Learn More at www.ceek.com and www.firstblock.ai

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We reviewed the top news, stats, and reports in the digital asset ecosystem for our 330k weekly subscribers. This week, SEC Chair Atkins said onchain capital raising should come “without endless legal uncertainty,” the SEC delayed decisions on several ETFs tied to staking and altcoins, and the SEC and Winklevoss-led Gemini reached a “resolution in principle” over their years-long Gemini Earn lawsuit. On the fundraising front, Figure raised $787.5M in an IPO to scale its Provenance Blockchain-based financial services, while Gemini raised $425M through its own IPO, selling 15.18M Class A shares at $28 each.

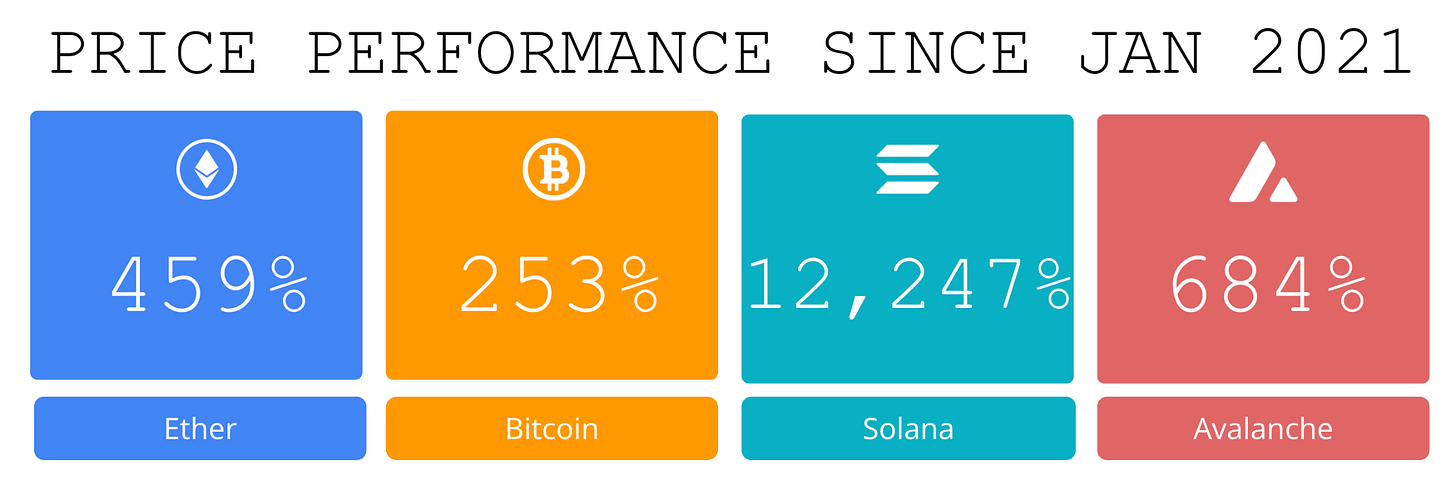

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Tap into the $8.5T Generative AI Economy with CEEK, the AI-powered platform securing content as digital assets on the Blockchain. Trusted by Meta, Universal Music, and Microsoft, CEEK enables users with Agentic AI tools to create, monetize and scale content and expertise. CEEK is the Web3 Monetization OS for the new economy. 👉 Learn more at www.ceek.com

First Block’s vision is clear: a world where every stock, bond, fund, and real asset can be tokenized, traded, and settled in real time. By merging the discipline of Wall Street with the innovation of blockchain, First Block is creating the infrastructure for liquid, compliant, and borderless capital markets. Learn more at www.firstblock.ai

Become a Coinstack Sponsor

To reach our weekly audience of 330,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

👨⚖️ SEC Chair Atkins says onchain capital raising should come 'without endless legal uncertainty': In a keynote speech to the Organization for Economic Co-operation and Development, new U.S. Securities and Exchange Commission Chair Paul Atkins reaffirmed that "most crypto tokens are not securities" as the agency continues to draft guidelines to benefit the industry.

