Issue summary: We’re in for a great Fall of 2021. We recap the top weekly happenings in crypto and feature an on-chain analytics piece showing how Bitcoin volume continues to increase above the $40k price level solidifying investor demand and signaling further bullish price action ahead. We also welcome our new sponsor HeartRithm, an algorithmic crypto quant fund. We’ll be writing much more about them next week.

In This Week’s Issue:

Our Crypto Market Forecast

This Week in Crypto…

🗞️ Top Weekly News

💵 Weekly Fundraises

📊 Key Stats

📝 Report Highlights

📈 Top 10 Performers

🎧 Best Podcasts

🚀 Coin Of The Week - C98 Up 319% in 30 Days

On-Chain Analysis by Mike Gavela - Price Floor Rising As Investors Remain Bullish

Welcoming Our New Sponsor: HeartRithm, A Crypto Quant Fund Focusing on Exceptional Returns & Social Impact

The Coinstack Alpha Fund

Coinstack Podcast Episodes

Top 30: A Good Long-Term Crypto Portfolio

Wednesday Crypto Community Calls

Join Our Telegram Group

Who We’re Following Closely on Crypto Twitter

How to Get Started in Crypto Learning

📈 Latest Crypto Market Forecast

We are now in the last 4-6 months of the bull market. Based on on-chain analytics and the amount of capital coming into the space from institutional investors, crypto markets are headed toward a double market peak as we first predicted July 5. We expect to see new all-time high during Fall 2021 for both Bitcoin and Ethereum. While things could change, we expect to see $80k+ BTC and $6k+ ETH by the end of 2021, driving major increases in most other L1 and DeFi valuations.

🗞️ Crypto News Recap: The Top 10 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 10 stories of the week...

😮 MicroStrategy Acquires $177M More Bitcoins in Q3 to date - MicroStrategy CEO Michael Saylor announced that the firm purchased an additional 3,907 bitcoin for about $177 million in cash during the third quarter period. (Source)

👨🏻 Former SEC Chair Jay Clayton Joins Fireblocks Advisory Board - Crypto custody provider Fireblocks has tapped former U.S. Securities and Exchange Commission (SEC) Chair Jay Clayton as a member of its board of advisors. (Source)

⚡ Coinbase Receives Board Approval To Purchase $500 Million in Crypto - Coinbase will also be investing 10% of all future profits into crypto, thanks to the recent board approval. Alesia Haas, Coinbase’s CFO, adds, “We will become the first publicly traded company to hold Ethereum, Proof of Stake assets, DeFi tokens, and many other crypto assets supported for trading; on our platform, in addition to Bitcoin, on our balance sheet.” (Source)

💰 Wells Fargo Files for Bitcoin Fund - Wells Fargo will be offering its wealthy clients indirect exposure to Bitcoin through a new fund issued in partnership with NYDIG and FS Investments. (Source)

🤑 Visa Buys CryptoPunk #7610 for $166,000 - Cuy Sheffield, Head of Crypto at Visa, said in a blog post Monday. “To help our clients and partners participate, we need a firsthand understanding of the infrastructure requirements for a global brand to purchase, store, and leverage an NFT.” Since their purchase on Monday, the average price of a Cryptopunk has increased rapidly. (Source)

🏦 Western Union Leaving Afghanistan - Anthony Pompliano says Western Union's abandonment of Afghanistan only adds to the demise of the legacy money transfer sector in its time of need. (Source)

⚖️ Circle To Convert USDC Reserves Into Cash and Short-Term U.S. Treasuries -The second-largest cryptocurrency stable coin will shift $27 billion into cash and short-term U.S. Treasuries and forgo riskier investments, creating a stronger backing for USDC. (Source)

📈 Citigroup Gearing Up To Trade CME Bitcoin Futures - Citi will begin trading CME bitcoin futures first and then bitcoin exchange-traded notes according to sources within the bank. (Source)

