Learn More at www.rootstock.io and www.crowdcreate.us

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 315k weekly subscribers. This week Paul Atkins was officially sworn in as SEC chairman (Bye, bye Gensler!), BTC soared above $93k, the Oregon attorney general sued Coinbase, and big new venture rounds came in from Auradine ($153M) and LayerZero ($55M).

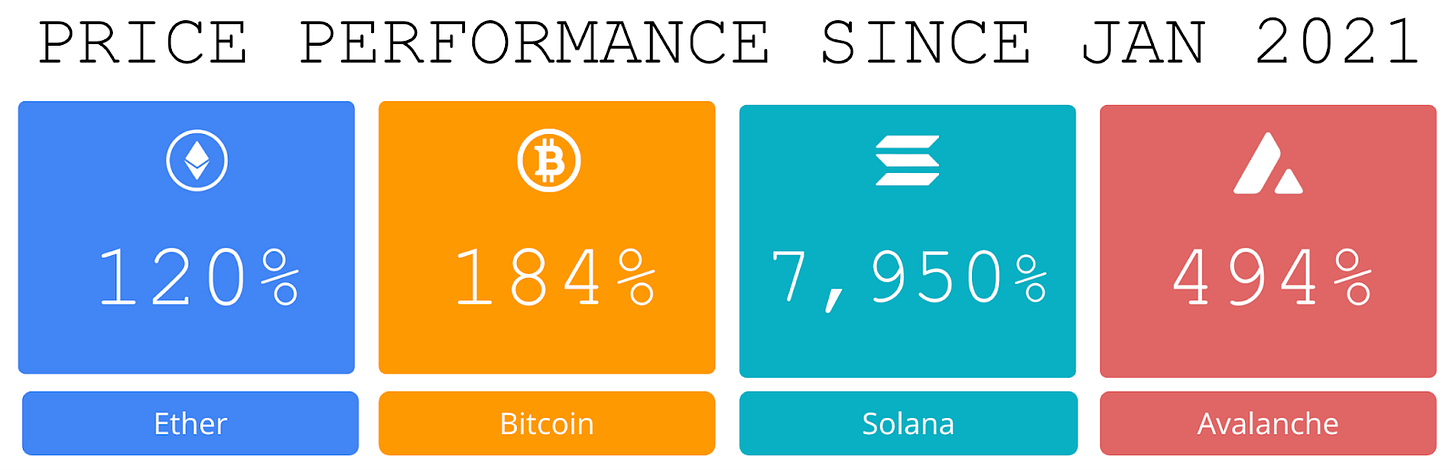

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.C

Thanks to Our 2025 Coinstack Sponsors…

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 60%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Looking to scale your brand and drive real engagement? Crowdcreate is a top-rated marketing agency specializing in marketing strategy, influencer marketing, PR, outreach, crowdfunding, social media management, and investor marketing. With 700+ successful projects—including Sandbox, KuCoin, BitMex, and Star Atlas—we’ve helped raise over $250 million and supported startups and Fortune 500 companies with data-driven strategies. Learn more: crowdcreate.us

Become a Coinstack Sponsor

To reach our weekly audience of 315,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ Crypto advocate Paul Atkins officially sworn in as SEC chairman: The U.S. Securities and Exchange Commission announced Monday that Paul Atkins was officially sworn into office as the 34th chair of the commission.Atkins, who is a long-time supporter of crypto, was nominated by President Donald Trump on Jan. 20, and confirmed by the Senate earlier this month.

