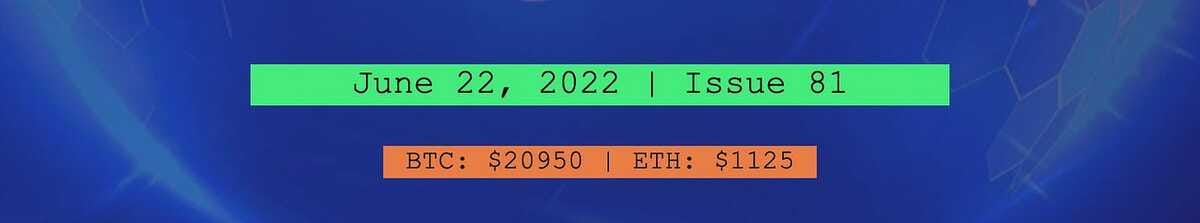

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors, where we review the top news and reports in the digital asset ecosystem.

In This Week’s Issue:

This Week in Crypto

🗞️ Top Weekly Crypto News - FTX Rescues BlockFi with $250M, Voyager’s $661M Exposure to 3AC, ProShares Launches Short Bitcoin-Linked ETF, Ethereum Testnet Ready for Trial Merge

💵 Weekly Fundraises - Magic Eden ($130M), zCloak ($5.8M), Crema Finance ($5.4M)

📊 Key Stats - ETH, NFTs, BTC

🧵 Thread of The Week - BlockFi & FTX Partnership

📝 Report Highlights - Messari: Hashing it out with Hedera Hashgraph

🎧 Best Crypto Podcasts - Coinstack, Bankless, Delphi Media

📈 Top 10 Tokens of the Week - DAR, UNFI, BEL

Coinstack Podcast Episodes

Join Our Telegram Group

Who We’re Following on Crypto Twitter

How to Get Started in Crypto Learning

Thanks to Our 2022 Coinstack Sponsors…

FTX US is the safe, regulated way to buy Bitcoin, ETH, SOL, and other digital assets. Trade crypto with up to 85% lower fees than top competitors and trade ETH and SOL NFTs with no gas fees and subsidized gas on withdrawals. Sign up at FTX.US today.

Peer is a blockchain technology company founded by Tony Tran to develop consumer-focused blockchain software, hardware, and services for Web3 — the next evolution of the internet. Peer is headquartered in Seattle, Washington. To learn more, visit www.peer.inc and follow @peerpmc. Register for their upcoming token launch here.

HeartRithm is a crypto DeFi fund that invests in DeFi, margin lending, and algorithmic trading to generate monthly yield for institutional allocators and qualified clients in a market-neutral manner. They also have a major social impact mission and are giving away a portion of their performance fee to fund philanthropic efforts. Learn more at www.heartrithm.com.

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🏦 BlockFi Secures $250 Million Bailout From FTX - BlockFi secures $250 million revolving credit facility from crypto exchange FTX, a week after competitor Celsius pauses withdrawals. BlockFi says the deal ‘bolsters our balance sheet and platform strength.’

Voyager Discloses $661M Exposure to Three Arrows Capital - Voyager, a major crypto savings app has announced it has $661M in exposure to potentially insolvent hedge fund Three Arrows Capital, which is in a work out plan with its investors and lenders. Shares in the publicly traded Voyager dropped 60% on the news. Last week, Voyager announced a $200M credit line from Alameda aimed at strengthening their balance sheet.

₿ ProShares to Launch First US Short Bitcoin-Linked ETF - ProShares plans to publicly launch the first short bitcoin-linked ETF in the United States on June 21.

⚡ Ethereum Testnet Beacon Chain Launched and Ready for Trial Merge - The Sepolia testnet is the next in line after Ropsten to undergo a merge trial run since its Beacon Chain is now live and ready to give developers valuable information leading up to the real thing.

🚫 UK Treasury Abandons Plans to Introduce KYC on Unhosted Wallets - The United Kingdom’s Treasury has loosened the travel rule, impacting unhosted wallets.

🔍 Binance Sees Deposits of 101,266 Bitcoin - The balance of Binance’s cold wallet rose by about 101,266 bitcoins on Sunday, reflecting increased deposits by users onto the exchange.

Uniswap Labs Pushes Further Into NFTs With Genie AcquisitionUniswap has acquired NFT Marketplace Aggregator Genie. Uniswap will airdrop USD Coin (USDC) to Genie users who used the marketplace more than once before April 15, as part of the acquisition.

