Issue Summary: Below, we write part two of our 2021 Crypto Year in Review. We also cover the top weekly news, stats, and reports in crypto and share our NFT of the week.

In This Week’s Issue:

Crypto: 2021 in Review (Part 2) by Ryan Allis

Big Story #6: NFTs Go Mainstream

Big Story #7: The Year of the Crypto Hedge Fund

Big Story #8: The Year Fundamentals Started to Matter in Crypto

Big Story #9: China Makes a Major Geopolitical Blunder Banning Bitcoin

Big Story #10: Digital Assets Finally Get Taken Seriously in D.C.

This Week in Crypto by Mike Gavela

🗞️ Top Weekly News

💵 Weekly Fundraises

📊 Key Stats

📝 Report Highlights

🎧 Best Podcasts

📈 Top 10 Performers

The NFT of the Week By Mrs. Bubble - Happy Dragon - $2 NFTs

Coming Soon: NFT Art & Culture Section By Mrs. Bubble

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

🎆 Crypto: 2021 in Review - Part 2

By Ryan Allis, Managing Partner at HeartRithm & Publisher of Coinstack

Here are the biggest stories of 2021 in crypto. This week we’ll be publishing stories 6-10. See last week’s issue for the first five stories.

Ethereum’s Progress Toward Flipping Bitcoin

Solana, Terra, Binance, Fantom, and Avalanche Have Breakthrough Years

The Year of DeFi

Institutional Investment in Crypto Explodes

Ethereum Scaling Solutions Have Arrived and Are Working

NFTs Go Mainstream

The Year of the Crypto Hedge Fund

The Year Fundamentals Started to Matter in Crypto

China Makes a Major Geopolitical Blunder Banning Bitcoin

Digital Assets Are Finally Taken Seriously in D.C.

Now, let’s take a closer look at stories 6-10…

Big Story #6: NFTs Go Mainstream

This was the year that NFTs went mainstream. From Beeple’s $69M sale of 5000 Days in February to Saturday Night Live’s NFT Skit in March, we saw 2021 be all about Non-Fungible tokens. You can read our Coinstack issue on NFTs here.

The biggest three use cases for NFTs are:

Buying access into communities (that often have private Discords and Telegram channels where trading information is shared and marketing of the project is coordinated)

Buying digital assets that have utility inside games (like Axie Infinity or Town Star)

Buying digital assets that have utility inside metaverses (like Decentraland or Sandbox)

While there are other uses coming in the realm of music, ticketing, and even real estate deeds… the above are the most common use cases so far for successful projects.

Key Tip for NFT Creators: So many artists have published NFTs this year and haven’t sold any. This is often because they haven’t built a community of owners who then market for them. For new artists publishing NFTs, we recommend publishing on Polygon to keep gas fees low (~$1 instead of $100 to mint an NFT) and keep your first 100 sale prices super low (like $2).

Only once you have 100+ owners and an active community of promoters who are incentivized to promote you should you start to raise your prices above a few dollars per piece. You can also attach real-world incentives (like a printed framed original send via mail or a chance to meet you) as a way to increase your sales. As an example, you can see a Mrs. Bubble NFT available for $2 here on OpenSea.

Below, you can see that the five most successful NFT projects of all time are CryptoPunks, Bored Ape Yacht Club, Decentraland, Mutant Ape Yacht Club, and Sandbox. Every single one of these fits into either a community of high net worth crypto traders (utility is to get tips and flex ego by being part of it) or metaverses/games (where the utility is digital land or game assets).

However, the order changes if you look at the current daily volume, which shows the projects with the most activity right now. The top five are Adidas Originals, CloneX, My Pet Hooligan, Terraforms, and Thingdoms.

Finally, if you sort by the highest current floor resale value, you get the following leaders: Bored Ape Yacht Club, Deafbeef, iNFT, RTFKT, and VeeFriends. Note that the current floor price for a Crypto Punk is 51 ETH ($200k), but for some reason DeFi Llama didn’t have that data.

The most expensive NFT sales for this week are as follows… with Cryptopunk 8713 in the lead selling for $714,656 today.

Big Story #7 - The Year of the Crypto Hedge Fund

This was the year of the crypto hedge fund. Multicoin, who backed Solana early, and Polychain, who backed Avalanche early, had particularly good years.

