Learn More at www.hypelab.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 260k weekly subscribers. This week Crypto.com sued the SEC, Coinbase will delist non-compliant stablecoins under MiCA, Grayscale launched an Aave trust, and big new venture rounds for Infinex ($65M) and SecondLive ($12M).

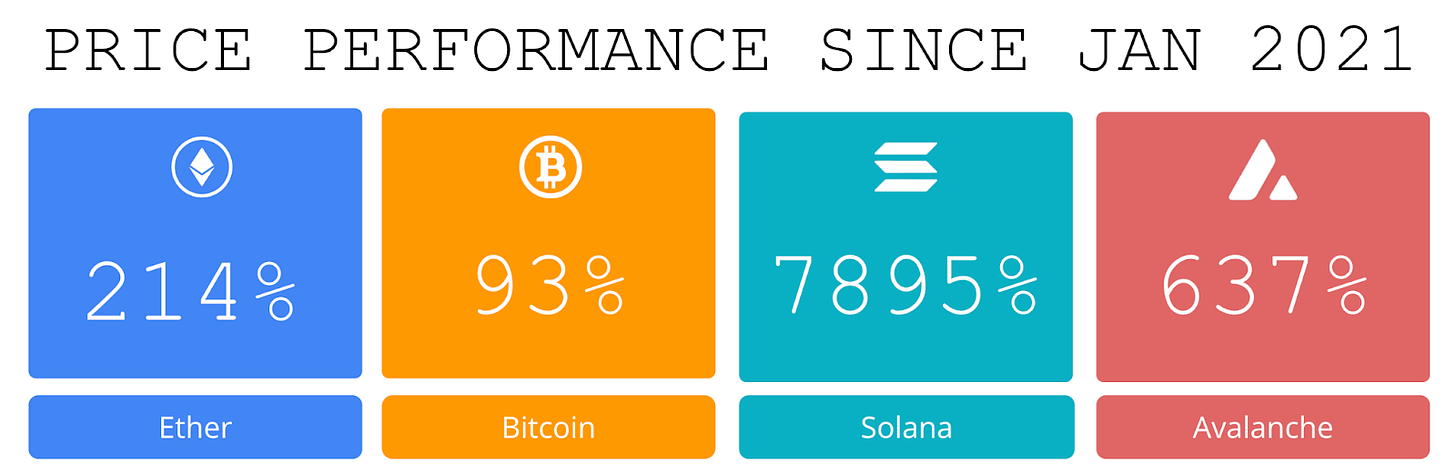

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

HypeLab is the premier web3 advertising network, building ‘Google ads for web3’. With HypeLab, you run ads to real crypto users on high-quality publishers like Chainlist, Coingecko, Quickswap, and hundreds more. Advertisers like Metamask, Uniswap, and Paypal use HypeLab to super-charge their web3 growth.

Become a Coinstack Sponsor

To reach our weekly audience of 260,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ Crypto.com Sues SEC, Chair Gary Gensler After Receiving Wells Notice: The case seeks to prevent the SEC from "unlawfully expanding its jurisdiction" to cover secondary-market sales of certain network tokens sold on the exchange.

👨⚖️ Coinbase Will Delist Non-Compliant Stablecoins in Europe as MiCA Deadline Looms: Crypto exchange Coinbase will delist stablecoins that fail to comply with the European Union's Markets in Crypto-Assets (MiCA) regulation for customers in the European Economic Area (EEA) by December 30.

👻 Grayscale Launches Aave Trust: Grayscale, an asset manager with over $20 billion in assets under management (AUM), has rolled out a new Aave fund for its clients. More than $150,000 has been deposited into the fund as of yesterday.

🚀 Bitwise Is Combining Bitcoin and Ethereum ETFs Into a ‘Momentum’ Fund:Asset manager Bitwise is streamlining three of its futures-based crypto ETFs, set to fold the products into a single offering in December, according to documents filed Friday with the U.S. Securities and Exchange Commission (SEC).

⚖️ Court greenlights FTX’s $16.5 billion bankruptcy plan to repay defrauded customers:Defunct crypto exchange FTX received court approval for its bankruptcy plan and its estate is now clear to repay customers in cash, with interest, using up to $16.5 billion in recovered assets, Reuters reported Oct. 7.

