Learn More at www.rootstock.io and www.kuladao.io and www.crowdcreate.us

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 320k weekly subscribers. This week, Coinbase introduced a BTC yield fund for institutional investors, US spot Bitcoin ETFs logged $3B in weekly inflows, SEC Chair Paul Atkins slammed Gensler regime for 'Stifling' crypto innovation, and big new venture rounds from Nous Research ($50M) and Symbiotic ($29M).

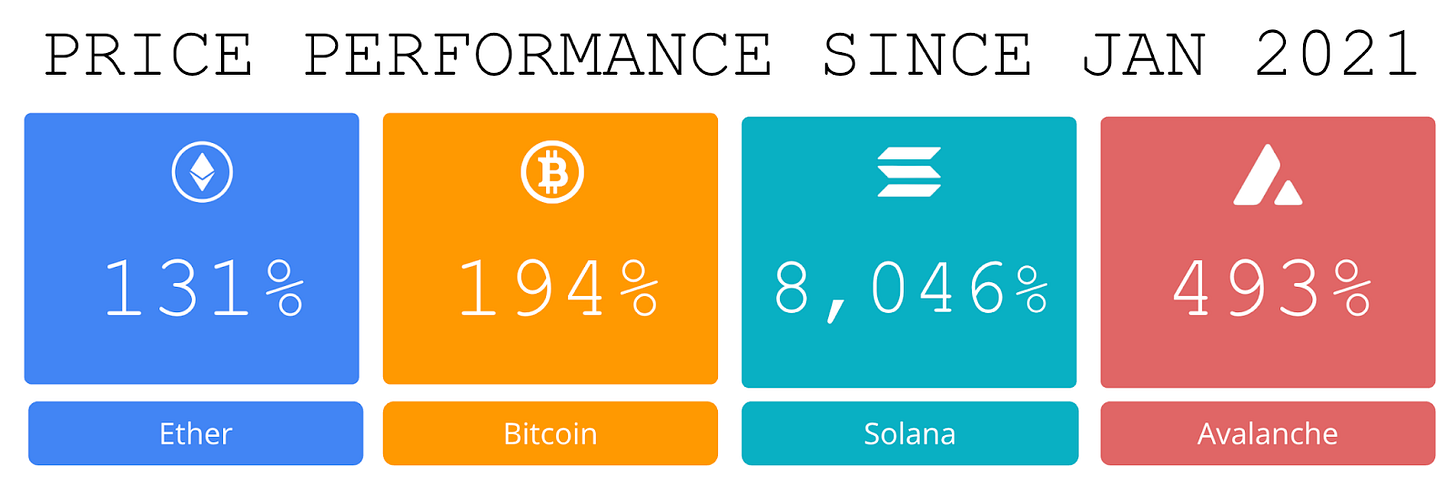

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2025 Coinstack Sponsors…

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 80%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Kula is a decentralised impact investment firm that transforms overlooked assets into shared prosperity and thriving communities by re-shaping how value and opportunity are recognised worldwide. By tokenising real-world assets, we provide opportunity, transparency, and financial sovereignty to historically excluded communities. Our model aligns economic growth with sustainable development, ensuring that wealth is not extracted but reinvested into the communities that generate it.

Looking to scale your brand and drive real engagement? Crowdcreate is a top-rated marketing agency specializing in marketing strategy, influencer marketing, PR, outreach, crowdfunding, social media management, and investor marketing. With 700+ successful projects—including Sandbox, KuCoin, BitMex, and Star Atlas—we’ve helped raise over $250 million and supported startups and Fortune 500 companies with data-driven strategies. Learn more: crowdcreate.us

Become a Coinstack Sponsor

To reach our weekly audience of 320,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

📈 Coinbase Introduces Bitcoin Yield Fund Seeking 4% to 8% Returns: Coinbase’s institutional investment arm has announced the creation of a new Bitcoin yield fund seeking in-kind returns of 4% to 8% per year.

