Social Links: Twitter | Telegram | Newsletter

Learn More at www.tokenx.is, and www.decard.io

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 115k weekly subscribers. This week we cover Gemini suing DCG, former FTX executive Ryan Salame being caught in a federal campaign finance probe, Multichain Bridges bring exploited for ~$130M, Ryan Selkis’ 2H 2023 Crypto Theses, and big new venture rounds for Sound ($20M) and Alluvial ($12M). Join our daily crypto news roundup here.

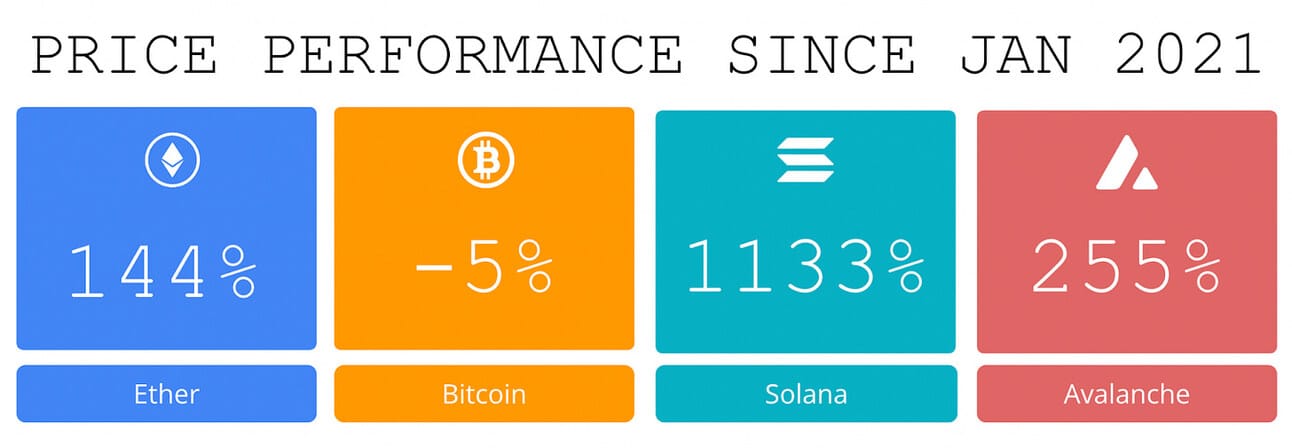

Price performance since we began writing Coinstack in January 2021. Things are starting to heat up!

Published By Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Join our Daily Crypto News Roundup

We’ve launching a new daily edition Coinstack that covers all the day’s news. If you’d like to join our daily edition, subscribe here.

Thanks to Our 2023 Coinstack Sponsors…

To reach our weekly audience of 115,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

TokenX streamlines Web3 tokenization for Web2 companies, simplifying integration of blockchain technology into existing applications. Powerful APIs tokenize assets with on/off blockchain metadata, policies, and authentication. Leveraging TokenX, Web2 companies can access the benefits of decentralization, ownership, authentication, and transparency provided by Web3, unlocking new opportunities for growth, customer engagement, and innovation. Learn more at www.tokenx.is

Unleash the power of DECARD’s DEX, the decentralized exchange designed to conquer the $11.5 trillion spot market. DECARD’s unique and patented tech stack, build on Tagion infrastructure, ensures a seamless trading experience and delivers never-before-seen effective order books in a decentralized environment. Bid farewell to frontrunning and custody risks and embrace a secure future with DECARD’s DEX. Join and revolutionize the way you trade at DECARD.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

