Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 300k weekly subscribers. This week, Gemini settled CFTC case, US prosecutors estimated over 1 million victims, Bitcoin bounced back above $100k and big new funding rounds for Silencio ($112M) and Beam ($72M).

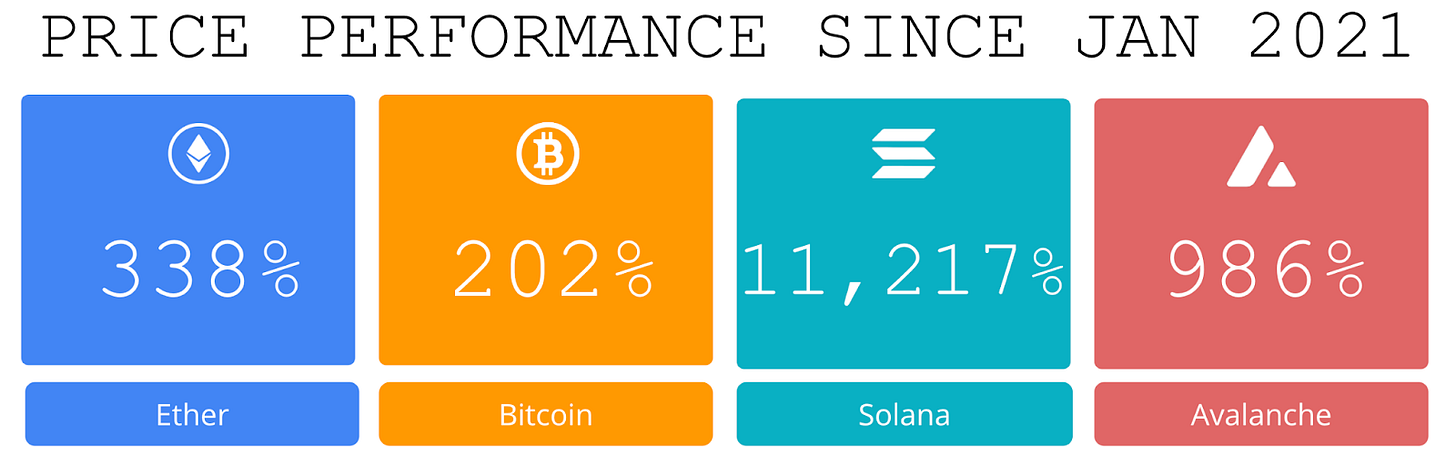

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2025 Coinstack Sponsors…

Amphibian Capital, managing $120M+ AUM, is a fund of the world's leading hedge funds. +21.58% net YTD approx with their USD fund, +16.51% net BTC on BTC YTD (*+164.8% in USD terms), and +19.61% net ETH on ETH YTD (+80.5% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com

Become a Coinstack Sponsor

To reach our weekly audience of 300,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ Gemini settles CFTC Bitcoin futures case for $5 million:Gemini co-founders Tyler and Cameron Winklevoss agreed to pay a $5 million fine to resolve the Commodity Futures Trading Commission (CFTC) allegations that it misled regulators during its bid to launch the first US-regulated Bitcoin (BTC) futures contract.

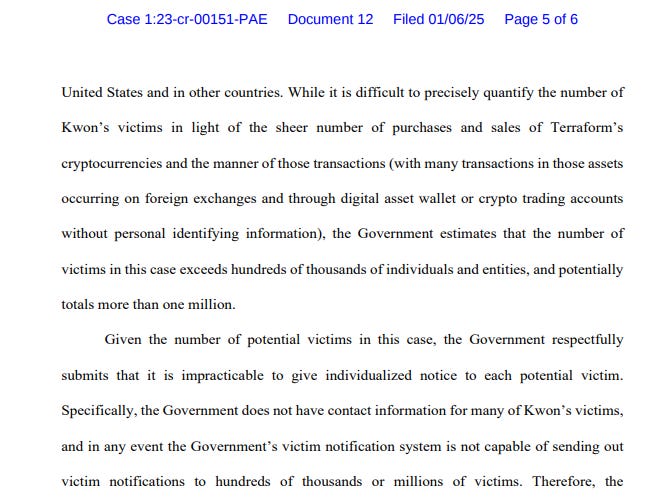

⚖️ US prosecutors estimate over 1 million victims in Do Kwon’s criminal case: U.S. prosecutors, who have filed criminal charges against former Terraform Labs CEO Do Kwon, estimate that the collapse of TerraUSD and Luna cryptocurrency potentially affected more than one million victims.

