Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We reviewed the top news, stats, and reports in the digital asset ecosystem for our 350k weekly subscribers. This week, Euler’s founding CEO stepped down as the protocol refocused toward institutional adoption, while Tether froze $182M in USDT linked to five Tron addresses. XRP ETFs also posted record weekly trading volume, Ripple secured FCA authorization to support UK expansion, and Florida became the latest U.S. state to explore establishing a bitcoin reserve ahead of the 2026 legislative session. On the fundraising front, Rain, a blockchain-based card issuing and stablecoin payments platform, raised $250M in a Series C led by Iconiq Capital, while Babylon, a Bitcoin staking infrastructure project enabling BTC to secure PoS networks and earn rewards, raised $15M led by a16z crypto.

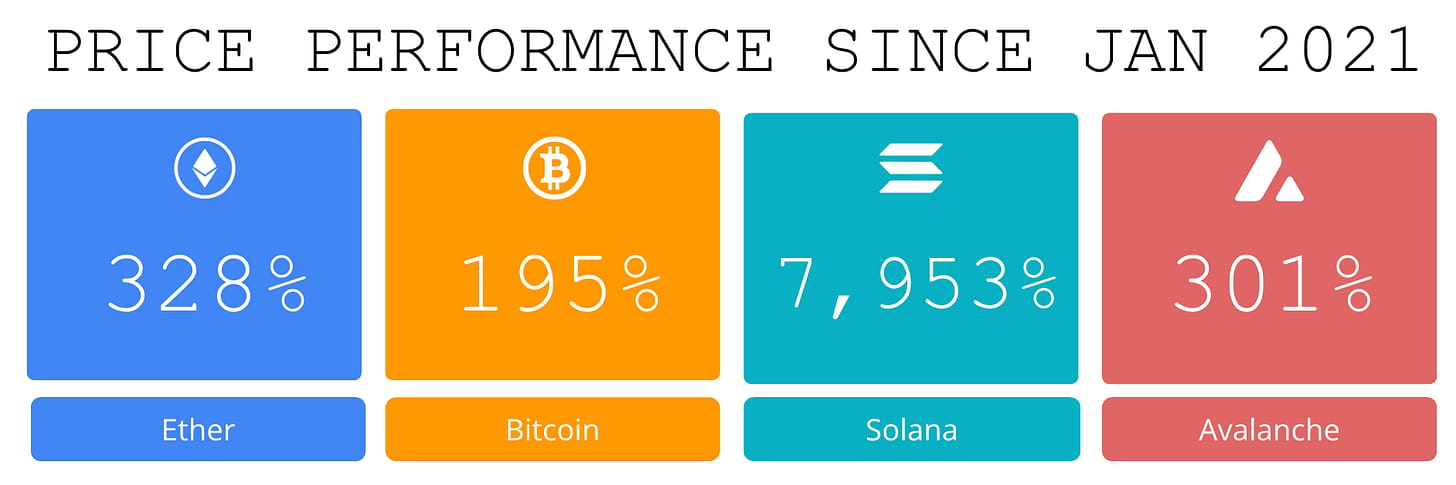

Price performance since we began writing Coinstack in January 2021

Become a Coinstack Sponsor

To reach our weekly audience of 350,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