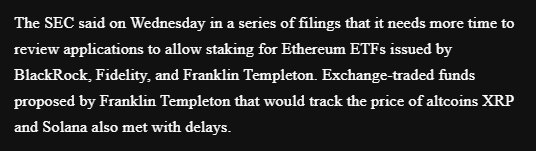

⚖️ SEC delays decisions on several ETFs tied to staking and altcoins: The Securities and Exchange Commission (SEC) delayed decisions on three crypto exchange-traded funds (ETFs) on Sept. 10.

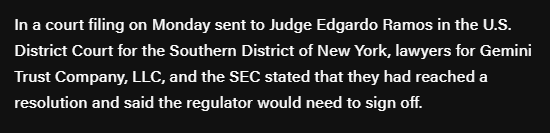

✍️ SEC, Winklevoss-led Gemini reach 'resolution in principle' over years long lawsuit involving Gemini Earn:The U.S. Securities and Exchange Commission and Gemini have reached "a resolution in principle," after the agency accused the crypto exchange of not following its rules when it launched a crypto lending program.

🚀 London Stock Exchange Group rolls out blockchain platform for tokenized private funds: The London Stock Exchange Group has launched a blockchain-based platform to help private funds issue and settle tokenized assets as traditional finance increasingly adopts onchain technology.

📈 Spot bitcoin ETFs log $553 million in daily inflows: Spot bitcoin exchange-traded funds in the U.S. saw a total daily net inflow of $552.78 million on Thursday as institutional investors rotate back to bitcoin with renewed confidence.

