Learn More at www.ceek.com and www.firstblock.ai

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We reviewed the top news, stats, and reports in the digital asset ecosystem for our 330k weekly subscribers. This week, Nasdaq sought SEC approval to trade tokenized securities, USDD—the Justin Sun-backed stablecoin—launched natively on Ethereum, Grayscale filed with the SEC to launch a spot Chainlink ETF, and major new funding rounds were announced from Etherealize ($40M) and Utila ($22M).

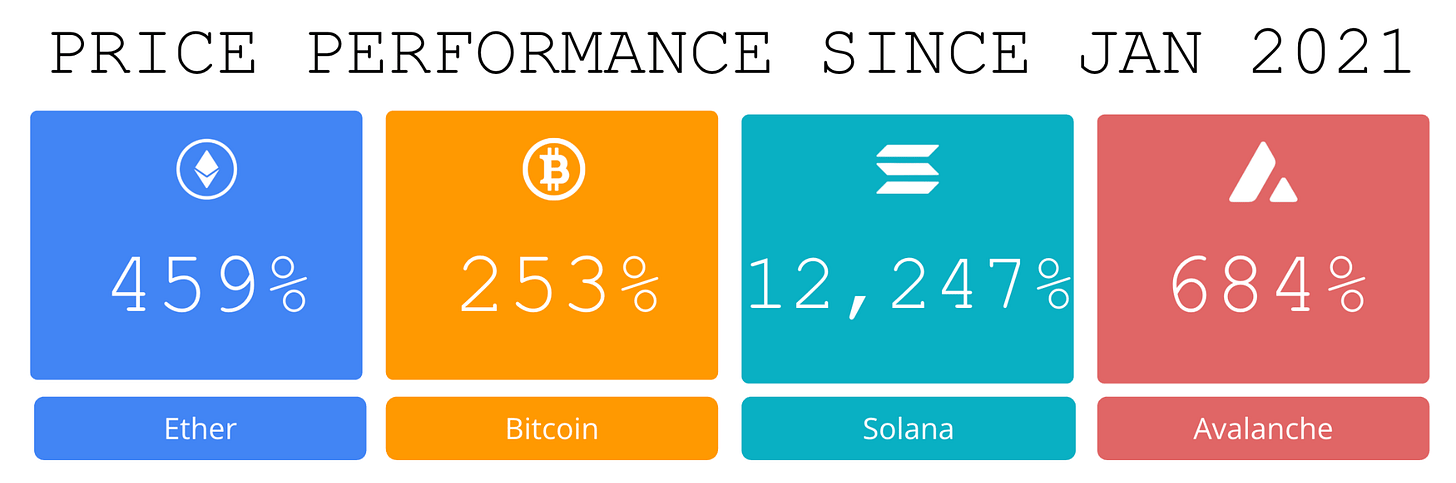

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Tap into the $8.5T Generative AI Economy with CEEK, the AI-powered platform securing content as digital assets on the Blockchain. Trusted by Meta, Universal Music, and Microsoft, CEEK enables users with Agentic AI tools to create, monetize and scale content and expertise. CEEK is the Web3 Monetization OS for the new economy. 👉 Learn more at www.ceek.com

First Block’s vision is clear: a world where every stock, bond, fund, and real asset can be tokenized, traded, and settled in real time. By merging the discipline of Wall Street with the innovation of blockchain, First Block is creating the infrastructure for liquid, compliant, and borderless capital markets. Learn more at www.firstblock.ai

Become a Coinstack Sponsor

To reach our weekly audience of 330,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

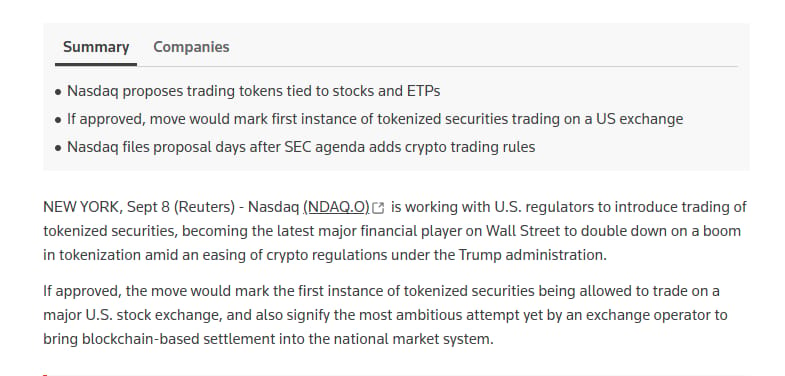

⚖️ Nasdaq seeks SEC nod to trade tokenized securities alongside traditional stocks: Nasdaq is pushing for permission to allow tokenized versions of listed stocks and ETFs to trade on the same order book as their traditional counterparts, a first-of-its-kind push that could bring blockchain-based settlement into the national market system as soon as the third quarter of 2026 if approved.

