Learn More at www.hypelab.com and www.kuladao.io and www.amphibiancapital.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 325k weekly subscribers. This week, Plasma filled a $500M ICO, IBIT rocketed to $70B, Crypto ETF inflows climbed to $11B, and big new rounds came in from Circle ($1.1B IPO) and Rails ($14M).

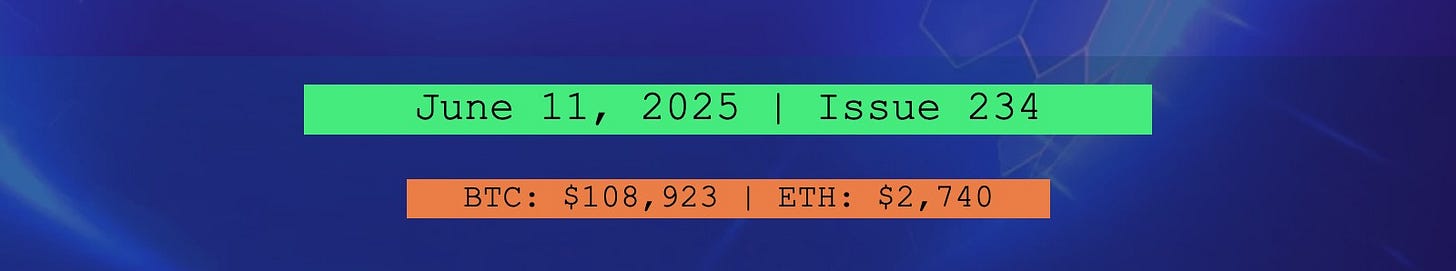

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

HypeLab is the premier web3 advertising network, building ‘Google ads for web3’. With HypeLab, you run ads to real crypto users on high-quality publishers like Chainlist, Coingecko, Quickswap, and hundreds more. Advertisers like Metamask, Uniswap, and Paypal use HypeLab to super-charge their web3 growth.

Kula is a decentralised impact investment firm that transforms overlooked assets into shared prosperity and thriving communities by re-shaping how value and opportunity are recognised worldwide. By tokenising real-world assets, we provide opportunity, transparency, and financial sovereignty to historically excluded communities. Our model aligns economic growth with sustainable development, ensuring that wealth is not extracted but reinvested into the communities that generate it.

Award-winning Amphibian Capital, managing $145MM+ AUM, is a fund of the world's leading hedge funds. +20.4% net 2024 approx with their USD fund, +14.1% net BTC on BTC in 2024 (*+152% in USD terms), and +17.3% net ETH on ETH in 2024 (+71.2% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com.

Become a Coinstack Sponsor

To reach our weekly audience of 325,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 Stablecoin Blockchain Plasma Fills $500 Million ICO Instantly: Layer 1 blockchain Plasma showcased the massive demand for exposure to the stablecoin sector this morning, filling a $500 million initial coin offering (ICO) deposit vault in a matter of minutes.

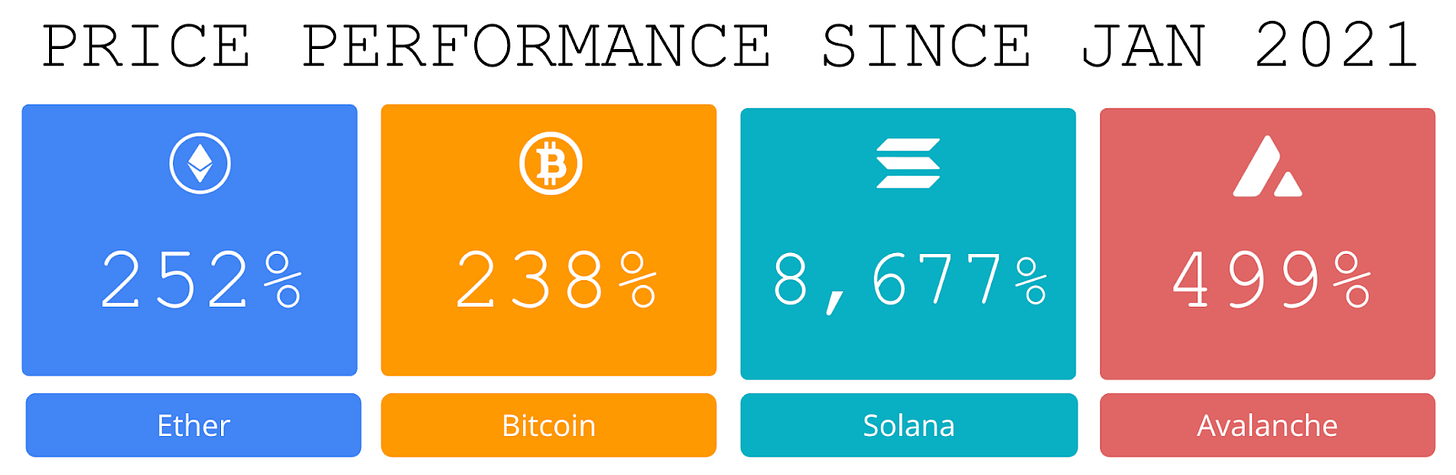

💸 BlackRock’s IBIT rockets to $70B in 341 days, 5x faster than previous record:BlackRock’s iShares Bitcoin Trust (IBIT) exchange-traded fund (ETF) crossed $70 billion in assets under management (AUM) on June 6, being the fastest to reach this mark in just 341 trading days.

