Learn More at www.ceek.com and https://kinto.xyz

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 330k weekly subscribers. This week, Do Kwon plead guilty, the SEC clarified liquid staking tokens are receipts, not securities, Spot Ethereum ETFs top $1B in daily net inflows for the first time, and big new rounds from Satsuma Technology ($217.6M) and Zoth ($15M).

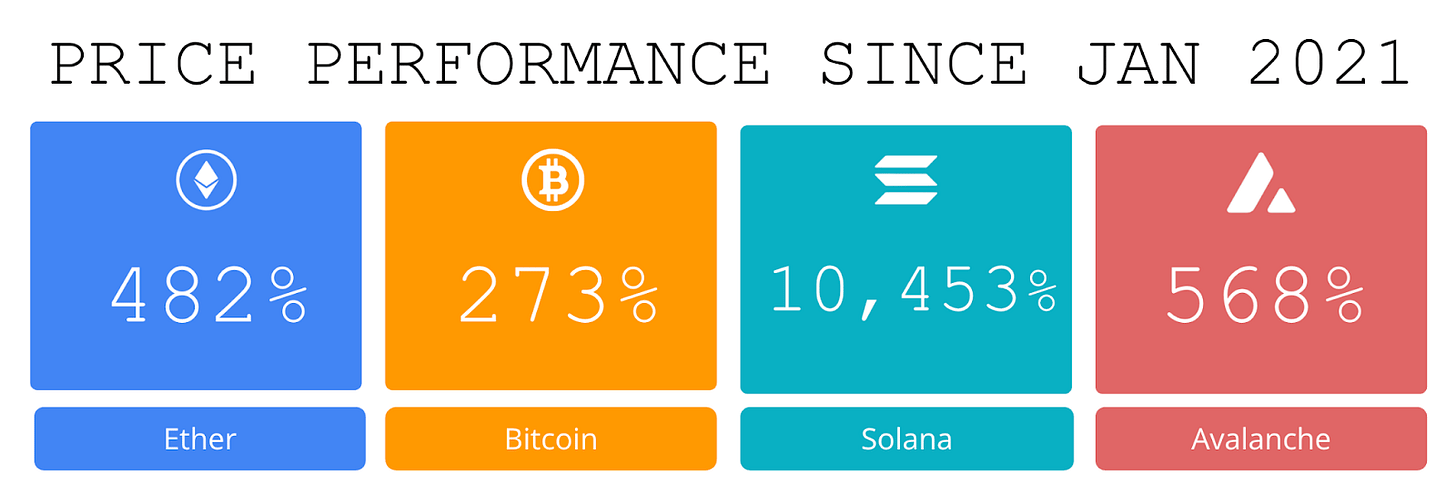

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Tap into the $8.5T Generative AI Economy with CEEK, the AI-powered platform securing content as digital assets on the Blockchain. Trusted by Meta, Universal Music, and Microsoft, CEEK enables users with Agentic AI tools to create, monetize and scale content and expertise. CEEK is the Web3 Monetization OS for the new economy. 👉Learn more at www.ceek.com

Kinto operates an Ethereum layer-2 network with built-in compliance mechanisms, including Know-Your-Customer (KYC) and Anti-Money Laundering (AML) protocols, facilitating financial institutions that face strict regulatory requirements to participate in decentralized finance. Kinto offers these services without sacrificing decentralization, and features a non-custodial smart contract wallet with native insurance and high-grade security. Web: https://kinto.xyz

Become a Coinstack Sponsor

To reach our weekly audience of 330,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

Kinto Secures a $5 Million Equity Commitment from Nimbus Capital and a $1.2 Million Debt Round to Accelerate Post-Hack Recovery

Tokyo, Japan — 11 August 2025

Kinto, the modular exchange bridging traditional finance and DeFi, has secured a $5 million capital commitment from Nimbus Capital, a private alternative investment group specializing in structured growth financing for high-potential blockchain and digital asset companies. Renowned for partnering with issuers at critical inflection points, Nimbus brings flexible, milestone-driven capital designed to provide runway to rebuild liquidity, restore Morpho suppliers, and continue product expansion.

“These backers share our vision: a compliant, intuitive gateway where institutions and everyday users can access DeFi securely,” said Ramon Recuero, CEO of Kinto. “Their support—during the toughest chapter in our history—shows conviction in both the tech and the mission.”

“Kinto is building compliance-forward, user-safe rails, exactly what institutions need to access DeFi without sacrificing self-custody,” said Robert Baker, Managing Partner at Nimbus Capital. “Our capital commitment supports Kinto’s strategy, turning a hard chapter into lasting momentum.”

The capital will be deployed to:

Expand liquidity and markets for the relaunched $K token.

Repay emergency credit used in the Phoenix rescue.

