Social Links: Twitter | Telegram | Newsletter

Learn More at www.amphibiancapital.com and www.rootstock.io

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 300k weekly subscribers. This week the SEC formed a new crypto task force, Trump named crypto-friendly SEC Commissioner Mark Uyeda, Hyperliquid reported record-high $22B in 24-hour volume and big venture news came in for Phantom Wallet ($150M) and 1Money ($20M).

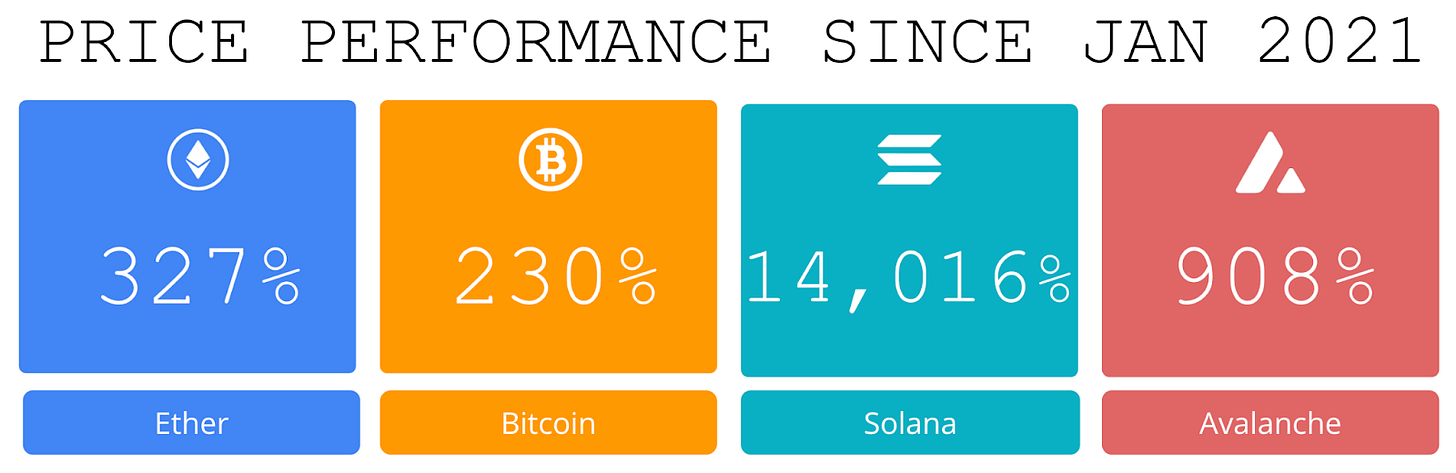

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2025 Coinstack Sponsors…

Amphibian Capital, managing $130M+ AUM, is a fund of the world's leading hedge funds. +20.26% net YTD approx with their USD fund, +15.02% net BTC on BTC YTD (*+154.26% in USD terms), and +18.10% net ETH on ETH YTD (+73.74% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 60%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Become a Coinstack Sponsor

To reach our weekly audience of 300,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

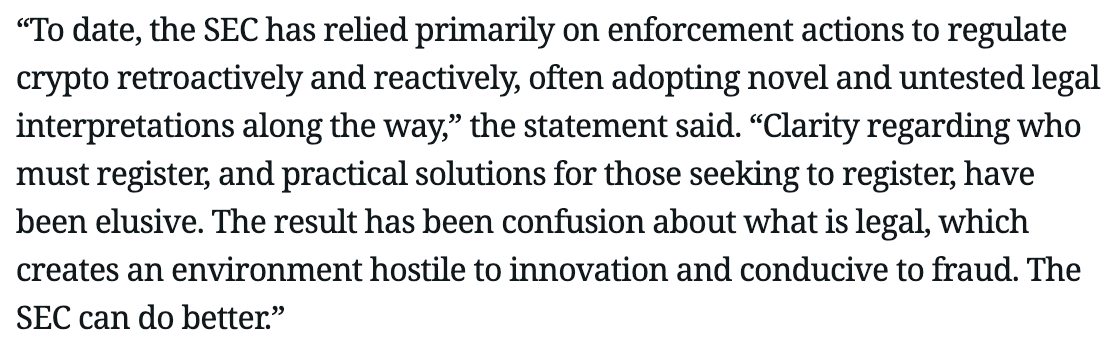

⚖️ SEC Forms New Crypto Task Force Spearheaded by Hester Peirce: Gary Gensler only officially stepped down as chairman of the U.S. Securities and Exchange Commission (SEC) yesterday, but the federal agency’s approach to crypto is already getting an overhaul.