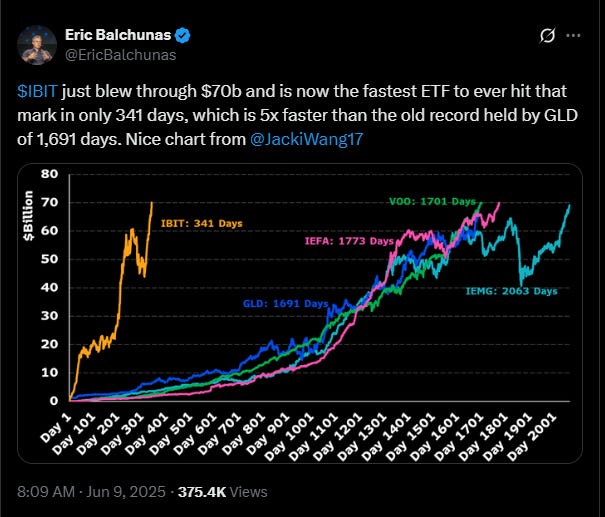

📉 Crypto ETF inflows climb to $11 billion in 7 weeks with Ethereum leading amid US policy uncertainty:Digital asset investment products attracted $224 million in inflows last week, extending a seven-week streak that now totals $11 billion, according to CoinShares‘ latest weekly report.

💸 15-day streak brings Ethereum ETFs to record high cumulative inflow value:Spot Ethereum ETFs in the U.S. market have reached their highest cumulative inflow level since the funds launched in July 2024 as nearly 40% price gain over the past month is met with increased demand from institutional and retail investors.

⚖️ Fed’s Bowman confirmed as vice chair for supervision:The US Senate confirmed Federal Reserve Governor Michelle Bowman to serve as vice chair for supervision at the central bank — a move that Sen. Cynthia Lummis said "signals a brighter future for digital assets."

💬 Tweet of the Week

Source: @econoar

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. While open interest on Hyperliquid recently hit record levels of $10B, open interest on $HYPE futures have followed suit, surpassing $1.75B and joining $ETH this week in shattering previous highs.

Over $1.1B in open interest has piled on this past month alone. And in just 6 months, HYPE has become the 6th largest digital asset by futures open interest.

Source: @DavidShuttleworth

2. Open interest on ETH futures just surged to a new all-time high of $38B, jumping 11% ($3.8B) today and now 78% ($16.5B) over the past month.

ETH also led all digital assets last week with nearly $300M in inflows, while BTC saw its second straight week of outflows (-$56M). This marks the 7th consecutive week of institutional inflows for ETH, pushing the total above $1.5B during the time.

In addition, BlackRock's spot ETH ETF product, $ETHA, was a primary beneficiary across the space here, pulling in $250M inflows last week and leading all BTC and ETH ETFs.

Source: @DavidShuttleworth

3. Net deposits into Kamino Finance have surged by $1.6B (80%) to a new all-time high of $3.6B. The protocol now manages $1.5B in active loans and just hit a record $1.4M in daily fees.

Kamino is now the 3rd largest lending protocol in terms of both active loans and total deposits, trailing only Aave ($16B / $40B) and Morpho ($2B / $5B).

As tokenized private credit funds like Apollo Global Management, Inc.'s ACRED and other RWAs launch on Solana, this could further accelerate adoption.

Source: @DavidShuttleworth

4. 📈 Jupiter’s DEX Routing Volume Rebounded in May, Climbing to Over $67.2 Billion — a 33% Increase from the Previous Month

Source: @OurNetwork

5. Since early 2025, CoW Swap has led the Ethereum DEX aggregator space in top-layer market share. In March, it reached an all-time high of 42% market share, showcasing sustained growth and solidifying its position as the go-to aggregator for best price, efficient, and MEV-protected trading.

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

On a dramatic week, welcome to OurNetwork's latest. For this one, we're covering aggregators, a subsector that's become key to crypto's user experience.

As the industry moves to abstract away blockchain's technical complexity, aggregators are positioned to capture value by finding optimal trading routes across blockchains and exchanges. They're already big business—aggregators have generated $150.8B in monthly volume so far in 2025, up 132% from the $64.9B monthly average in 2024.

We have three of the top aggregators below, courtesy of Pavel, Ario, and Alex. We'll also get into up-and-comers thanks to contributions from Nakita, yasmin, and Williams.

Let's get into it.

– ON Editorial Team

📈 In 2025, 1inch Proved To Be A Leading DeFi aggregator, Achieving Record-Breaking Growth in Terms of Volume, Swaps and Users

Since 2019, 1inch has been a leading force in DeFi. In May, boosted by strong user activity in Binance Wallet, 1inch saw a major surge — 63% market share by volume, 80% by swaps, and 59% by users. These milestones reaffirm its dominance in the DeFi aggregator space and its appeal to a wide user base.

On May 21, 1inch processed $4.7B in 24-hour trading volume – a massive 10-to-12x surge compared to its daily average.

In 2024, Base led all blockchains by number of swaps on 1inch Router. But in 2025, BNB Chain took a commanding lead, becoming the top chain by swap activity with a significant margin.

🔦Transaction Spotlight:

1inch regularly processes large trades worth tens of millions of US dollars each. For example, on Feb. 19, a user exchanged 15,000 WETH for 40,875,000 aEthUSDT via a limit order. This order was split into 558 separate executions, a functionality called partial fills.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.hypelab.com and www.kuladao.io and www.amphibiancapital.com