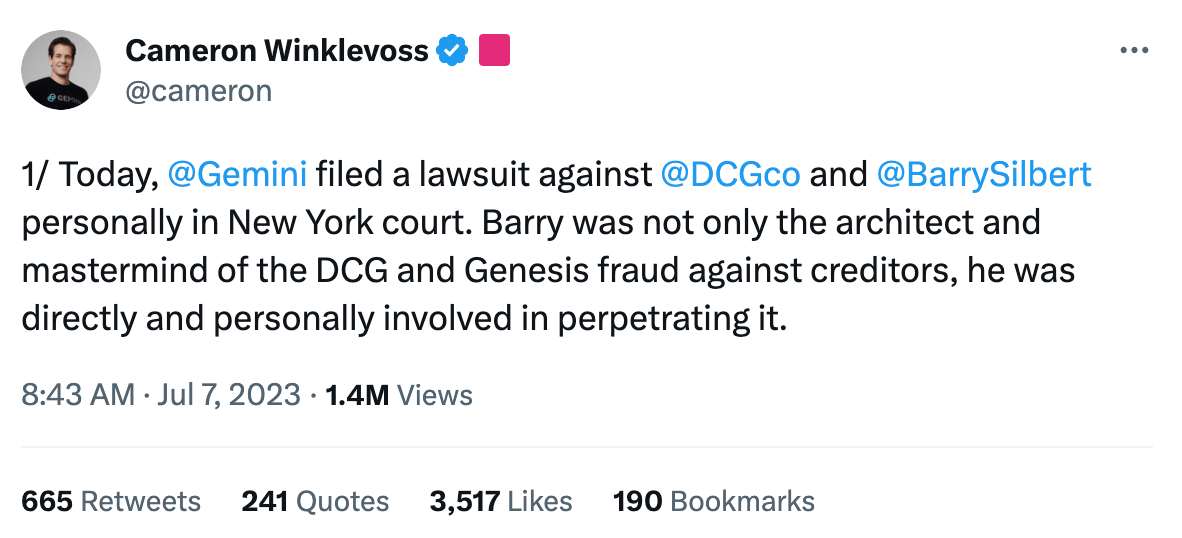

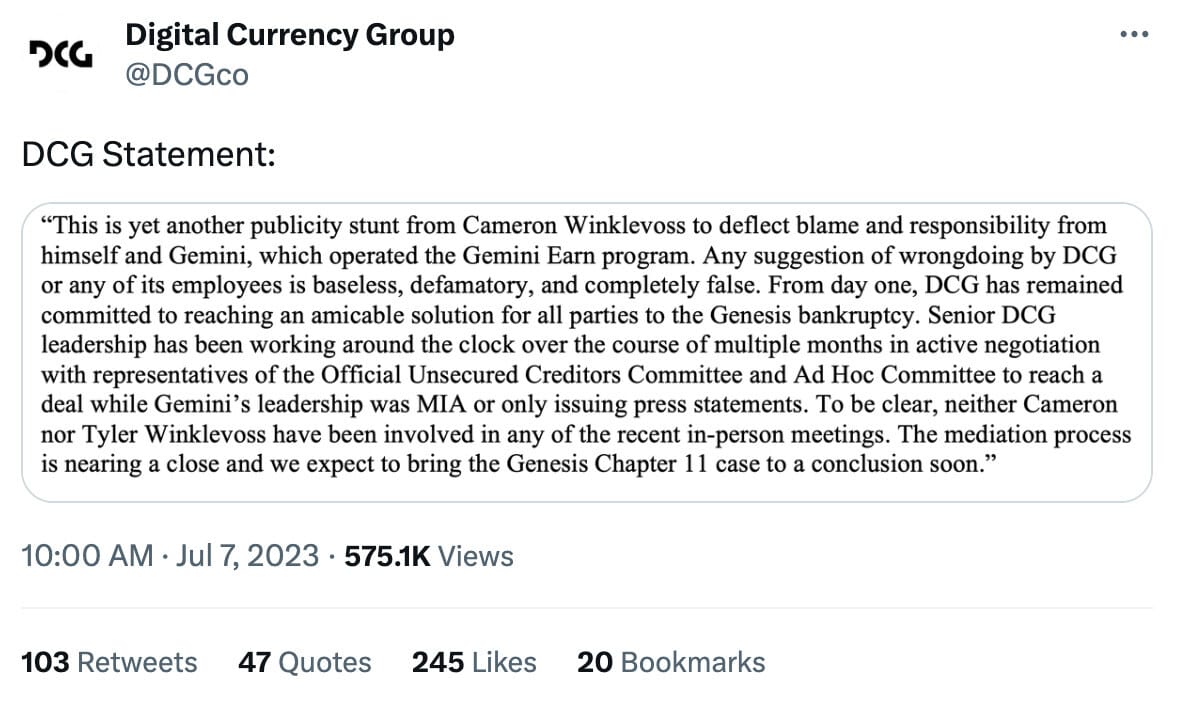

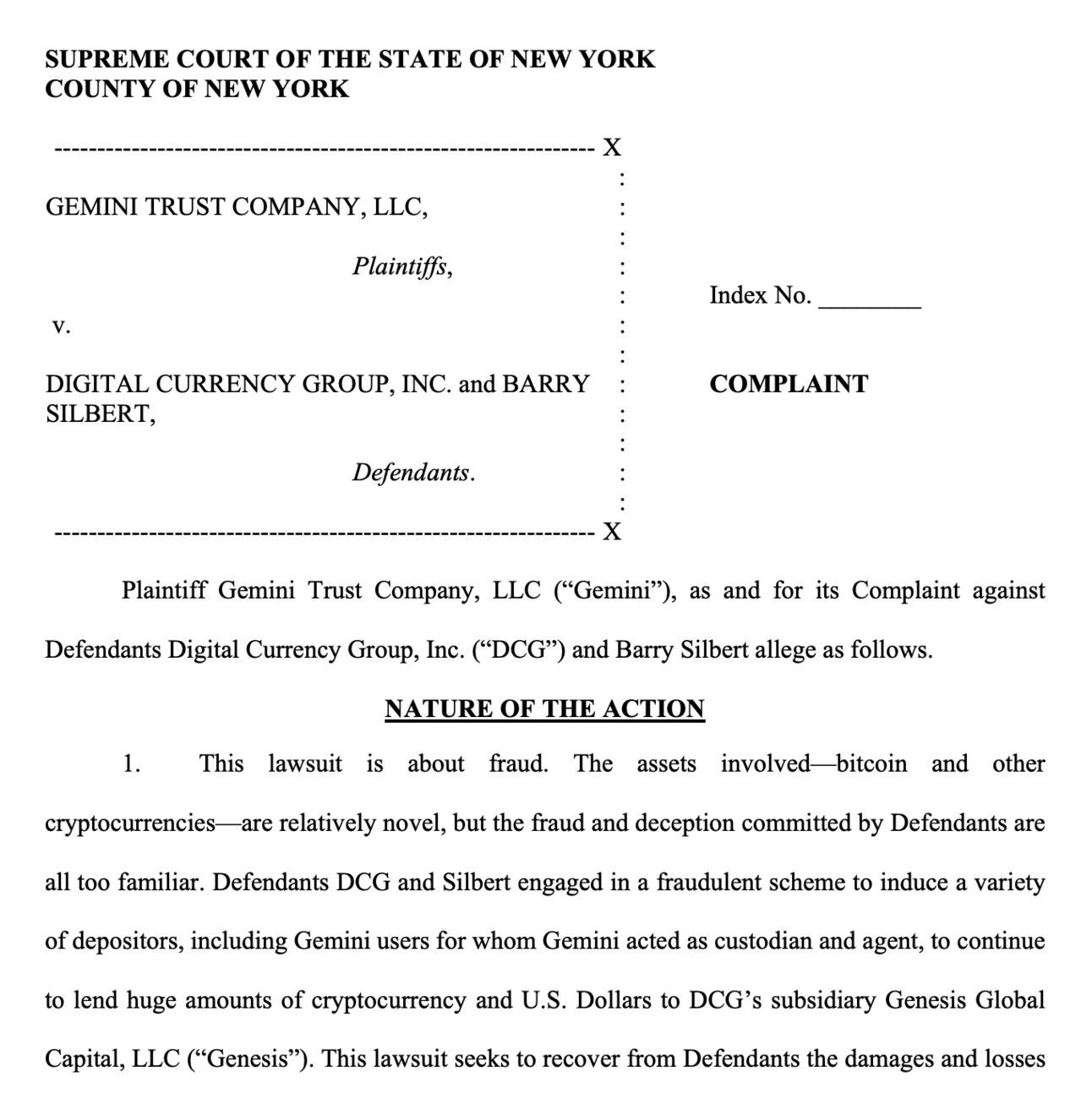

🧑⚖️ Gemini Sues Digital Currency Group and Founder Barry Silbert Alleging 'Fraud'- Crypto trust firm Gemini sued Digital Currency Group last Friday, alleging the industry conglomerate and its founder Barry Silbert committed "fraud" through DCG subsidiary Genesis, which held funds for Gemini tied to the latter company's Earn program. See the complaint here.

⚖️ Former FTX Exec Probed Over Possible Campaign Finance Violations- Ryan Salame, a former senior executive at bankrupt crypto exchange FTX, is being investigated by federal prosecutors in Manhattan over potential violations of campaign finance law.

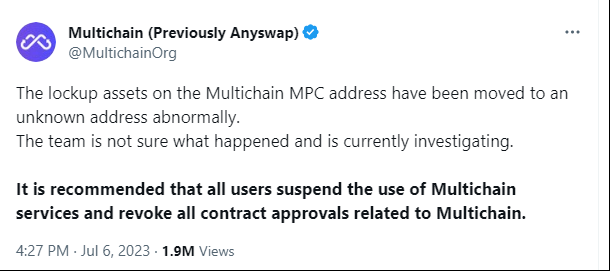

🎭 Multichain Bridges Exploited for Nearly $130M Across Fantom, Moonriver and Dogechain- Cross-chain router protocol Multichain has been exploited for nearly $130 million after an attacker siphoned capital out of numerous token bridges.

🔍 Kraken Co-Founder Jesse Powell Under Federal Investigation on Claims of Hacking, Cyberstalking Non-Profit-The F.B.I. searched the home of the cryptocurrency executive Jesse Powell in March as part of a criminal investigation into claims that he hacked and cyber-stalked a nonprofit that he founded, three people with knowledge of the matter said.

5. ⚖️ Seoul Court Holds First Hearing for Terra Co-Founder Daniel Shin - The Seoul Southern District Court on Monday held the first preliminary hearing for Terraform Labs co-founder Daniel Shin and seven other former Terraform employees

6. 🎉 Dell Launched a New Global Loyalty Program With Web3 Data Storage Benefits - Dell partnered with Oort, a web3 data cloud service provider, to launch a new global loyalty program with decentralized data storage.

