Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We reviewed the top news, stats, and reports in the digital asset ecosystem for our 330k weekly subscribers. This week, Hyperliquid unveiled HIP-4, introducing outcome-based contracts for prediction markets on HyperCore. Bitcoin dropped out of the global Top 10 assets by market cap after falling below $80,000 amid broader market weakness. Meanwhile, Ripple secured full EU approval for an EMI license, strengthening its regulated payments footprint across Europe. On the fundraising front, Propy secured a $100M U.S. credit facility to scale blockchain-based real estate lending with AI automation. Meanwhile, crypto payments network Mesh raised $75M in a Series C round at a $1B valuation, signaling strong investor confidence in payment infrastructure.

Price performance since we began writing Coinstack in January 2021

Become a Coinstack Sponsor

To reach our weekly audience of 330,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🧠 Hyperliquid unveils HIP-4 for prediction markets: Hypercore will support HIP-4 Outcome Trading and limited risk options, fully collateralized contracts within a set range. Outcomes are currently at the testing phase on the testnet. Following the announcement, $HYPE price rose more than 10% in 24 hours.

🚨 Bitcoin knocked out of the “Top 10” asset list: Bitcoin took a sharp fall below $80,000, wiping billions, and dragging the OG coin out of the Top 10 asset list by market cap. Escalating geopolitical tensions, Fed Chair Kevin Warsh's appointment, and renewed U.S.-Iran tensions triggered forced liquidations and panic selling across risk assets.

🏛️ Ripple scores major regulatory expansion, secures full EU approval for EMI license: Ripple secures Electronic Money Institution (EMI) license granted by Luxembourg’s financial regulator. The license clears the way for Ripple payments in the EU and strengthens its position in the European financial ecosystem.

🎯 Coinbase launches prediction markets for U.S. customers: Coinbase rolls out “Coinbase Predict” across 50 U.S. states in partnership with prediction market platform, Kalshi.

💸 Solana hits 10-month low below $100 for the first time since April 2025: Solana’s native token $SOL hits rock bottom. The token dips to $98, marking its lowest price since April 2025 amid broader crypto market uncertainty.

Together With Counterflow

Money Management Making You Mad?

Most business owners hit revenue goals and still feel cash-strapped.

Not because they're not making money. But because their money flow is broken, their decisions feel urgent instead of strategic, and their systems feel fragile instead of solid.

The Find Your Flow Assessment pinpoints exactly where friction shows up between your business and personal finances.

5 minutes with the Assessment gets you clarity on:

where cash leaks

what slows progress,

whether your current setup actually serves you

No spreadsheets, or pitch. Just actionable insight into what's not working and why.

Educational only. Not investment or tax advice.

💬 Tweet of the Week

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Fantastic piece. It surfaces a reality that many still miss: DeFi is steadily overtaking core fintech, and the clearest signal is scale.

Onchain lenders are already larger. Aave Labs ($22.6B) not only has 2x the outstanding loan volume of fintech giant Klarna ($10.1B), but more than the entire Buy Now Pay Later sector’s outstanding loan balances combined (~$21B).

Source: @DavidShuttleworth

2. Bitcoin vs. Silver

RSI is at HISTORICAL lows.

Under current conditions, I'm not screaming 'bottom'.

But what is clear, is the HUGE undervaluation of the hardest asset known to man.

Source: @JamesEastonUK

3. USD1 is surging.

Over the past week, World Liberty Financial's USD1 supply grew 51% (+$1.85B) to a record $5B, making it the 5th largest stablecoin.

Expansion is happening across every major chain:

• Ethereum: +93% in the past 7 days → $2.37B supply

• BNB: +10% in the past 7 days → $2.10B supply

• Solana: +200% in the past 7 days → $470M supply

This is one of the fastest stablecoin supply expansions of this cycle.