👨⚖️ Trump names crypto-friendly SEC Commissioner Mark Uyeda as acting chair as Gensler departs: President Donald Trump has picked Mark Uyeda, one of the U.S. Securities and Exchange Commission's top officials, to lead the agency until a permanent chair is confirmed.

🚀 Hyperliquid reports record-high $22 billion in 24-hour volume: Hyperliquid :said on social media platform X that its trade volume was over $22 billion in the 24 hours leading up to 11:41 p.m. ET on Monday. The platform’s $22 billion trade volume overwrote the previous record high of $21 billion reported a day prior. It also reported $4.7 billion in open interest and $9.5 million in protocol revenue.

📊 Solana hits new all-time high, DEX tokens surge: Solana’s underlying token hit a new all-time high on Saturday amid the massive runup of Official Trump (TRUMP), the memecoin launched by President-elect Donald Trump.

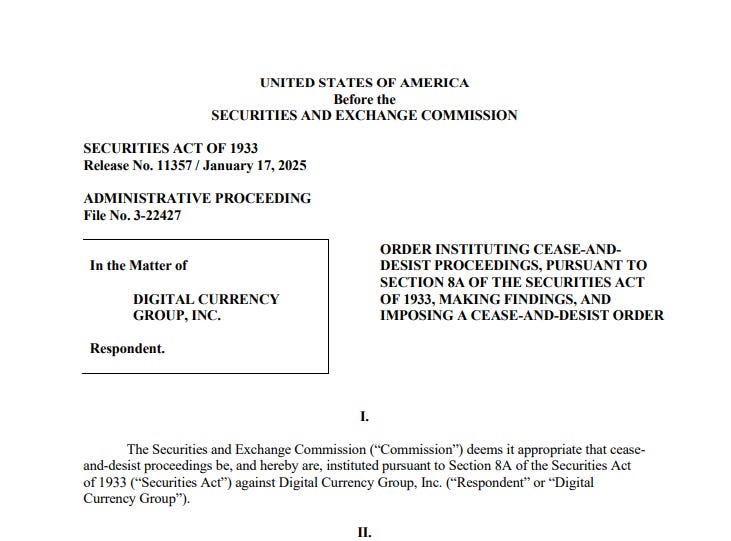

⚖️ Digital Currency Group agrees to pay $38 million to settle with SEC over negligence: Global investment firm Digital Currency Group agreed to settle and pay $38 million to the U.S. Securities and Exchange Commission on Friday over allegations that it misled investors via crypto lender Genesis Global Capital, LLC.

