Learn More at www.rootstock.io and www.crowdcreate.us

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 315k weekly subscribers. This week, Ripple purchased Hidden Road for $1.25B, the SEC declared stablecoins are not securities, and big venture rounds came in for Codex ($15.8M) and Ultra ($12M).

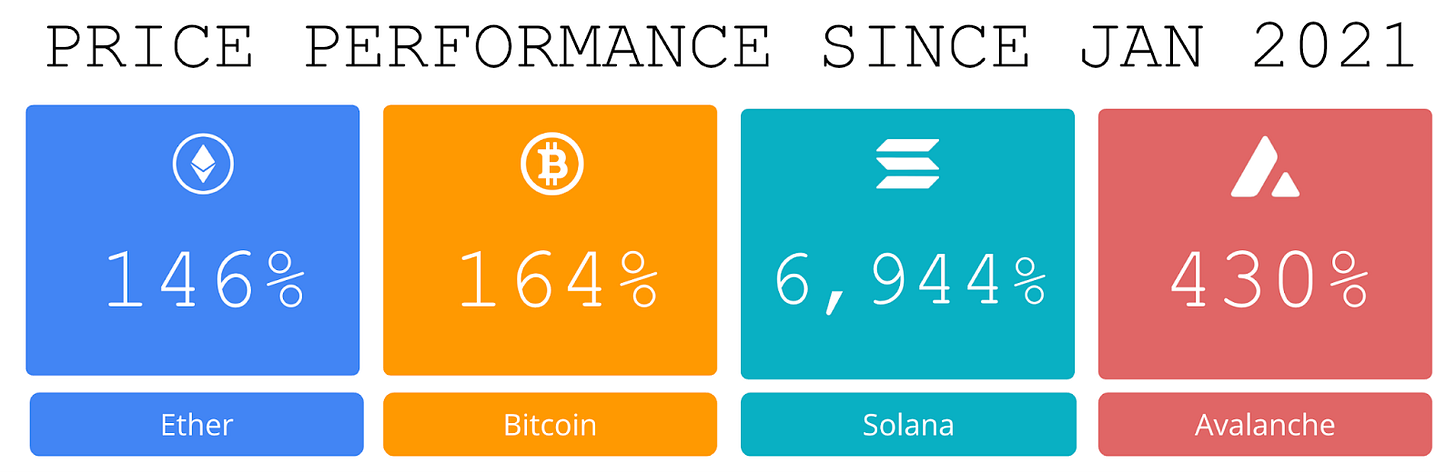

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2025 Coinstack Sponsors…

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 80%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Looking to scale your brand and drive real engagement? Crowdcreate is a top-rated marketing agency specializing in marketing strategy, influencer marketing, PR, outreach, crowdfunding, social media management, and investor marketing. With 700+ successful projects—including Sandbox, KuCoin, BitMex, and Star Atlas—we’ve helped raise over $250 million and supported startups and Fortune 500 companies with data-driven strategies. Learn more: crowdcreate.us

Become a Coinstack Sponsor

To reach our weekly audience of 315,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🤝 Ripple Buying Prime Brokerage Hidden Road for $1.25 Billion: Ripple has acquired crypto-friendly prime brokerage Hidden Road for $1.25 billion, marking one of the largest deals in the crypto industry's history.

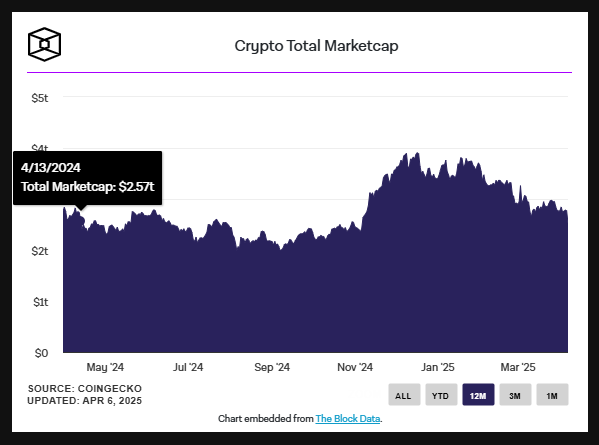

📉 Total crypto market cap falls 30% from peak levels as tariffs create turbulence: The total crypto market capitalization has contracted significantly, falling to $2.7 trillion from its December 2024 peak of $3.9 trillion, representing a 30% decline in total market value over roughly four months.