Accelerate development of Kinto’s KYC-native L2 and mobile application.

In addition, Kinto has closed a $1.2 million debt round led through Wildcat Markets with participation from Mark Hart (Corriente Capital) and crypto angels like Johnny Reinsch, founder of Token Asset Coalition and Jill Gunter, co-founder of Espresso Systems.

Kinto thanks all investors and the wider community for standing firm through the recent exploit and migration. Together we are writing one of crypto’s most resilient comeback stories.

About Nimbus Capital:

Nimbus Capital is a private investment group focused on cross-border transactions. The group offers flexible and innovative funding solutions to growing businesses across the globe. Nimbus actively invests in blockchain technologies, including tokenized real-world assets (RWAs), digital infrastructure, and projects with transformative financial potential. The firm is led by experienced managers with strong track records in international markets and is backed by In On Capital, a boutique wealth management firm with over USD $1.3 billion in AUM.

Media contacts:

Kinto: [email protected]

Nimbus Capital: [email protected]

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🌕 Terraform's Do Kwon Pleads Guilty to Conspiracy, Wire Fraud in UST Blow-up: The Terraform Labs co-founder was indicted in 2023 on nine charges related to the collapse of the ecosystem, resulting in an estimated $40 billion in losses.

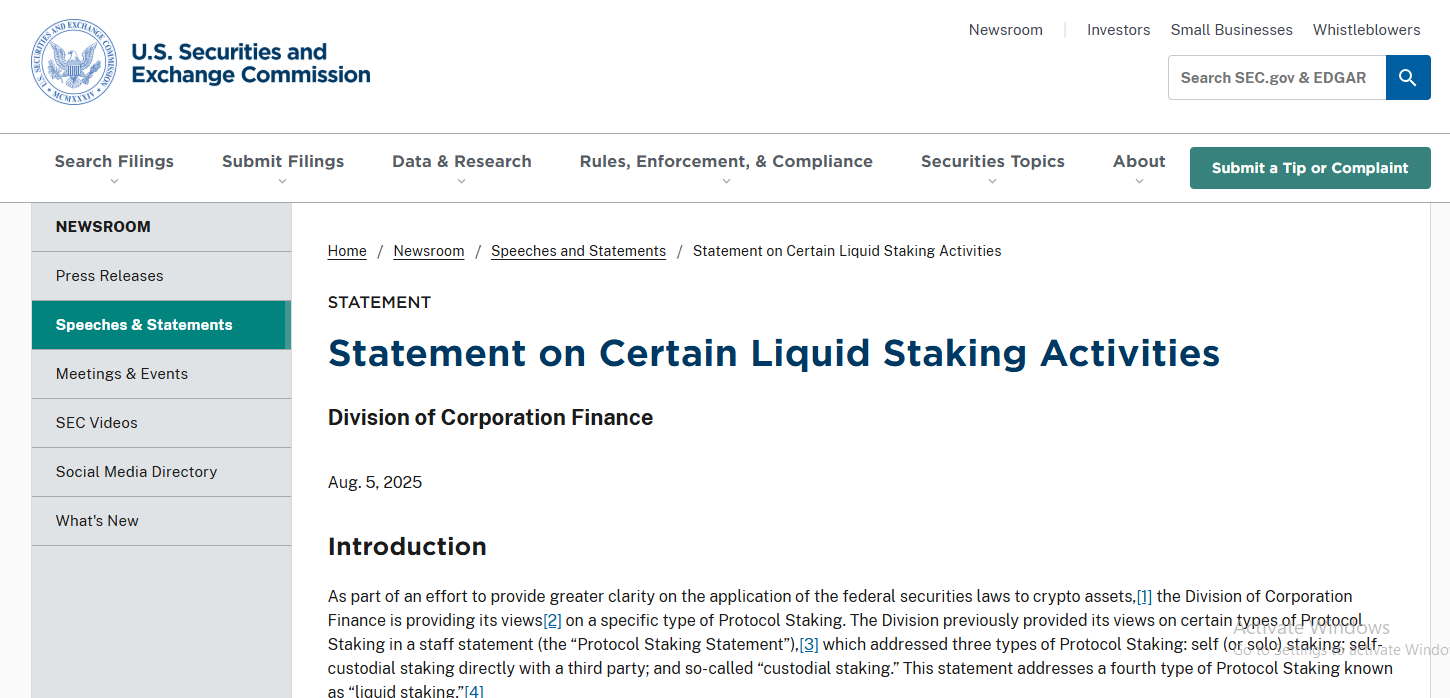

⚖️ SEC clarifies liquid staking tokens are receipts, not securities: The US Securities and Exchange Commission’s (SEC) Division of Corporation Finance issued new staff guidance stating that liquid staking does not automatically constitute a securities offering.

