Learn More at www.amphibiancapital.com and www.plutus.it

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We reviewed the top news, stats, and reports in the digital asset ecosystem for our 350k weekly subscribers. This week, the CFTC cleared the path for Bitcoin, Ethereum, and USDC to be used as collateral in derivatives markets, marking a major step toward mainstream institutional adoption. Tether received regulatory approval from Abu Dhabi to expand USDT usage across nine major blockchains, while the SEC closed its investigation into Ondo Finance with no charges. The UK officially recognized crypto as a third category of property under law, and MetaMask entered the prediction market space through a new integration with Polymarket. On the fundraising front, Canton Network, an institutional Layer-1 blockchain focused on privacy and interoperability, raised $50M in a strategic round, while Aztec Network, a zero-knowledge Layer-2 for encrypted smart contracts on Ethereum, raised $40.2M in a public token sale.

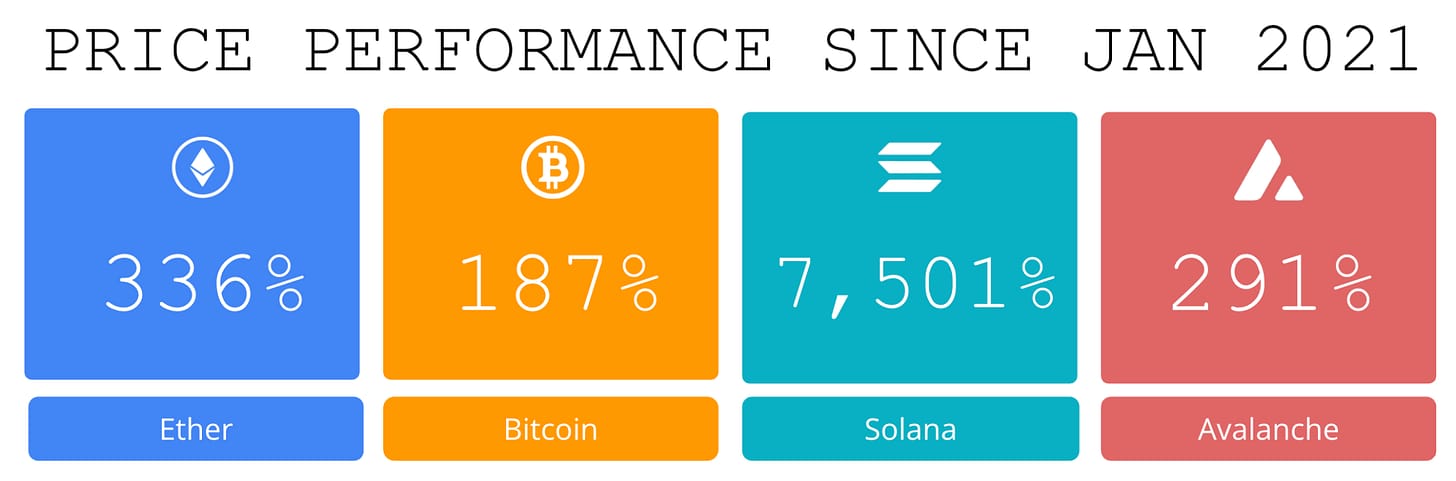

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Award-winning Amphibian Capital, managing $145MM+ AUM, is a fund of the world’s leading hedge funds. +20.4% net 2024 approx with their USD fund, +14.1% net BTC on BTC in 2024 (*+152% in USD terms), and +17.3% net ETH on ETH in 2024 (+71.2% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com.

Plutus is a Web3 rewards platform where everyday spending earns PLUS, a merchant-funded reward token with a guaranteed £/$/€10 in-app value. Redeem PLUS for gift cards, cashback, travel rewards, or miles across 400+ global brands. With 250k sign ups and powering $40M+ in monthly spend, Plutus brings real utility to digital rewards.

Become a Coinstack Sponsor

To reach our weekly audience of 350,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

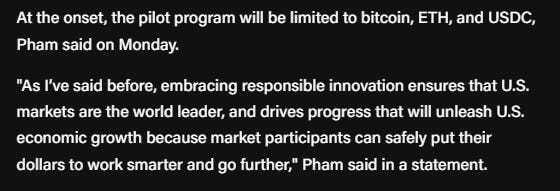

🚀 CFTC clears path for ETH, Bitcoin and USDC to be used as collateral in derivatives markets: In her latest move to update financial markets, Commodity Futures Trading Commission Acting Chair Caroline Pham debuted a “digital assets pilot program” allowing certain cryptocurrencies to be used as collateral in derivatives markets.

