Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This week, crypto fans want a Bitcoin reserve, Crypto.com, Gemini joined Coinbase in opposing the CFTC proposal, Celsius targeted Tether, Badger DAO, Compound in lawsuits and big new venture rounds for Metaplanet ($68M) and Moonveil ($9M).

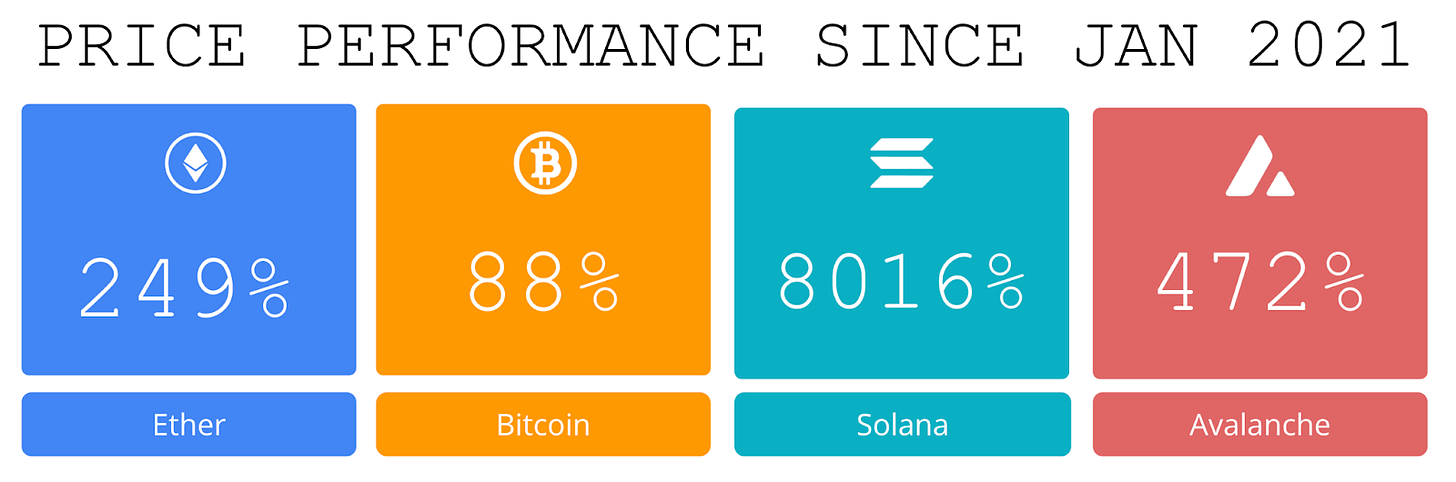

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Amphibian Capital, managing $75M+ AUM, is a fund of the world's leading hedge funds. +11.99% net YTD with their USD fund, +10.53% net YTD in their ETH fund (64.4% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️Crypto Fans Want a Bitcoin Reserve. Politicians Want Their Votes: Crypto fans have an idea to burnish the stature of digital tokens: Establish a U.S. bitcoin reserve, similar to the country’s gold reserve.

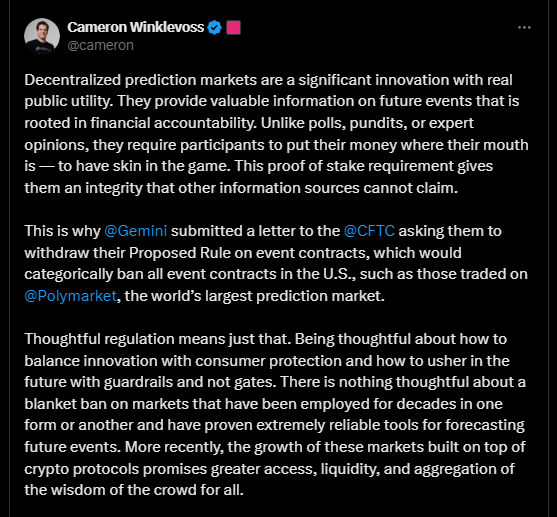

⚖️Crypto.com, Gemini join Coinbase in opposing CFTC proposal that could ban prediction markets: A number of industry leaders across crypto and fintech, from Gemini and Crypto.com to Robinhood and influential blogger Scott Alexander, have declared their opposition to a proposed rule change that could see political prediction markets banned in the United States.

⚖️Celsius targets Tether, Badger DAO, Compound, and Netanyahu's niece and nephew in lawsuits: While the suit against Tether is the latest in a litany of lawsuits intended to recover withdrawals and preferential payments made by Celsius in the crucial 90-day period before its bankruptcy, Celsius's lawsuits against the other DAOs are more general complaints of mismanagement leading to losses. Tether has vigorously denied wrongdoing, calling the suit "Shake Down litigation" in a blog post. .