💬 Tweet of the Week

Source: @CryptoHayes

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

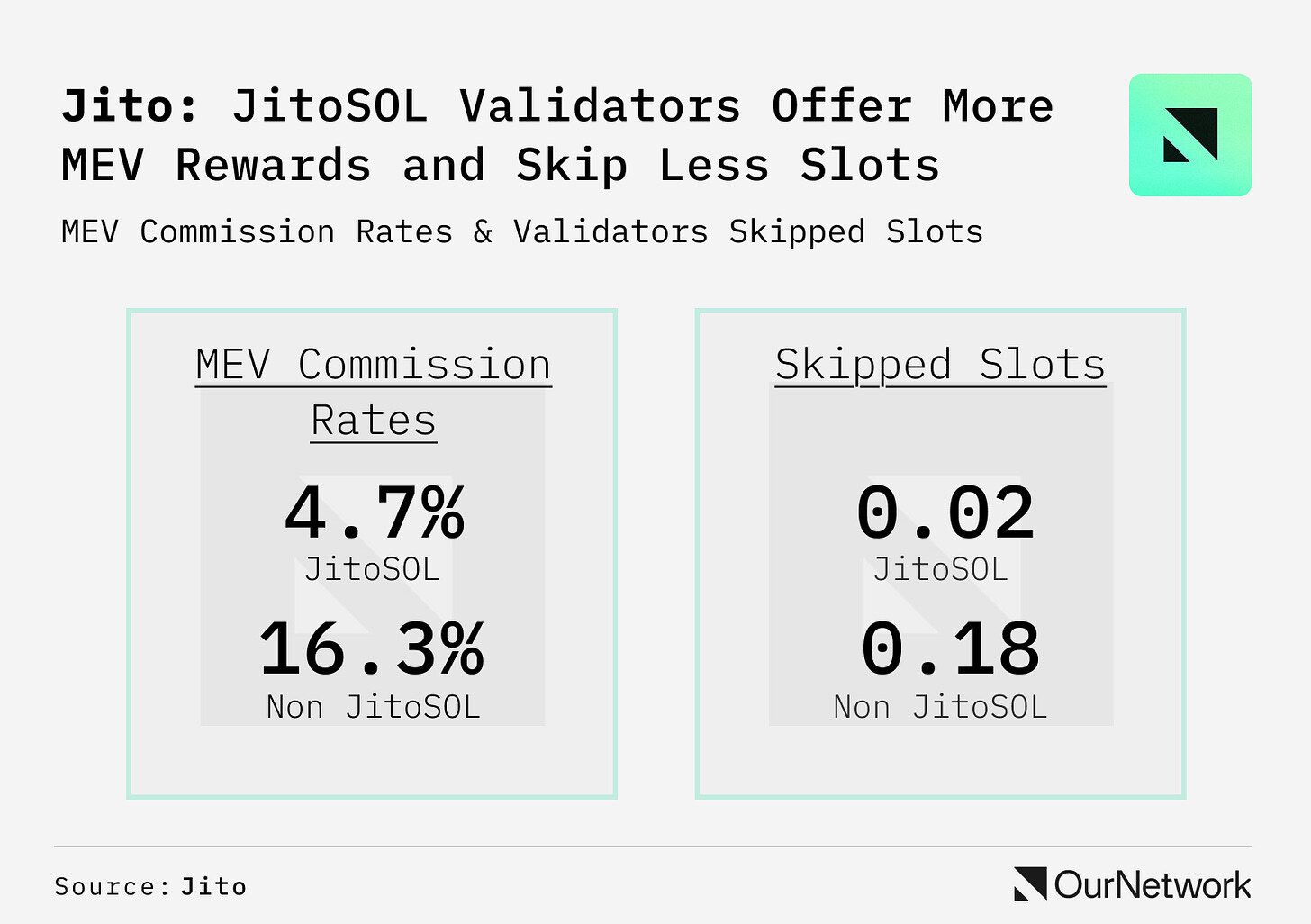

1. JitoSOL leverages a novel onchain programmatic stake delegation protocol: StakeNet stores key validator history, and the Steward Program rebalances stake across ~200 validators based on validator history and criteria that optimizes higher performance and low commissions. This improves Solana's performance and decentralization, increases the amount of revenue distributed to stakers, automatically and transparently diversifying delegation risks across a set of highly qualified validators.