💵 Tether gains Abu Dhabi’s approval to expand USDT use across nine major chains: Tether’s USDT stablecoin has received regulatory recognition as an accepted fiat-referenced token across various major blockchains within Abu Dhabi Global Market (ADGM), advancing the company’s push to expand its footprint in the region.

⚖️ SEC ends investigation into Ondo Finance without charges, firm says:ONDO Finance said the U.S. Securities and Exchange Commission has closed a confidential, multi-year investigation into the company without filing charges, marking what it described as a “major step forward for tokenized securities in the United States.”

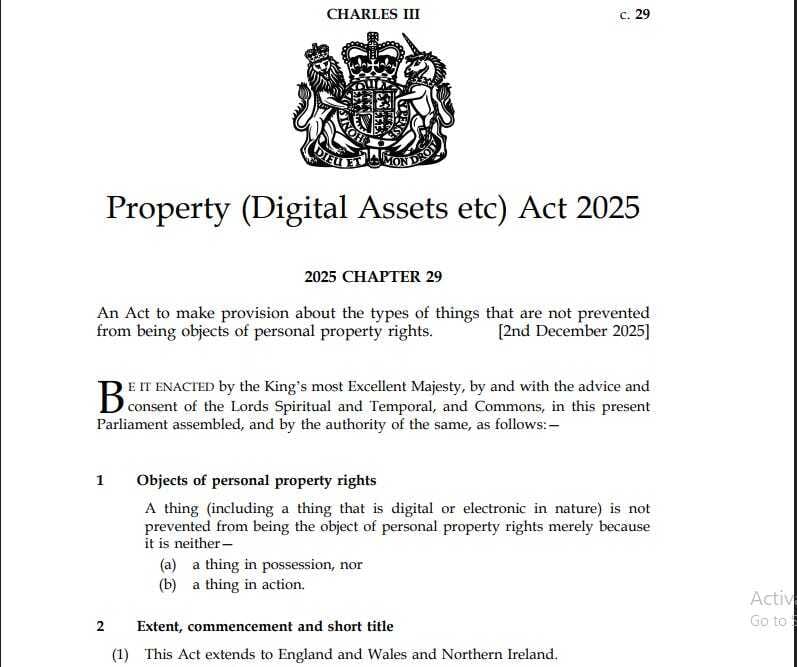

📜 UK passes law officially recognizing crypto as third kind of property: The UK’s crypto regulation reached a major milestone on Tuesday after the Property (Digital Assets etc.) Act 2025 received Royal Assent from King Charles III, legally recognizing digital assets as a form of property.

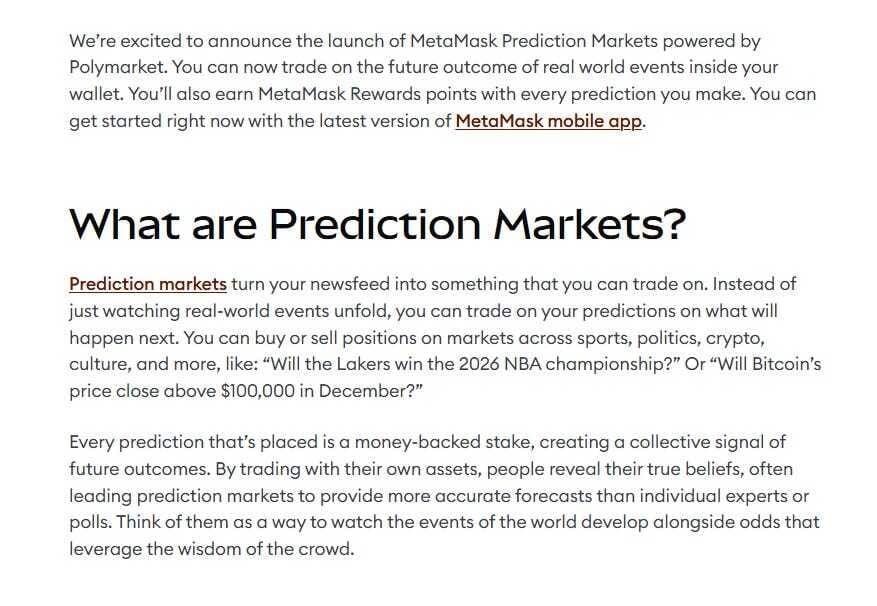

🎭MetaMask moves into prediction markets with Polymarket integration:The largest Ethereum wallet MetaMask is moving into the prediction market sector with an integration with Polymarket.“You can now trade on the future outcome of real world events inside your wallet,” Consensys’ Gabriela Helfet wrote in a recent blog. “You’ll also earn MetaMask Rewards points with every prediction you make.”