🎆 NASDAQ Reveals Valkyrie Bitcoin Futures ETF Application - On Tuesday, a surprise regulatory filing by Nasdaq to “list and trade shares” of the Valkyrie XBTO Bitcoin Futures Fund revealed the existence of the previously undisclosed ETF proposal, Valkyrie’s second that seeks to wrap bitcoin futures into an ETF. (Source)

🏧 El Salvador Set To Install 200 ATMs and Prep Bank Branches To Handle Crypto - El Salvador President Nayib Bukele said his country is installing 200 ATMs and preparing over 50 bank branches ahead of the implementation on September 7. (Source)

💬 Tweet of the Week

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Futures Open Interest Continues To Climb for Both BTC and ETH Signaling Increased Confidence by Investors

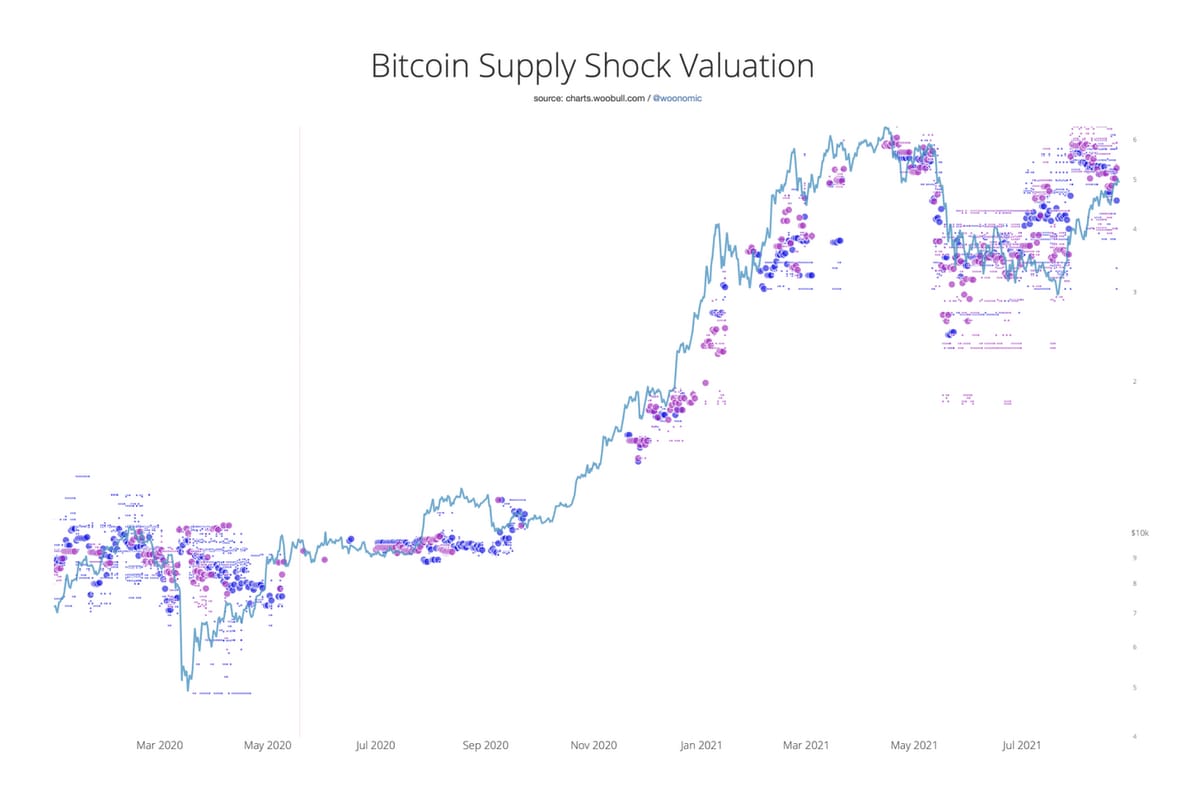

2. Willy Woo Sees ETH As Having A Bullish Demand and Supply Structure. Woo Maps Ethereum’s Price in Blue and Ethereum’s Supply Shock Metric in Purple