Source: @DavidShuttleworth

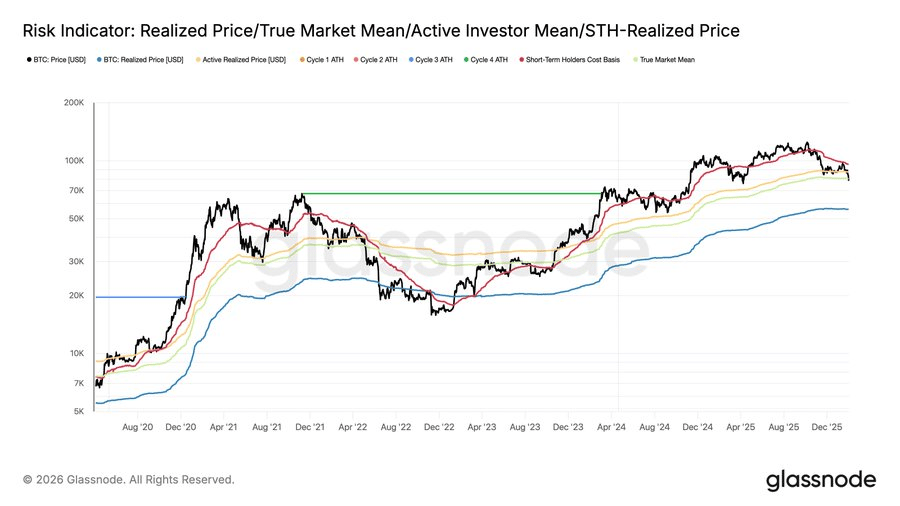

4. With the spot price plunging to $78.6K, the key on-chain price models are as follows:

🔴 STH Cost Basis: $95.4K

🟡 Active Investors Mean: $87.3k

🟢True Market Mean: $80.5K

--- Spot Price: $78.6K ---

🔵 Realized Price: $55.9K

Source: @glassnode

5. We’ve seen a 16% drop in Bitcoin’s hashrate, which is the largest decline since the China mining ban in 2021.

Moves of this magnitude don’t happen in healthy, complacent environments. They reflect real miner stress, forced adjustments, and periods where the network sheds inefficient hashpower before stabilising again.

They’ve also historically been great dip buying opportunities.

Source: @OnChainMind

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: Pantera Capital, aims to help you understand crypto like never before by harnessing the power of global macro strategy along with onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 By Cosmo Jiang, General Partner:

2025 was not a fundamentals-driven year for returns in the crypto markets. It was a year where macro, positioning, flows and market structure effects were the dominant drivers – particularly for assets outside of Bitcoin.

Looking at a timeline of the year’s major macro and policy inflection points helps capture why the tape felt so discontinuous.

The year opened with the U.S. inauguration, which ultimately proved to be a classic “sell-the-news” moment and an early warning shot for volatility. Subsequent months saw repeated whipsaws in risk appetite – from optimism around a U.S. Strategic Bitcoin Reserve announcement, to renewed pressure from “Liberation Day” tariffs. Mid-year brought constructive developments, including passage of the GENIUS Act, digital asset treasuries (“DATs”) like Bitmine Immersion taking off, and the onset of Federal Reserve rate cuts, which stabilized sentiment for a few months.

The fourth quarter marked a decisive break as multiple challenges arose. The October 10 selloff triggered the largest liquidation cascade in crypto history – larger than during both the Terra/Luna collapse and the FTX unwind – with more than $20 billion in notional positions wiped out. Markets needed time to digest that shock. At the same time, a key marginal buyer throughout the year (DATs) began to exhaust incremental purchasing power. That downward momentum was exacerbated by seasonal pressures, including tax-loss selling (in particular in ETFs and DATs), portfolio rebalancing, and systematic CTA flows into year-end.

Bitcoin finished 2025 modestly lower, down approximately 6%. Ethereum declined roughly 11%. From there, performance deteriorated sharply. Solana fell 34%, and the broader token universe[1] (BGCI excluding BTC, ETH, and SOL) declined close to 60%.