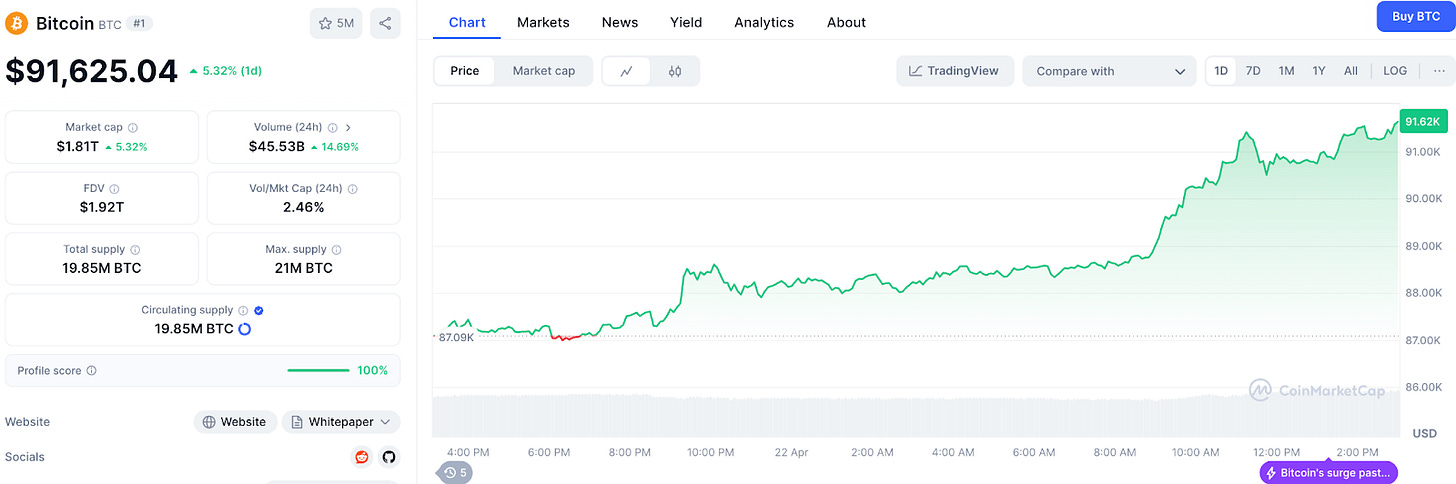

📈 Bitcoin Soars Above $93,000 as Global Markets Rebound: The rally comes as global stock markets rebound after five straight days of losses after Trump lets everyone know he’s not about to attempt to fire Fed Chair Jerome Powell — and that China tariffs will soon be decreased.

⚖️ Oregon attorney general sues Coinbase months after SEC drops case: Oregon Attorney General Dan Rayfield filed a securities enforcement action against cryptocurrency exchange Coinbase, echoing federal charges that were brought under the Biden administration but dropped earlier this year.

🏛 Canary Capital Seeks SEC Approval for Tron ETF With Staking:The ETF applications keep coming. Canary Capital on Friday filed an S-1 prospectus with the U.S. Securities and Exchange Commission on Friday for a spot Tron ETF that would include staking capabilities. The staking feature of the Canary Staked TRX ETF would allow investors to earn extra yield with their investment.

🇧🇷 Lead launderer in $190 million Brazilian crypto Ponzi scheme gets record 128-year sentence:A Brazilian judge has handed down a record 128-year prison sentence to the man convicted of leading the money laundering operation behind the Braiscompany cryptocurrency Ponzi scheme, which operated from June 2018 until its collapse in early 2023.

💬 Tweet of the Week

Source: @RaoulGMI

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

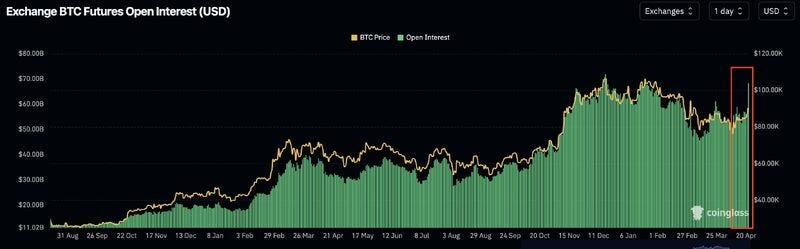

1. Over the last 24 hours, open interest on BTC futures increased by $10B (17%) and now stands at $68.3B, its highest level since January.

Meanwhile, inflows into spot BTC ETFs flipped positive ($488M in the last two days) after experiencing considerable net outflows through April (-$798M).