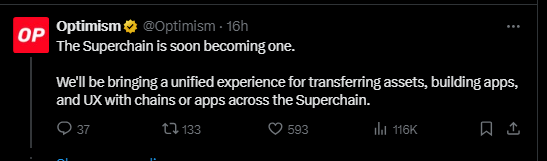

🚀Optimism is developing a native interoperability system for Layer 2 chains:Layer 2 chains within the Optimism ecosystem — also called the Superchain — currently rely on the Layer 1 Ethereum mainnet for secure communication and asset transfer, which results in fragmented assets and users. The developers plan to introduce native interoperability in the Superchain, which aims to enable asset and user portability across chains and make them accessible anywhere through integrated applications.

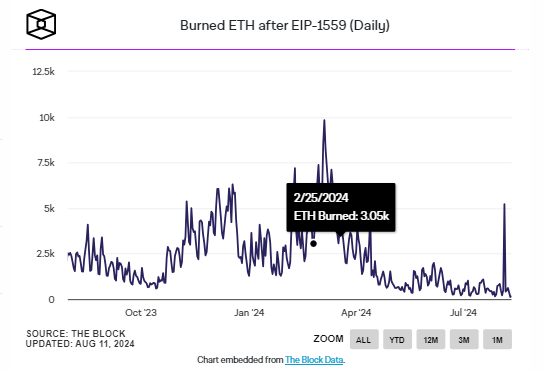

📉ETH burn rate drops to lowest levels as gas fees hover at 2 gwei: The daily amount of ETH burned on the Ethereum network has fallen to its lowest level this year, with base fees currently hovering between 1 and 2 gwei at the time of writing.

💬 Tweet of the Week

Source: @intangiblecoins

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

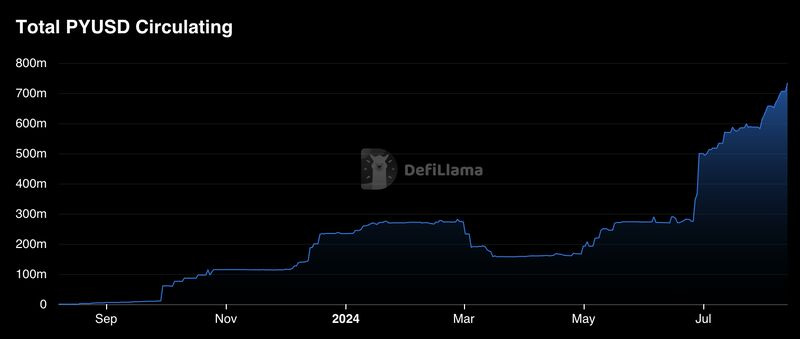

1. Total circulating supply of PayPal's PYUSD has increased by 49% since July and now stands at $734M, its highest level ever. This is the largest growth rate for any major stablecoin month-over-month including Tether (2.8%), USDC (1.2%), DAI (-3.2%), and FDUSD (1.5%).

This activity has been driven by PYUSD's recent integration on Solana which now has $378M of PYUSD in circulation, surpassing Ethereum ($356M) in just one month.

Source: @DavidShuttleworth

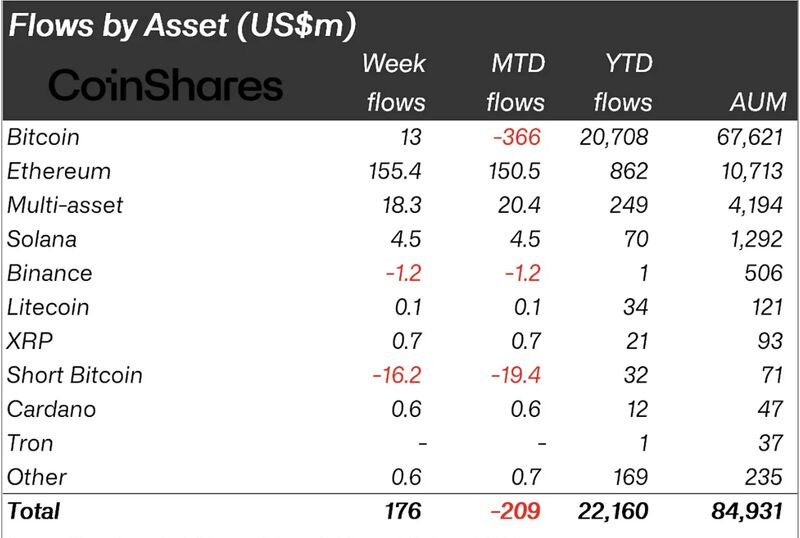

2. Another interesting takeaway from the recent market headwinds is that institutional inflows into ETH investment products outpaced their BTC counterparts significantly. Despite considerable downward pressure on prices throughout the market, digital asset net inflows reached $176M last week, with $155M allocated into ETH compared with just $13M into BTC.