Source: @OurNetwork

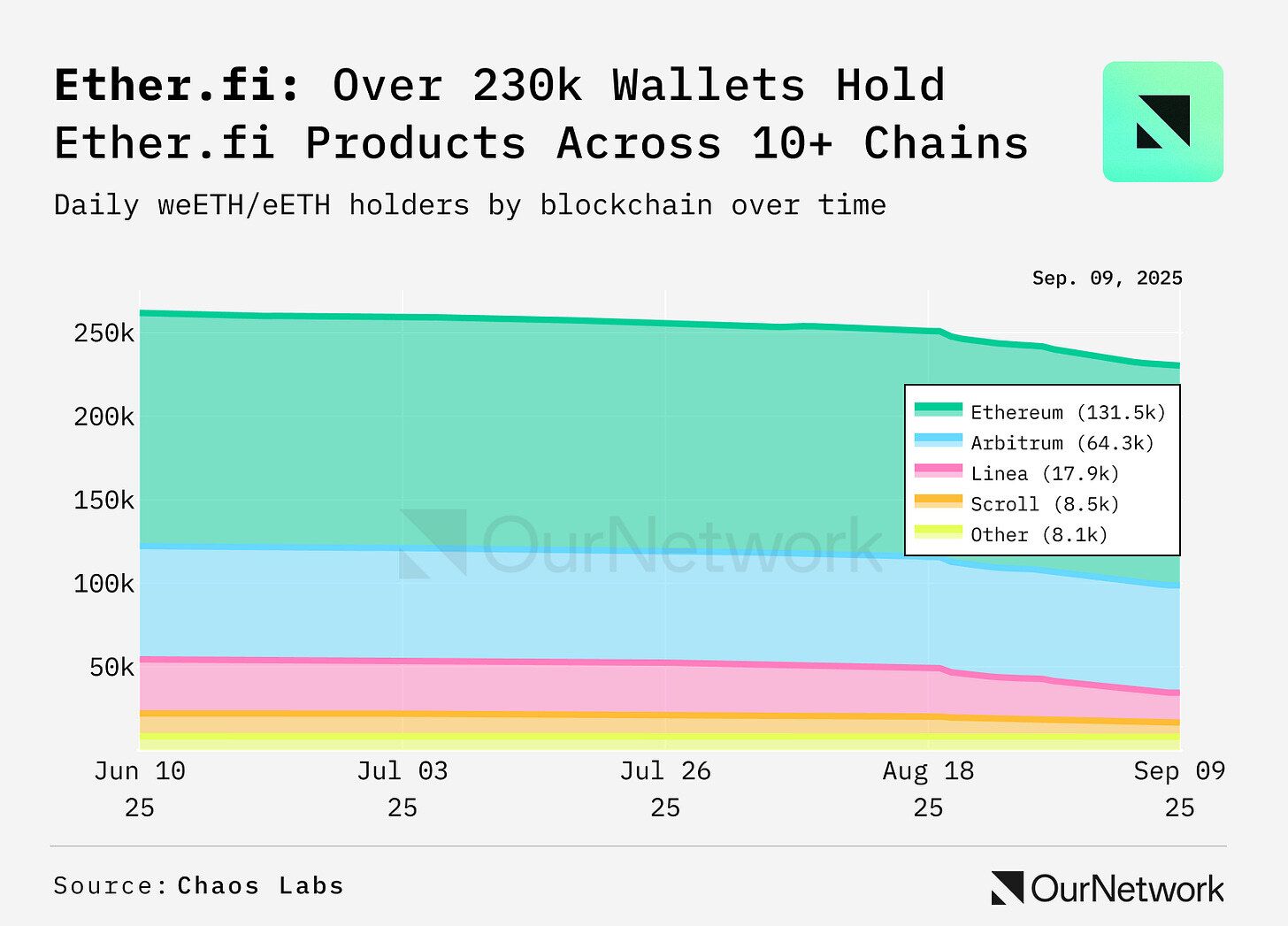

2. Ether.fi continues to lead the liquid restaking sector (LRT) sector with dominant ecosystem traction. Currently, its flagship LRT, weETH/eETH, saw supply reach almost 2.9M ETH, reinforcing its role as a prominent staked ETH collateral. Over 230K wallets hold Ether.fi products across chains. Ethereum leads with over 130K wallets. Arbitrum is next with 64K wallets. And Linea has almost 18K wallets holding Ether.fi tokens.