🚀 USDD, the Justin Sun-backed stablecoin, launches natively on Ethereum: USDD, the algorithmic stablecoin backed by Tron founder Justin Sun, has launched on Ethereum, according to an announcement on Monday.

⚖️ Grayscale seeks SEC approval to launch spot Chainlink ETF in the US:Grayscale has filed an S-1 registration statement with the Securities and Exchange Commission in a bid to manage what could be one of the first spot Chainlink exchange-traded funds in the United States — including a potential staking component.

⚖️SEC and CFTC aim to harmonize crypto rules, boost US market leadership:The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) will hold a joint roundtable on Sept. 29 to advance regulatory coordination in the digital asset sector.

🚀 OpenSea Reveals 'Flagship' NFT Treasury Stockpile as SEA Token Drop Nears:Prominent NFT marketplace OpenSea said Monday that it has committed more than $1 million to acquiring culturally relevant NFTs as it charges towards the launch of its native ecosystem token, SEA.

💬 Tweet of the Week

Source: @RyanSAdams

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Velodrome spans 11 superstack chains, but due to Dune data limits, five are analyzed below. The DEX's TVL stabilized in May, with Optimism leading at between $50M and $123M, hitting a peak of $123.8M in January. Q1 saw TVL dips. Ink holds between $5M and $7M, Unichain between $0.5M and $2.5M, Celo is at $1.2M and $2.6M, and Superseed is at $0.15M and $1M.

Source: @OurNetwork

2. DragonSwap has surpassed $3.2B in cumulative trading volume, making it the largest spot trading protocol on Sei. It took DragonSwap 5 months to reach $200M in total trading volume, then just 19 days to double that. The platfrom crossed $2B in under a year and has ranked among DefiLlama’s top 50 DEXs multiple times.

Source: @OurNetwork

3. Shadow Exchange is a concentrated-liquidity DEX built natively on the Sonic blockchain. Designed for capital efficiency and deep liquidity, it adopts an organic growth model funded through protocol-generated fees and community incentives. After an impressive run in Q1 2025, the Sonic ecosystem (including Shadow) has seen waning metrics, but Shadow remains the leader in volume, swaps, and user base. It commands over 65% of Sonic’s DEX volume.