🚀 Bitcoin back above $100,000 since Dec. 19: Bitcoin has climbed back above $100,000 for the first time since Dec. 19, 2024, reaching $102,137, a 24-hour increase of 4%.

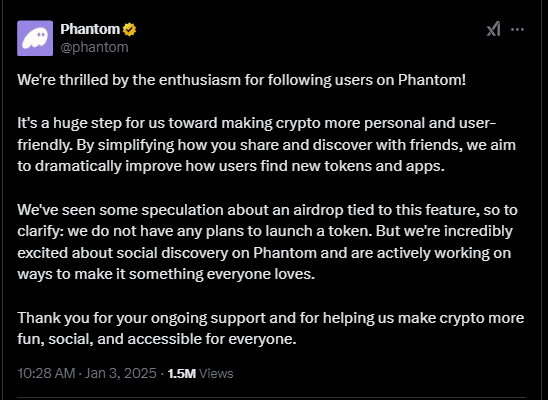

🚫 Crypto wallet Phantom quashes airdrop rumors after social feature launch:Crypto wallet Phantom dispelled rumors of an incoming airdrop in a message posted to its X account on Friday, after some X users speculated that the platform's recent social feature launch could lead to a token launch.

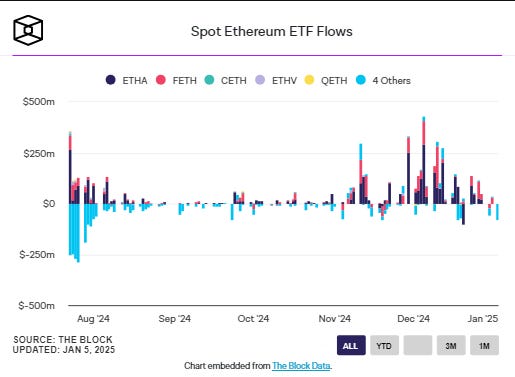

📈 Spot ether ETFs logged record monthly inflows exceeding $2 billion in December:The nine ether ETFs had over $2.08 billion in net inflows last month, according to data from SoSoValue. This is nearly double the amount of November’s net inflows of just over $1 billion.