3. Bitcoin Exchange Flows Have Returned to Outflow Dominance In August As Investors Withdraw BTC At Rates Not Seen Since Late 2020 (Bullish)

4. Whales Are Getting Bullish on Bitcoin As Addresses With at Least 1,000 Bitcoin Have Been Accumulating since May.

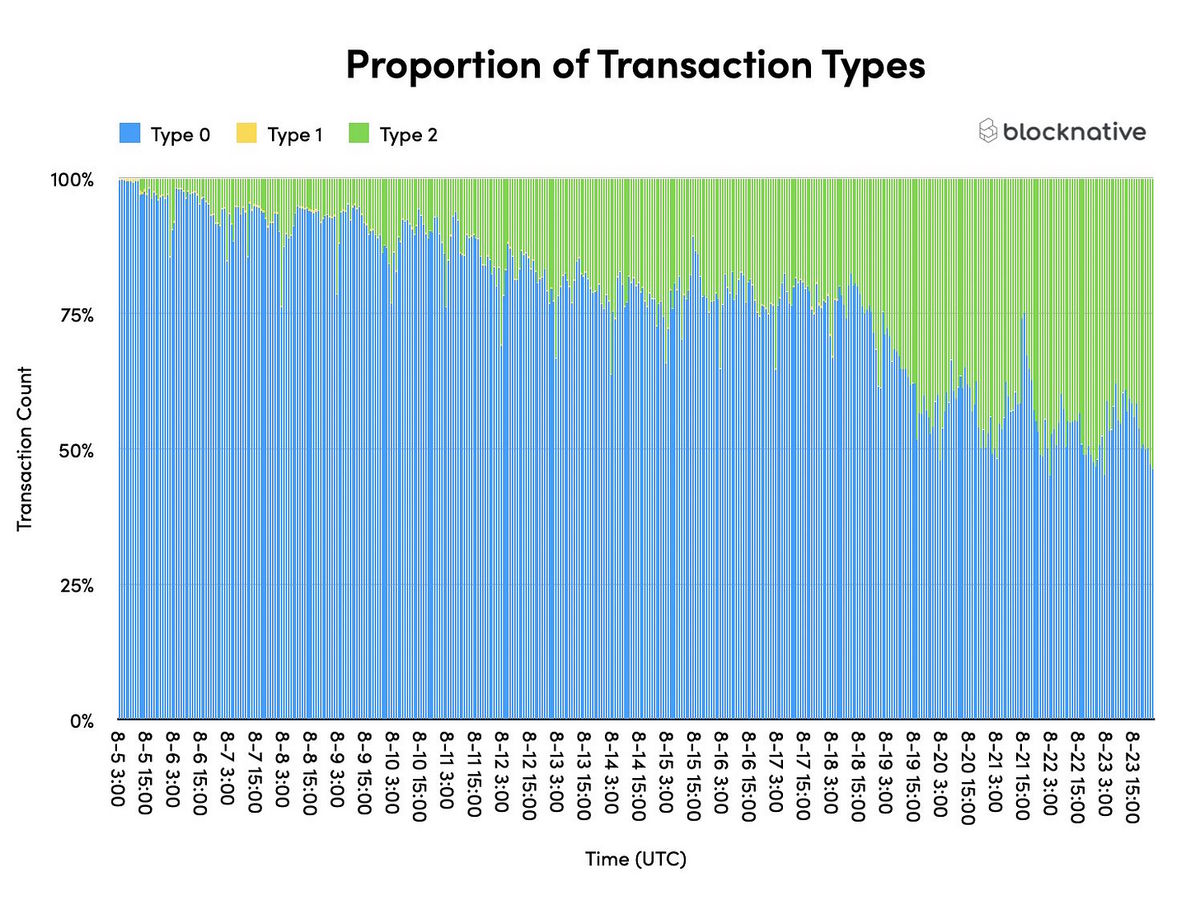

5. EIP-1559 Adoption Is Growing — Now Accounting for Nearly 50% of All Ethereum Transactions, Which Is Leading to Even More ETH Burning