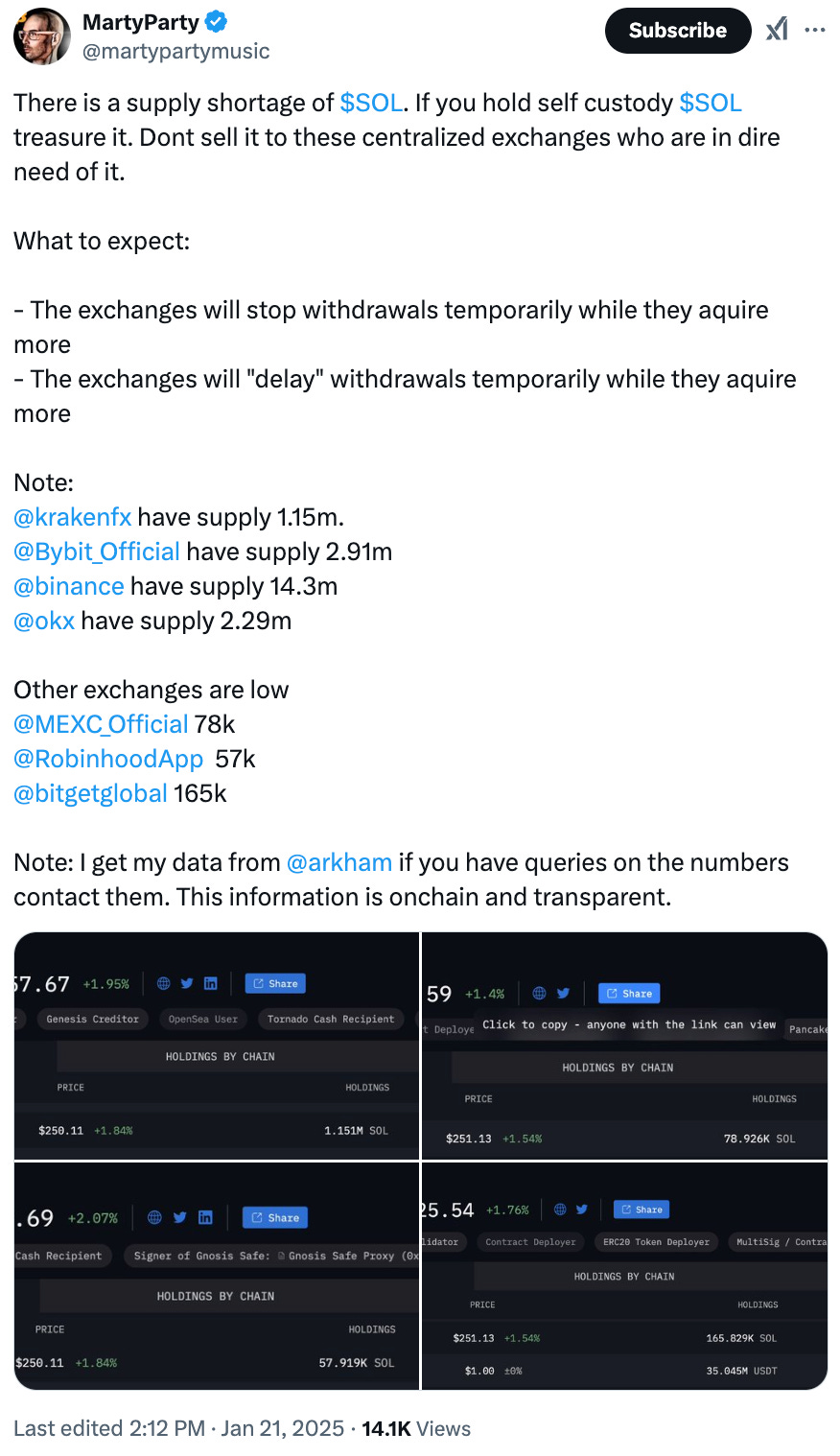

💬 Tweet of the Week

Source: @martypartymusic

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Demand for Solana has gone parabolic. 4 of the top 5 fee generators are now Solana-based as users continue to pile in, pushing the network to 88M daily transactions and over $31B in daily DEX volumes.

Meteora leads the entire space with a staggering $60M in daily fees, followed Raydium ($31M), and Jito ($26M), while the network itself stands at $35M. Perhaps just as interestingly, these are all more fees generated than Tether ($18M), the historic market leader, and Circle ($5M) combined.

On an annualized basis, each of these protocols would collect upwards of $788M in fees.

Source: @DavidShuttleworth

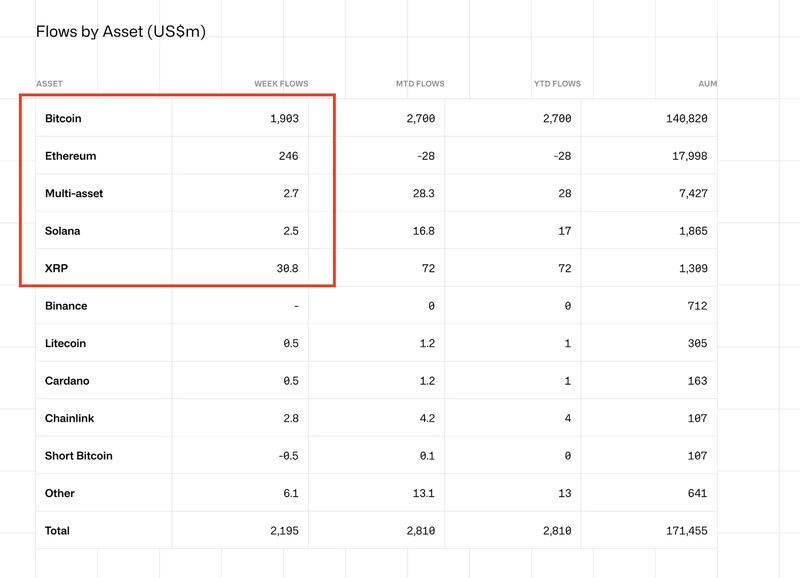

2. Inauguration Day is here, and last week we had the largest volume of institutional inflows so far this year. Overall, $2.2B poured in led by BTC ($1.9B), ETH ($246M), XRP ($31M). Interestingly, this brings XRP's total inflows since November to $484M. Overall, however, this volume pales in comparison to some of the levels seen in November and December ($3B-$4B).