In August, I joined as a Managing Partner with crypto hedge fund called HeartRithm, which focuses on crypto yield generation for high net worth investors and institutional asset allocators as an alternative to lower yields from bonds, savings accounts, treasuries, and crypto banks.

We do DeFi-as-a-Service as well as margin lending, DEX liquidity provision, and some algorithmic trading. Please reach out to me if you’d like additional information about what we do.

It’s worth going back to our November 2021 article, Crypto Hedge Funds: An Ecosystem Map, one of our most-read articles all year.

At a 30,000 foot level, there are four main types of crypto hedge funds, each with its advantages I discuss in the article.

Crypto Yield Funds - Invests in DeFi, arbitrage, staking, and margin lending to generate positive yield at higher rates of return than corporate bonds or traditional fixed income, usually with low volatility and high Sharpe ratios. Often these funds can generate 12-20% net returns per year in a market-neutral way, allowing for relative safety during both bull and bear markets.

Crypto Quant Funds - Invests in crypto using algorithms and AI/ML to generate returns, often with high-frequency trading. These are often highly volatile and affected by market conditions.

Crypto Token Funds - Invests in early-stage token projects. These types of funds can offer high returns during bull markets but often achieve negative returns in bear markets.

Crypto Venture Funds - Invests in early-stage token projects (in both tokens and equity). Has a 7-10 year lock up for their investors.

Here’s a map of the existing crypto hedge fund ecosystem.

Big Story #8: The Year Fundamentals Started to Matter in Crypto

2021 was definitely the year that fundamental analysis from shops like Messari, Delphi, The Block, TokenTerminal, and yes Coinstack began to change the game. My favorite crypto analysts are usually ex-ibankers like Mira Christanto, who recently left Messari for other pursuits.

Those who realize that reviewing and placing investment bets using transparent blockchain and dapp data on MAUs, TVL, and earnings can give investors a big advantage going forward.

Here were all the blockchain applications (Dapps) with $50M or more in protocol revenues (revenues that go to token holders, usually directly via staking or indirectly via token burns) in the last 365 days…

And here were all the blockchains ranked by revenues in the last 365 days. I had to use a logarithmic scale since Ethereum is so far ahead, having generated $9.6B in revenues in the last year alone, more than 9x Bitcoin and 300x Avalanche.

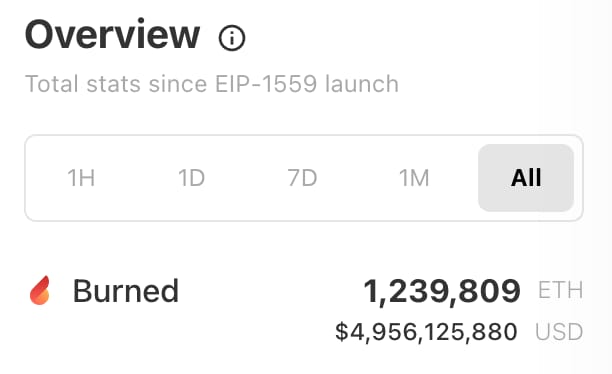

$4.9B of those revenues in the last year from Ethereum’s blockchain usage have gone back to Ethereum token holders indirectly in the form of burning, which reduces the overall supply of Ether, keeping the price up through continual supply reduction, something Bitcoin does not offer. Ethereum is on track once it launches its Proof of Stake upgrade around Mid-2022 to have a negative net issuance annually -- which should further buoy its price.

Ethereum is currently trading at a 35.8x Price to Earnings (PE) multiple, less than an average S&P 500 stock, while it should be valued at more like Tesla, a high growth asset, which is trading at a 300 PE Ratio.

What are the apps with the lowest P/E ratios? It looks like PancakeSwap, Nexus Mutual, Cap, and dYdX are trading at the best values right now. It’s amazing how inexpensive these apps are compared to their cashflows -- especially considering how fast their cashflows are growing.

Lastly, it’s important to study the metric Total Value Locked, which shows the top DeFi protocols. Here are the top 13 by TVL.

