Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 280k weekly subscribers. This week, Montenegro extradited Do Kwon, judge pushed CFTC trial with Gemini to Jan, monthly volume on decentralized exchanges surged to record high and big new venture rounds came in for Trrue ($10M) and Nodepay ($7M).

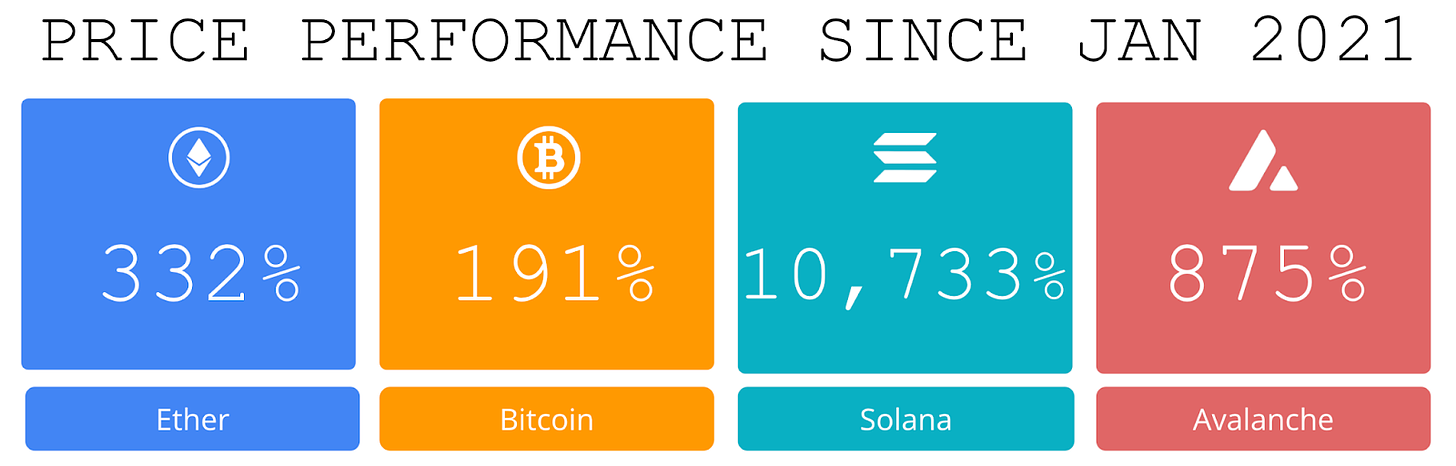

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Amphibian Capital, managing $110M+ AUM, is a fund of the world's leading hedge funds. +11.99% net YTD with their USD fund, +10.53% net YTD in their ETH fund (64.4% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com

Become a Coinstack Sponsor

To reach our weekly audience of 280,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