💬 Tweet of the Week

Source: @jdorman81

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

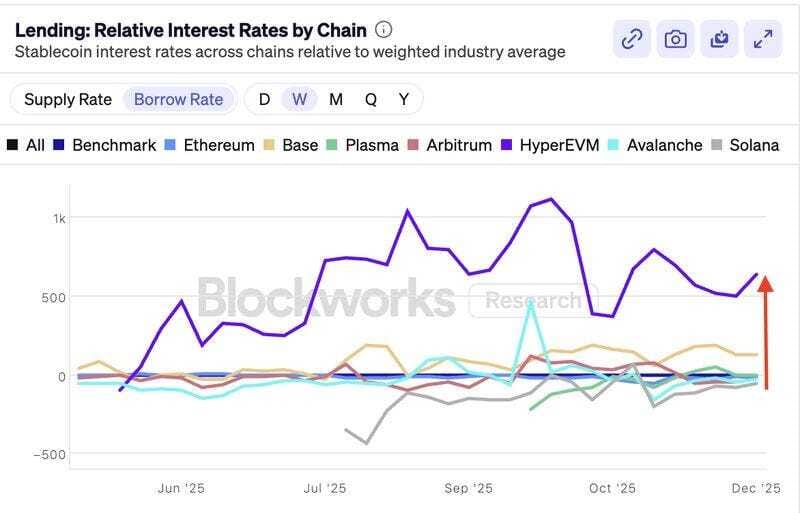

1. Liquidity markets are becoming ultra-competitive, especially across lending protocols. With platforms battling for user deposits, rate dispersion is widening: HyperEVM leads with yields 640 bps above the industry average, while Solana, interestingly, ranks last at 58 bps below.

Source: @DavidShuttleworth

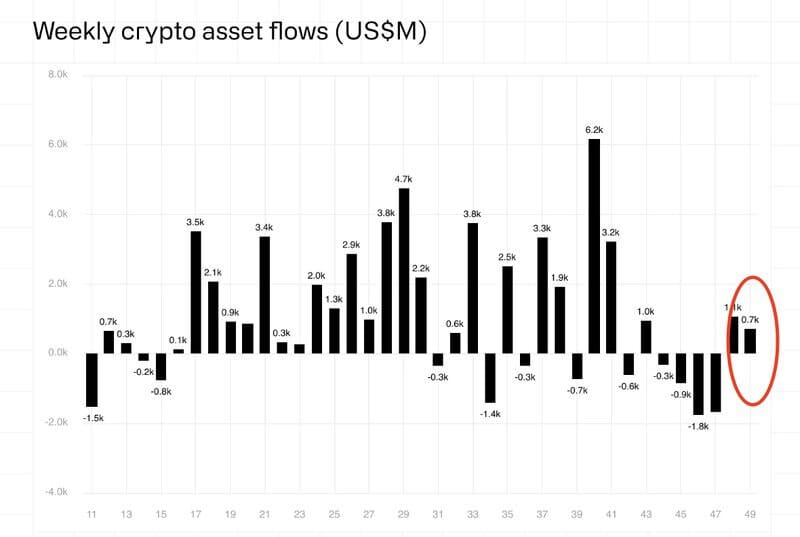

2. Second straight week of positive inflows ($716M), led by BTC ($352M) and boosted by unusually strong activity in XRP ($245M) and LINK ($53M).

Source: @DavidShuttleworth

3. Competition within the perp space has accelerated throughout 2025, with year-over-year volume surging more than $1T (+580%).

And while newer entrants like Lighter (28%) and Aster (19%) have eaten into market share, Hyperliquid still owns the core of the market: 80% of all perp DEX users and 52% of open interest remain on Hyperliquid.

