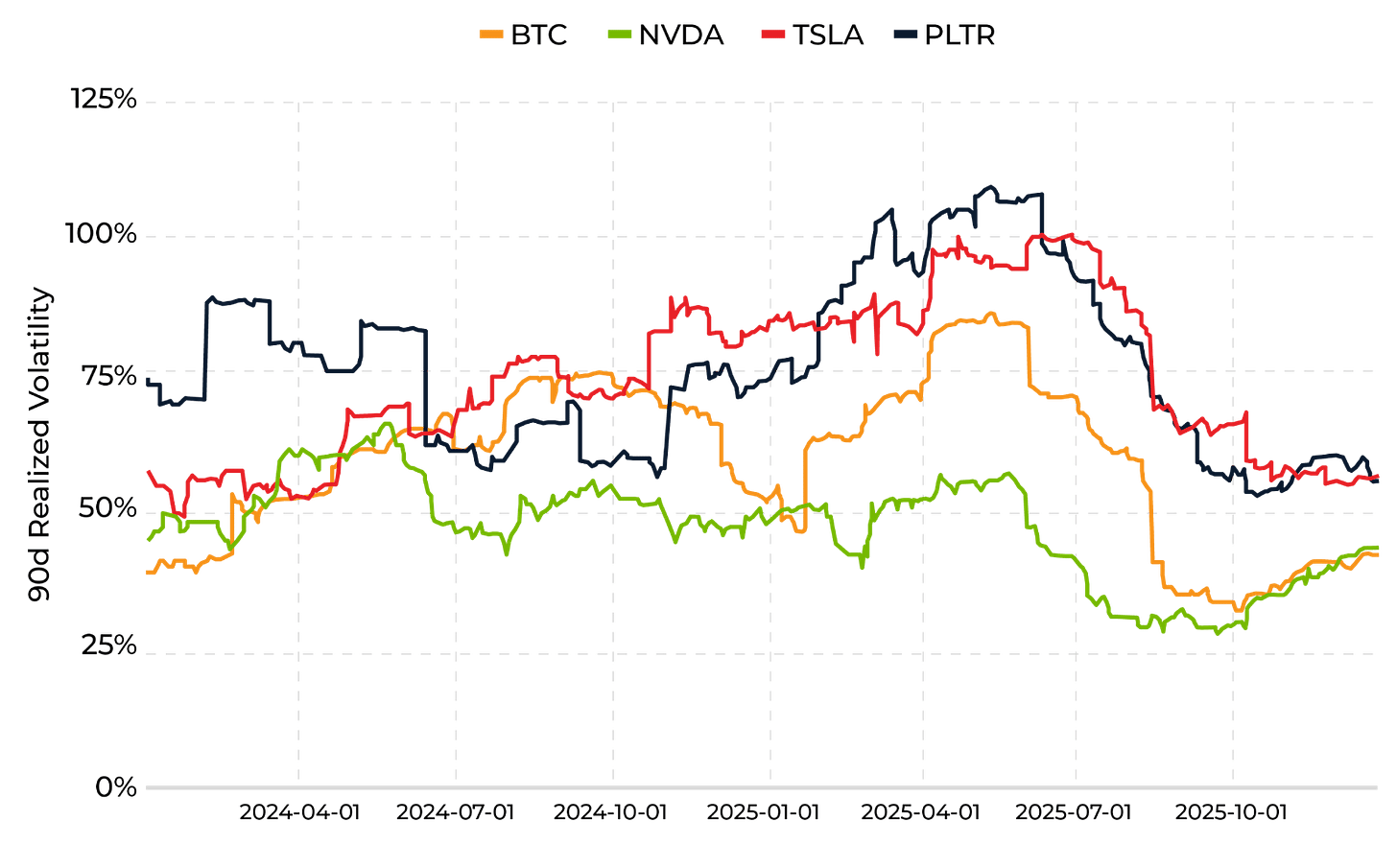

Bitcoin volatility dropped to big tech levels

92% of major institutions now offer crypto custody

401(k) crypto access is now on the horizon

As the industry looks toward 2026, the foundation laid in 2025 suggests a landscape defined more by structural maturity than speculative fervor. While the year was marked by a stark contrast between legislative progress in Washington and volatile price action on the charts, the underlying shift is undeniable: digital assets are a cornerstone of modern portfolio construction.

About SDM

Secure Digital Markets (SDM) is a full-service crypto dealer offering spot trading, derivatives, and collateralized lending. SDM serves HNWIs, institutions, miners, protocols, and OTC desks, providing deep liquidity across 40+ assets with T0–T+1 settlement. Clients can borrow up to $250M at 7.5%–10.5% with 65% LTV on select top 50 assets. Our U.S.-based derivatives desk offers TRS, NDFs, options, and structured products designed for hedging, yield generation, or directional strategies.

Get our free 2025 Crypto Year in Review: https://www.sdm.co/resources/2026-digital-assets-year-in-review?utm_source=newsletter&utm_medium=email&utm_campaign=2026-DAYIR-1&utm_id=2026-DAYIR

Learn more: www.sdm.co

Follow us on X: @SD_Markets