BitGo Launches First NFT Custody Platform for US InstitutionsBitGo has launched an NFT Custody wallet for institutions. They expect more institutions will feel comfortable entering the space with more secure custody options available.

Iran bans bitcoin mining as its cities suffer blackouts and power shortagesIran has banned BTC mining due to power supply issues. Around 4.5% of all bitcoin mining globally between January and April of this year took place in Iran, according to blockchain analytics firm Elliptic.

Blockchain Payments Firm Roxe to List Via $3.6B SPAC Deal. Roxe announces plans to list on NASDAQ in early 2023. The deal is expected to close by Q1 2023 and the combined company will trade under the symbol "ROXE."Share Coinstack

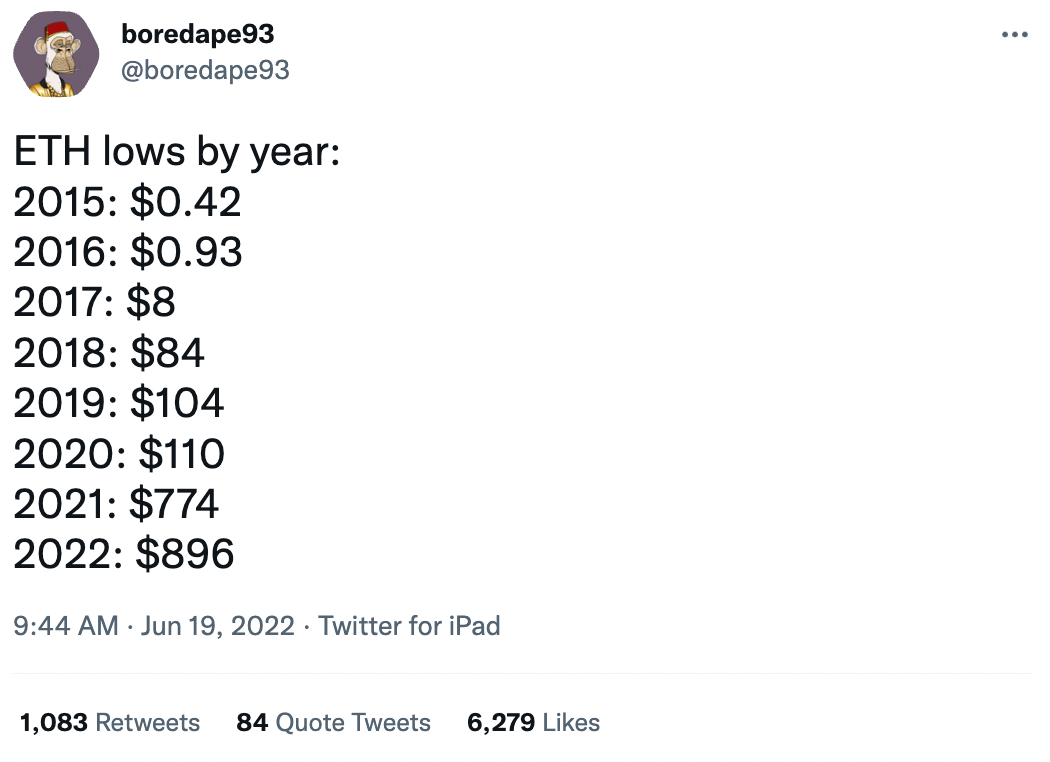

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

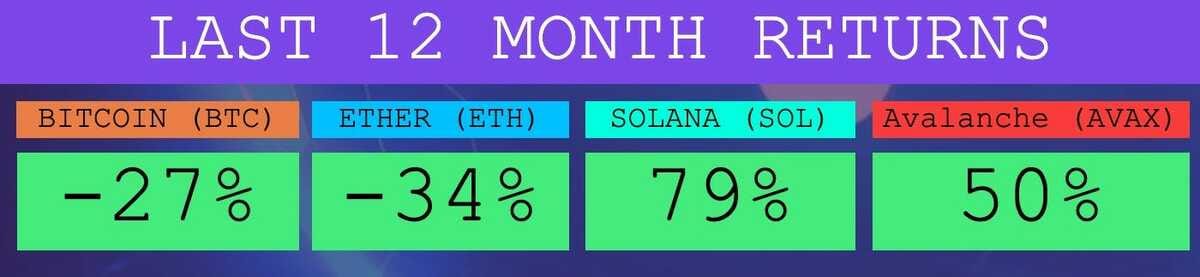

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. ETH Climbed 19% Sunday Night to $1140 After Bottoming Around $860 on Saturday Due to Forced Sales From Liquidations