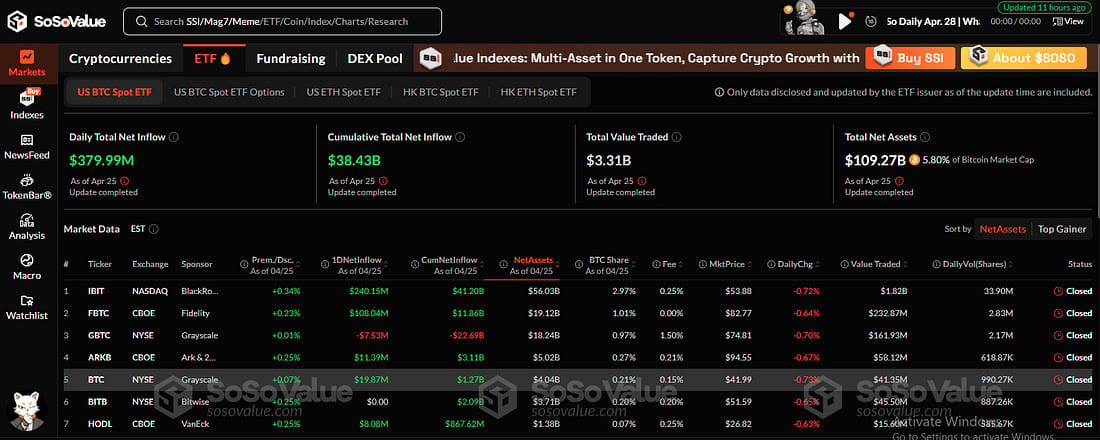

🚀 US spot bitcoin ETFs log $3 billion in weekly inflows, a 5-month high following BTC price spike:As crypto prices recovered last week, U.S.-based spot bitcoin ETFs logged over $3 billion worth of inflows, the highest such value since November, 2024, while their Ethereum equivalents logged the first net weekly inflows since February.

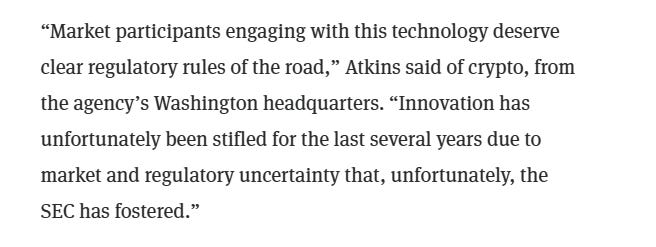

⚖️ SEC Chair Paul Atkins Slams Gensler Regime for 'Stifling' Crypto Innovation:Newly sworn-in SEC Chair Paul Atkins gave his first full address Friday, praising the Commission’s recent pro-crypto work in his absence, and condemning the agency’s previous moves against the industry under previous Chair Gary Gensler and the Joe Biden administration.

🏛 Federal Reserve Withdraws Crypto Rules for Banks, Ending 'Choke Point' Practices:The Federal Reserve said Thursday evening it will no longer obligate member banks to provide advanced notice of crypto and stablecoin-related ventures, and will instead monitor engagement with digital assets like it would any other banking activities.

⚖️ US court to sentence former Celsius CEO Alex Mashinsky on May 8 over fraud and manipulation charges:The sentencing of former Celsius CEO Alex Mashinsky is scheduled for May 8, 2025, following his guilty plea on two criminal counts late last year, according to a New York district court filing on Wednesday.