Source: @DavidShuttleworth

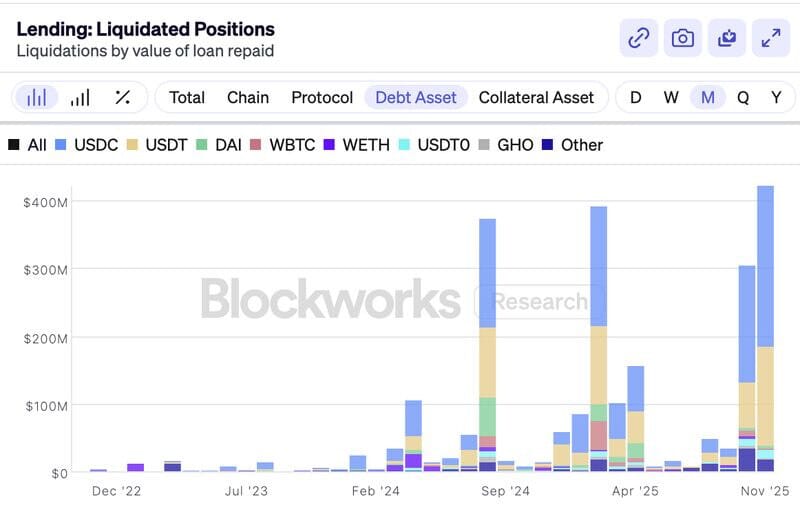

4. As onchain banks surge past $70B in deposits and $27B in active loans, one of the more under-appreciated dynamics is what’s happening beneath the surface with repayments and liquidations, especially the scale of forced deleveraging.

November just posted the highest liquidation volume ever, with more than $422M in positions forcibly unwound. Combined with October, that brings two-month forced deleveraging to a staggering $727M.

Importantly, this occurred without contagion or protocol instability and instead was a meaningful validation of onchain risk frameworks.

Source: @DavidShuttleworth

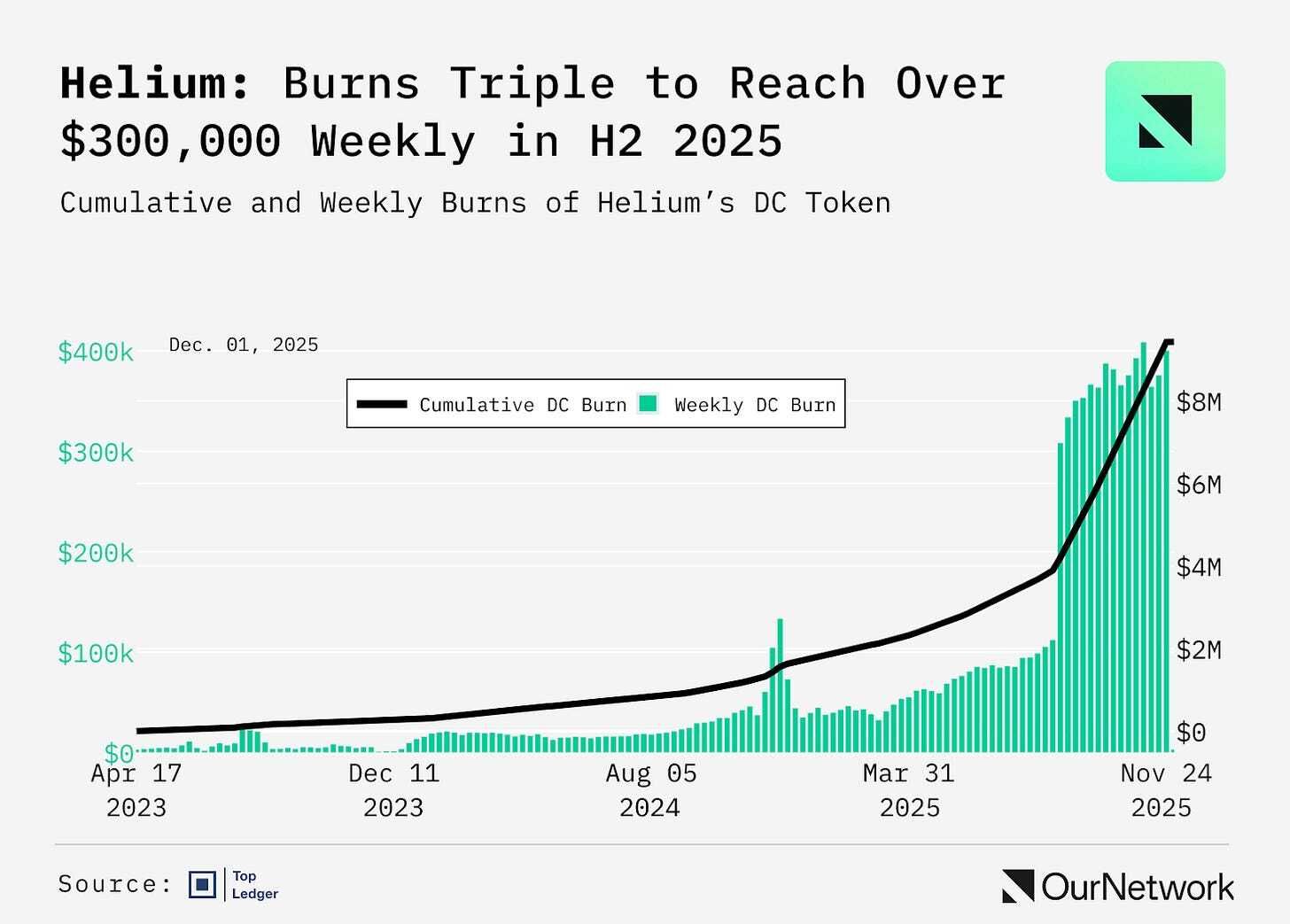

5. Helium’s cumulative data credits burned tops $9.43M. This is considered as revenue for the Helium Network as data credits are burned each time the network is utilised by an end point to access the internet.