2. Bluechip NFTs Are Up 40% From a Week Ago, With BAYC and CryptoPunks Up Double Digits

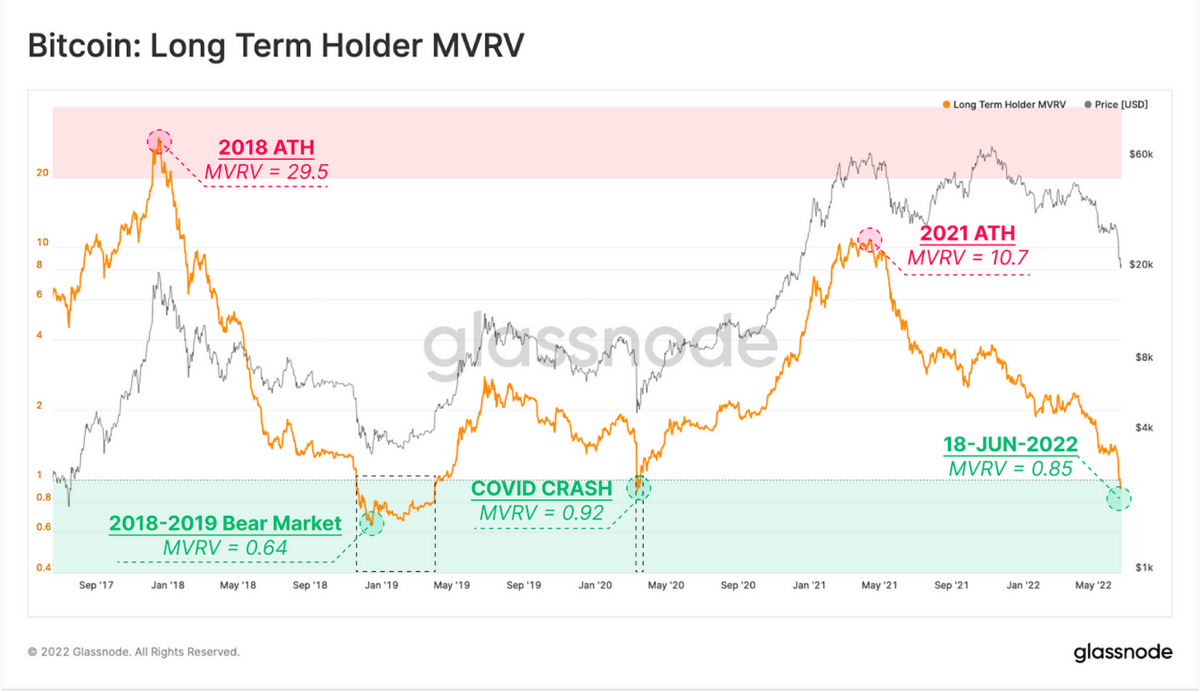

3. The Recent Market Crash to $17.6K BTC Pushed Long Term Holder MVRV to 0.85 Signaling Nearing Potential Market Bottom

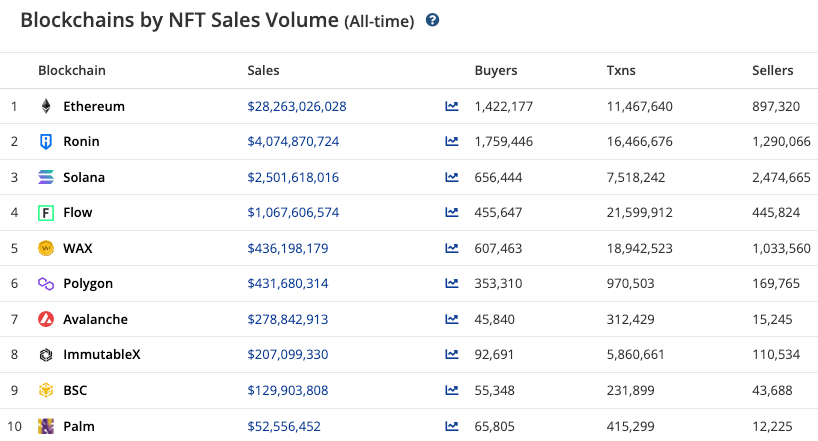

5. Ethereum Leads the Pack As the Most Used Blockchain for NFTs When Measured by Sales Volume Transacted With Ronin, Solana, and Flow All Above $1B in Total Volume