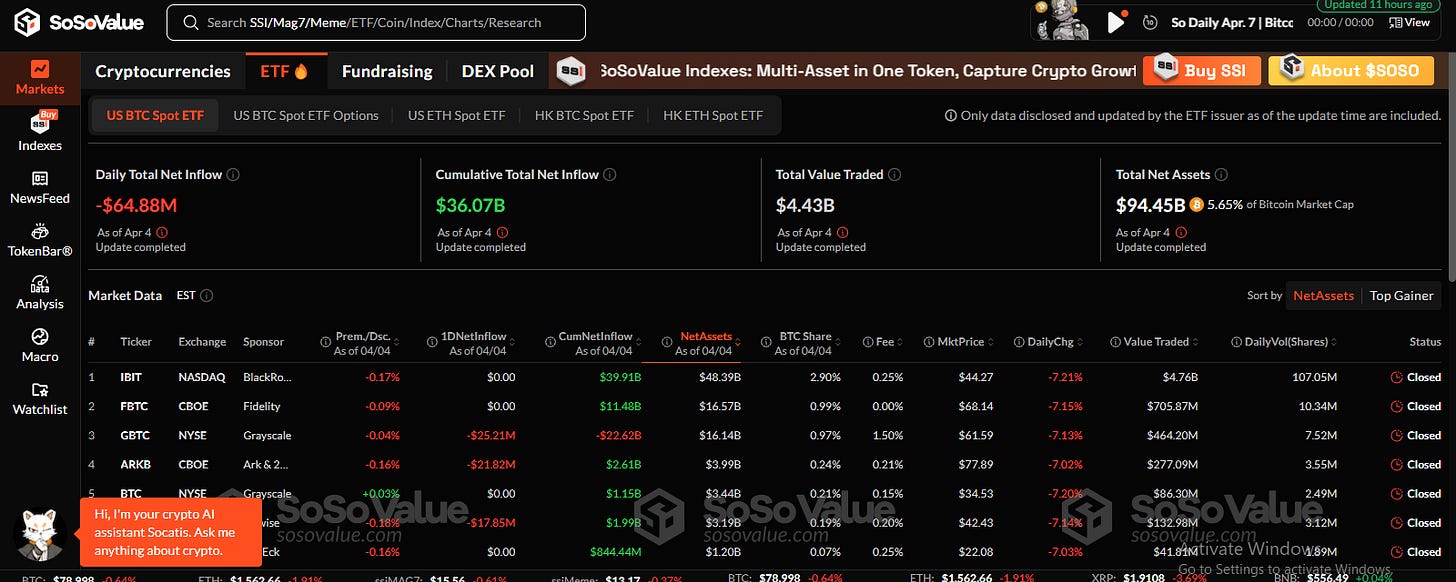

📉 Spot bitcoin ETFs see nearly $100 million in net outflows:U.S. spot bitcoin exchange-traded funds logged $99.86 million in net outflows Thursday, as the U.S. stock market tumbled following Trump's tariff announcement.Grayscale's GBTC led the outflows with $60.2 million, followed by Bitwise BITB's outflows of $44.19 million and Fidelity FBTC's $23.27 million, according to SoSoValue data. Ark and 21Share's ARKB, VanEck's HODL and WisdomTree's BTCW also logged outflows.

⚖️ SEC declares 'covered' stablecoins like USDT and USDC are not securities, no registration needed for minting or redeeming: The U.S. Securities and Exchange Commission has taken a formal position on stablecoins, the popular cryptocurrency that tends to be pegged to the U.S. dollar and backed by real-world assets.On Friday, the agency said in a statement that it does not consider "covered" U.S. dollar stablecoins to be securities and that those involved in the process of “minting” and redeeming stablecoins are not required to register the transactions with the commission.