💬 Tweet of the Week

Source: @Crypto_Briefing

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

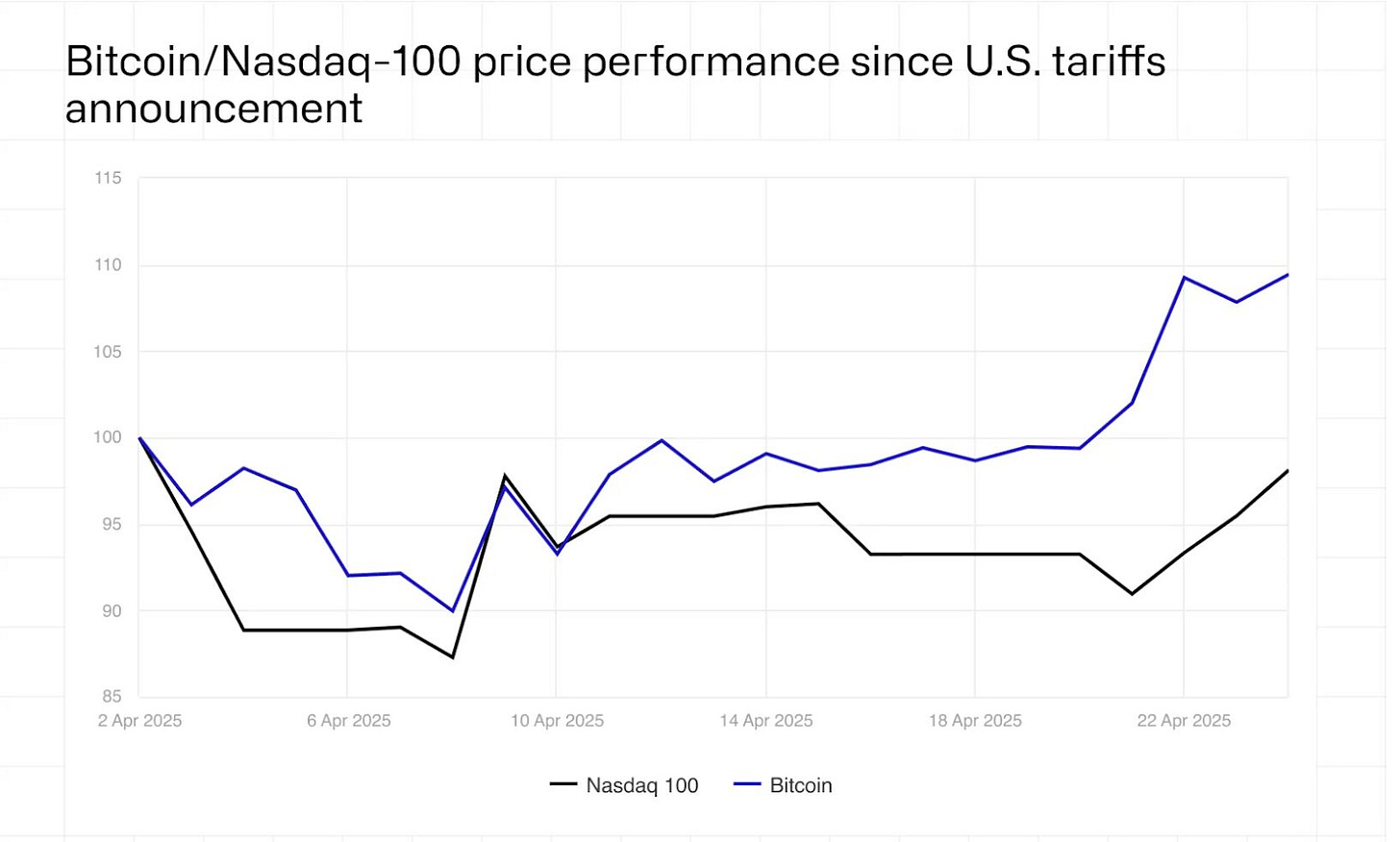

1. While Bitcoin ETF inflows hit record levels, BTC's performance against the broader market is reaching yearly highs.

Since "Liberation Day" tariffs were announced on April 2nd, $BTC has risen more than 12% relative to the Nasdaq.

BTC is once again functioning as a macro hedge, but this could also signal a deeper capital rotation into digital assets as uncertainty grows across traditional markets.

Source: @DavidShuttleworth

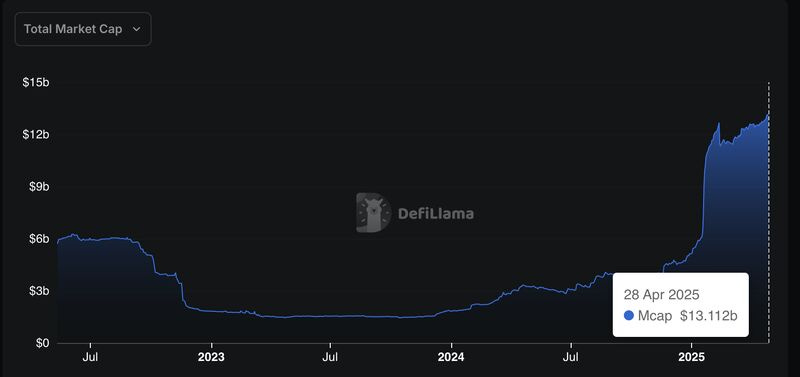

2. Total stablecoins in circulation on Solana just surpassed $13B for the first time ever. This includes a growth rate of 156% ($8B) since January. The network now handles upwards of $9B in daily stablecoin transfer volume.

In terms of composition, Circle USDC leads the way with $10B onchain, but interestingly Ondo Finance USDY has emerged as the third largest stablecoin on the network, growing by 65% this month alone.