6. Stablecoin Reserves Suggest Continued Bullish Run Past BTC $50,000

7. Glassnode Shows That the Total Amount of Long-Term Bitcoin Holders (155+ Days) Has Reached 33.96% or 7,131,084 Bitcoin Held in These Wallets

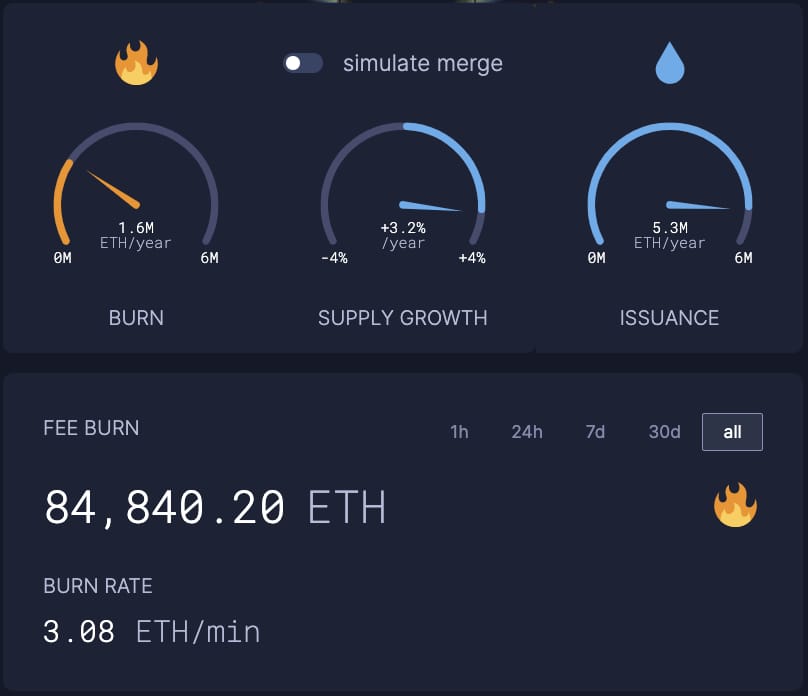

8. Current ETH Burn Rate Sits at 1.6M ETH/Yr (~$5.1B USD per Year)

📝 Highlights from Crypto Reports

Here are the top highlights from the best crypto research reports this week…

1. Emerging Markets Achieved Over 880% Global Crypto Growth In 2021

Chainalysis, an on-chain research firm, released an in-depth report on countries with the highest crypto adoption by ranking their transaction volumes, examining their use cases and related transactions, rather than relying on trading and speculation.

“Our research suggests that reasons for this increased adoption differ around the world — in emerging markets, many turn to cryptocurrency to preserve their savings in the face of currency devaluation, send and receive remittances, and carry out business transactions, while adoption in North America, Western Europe, and Eastern Asia over the last year has been powered largely by institutional investment. In a year when cryptocurrency prices rose dramatically, each region’s respective reasons to embrace the asset class seem to have proven compelling.”

2. Bitcoin Is Not Longer at “Fire Sale” Prices

In his latest report, famed on-chain analyst Willy Woo outlines his latest short-term market forecast while ensuring us that his macro forecast remains unchanged. Willy forecasts a potential drawdown into the $40k to $44k range for BTC the next couple of weeks before rallying to new highs. While BTC may indeed see a slight drawback over the next couple weeks, based on what we are seeing now we anticipate a continued overall bullish move into $60k+ this Fall.

“Here is an updated view of the Supply Shock Valuation model, which does a look back on past valuations when the demand and supply dynamics were at similar levels. Last week the valuation was $55k, which presented BTC at a 20% discount. With the new wave of supply entering the market, this gap has closed, with price now sitting in the middle of the valuation range. In essence, BTC price has found balance with the new demand and supply dynamics of long-term investors. It is no longer undervalued.”

