Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 250k weekly subscribers. This week the SEC cleared the final hurdle to launch the first US ETH ETF, Hong Kong launched Asia’s first inverse Bitcoin ETF, and big new venture rounds came in for NPC Labs ($18M) and Allium ($16.5M).

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Amphibian Capital, managing $75M+ AUM, is a fund of the world's leading hedge funds. +11.99% net YTD with their USD fund, +10.53% net YTD in their ETH fund (64.4% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ SEC Clears Final Hurdle for Ether ETFs to Launch: The Securities and Exchange Commission on Monday cleared the final hurdle for the launch of the first U.S. exchange-traded funds holding ether, paving the way for them to start trading Tuesday.

⚖️ Hong Kong to launch Asia’s first inverse Bitcoin ETF: CSOP’s new inverse Bitcoin ETF aims to profit from BTC price declines following their successful 2022 launch of the firm’s Bitcoin Futures ETF.

🚀 Bitcoin Briefly Tops $68K as Biden Dropout Riles Up Crypto Bulls: Bitcoin briefly surged above $68,000, driven by positive U.S. election predictions, before settling around $67,500 during early Asian trading hours on Monday. “Biden’s withdrawal has opened up a possibility where, regardless of who sits in the White House, the U.S. government embrace a more constructive stance towards the digital asset industry after November,” Singapore-based crypto research firm Presto shared in a Monday note to CoinDesk.

🤝 Polymarket hits new all-time high in July trading volumes: Dune: Now, the decentralized prediction market dapp on Polygon is hitting all-time highs in monthly trading volumes of $213 million, according to Dune. To put that in perspective, June racked up monthly trading volumes of $111 million, per the same chart.

🪂 Bitcoin DeFi Platform Liquidium Distributes Surprise Airdrop: The unannounced airdrop marks Liquidiums token-generation event (TGE) and distributed 10% of the total token supply, with 7% of tokens awarded to Liquidium users, while 3% went to select Ordinals communities.