Internet capital markets, in-person payments, programmable money. Accelerating. Solana Foundation

Source: @DavidShuttleworth

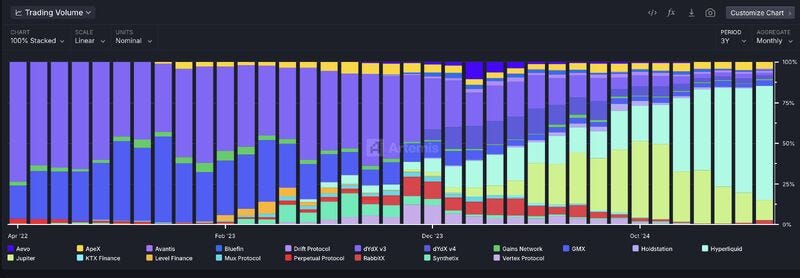

3. Hyperliquid is on pace to finish April with more than 70% of the entire decentralized perps marketshare. The last time a single protocol dominated like this was back in April 2022 when dYdX represented 73% of the market.

Overall Hyperliquid has handled over $166B in total volume this month and has now grown its marketshare by 55% YTD.

Source: @DavidShuttleworth

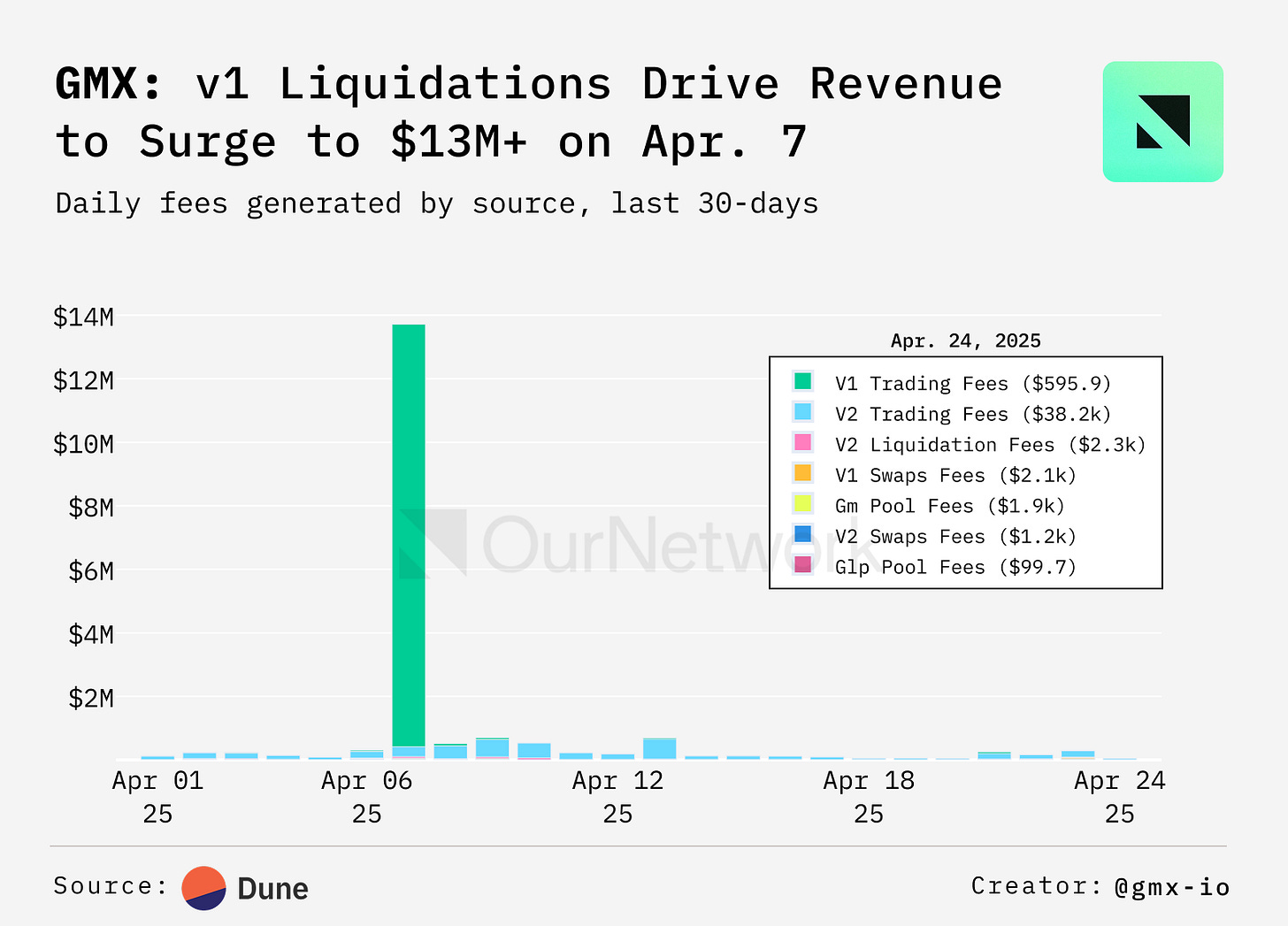