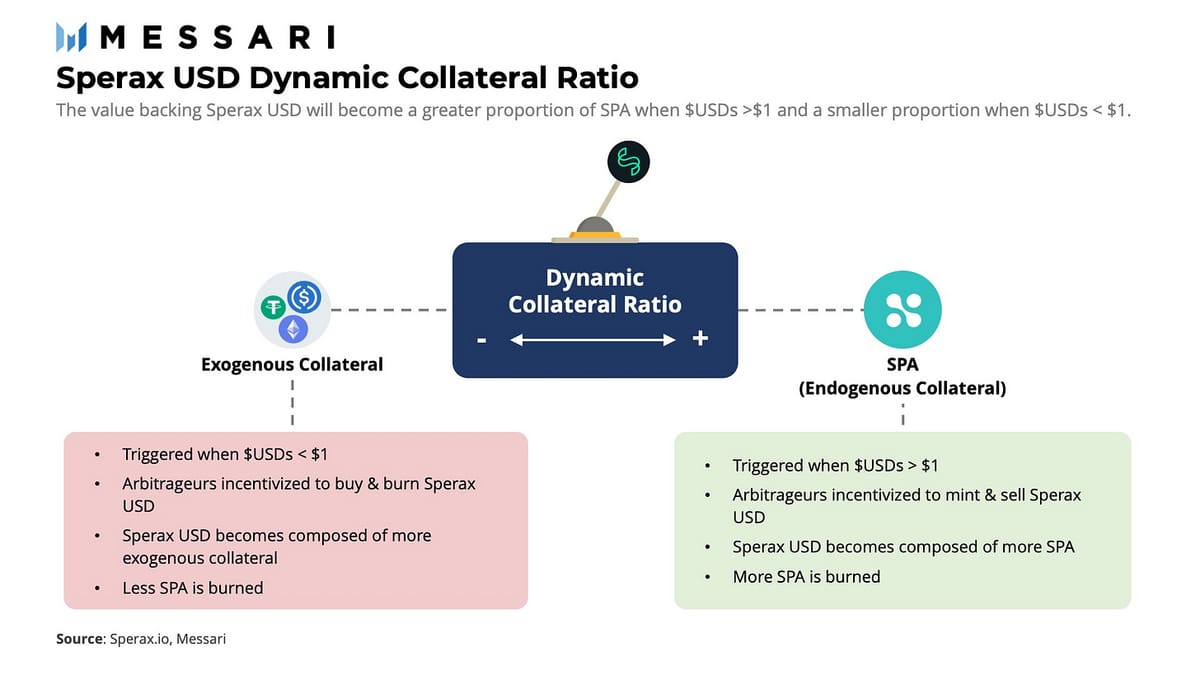

3. Sperax USD: A Hybrid Stablecoin With a Twist

Chase Devens from Messari takes a deep dive on Sperax USD, a decentralized stablecoin that delivers a native yield to its holders using a balance between exogenous and endogenous collateral that the protocol’s dynamic collateral ratio will determine.

“To date, we have not seen a decentralized stablecoin that delivers a native yield to its holders. Sperax is aiming to change that with the upcoming launch of its stablecoin Sperax USD ($USDs). Sperax is a Silicon Valley-based blockchain company with the mission to build DeFi infrastructure accessible to anyone in the world. Sperax's stablecoin model will allow users to deposit or redeem $1 of protocol value at any time in exchange for 1 Sperax USD. Similar to FRAX, the collateral backing Sperax USD is composed of exogenous collateral, in the form of external cryptoassets, and endogenous collateral, in the form of SPA - Sperax’s native governance, volatility absorption, and value accrual token.”