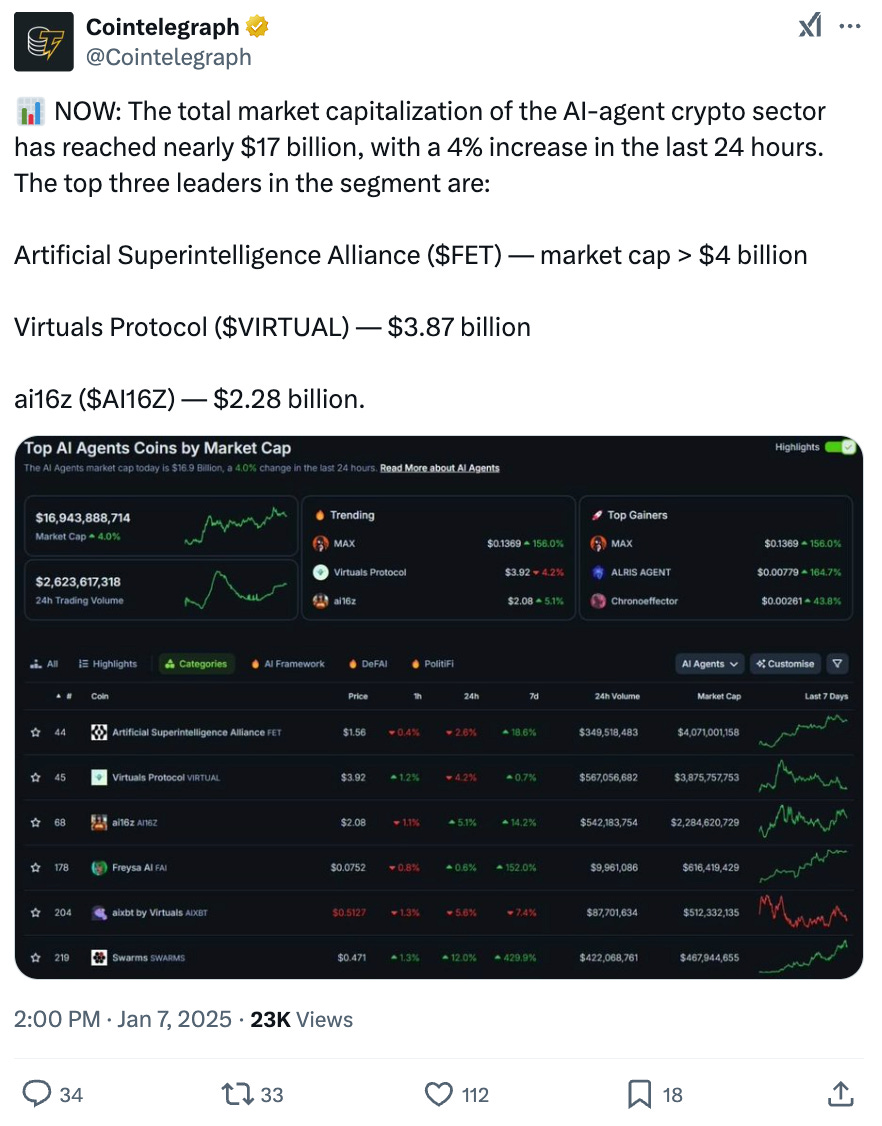

💬 Tweet of the Week

Source: @Cointelegraph

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

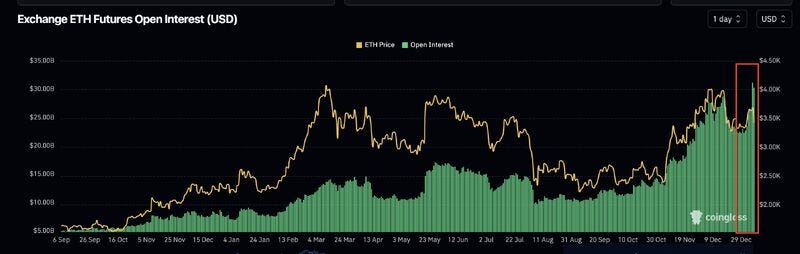

1. We enter the first week of 2025 with considerable volume and activity:

ETH futures open interest has grown by 40% ($8.8B) this week to reach $31.1B, its highest level ever.

SOL open interest experienced similar traction, growing by 50% to also reach a new all-time high ($6.4B).

Meanwhile, BTC open interest grew by 17% to $65B.

Source: @DavidShuttleworth

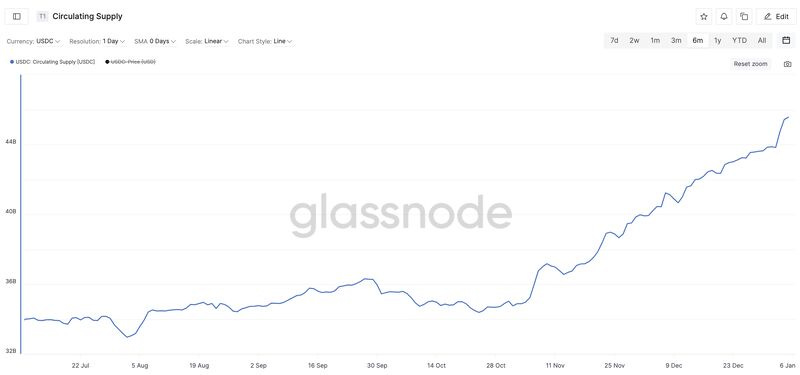

2. Stablecoin liquidity and demand continues to surge. The total circulating supply of Circle USDC increased by $2.3B (5.5%) last week to reach $45.7B, its highest level since October 2022.

Let's see how this impacts the broader market 😈

Source: @DavidShuttleworth

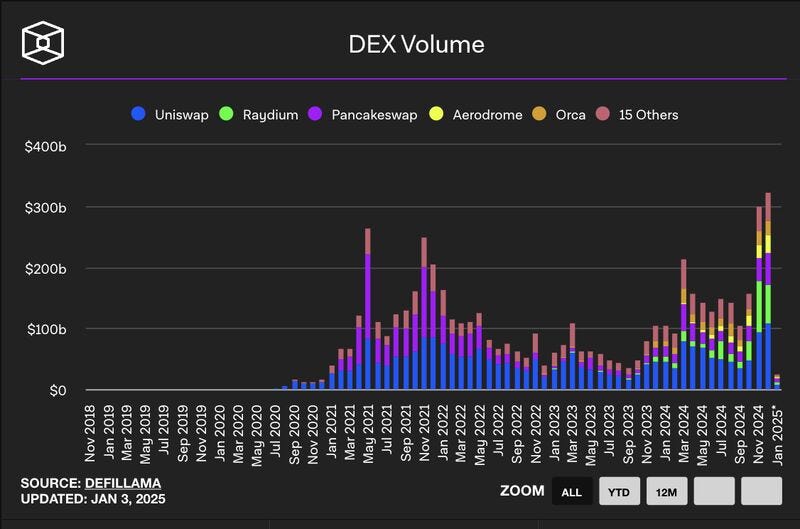

3. Absolutely wild decentralized exchange volume in December. On the month, DEXs handled an incredible $322B in total volume. This is the most monthly DEX volume ever and is also the first time it has surpassed $300B.