Meanwhile, SOL remained relatively muted with just $2.5M of inflows and only $17M YTD. This could change, quite abruptly, especially with the prospective of several ETF products looming along with a pro-crypto administration.

Source: @DavidShuttleworth

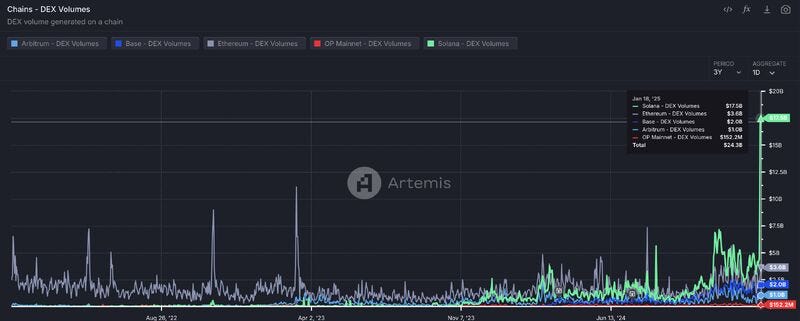

3. Absolutely wild activity on Solana right now as over $17.5B of DEX volume has been settled on the network within the last 24 hours.

To put this into perspective, this is not only the most daily DEX volume ever in the history of DeFi, but is more than double the daily volume of Ethereum ($3.6B), Base ($2B), Arbitrum ($1B), and Optimism ($152M) combined.

Raydium leads the way with a staggering $13B in daily volume (74% of all DEX volume on Solana) and has generated $26M in daily fees, the most of any application in the entire space.

This is incredible progress and a win for everyone onchain.

