Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We reviewed the top news, stats, and reports in the digital asset ecosystem for our 320k weekly subscribers. This week, CFTC greenlights National Trust Banks to issue payment stablecoins, while Bithumb crypto exchange made headlines for accidentally distributing $44B Bitcoins to users, and BitMEX launches Hyperliquid copy trading for everyday users to leverage strategies of elite traders. On the fundraising front, Tether secured the front row by investing $100M at $4.2B valuation in Anchorage Digital and TRM Labs raised a $70M in Series C round at a $1B valuation to scale its AI-driven application tools globally.

Price performance since we began writing Coinstack in January 2021

Become a Coinstack Sponsor

To reach our weekly audience of 320,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

Together With CoW Swap

Stop overpaying to swap crypto.

The exchange you're using? Probably charging you more than you need to pay.

CoW Swap compares prices across every major exchange in real time. Gets you the best deal automatically. You just swap like normal.

No extra work. Better prices.

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🟢 CFTC greenlights National Trust Banks to issue Payment Stablecoins: The Commodity Futures Trading Commission’s Market Participants Division expands its rules and reissues CFTC Staff Letter 25-40. The new guidance permits national trust banks to issue “payment stablecoin” as collateral in crypto markets.

😲 Bitthumb accidentally gives away $44B worth of BTC to users: South Korean crypto exchange, Bitthumb accidentally sends $44B worth of Bitcoins as an internal reward to users making them instant millionaires. The exchange immediately froze trading and withdrawals of 695 such users within 35 minutes. About 99% of the overpayments were recovered.

🔁 BitMEX launches Hyperliquid copy trading: The leading crypto derivatives and trading exchange now allows users to replicate trading strategies of up to 5 Hyperliquid elite traders through a dedicated leaderboard.

🎯 🛸 Aster layer-1 testnet goes live: The futuristic perp DEX rolls out its layer-1 blockchain testnet for users. It is now open to the public, with potential mainnet deployment in Q1 2026. The Q1 launch aims to introduce several features, including fiat on-ramps, Aster’s open-source code for builders, and more.

⚖️ Illinois introduces budget-neutral Community Bitcoin Reserve Bill: On February 5, Senator Emil Jones III introduced the groundbreaking Community Bitcoin Reserve Act (Senate Bill - SB3743), originally proposed by Illinois State Representative John Cabello as a separate bill in January 2025. The Bill recognizes Altgeld Bitcoin Reserve in Chicago as the first community reserve site and encourages greater community participation without additional tax burdens.

💬 Tweet of the Week

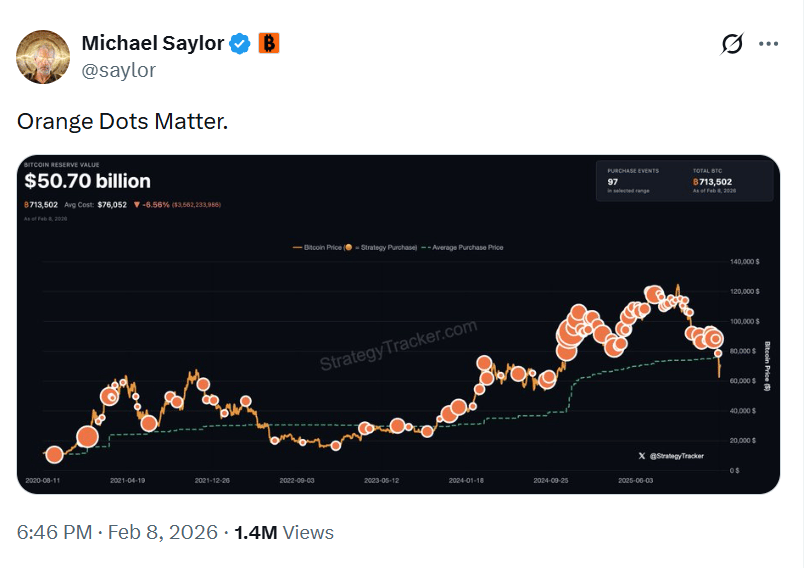

Source: @saylor

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. January was a historic month for prediction markets, and sports betting was the catalyst.

Sports markets accounted for 51% ($8.8B) of the $17.3B in combined volume on Polymarket and Kalshi, making it the primary growth driver.

The impact showed up in the data: monthly volume surpassed $27B across prediction markets, up 47% (+$8.7B) from December, with activity crossing 100M transactions and $1B in open interest for the first time. January also marked the first time daily volume exceeded $1B, and it did so on multiple occasions.