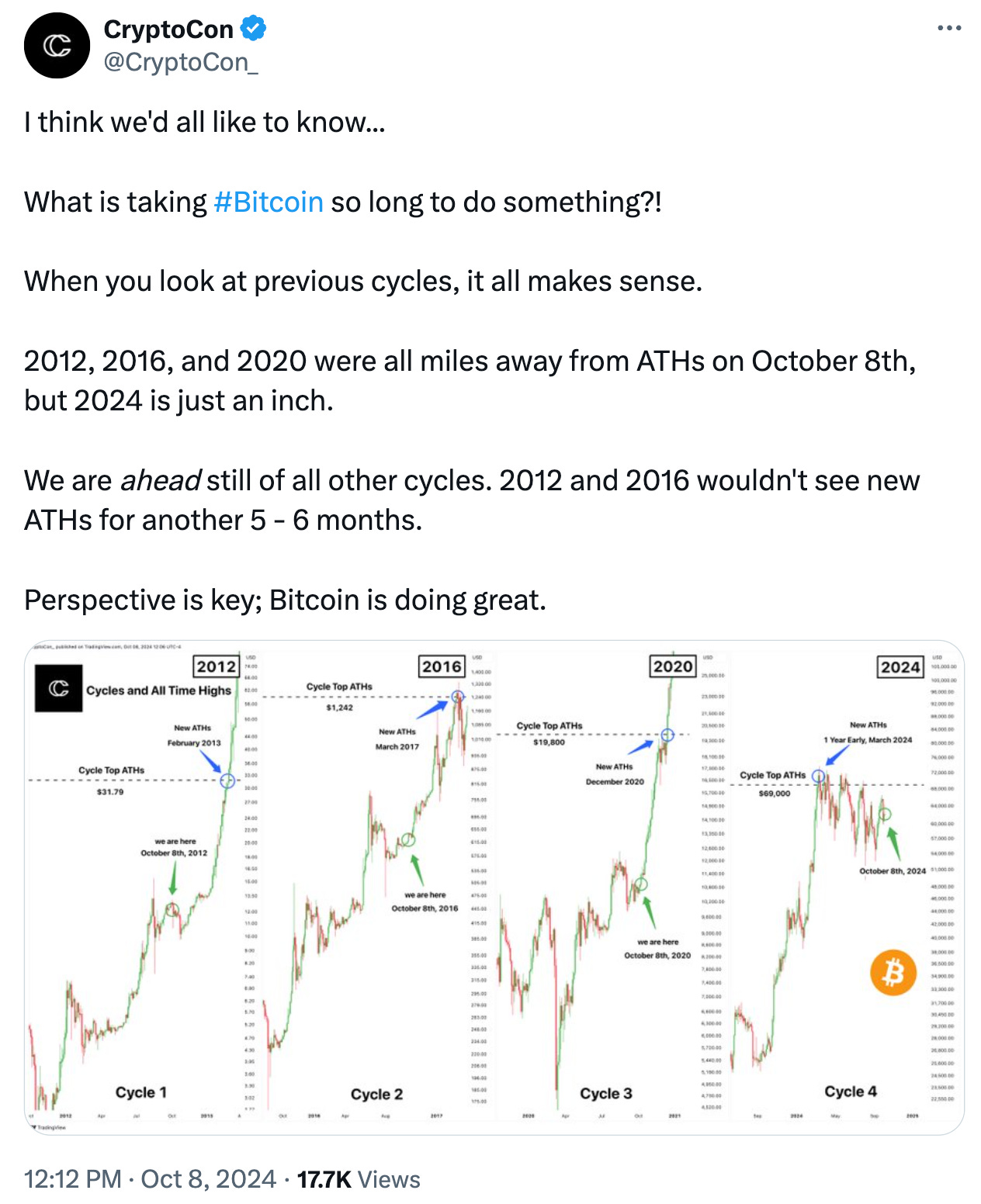

💬 Tweet of the Week

Source: @CryptoCon_

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

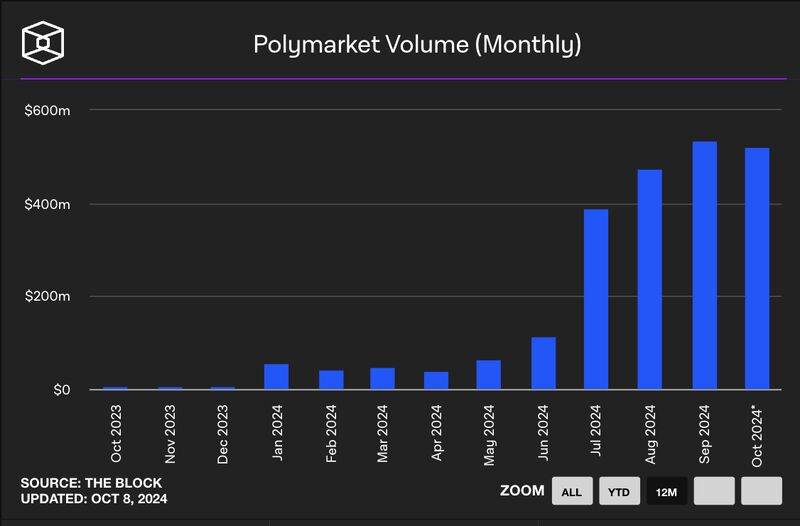

1. Monthly volume on Polymarket market has already surpassed $519M and is quickly closing in on its all-time high of $534M achieved last month. At this pace, Polymarket will handle nearly $2.1B of volume in October.

Source: @DavidShuttleworth

2. An interesting angle around spot Bitcoin ETF activity is its impact on exchange liquidity. Since launching in January, the total balance of BTC on exchanges has decreased by 16% as nearly 400,000 BTC ($24.8B) was withdrawn from exchanges. Meanwhile, BlackRock (361K BTC), Grayscale Investments (220K BTC), and Fidelity Investments (208K BTC) now collectively hold more than 790,000 BTC in custody.

Source: @DavidShuttleworth

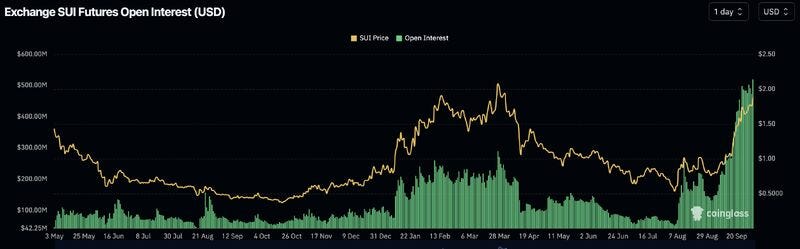

3. Despite prevailing market conditions, open interest on SUI futures has surged to record levels of $519M and has increased 293% over the last 30 days. Meanwhile, the demand for SUI continues to gain momentum, as daily trading volumes are at all-time highs and now stand at $1.5B (up 650% from last month).