Source: @DavidShuttleworth

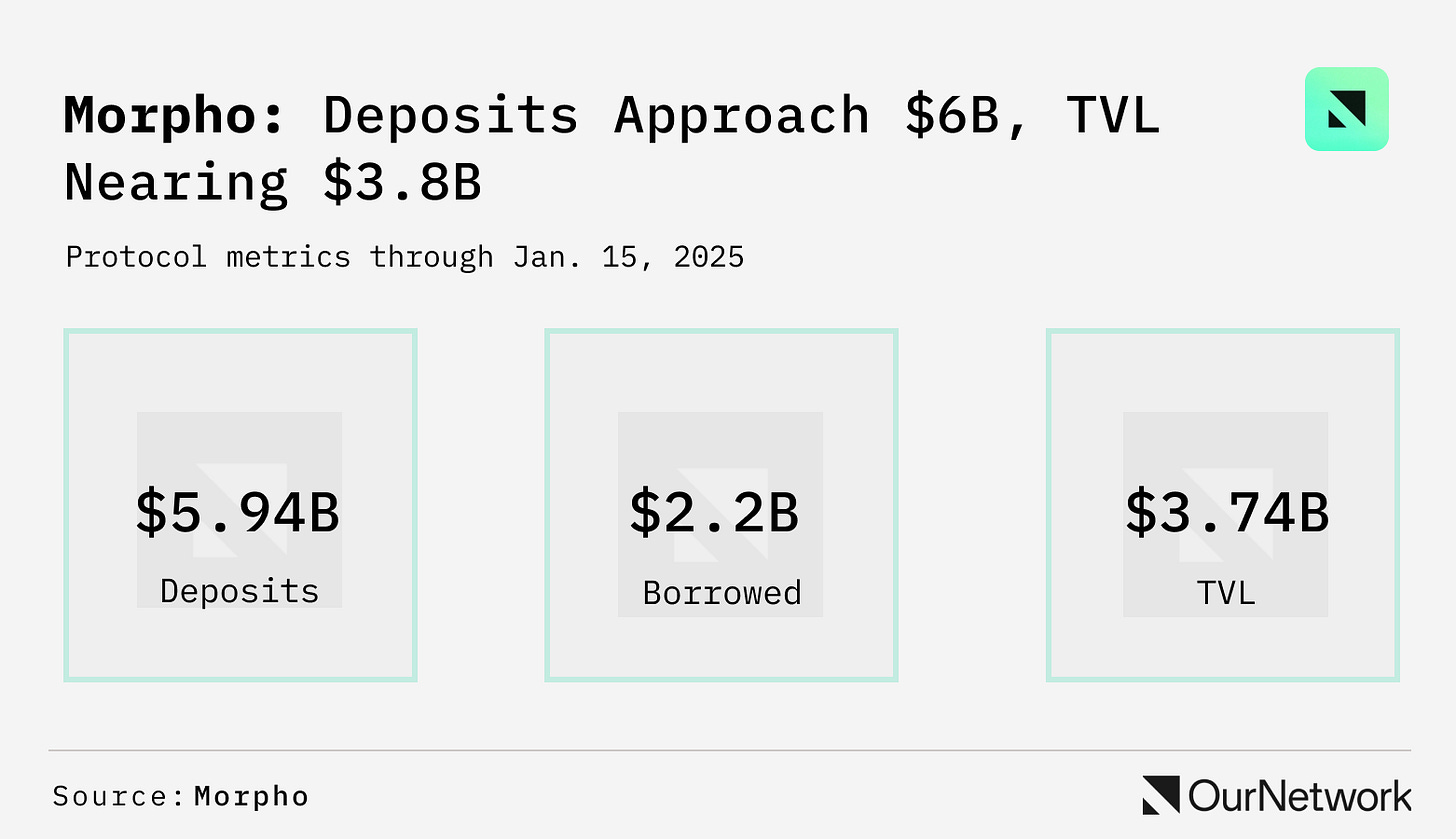

4. Morpho Crosses $5.9B deposits, $3.7B TVL & 100K users

Source: @OurNetwork

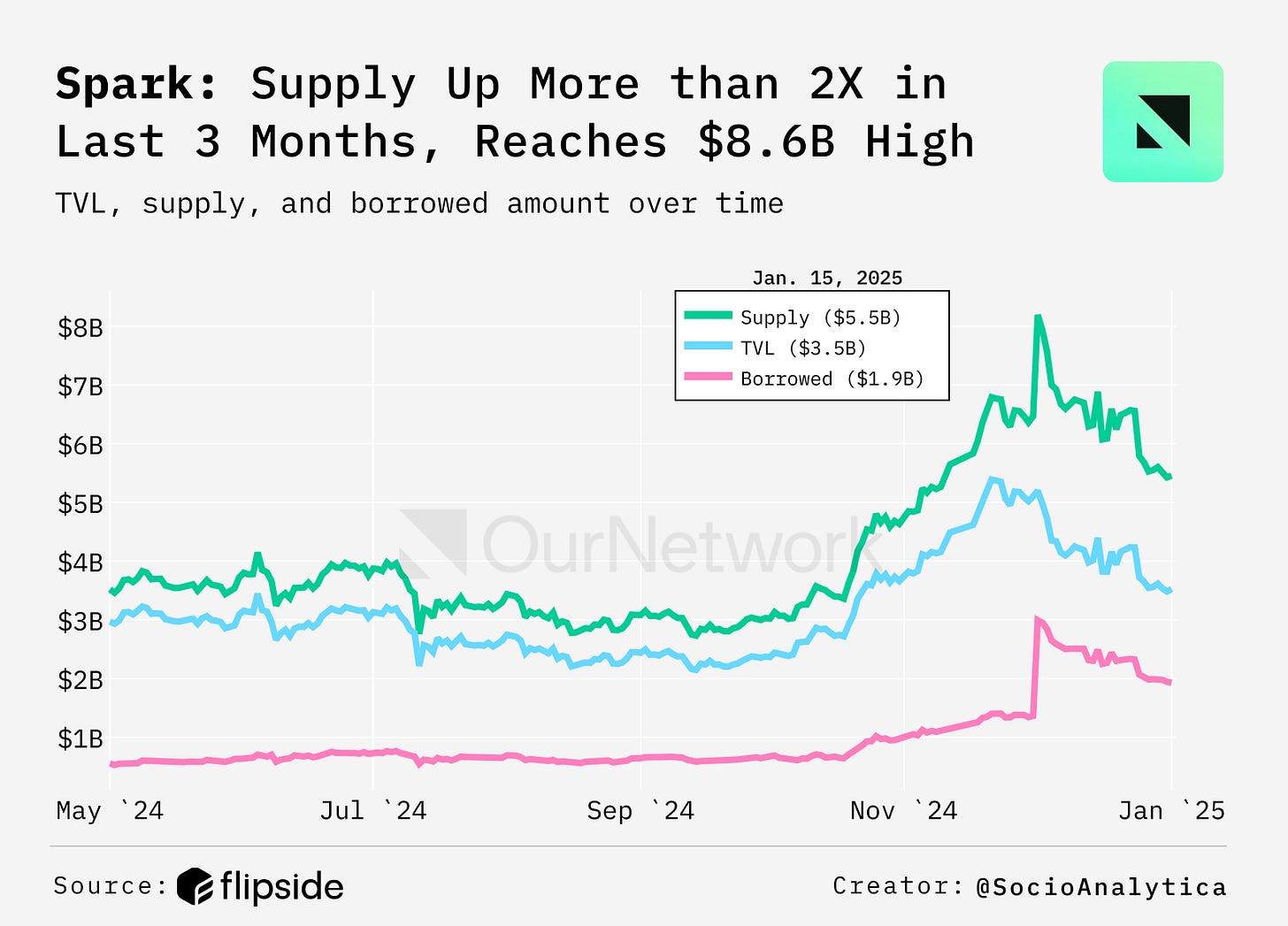

5. Spark Pulls back 25% After Hitting $8.63B ATH Supply in a Month

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is made possible by a community of contributors who actively participate at the forefront of this emerging data landscape. This is an excerpt from the full article, which you can find here.

Introduction

President-elect Donald Trump is scheduled to be inaugurated on Monday, January 20, 2025. I discussed the impact of the election in a blog on Coindesk, where I predicted that “Positive tailwinds in crypto caused by the election itself may not be as sticky in a month. However, the ramifications of a unified Republican House and Senate majority may mean a more productive government, and one that passes more legislation surrounding crypto.”

In this blog, I focus more on the legislative environment with tailwinds pre-inauguration followed by policy opportunities post-inauguration.

Pre-Inauguration:

Before the election, the Blockchain Association’s polling found that “Two-fifths of Crypto-Positive voters [in swing states] say crypto is a major issue for them in the election; half pay attention to candidates’ crypto stances.” . In this election, the crypto voting bloc has proven itself to be a credible group to court.

Large crypto-focused PACs also emerged to fund candidates, like Protect Progress ($37M), Fairshake ($227M), and Defend American Jobs ($59M).

Cabinet and Staff Picks

Trump has been announcing staff picks and Cabinet picks (who still need to be confirmed), many of which are pro-crypto. Here are some of the most notable.