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Welcome to OurNetwork’s latest.

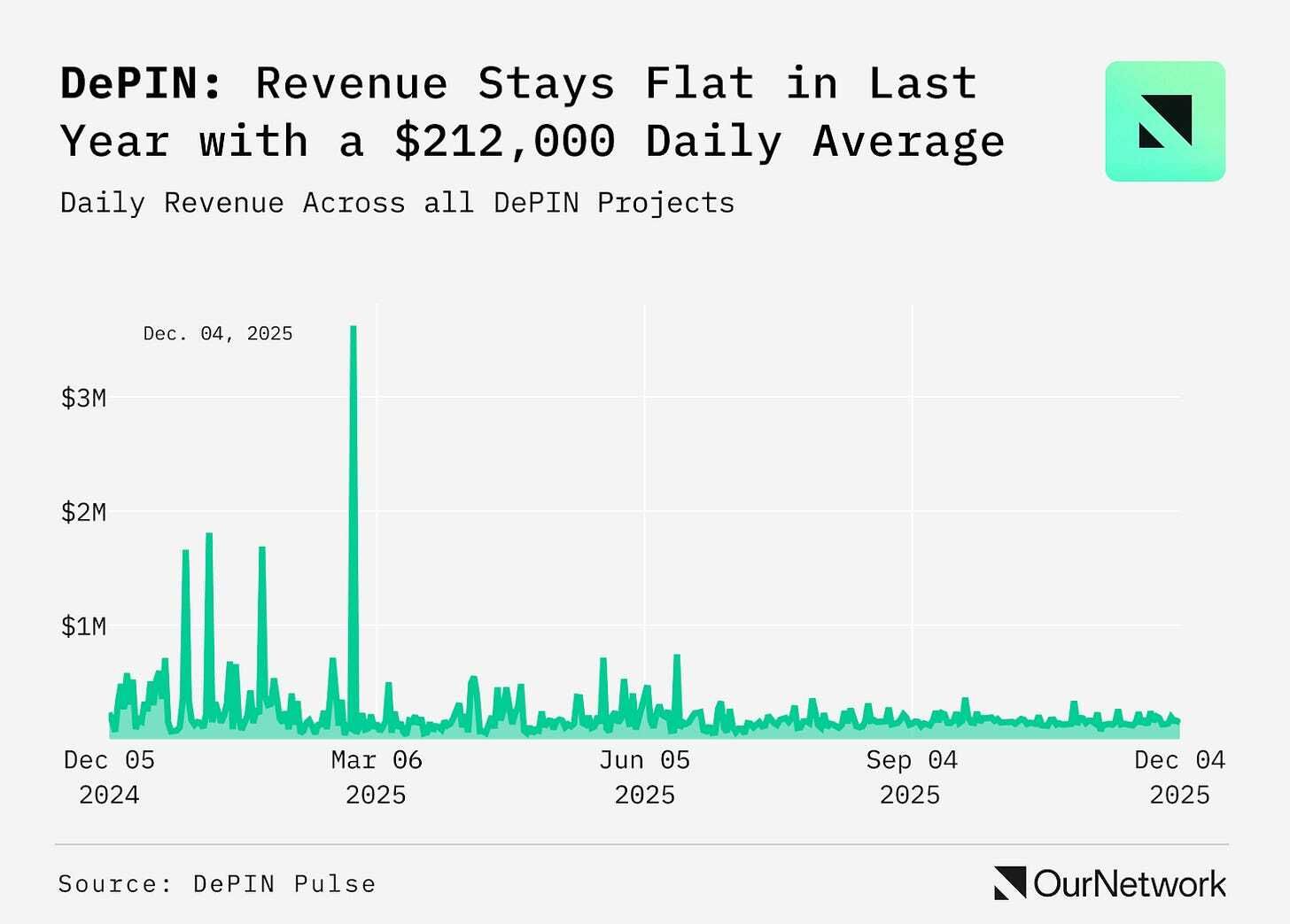

In this issue we’re looking at decentralized physical infrastructure networks (also known as DePIN). The essential idea behind DePIN is that blockchain-based networks can be used to incentivize disparate actors to provide a real world service.