During this time, Uniswap led the way and also set a new record for monthly volume with $109B. Raydium followed with $61B (the second most ever), along with PancakeSwap ($54B), Aerodrome ($29B, the most ever), and Orca ($23.5, the most ever).

Overall, monthly DEX volume has grown by 206% from December 2023 and has posted back-to-back months of record breaking numbers.

Source: @DavidShuttleworth

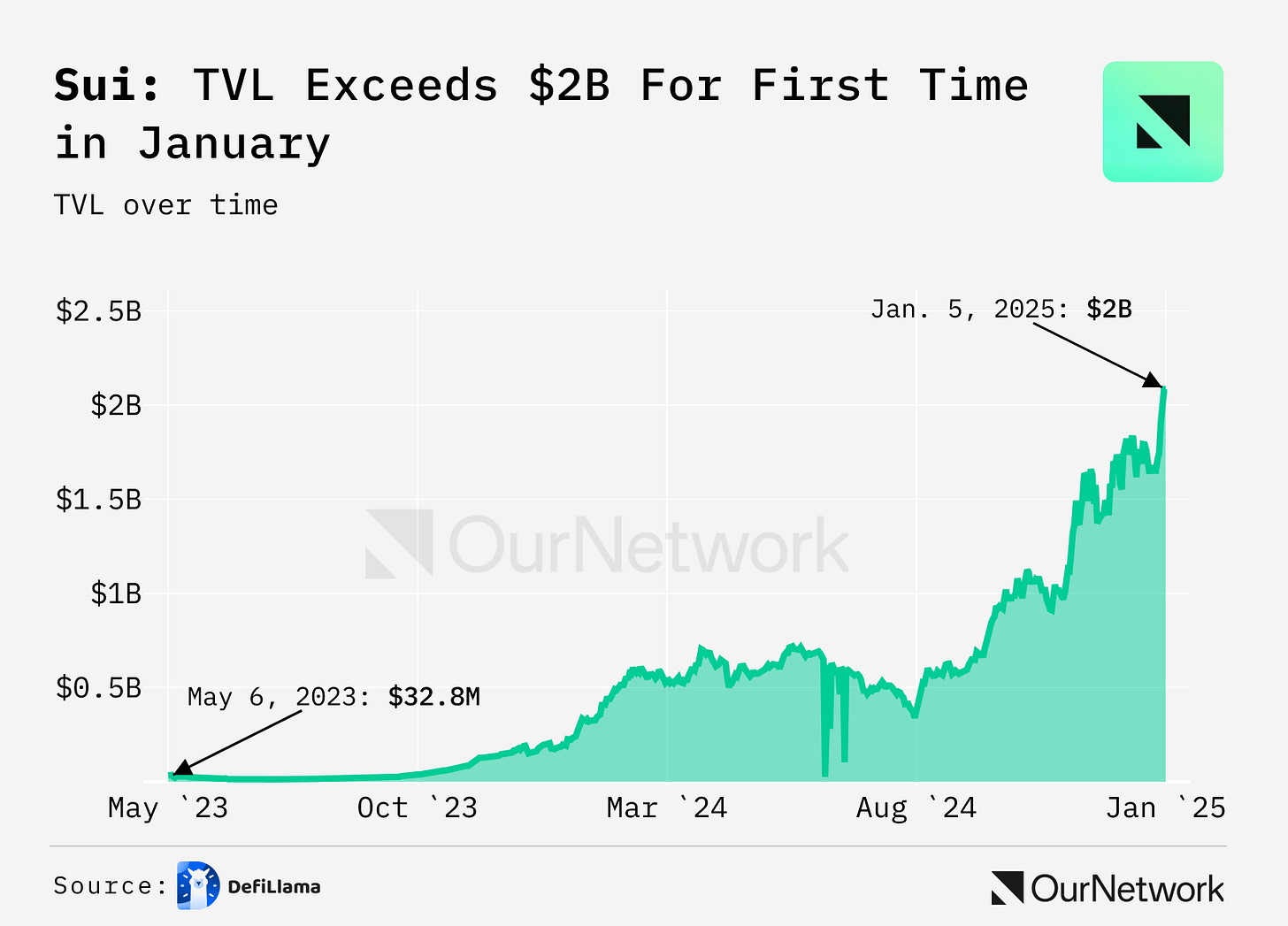