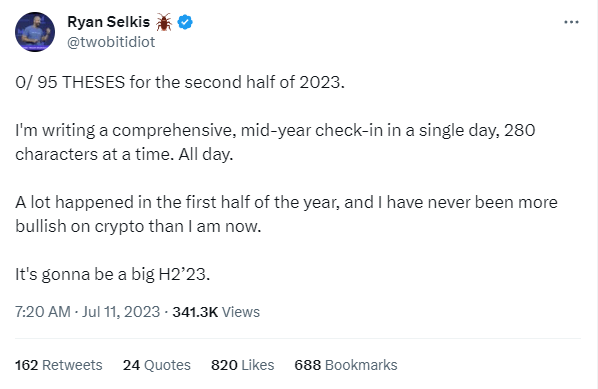

💬 Tweet of the Week

Source: @twobitidiot

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

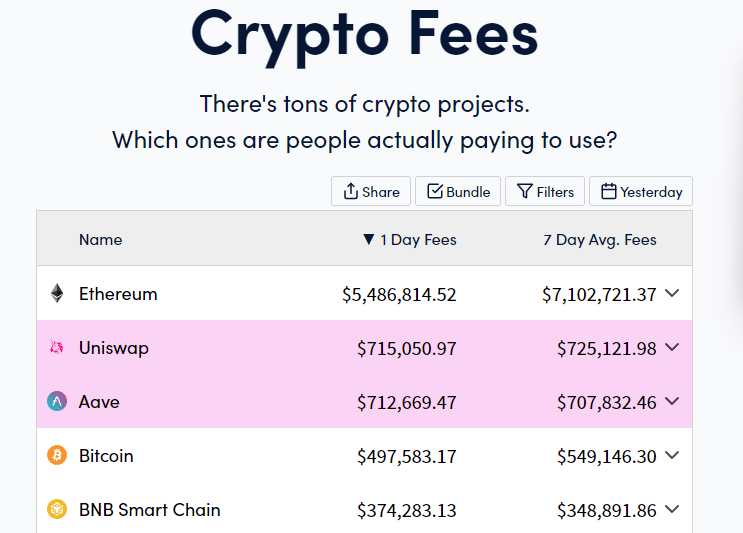

1. Bitcoin surpasses BNB via 1-Day and 7 Day Avg Fees, Trails Ethereum by 14x

Source: @CryptoFees.info

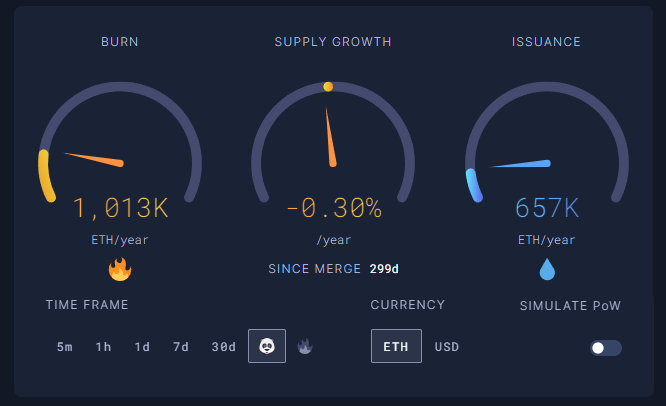

2. Since “The Merge” ETH has remained deflationary with -0.30% supply growth

Source: @UltraSoundMoney

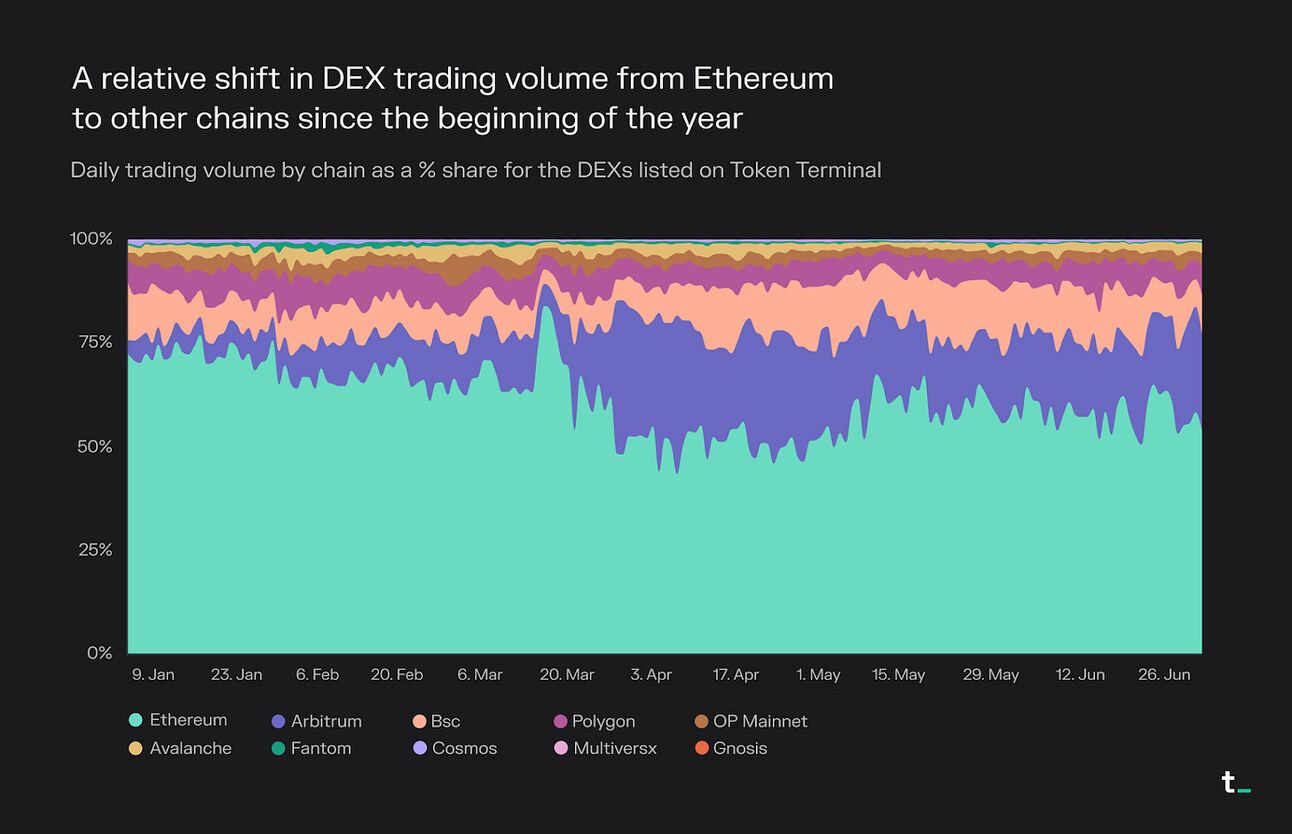

3. DEX trading volume is shifting to chains outside of Ethereum

Source: @TokenTerminal

4. Since the beginning of 2023, the share of DEX trading volume on Ethereum has decreased from 72% to 54% due to growth on Arbitrum.