Total ETH inflows on the year now stand at $862M, their highest level since 2021.

Source: @DavidShuttleworth

3. Recently, Lido Finance generated the most daily fees and daily revenue in the history of the protocol. Overall, $7.15M in fees and $715,000 in revenue were collected in just one day.

This is particularly interesting because Lido collects fees through a 10% commission on the staking rewards earned by all of the ETH staked on the protocol, yet the total ETH staked on Lido was largely unchanged during this time.

Source: @DavidShuttleworth

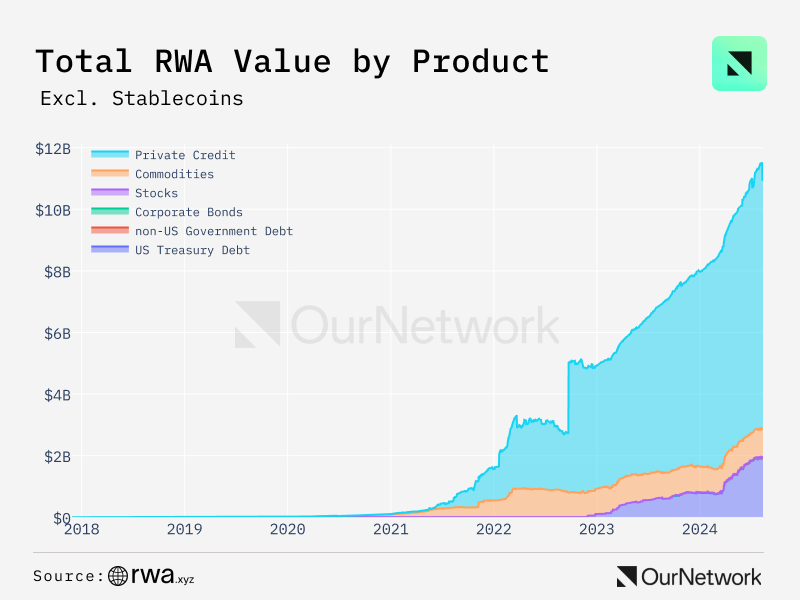

4. There are now $10.9B+ of RWAs on Public Blockchains

Source: @OurNetwork

5. Tokenized U.S. Treasury debt continues to accelerate following the $BUIDL launch in March. The asset class jumped $1.1 billion in the past five months.

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

The Dog Days Are Over 🐶 Volume Arrives for Altcoins at Important Levels 🚨 Key Indicators Reveal Alt Season is Imminent ⏳

About the Author: Cole DeRousse serves as a Research Assistant at 1995 Digital Asset Research, where he blends technical research with social investing strategies. His primary focus is on fostering the growth of the Web3 community and ecosystem, aiming to awaken people to the transformative power of Web3 apps and technologies. This is an excerpt from the full article, which you can find here.

Introduction

1The Dog Days Are Over - August 15th, 2024 is setting up to be one of the most significant dates of the year. THIS IS IT!! THIS IS THE MOMENT WE HAVE ALL BEEN WAITING FOR 🚨 In this report we will outline why.

It’s decision time, if the time confluence from past alt season lines up then we should have confirmation this week. ⏳

All eyes are on the Russel 2000, The Saftey Trade (btc.d+eth.d+usdt.d+usdc.d), Bitcoin.d itself, and last but not least the DXY. This is major confluence and the exact recipe we need for alt season to happen. 🍻.

First, we want to remind you of this comparison chart in the previous report highlighting the safety trade (btc.d) from 2018 overlayed on the current safety trade in 2024 (btc.d+eth.d+usdt.d+usdc.d). From a timing perspective, we are even farther along now, if history repeats this pattern should provide the confirmation we need this week to know if we will get an alt-season run-up before the first-rate cuts and the election.

But First What Are the Dog Days?

