DATE & TIME:

Wednesday, November 26th at 10am EST

DURATION:

60-75 minutes + live Q&A (Zoom)

Link provided upon registration via email/text

Bitcoin is down ~25 % from the local top in 41 days, trading just above $91k this morning.

Short-term holder supply in loss has hit full-capitulation levels seen only at major bottoms.

Momentum is exhausted, the Risk-Off regime is still in control, liquidity is compressing — but spot demand has not broken.

This is exactly is how cycle exhaustion looks like.

The question is whether this exhaustion resolves into a final shakeout and new highs into 2026…

or whether we have already seen the bull market peak.

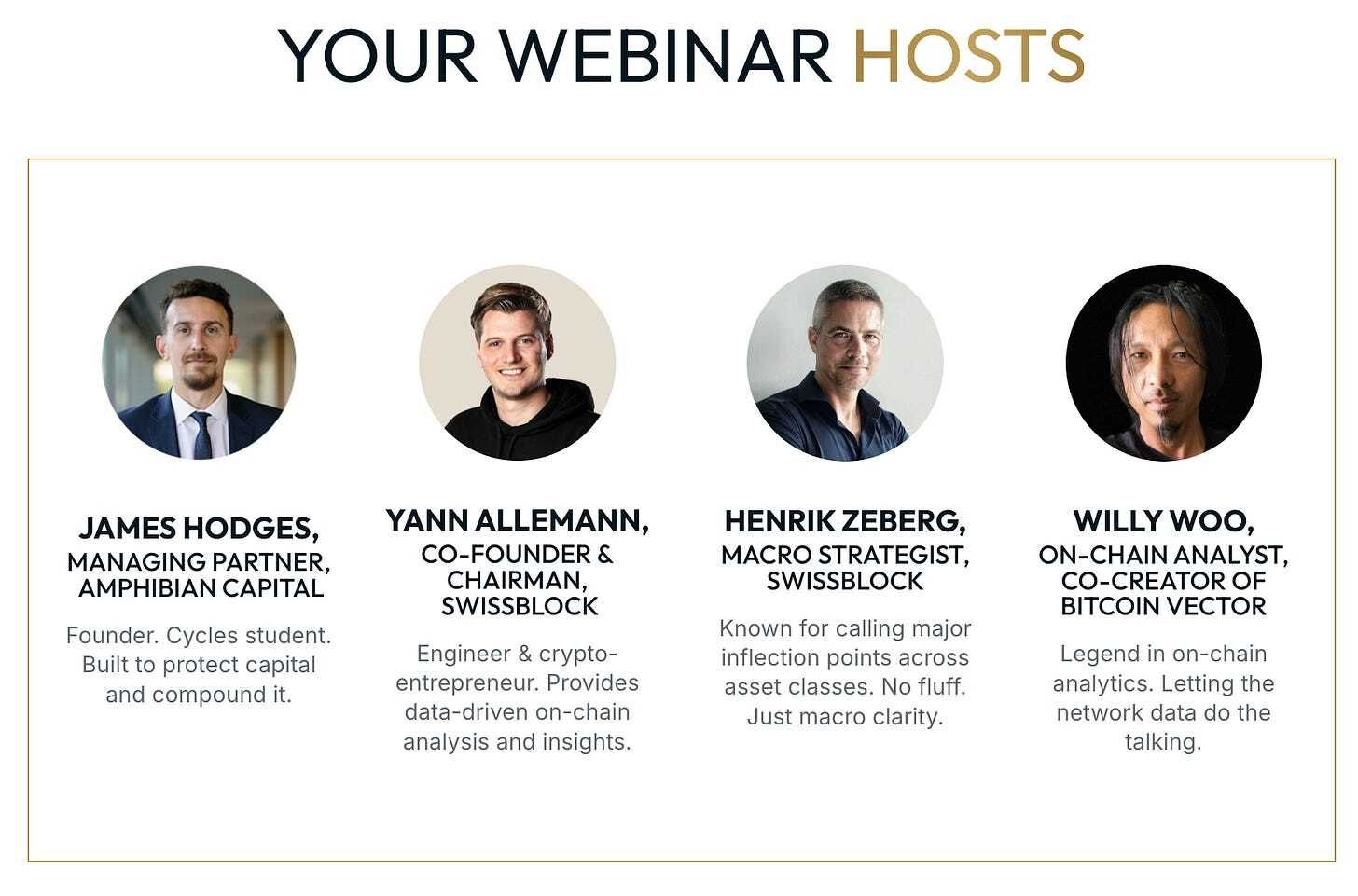

Next Wednesday Yann Allemann (Co-Founder & Chairman, swissblock), Henrik Zeberg (Head Macro Economist, swissblock), Willy Woo (on-chain pioneer & Crest), and I will go straight into the data — no narrative, no hopium, no doom and gloom— just the actual signals we are trading on right now.

What We’ll Cover:

Signals of a Blow-Off Top: How to Recognize the Final Run

On-Chain: what the latest flows, holder behavior, and Woo’s updated Vector model are really say about cycle extension vs distribution phase

Macro regime map: are we still in the early stage of Risk-Off or is full liquidity capitulation coming?

Key technical levels & invalidations for both outcomes (bull resumption vs bear market confirmation)

How we are currently positioned across BTC / ETH / USD Alpha into year-end and 2026

Who this is for?

Institutional investors, CIOs, and family offices managing serious capital

LPs and crypto fund investors looking to navigate the final potential phase (s) of this cycle

Risk-conscious allocators who want to compound through volatility

Advisors and consultants needing clarity to guide clients right now