User behavior is shifting toward sports-driven prediction markets, signaling a more mainstream and repeatable demand profile.

Source: @DavidShuttleworth

2. One of the most powerful products launched this year. Fully self-sovereign, onchain banking infrastructure built on a private, scalable payments network. Borrow, lend, spend in private and retain complete autonomy over your money. No more slapping "payments" on top of legacy systems and credit cards.

Fantastic work Payy!

Source: @DavidShuttleworth

3. The #Bitcoin valuation is the lowest it has ever been.

The Gold valuation is the highest it has been in fifteen years.

The upside to this entire story is the following:

The higher Gold goes, the higher the ceiling will be for #Bitcoin.

That's why it's inevitable Bitcoin will run to $500,000-1,000,000 in the next run.

Source: @CryptoMichNL

4. Since the euphoria around the 2024 election, the Solana user base has undergone an about-face.

After reaching a record $346B in monthly trading activity in January 2025, Solana DEX volumes have ground down to just $107B in January 2026: a 69% decline. Over that same period, Solana’s share of total DEX activity across the ecosystem has fallen sharply, from a peak 79% to just ~34% today.

The composition of that drawdown is even more revealing.

In January 2025, memecoin trading alone accounted for $169B, nearly half of all Solana DEX volume. One year later, meme volume has fallen to just $16B, a 90% drawdown.

Newer primitives are feeling the pressure as well. Prop AMMs are losing share across the broader DEX landscape, with HumidFi’s monthly volume down 33% MoM and its share of total DEX activity sliding from 14% in December 2025 to 7% today.

This looks less like a temporary lull and more like a structural rotation. Spot DEX activity on Solana has faded, while perp DEX activity elsewhere has remained resilient, with open interest at $13.6B in January, only modestly below December (-8%) and up ~350% since the election.

Meanwhile, prediction markets just posted their strongest month ever in January, handling $27B+ in spot volume (+47% / +$8.7B MoM), crossing 100M transactions and $1B in open interest for the first time.

User attention moves onwards.

Source: @DavidShuttleworth

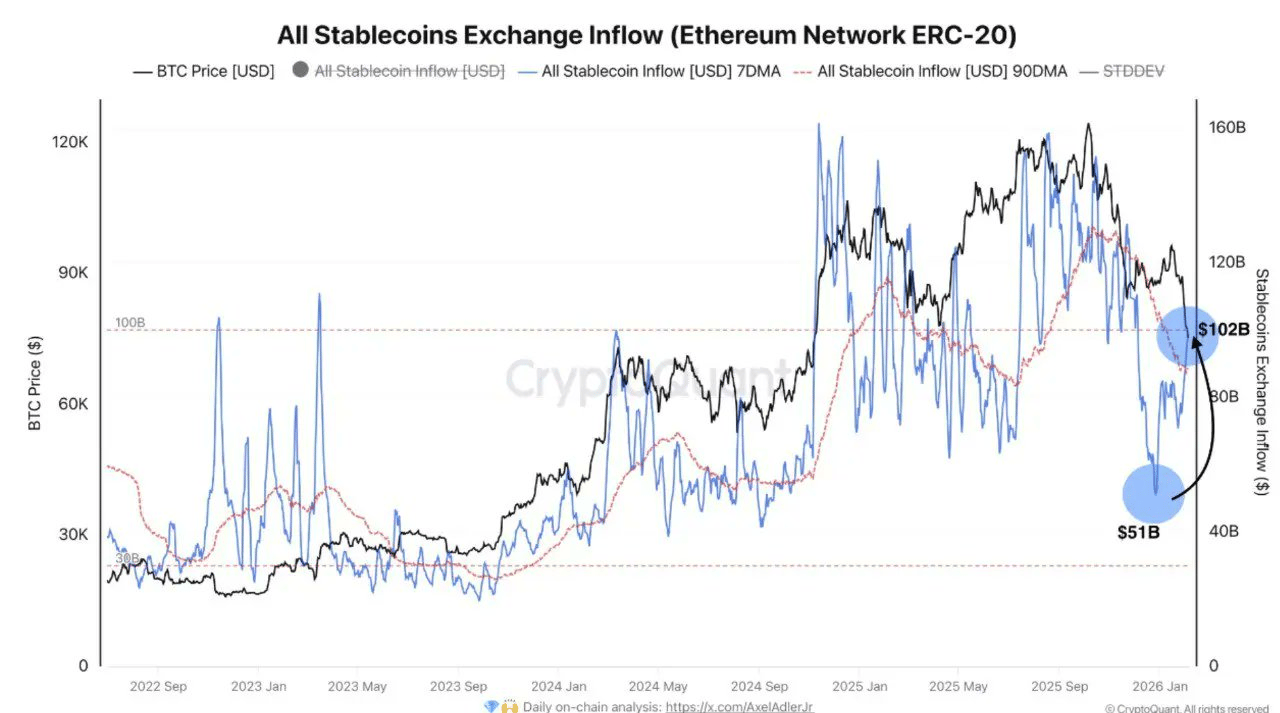

5. 🚨STABLECOIN INFLOWS JUST DOUBLED

Even as crypto sells off, money isn’t leaving crypto.