Source: @OurNetwork

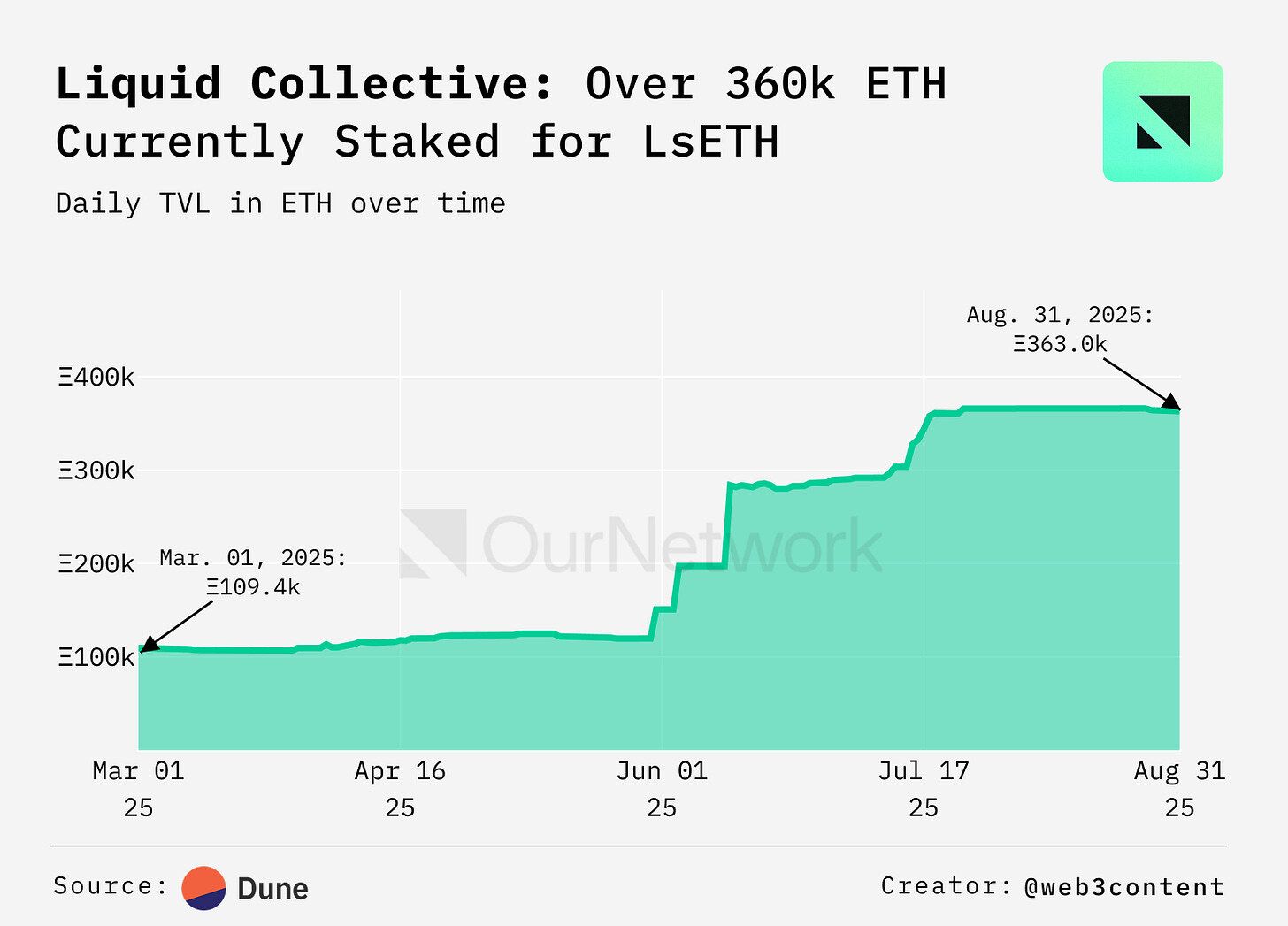

3. Liquid Collective is an institutional-grade liquid staking protocol designed for enterprise compliance and security, a focus which has positioned it to capture significant inbound stake from the emerging corporate treasury sector. Digital Asset Treasury (DAT) inflows have contributed to a 231% surge in LsETH’s TVL over the last six months, as companies adopt LsETH for a liquid, multi-operator, onchain staking solution to make their ETH holdings productive.

Source: @OurNetwork

4. JupSOL is Jupiter's liquid staking token. With 5.1M circulating JupSOL, the circulating supply has increased by 106% year-over-year and market cap has grown 274% along with SOL price appreciation. With these metrics, JupSOL has rapidly ascended to become the third ranking LST on Solana following JitoSOL and bnSOL. Despite a significant market cap gap with the top 2 LSTs, JupSOL's growth signals strong adoption momentum.