4. GMX Yields Rise above 100% after Collecting $13.3M in Trading Fees in a Single Day

Source: @OurNetwork

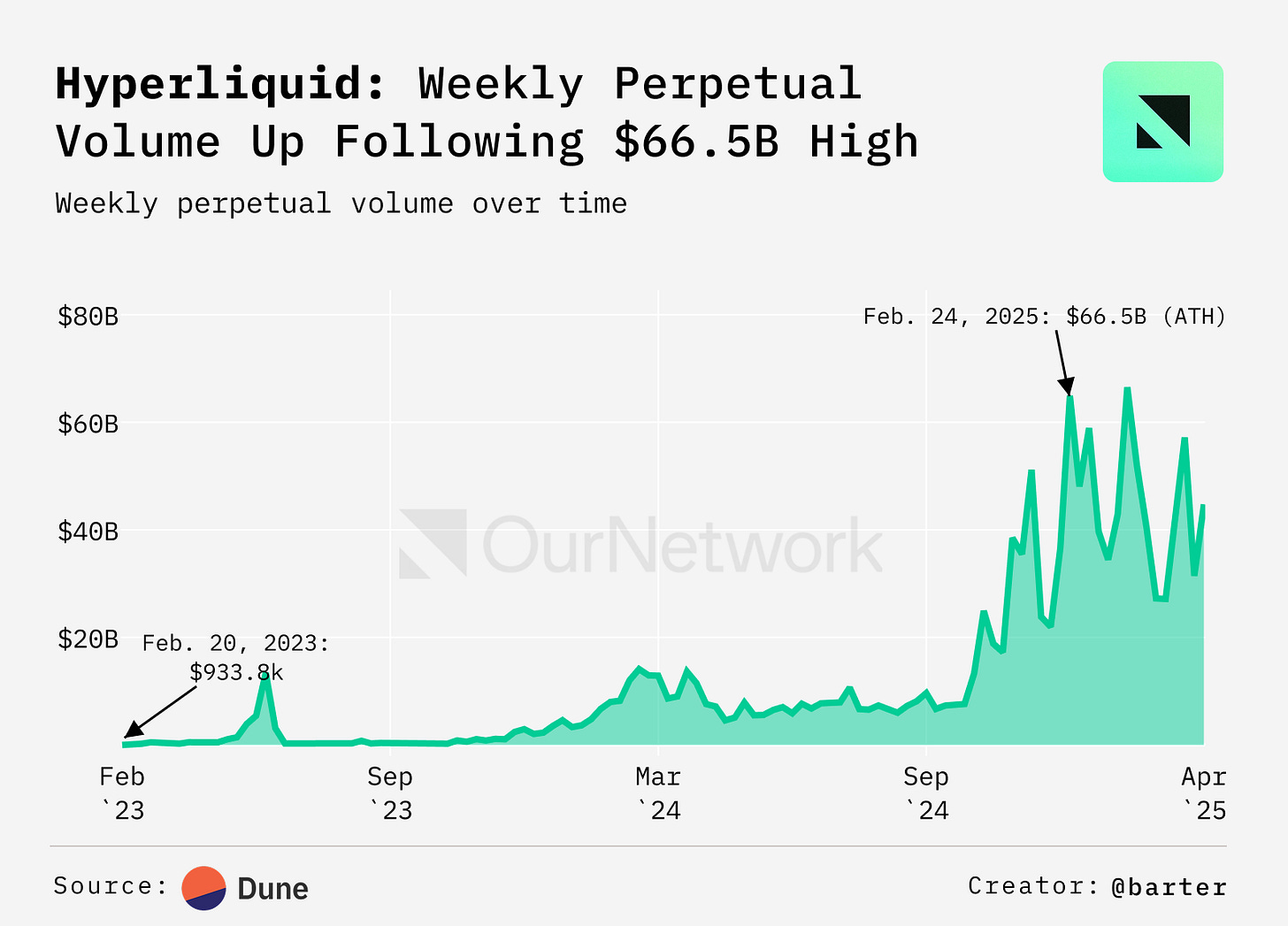

5. Hyperliquid has Rapidly Become a Leading Decentralized Perpetual Exchange, delivering a CEX-like experience while remaining fully on-chain.

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Welcome to OurNetwork's latest. Crypto markets have climbed steadily, gaining 8.8% in the past week as of Apr. 29. This represents a $250B increase in total market capitalization, pushing the sector above $3T for only the third time in its history.