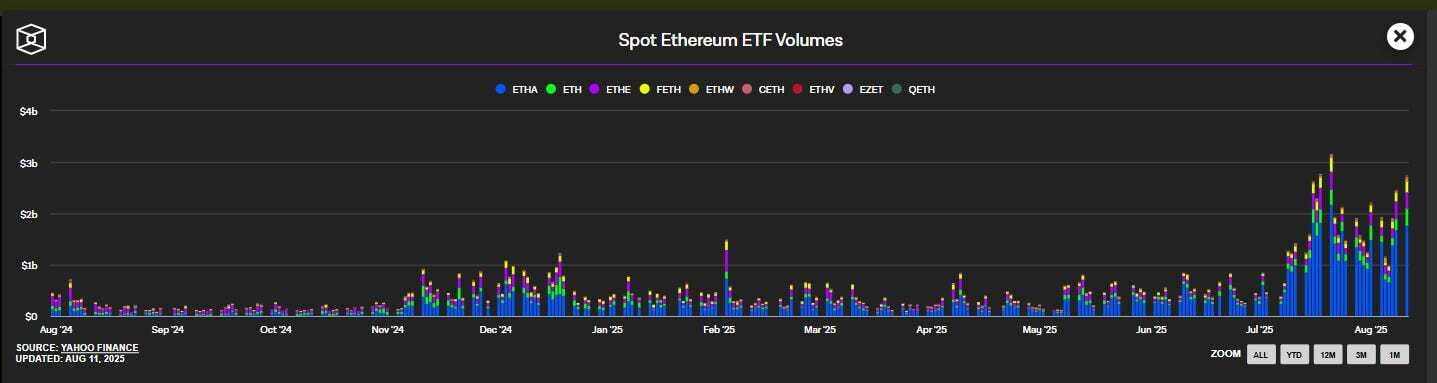

📈 Spot Ethereum ETFs top $1 billion in daily net inflows for the first time:U.S. spot Ethereum exchange-traded funds surpassed the $1 billion mark in net inflows for the first time on Monday since their launch in July last year."Investors are increasingly recognizing Ethereum's value as both a store of value and a foundational layer for decentralized finance and Web3 innovation," said Nick Ruck, Director at LVRG Research. "This demand reflects growing institutional confidence in ETH’s long-term potential."

⚖️ SEC and Ripple End Appeals, Closing Landmark Crypto Case:The U.S. Securities and Exchange Commission and Ripple Labs Inc. have formally closed their legal dispute, filing to end their respective appeals in the case over the sale of XRP tokens.

🚀 Ethereum hits new multiyear high as Tom Lee's BitMine plans $20B ETH raise: Ether price action targets all-time highs amid excitement over BitMine's giant accumulation plan, shifting the focus away from rangebound Bitcoin.