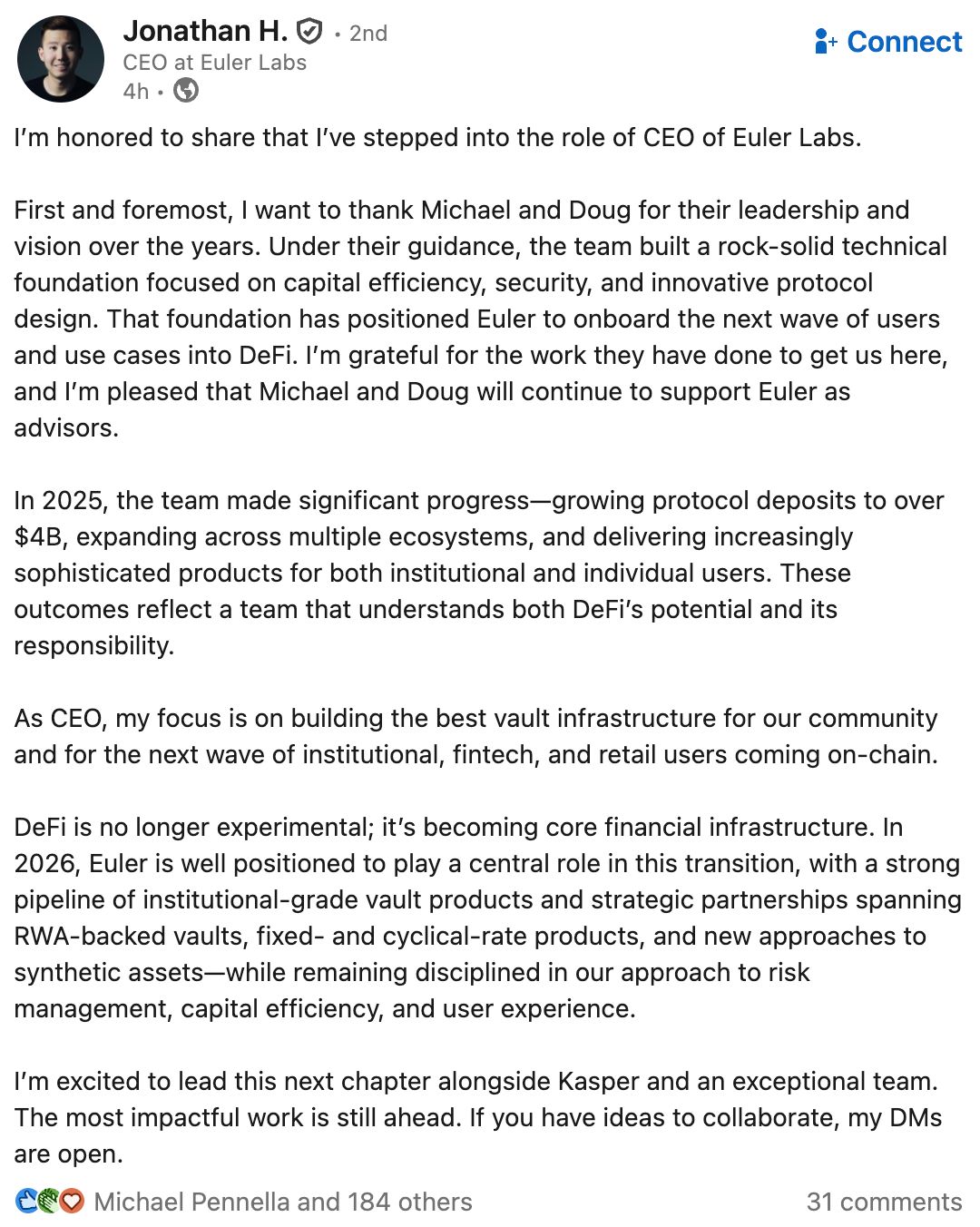

😲 Euler’s Founding CEO Steps Down as Protocol Refocuses on Institutions: Michael Bentley, co-founder of Euler Labs, the team behind multi-chain lending protocol Euler Finance, said he will step back from the protocol’s day-to-day leadership after nearly six years at the helm.

🧊 Tether freezes $182 million in USDT tied to five Tron addresses: Tether froze more than $182 million in across five wallet addresses on the Tron blockchain on Jan. 11, according to onchain data and reporting from Whale Alert.

🚀 XRP ETFs hit record weekly volume: The newer XRP ETFs bucked the trend with continued inflows and hit a trading volume milestone, while ETFs also saw net inflows.

🌱 Ripple secures FCA authorization, clearing path for UK expansion: Financial technology firm Ripple has secured approval from the UK’s top financial regulator, clearing the way for an expansion of its platform in the country.

