Learn More at www.chroniclelabs.org and www.bumper.fi

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 200k weekly subscribers. This week we cover FTX filing lawsuits to realize its $16.6B of clawback claims, BlackRock updating its SEC filing for spot bitcoin ETF, Vitalik Buterin sharing an updated 2024 roadmap for Ethereum, and bnew venture rounds for Cumulus ($8M) and Eclipse ($1.9M).

The countdown to one of the key historical catalysts for the start of each four-year bull market cycle

Price performance since we began writing Coinstack in January 2021

Become a Coinstack Sponsor

To reach our weekly audience of 200,000 crypto insiders and daily audience of 60,000 subscribers, view our sponsor deck and schedule a call to discuss sponsoring Coinstack. We’re filling up our 2024 sponsor slots now.

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

The exclusive Oracle of MakerDAO, securing $6bn+ since 2017, Chronicle Protocol is now available to all builders in DeFi and beyond. Recently spun out of Maker, Chronicle launched in September with a new Oracle primitive that is ~80% more cost-efficient vs Chainlink and delivers verifiable data, a first for any Oracle. The data provenance & journey can be tracked end to end and verified cryptographically. Try it on The Chronicle.

Bumper is now live on Arbitrum, early trading incentives are waiting. Introducing a new solution for crypto traders to capitalise on volatility. Open a hedged position to lock in a protected floor price with retained upside exposure or deposit stablecoin liquidity for a juicy yield. Bumper delivers increased efficiency for traders looking to master volatility and maximise their returns. Open your first position today at bumper.fi.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

💼 FTX Says It Is Owed Billions. It Has Filed About a Dozen Lawsuits to Realize Its Claims: FTX is on the hunt for billions of dollars that the cryptocurrency exchange says it is owed. Since filing for bankruptcy in November 2022, the company—through a dozen or so lawsuits—has been trying to claw back the money. FTX is expected to file more such lawsuits in 2024. U.S. bankruptcy code generally allows reorganizing businesses to try to unwind certain transactions that occurred before their filings. In a September presentation to creditors, FTX said it had identified $16.6 billion in such potential actions. The company faces 36,075 customer claims for a total of $16 billion. FTX has said customers would get as much as 90% of whatever is recovered during the bankruptcy. Roughly $9 billion of customer deposits remain unaccounted for. So it’s possible that through these clawbacks plus its venture investments (in firms like Anthropic) that customers may eventuallyget much of their money back.

⚖️ BlackRock Updates SEC filing for Spot Bitcoin ETF, Names Jane Street and JPMorgan as Authorized Participants: BlackRock updated its filing with the Securities and Exchange Commission on Friday for its proposed spot bitcoin ETF in what could be a final push from the asset manager toward gaining approval from the regulator, naming Jane Street Capital and JP Morgan Securities LLC as authorized participants.

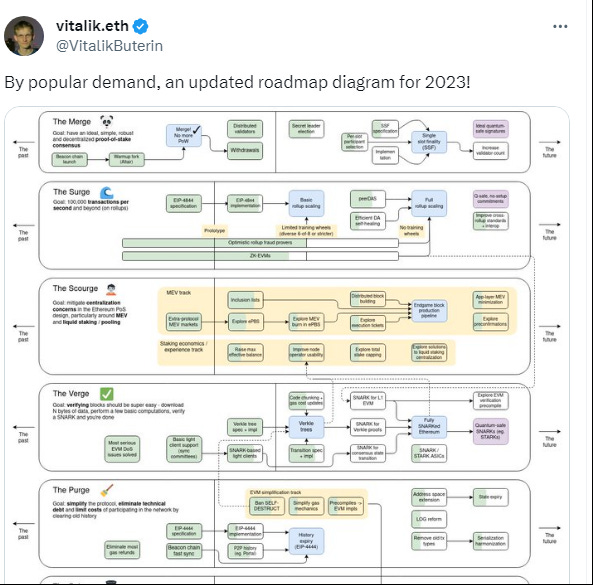

🚀Vitalik Buterin shares updated 2024 roadmap for Ethereum: Co-founder Vitalik Buterin has shared an updated 2024 roadmap for the blockchain, outlining the core priorities for the ecosystem moving forward and how the Ethereum network did against its 2023 R&D goals.

⚖️ Coinbase's Top Lawyer, RFK jr., and More Slam Decision to Drop Second SBF trial: United States prosecutors have decided not to try Sam Bankman-Fried on the remaining charges he faces, including charges of foreign bribery, bank fraud, and more.

👨⚖️ Judge Sides With SEC Over Do Kwon, Says UST, LUNA Are Securities: A federal judge ruled Thursday that Terraform Labs and its founder, Do Kwon, offered and sold unregistered securities in the form of cryptocurrencies, including LUNA and UST, in a major victory for the Securities and Exchange Commission (SEC).

Coinstack Daily

We’re launching a new daily edition Coinstack that covers all the day’s news and funding announcements. If you’d like to join our daily edition, subscribe here.

💬 Tweet of the Week

Source: @EricBalchunas

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Welcome to 2024! Last month Ethereum handled $97.8B of on-chain volume. This was the network's highest monthly volume in all of 2023 and represents a 21% increase month-over-month.

Source: @DavidShuttleworth

2. As we close out December, there have been some interesting Ethereum movements across centralized exchanges. Last week over 220,000 ETH ($516M) was moved off of exchanges in one day, easily the largest daily outflow since June.