4. L1s Take Off, Can ETH Catch Up?

Ashwath Balakrishnan and Jeremy Ong from Delphi Digital outline the price action of L1s from the past week detailing why the rise of each protocol while sharing their concern for Ethereum. Keep in mind that Ethereum has over 2,800 Dapps and over 4k smart contracts on-chain making it the most used blockchain in the world—by far.

“What stands out, however, is ETH’s underperformance relative to other L1 assets. Ethereum’s market cap is 10x higher than the second-largest network on this list (DOT), making it much more challenging to move price. However, remember: the less liquidity and the steeper an asset’s price swings up, the more likely it will fall with an equivalent ferocity. ETH’s liquidity and size partially shield it from this, though it still does have violent drawdowns from time to time.”

5. Whales Driving BTC Price As Wallet Activity Continues To Spike

The team at Decentral Park Capital released an on-chain report highlighting the Daily Active Address activity for BTC and believe whales are driving this rally.

“Daily Active Addresses (DAAs) for BTC remain low relative to peak levels throughout 2021 (~25%). However, the BTC price is only down ~14% since the DAAs peak in May, suggesting that more prominent market participants drive prices.”

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

📈 Top 10 Performers This Week

Here are the top 10 performing digital assets this week, out of the top 100 by market cap. Some of our favorites like ATOM, LUNA, FTM, and AVAX had an especially great week.

And here are the top 15 performers in the last week from all tokens with a market cap of $20M+.

🚀 Coin Of The Week

We write about a new utility token each week to help spread the word about new and upcoming projects. As always, investing in early-stage crypto projects is particularly risky with the opportunity for major gains and major losses.

Coin: Coin98Symbol: C98Available On: Binance, Gate.io, FTXFully Diluted Market Cap: $5BPrice Change Last 30 Days: +319%Coin Ranking: #214 by Market Cap

Coin98 provides a one-stop platform for users to access the DeFi ecosystem, such as decentralized exchanges, lending protocols, on-chain governance, blockchain-based games, and cross-chain transfer on over 20 networks such as Ethereum, Binance Smart Chain, Solana, Avalanche, and more. The project has been in development for over a year as a wallet and launched on Binance’s Launchpad.

