Social Links: Twitter | Telegram | Newsletter

Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 150k weekly subscribers. This week we cover Chase UK blocking crypto payments, the court denying SBF’s second attempt at bail, the court rejecting testimony from seven expert witnesses put forward by Sam Bankman-Fried, and big new venture rounds for Proof of Play ($33M) and Fuzefinance ($14M).

Price performance since we began writing Coinstack in January 2021

Published By Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Join our Daily Crypto News Roundup

We’re launching a new daily edition Coinstack that covers all the day’s news. If you’d like to join our daily edition, subscribe here.

Become a Coinstack Sponsor

To reach our weekly audience of 150,000 crypto insiders and daily audience of 50,000 subscribers, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

Thanks to Our 2023 Coinstack Sponsors…

Amphibian Capital is a market/delta neutral fund for the world’s leading crypto funds. They returned approximately 5.35% net in Q1 ‘23, 186.33% net (pro-forma) since '19* and aim to deeply mitigate downside. They have USD and ETH share classes, soon BTC. Deck here: www.amphibiancapital.com.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚫 Chase U.K. to Block Crypto Payments - Starting Oct. 16, the bank will decline customer attempts to make payments related to crypto assets via debit card or outgoing bank transfers. This brings up many questions as to whether a bank actually should legally have the power to block what its customers choose to legally spend money on.

Our take: Could this lead to a class action law suit against Chase bank or legislative action from the pro-digital assets Sunak administration? And why is Chase digging itself into the ground as an anti-innovation and anti-blockchain bank? Is the future of money centralized? We don’t think so.

⚖️ Appeals court denies Sam Bankman-Fried’s second attempt at bail- Three judges in an appeals court have denied former FTX CEO Sam Bankman-Fried’s bail request, according to a court filing on Sept. 21. Those judges, all on the 2nd U.S. Circuit Court of Appeals in Manhattan, found no error in an earlier decision by U.S. U.S. District Judge Lewis Kaplan.

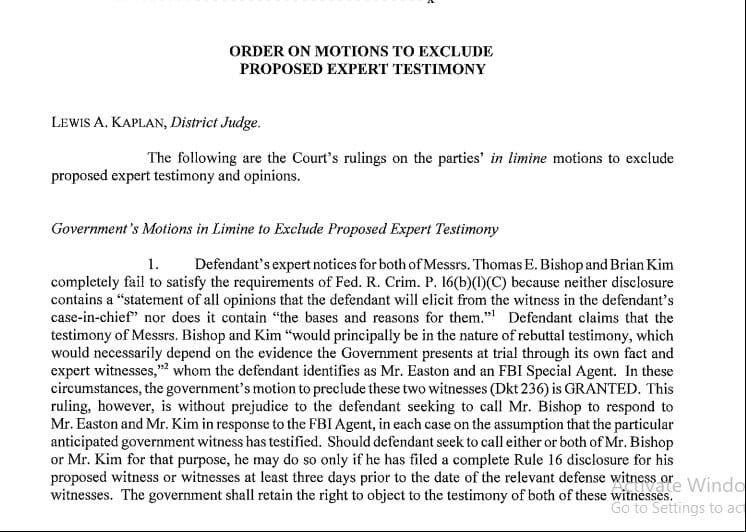

⚖️ Court rejects testimony from seven expert witnesses put forward by Sam Bankman-Fried- Seven expert witnesses expected to testify on behalf of former FTX CEO Sam Bankman-Fried have been rejected, according to a ruling dated Sept. 21.

✅ Celsius' Bankruptcy Nears End as Creditors Approve Reorganization Plan- Bankrupt crypto lender Celsius' creditors have voted to approve a plan that would return 67%-85% of holdings back to them, according to a voting declaration filing by restructuring specialist Stretto that awaits final approval from the court.

👋 NEAR Foundation’s Marieke Flament Steps Down as CEO- NEAR Foundation CEO Marieke Flament has stepped down after two years in her role running the organization behind the NEAR protocol (NEAR). Chris Donovan, the foundation’s general counsel, will take her place, according to a Thursday blog post.

💬 Tweet of the Week

Source: @singularity7x

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. The amount of ETH staked has consistently grown. Along with that, Lido's share has remained high and is nearing a key threshold of 33%

Source: @kunalgoel

2. Base doing ~$200k/week in profit

Source: @JasonYanowitz

3. Users in the Ethereum ecosystem are at an all-time high despite being 2 years into a bear market📈

Source: @ThorHartvigsen

4. The chart below illustrates the speed at which Ethereum has gathered product market fit and become a widely used product

Source: @ThorHartvigsen

5. Liquid staking grew from $7.9b to over $20b in 2023 alone

Source: @ThorHartvigsen

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Introduction

This past week of 8/26 to 9/1 was Stanford Blockchain Week, a week-long series of conferences, summits, and events centered around the 6th annual Sciences of Blockchain Conference (SBC). In addition to this main, primarily academic conference, this year there were also a large number of other summits, including the Blockchain Application Stanford Summit (BASS) by Stanford Blockchain Club, the Starknet Summit in SF, and academic workshops focused on consensus, MEV and DAOs, and countless other side events. In this article, we will explore three key trends throughout the week, and what all of this means for the industry’s development at large.

Trend 1: Optimization of ZKPs in both theory and practice

Much of the conference was, not surprisingly, focused on zero knowledge proofs (ZKPs). The optimization of existing ZKP solutions was a core topic during SBC itself, with a session focusing on breakthroughs in efficient folding schemes such as HyperNova and Protostar. In addition to these, there were also other academic talks focusing on applying zkSNARKs for more efficient batch Merkle proofs, and formal verification for ZK circuits.

Moreover, it wasn’t only the academics at Stanford that were interested in advancing research in ZKPs. During the week, several Stanford startups from the Stanford Blockchain Accelerator presented novel applications of Zero Knowledge Proofs in various areas. Nexus Labs and Modulus Labs, for example, used ZKPs for verifiable computation, Ironmill and Succinct presented use-cases in new dev-tooling and infrastructure, and Nocturne and Hinkal presented applications in private transactions.

The key observation here is that the ZKP ecosystem is gradually specializing, where different companies focus on one specific part of the ZK pipeline – whether that is connecting applications to provers, providing ZK proofs for a specific vertical (such as AI in the case of Modulus), or providing other enhanced integration tools. This specialization may signal how the industry is gradually developing a modularized and sophisticated pipeline, thus highlighting ZKPs growing maturity as a technology. All this, of course, is undergirded by a steady pace in academic breakthroughs (such as the novel folding schemes presented at SBC) that opens up new use cases for the technology and creates a symbiotic relationship between ZKP theory and practice.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com