Learn More at www.sdm.co and www.plutus.it and www.usefundex.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We reviewed the top news, stats, and reports in the digital asset ecosystem for our 350k weekly subscribers. This week, Polymarket volumes surged amid growing Layer 2 speculation, TRON integrated with Base to enable TRX access on Coinbase, and a new XRP yield product, earnXRP, launched using Flare Network infrastructure. Meanwhile, the Terraform Labs liquidator filed a $4 billion lawsuit against Jump Trading, and Bybit relaunched its UK crypto platform following its 2023 exit tied to FCA regulations. On the fundraising front, Erebor raised $350M at a $4.35B valuation and Gensyn Foundation raised $16.14M in a public token sale.

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Secure Digital Markets (SDM) is a full-service crypto dealer offering spot trading, derivatives, and collateralized lending. We serve HNWIs, institutions, miners, protocols, and OTC desks, providing deep liquidity across 40+ assets with T0–T+1 settlement. Clients can borrow up to $250M at 7.5%–10.5% with 65% LTV on select top 50 assets. Our U.S.-based derivatives desk offers TRS, NDFs, options, and structured products designed for hedging, yield generation, or directional strategies.

Learn more: www.sdm.co

Contact: [email protected]

Get out Free CFO Briefing: https://treasuries.sdm.co/

Plutus is a Web3 rewards platform where everyday spending earns PLUS, a merchant-funded reward token with a guaranteed £/$/€10 in-app value. Redeem PLUS for gift cards, cashback, travel rewards, or miles across 400+ global brands. With 250k sign ups and powering $40M+ in monthly spend, Plutus brings real utility to digital rewards.

Fundex helps founders run a disciplined, data-driven fundraise. We combine investor intelligence, structured outreach, and hands-on execution so you can stay focused on building while fundraising runs in parallel. Coinstack readers get 25% off with code COINSTACK25 — monthly pricing drops from $2,500 to $2,000 for a limited time.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

CFO Briefing: Year-End Bitcoin Moves To Cut Your Tax Bill

For corporates with meaningful Bitcoin exposure, the year-end can feel less like “tax planning” and more like tax triage. Finance teams are staring at volatile digital asset markets, and a tax calendar that does not care how bullish the board is.

The tradeoff is uncomfortable: pay more than you likely need to, or move quickly in ways that may appear reactive rather than deliberate.

Thankfully, Secure Digital Markets (SDM) can help. As a leading crypto asset dealer, the firm works with digital asset treasury companies, miners, and funds to help them optimize their year-end portfolio construction. They have put together a brief overview on utilizing capital preservation and tax deferral strategies to manage digital asset portfolios.

Solve real problems for your corporate treasury

“Unlock Liquidity While Preserving Your Position” Many treasuries hold substantial unrealized gains in BTC and digital assets. However, liquidating these positions to fund capex, buybacks, or runway triggers immediate, significant tax liabilities. SDM provides collateralized lending structures that allow clients to access liquidity without triggering a taxable event in many jurisdictions. This approach helps navigate the math of “borrowing vs. selling” to preserve your core holdings while meeting operational needs.

“Convert Unrealized Losses into Functional Tax Assets” Many treasuries overlook the opportunity to harvest losses, resulting in unnecessary tax liabilities even when natural offsets potentially exist. SDM facilitates structured tax-loss harvesting to convert “paper losses” into realized tax assets without sacrificing your long-term Bitcoin exposure. The firm provides the execution framework to offset capital gains and optimize your net tax position while maintaining your desired market profile.

“Discreet Execution & Audit-Ready Reporting” Large-scale treasury adjustments require more than just a liquid market; they require zero market footprint. SDM leverages multi-venue routing and algorithmic order types to absorb high-volume trades without alerting the market and moving the price against you. The firm handles the heavy lifting of executing within narrow tax deadlines and provides a consolidated, auditable record of every trade.

SDM and its team of specialists can craft a decision framework your CFO and treasurer can use to answer:

Where does lending make more sense than selling, given our cost of capital and effective tax rate?

