Learn More at www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. This week OpenSea received a Well’s Notice and is now expecting an SEC lawsuit, courts dismissed $258B lawsuit against Elon regarding Dogecoin, Cardano moved to embrace decentralized governance, and big new venture rounds came in for Bridge ($58M) and Edge Matrix Chain ($20M).

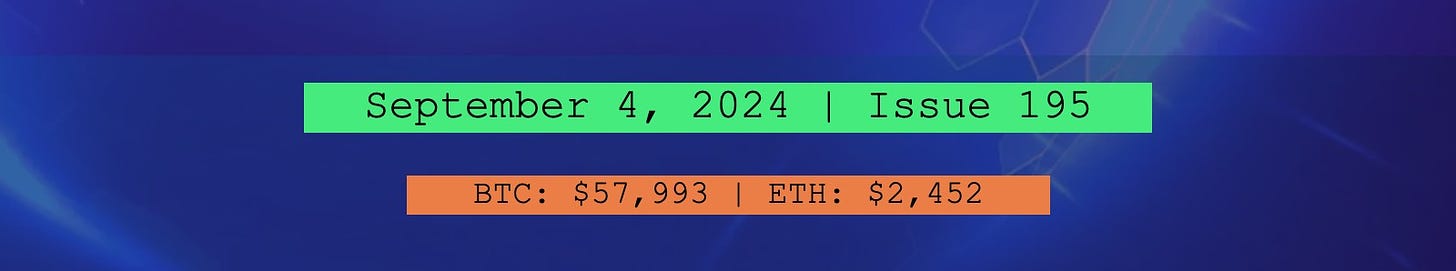

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships and access to all of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2024 Coinstack Sponsors…

Amphibian Capital, managing $75M+ AUM, is a fund of the world's leading hedge funds. +11.99% net YTD with their USD fund, +10.53% net YTD in their ETH fund (64.4% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com

Become a Coinstack Sponsor

To reach our weekly audience of 250,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

⚖️ OpenSea Expecting SEC Lawsuit Over NFTs Being Securities, Says CEO: Prominent NFT marketplace OpenSea is expecting a lawsuit from the United States Securities and Exchange Commission (SEC), co-founder and CEO Devin Finzer said Wednesday, due to what he said is scrutiny over whether NFTs should be considered securities.

⚖️ Court Dismisses $258B Lawsuit Alleging Elon Musk and Tesla Manipulated Dogecoin: A U.S. court has dismissed a lawsuit accusing Elon Musk and Tesla of engaging in market manipulation and insider trading targeting the Dogecoin (DOGE) cryptocurrency.

🚀 Cardano Moves To Embrace Decentralized Governance With First Chang Hard Fork: Cardano’s long-awaited first Chang upgrade is live, unlocking governance functionality for ADA holders. The Voltaire hard fork was executed on Sept.1,activating the Chang #1 hard fork and its principal upgrade, Cardano Improvement Proposal (CIP), CIP-1694.

🚀 OKX bags Singapore crypto license: Crypto exchange OKX has secured a full license in Singapore, allowing it to facilitate crypto trading and cross-border transfers. The company simultaneously announced that it had also onboarded a former regulator as the CEO of its arm, OKX Singapore.

⚖️ SEC warns FTX against paying creditors back in stablecoins, other crypto: Now, in a recent filing, the Securities and Exchange Commission has warned FTX that it reserves the right to challenge the legality of paying back claims or otherwise trying to make money from its stash of "crypto asset securities." The SEC's filing also notes that the plan fails to specify who would distribute the stablecoins, should that provision be approved.

💬 Tweet of the Week

Source: @drakefjustin

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. There are now more than 1.2M daily active addresses on Coinbase Base while the network has just settled $5.4B worth of stablecoin transfers in one day. Meanwhile, over 154,000 new contracts have been deploy to the chain. All of these numbers are new all-time records.

The best builders build through battles.