📰 On-Chain Analysis: Price Floor Rising As Investors Remain Bullish

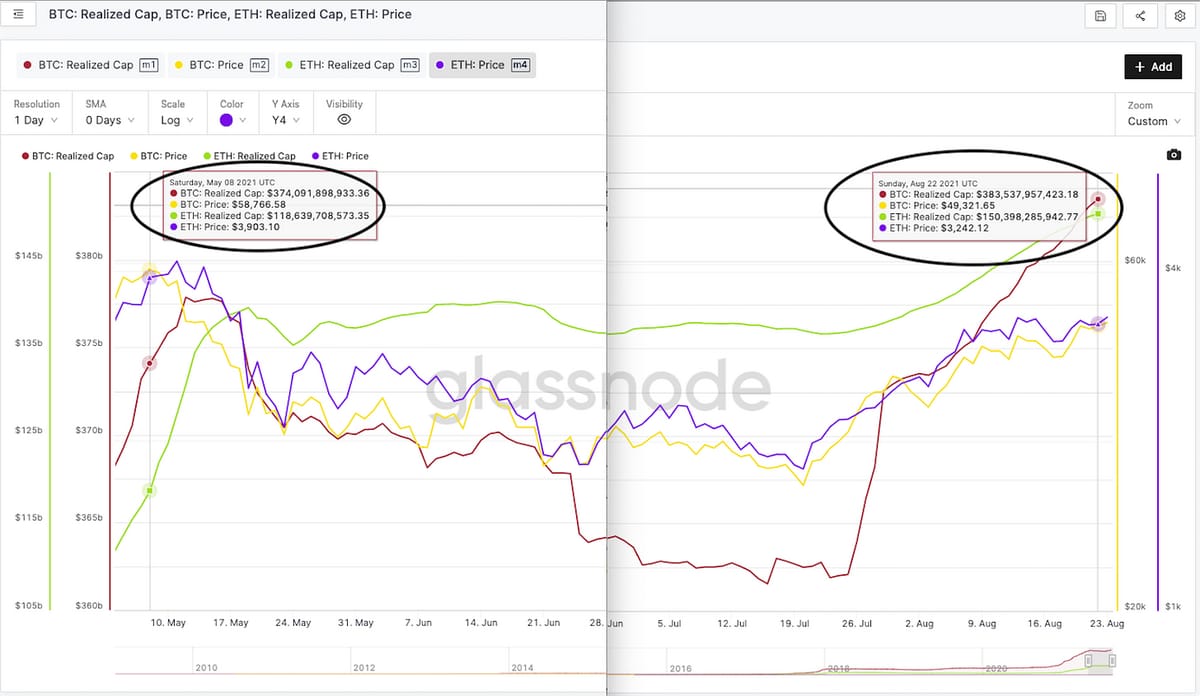

With BTC breaking the $50k price level over the weekend for the first time since May, the market continues to support a new floor price of $40k. We can see on-chain how the $40k price floor for BTC continues to deepen in volume as long-term holders begin to realize profits and re-enter the market at a new cost basis using their realized profits, increasing the market’s realized price for both BTC and ETH.

Last week we wrote about the importance of UTXOs and how they are used in the URPD (UTXO Realized Price Distribution) metric to show at which prices the current set of Bitcoin UTXOs were created. The chart below shows at which price the existing Bitcoins last moved within that specified price bucket.

We highlighted in our last issue how smart money and long-term holders were buying up the $30k dip throughout May and June.

We can see in the chart above that investors continue to buy within the $40k zone, which further solidifies that floor price. As more investors continue buying within the $40k+ BTC price range, we can see the Realized Cap for both BTC and ETH rocket to new All-Time Highs.

Using the chart above, we can see the recent buyer activity on-chain has raised the Realized Cap for BTC by about $10bn and ETH by about $30bn since the peak in May. Keep in mind that Realized Cap is the metric that allows investors to determine whether a cryptocurrency is overvalued or not because it valued each UTXO based on the price when it was last moved, as opposed to spot price, which values each UTXO by the price it was last traded. When Realized Cap goes up exponentially as we see now, it means that the market accepts current prices, suggesting a solid fundamental build-up for the asset.

The beauty of crypto is that the entire blockchain is designed to be transparent. Using on-chain analysis, we can pull data on the assets traded on the chain and the wallet addresses that hold them.

Into the Block’s, In/Out of the Money metric classifies addresses based on if they are profiting (in the money), breaking even (at the money), or losing money (out of the money) on their positions at the current price. They calculate an address’ average cost based on the weighted average price at which it bought or received the tokens currently held by the address. IntoTheBlock categorizes addresses and tokens accordingly to obtain an aggregate view of profitability for a particular crypto asset.

Over 87% of BTC addresses are in profit, while 94% of ETH addresses are also in profit, which explains the hockey stick movement we see right now with Realized Cap on both assets. The dip we had in May cut out all the leverage and weak hands in the market. Smart money and long-term holders who bought the $30k dip are fueling this rally by realizing profits and accumulating more coins at the $40k price level creating a new floor price, as mentioned in the previous issue.

It is clear from the above metrics that the crypto market is creating a new price floor post the May dip and we can also see long term holders as the investors creating the supply.

Let us take a look at the spending behaviors of long-term token holders by using Glassnode’s Spent Output Lifespan charts to see how old these coins that are fueling the market are.

Spent Output Lifespan is simply the total number of spent outputs created between a designated time. Meaning the above charts demonstrate the movement of coins separated by when they were last purchased. If there is a flat line, the investor purchased their token and held it. Since July, we are witnessing a trend of long-term holders realizing profits. Meaning it is the long-term holders supplying the retail investors during this rally.