Which loss pockets are genuinely worth harvesting in 2025, and what structures keep us aligned with our Bitcoin thesis?

How do we document this so that auditors, regulators, and shareholders see risk-managed treasury work, not just opportunistic speculation?

If your company has material BTC exposure and no clear “playbook” for your year-end, this SDM brief is one of the cleaner ways to turn a source of unmanaged exposure into a controlled, board-level win.

If you’d like a session that maps these strategies to your actual positions, jurisdictions, and policies, reply to this email and the CoinStack team can coordinate a joint workshop with SDM around your year-end calendar.

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 Polymarket Volumes Surge on Layer 2 Speculation: Polymarket airdrop speculation is ramping up after a screenshot emerged of a Polymarket team member saying that a Polymarket Layer 2 network is the prediction market’s “#1 priority.”

⚖️ TRON Integrates with Base, Enabling TRX Access on Coinbase:TRON DAO, the community-governed DAO dedicated to accelerating the decentralization of the internet through blockchain technology and decentralized applications (dApps), today announced the integration of TRON with Base, an Ethereum Layer 2 network incubated by Coinbase. Enabled by LayerZero, the integration allows TRX, TRON’s native utility token, to be seamlessly bridged to the Base network.

🥳 New XRP yield product earnXRP launches using Flare Network’s infrastructure:earnXRP, a new yield product, has launched as more projects look to expand the “XRPFi” ecosystem — an effort to bring into decentralized finance and put idle XRP to work onchain.

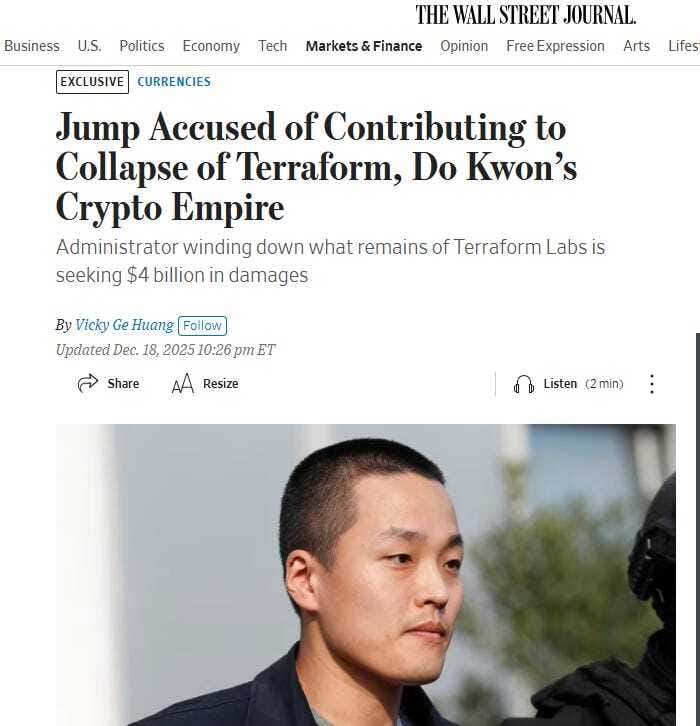

🏛️ Terraform Labs liquidator sues Jump Trading for $4 billion in damages:The administrator overseeing Terraform Labs’ liquidation has sued Jump Trading and its top executives, seeking to hold them liable for the firm’s multibillion-dollar collapse in 2022.

🎉 Bybit relaunches UK crypto platform after 2023 exit linked to FCA rules:Crypto exchange Bybit has relaunched its platform in the United Kingdom, making spot trading and peer-to-peer services available to UK users under a framework designed to comply with the Financial Conduct Authority’s financial promotion rules.