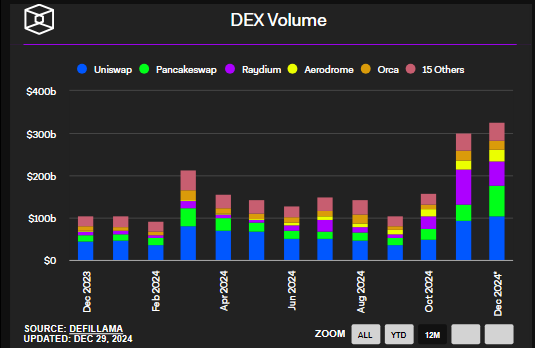

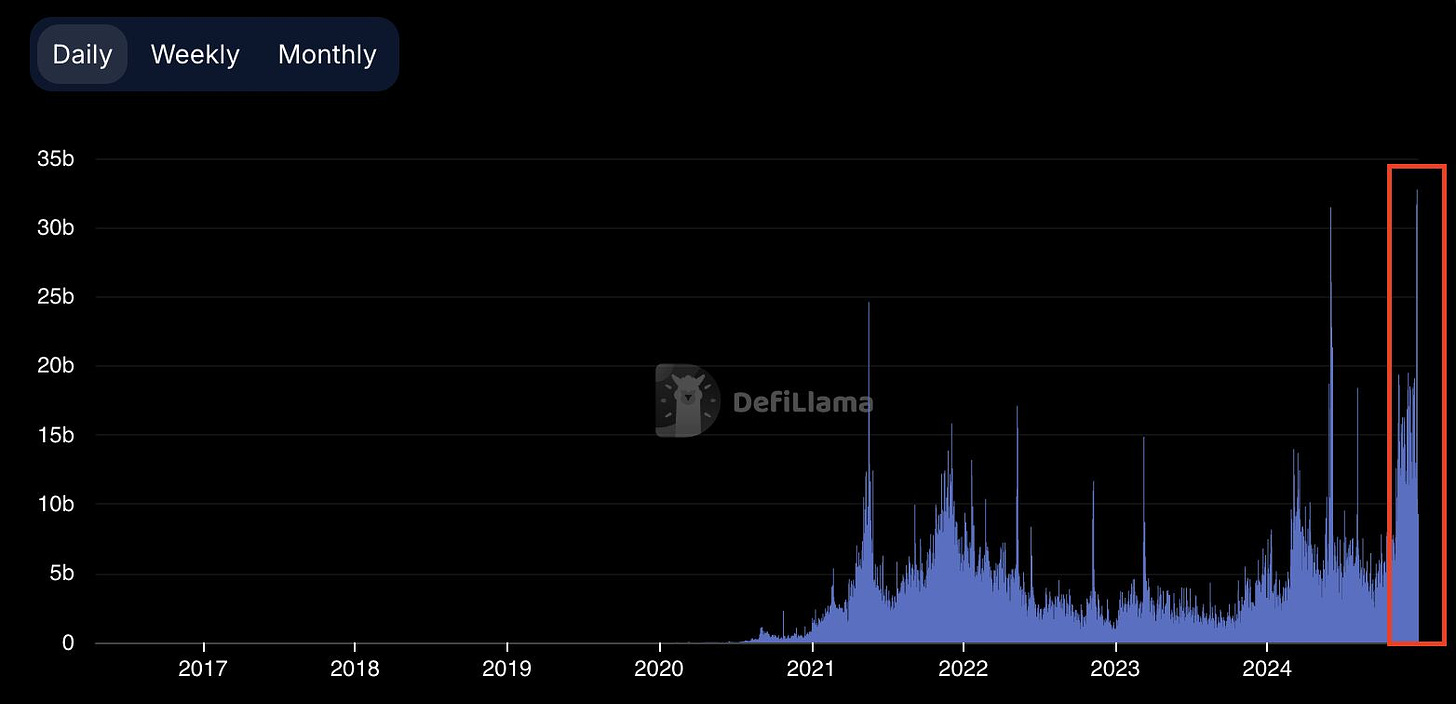

🚀 Monthly volume on decentralized exchanges surges to record high in December, surpassing $320 billion: December’s total DEX volume reached $320.5 billion, surpassing the previous record of $299.6 billion set in November.

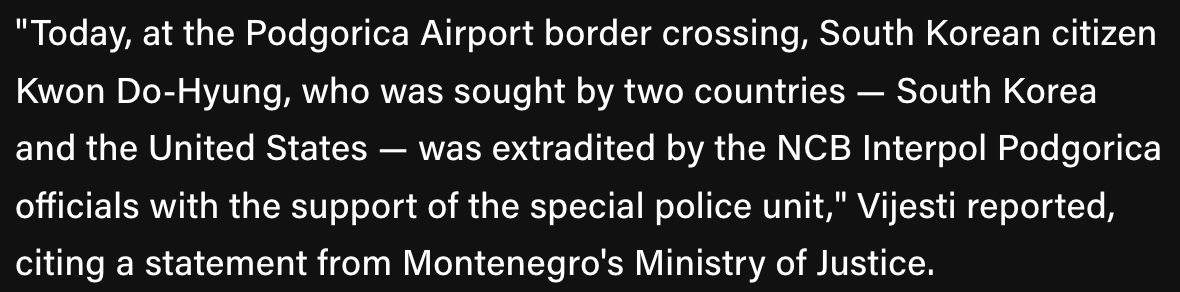

✈️ Montenegro extradites Terraform Labs co-founder Do Kwon to the US with help from Interpol: Montenegro extradited Terraform Labs co-founder Do Kwon to the U.S. on Tuesday, with the assistance of Interpol and the nation’s Special Police Unit, according to local publication Vijesti.