Source: @DavidShuttleworth

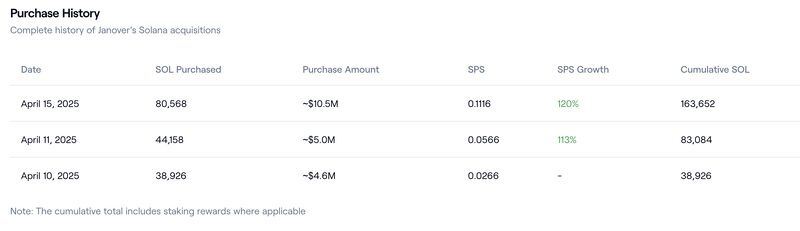

2. Over the last 9 days, Solana treasury strategy product Janover (NASDAQ: JNVR) has purchased 163,652 SOL ($22.5M). While this is a relatively small amount of inflows, it signals an interesting path forward. One of the more particularly powerful aspects of this approach is that this SOL can be staked and thus generates additional revenue, unlike traditional ETF products. Moreover, Janover aims to run their own validators, further extending their potential impact (and profitability).

To put this into perspective, inflows into spot $BTC and $ETH ETFs are -$137M and -$100.3M during this same interval (and -$798M and -$171M on the month), respectively.

Source: @DavidShuttleworth

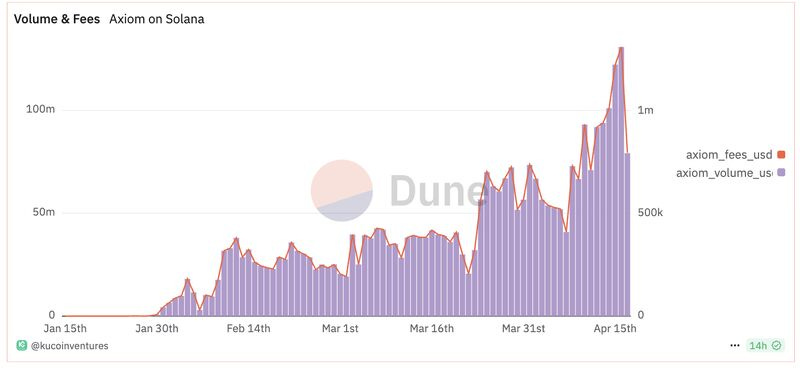

3. In less than 3 months, Axiom grew daily trading volume by 3000%, generating over $1.3M in daily revenue, and now captures 46% of all trading bot activity on Solana.