Source: @DavidShuttleworth

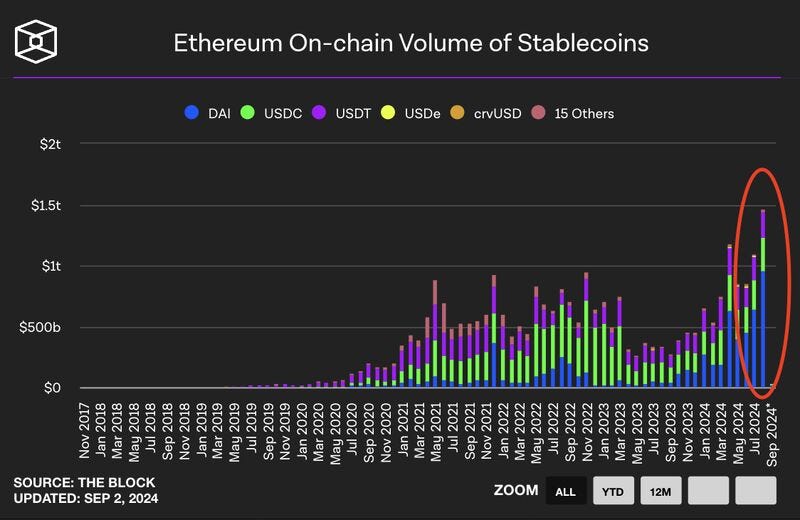

2. Despite all of the headwinds throughout the market, stablecoins on Ethereum experienced their largest monthly volume ever in August, settling over $1.46T worth of transactions on-chain. This represents a 34% increase month-over-month and a staggering 124% YTD.

Interestingly, MakerDAO DAI led the way with $962B of monthly volume (its most ever) followed by Circle USDC ($266B) and Tether.io USDT ($210B).

Source: @DavidShuttleworth

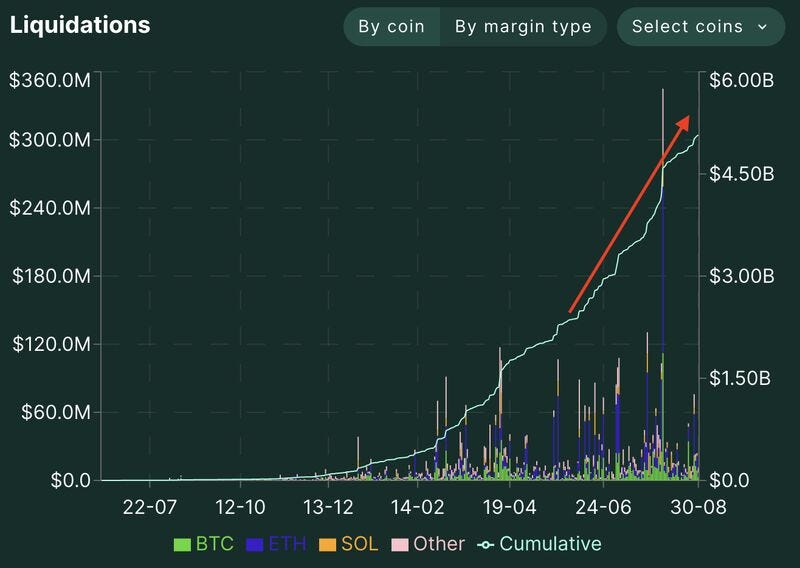

3. Summertime Sadness: since June 1st there have been more than $2.71B in liquidations on Hyperliquid, an increase of 115% and pushing total liquidations to $5.1B.

Everyone has a "thesis" and is an "expert" in a bull market until the wolves come out 😈