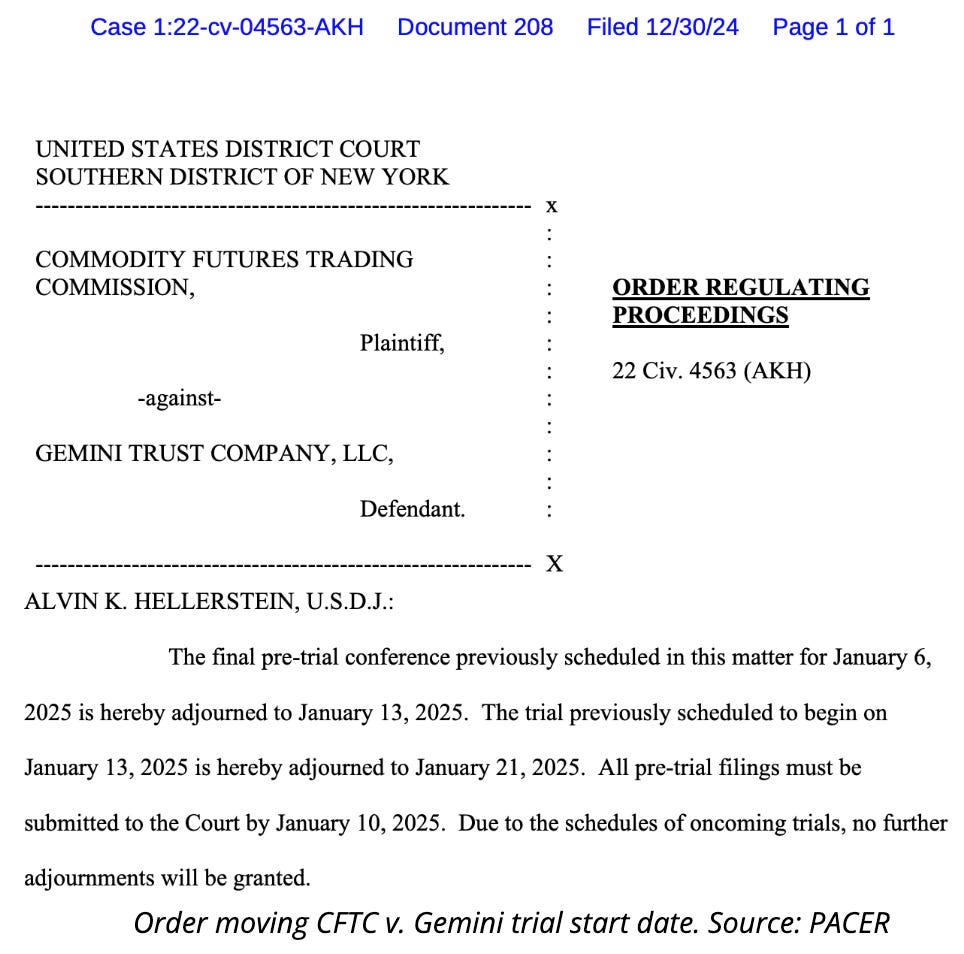

⚖️ Judge pushes CFTC trial with Gemini to Jan. 21: The civil case between the US financial regulator and Gemini Trust Company was initially scheduled to go to trial before Donald Trump’s inauguration.

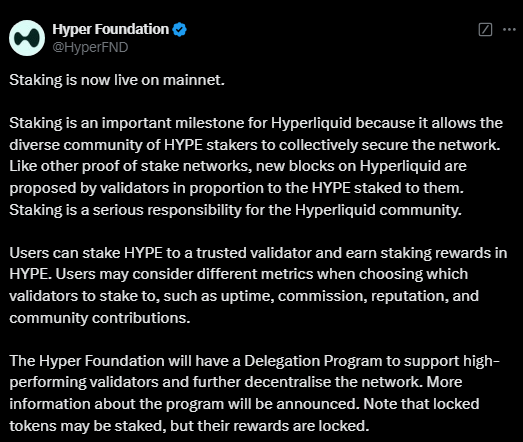

📈 HYPE token staking goes live on the HyperLiquid mainnet: Staking of HyperLiquid's native token has officially launched on the decentralized exchange's mainnet, according to a statement from the Hyper Foundation.