Source: @DavidShuttleworth

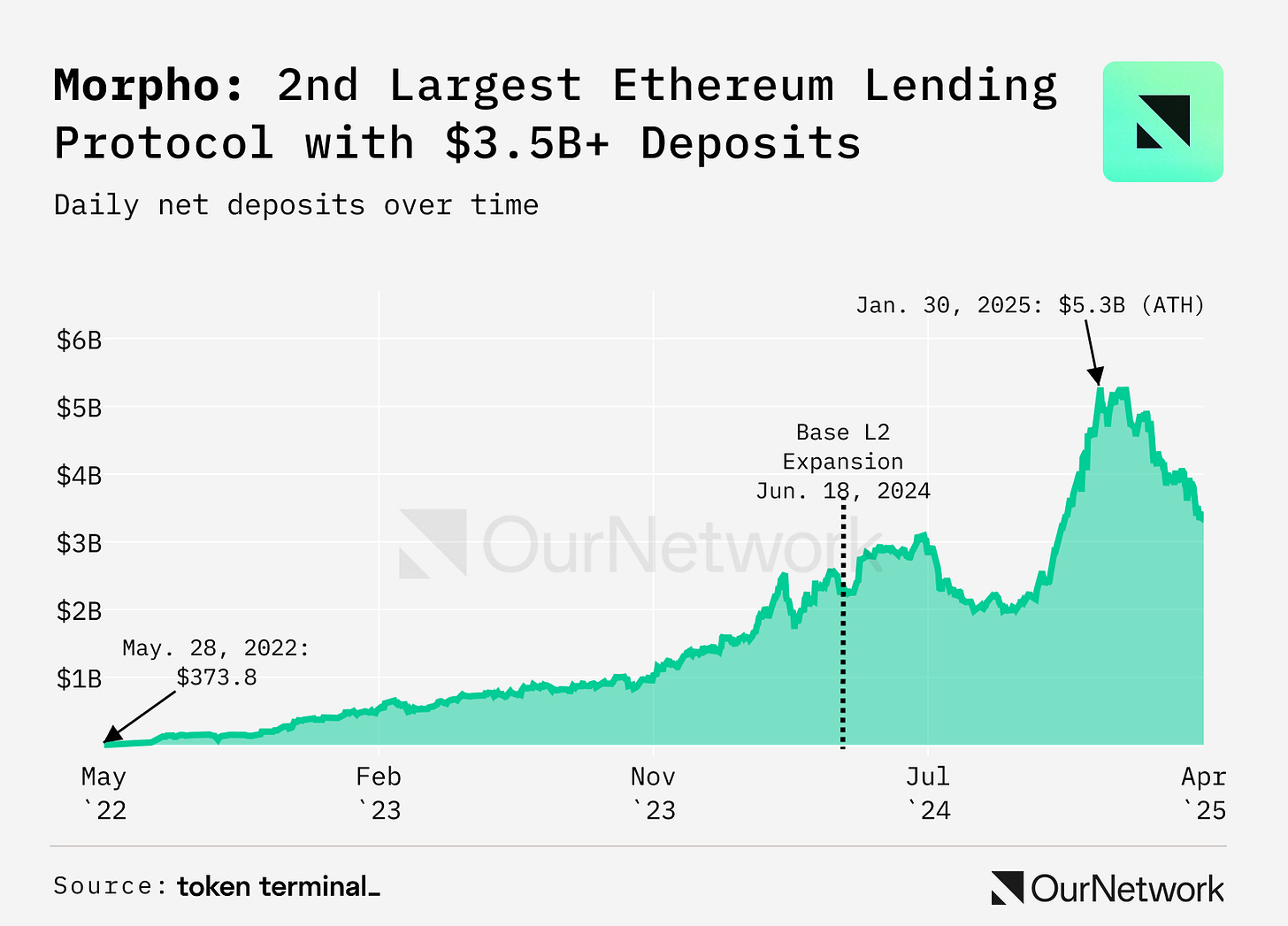

4. Morpho Has Established Itself as Key Infrastructure for Curated, Onchain Lending as the "DeFi Mullet" Model Emerges

Source: @OurNetwork

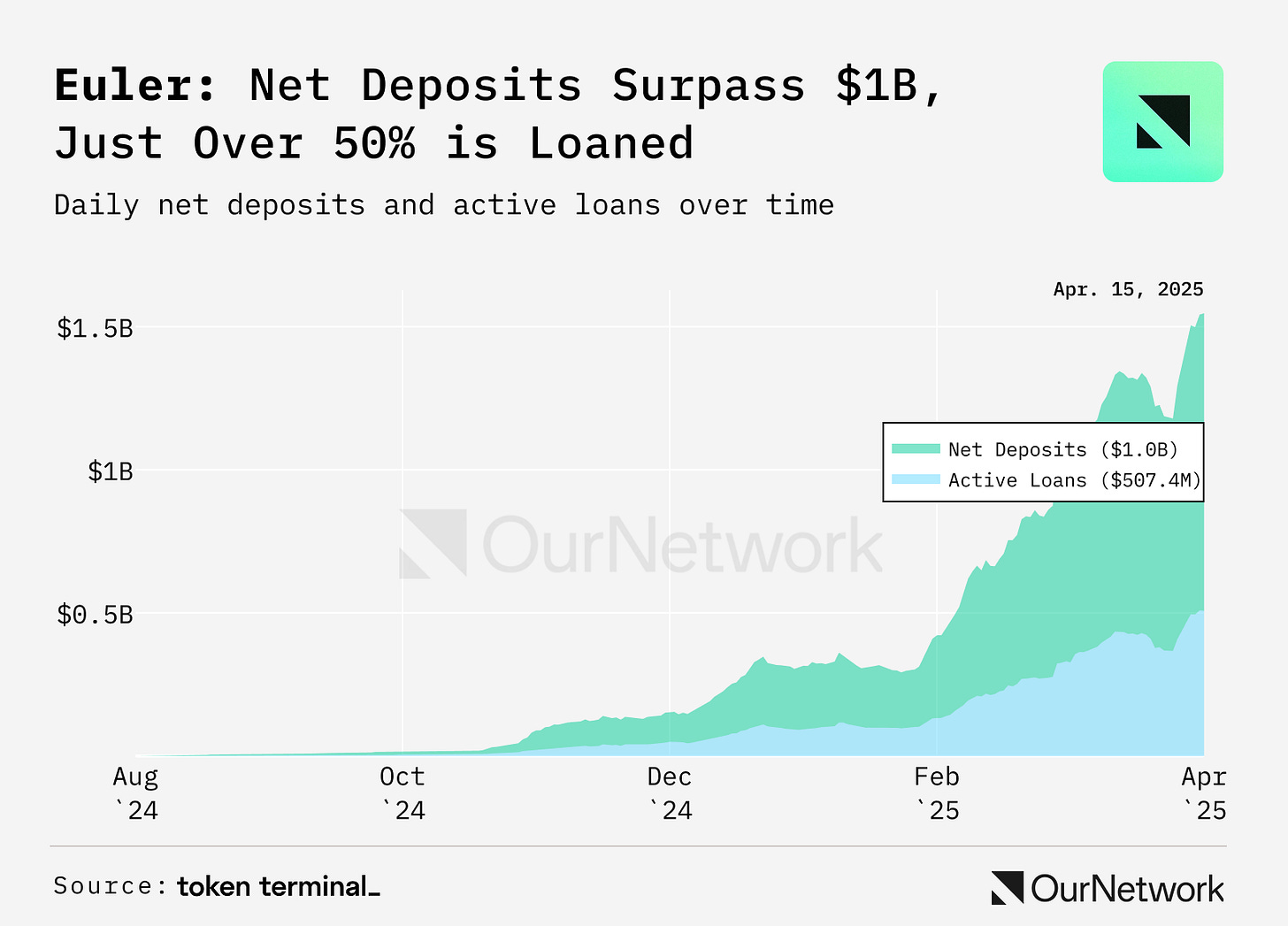

5. Euler Hits $1 Billion Deposits, The Fastest Growing Lending Protocol

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Welcome to Part One of OurNetwork's two-part series covering lending protocols, platforms which allow users to borrow permissionlessly, typically against collateralized assets.

This issue features some of the most impactful projects in the DeFi subsector — this includes Aave, crypto’s largest protocol by total value locked, as well as Morpho, whose peer-to-peer model propelled the relative newcomer to rank third by TVL among lenders.

We're also featuring Euler, whose modular infrastructure allows for permissionless vault creation. Euler has ridden a wave of momentum in 2025 to enter the top 10 lending protocols by TVL.

Finally, we've got coverage of Suilend, the leading lending protocol on the Sui blockchain.

Shoutout to Omer + Chaos Labs, JJ, Miguel, and Biff for writing up the reports below.

Let’s get into it.