Our focus today — derivatives platforms, whose financial instruments derive value from underlying crypto assets. These protocols have become increasingly central to the ecosystem — perpetual futures offered by the six platforms included in this issue generate over $300M in daily volume according to Artemis.

As the market heats up, sophisticated investors are turning to these platforms not just to hold assets, but to amplify returns and manage risk exposure beyond traditional spot positions.

In this issue we have the following six players — Drift, GMX, Hyperliquid, Vertex, gTrade, and Contango.

Let's get into it.

– ON Editorial Team

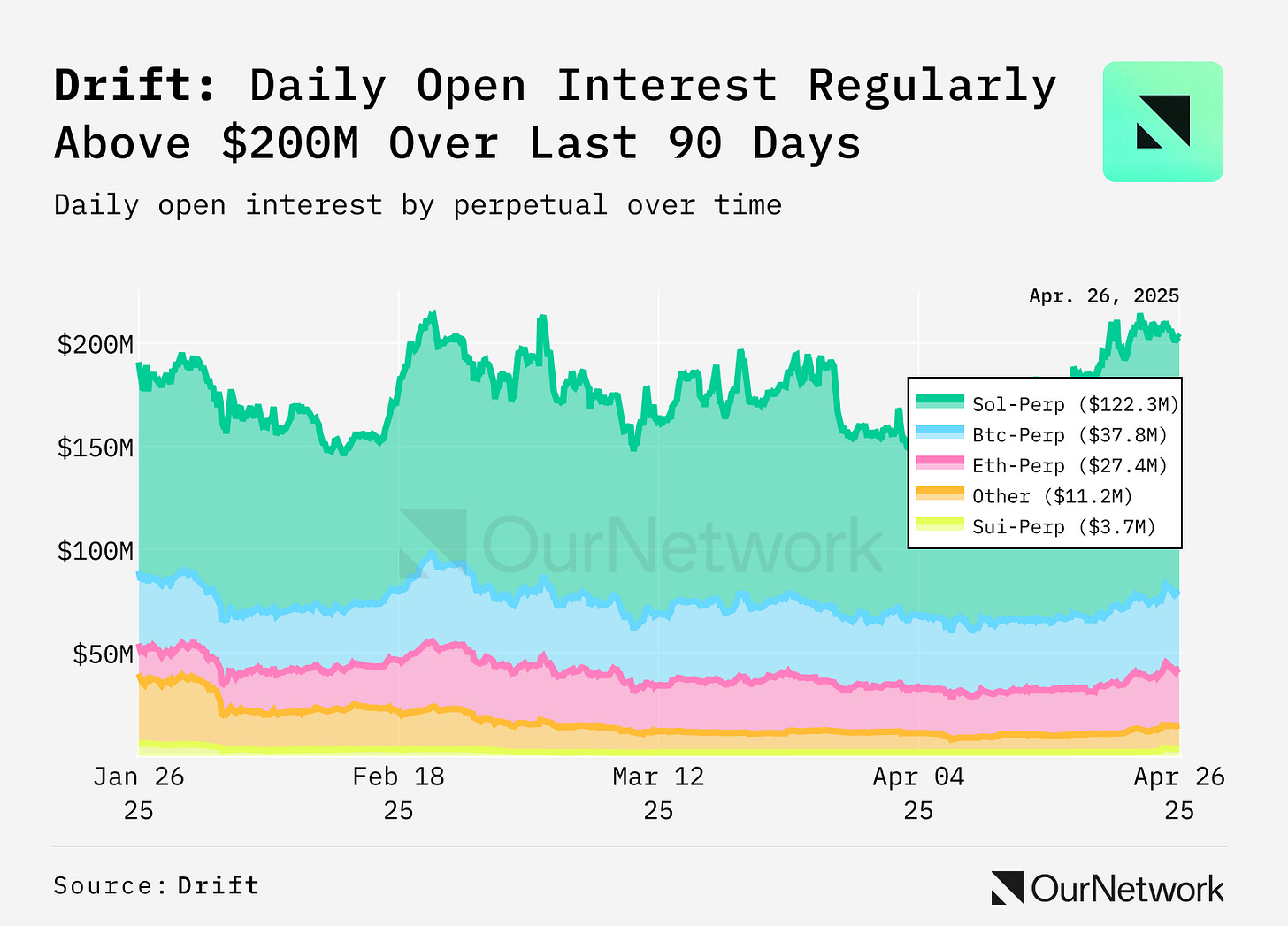

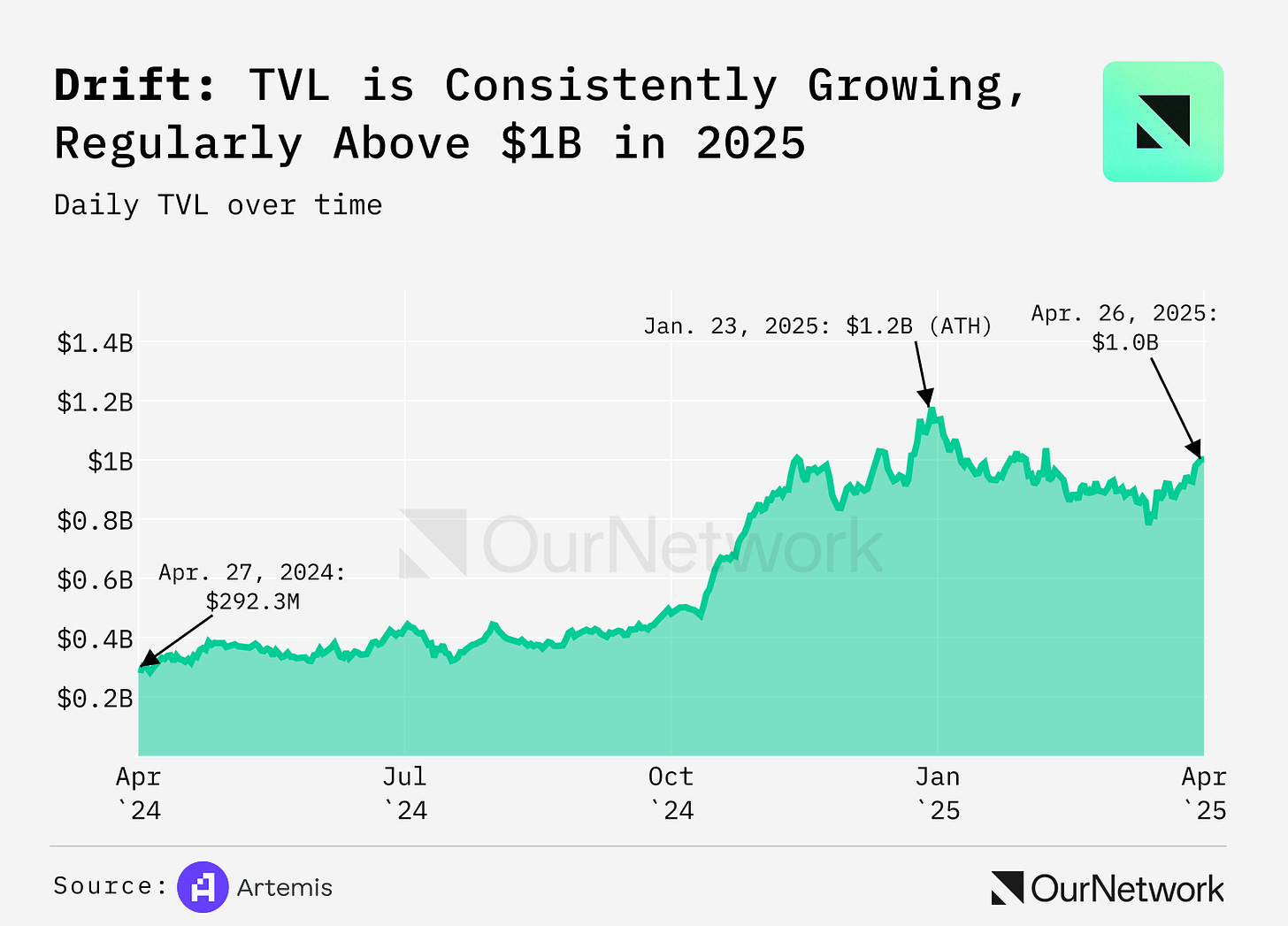

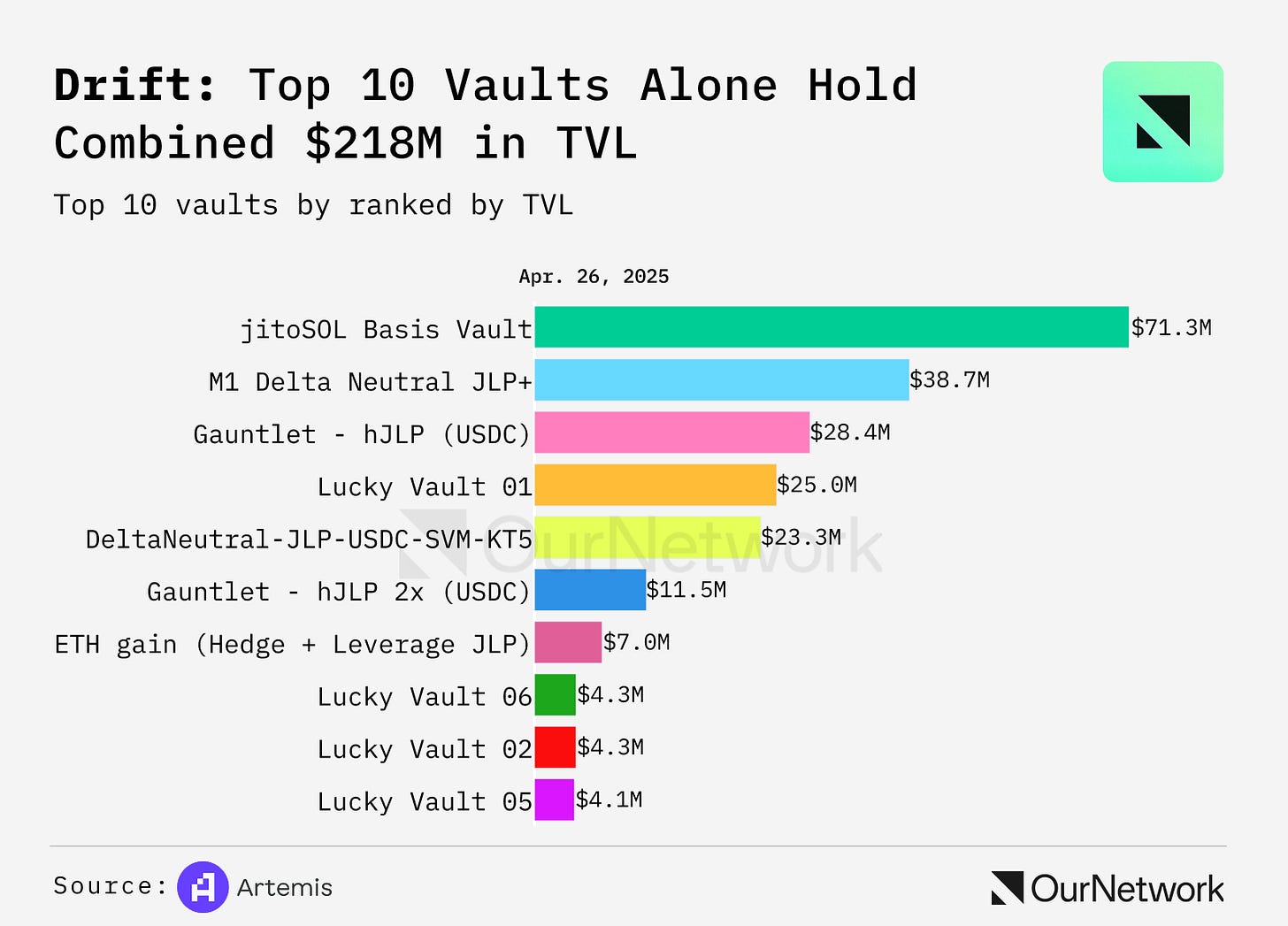