Source: @OurNetwork

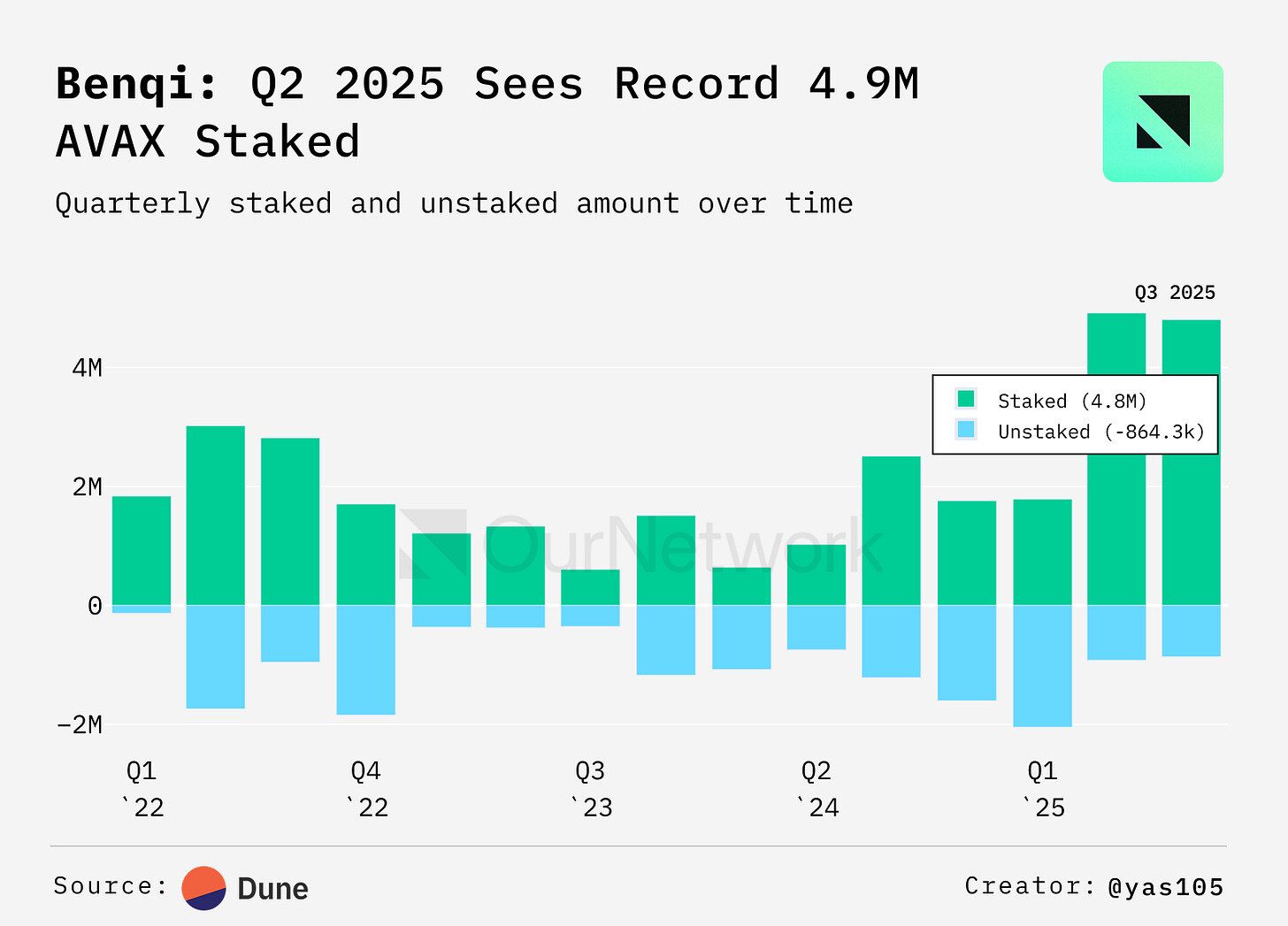

5. Benqi, Avalanche's premier liquid staking protocol, has achieved record-breaking growth in the last two months, pushing the total liquid-staked AVAX (sAVAX) to its all-time high. This surge has resulted in a net total of over 16.6M AVAX ($423M) being secured by the platform. Backed by a solid 5.05% APR, the average staking volume in July-August 2025 has been 3-4 times higher than any previous period, signaling a massive new wave of capital inflow.

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Welcome to OurNetwork's latest. This issue focuses on the liquid staking space and covers some of its most significant protocols. A big shoutout to mar1na, Hayden Tsutsui, Chaos Labs, Melissa Nelson, Seoul Data Labs, YASMIN, and Eduardo Rigon for contributing.

Let's get into it.