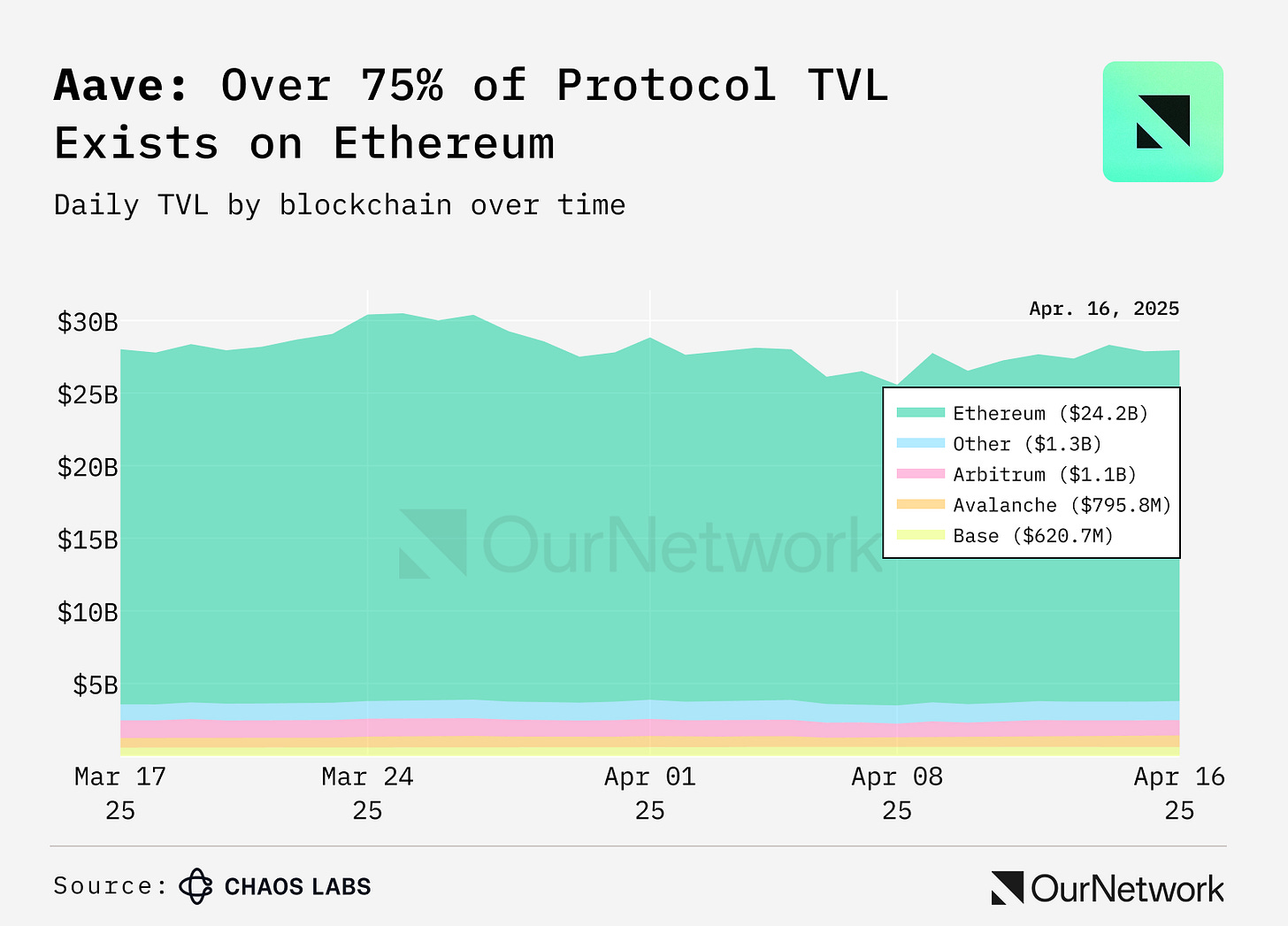

📈 Aave Proves Itself as DeFi’s Premier Lending Protocol with 14 Network Deployments and Best-in-Class, Battle-Tested Risk Management

Aave is a decentralized, non-custodial protocol that enables users to lend and borrow crypto assets permissionlessly. Aave has over $28B in TVL across deployments on Ethereum, Arbitrum, Optimism, Polygon, Avalanche, Base, zkSync, and most recently, Sonic. Ethereum remains the largest market on Aave, with over $21.6B in total supply. However, BNB and Avalanche have experienced rapid growth year-to-date, up +19% and +14%, respectively. Sonic, a newly launched EVM Layer 1 developed by the well-established Fantom Foundation, has already reached $480M in TVL.

✏️ Editor's Note:

TVL figures for Aave, Morpho, and Euler include borrowed assets. This means that, in addition to the deposited assets in the platforms, TVL includes assets borrowed against those deposits. The thinking there is that the protocol programmatically 'owns' these borrowed assets.

This does inflate TVL for lenders as it effectively double counts the borrow assets, which were already deposited —and counted as TVL— by a separate user.