Yes, my friends. Fundamentals matter now in crypto. And if you can learn this, you will be able to make wise investment decisions and separate the signal from the noise -- and potentially outperform a basket index of the overall crypto market.

Big Story #9: China Makes a Major Geopolitical Blunder

One of the biggest stories of 2021 was China making a 30-year generational mistake and banning Bitcoin mining in May 2021.

China thinks it can insulate itself from the rest of the global financial system and only rely on its Central Bank Digital Currency (CBDC), the digital yuan which has now launched and will get major promotion during the Beijing Winter Olympics in February 2022.

But who wants to invest in a central bank digital currency whose supply can be manipulated and changed at any time.

The world wants e-money where the supply of it doesn’t keep going up, leading to massive inflation and hurting the poor by inflating their savings away and keeping the cost of goods going up forever. This is why Bitcoin (with a formulaic declining increase in supply each year) and Ethereum (with an actual decrease in total supply starting in 2022 once PoS launches), and their algorithmic stablecoin cousins like Dai, UST, Fei, and Ohm all have meaningful potential to become the global reserve currency by 2035, displacing currency issues by centralized governments that too often change the supply, with hugely damaging effects on their citizens.

The world is splitting into two camps -- the centralized planners who attempt to control everything (China) and the decentralized innovators who trust decision-making at the edges where knowledge is greatest instead of at the core.

Decentralized innovators with proper incentive alignment in complex systems will always outcompete and produce better results than centralized planners.

We’ve already seen how Central Planning went for China and the USSR the first time around (1917-1989).

While China will likely succeed in making its own CBDC the only currency within its borders, it will cut itself off from the rest of the global financial system to do so -- deeply hurting its people and economy -- and sadly and terribly preventing 1.4 billion people from being able to save in a currency that can’t be manipulated by a central bank. I know their intentions are likely good, but they are disobeying a core law of nature of distributed decision making.

Here’s a great and relevant quote from health educator Dave Asprey from this week:

“Complex systems only exist when you distribute decision-making to the edges. It’s how we built the Internet. It’s how your body is made. Your brain would explode if it had to make all the right decisions for every cell in your body. That’s why the cells make most of their own decisions. The same principle applies universally. In your body, when the brain tries to override the system, you get massive ego stress, and then individual cells get weak and can even turn against the body by becoming cancerous. In governments and societies, when the highest level of government tries to override the system of society, you get massive societal stress.”

This decision to ban Bitcoin mining and effectively give the US, Europe, and the rest of Asia a monopoly on one of the largest sectors of the innovation economy. This will become a geopolitical disaster for China as they’ve essentially banned themselves from the fastest growing sector of the global financial economy. I wouldn’t be surprised if the decision is reversed within three years.

As we move into the post-Bretton Woods financial system that is based on continual markets, tokens, smart contracts, and innovation, this is one of the reasons I am bullish on America -- we aren’t a nanny state that tries to control everyone and everything (I’m looking at you, Australia 😉).

In the meantime, thanks for the huge economic gift, China! The US share of Bitcoin mining went from 16.8% in April 2021 to 35.4% by August 2021.

One bold prediction: That by the end of 2025 the USA will need to create its own CBDC stablecoin to compete with the digital yuan -- and instead of doing so within the government, will nationalize the USDC coin from Center and Coinbase, and make USDC part of the FDIC system.

Big Story #10: Digital Assets Finally Get Taken Seriously in D.C.

2021 was the year that digital assets got taken seriously in Washington D.C.

In January, we saw blockchain expert Gary Gensler take over as SEC Chain. We also saw former Comptroller of the Currency Brian Brooks go from Binance.us CEO to Bitfury CEO to Congressional guide.

Here’s a quote from Mr. Brook’s prescient and wise December 8, 2021 testimony:

“First, a national policy agenda that takes crypto compliance seriously should assess whether it makes more sense to continue to keep crypto activities largely out of the regulated financial system or to bring them inside the system precisely so they can be supervised and operated with appropriate levels of risk management. For example, is it consistent with taking the position that only banks should be allowed to issue stablecoins, but then fail to grant bank charters to the largest issuers of stablecoins? That would, after all, bring stablecoin activity within the ambit of national bank supervision. Or does it make sense to bring enforcement actions challenging certain cryptoassets as unregistered securities, but then fail to allow those assets to be registered and trade on a national securities exchange or alternative trading system that is supervised by FINRA and the SEC?”