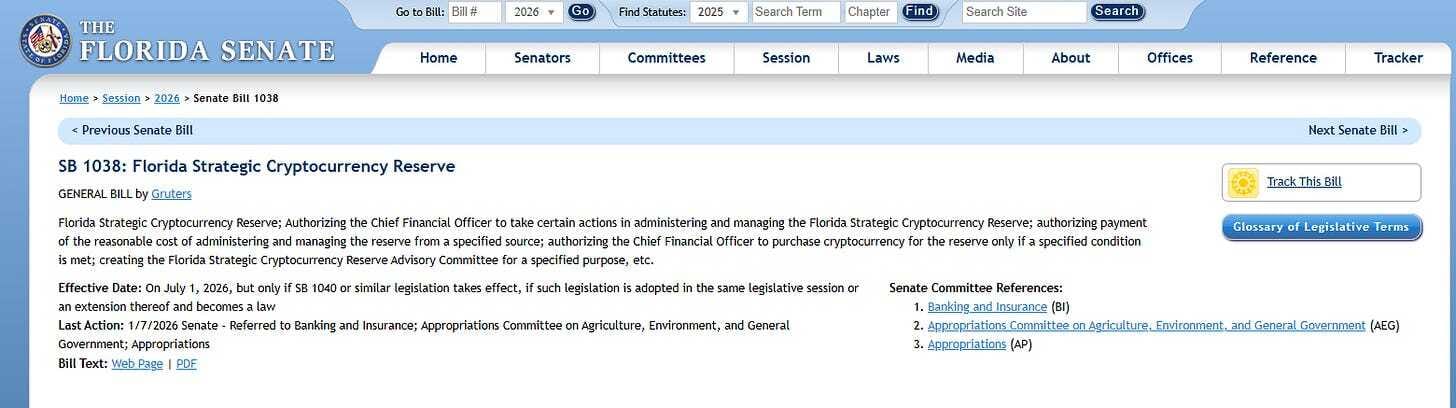

💰 Florida becomes latest state to pursue bitcoin reserve ahead of 2026 session: Florida lawmakers have filed a new proposal that would authorize the creation of a state-managed bitcoin reserve, marking the latest attempt by a U.S. state to formally place the cryptocurrency on its balance sheet ahead of the 2026 legislative session set to kick off on Jan. 13.

💬 Tweet of the Week

Source: @LidoFinance

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

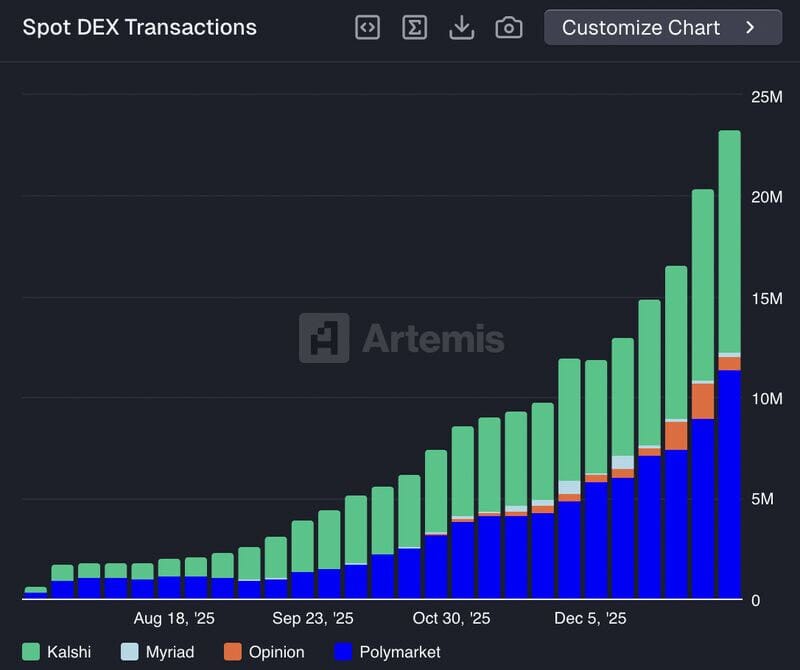

1. Prediction markets continue to capture user attention, drive organic volume, and scale faster than most realize.

Last week alone, the sector handled 23.3M transactions — an all-time high and 2x December — while volume reached $5B, the second-highest week on record.

Polymarket (11.4M) and Kalshi (11.1M) are now operating at near-parity and account for 96% of all activity, with Opinion Labs adding 683k.

Distribution is becoming the real moat: prediction markets are now scaling through familiar, regulated venues like Robinhood and Coinbase, and direct integrations such as Google, rather than crypto-native discovery alone.