These services range from compute, storage, mapping services, cellular data, and more. It’s a tricky arena to navigate and revenue has been flat in the last year, according to DePIN Pulse.

Still, as you’ll read below in Robert Koschig of 1kx’s submission, the space is generating interest, and has grown significantly on a multi-year basis.

And specific projects like, Daylight Energy, an energy company, raised $75M in October to build out a decentralized electrical grid. Hivemapper too, a project which maps the globe through a decentralized cadre of cameras, people, raised $32M in October as well.

As DePIN still seeks to dethrone traditional forms of infrastructure provision, OurNetwork’s analysts, Robert, Nitin Shukla of Top Ledger, and Theo Messerer of Silencio, are digging into onchain latest in the space.

– ON Editorial Team

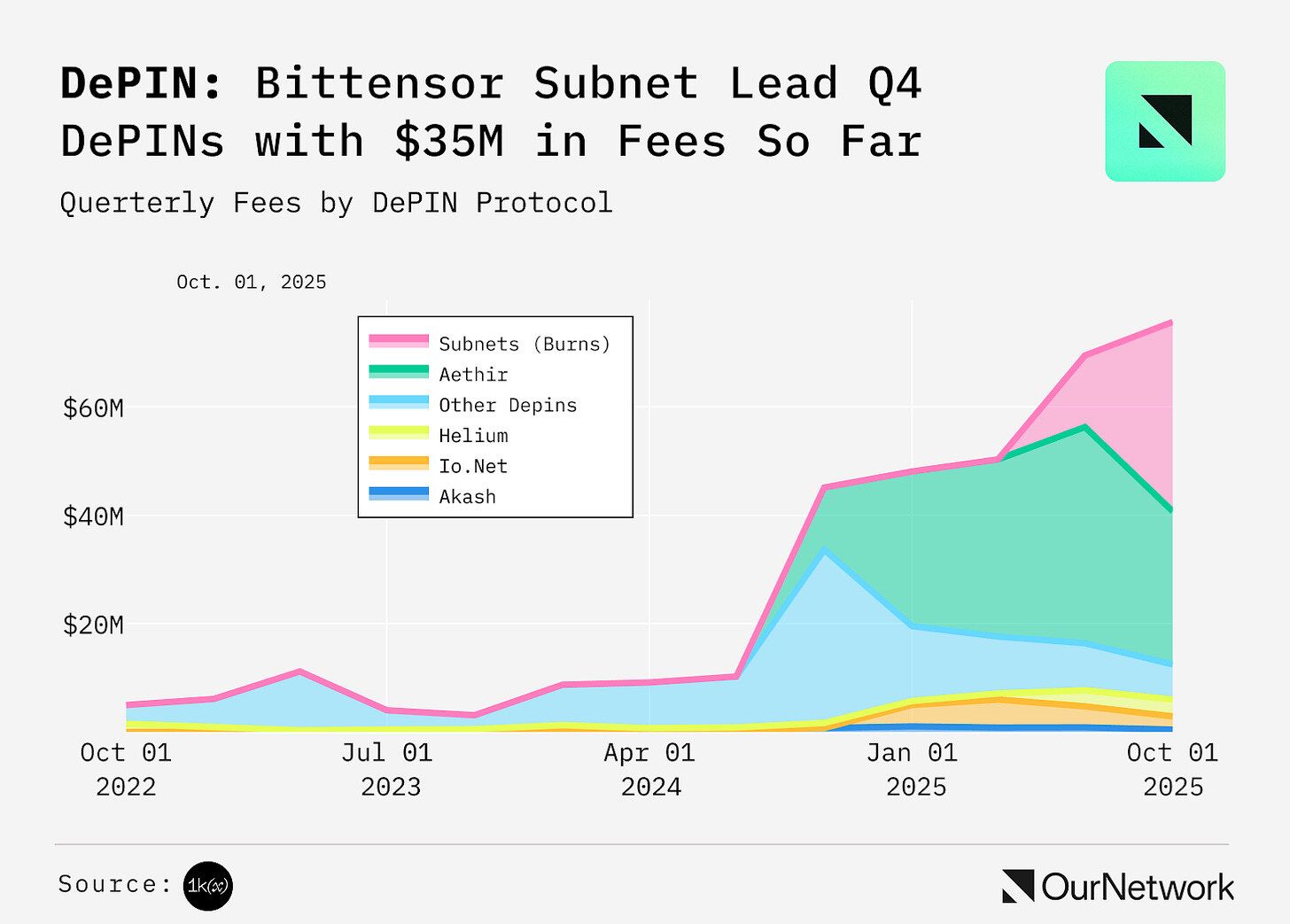

📈 DePINs Continue to Grow: Q4 2025 Fees on Track to Hit $76M, Full Year ~$240M, 3.3x Growth Year-over-Year. Valuations Improve: Median Price-to-Fee Ratio 106x

Based on November year-to-date data, Q4 2025 DePIN fees are on track to reach another all-time high of $76M. As highlighted in the 1kx revenue report, DePIN remains the fastest-growing sector, with 3.5x year-over-year growth. The increase in Q4 is driven by reported Bittensor Subnet burns, which are not 100% user-paid fees, yet only fee Subnets provide explicit fee numbers (e.g. Celium). The remaining 31 DePINs actually saw a 27% quarter-over-quarter decline in fees.