Source: @DavidShuttleworth

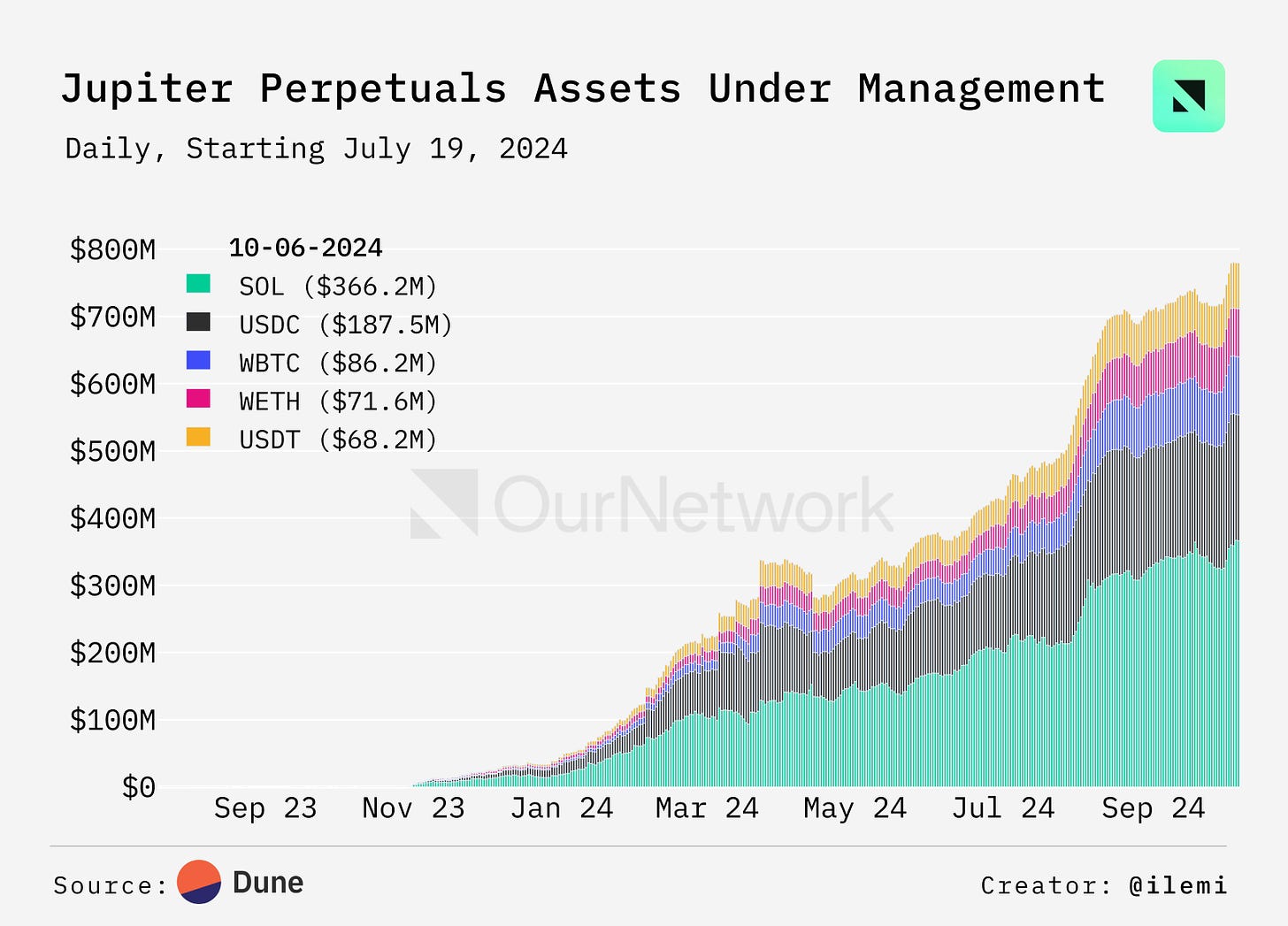

4. Jupiter Perps Facilitate $100B of Volume on Solana

Source: @OurNetwork

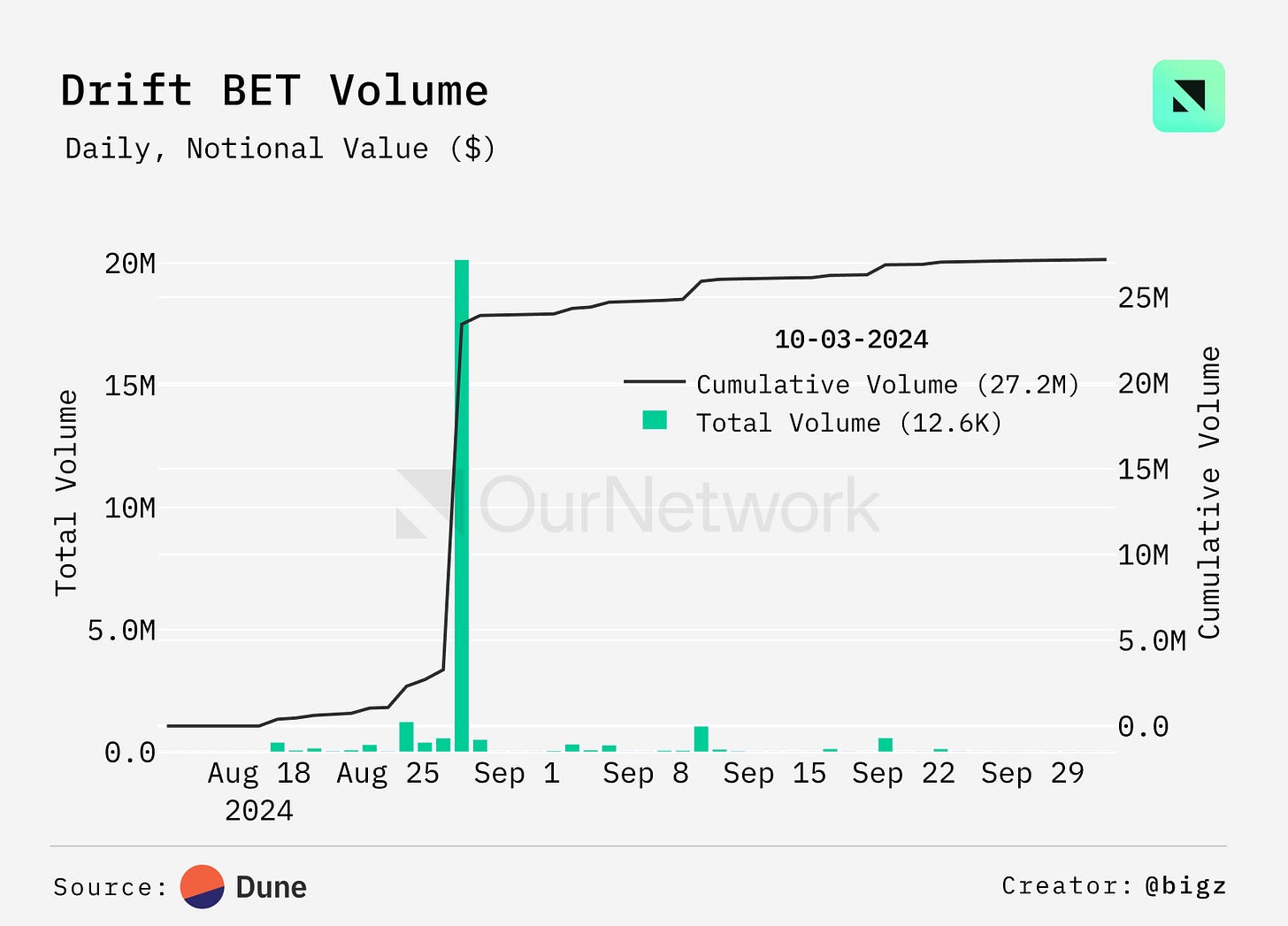

5. Drift Generates Over $900M in Trading Volume Over the Last Week

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Introduction

The prerequisite for any healthy market is regulation. Financial regulation allows for seamless capital exchange, antitrust laws control rent seeking, and IP laws encourage innovation. On blockchains, since everything is code, those who build the code build the laws.

This power is especially prevalent when looking at the very bottom of the blockchain stack: blockbuilders. The stakeholders that compete to build blocks make or break the blockchain itself; if block production stalls or incentives encourage predatory behavior, the integrity of the chain crumbles and users disappear. For example, when Solana faced an outage, users were unable to perform any transactions, meaning they could not deposit or withdraw tokens.