Source: @TokenTerminal

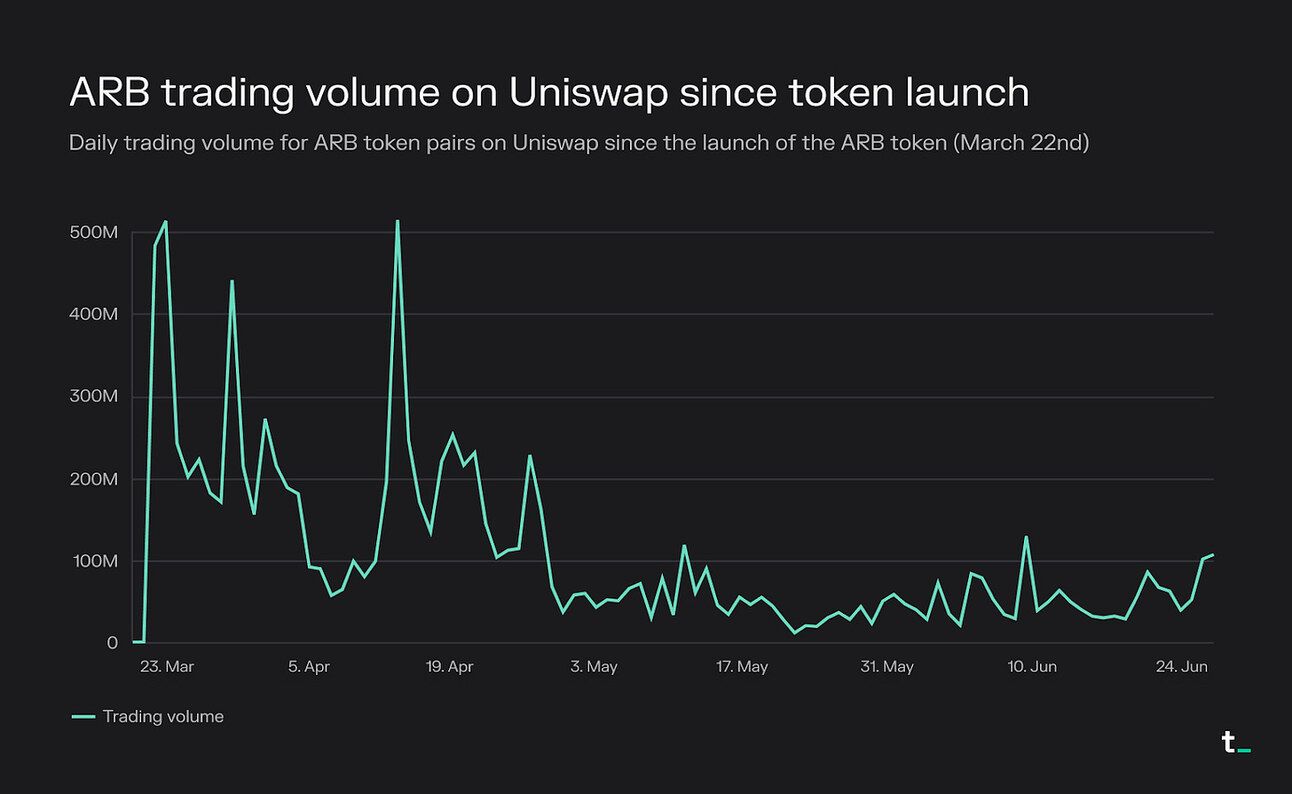

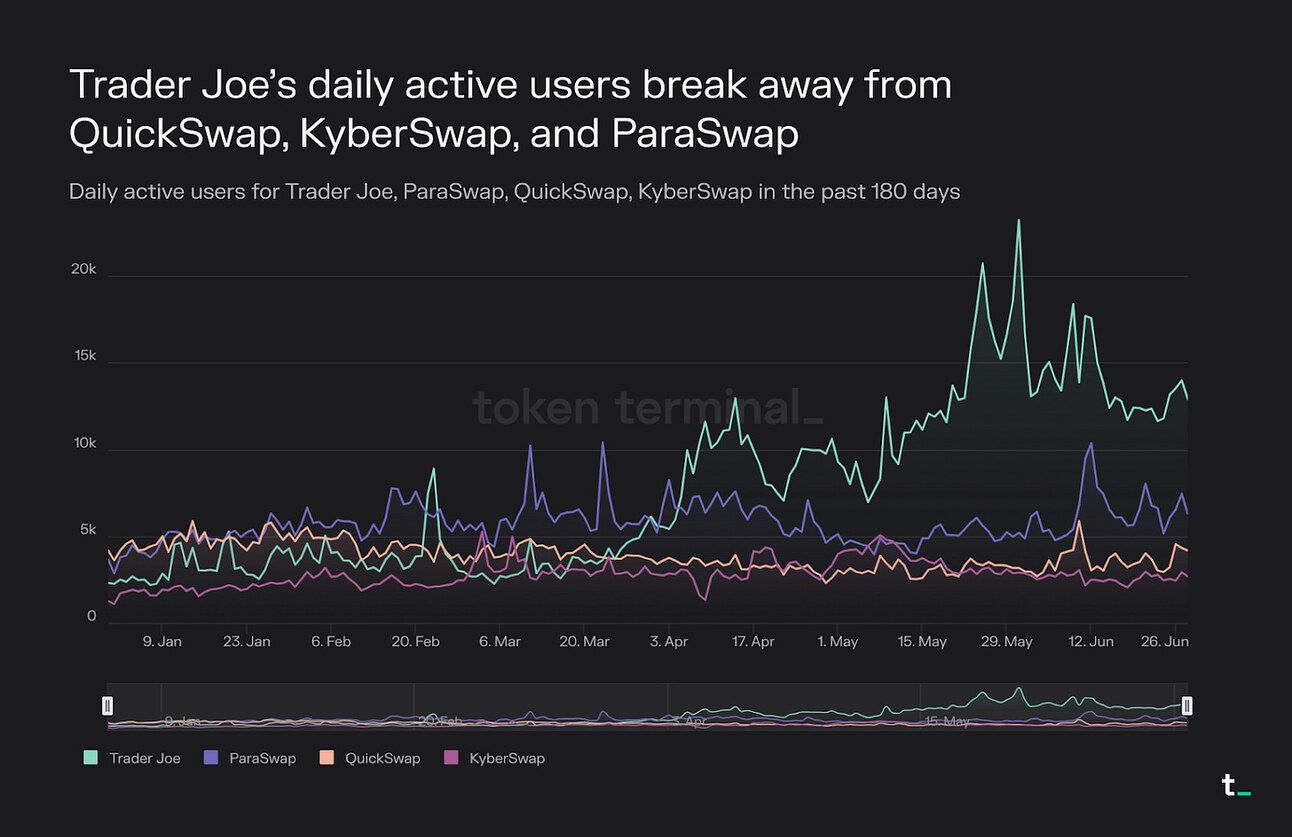

5. Trader Joe, Quickswap, KyberSwap, and ParaSwap are the best-performing projects in the DEX market sector based on growth in trading volumes over the past 180 days.

Source: @TokenTerminal

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Messari brings transparency to the crypto economy. Messari wants to help investors, regulators, and the public makes sense of this revolutionary new asset class and build data tools to drive informed decision-making and investment. This is an excerpt from the full article, which you can find here.