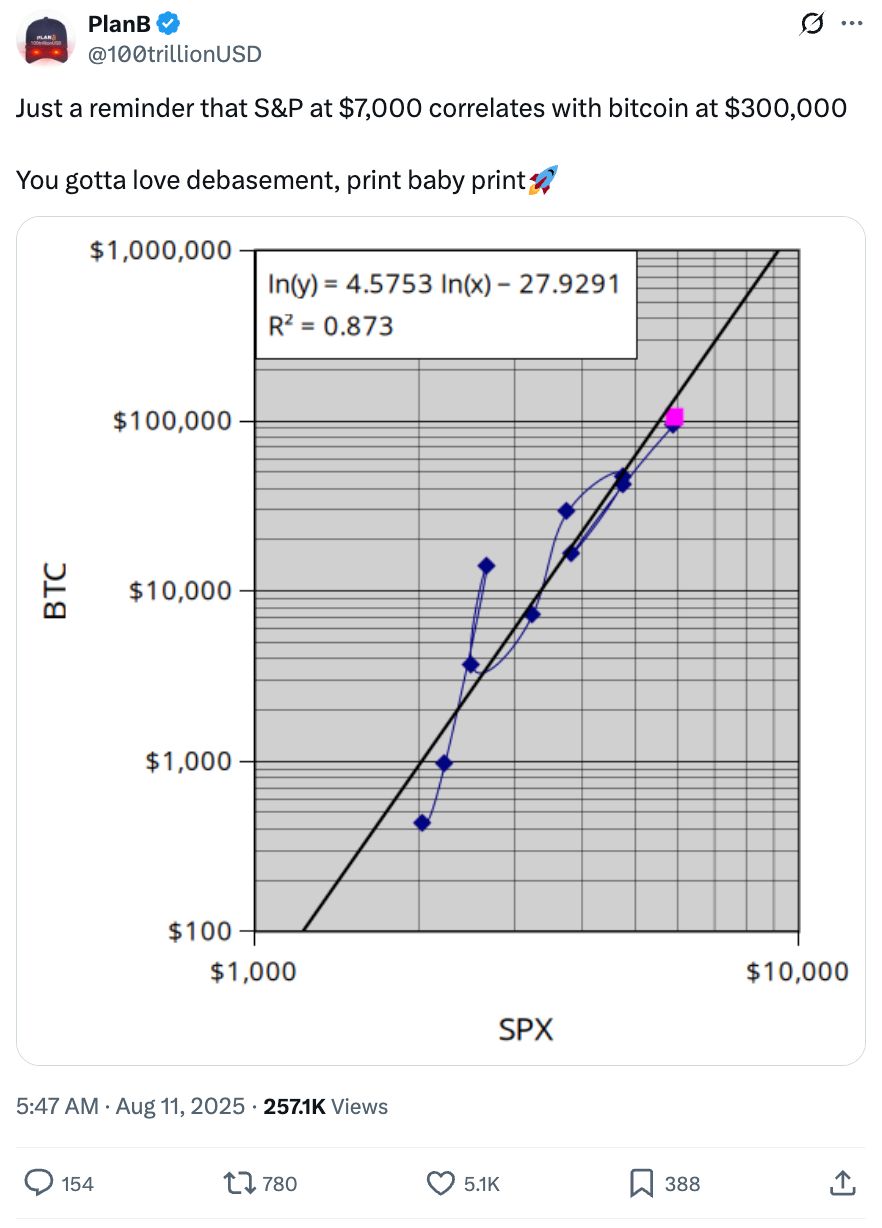

💬 Tweet of the Week

Source: @100trillionUSD

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Over $1B poured into ETH ETFs yesterday, shattering the previous record set in July ($726M). This nearly surpassed June's entire monthly total ($1.16B) in a single day.

ETH ETFs now hold more than 6,100,000 ETH ($26.8B) and account for 5% of the entire supply.

Source: @DavidShuttleworth

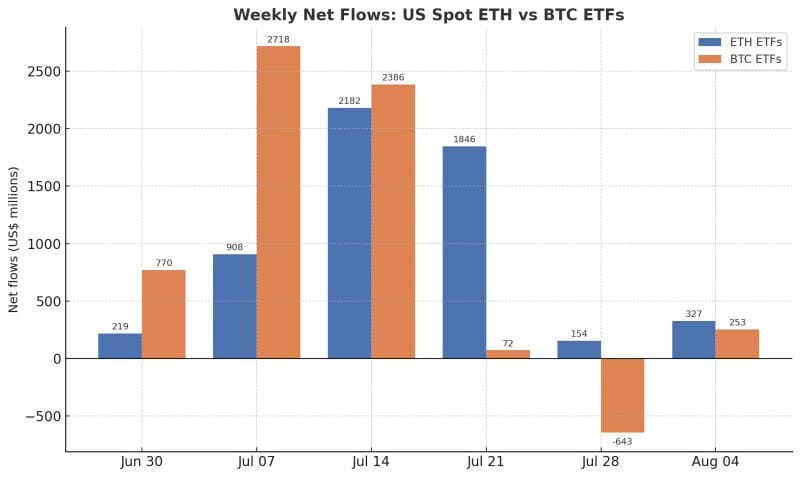

2. For the third consecutive week, ETH ETF inflows outpaced BTC ETFs: $327M compared to $253M.

Over the same period, ETH strategic reserves accumulated another 1,281,000 ETH ($5.38B), boosting aggregate holdings by 73% in just 3 weeks.

Meanwhile, ETH:BTC is up 23% this month and just reached its highest level (0.037) since January.

Source: @DavidShuttleworth

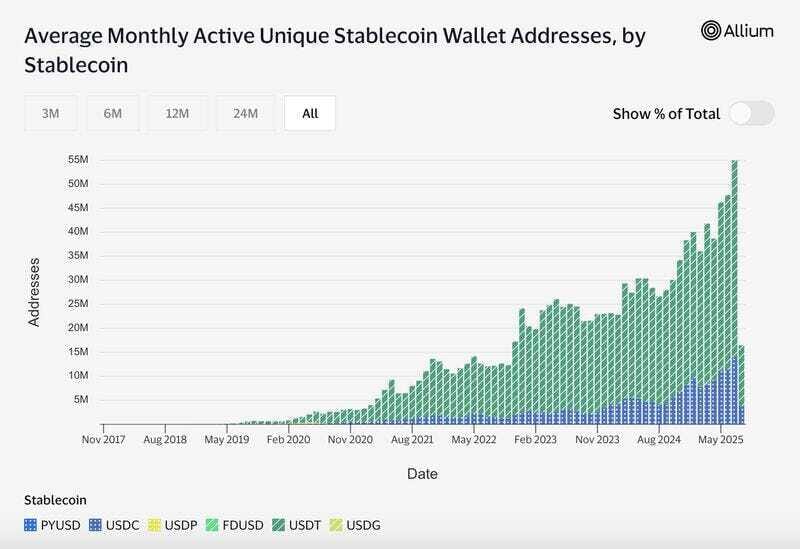

3. Fiat-backed stablecoins saw their highest active userbase ever in July, growing by 15% from June and 93% from July 2024. This includes incumbents like Tether.io USDT, Circle USDT, and PayPal PYUSD.