📈 Drift Vaults Lead the Way for Total Value Locked and Open Interest Resilience During Market Downturn

Drift is an all-in-one DeFi platform built on Solana. Open interest (OI) on Drift's perpetuals market remained strong over the past 90 days despite a broader market downturn. Drift's OI ranged between $145M and $205M. For much of the 90 days, Drift's OI remained higher than daily trading volume on the platform demonstrating considerable OI-to-volume strength compared with other venues. Drift's SOL-PERP, the Solana token's perpetual futures contract, remained the leader, making up around 60% of OI on Drift's perp market.

✏️ Editor's Note:

Perpetuals, also called perps, are derivatives which don't expire, essentially allowing traders to hold leveraged positions indefinitely.

Open interest in the context of perpetuals indicates how many positions haven't been closed yet.

Similar to OI, Drift's total value locked (TVL) remained strong around $1B during broader market weakness across the last 90 days. Strong demand for, and performance of, Drift Strategy Vaults, has been one of the primary drivers of the resilience of both OI and TVL.

Strategy Vaults are permissionless vaults on Drift enabling vault managers to execute strategies on behalf of depositors. Since launch, 318 Strategy Vaults have been deployed on Drift and account for around $280M of TVL deposited by 21,052 unique depositor accounts.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.rootstock.io and www.kuladao.io and www.crowdcreate.us