Source: @DavidShuttleworth

3. Despite largely positive momentum from both retail and institutions throughout the broader crypto markets for the past 6 months, we are poised to close out the year with substantially less stablecoin liquidity than we started with.

Source: @DavidShuttleworth

4. Dopex V2 Crosses $50M+ In Option Volume After One Month

Source: OurNetwork

5. Azuro had $650k in revenue in December. On track to become a top 10 DeFi protocol by revenue in H1 2024.

Source: @RossToTheFuture

6. Top Moving Coins From the Top 100

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Paul Veradittakit, is a Managing Partner at Pantera Capital, one of the oldest and largest institutional investors focused on investing into blockchain companies and cryptocurrencies. This is an excerpt from the full article, which you can find here.

Introduction

2023 marks 10 years since Pantera became the first institutional asset manager in the US to invest in Bitcoin, recognizing then its tremendous resilience and potential for disruption. This past year in particular has been a testament to the blockchain space’s ability to recover from even the harshest external conditions. From the depths of the “crypto winter” at the beginning of the year, the overall market cap of the crypto space has grown by 90% to $1.69 Trillion, with Bitcoin more than doubling from its yearly low of $16k in Jan 2023 to over $40k in December.

In 2023, we’ve continued to feel some of the aftershocks of the wave of major collapses in 2022, most notably the FTX trial and verdict and the Binance plea deal in November, as well as the momentary depegging of the USDC stablecoin in March amidst the banking crisis (which triggered memories of the Terra UST collapse in May 2022). At the same time, we’ve continued to see breakthroughs in the space, from technological innovations to regulatory wins, to increased institutional adoption to novel social and consumer experiences.

Some of the highlights over the past year include the Ethereum’s Shapella upgrade to a full Proof of Stake network in March, the ruling that XRP was not a security in July, the launch of Paypal’s PYUSD stablecoin and Grayscale’s win over the SEC for the Bitcoin spot ETF in August, and the pioneering of novel tokenized social experiences such as the rise of friend.tech. We thus enter 2024 with a great optimism on the road ahead.

Here are my top predictions for crypto industry in 2024:

1. The resurgence of the Bitcoin ecosystem and “DeFi Summer 2.0”

In 2023, Bitcoin has staged a comeback, with Bitcoin dominance (Bitcoin’s proportion of crypto market cap) rising from 38% in January to around 50% in December, making it one of the top ecosystems to look out for in 2024. There are at least three major catalysts driving its renaissance in the next year: (1) the fourth Bitcoin halving due for April 2024, (2) the expected approval of several Bitcoin spot ETFs from institutional investors, and (3) a rise in programmability features, both on the base protocol (such as Ordinals), as well as Layer 2s and other scalability layers such as Stacks and Rootstock.

On the infrastructure level, we expect to see a proliferation of Bitcoin L2s and other scalability layer to support smart contracts. The Bitcoin ecosystem will likely coalesce around one or two Turing-complete smart contract languages, with top contenders including Rust, Solidity, or the extension of a Bitcoin-native language such as Clarity. This language will become the “standard” for Bitcoin development, similar to how Solidity is considered to be the “standard” for Ethereum development.

We also see the fundamentals for a possible “DeFi summer 2.0” on Bitcoin. With Wrapped BTC (WBTC) today having a market cap and Total Value Locked (TVL) of around $6B, there is clearly an enormous demand for Bitcoin in DeFi. Today, Ethereum has about 10% of its $273B market cap in TVL ($28B). As Bitcoin DeFi infrastructure matures, we could potentially see Bitcoin DeFi Total Value Locked (TVL) rise from the current $300M (<0.05% of market cap) to ~1-2% of Bitcoin market cap (~$10-15B at current prices). In this process, many Ethereum DeFi practices are likely to be transferred and “naturalized” on Bitcoin, such as the recent rise of BRC-20 inscriptions and ideas such as staking such as in Babylon’s L2.

Bitcoin NFTs, such as those inscribed on Ordinals, may also see increased popularity in 2024. As Bitcoin has much higher cultural recognition and memetic value, it is possible that web2 brands (such as luxury retailers) will choose to release NFTs on Bitcoin, similar to how Tiffanys partnered with Cryptopunks to release the “NFTiff” pendants collection in 2022.

Whereas Web2 has moved from social to finance, Web3 is moving from finance to social. In August 2023, friend.tech pioneered a new form of tokenized social experiences on the Base L2, with users able to buy and sell fractionalized “shares” of others’ X (fka. Twitter) accounts, reaching a peak of 30k ETH TVL (~$50M USD at the time) in October, and inspiring several “copycat projects” such as post.tech on Arbitrum. It seems that friend.tech, through financializing Twitter profiles, has successfully pioneered a new tokenomics model for the SocialFi space.

In the upcoming year, we expect more experiments in the social space, with tokenization (both as fungible and non-fungible tokens) playing a key role in reinventing the social experience. Fungible tokens are more likely to be novel forms of points and loyalty systems, whereas non-fungible tokens (NFTs) are more likely to serve as profiles and social resources (such as trading cards). Both would be able to be traded on-chain and participate in DeFi ecosystems.

Lens and Farcaster are two of the leading web3-native applications integrating DeFi with social networks. Projects like Blackbird will also popularize tokenized points systems for loyalty programs in specific verticals (such as restaurants), using a combination of stablecoin payments and tokenized rebates to reinvent the consumer experience, functionally providing an on-chain alternative to credit cards.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.chroniclelabs.org and www.bumper.fi