It was an exceptionally narrow market. This dispersion becomes even more stark when looking at return distributions across the token universe.

Only a small fraction of tokens generated positive returns. The overwhelming majority experienced deep drawdowns – the median token declined 79%.

Over A Year-Long Altcoin Bear Market

Perhaps the most underappreciated reality of 2025 is that the non-bitcoin token market has actually been in a bear market since December 2024.

In 2025, Jupiter grew into the backbone of stablecoin DEX aggregation, processing $461B in volume. Momentum peaked in December with a record $70B month. Average stablecoin monthly volume reached $36B, growing ~6% month-over-month, as Jupiter captured over 90% of the maTotal crypto market capitalization excluding bitcoin, ethereum, and stablecoins peaked in late 2024 and has been in a grinding decline ever since – down approximately 44% through the end of 2025. From this perspective, what appeared to be at least at times a constructive year for bitcoin was, for the rest of the market, a continuation of an unresolved bear market.

Portfolios with meaningful exposure to mid- and small-cap tokens structurally struggled.

The divergence between Bitcoin and the broader token market reflects fundamental differences. Bitcoin benefits from a singular, widely understood thesis – digital gold – and increasingly from mechanical demand driven by sovereigns, governments, ETFs, and corporate treasuries. Other tokens, by contrast, represent a heterogeneous set of disruptive technologies with less standardized access, less institutional sponsorship, and more complex value capture dynamics.

That divergence showed up clearly in price.

Structural Headwinds Facing Tokens

Several forces compounded pressure on the broader token complex in 2025.