Source: @DavidShuttleworth

2. Onchain lending activity just posted its first month of growth since the October market crash.

Active loans in January now stand at $36.6B, up $2.1B (+6%) month-over-month, marking their highest monthly levels since the drawdown began.

This rebound is being led by Aave Labs ($1.1B MoM) and Morpho ($450M).

More broadly, this signals a return of risk-on behavior across onchain credit.

Source: @DavidShuttleworth

3. Interesting stablecoin dynamics on Solana: USDC supply, the network’s primary source of dollar liquidity, declined $1.7B this week (-17%) and $3B month-over-month (-27%) and is now sitting at its lowest level since November.

This comes even as Solana remains a live USDC settlement rail for Visa, highlighting a meaningful short-term drawdown in onchain dollar liquidity.

Source: @DavidShuttleworth

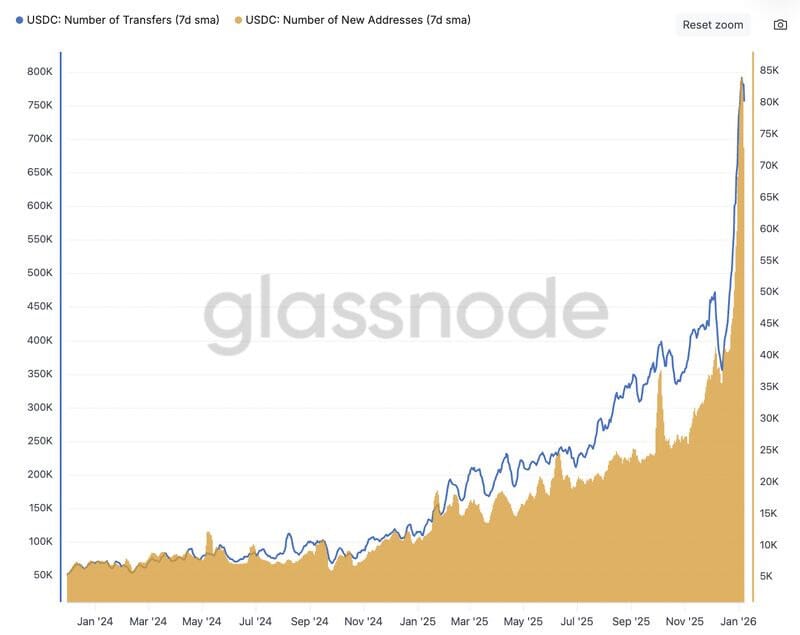

4. USDC is experiencing a massive spike in adoption and usage.

More than 73,000 new accounts are using Circle USDC every day in January: nearly 2x December’s peak (41k) and over 7x year-over-year.

At the same time, USDC transfers have surged to record highs, now averaging 792k per day (+80% MoM, +600% YoY).

Source: @DavidShuttleworth

5. Tether and USDC have surged to record levels of activity. Tether now processes over 1.2M transactions per day, up 170% month-over-month, while USDC handles 792K daily transactions, up 80% MoM.

Stablecoin adoption is accelerating well beyond on-ramps and speculation, increasingly becoming foundational payment and settlement infrastructure.

Source: @DavidShuttleworth

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Happy 2026!

In today’s issue we’re focusing on yield, the flows of capital which have some active traders moving money on a daily basis, while others park their stablecoins for low-risk yield.

Leading off we have the vaults.fyi team, who index hundreds of opportunities to earn yield across crypto. We then have Alex, digging into Pendle, by far the largest and most impactful yield-splitting protocol in crypto. To close, Diego checked out Merkl, a project focused on distributing incentives.

Enjoy!