🧑⚖️ Hong Kong allows crypto staking for licensed platforms, ETFs as global competition heats up:In a statement released Monday, the Hong Kong Securities and Futures Commission said it provided regulatory guidance about staking for licensed "virtual asset trading platforms" (VATPs) and for crypto ETFs. "We have noted investors’ demand for staking services, and the potential for staking activities to contribute to the security of the blockchain network," the SFC said.

💬 Tweet of the Week

Source: @CryptoHayes

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

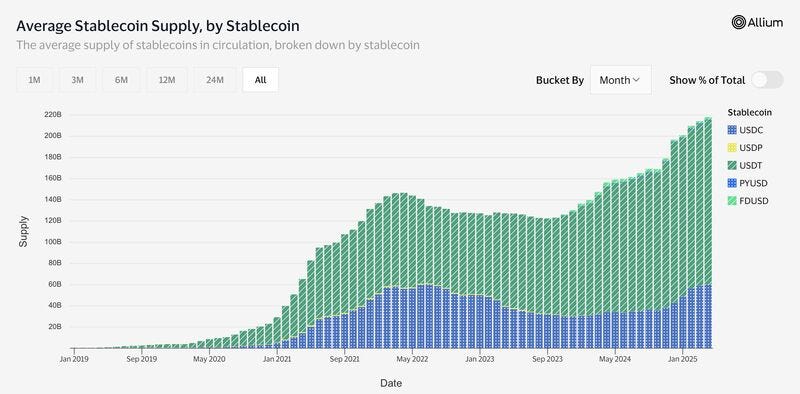

1. Stablecoin growth continues to accelerate…💵 $214B fiat-backed stablecoins in circulation in March, the most ever.💴 19 consecutive months of growth💶 Average total supply has increased 11% YTD and 40% since April 2024.

And this only includes vanilla stablecoins that earn no yield for end users. Wait until users realize they can earn the risk-free rate, at minimum, simply by holding their digital dollars. And wait until they realize their digital dollars can be put to further work, with increasingly more utility and more agency, and extend well beyond the confines of the U.S. Treasury.

Source: @DavidShuttleworth

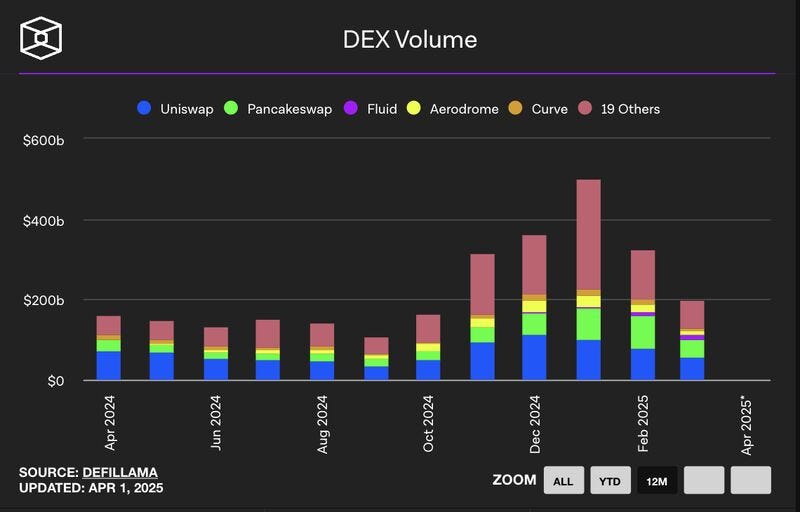

2. Total DEX volume across the space has declined 39% ($124B) month-over-month, and is now down 60% ($300B) since January. Perhaps more interestingly, Raydium monthly volume has declined by a staggering 89% ($110B) YTD while Uniswap is down 43% ($44B).

Overall, DEX activity has retreated to its pre-election levels in October.