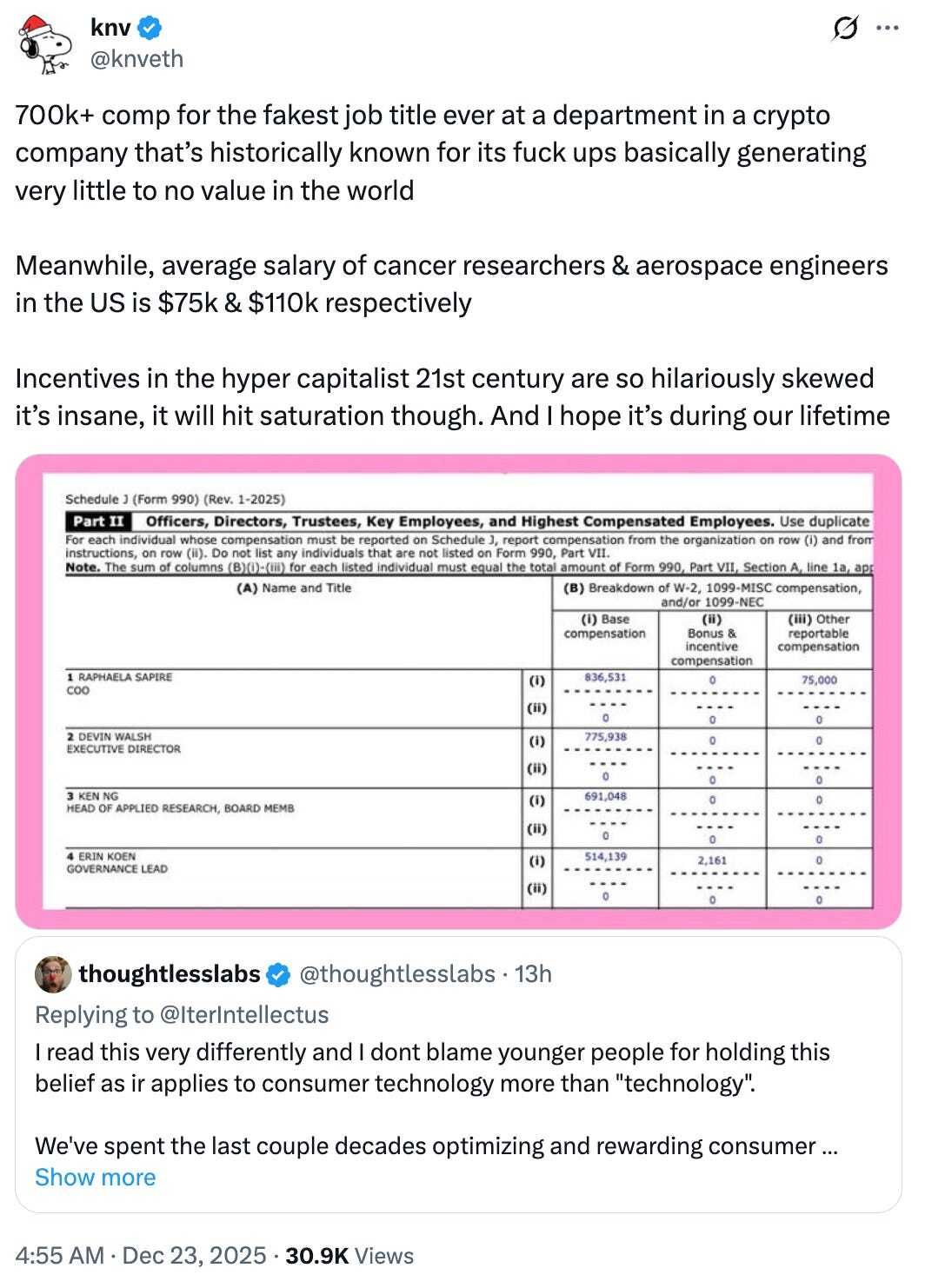

💬 Tweet of the Week

Source: @knveth

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

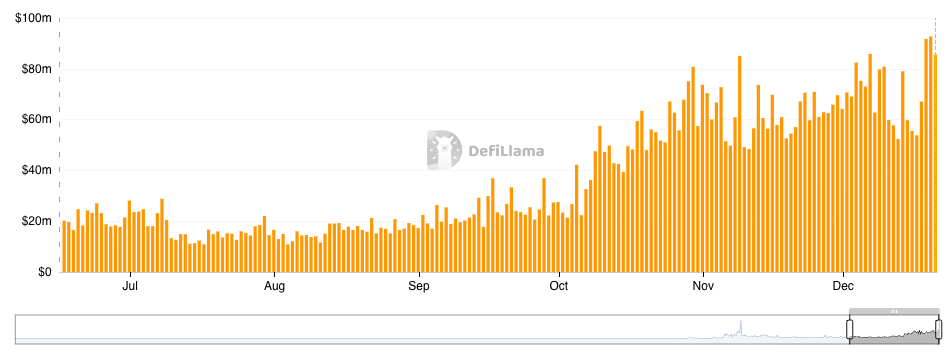

1. Broader crypto is dragging, but prediction markets keep gaining traction.

Weekly volume just topped $2B (the third-highest level ever), and December has already seen $5.4B in volume after a historic November ($8.2B).

Distribution is now the real moat.

Since Robinhood integrated Kalshi in March, Kalshi has surged to 74% market share, flipping Polymarket (26%), while aggregate trading volume has grown 8.2x over the same period.

Now Coinbase - fresh off launching regulated prediction markets and sourcing liquidity from Kalshi - has acquired prediction market The Clearing Company.

This likely expands total volume significantly, but raises the bar dramatically for new entrants.

Source: @DavidShuttleworth

2. Holders with between 10k - 100k $ETH ($29M - $290M) has shot up

Source: @JamesEastonUK

3. 🚨 LATEST: Annual performance of major assets in 2025 (per chart):

Silver: +128.47%

Gold: +66.59%

Copper: +35.45%

Nasdaq: +19.70%

Russell 2000: +12.53%

$BTC: -5.75%

$ETH: -11.58%

Altcoins: -42.27%

Source: @Cointelegraph

4. 2nd worst Q4 for $BTC so far

Source: @CarpeNoctom

5. 2025 token launches have mostly been a bloodbath

Tracked 118 TGE launches this year and compared today’s FDV vs opening:

• 84.7% (100/118) are below TGE valuation

• This means ~4 out of 5 launches are below their opening valuation

• Median token is -71% FDV (-67% MC) from launch

• Only 15% are green vs TGE

Source: @ahboyash

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Welcome to OurNetwork’s latest. In this issue we’re looking at Layer 2s, the scaling solution pioneered by the Ethereum community.

Layer 2s (L2s) have been a major strategic flashpoint in the crypto space.