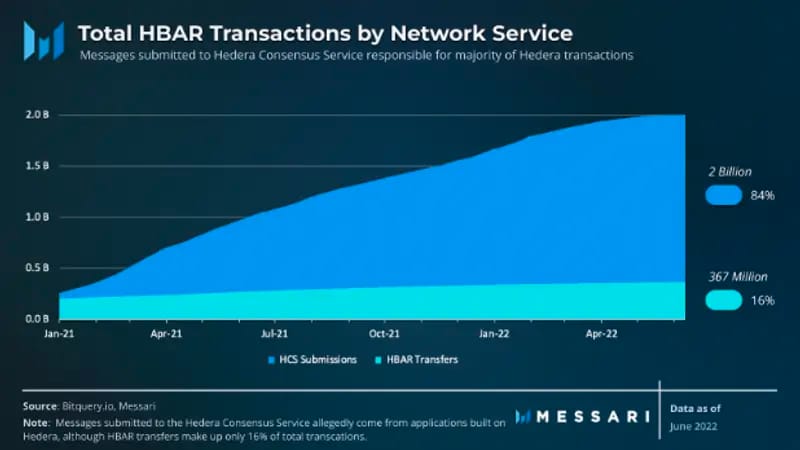

5. Hedera Hashgraph Surpasses 2 Billion Transactions Recorded on Hedera’s Network

🧵 Thread of the Week - FTX Provides $250M to BlockFi to Support Balance Sheet, A Week After Competitor Celsius Pauses Withdrawals

1/ The proceeds of the credit facility are intended to be contractually subordinate to all client balances across all account types (BIA, BPY & loan collateral) and will be used as needed.

2/ Throughout the market volatility of the last several weeks, I’m incredibly proud of how our team, platform and risk management protocols have performed. Today’s landmark announcement reinforces BlockFi’s commitment to serving its clients and ensuring their funds are safeguarded.3/ This agreement also unlocks future collaboration and innovation between BlockFi & FTX as we work to accelerate prosperity worldwide through crypto financial services. This is a significant step forward in our commitment to the strength and accessibility of crypto markets.4/ To @BlockFi clients: We are here for you. Our team is battle tested and has weathered many storms over the years, which only makes us stronger and more resilient as we navigate today’s market environment.

5/ We look forward to sharing more details about future plans and initiatives to support the industry shortly!

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

Messari: Hashing it out with Hedera Hashgraph

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public make sense of this revolutionary new asset class and is building data tools that will drive informed decision-making and investment. This is an excerpt from the full article, which you can find here

Key Insights:

Hedera is a low-cost, Proof-of-Stake (PoS) public ledger with quicker transaction speeds than existing Layer-1 (L1s).

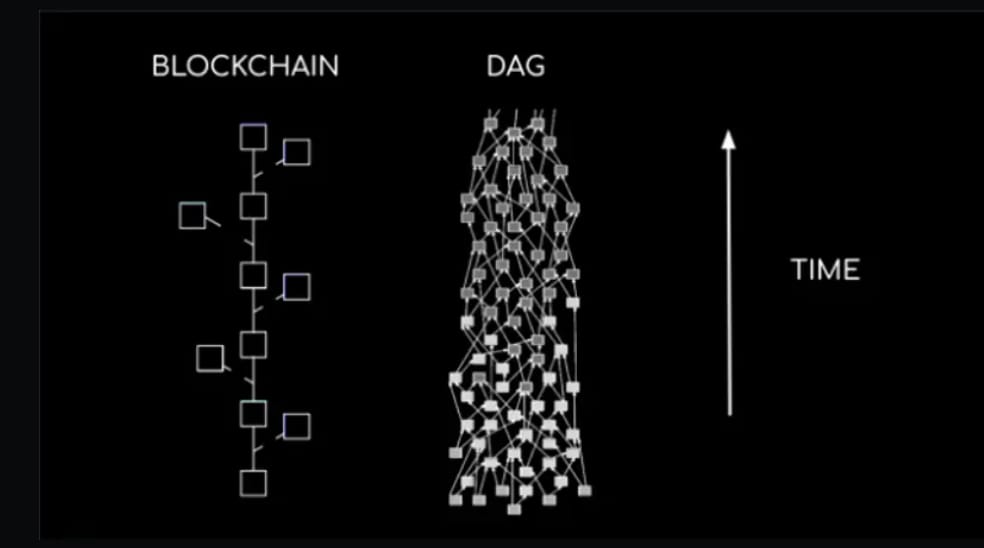

Hedera’s unique hashgraph consensus algorithm functions as a Directed Acyclic Graph (DAG), making it different from most traditional blockchains.