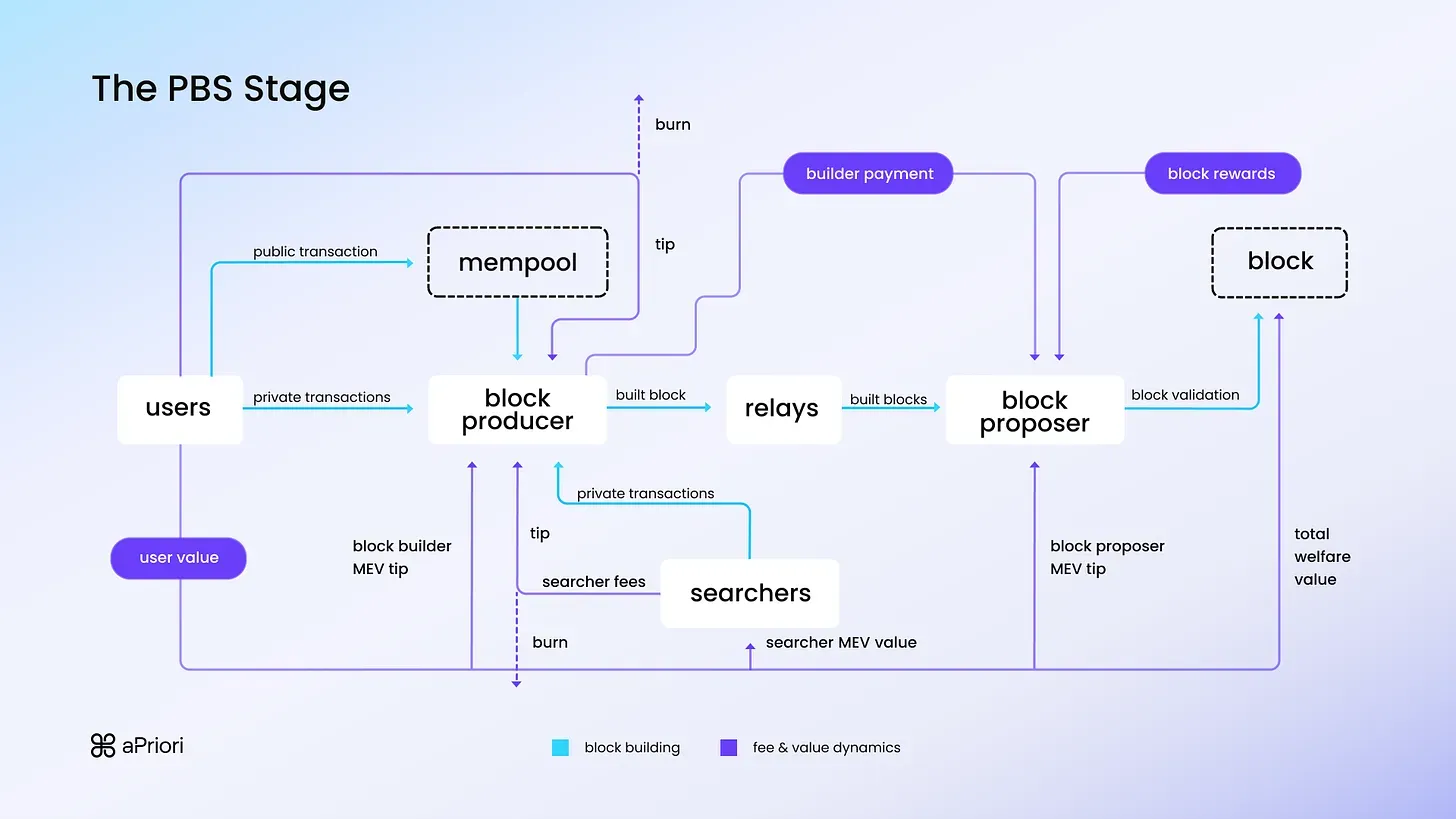

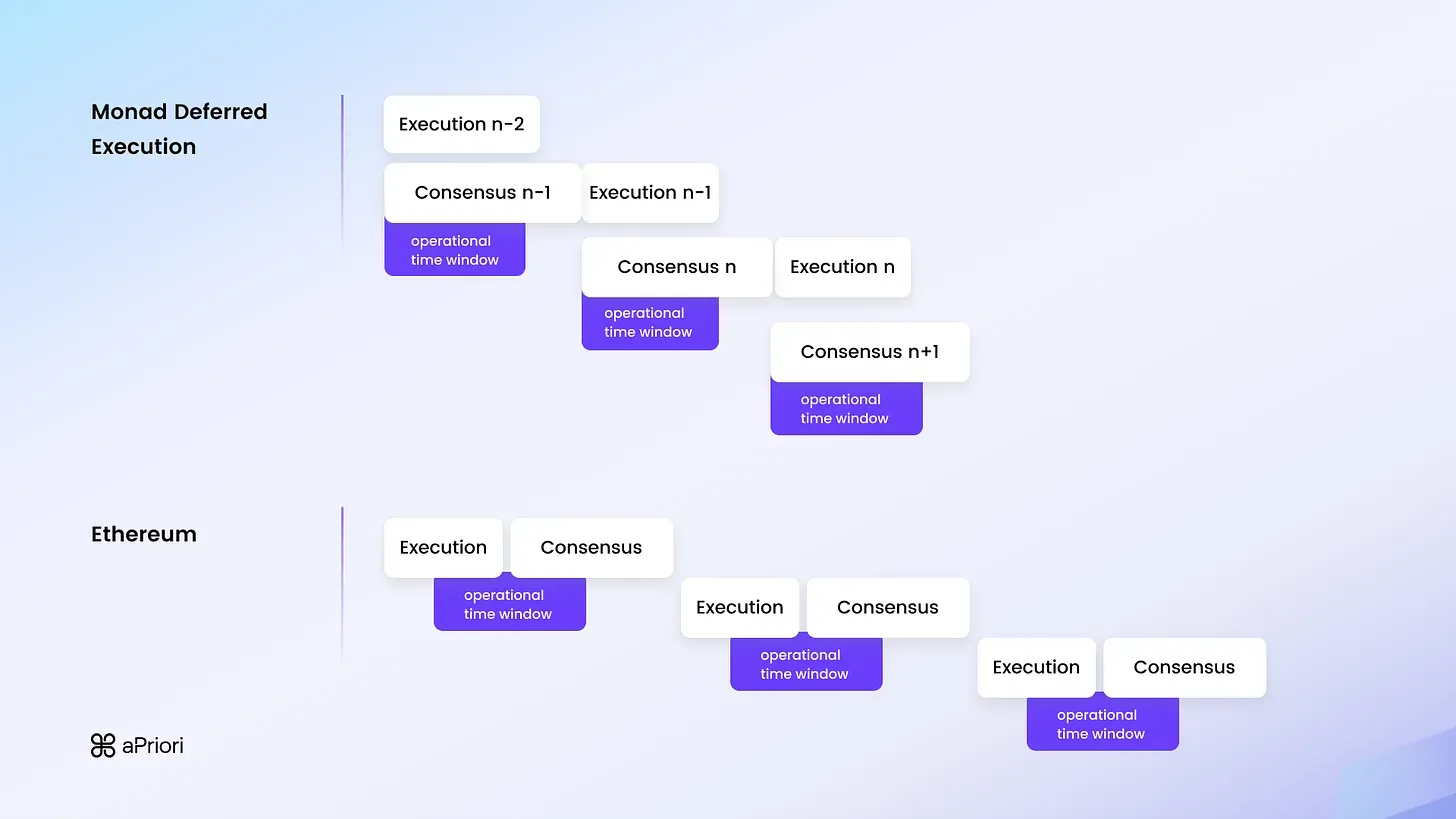

Blockbuilders are those that physically take transactions out of a mempool and build transaction blocks that they then propagate to other blocks to reach consensus for the state of the blockchain. The design of how the stakeholders in the block building process interact with each other depends on companies that build these systems. On Ethereum, Flashbots (a Pantera portfolio company) is the go-to. On Solana, Jito is king. And when Monad launches, aPriori will dominate.

MEVA

The umbrella term that is used to describe the problems these companies seek to solve is “MEV” or “maximal extractable value”. In a nutshell, the individuals that order these blocks into transactions are incentivized to order them to maximize the fees they generate, which means they might reorder transactions maliciously to maximize their own profits and increase costs for users.

The design goals that Miner Extractable Value Auction Infrastructure (MEVA) aim to solve are gas fee stability, competition, and concentration. Most of this boils down to incentives; if the stakeholders are financially compensated for adding positive externalities (or removing negative externalities) to block building, then they will do so. However, there is no perfect harmony.

On Ethereum, where block times are around 12 seconds, all stakeholders have the time to access all transactions and simulate all of them in order to maximize their profits. With this in mind, the current gold standard approach on Ethereum is Proposer-Builder Separation (PBS). This setup separates the process into 5 stakeholders: users, block producers, relays, block proposers, and searchers. By separating the block welfare value with multiple stakeholders, they are all incentivized to share information with each other, which allows for competitive block building, while ensuring blocks stay profitable (which minimizes failed transactions). This has its own issues though; block producers have become centralized with the top two builders capturing more than half of the value from block building. Apps have also realized that they can capture their own MEV through mechanisms like MEV taxes, allowing them to participate in the transaction ordering process and reclaim value that would otherwise go to block proposers.

Monad

Monad is an upcoming new chain that will be the most performant EVM-Compatible layer 1 blockchain ever, with 10,000 transactions per second, 1-second block times, single-slot finality, and low-hardware requirements. One of the innovations that makes this possible is separating the execution and consensus layer, which allows the current block to run its consensus while the previous block is executed. Monad Labs raised $225 million and are poised to be the next big L1, having already amassed more than 300k followers on Twitter.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.hypelab.com