However, there were still just 55M total users, a far cry from Visa's 4B+ global users.

Payments are accelerating on blockchain rails, UX is becoming decidedly more 1-click, money is becoming programmable.

Source: @DavidShuttleworth

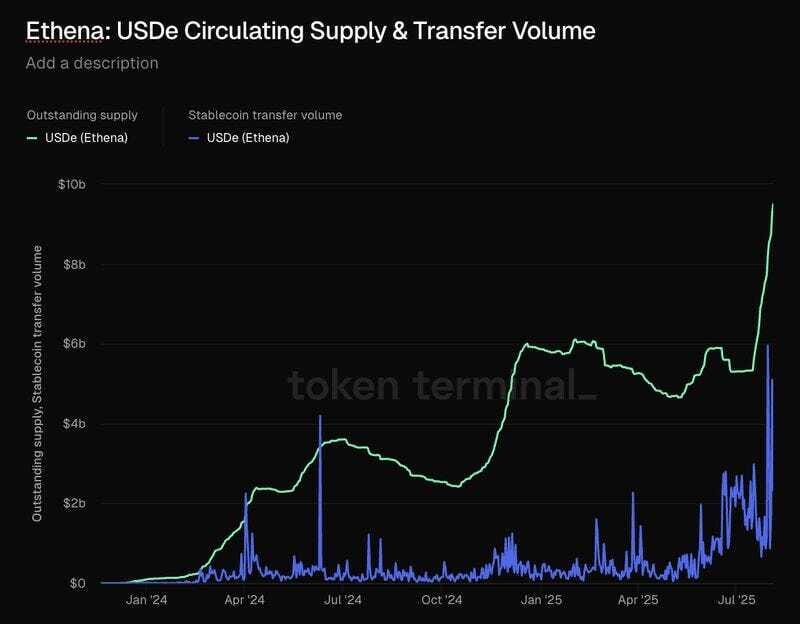

4. One massive shift that has been under-indexed is the ascension of Ethena Labs USDe. Circulating supply has now grown by a staggering 78% in just two weeks to reach a new all-time high of $9.5B.

This makes USDe the 3rd largest stablecoin in the entire space, behind only Tether USDT ($165B) and Circle USDC ($64B).