💬 Tweet of the Week

@matthew_sigel

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

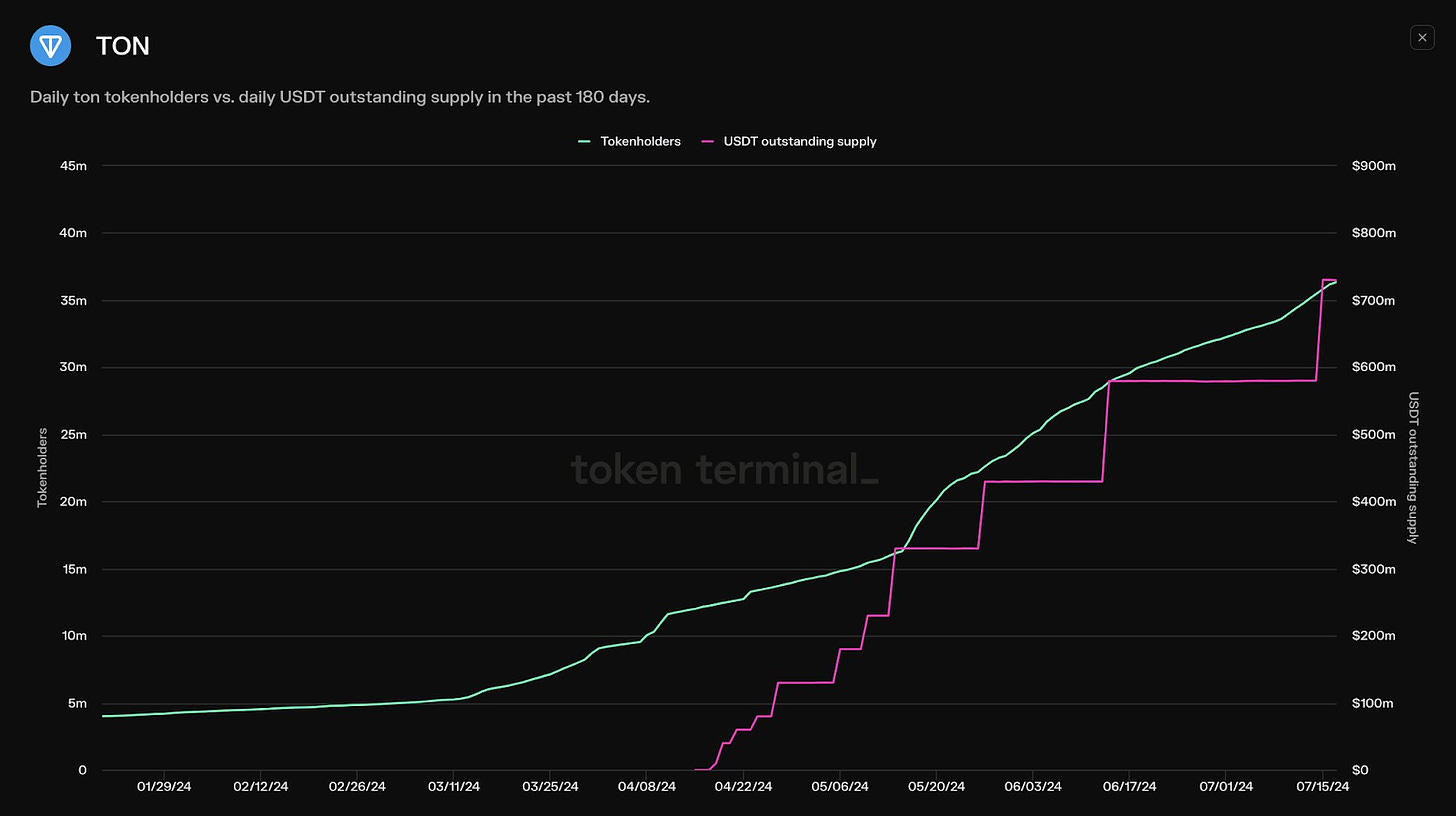

1. Total outstanding supply of Tether.io USDT on TON increased by 26% this week and now stands at $730M. In less than 4 months, the network has been able to amass a tremendous amount of stablecoin liquidity.

Source: @DavidShuttleworth

2. Daily active users on Solana have grown by 50% over the past week and have surpassed 2M for the first time since May. Meanwhile, the network continues to handle over 41M transactions per day.

Source: @DavidShuttleworth

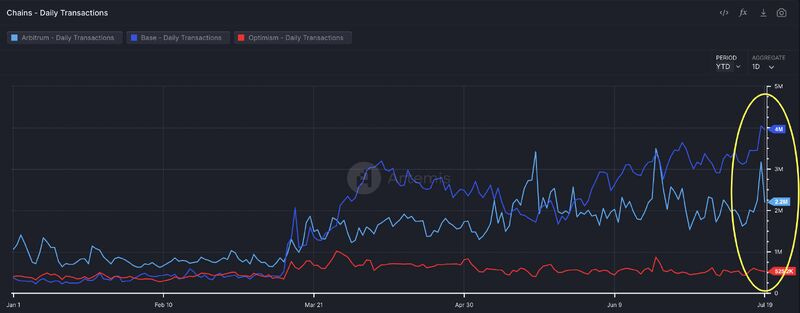

3. Daily transactions on Coinbase Base recently surpassed 4M, a new all-time high and an increase of 28% month-over-month. Base currently handles nearly double the amount of daily transactions than Arbitrum (2.2M) and Optimism (526K) combined.