⚖️ Hong Kong lawmaker advocates including Bitcoin in national reserves:Hong Kong lawmaker Wu Jie has urged the city-state’s government to consider integrating Bitcoin into its fiscal reserves, a local media outlet reported.The report showed that Wu proposed that the Hong Kong Special Administrative Region (SAR) explore the inclusion of cryptocurrencies in its fiscal reserves and leverage foreign exchange funds to acquire and hold digital assets over the long term.

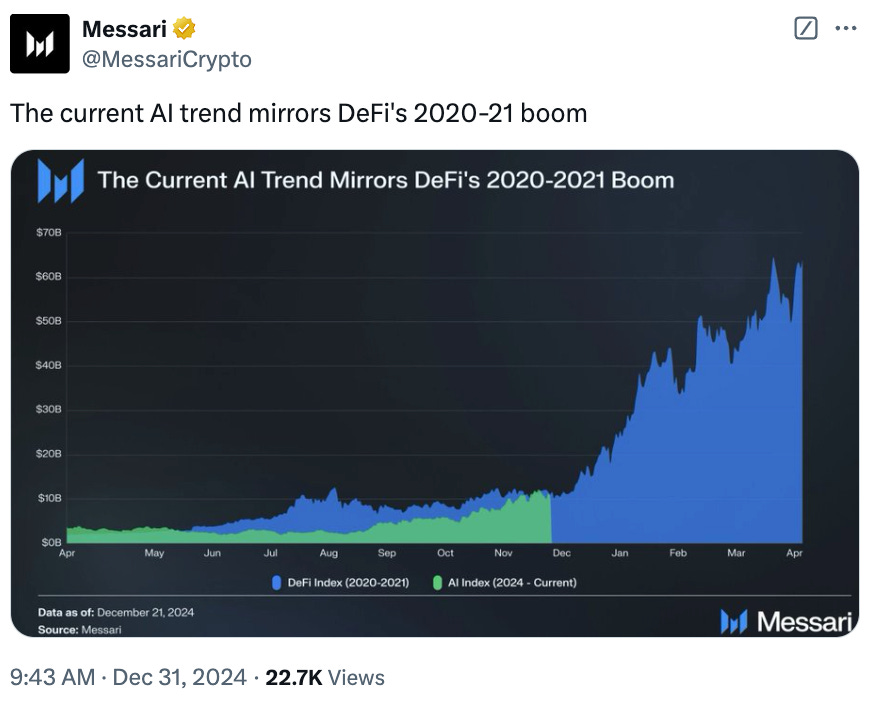

💬 Tweet of the Week

Source: @MessariCrypto

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. User trading activity continues to shift towards decentralized applications as DEX volumes surge to close out the year. On Christmas day, DEXs handled over $32.75B in volume, the most daily volume ever. Weekly volumes have also achieved record highs of $118B.

This month alone, Uniswap has managed $103B in total volume, followed by PancakeSwap ($72B) and Raydium ($55B).

Source: @DavidShuttleworth

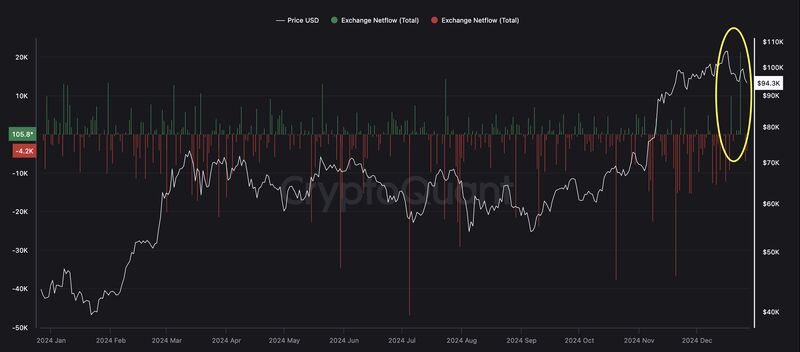

2. Interestingly, exchanges recently experienced their largest daily net inflows of BTC since November 2023.

Overall users sent over 21,400 BTC ($2.04B) to exchanges in one day, and the price of BTC has slid by 5% since.

