Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We reviewed the top news, stats, and reports in the digital asset ecosystem for our 350k weekly subscribers. This week, Uniswap governance approved a major “UNIfication” proposal aimed at streamlining protocol governance, while Eclipse founder Neel Somani stepped down as Executive Chairman. Trust Wallet users suffered losses of at least $6M following a security breach, and the SEC charged the operators of a $14M crypto investment scam that targeted users via social media. Meanwhile, former Alameda Research CEO Caroline Ellison is set to be released from federal custody next month. On the fundraising front, Architect, a fintech firm building high-throughput, low-latency trading infrastructure for traditional and tokenized assets, raised $35M in a Series A led by Tioga Capital, while octra, a blockchain network focused on Fully Homomorphic Encryption, raised $20M in a public token sale led by multiple investors.

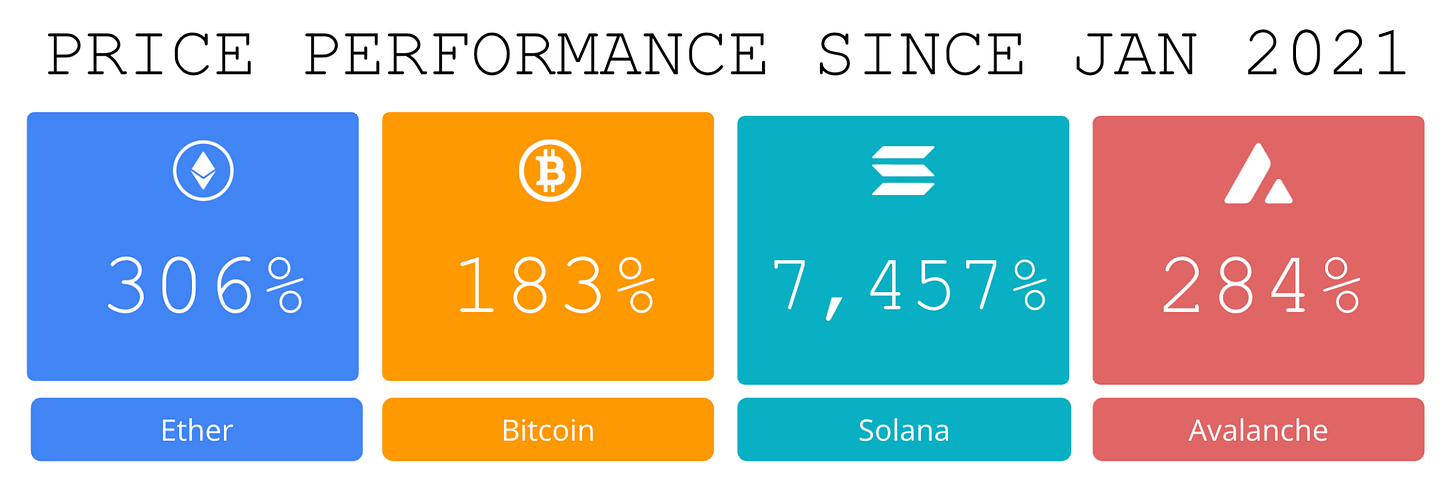

Price performance since we began writing Coinstack in January 2021

Become a Coinstack Sponsor

To reach our weekly audience of 350,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 Morgan Stanley files with SEC for spot Bitcoin and Solana ETFs: Morgan Stanley has filed registration statements with the U.S. Securities and Exchange Commission to launch exchange-traded funds tracking, marking another major step by a traditional finance heavyweight into the growing crypto ETF market.

🎊 Spot bitcoin ETFs report $697 million in net inflows, largest daily total since October: Spot bitcoin exchange-traded funds in the U.S. saw their largest daily net inflows since early October on Monday, as broader crypto market sentiment improved at the start of the new year.

🎉 Jupiter rolls out native JupUSD stablecoin backed 90% by BlackRock and Ethena’s USDtb: The stablecoin will be a key component of Jupiter’s growing “superapp” as the platform continues to expand beyond its beginnings as a DEX swap aggregator into spot and perps trading, lending, staking, token creation, prediction markets, and other functions.

🥳 Grayscale begins distributing staking rewards to Ethereum ETF investors in ‘landmark moment’: Crypto asset manager Grayscale has begun distributing staking rewards to investors in its Ethereum staking exchange-traded fund. In a statement on Monday, the firm said the Grayscale Ethereum Staking ETF is the first Ethereum ETF to pass staking rewards directly through to shareholders.

💪 Ethereum daily transactions hit all-time high, surpassing 2021 NFT boom: The number of daily transactions on Ethereum surged to a new all-time high, alongside notable increases in the number of new and active addresses, data shows.

💬 Tweet of the Week

Source: @WClementeIII

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Tether and USDC have surged to record levels of activity. Tether now processes over 1.2M transactions per day, up 170% month-over-month, while USDC handles 792K daily transactions, up 80% MoM.

Stablecoin adoption is accelerating well beyond on-ramps and speculation, increasingly becoming foundational payment and settlement infrastructure.

Source: @DavidShuttleworth

2. One under-discussed takeaway from 2025: Circle’s USDC is growing meaningfully faster than Tether.

USDC grew 84% YoY (+$34.8B) versus 33% (+$47.3B) for Tether, materially narrowing the gap.