4. Sui's TVL Soars to $2.06B, Lead by Suilend

Source: @OurNetwork

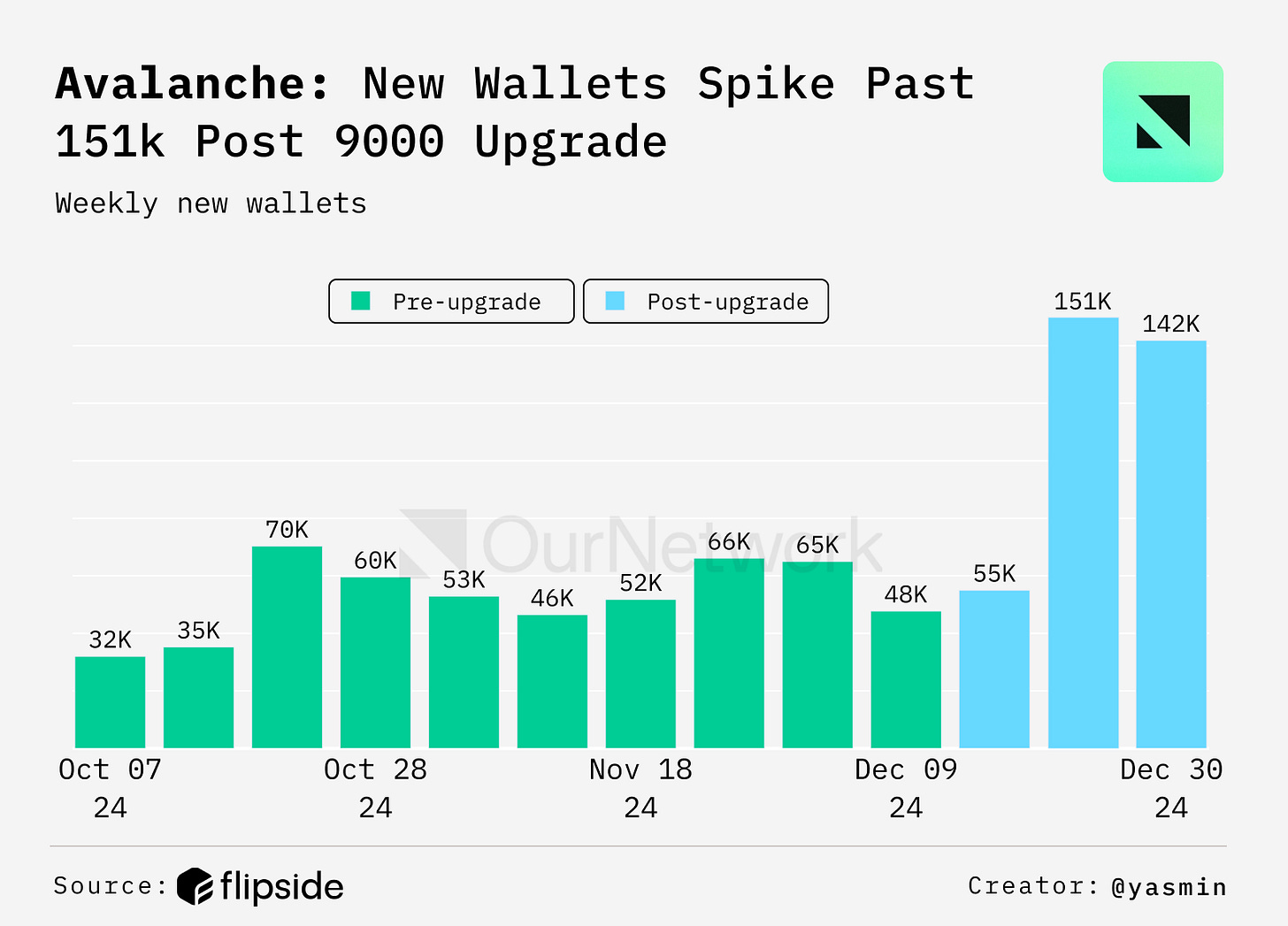

5. Avalanche 9000 — Gas Fees Analysis - 90% Cost Reduction

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is made possible by a community of contributors who actively participate at the forefront of this emerging data landscape. This is an excerpt from the full article, which you can find here.