Source: @DavidShuttleworth

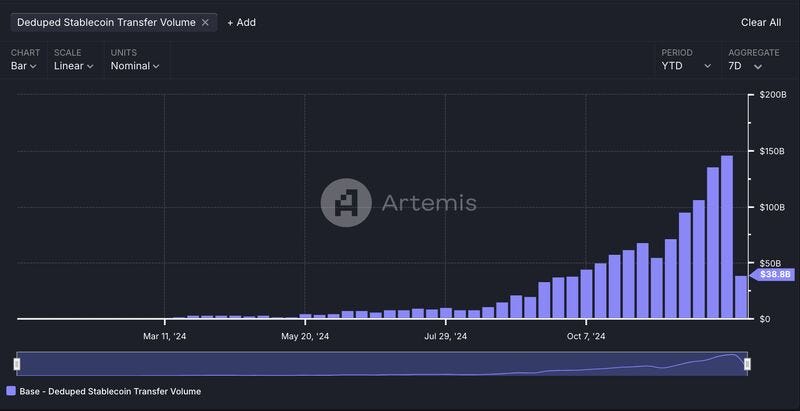

3. As we close out the year, it's pretty incredible how much economic activity Base has handled, even from just a purely "unbanked" perspective.

Overall, the network settled a staggering $1.2T of total stablecoin transfers onchain this year. This is about 1/10th of Visa's $13T of total payments volume in 2024. Weekly volume has steadily grown throughout the year, increasing by 166% since the beginning of November and, now stands at $146B. All of this accomplished despite the current challenges and complexities of crypto UX.