Source: @DavidShuttleworth

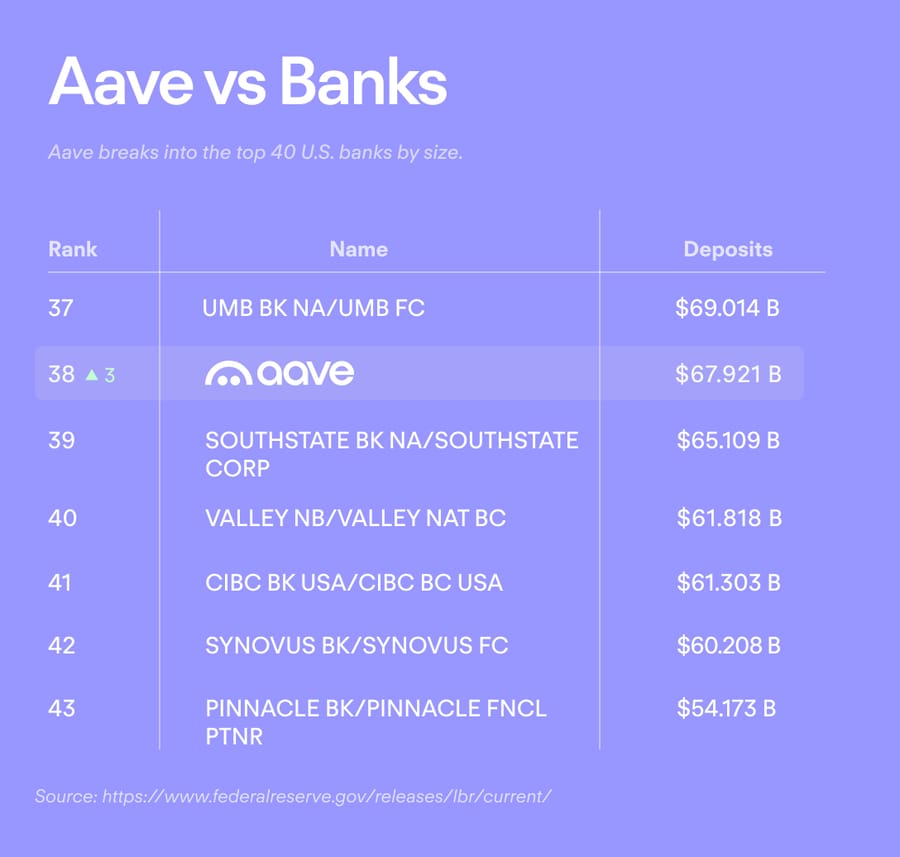

5. Aave flips three more banks and breaks into the top 40.

Source: @0xKolten

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

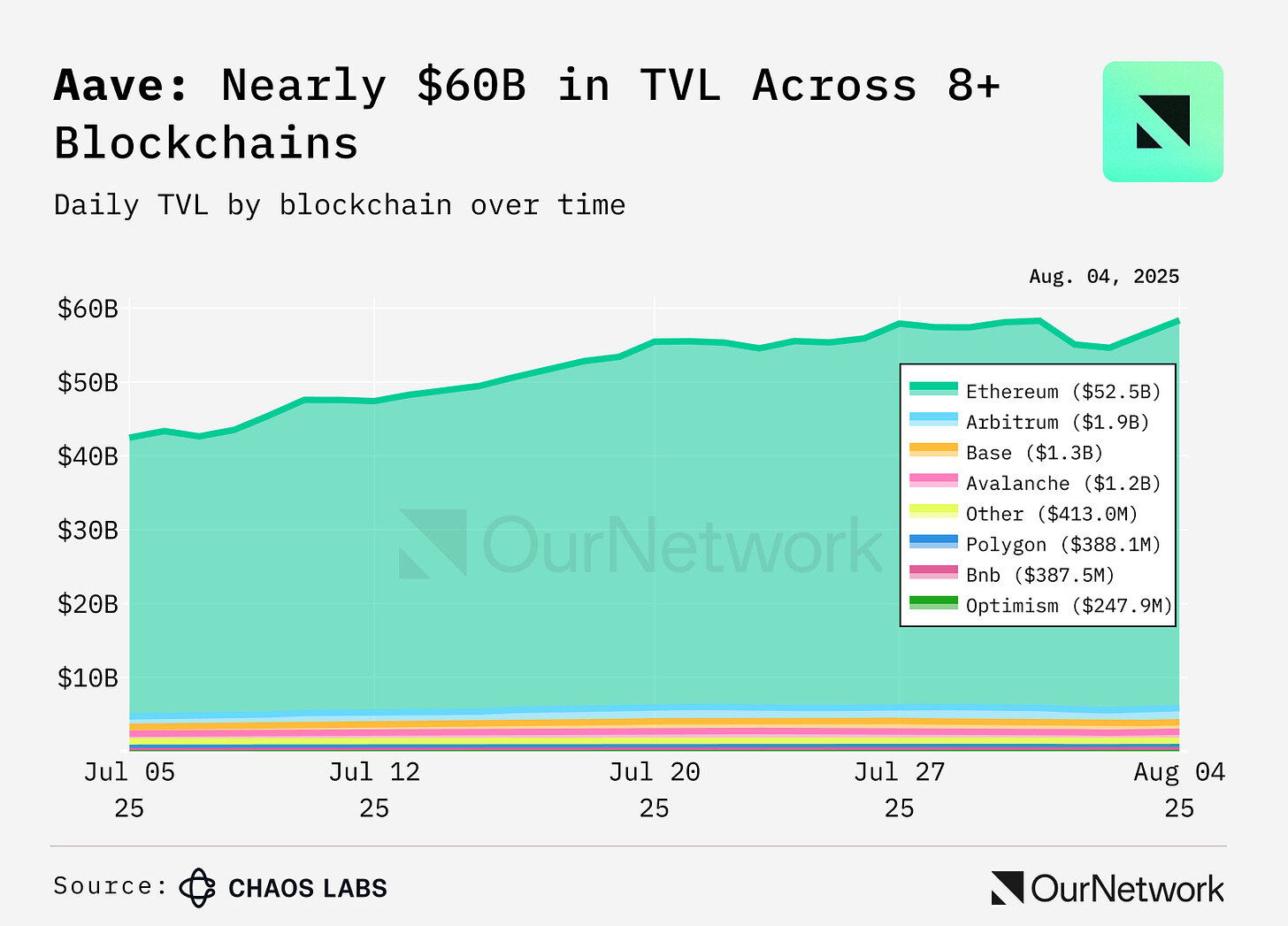

Welcome to OurNetwork's latest, an onchain look at some of crypto's top lending protocols. Below we have Chaos Labs digging into Aave, DeFi's largest protocol by total value locked. Integrations with Ethena and Pendle have been particularly instrumental in Aave's recent growth.