Primer on Filecoin

At its core, Filecoin offers distributed data services on top of the InterPlanetary File System (IPFS). The Filecoin blockchain is primarily used by:

The demand side of the storage market (i.e., consumers of data storage services)

The supply side of the storage market (i.e., service nodes with excess storage capacity).

Beyond verifiable storage, the introduction of the Filecoin Virtual Machine (FVM) in March 2023 enables user-programmable smart-contracts, and data services such as perpetual storage, data retrievability, and generalized compute. Other efforts, such as compute over data, and retrieval markets are expected services to be anchored into the Filecoin blockchain.

Like other Web3 infrastructure networks, Filecoin facilitates a crypto economy (referred to as cryptoecon throughout this report) around the supply and demand of data services. Filecoin uses its native token, FIL, to incentivize service nodes to serve potential demand via storage deals. This report models FIL’s cryptoecon using historical data and assumptions of future supply and demand of data services.

Understanding FIL CryptoEcon

FIL is consumed by users and applications accessing data-related services on the Filecoin network. The FIL token can be used for storage deal initiations and renewals, as well as for data retrieval. While FIL currently accrues value from burning network transaction fees and from locking, FIL demand is set to expand beyond storage, following the launch of the FVM. Hence, it’s important to understand the long-term implications for the FIL cryptoecon.

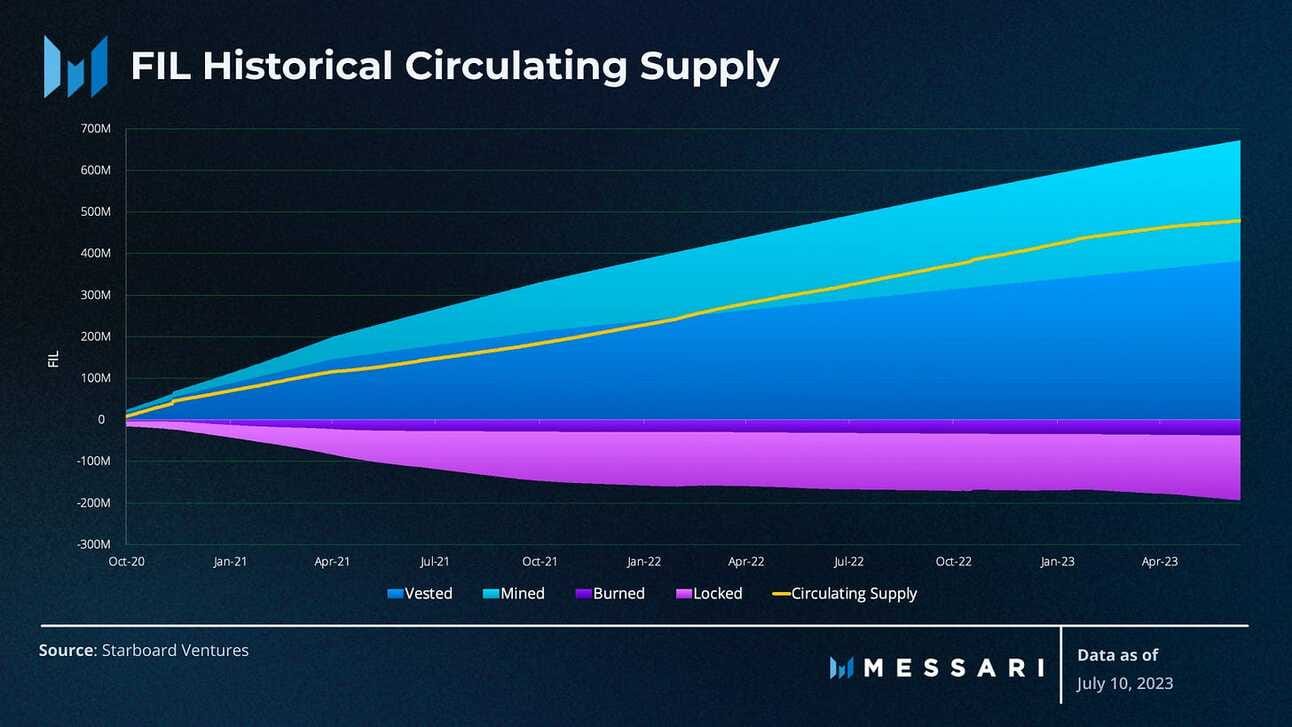

The FIL supply consists of:

Emissions via block reward minting and vesting.

Reductions via locks and burns.

These four components of the FIL supply are discussed in detail below.