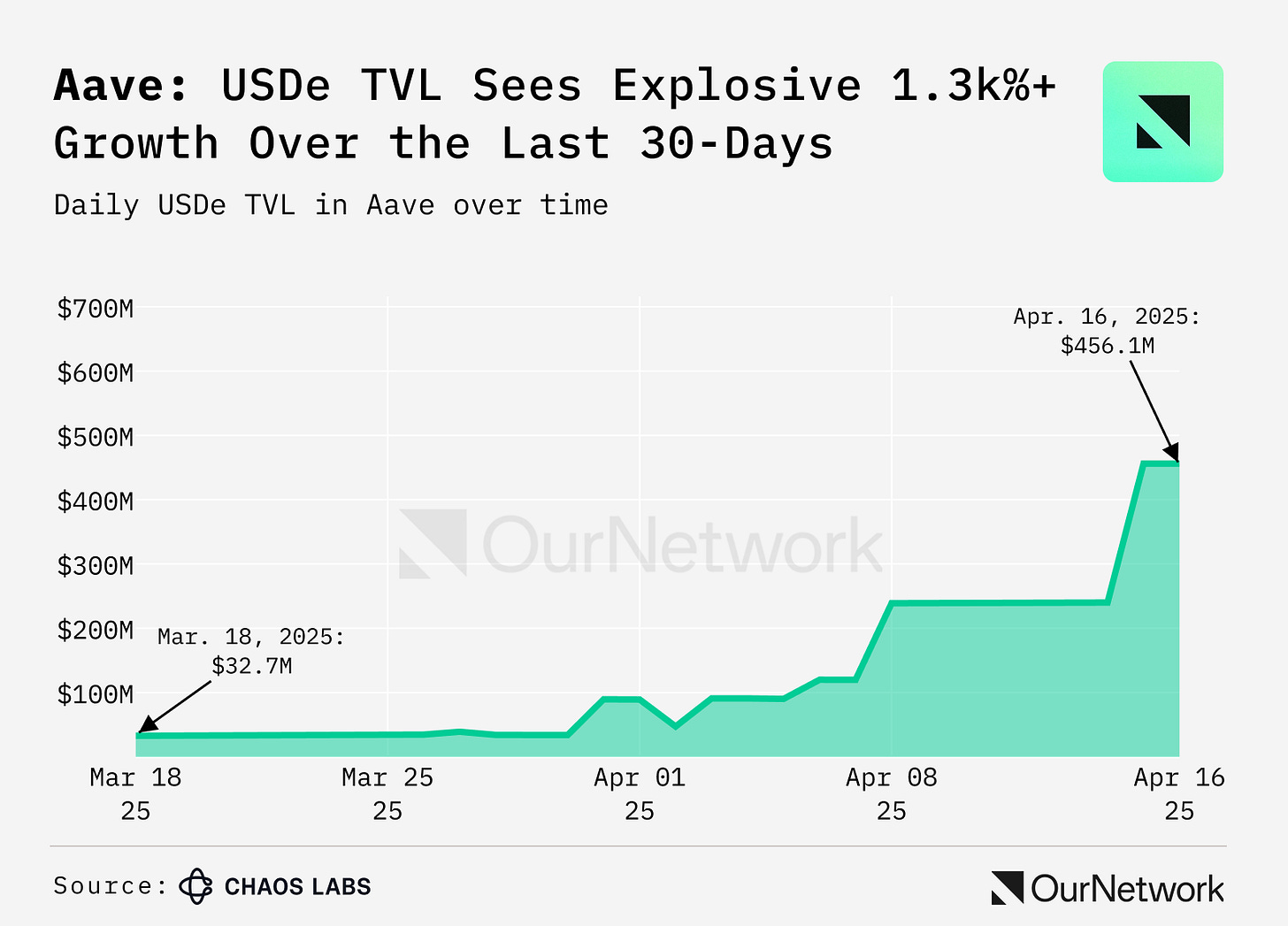

Stablecoins and synthetic dollars currently comprise approximately 31.3% of Aave’s total TVL, totalling $8.81B. Ethena’s synthetic dollar, USDe, has seen explosive growth of ~1,340% over the past month — reaching over $450M in TVL.