Source: @OurNetwork

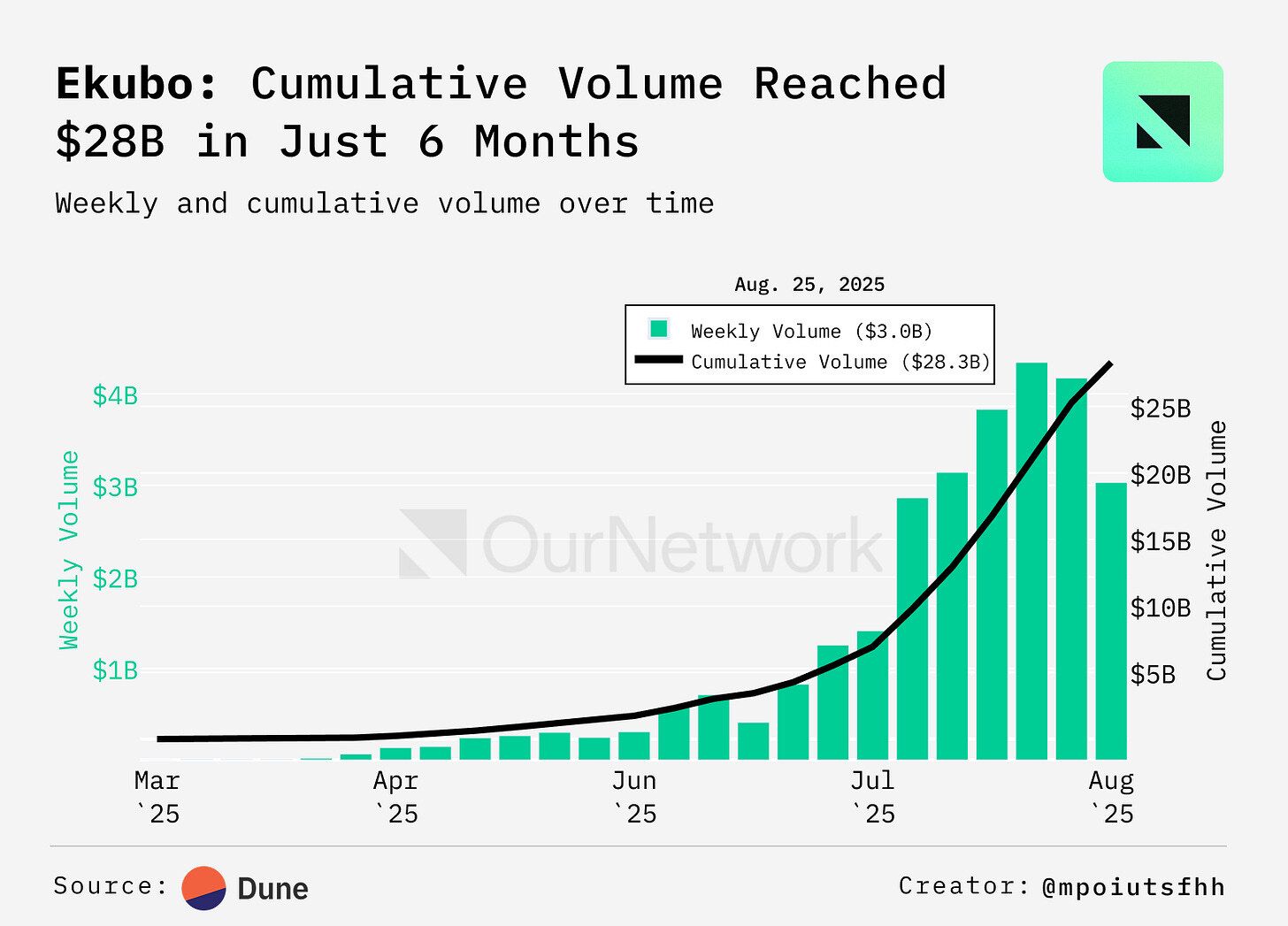

4. Ekubo Protocol is an automated market maker deployed on Ethereum and Starknet, designed for capital efficiency and modularity. With liquidity ticks 100 times smaller than Uniswap v3, a singleton “till” design that minimizes gas, and extensible pools for features like TWAMM or oracles, Ekubo enables $1k to perform like $100k elsewhere. In just six months it has surpassed $27B in cumulative volume and 1.06M trades, making it one of the fastest-scaling DEXs.

Source: @OurNetwork

5. Q2 2025 was Raydium’s fifth straight quarter as the leader in Solana daily DEX volume. The DEX generated 28.9% of total volume on the network.

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Welcome to OurNetwork’s latest on decentralized exchanges.

Leading off, we have our friends at Token Terminal providing an overview. Oğuz covers Velodrome's by chain dynamics, Jelena digs into DragonSwap, Sei's leading DEX, and Oluwole checks out Shadow Exchange and its token mechanics. Last but not least, Alex checks out Ekubo's surprising momentum facilitating trades of on the USDC-USDT pairs.

The chains never sleep. Let's get to it.

– ON Editorial Team

📈 Onchain Trading Activity at All-Time High, With Concentration of Chains & DEXs powering ~80% of Trading Volume

DEX activity is at an all-time high as quarterly trading volume surpassed $1 trillion in Q2 2025. DEX trading volume is up ~100% year-over-year.

BNB Chain is the top venue for onchain trading. The top three chains, based on Q2 DEX trading volume, are BNB Chain, Solana, and Ethereum. BNB Chain accounted for ~50% of the market sector's volume during Q2.

PancakeSwap is the top DEX by volume. The top three DEXs, based on Q2 trading volume, are PancakeSwap, Uniswap, and Raydium. These three exchanges accounted for ~80% of the market sector's volume during Q2.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.ceek.com and www.firstblock.ai