Layer 1s 🛣️

Ethereum | Sui | Avalanche | TRON | Ronin

Ethereum 🦄

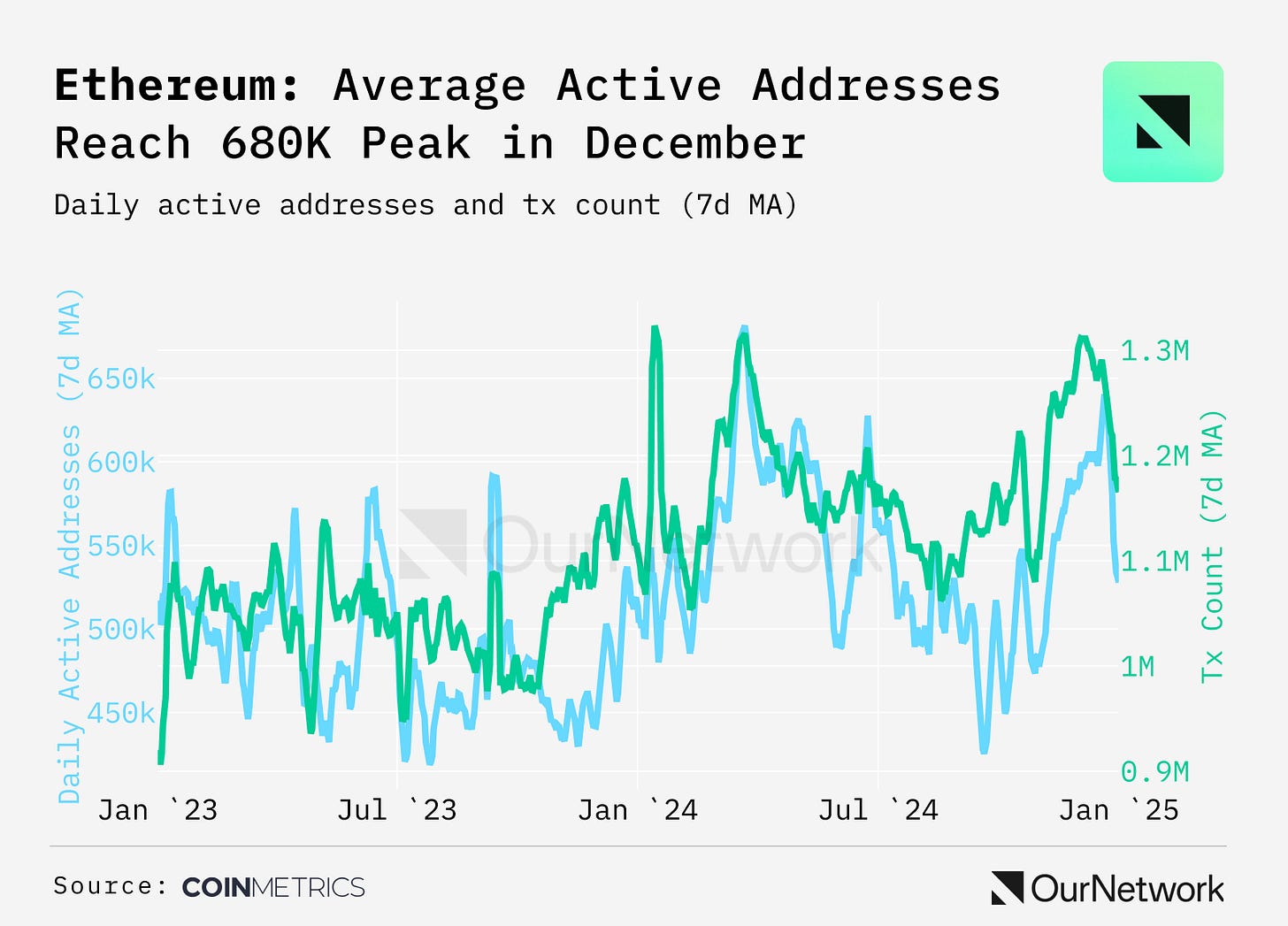

📈 Ethereum Mainnet Hits 1.3M Transactions, Inflation Rate Drops to 0.5%, 3M+ ETH Bridged to L2s

Activity on Ethereum mainnet, the most valuable smart contract platform with a market capitalization of $440B, trended higher in March 2024 spurred by marketwide growth, with daily active addresses and transaction counts rising to 680K and 1.3M respectively. While activity tapered down in the summer after the Dencun upgrade —also in March 2024— it has since rebounded, supported by the Layer 2 ecosystem as markets heat up once again, illustrating the reflexive nature of blockspace demand on Ethereum.