Source: @DavidShuttleworth

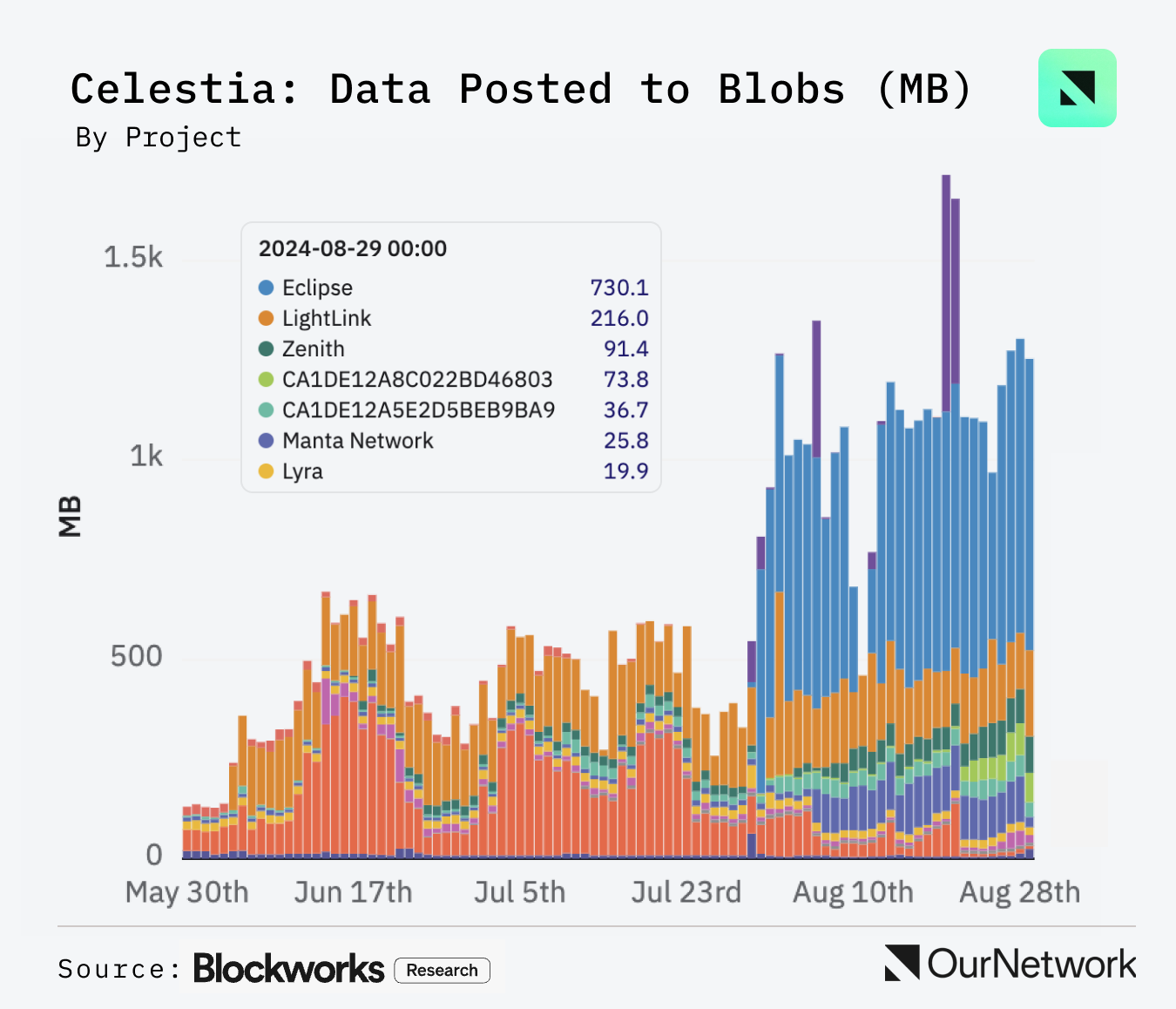

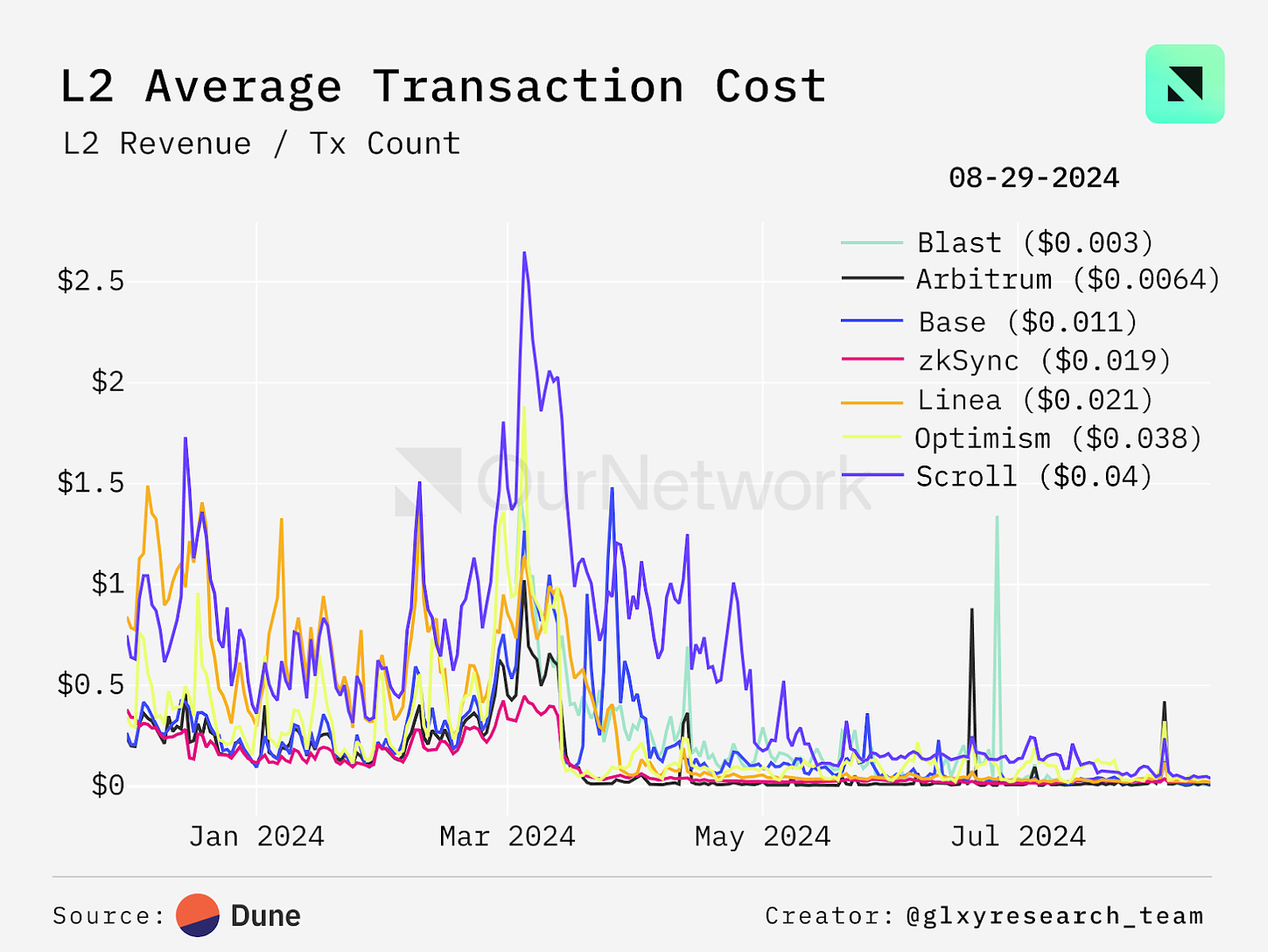

Source: @OurNetwork

5. Omni enables chain abstraction for $4.7B worth of rollup TVL between Arbitrum, Optimism, and Base.

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: 1995 Digital Asset Research, serves actionable insights, market research, and Web 3 Tech Tutorials for informed investing. This is an excerpt from the full article, which you can find here.

Introduction

About a year ago today I learned one of the most valuable lessons of my life as a trader.

I was speaking with a mentor of mine, someone who I respected very much and who had a great career trading billions of dollars a day on Wall Street. At the time, I was still finding my feet in this business and I was seeking confirmation bias from others. I wanted to know what he thought about the crypto market and what he thought about the current price action.

For those of you that were in the market at that time or remember, it was eerily similar to where we are today. But, more on that in a minute.

In short, he proceeded to tell me to sell all of my crypto holdings and that it would go nowhere for another 10 years. Now, that may not sound like all that big a deal to you but, when you hear that from not only a mentor of yours, but a great trader in their own right it creates an enormous mental conflict.

Was I going to be right?

Or was the guy that had a 30 year career trading with some of the best in the business going to be right?

It was an extremely tough time in the market and the decision would prove to be critical. After a five month range and death by a thousand cuts many people were throwing in the towel on bitcoin. Stocks had staged a great run meanwhile crypto seemed like it was on life support.