Proponents of the technology, which separates execution from settlement, argue that L2s allow for uncompromised scaling and security. On the flip side, detractors say monolithic architectures like Solana’s offer better trade-offs in terms of user experience, composability, and liquidity.

While battles over the best way to scale blockchains continue on social media, in the end the market will decide on winners. For now, though, growthepie, Seoul Data Labs, and Patryk Krasnicki are checking in with the latest for the L2 side of the equation.

Enjoy and happy holidays.

– ON Editorial Team

📈 Growth in Layer 2 app revenue outpaces chain revenue (currently by 15x) as long-term adoption is prioritized over short-term profits

October was the biggest month yet for L2 app revenue, hitting a new high of $228M. Due to power-law dynamics common in crypto, the top 3 L2s contribute over 90% of the total (Base ~55%, Arbitrum One ~32%, Linea ~4.5%). Combined L2 app revenue is still ~6x smaller than Ethereum L1 - but this gap has narrowed from 15x in 2023 and 8x in 2024. With the success and growing number of Layer 2s, we can expect app revenue to outpace the L1 in the future.

There are currently 101 L2s with over $100k total value secured. Recently, some L2s have wound down, but this has largely been offset by new additions. Once the less successful L2s from the first wave have been flushed out, this chart should resume its upward trend.

L2s are posting more data to Ethereum blobs - Over the last 6 months, blobs have grown their market share from ~41% to 54%, with upcoming BPO forks set to further boost supply. However, new high-throughput L2s such as MegaETH (EigenDA) and Rise (Celestia) could reverse this trend.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.sdm.co and www.plutus.it and www.usefundex.com