We also have Seoul Data Labs, checking out Spark, a spinoff from MakerDAO which has entered the top 10 DeFi protocols by TVL. Miguel dropped in to cover Euler's growth story and Ayham chronicled Silo's recent rise on the Sonic blockchain.

– ON Editorial Team

📈 Aave TVL Grew 82% Over the Last 3 Months, Driven by Inflows to Its Growing Network Deployments

Aave is a decentralized, non-custodial protocol that enables users to lend and borrow crypto assets permissionlessly. Aave has over $58B in TVL across Ethereum, Arbitrum, Optimism, Polygon, Avalanche, and Base deployments. Ethereum remains the dominant network for Aave, adding over $24B in TVL and accounting for over 85% of all growth during this period. Base nearly doubled its TVL with a 93% increase, marking the most substantial growth among Layer 2s.

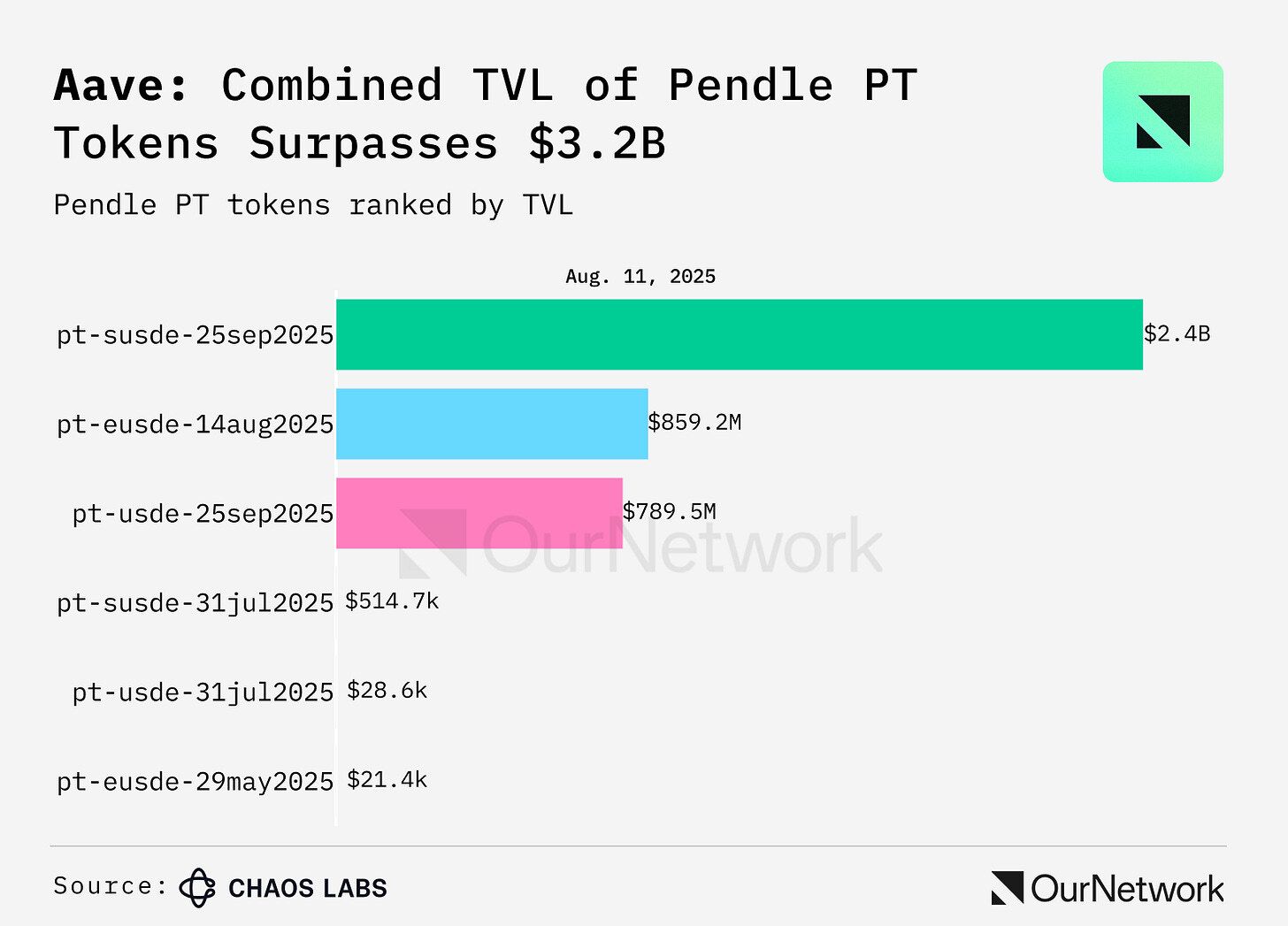

Pendle's PT tokens have amassed $3.2B in TVL on Aave, driven by Ethena-related assets and powered by Chaos Labs’ dynamic risk oracle, which enables real-time pricing and collateral adjustments to protect capital and support market efficiency.