– ON Editorial Team

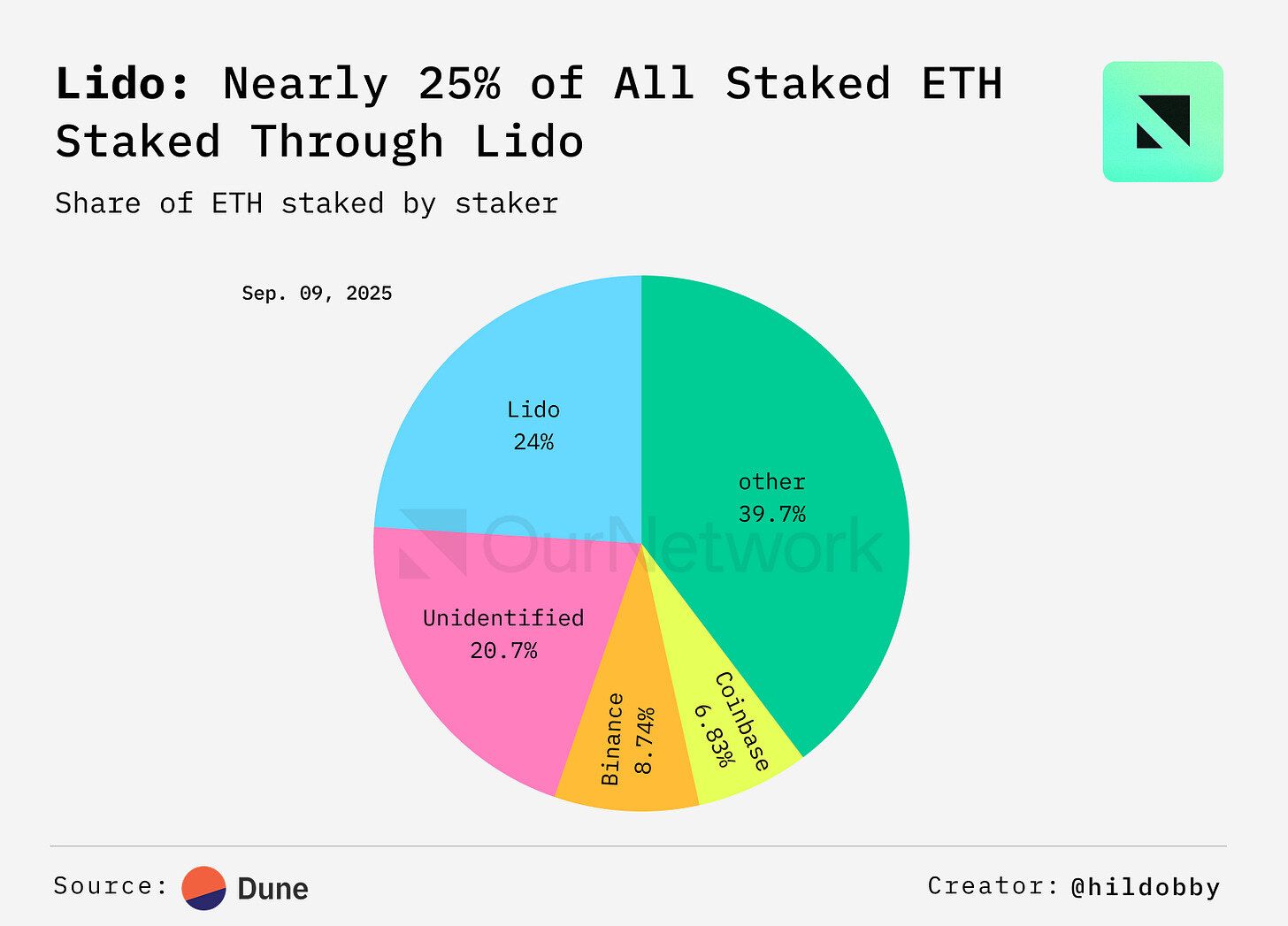

📈 Lido Dominates Ethereum Staking Market Despite Eroding Share

Amid weakening dominance in the staking sector, Lido still remains Ethereum’s juggernaut. It leads the LST space with 8.7M ETH staked, and is head to head with Aave (9M ETH locked) in the battle to be the top DeFi protocol. Yet a changing staking space and growing staked ETH outflows have contributed to market share loss for Lido, down from 26% to 24% in the past 3 months. This is an ongoing downtrend since late 2023, after Lido had brushed close to the critical threshold of one third staked ETH and roused urgent centralization concerns.