Source: @OurNetwork

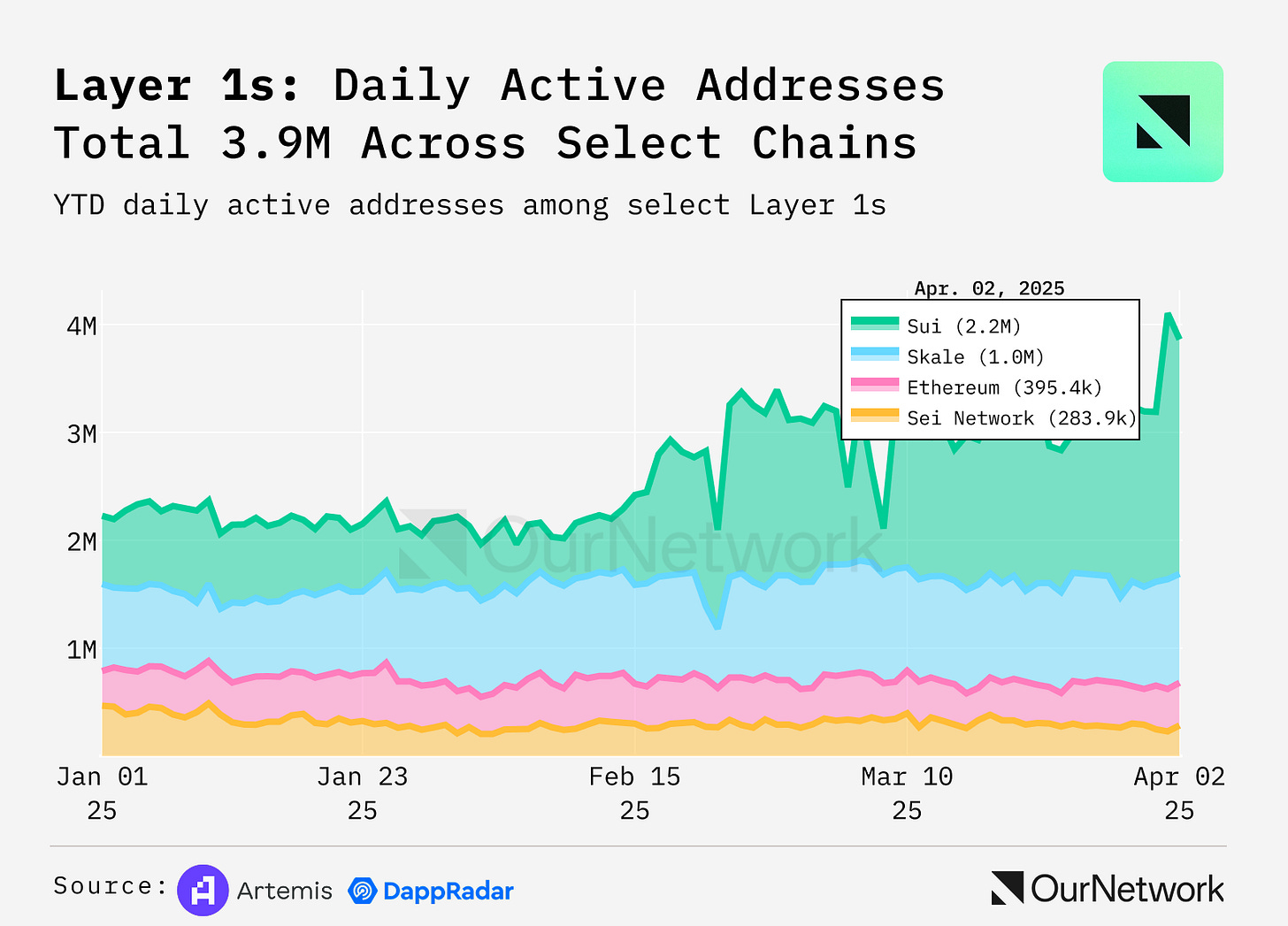

3. Sui Ecosystem Stays Hot Following Walrus Protocol's WAL Token Launch, Total Value Locked Back at $1.26B with Near All-time High Stablecoin Supply