– ON Editorial Team

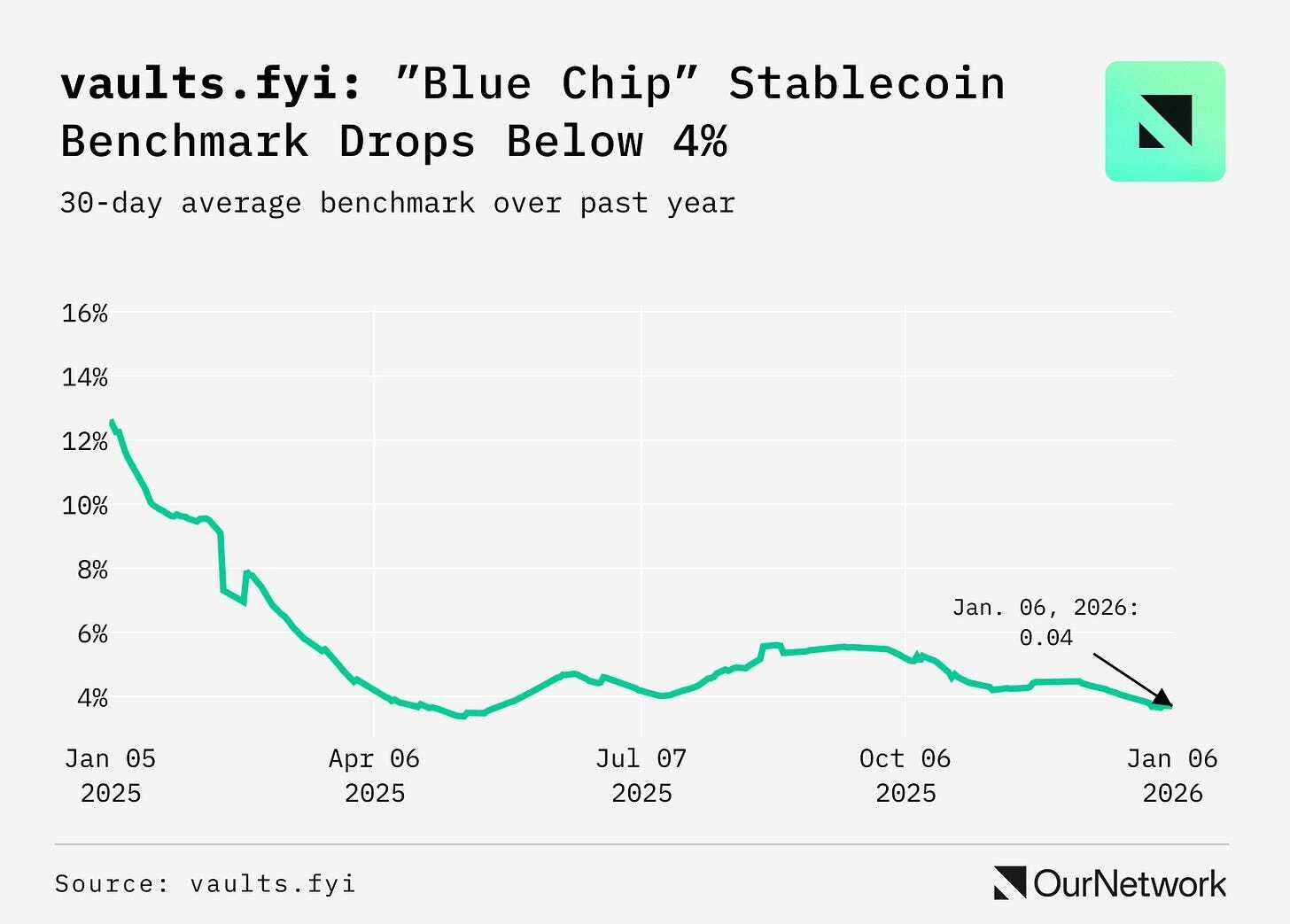

📈 As Some Stablecoin Yields Dip Below TradFi Risk-Free rates, Farmers Have Had to Stay Nimble to Get Attractive Yield and Avoid Losses on Bad Debt

Vaults.fyi simplifies the yield landscape by bringing together hundreds of yields across protocols and chains into one place. Currently, the vaults.fyi “blue chip” stablecoin 30-day average benchmark yield has dipped to ~3.8%, marking a significant shift from the 10%+ highs seen in previous months, as demand for leverage has fallen across major lending markets.

With the 1-month U.S. T-bill yielding 3.7%, USDC and USDT yields on Aave currently sit below TradFi’s risk-free rate. DeFi’s other largest stablecoin vaults from Sky and Ethena are only slightly higher, returning just over 4% APY during the past 30 days.

Alpha still exists for active farmers. Vaults.fyi data currently shows several opportunities that have returned >10% APY over the past 30 days on large TVLs. Aave Horizon RLUSD and Turtle Avalanche USDC both offer double digit yields, driven heavily by incentives.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.