Then, for nearly a month from mid August, to mid September the market traded virtually no where. BTC traded in a one thousand point range while bulls and bears both got chopped to pieces.

Sound familiar? I think so. The market today is in the exact same position as it was then. What happened in the next six months was a tripling of the BTC price as it went from 25k to nearly 75k. But, in order for us to get there, everyone including the best analysts had to be fooled by the lackluster price action.

It’s the exact reason why we put so much emphasis on time and not as much on price. Price action will, at one point or another, fool everyone. Time will not.

There is a common saying about life coming full circle. A full circle moment is when life undergoes a series of changes or events and then returns back to its original state or position. I believe that is what we are seeing once again today in this market.

We talk a lot about time by degrees and time frames but one of particular important is the number 360. There are 360 degrees in a circle and therefore the reasoning behind Gann’s 360 degrees in a year. A cycle is just another word for circle.

It just so happens that this week on Thursday we will be 360 degrees from the low of September 11th 2023 where BTC began its slow ascent to 74k from 25k.

At the same time, price action has been almost identical coming off a five month range into a near standstill while more and more prominent bulls begin to truly question their thesis.

Even the sentiment is much worse this year than last year with price trading at over double what it was a year ago. Fear is at 26 right now opposed to last year at this time it was at 40. I believe this is once again setting up the perfect bear trap.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com