✏️Editor’s Note:

1kx categorizes DePINs differently than DePIN Pulse, which leads to the difference in fee calculation. 1kx’s numbers include 31 protocols and 78 Bittensor Subnets.

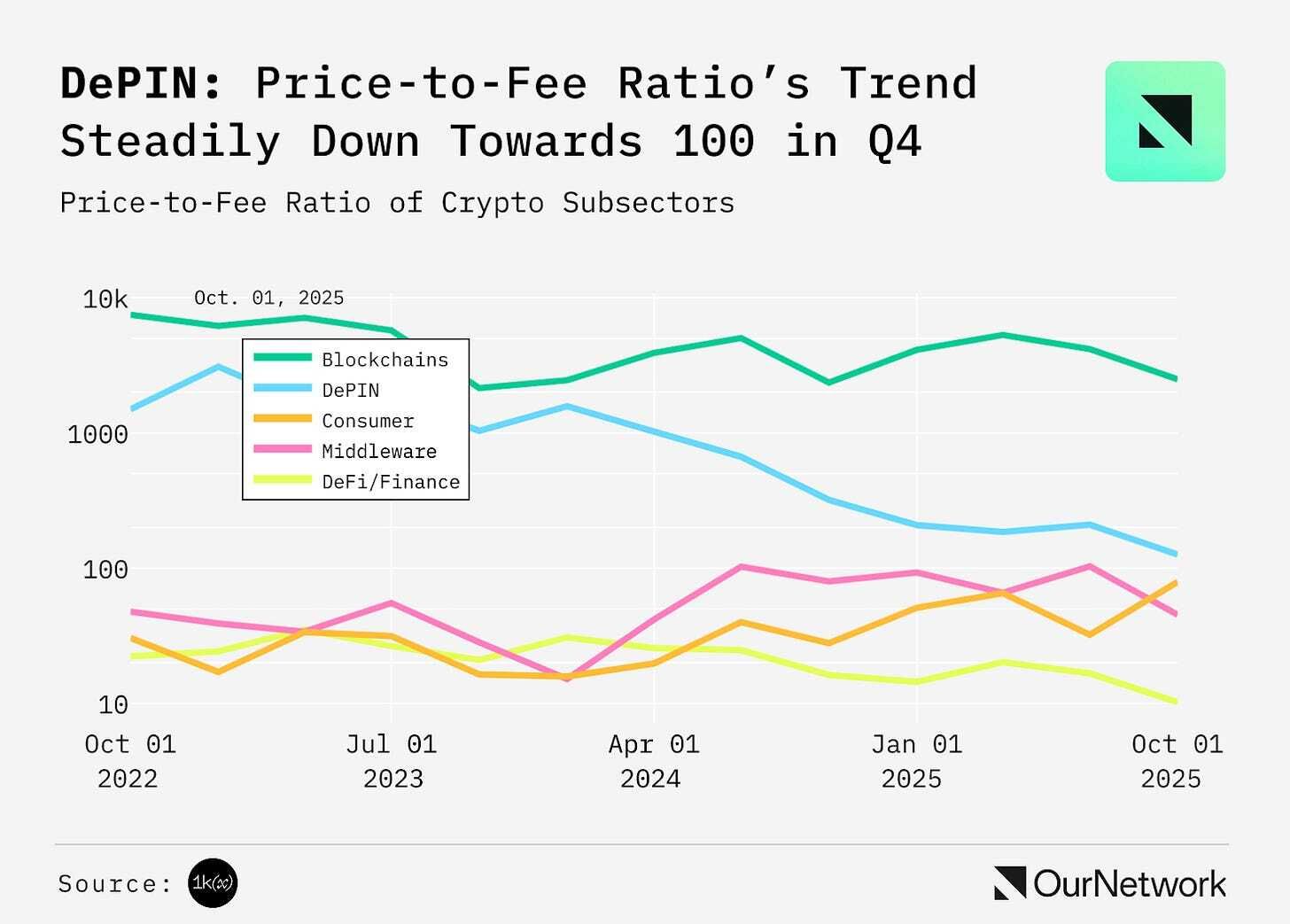

Median Price-to-Fee ratio of DePINs is now 106x, down from 211x in Q3 2025 as DePINs have fallen steadily since late 2023. Some of the largest DePINs are on par with DeFi protocols in terms of their ratios, (e.g. Aethir at 9x and Geodnet at 24x).