Source: @OurNetwork

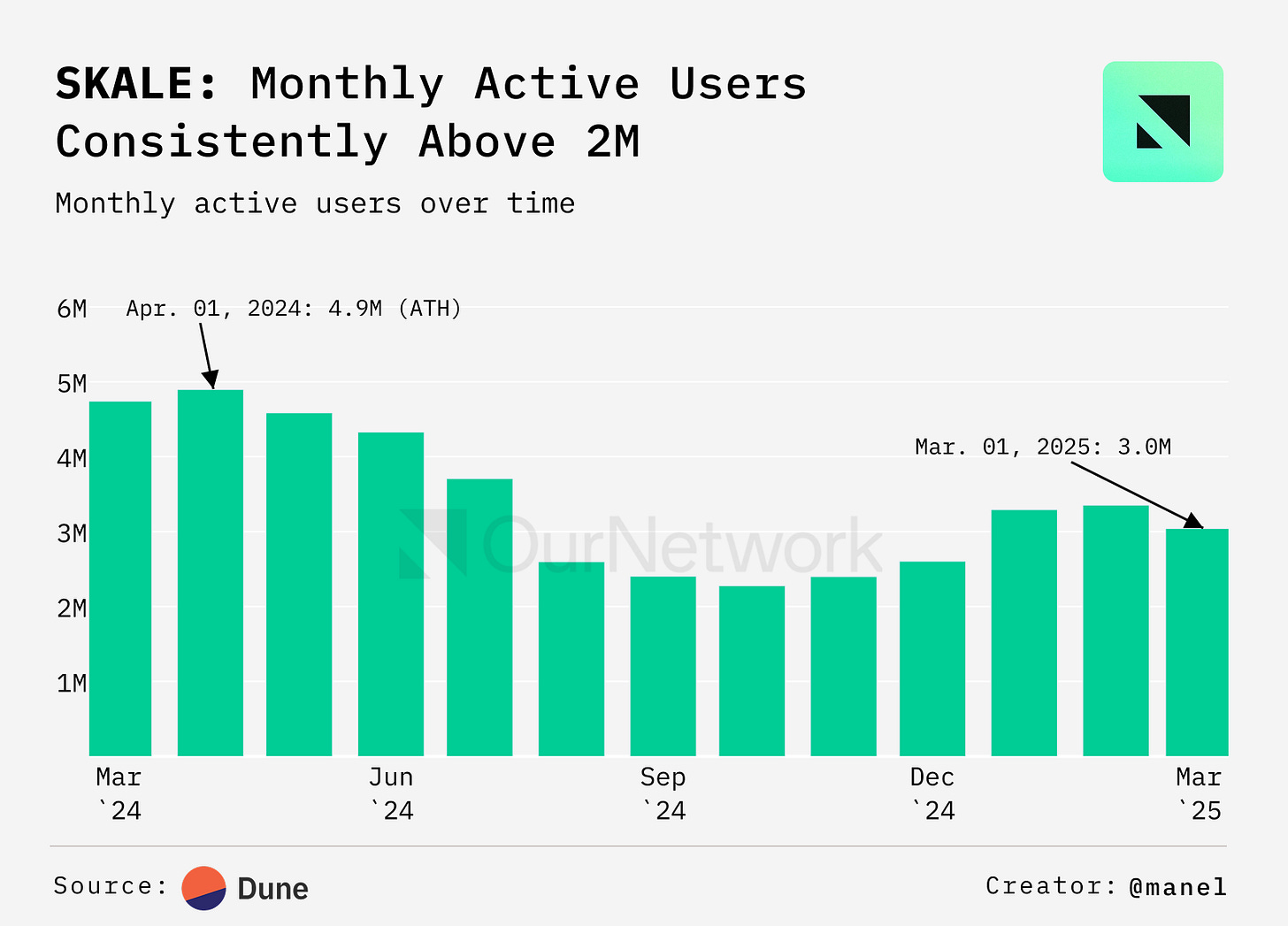

4. Defying the Broader Market Slump, SKALE Posts 46% Transaction and 33% Unique Active Wallets Growth Quarter-over-Quarter, as 17 dApps Surpass 10k Users in March