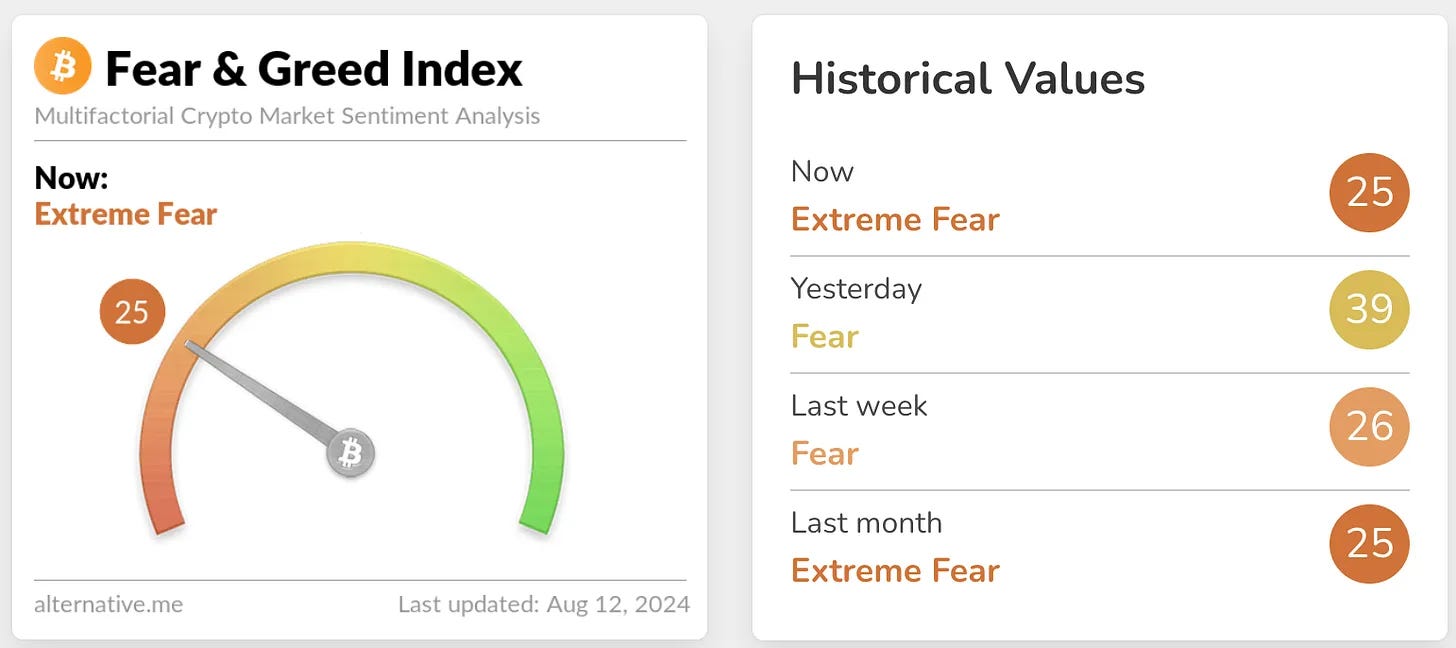

As the summer winds down, the crypto markets are often characterized by what’s known as the "Dog Days of Summer"—a period marked by low trading volumes, sluggish price action, and a general lack of excitement. This quiet phase, which usually spans the mid-summer months, often leads to complacency among investors. However, as history has shown, the transition from summer to fall and winter can bring a dramatic shift in market dynamics. Right now Bitcoin is consolidating at 60k while sentiment is in ‘extreme fear’. In all previous alt seasons, extreme fear always tends to precede parabolic rises and catch the bulk of market participants offside. In reality, the market is just washing out overleveraged players and resetting funding rates which also tends to mark bottoms and sometimes even bullish reversals. this is as good of a setup as any for a bullish reversal given sentiment and funding rates.

In previous years, we've seen the crypto markets come alive after the summer doldrums, with significant rallies and the onset of alt seasons that have caught many off guard. This year is no different and even arguably more bullish with the rate cuts and the election on the horizon. As we approach mid-August 2024, all signs are pointing to a similar pivotal moment where the markets could quickly reverse from the summer chopsolidation to give investors an exciting and explosive end to the year.

If you have seen the recent note posted, you are aware that we have selected August 15th as a significant date to circle on your calendar which could mark the start of alt season. BUT, for us to officially confirm we are entering said alt season we need to review these 4 charts below so you can also understand the path to get there and also a few secret bonus hints the market has given us that might have already shown its hand. Let’s jump in below 👇

Key Market Indicators to Watch

1. Russel 2000:

The Russel 2000 index, often seen as a barometer for risk appetite in the broader market, is approaching a critical juncture. A breakout here could signal a shift in investor sentiment, paving the way for a new wave of capital into riskier assets like altcoins. Notice the 2 large green volume bars after the scare last week on Monday. To us, this shows the rotation from Magnificent 7 stocks to low caps is underway and investors are going ‘risk on’. Risk on is also a key indicator that alt season is here so if we officially go risk on we can expect altcoins to follow suit with Russel 2000 and breakingout together. You can see in this chart that Aug 15th could be the breakout date, lets look for a big green volume candle on this date to confirm this.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com