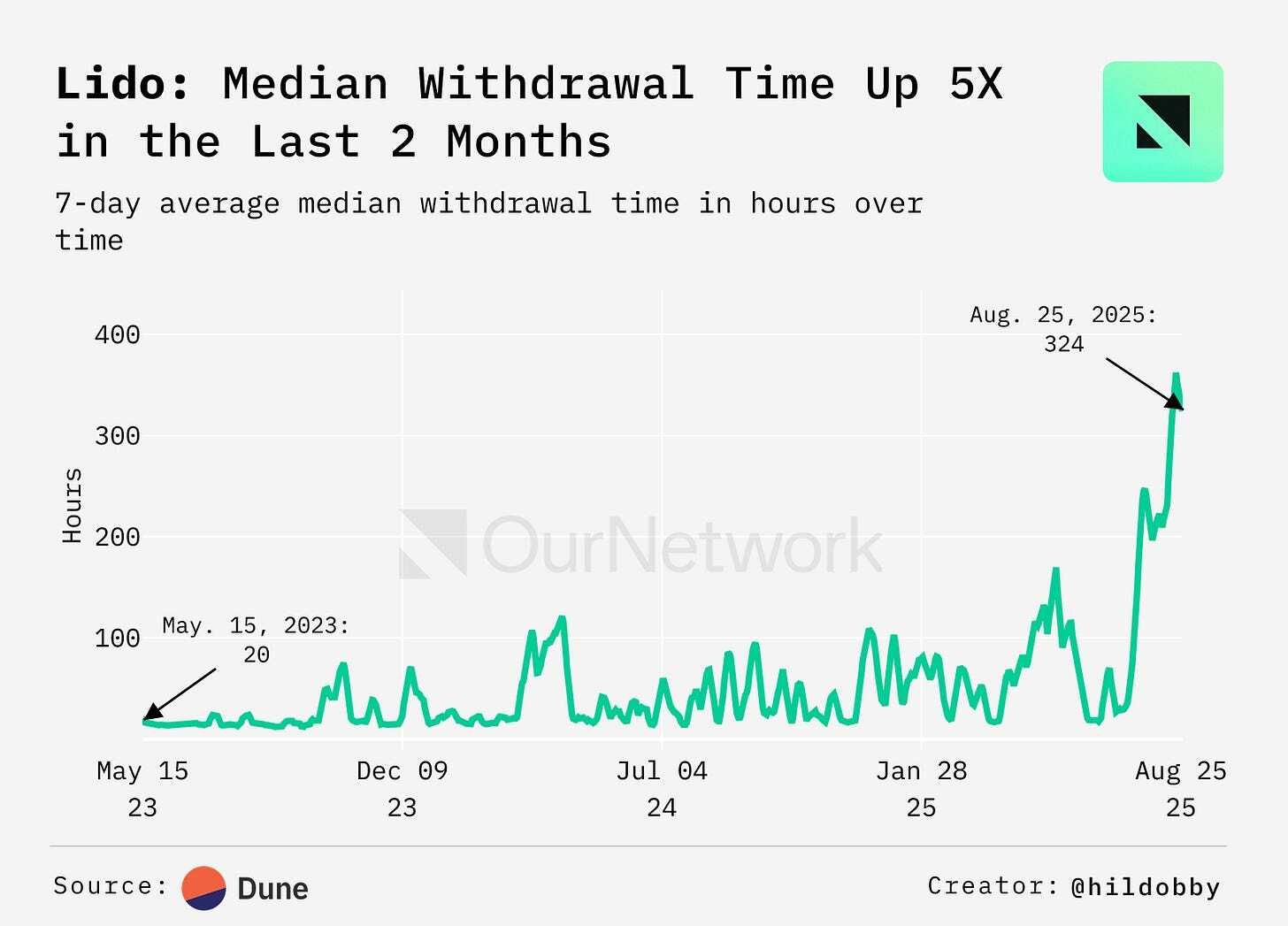

Participation in Lido underwent a shock in July. An ETH liquidity crunch impaired a popular Lido stETH earn strategy on Aave. stETH faced a selloff and temporary depeg, and a spike in unstake volume that increased the withdrawal wait by a factor of 20. Neither Lido’s nor overall Ethereum unstake queue fully recovered.

In search of diversity, the past six months saw growing staking competition. Ether.fi, Binance (wBETH), Kiln and Figment showed 20-60% respective gains in staked ETH for this period. Lido made competitive bids in return, from cost cutting, to innovation including Lido Earn and the upcoming V3 release.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.ceek.com and www.firstblock.ai