Block Reward Minting

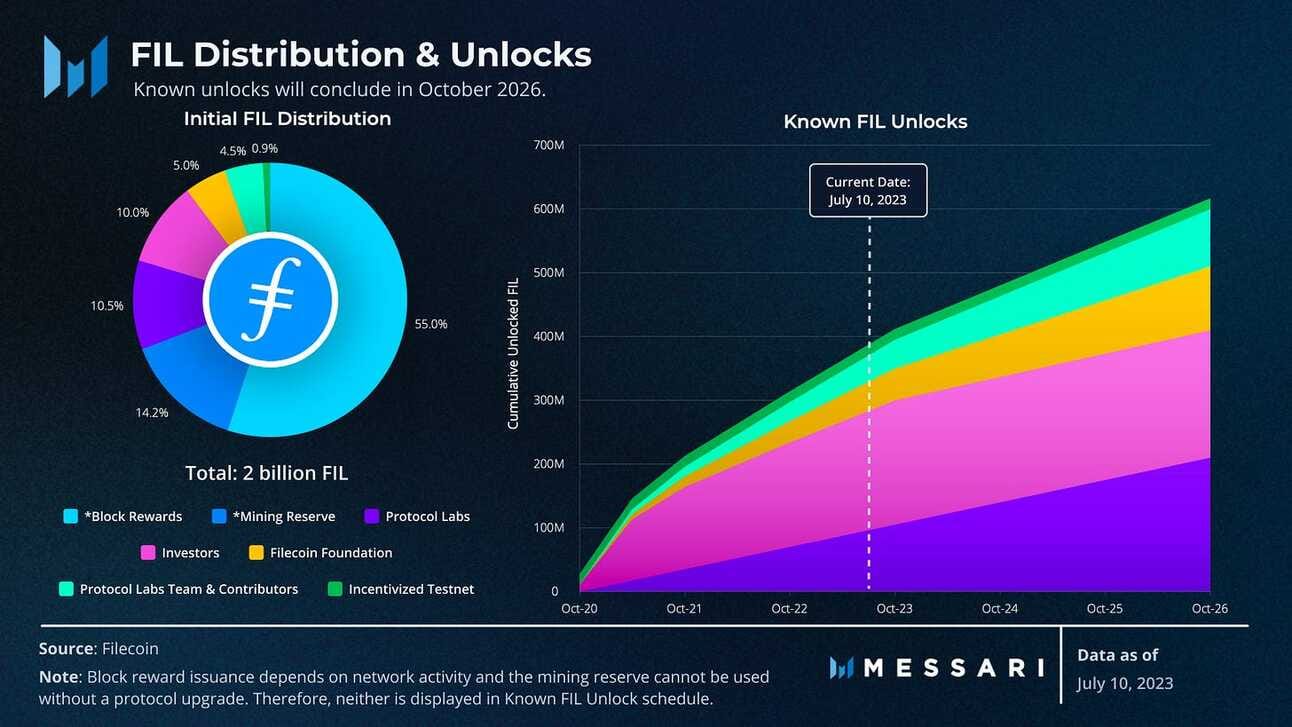

Newly-issued block rewards are used to incentivize storage capacity and deals. Block rewards comprise up to 1.1 billion FIL, i.e., 55% of FIL’s 2 billion maximum supply and are issued in two ways:

A simple exponential decay model (up to 330 million FIL): Block rewards are highest at the network’s initial stages to stimulate the participation of service nodes; however, block rewards decrease following a continuous exponential decay function with a six year half-life. This model is used to incentivize initial network bootstrapping (i.e., service nodes being able to run their operations).

A baseline minting model (up to 770 mn FIL): Block rewards increase with the network’s storage capacity. However, rewards are capped when storage capacity exceeds the target baseline function (i.e., Filecoin uses a target level of storage capacity over time to incentivize sustainable network growth). According to Filecoin’s cryptoecon specs, an upper cap of 770 million FIL would be, in theory, fully released if the Filecoin network reached a Yottabyte (10^12 Terabytes) of storage capacity in under 20 years. This would represent a ~40,000x increase from Filecoin’s highest raw byte capacity of ~17 EiB reached in 2022.

Vesting

Vested FIL tokens are added to the circulating supply according to the above vesting schedule. The known FIL unlocks for investors, the Filecoin Foundation, and Protocol Labs and its team total 600 million FIL (30% of the maximum supply of 2 billion FIL) and are scheduled to conclude in October 2026. As of July 10, 2023, vesting is 61% complete. According to the current cryptoecon specs, the FIL mining reserve (283 million FIL) is dormant, and there are no ongoing proposals to modify the specs. As such, the FIL mining reserve is not included in the circulating supply calculations.

Locks

FIL is removed from circulation by storage providers that lock FIL as collateral for committing storage power to the network. The lockup period is determined by the duration of the basic units of storage on the network (i.e.,

sectors

). A sectorʼs lifetime is determined in the storage market and specifies the agreed duration of the sector.

Burns

FIL burns are determined by users demanding blockspace. Filecoin’s base fees are burnt similarly to EIP-1559’s transaction fee mechanism. Base fees (and hence FIL burnt) are generally higher when there is more demand for blockspace, measured in gas units. Since blockspace is finite and scarce, gas becomes more expensive with higher demand. Hence, more FIL is burned to compensate for the cost of each gas unit.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.tokenx.is, and www.decard.io