While there are people that just don’t properly understand digital assets, distributed ledger technology, and smart contracts yet (like Elizabeth Warren and Janet Yellen), we now have many political leaders who do get it (like Cynthia Loomis, Hester Pierce, Francis Suarez, Andrew Yang, Eric Adams, and Ted Cruz).

Yes, my friends smart contracts built on distributed blockchains will underpin all of the global finance by 2035 -- and all financial assets are in the process of being tokenized and will trade 24/7/365 by the end of this decade -- from stocks to bonds to real estate. It’s as inevitable as the switch from ticker tape to digital price quotes.

The party which embraces digital assets the most will be the ones doing the best in fundraising in 2024 and 2028. Right now, Republicans are the bigger fans, but there’s still time for Democrats (like Eric Adams) to realize this is the future just like the internet fundraising was the future in 1997, which led to Howard Dean’s initial rise in 2004 and Barack Obama’s eventual rise in 2008.

Yes, for the politicos reading this -- getting behind the digital asset bandwagon in 2022 is like getting behind the social media bandwagon in 2004.

And don’t forget, friends, Bitcoin is now legal tender in El Salvador. Yep, the course of human monetary history was changed this year by Nayib Bukkele. Congratulations sir! And thank you Jack Mallers and Strike for your work enabling this historic moment.

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week...

⚡ SEC Postpones Decisions on Bitcoin ETFs From Bitwise and Grayscale Until February - US financial watchdog delayed decisions on the two ETFs that would allow more direct exposure to Bitcoin until early February. (Source)

😮 Uniswap v3 Contracts Deployment on Polygon Approved With 99.3% Consensus - The deployment of Uniswap v3 contracts will be supported by a $20 million fund for a long-term liquidity mining campaign and the overall adoption of Uniswap on Polygon. (Source)

🏧 Rari Capital, Fei Protocol Token Holders Approve Multibillion-Dollar DeFi Merger - A total of 103 wallet addresses participated in the election. The joint effort will immediately command $2 billion in total value locked (TVL) making the merger the biggest in DeFi. (Source)

💰 Senators Ask Treasury To Put Out Guidance for Crypto Brokers by Year’s End - CEOs from six major cryptocurrency companies will testify at a Dec. 8 hearing of the House Financial Services Committee, Committee Chair Maxine Waters (D-Calif.). (Source)

🤑 JPMorgan To Develop Payment Blockchain System for Siemens: Report - JPMorgan Chase has partnered with German industrial group Siemens to develop a blockchain-based system for payments. (Source)

💬 Tweet of the Week

😂 Meme of the Week

Celo, the mobile-first blockchain that makes financial tools accessible to anyone with a mobile phone number, is a proud sponsor of Coinstack. Connect, transact, and store your crypto assets on the Celo blockchain using only an SMS interface. Celo is fully compatible with Ethereum, so you can run smart contracts built in solidity. It uses proof-of-stake consensus, has high throughput, and five-second transaction finality. Celo is now the fourth fastest-growing blockchain in all of DeFi. Learn more about Celo and its family of stablecoins by visiting http://celo.org.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Crypto Market Rallies Despite a Hawkish Federal Reserve, the S&P 500 Was Up 1.6%, and Bitcoin Was Up 3.0%, While Bond Prices Dropped and Rates Rose Slightly After the Release

2. Development Activity on Avalanche Climbs With Over 400 Developers and 70K Unique Contracts Deployed

3. Terra, Rockets Up to the 2nd Largest DeFi TVL With a 42% Increase in Total Value Locked in the Last 7-Days Knocking Binance Smart Chain to 3rd Place With $16.79B TVL

4. Stablecoin Supply Grew by 388% This Year, Driven by DeFi and Derivatives

5. Yearn Completed Its YFI Buyback of 0.77% of the Total Supply and Will Now Distribute the Protocol’s Earnings to Stakers

📝 Highlights From Crypto Reports

Here are the top highlights from the best crypto research reports this week…

The Metaverse May Be an Old Idea, but It’s Just Getting Started

The Defiant curates, digests, and analyzes all the significant developments in decentralized finance so that you can stay informed and intelligent about the most cutting-edge and fastest-changing corner of crypto and finance. This week, DappRadar releases an exclusive report on the metaverse.