Source: @DavidShuttleworth

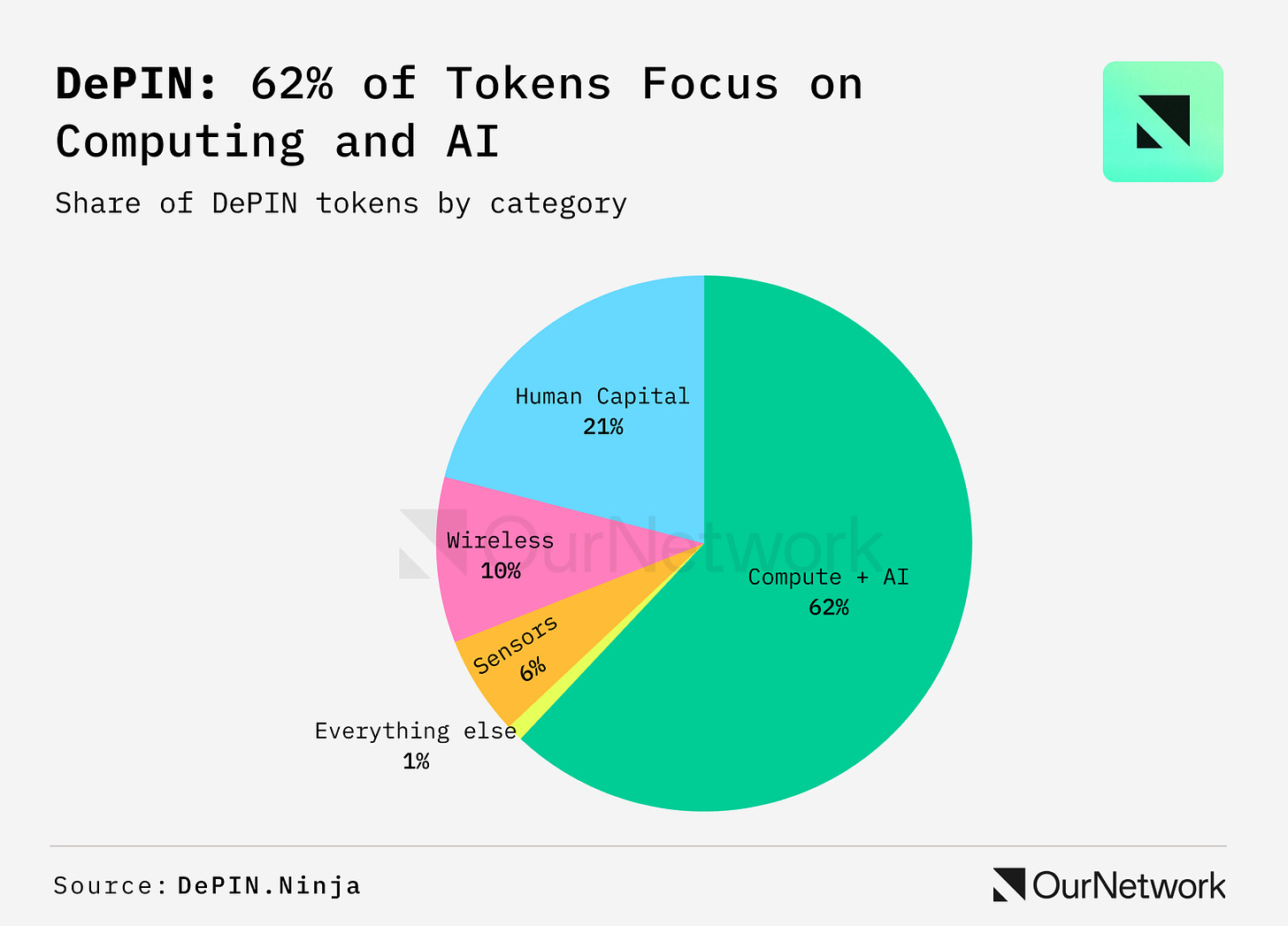

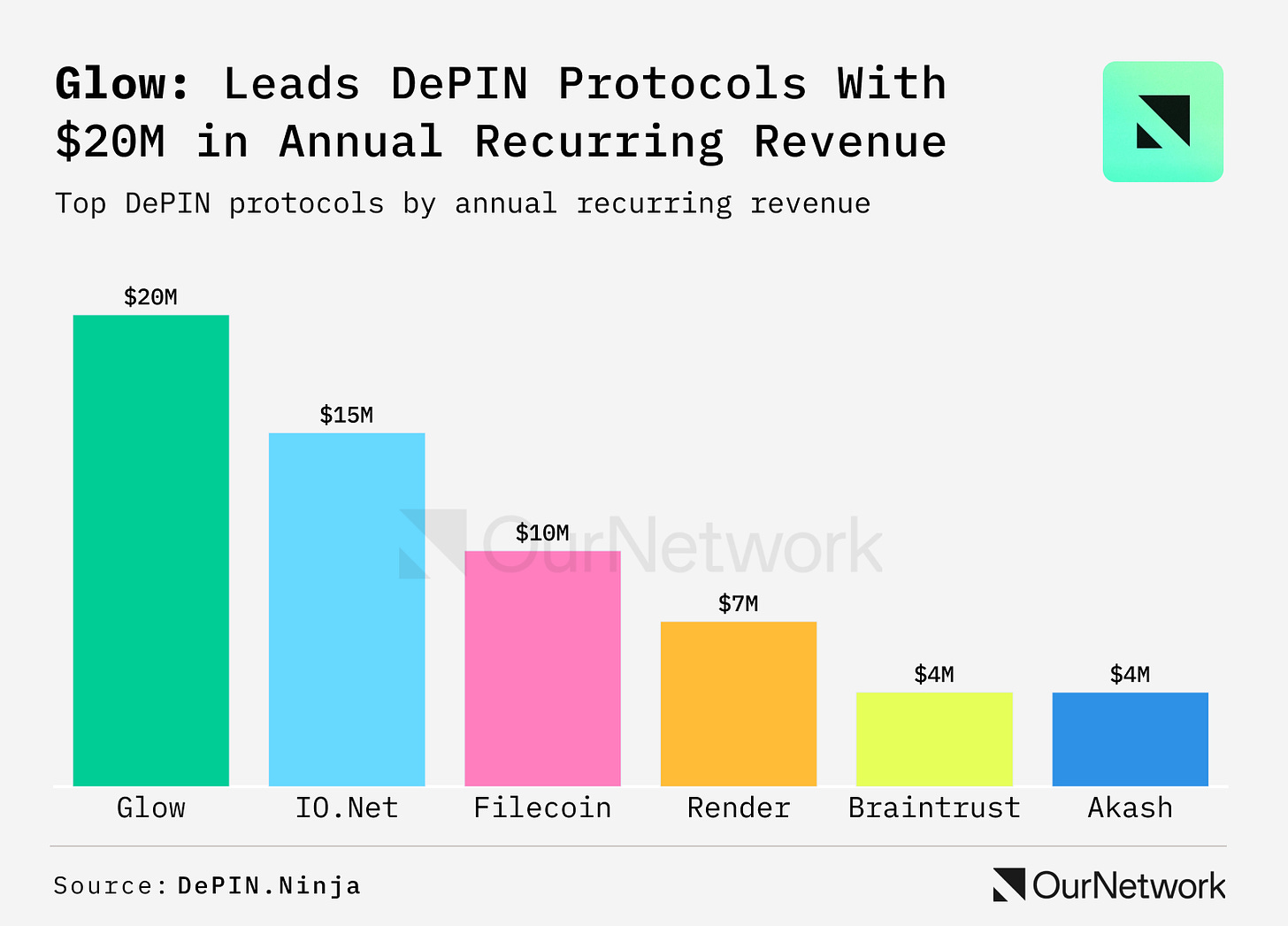

4. DePIN Continues It's Strong Momentum

Source: @OurNetwork

5. sUSDe Total Value Locked Surpasses $4B

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

I wanted to publish here the full version, including an overview of this year, a review of my 2024 predictions, and my predictions for 2025.

Every year, bulls and bears use short-term case studies to forecast crypto armageddon or exponential growth. And every year, neither group is right.

Some notable events this year: Ethereum’s Dencun Upgrade, the U.S. election, crypto ETFs, Wyoming's DUNA, the wBTC controversy, Robinhood’s Well’s notice, Hyperliquid’s near $2 billion airdrop, Bitcoin hitting $100,000, and SEC Chair Gary Gensler’s January resignation announcement.

2024 was a year with no major market shocks. And, though it didn’t bring in an explosion of new capital, it proved that a grow number of companies in the crypto ecosystem are sustainable. Bitcoin is worth $1.9 trillion and all other cryptos are worth $1.6 trillion. The market cap of all crypto has doubled since the start of 2024.

The diversification of crypto has strengthened its ability to react to shocks. Payments, DeFi, gaming, ZK, infrastructure, consumer, and more, are all growing sub-sections. Each of these now have their own funding ecosystems, their own markets, their own incentives, and their own bottlenecks.

This year, at Pantera, we’ve invested in companies that target these ecosystem-specific problems. Crypto gaming companies face issues adopting Web3 data analysis tools, so we invested in Helika, a gaming analysis platform. Web3 AI products often face adoption challenges because of the fragmentation of the AI stack, so Sahara AI aims to create an all-in-one platform to allow permissionless contribution while keeping a seamless Web2-like user experience.

Intent infrastructure is messy and orderflow is fragmented, so Everclear standardizes the process by connecting all stakeholders. zkVM’s are complicated to integrate, so Nexus uses modularity in order to cater to customers who want only parts of their hyper-scalable layer. Building consumer apps faces the issue of attracting users, so we made our largest ever investment in TON, the blockchain that directly plugs into Telegram’s 950 million monthly active users.