Ethereum Virtual Machine (EVM)-compatible Smart Contracts 2.0 launched on mainnet as of Q1 2022, along with the open-sourcing of its hashgraph algorithm.

Hedera is currently a permissioned network of 26 nodes governed by leading organizations around the globe such as Google and IBM.

Anyone can use the tools offered by Hedera to build fast, customizable, and secure applications.

Introduction

Over the past decade, it has become more apparent that the future of trade, ownership, and the global economy is tokenized. Traditional server-based enterprise solutions lack the ability to make this future a reality. Hedera Hashgraph is a Proof-of-Stake (PoS) Layer-1 distributed ledger that aims to enable the next wave of crypto adoption.

Hedera was born out of Dr. Leemon Baird’s vision of enabling “Shared Worlds, where anyone can gather, collaborate, conduct commerce, and control their own online footprint.” His invention of the hashgraph algorithm would later serve as the foundation for this vision.

Unlike most DLTs, Hedera’s software is overseen by a group of leading enterprises from diverse industries around the world that comprise the Hedera Governing Council. With plans to eventually shift to a fully permissionless and decentralized network, Hedera is currently permissioned, where up to 39 Council members act as the initial node operators. Hedera claims to process transactions faster than most existing networks since decentralized applications (dApps) can be built leveraging the speed of the hashgraph base layer. Even though the network saw a monthly average of ~5 TPS in May 2022, Hedera reports that the network can handle tens of thousands of TPS.

Background

Computer scientists and former US Air Force Academy faculty Dr. Leemon Baird and Mance Harmon co-founded software company Swirlds to test the resiliency of Leemon’s hashgraph algorithm, created in 2015. Swirlds raised the funding to create what would become Hedera Hashgraph towards the end of 2017, and the Hedera mainnet launched one year later in August of 2018.

In just the past few months Hedera has checked off multiple items from its roadmap. It’s open sourced its entire codebase, upgraded the EVM-compatible smart contracts, welcomed its 26th Governance Council member, and passed a vote to enable proxy staking on the network.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

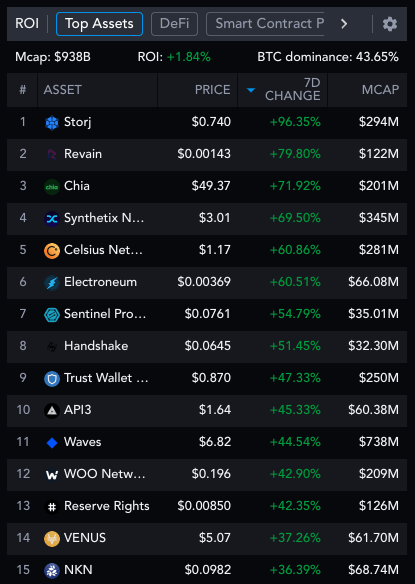

📈 Top Performers This Week

Here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

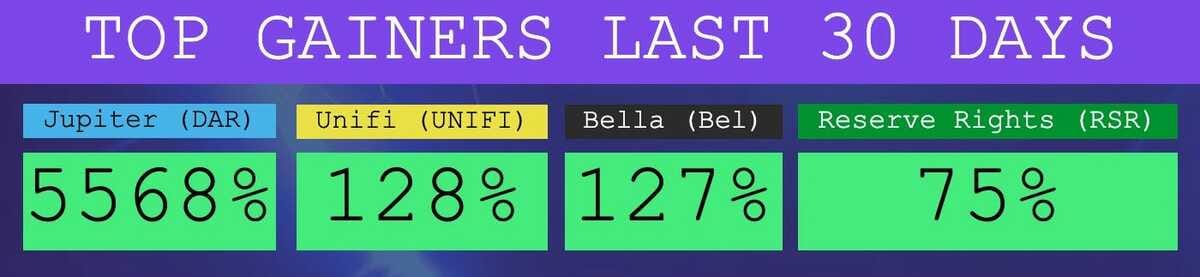

The Top Performers This Month from the Top 100: Jupiter is an L1, Unifi is an L1, Bella is a DeFi Ap, and Reserve Rights is an L1.

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 25,840 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1800 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may belong on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

The information above does not constitute an offer to sell securities or a solicitation of an offer to buy securities. Further, none of the information here is a recommendation to invest in any securities. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.