Weekly stablecoin inflows jumped from about $51B in late December to roughly $102 BILLION now, well above the 90-day average of $89 BILLION.

Sidelined capital is stacking up. 🔥

Source: @coinbureau

Together With Fintech Takes

Most coverage tells you what happened. Fintech Takes is the free newsletter that tells you why it matters. Each week, I break down the trends, deals, and regulatory shifts shaping the industry — minus the spin. Clear analysis, smart context, and a little humor so you actually enjoy reading it. Subscribe free.

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Glassnode Insights offers in-depth data-driven reports, aims to help you understand crypto like never before by harnessing the power of DeFi market dynamics along with on-chain data & analytics. This is an excerpt from the full article, which you can find here.

📝 By Chris Beamish, CryptoVizArt, Antoine Colpaert, Glassnode:

Executive Summary

BTC has confirmed a decisive breakdown, with price slipping below True Market Mean and keeping market participants firmly on the defensive.

On-chain cost basis distributions reveal initial accumulation in the $70k–$80k range, with a dense supply cluster between $66.9k and $70.6k emerging as a high-conviction zone where near-term sell pressure may be absorbed.

Realized losses are accelerating, with sustained sell pressure suggesting many holders are being forced to exit at a loss as downside momentum persists.

Spot volume remains structurally weak, reinforcing a demand vacuum where sell-side flows are not being met with meaningful absorption.

Futures markets have entered a forced deleveraging phase, with the largest long liquidation spikes of the drawdown amplifying volatility and downside continuation.

Demand from major allocators has softened materially, as ETF and treasury-linked netflows fade and fail to provide the consistent bid seen during prior expansion phases.

Options markets continue to price elevated downside risk, with volatility staying bid and skew steepening as traders pay up for protection.

With leverage being flushed but spot demand still absent, the market remains vulnerable, and any relief rallies are likely to be corrective rather than trend-reversing.

On-chain Insights

Following last week’s assessment, where we highlighted mounting downside risk after price failed to reclaim the short-term holder cost basis around $94.5k, the market has now decisively broken below the True Market Mean.

Below the Structural Mean

True Market Mean, which represents the aggregate cost basis of the actively circulating supply, excluding long-inactive coins such as lost supply, early miner holdings, and Satoshi-era coins, has repeatedly served as the final line of support throughout the current shallow bear phase.

The loss of this structural anchor confirms a deterioration that has been building since late November, with the broader market configuration increasingly resembling the early-2022 transition from range compression into a deeper bear market regime. Weak demand follow-through, combined with persistent sell-side pressure, suggests that the market is now in a more fragile equilibrium.

From a mid-term perspective, price is increasingly constrained within a broader valuation corridor. On the downside, the True Market Mean near $80.2k now acts as overhead resistance, while the Realized Price, currently around $55.8k, defines the lower bound where long-term capital is historically re-engaged.

Mapping the First Demand Zones

With the structural backdrop now reset, attention naturally turns to downside stabilization. As the market transitions deeper into this phase of the cycle, the key question shifts toward identifying zones where a durable bottom may begin to form. While no single metric can define this with certainty, several on-chain tools provide insight into where near-term demand may emerge.

One such lens is the UTXO Realized Price Distribution (URPD), which maps the supply held at different cost bases. Current distributions show notable accumulation by newer participants within the $70k–$80k range, suggesting early positioning by buyers willing to absorb weakness at these levels. Beneath this zone, a dense supply cluster between $66.9k and $70.6k stands out as a particularly high-conviction region. Historically, areas with concentrated cost basis often act as short-term shock absorbers, where sell-side pressure is more readily met by responsive demand.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. AI usage disclosure: Some portions of this document may have been created with the assistance of AI tools. The content has been reviewed and edited by a human. As a result, our research/editorial may contain errors. For more information on the extent and nature of AI usage, please contact the publisher. For personalized investment advice consult with a registered investment advisor.

Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.