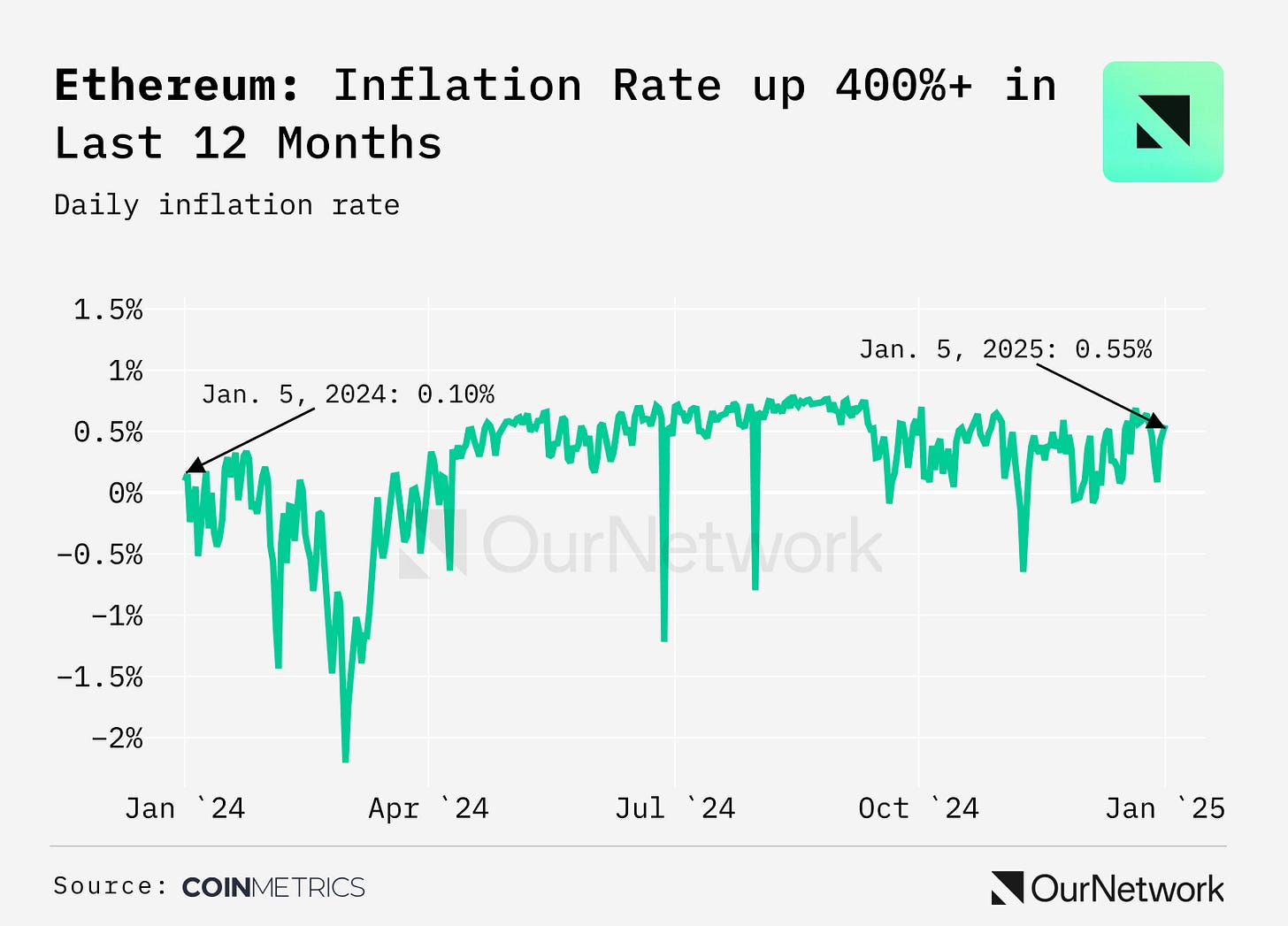

Ethereum’s inflation rate, tied to blockspace demand, stands at 0.5% as total issuance (78K) exceeded ETH burned (47K) in 2024. ETH continues to be exported, with over 3M tokens bridged to Base, Arbitrum, and other Layer 2s, as the upcoming Pectra upgrade scales blob capacity and grows blockspace secured by ETH.