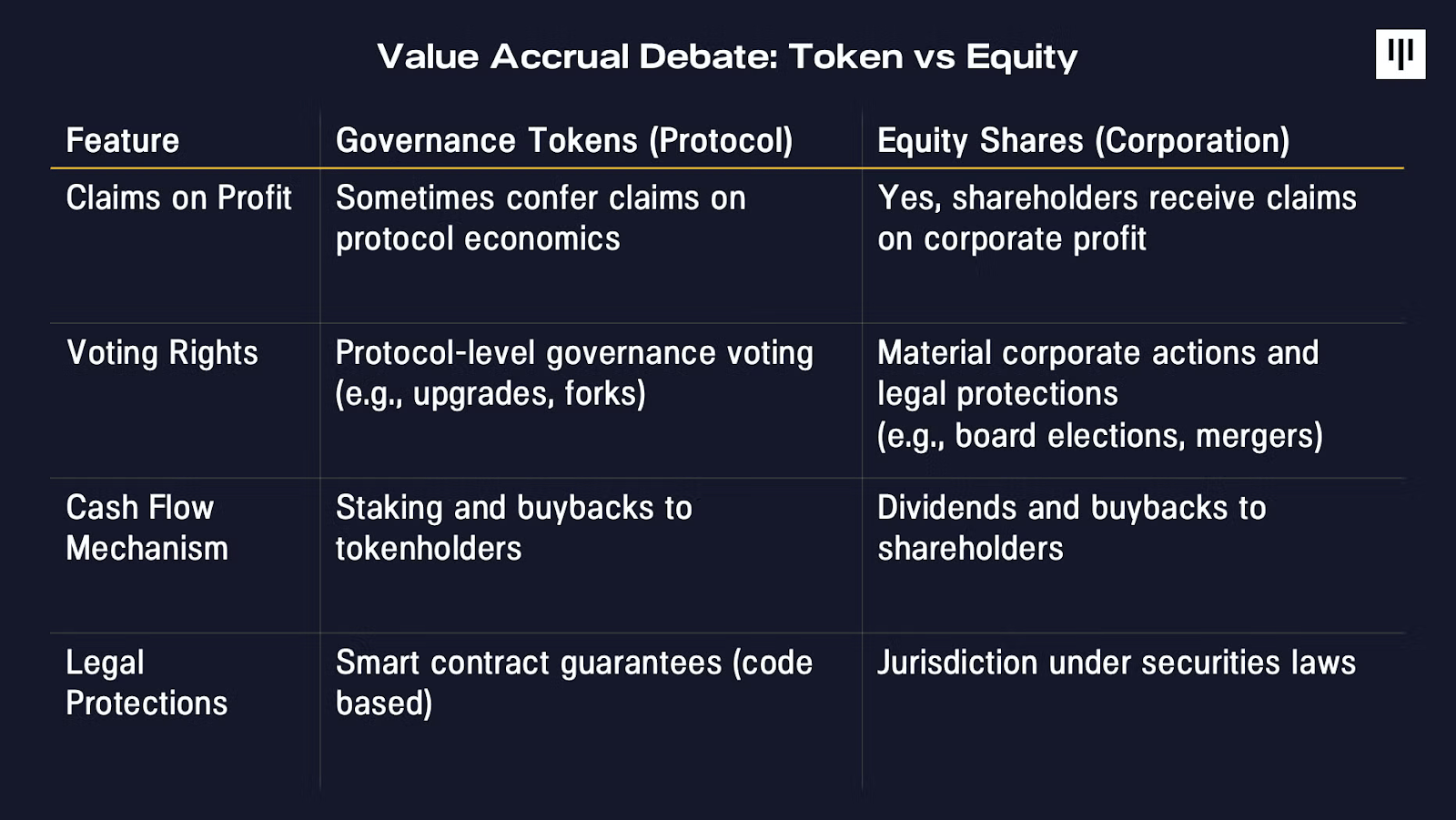

1. Value Accrual and Investor Rights

One of the most persistent challenges was the unresolved question around value accrual. In traditional equity markets, shareholders benefit from clear legal claims on cash flows, governance, and residual value. Tokens, by contrast, often rely on protocol-level mechanisms enforced by code rather than by governmental body enforced law.

Beyond aggregation, Jupiter is also expanding into prediction markets, powered by Kalshi. Just three months after launch, the platform has already generated over $3.3M in prediction market volume, alongside a growing TVL of $451K, signaling early traction & user demand beyond spot trading and swaps.

This year, multiple high-profile cases brought that tension into focus, particularly where token-based ecosystems were acquired or restructured without direct compensation to token holders, including Aave, Tensor and Axelar. These events reverberated across the market, undermining confidence even in projects with comparatively strong token economics.

Against this backdrop, digital asset equities outperformed tokens, benefiting from clearer paths to value capture at a time when investors were already seeking defensiveness.