1. Virtual Land Prices Skyrocket 500%

"The price on average for virtual lands in The Sandbox skyrocketed almost 500% from the end of November. Virtual lands on The Sandbox were traded for $14,800 in November, a massive growth from October's $2,500 average.

Similar scenarios unfolded in other BVW. Decentraland parcels, for instance, appraised 116% and were traded for $25,000 on average in November. Whereas CryptoVoxels digital lands were sold with a price 25% higher than the one registered in October."

2. NFT Market Cap: Virtual Land vs. Collectibles (Billions)

“In October, the floor market cap of the top 100 NFT projects was estimated at $16.8 billion, with only 8% constituted by virtual lands. One month later, the market cap for virtual real estate ascended to $4 billion and now represents at least 25% of the NFT floor market cap figure.”

3. Metaverse Related Cryptos Skyrocket to All-Time Highs

"Cryptocurrencies are the monetary forces that sustain the metaverse. Besides virtual real estate, cryptos that are native or related to the metaverse, including several play-to-earn dapps, saw their value soar in the last weeks. Despite the latest dip in the cryptocurrencies market, metaverse tokens are still overperforming most of their peers.

SAND, The Sandbox's utility and governance token reached an all-time high of $8.40, increasing its price by 728% from October 15. The price of MANA, Decentraland's native and governance token rose 456% in the same timeframe, while the price of CUBE, Somnium Space's native utility token, surged 727%."

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap. Some of our favorites like YFI, AR, and LUNA had an especially great week.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

The Top Performers This Month from the Top 100: Terra is an L1, Polygon is an L2, Okex is an exchange, Yearn is a DeFi yield aggregator.

🎨 NFT of the Week by Mrs. Bubble

Above is our featured NFT of the Week, The Happy Dragon, from Mrs. Bubble. It is available on OpenSea for a special price of just $2 (0.005 ETH). Read more below in the new NFT Art & Culture section from Mrs. Bubble.

Back when Beeple was getting started minting NFTs in 2019 and 2020 he would sell them for $1 to $2 each to build up his community of fans and supporters. Some of those NFTs ended up being resold for over $100k during 2021.

It is minted on the Polygon blockchain on OpenSea, to keep gas fees minimal.

If you’re curious about NFTs but don’t have thousands of dollars to spend on them, here’s a chance to buy one at a very affordable price and begin building your collection.

There are just 10 copies available, so get yours today for $2.

Coming Soon: NFT Art & Culture Section By Mrs. Bubble

Hi, I am Morgan Allis, an artist, creator and community uplifter and the partner of Coinstack founder Ryan Allis. You can view my art and NFTs on OpenSea. Please consider buying one to support our art fund and Coinstack.

Coming soon we will have an NFT Art & Culture section of Coinstack that I’ll be writing and curating. I’m excited to share more in 2022!

My passion is creating art that supports new ideas, dreams and ways of being on the planet that have either never been done or rarely been done before. Sometimes I describe this world I am creating as magic, because the power of a dream feels like that. Once you commit, and you boldly take your next step you discover only what those who dare to dream and live it do, how much the universe is on your side even when it is challenging.

We as a family have been dreaming of spaces, education, art, community that support the new blueprints, and experiences that allow us all to live in a world of love, joy, connection, and shared prosperity. Some people are more focused on the technology that support this new world (like Ryan) and I am focused on the new vision for this new world. I hope to inspire you with my art, my words, my creativity while also sharing others creativity that truly is visionary holding the keys to this world we are all craving.

This week I am sharing one special NFT for purchase for $2 as a way of getting more owners of my art. One of the dreams of my NFT collections and works of art is shared prosperity inside of our community. That through each sale and second sale, that each person knows they are sharing the prosperity through both the smart contracts and that the profits from the sales on our end goes into an art fund that is dedicated to creating spaces, art, artifacts, education and unique offerings to our community that uplift and inspire us all to give their unique genius.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 13,696 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 5: ETH, DOT, SOL, AVAX, & FTM. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.