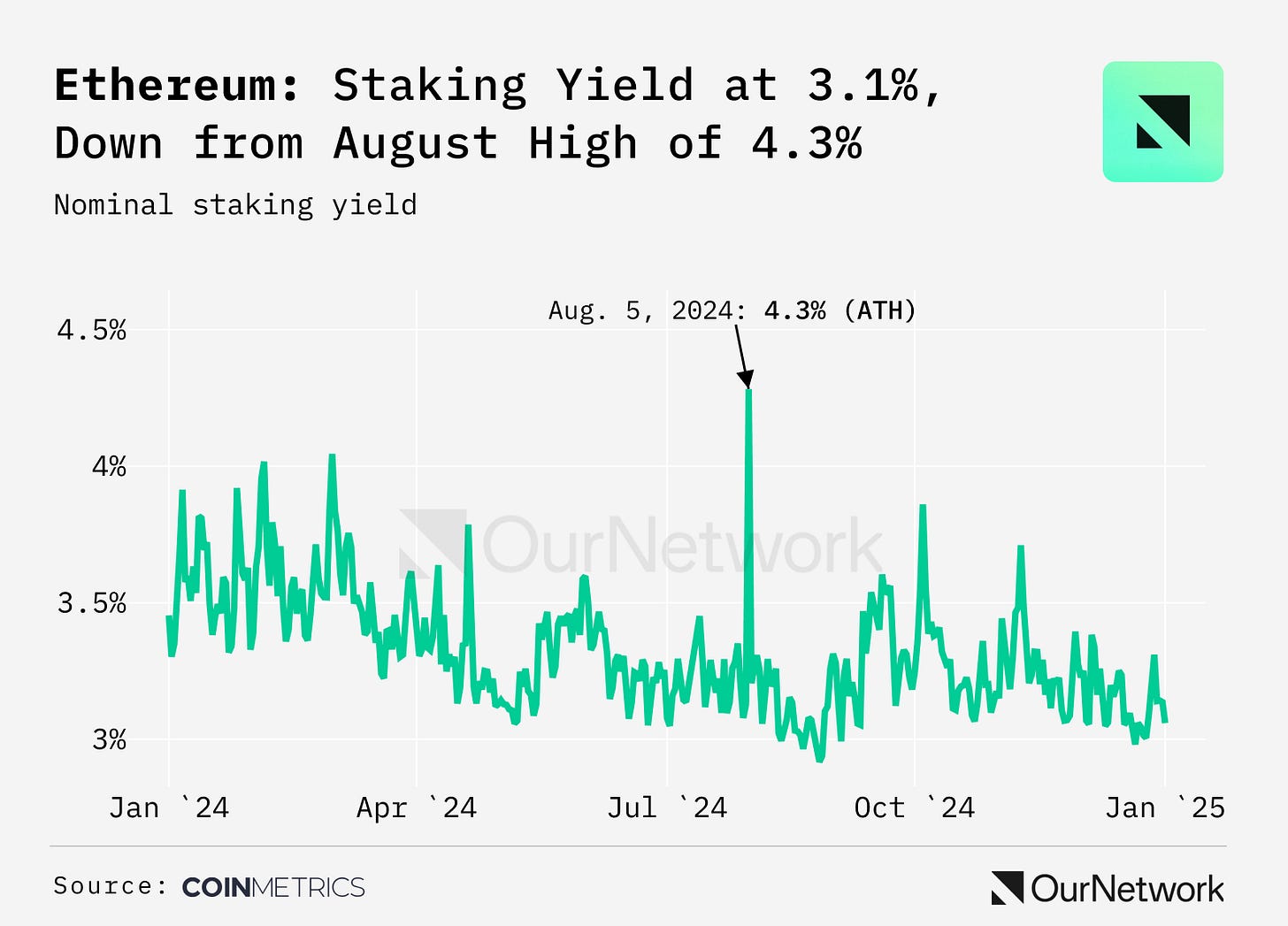

A 3.1% nominal staking yield (2.6% inflation-adjusted) presents an attractive proposition, incentivizing validators and institutions alike. Prospects of a staked Ether ETF, rising blobspace demand could drive deflationary ETH supply and strong on-chain growth in 2025.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com