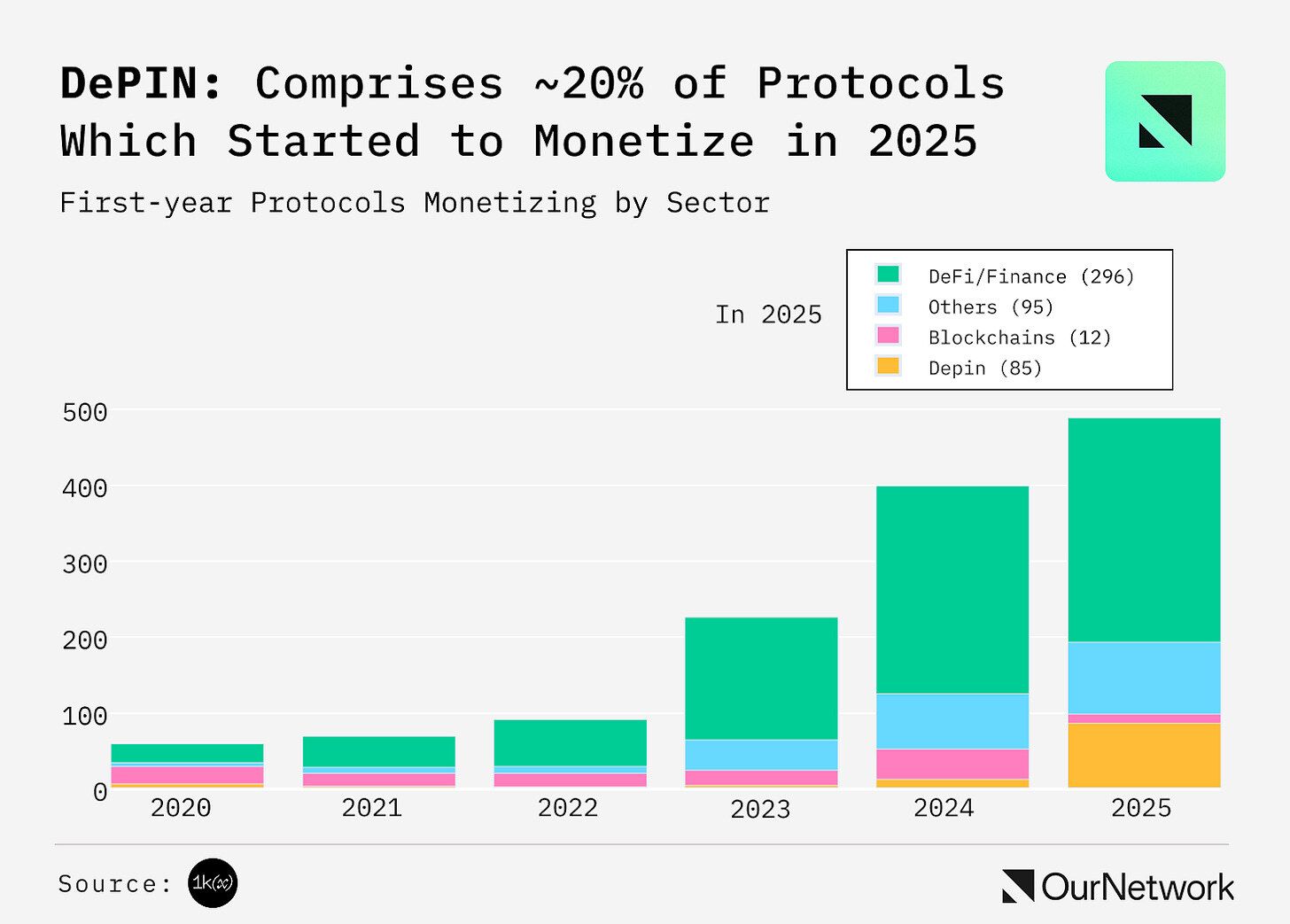

DePIN is the main driver of the 2025 cohort that started to monetize or report on-chain fees - nearly 20% of 488 protocols. Of the 85 DePIN projects, most are Bittensor subnets, with others like Impossible Cloud Network, Silencio, and Walrus. New additions include Rovr and Beamable.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com and www.plutus.it