Paul Atkins (SEC commissioner from 2002 to 2008) was selected to be the new SEC chair. He is an advisor to the Chamber of Digital Commerce, an institution focused on promoting the acceptance of crypto.

Trump’s new Department of Government Efficiency (DOGE) is to be led by Elon Musk and entrepreneur Vivek Ramaswamy. Trump announced that they would “dismantle Government Bureaucracy, slash excess regulations, cut wasteful expenditures, and restructure Federal Agencies”. Given Musk’s advocacy for crypto, like Dogecoin, he may well use his platform to publicly support crypto. For example, he recently posted on X that “If dollar inflation is solved, the price in dollars to buy cryptocurrency will actually drop, other things being equal.”

The Commerce Secretary pick, Howard Lutnick, is pro-crypto. At the Bitcoin 2024 conference in Nashville, he said “Bitcoin is like gold and should be free trade everywhere in the world.”

Labor Secretary pick Rep. Lori Chavez-DeRemer of Oregon voted for the SAB 121 House Joint Resolution and FIT 21. She stated that she’s “talked to several leaders in this space that welcome safe regulations & oversight to help legitimize the industry mainstream.”

Many of Trump’s supporters in government are pro-crypto, like RFK Junior, JD Vance, and Michael Walz. They have supported bills like FIT21 and SAB 121, for example.

For the first time, the US president appointed an “AI & crypto czar”. Czars are typically industry veterans that directly work with the executive branch to oversee a specific mandate and do not require Senate approval. Trump named David Sacks, a tech investor and former CEO of Yammer and COO of PayPal, to serve as the “AI & crypto czar.”. In Trump’s announcement, he said that “[David Sacks] will work on a legal framework so the Crypto industry has the clarity it has been asking for.”

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com and www.rootstock.io