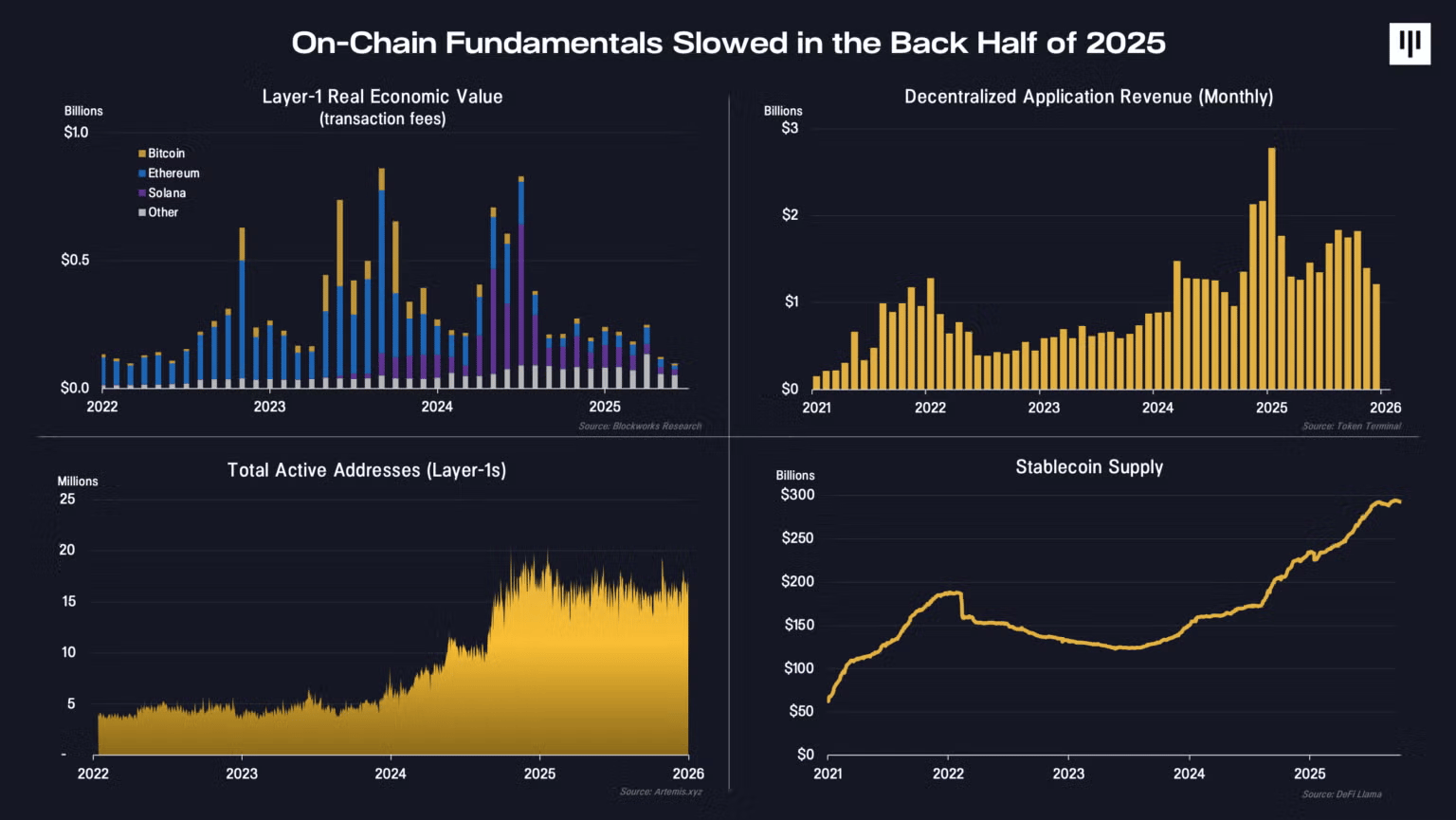

2. Slowing On-Chain Activity

On-chain fundamentals also softened in the back half of the year.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Together With Masterworks

What investment is rudimentary for billionaires but ‘revolutionary’ for 70,571+ investors entering 2026?

Imagine this. You open your phone to an alert. It says, “you spent $236,000,000 more this month than you did last month.”

If you were the top bidder at Sotheby’s fall auctions, it could be reality.

Sounds crazy, right? But when the ultra-wealthy spend staggering amounts on blue-chip art, it’s not just for decoration.

The scarcity of these treasured artworks has helped drive their prices, in exceptional cases, to thin-air heights, without moving in lockstep with other asset classes.

The contemporary and post war segments have even outpaced the S&P 500 overall since 1995.*

Now, over 70,000 people have invested $1.2 billion+ across 500 iconic artworks featuring Banksy, Basquiat, Picasso, and more.

How? You don’t need Medici money to invest in multimillion dollar artworks with Masterworks.

Thousands of members have gotten annualized net returns like 14.6%, 17.6%, and 17.8% from 26 sales to date.

*Based on Masterworks data. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. AI usage disclosure: Some portions of this document may have been created with the assistance of AI tools. The content has been reviewed and edited by a human. As a result, our research/editorial may contain errors. For more information on the extent and nature of AI usage, please contact the publisher. For personalized investment advice consult with a registered investment advisor.

Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.