While Tether still dominates with 69% market share (down 7% YoY), USDC now represents 28% of fiat-backed stablecoin supply, up from 22% last year.

Source: @DavidShuttleworth

3. Through all of the macro, geopolitical, and market headwinds, users pushed a record $87B of digital dollars onchain in 2025.

Fiat-backed stablecoin supply grew 47% on the year — the most resilient segment in crypto — marking 27 consecutive months of growth.

That demand was broad-based: Ethereum absorbed $53B in inflows (+49% YoY), Solana $10B (+167%), Base $1B (+31%), while newer ecosystems like Hyperliquid attracted over $4.5B in just 12 months.

The demand for programmable money is now structural.

Source: @DavidShuttleworth

4. 2025 was a defining year for tokenized stock trading.

December closed with a record-setting $2.57B in onchain volume, accounting for 42% of all 2025 activity and pushing yearly volume to $6.18B. More than 147,000 users now own tokenized stocks - still just a fraction of the broader equity market.

Overall, onchain stock trading volume grew a staggering 13,436% year-over-year.

Capital is increasingly moving onchain: driven by better UX, more performant infrastructure, and converging distribution. For the first time, users can access tokenized equities through familiar crypto-native rails, with platforms like Coinbase, Bybit, Kraken, and Robinhood bringing stock exposure into the same environments where users already trade crypto.

The land grab for onchain equities is just beginning.

Source: @DavidShuttleworth

5. 2026 is starting with a risk-on signal.

On the first trading day of the year, ETH ETFs pulled in $174M — their best day since early December — after suffering $2B in total outflows from November through December.

BTC ETFs followed with $471M, the strongest inflow since November, after $4.6B of outflows over the same period.

Source: @DavidShuttleworth

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: CoinDesk is the world’s leading media platform dedicated to covering the cryptocurrency and blockchain industries, delivering trusted news, data, analysis, and insights on digital assets and decentralized finance. This is an excerpt from the full article, which you can find here.

What to know:

2025 was defined by a stark divergence: structural progress collided with stagnant price action. Institutional milestones were reached and TVL increased across most major ecosystems, yet the majority of large-cap Layer-1 tokens finished the year with negative or flat returns.

This report analyzes the structural decoupling between network usage and token performance. We examine 10 major blockchain ecosystems, exploring protocol versus application revenues, key ecosystem narratives, mechanics driving institutional adoption, and the trends to watch as we head into 2026.

Overview

2025 has been a year of divergence between structural progress and market performance. While regulatory clarity and institutional validation have reached new milestones, price performance has stagnated. L1 tokens are a primary example, broadly underperforming despite a backdrop of accelerating political approvals and expanding institutional products.

Performance among leading ecosystem tokens has been weak, with almost every asset - excluding one or two outliers - posting negative yearly returns.

This underperformance contrasts with network fundamentals: seven of the eight selected ecosystems recorded Total Value Locked (TVL) growth in native token terms and four of the eight experienced a rise in daily activity.

However, this growth was not reflected in the base layers. Chain Fees were down for all eight ecosystems, confirming a clear disconnect in value accrual to the chains themselves.

Instead, value flowed to the application layer: six ecosystems saw app revenue growth, with ecosystems like Near posting a +190% increase. Despite L1s capturing 90% of the market share (in terms of market cap), they now only collect 12% of fees (down from 60% in 2025). This trend highlights the market’s maturing selectivity, where value capture is increasingly isolated to successful apps rather than automatically accruing to the underlying Layer 1 token.

The macro backdrop for 2026 is structurally supportive, driven by expected rate cuts that should lead to reduced borrowing costs and theoretically, boost risk on assets liquidity.

The divergence between declining chain fees and growing app revenue in 2025 suggests that market structure could be heading toward an inversion in value capture. As L1 security and throughput become commoditized, capital will increasingly flow to the application layer to find returns, confirming that selective, application-level narratives will remain the primary sources of performance.

Overview

Bitcoin entered 2025 on a wave of optimism, buoyed by expectations of a more favorable regulatory stance under President Donald Trump. That enthusiasm, however, was short-lived, as renewed trade tensions - particularly tariffs on China and other major partners - reintroduced macroeconomic uncertainty and market volatility.

After surging to a record high of $126.2k - a rally propelled by unprecedented adoption, particularly among corporate treasuries - Bitcoin has since staged a sharp retreat as risk appetite wanes and investors reassess the shifting economic landscape. The asset is currently trading near $90.3k, down 3.45% year-to-date. Despite this price drawdown, Bitcoin’s market dominance has actually strengthened, climbing from 58.1% to 59.4%, indicating a flight to quality within the crypto sector even amidst the downturn.

Much of Bitcoin’s price appreciation from April to October was driven by the accelerating adoption of BTC by publicly listed companies. As the influx of new corporate entrants began to plateau, the momentum behind the rally lulled. This dynamic was starkly visible between August and November, where the slowdown in public company accumulation coincided directly with the easing of upward price pressure.

Bitcoin’s price momentum also began to stall in August, a shift likely influenced by long-term holders selling their assets. According to Whale Alert, since July, 25 whale addresses that had been inactive for more than a decade moved coins on-chain, suggesting profit-taking or repositioning by early holders. This reintroduction of long-dormant BTC into the market added incremental sell-side pressure at a time when broader demand was already softening.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.