The Takeaway: Investors remain bullish as they continue to buy from very long-term holders realizing profits and re-adjusting their cost basis. We can see from the momentum of Realized Price that the market remains bullish. With URPD for BTC also slowing inching its way to higher price levels, it is safe to say we can expect an uptick in price over the next few weeks as investors continue to rally.

❤️ Welcoming Our New Sponsor

We are very excited to be welcoming HeartRithm as the headline sponsor of the Coinstack newsletter and podcast. HeartRithm is an algorithmic crypto quant fund in the top 10% of funds by AUM. They use market-neutral algorithmic trading, margin lending, DeFi yield farming, and hedged liquidity pool strategies to be able to drive exceptional returns to their investors without a single month of drawdown since their strategies began in January 2018.

As part of their social impact mission, HeartRithm takes 50% of their performance fees and donates it to organizations and individuals working on creating a better world. Their community together decides on the allocation of these funds through the HEART token. You can learn more about them at www.heartrithm.com.

💻 HeartRithm is Hiring

HeartRithm is actively hiring for smart contract developers. You can learn more here. We will be writing much about HeartRithm next week as we introduce them fully to the Coinstack community and share more about how they’ve generated exceptional returns with minimal volatility.

🎧 Latest Episodes of The Coinstack Podcast

We have a new Coinstack podcast. So far we’re at 3,000 listens and growing!

You can listen to it on Anchor, Spotify, or Google Podcasts -- or add the RSS feed to Apple Podcasts.

Here are the episodes we’ve released so far...

You can listen and subscribe on:

We really appreciate you listening and sharing the link with your friends.

📈 Our Top 30: A Long-Term Crypto Portfolio

Each week we include our top 30 list. If we were creating a portfolio from scratch right now that we didn’t want to touch for 5-10 years, we would be sure to include our top 4: ETH, DOT, SOL, & NEXO. Here’s our current top 30 for a well-rounded long-term crypto portfolio…

To see which exchanges to buy these on, use Coinmarketcap or Coingecko. We recommend using dollar-cost averaging and holding for a 5-10 year time horizon for any crypto investor as prices can fluctuate a lot in the short term.

📈 The Coinstack Alpha Fund

In April 2021 we launched The Coinstack Alpha Fund, which is an on-chain fund on top of the Enzyme platform.

You can invest here in the Coinstack Alpha Fund. There is no minimum investment, although there is a gas fee you pay to Ethereum network to invest -- which has been around $10-$20 recently.

We are now up to $293k from 32 depositors in the Coinstack Alpha Fund. Enzyme allows deposits with both USDT or ETH. We charge a 2% management fee annually plus 20% of profits. Withdrawals are allowed at any time, although we recommend a 5-10 year hold period for optimal returns.

You can invest directly via your Metamask, Argent, TrustWallet, or any wallet that works with WalletConnect. We don’t hold your funds, Enzyme does. We simply invest them on your behalf. You can learn more about Enzyme here.

Our current portfolio allocation in our fund is:

📞 Join Our Wednesday Crypto Community Zoom Calls

After two weeks off for summer vacation, we will be restarting our weekly calls this week. Restarting next Wednesday, August 25, Coinstack Founder and Publisher Ryan Allis does a live 30 minute Crypto Advice Zoom call at 12PM PT / 3PM ET / 8pm GMT. All investors in our Coinstack Alpha Fund on Enzyme and all owners of Mrs. Bubble NFTs are invited to join and ask questions and share learnings with each other. After you invest or buy an NFT, just reach out to us on Telegram (or reply to this email) to get added to the weekly call invite.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone. We now have over 1700 members on our Telegram.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

📰 The Coinstack Newsletter:

Tracking the most important blockchain stories of the 2020s including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may be long on many of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela. Comments and thoughts welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at Twitter.com/ryanallis

Telegram channel at t.me/thecoinstack

NFTs at opensea.io/assets/mrsbubble

Ethereum Fundamental Value Model at Coinstack.co/ethvalue

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.