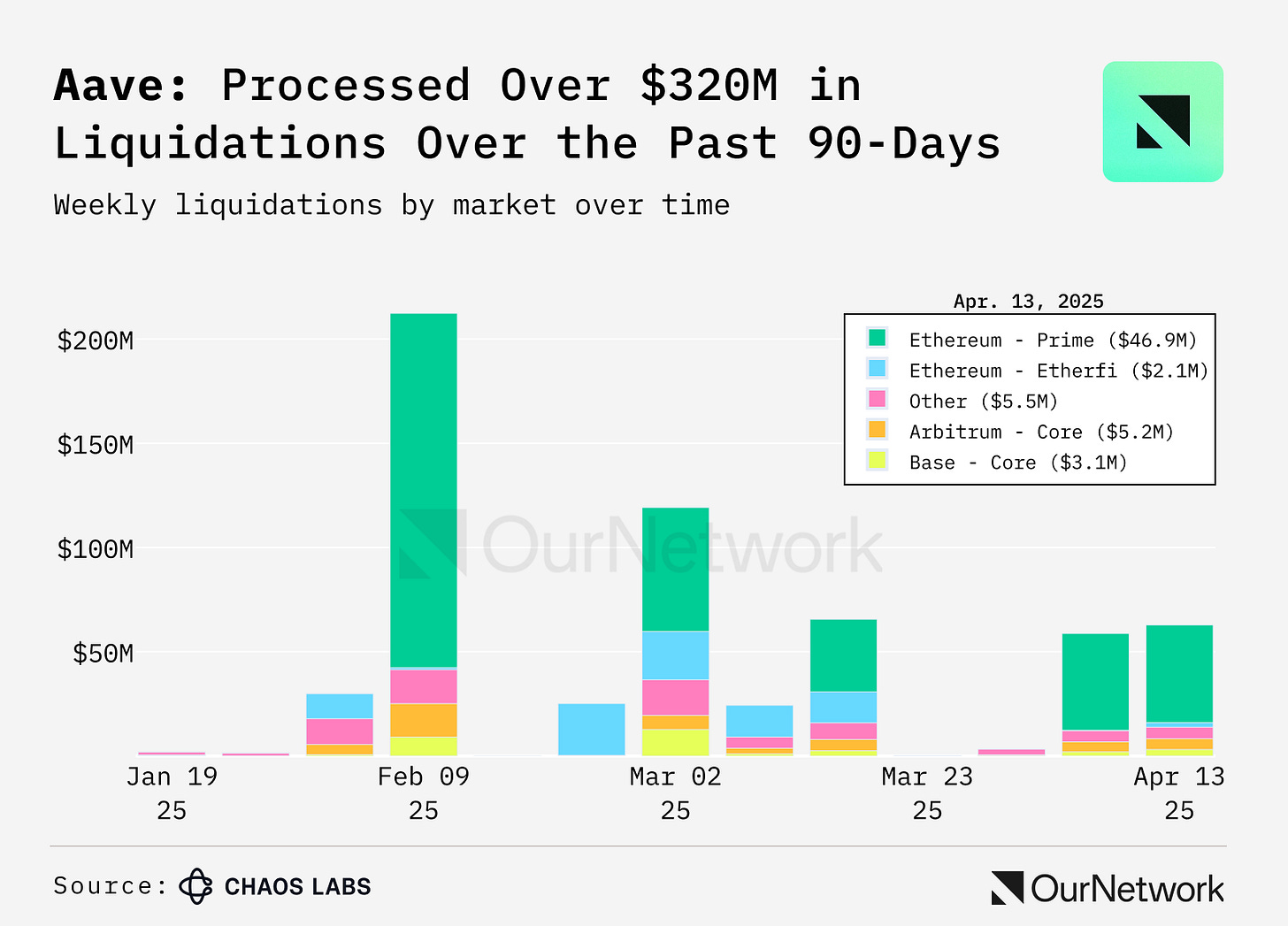

Aave has been battle-tested over the past 90 days, processing $320M in liquidations—including $210M in a single day during February’s tariff-driven market crash. This resilience reflects Aave’s risk framework, now enhanced by Edge Risk Oracles for real-time, onchain risk management.

April saw some of the largest single liquidations of the year so far. Users 0x67e and 0x1f9 both got their ETH positions liquidated during the Apr. 7 market crash for $4.25M and $3.75M each (6.13% of the total liquidations in the last 30 days). This did not stop the two users from transacting on Aave, as they both still have a seven-figure balance in supplied assets.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.rootstock.io and www.crowdcreate.us