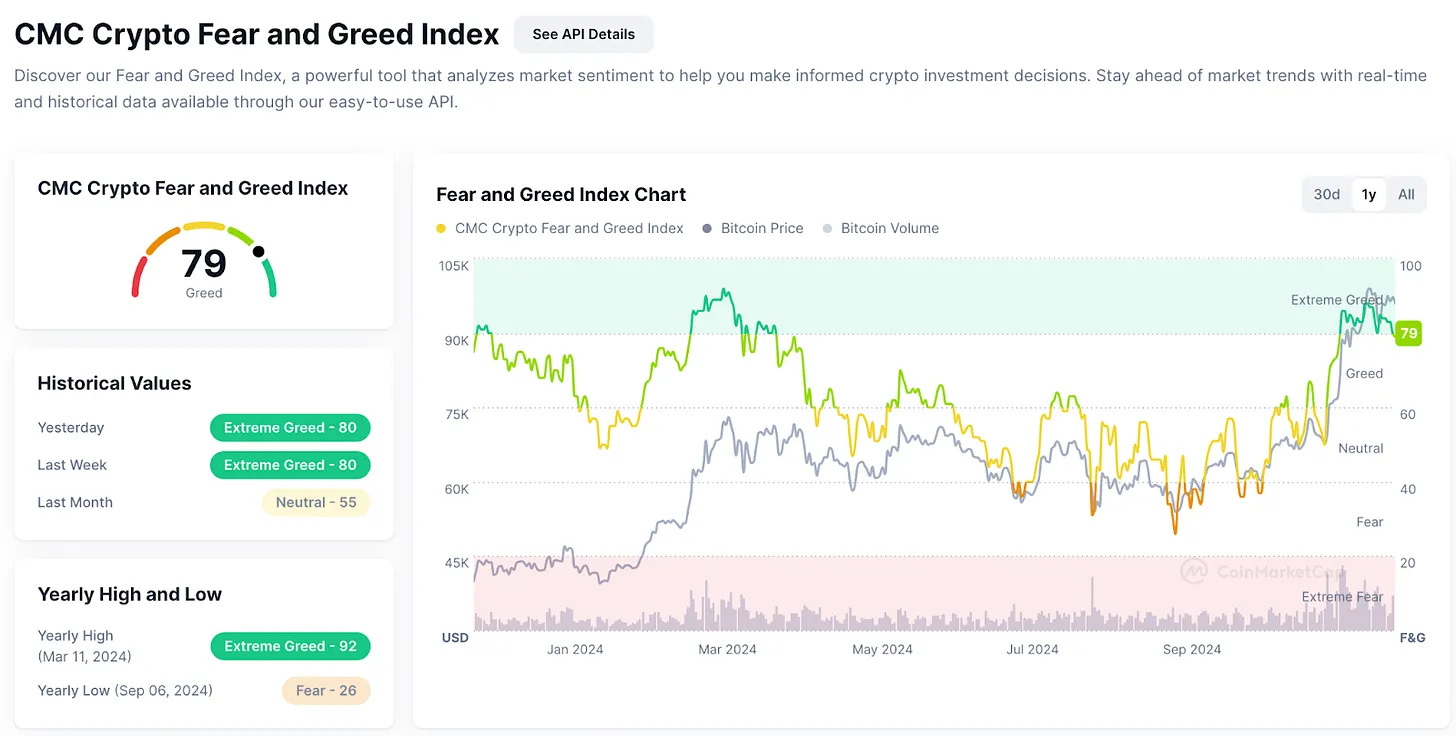

We enter 2025 on tailwinds of possible regulatory clarity, continued mainstream interest, and rising crypto prices. Even after a bit of a summer slump this year, crypto users are entering the new year with strong optimism (or “greed”).

CoinMarketCap’s Fear and Greed Index

Before we dive into 2025 predictions, let’s take a look back at how I did predicting 2024.

Review of 2024 Predictions:

The resurgence of Bitcoin and “DeFi Summer 2.0”

Accuracy: 4/5

In 2023, Bitcoin went from a low of 16k in January to a high of 40k in December.

Bitcoin is now >90k. Bitcoin dominance peaked at over 60% this year.

There was a Bitcoin DeFi Summer, but defining success comes down to metrics. Less than 1% of Bitcoin is wrapped and used in DeFi, with menial growth from last year. Bitcoin ecosystems like Mezo, Stacks, and Merlin have built communities, but struggle with continued user growth. Last year I predicted that Ordinals, inscriptions, and staking might push up to 1% of Bitcoin users to try DeFi. This arguably did not happen.

However, Babylon, which simply makes users lock their Bitcoin without having to wrap them, launched this year and single handedly attracted ~$2b worth of Bitcoin. Prices also doubled this year, helping to pump TVL to an impressive $3.549b. This is 10x the $300M TVL it was last year, but remains far from the 1% or ~200k Bitcoins (with a current value of $19b) I predicted.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com