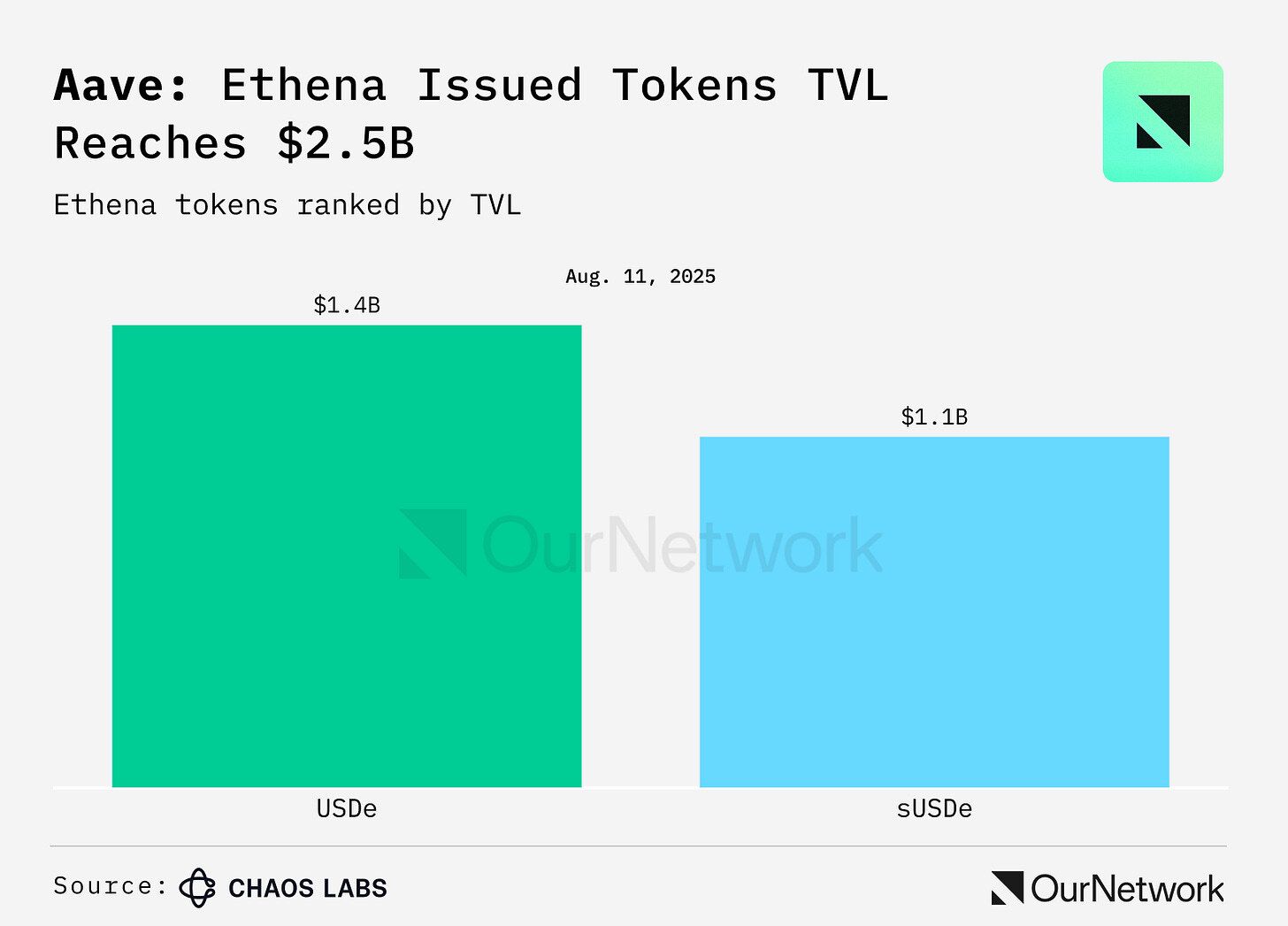

Ethena's sUSDe & USDe have seen sharp growth, driven by liquid leverage strategies on Aave. Users can supply a 50-50 sUSDe–USDe position, borrow against it, and recursively loop to amplify exposure, capturing the full staking yield. This dynamic has fueled demand for both assets.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.ceek.com and https://kinto.xyz