Source: @DavidShuttleworth

4. Over $50B Locked in Liquid Staking Protocols

Source: @OurNetwork

5. Sanctum's Wonderland has increased LST volume by 25% on Solana, currently at 25m+ SOL

Source: @OurNetwork

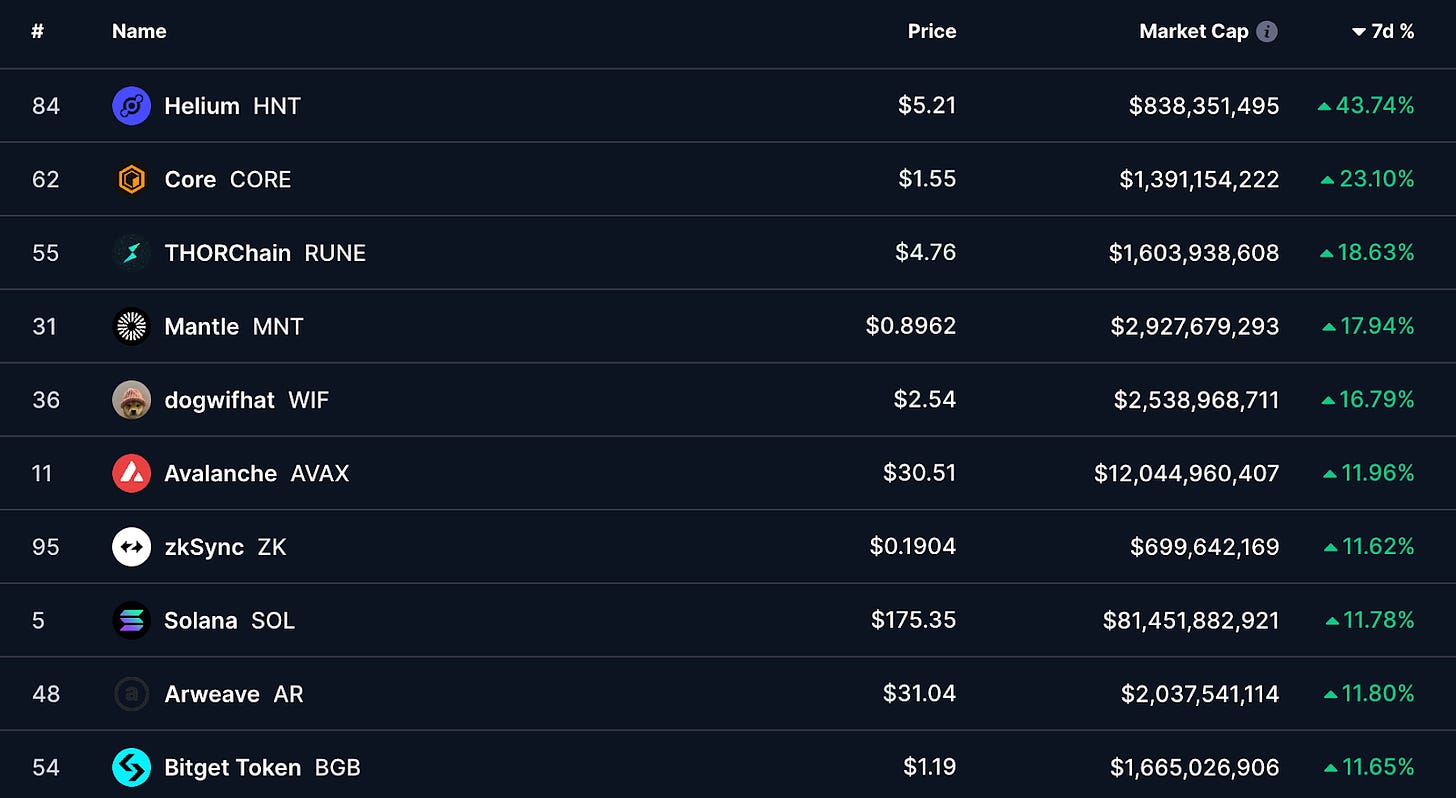

6. Top Moving Coins From the Top 100

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Background

Throughout much of our industry’s history, centralized exchanges (CEXs) such as Coinbase, Binance, and Kraken have thrived as the preferred choice for crypto traders. Users have mainly gravitated towards these products due to their strong liquidity and compelling user experiences (UX)—a notoriously key pain point for legacy decentralized exchange (DEX) applications.

But what if there was a trading venue that combined the speed and liquidity of CEXs with the transparency, sovereignty, and settlement of decentralized finance (DeFi)?

That's the core idea behind Orderly Network.

Orderly Network is addressing the historical shortcomings of early DeFi applications by building a trading infrastructure through which liquidity converges. Orderly creates an efficient and robust trading ecosystem fitted with better price discovery, lower slippage, deeper liquidity, and execution-speeds that rival CEXs—all the while maintaining the benefits of DeFi.

Introduction

Orderly is a Layer 2 (L2) solution that provides:

Orderbook-based trading: Similar to CEXs, Orderly uses an order book to match buyers and sellers, ensuring smooth and efficient trades.

Omnichain liquidity: Orderly aggregates liquidity from various blockchains, offering a wider pool of assets and tighter spreads.

High-speed execution: Orderly prioritizes fast trade execution, minimizing delays and frustrations.

Orderly uses a unified orderbook; users trade on different chains but in the same orderbook, removing the need for bridging.

Orderly inherently plays a significant role in improving the overall efficiency and robustness of the DeFi trading landscape, quickly emerging as one of the largest liquidity sources for permissionless Web3 trading.

Key Achievements and Impact

Orderly Network has already made significant waves in the DeFi world, including:

Over $50 billion in total trading volume

Integration with six major blockchains (Arbitrum, Optimism, Polygon, Base,

More than $56 million in Total Value Locked (TVL)

A user base exceeding 215,000 unique wallets

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com