Source: @OurNetwork

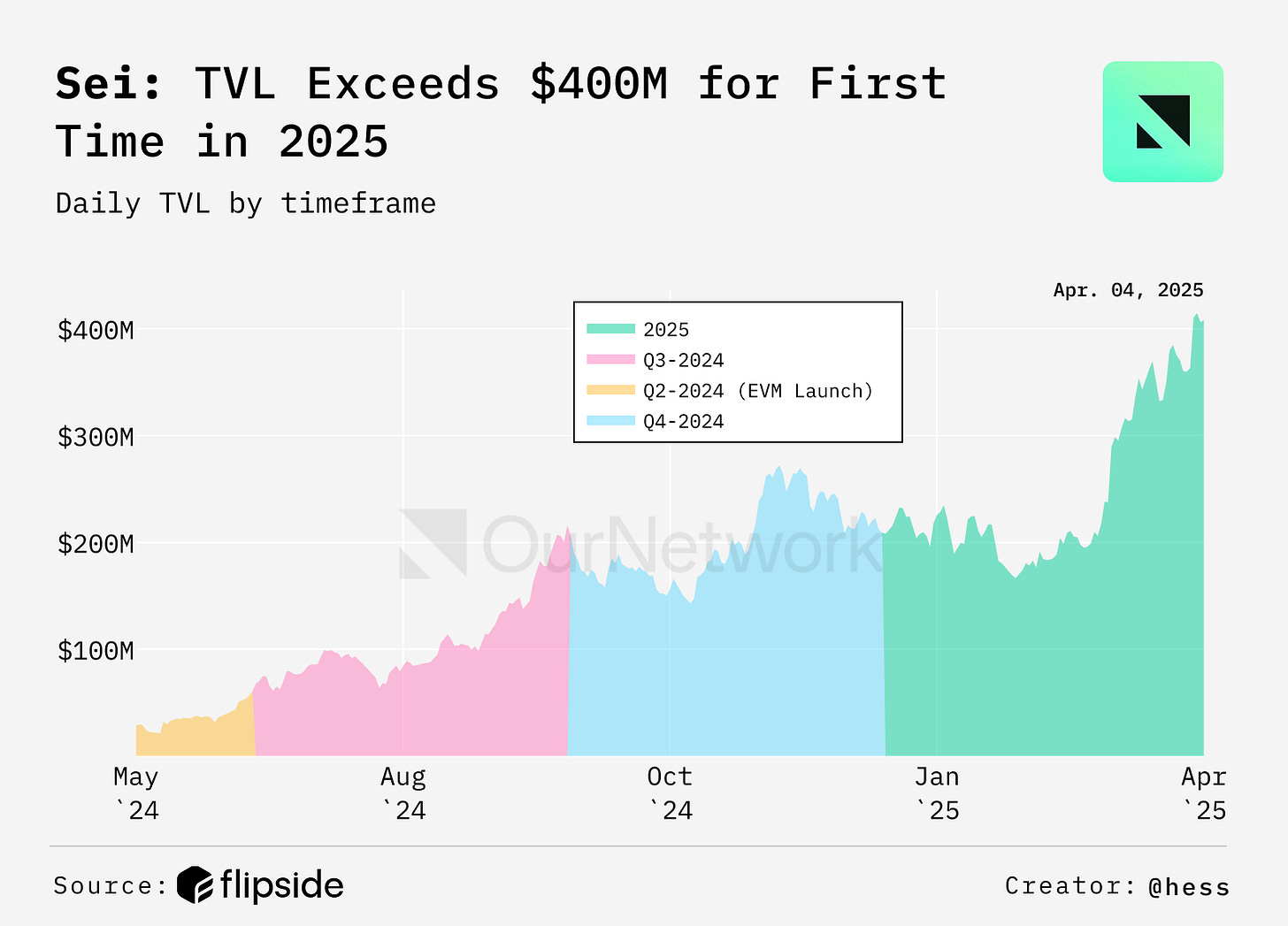

5. Sei Generated 350% Total Value Locked Growth in Q1 2025 to $413M, 500k-700k Daily Transactions, 200k-400k Active Addresses, and Strong Adoption of Gaming dApps

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

On a volatile week inside and outside of crypto, OurNetwork is chugging along.

So are the Layer 1s that contributors are covering in this issue — in fact, the four chains in this issue have nearly 3.9M daily active addresses, according to data from Artemis and DappRadar.

There's a lot to unpack — let's get into it.

– ON Editorial Team

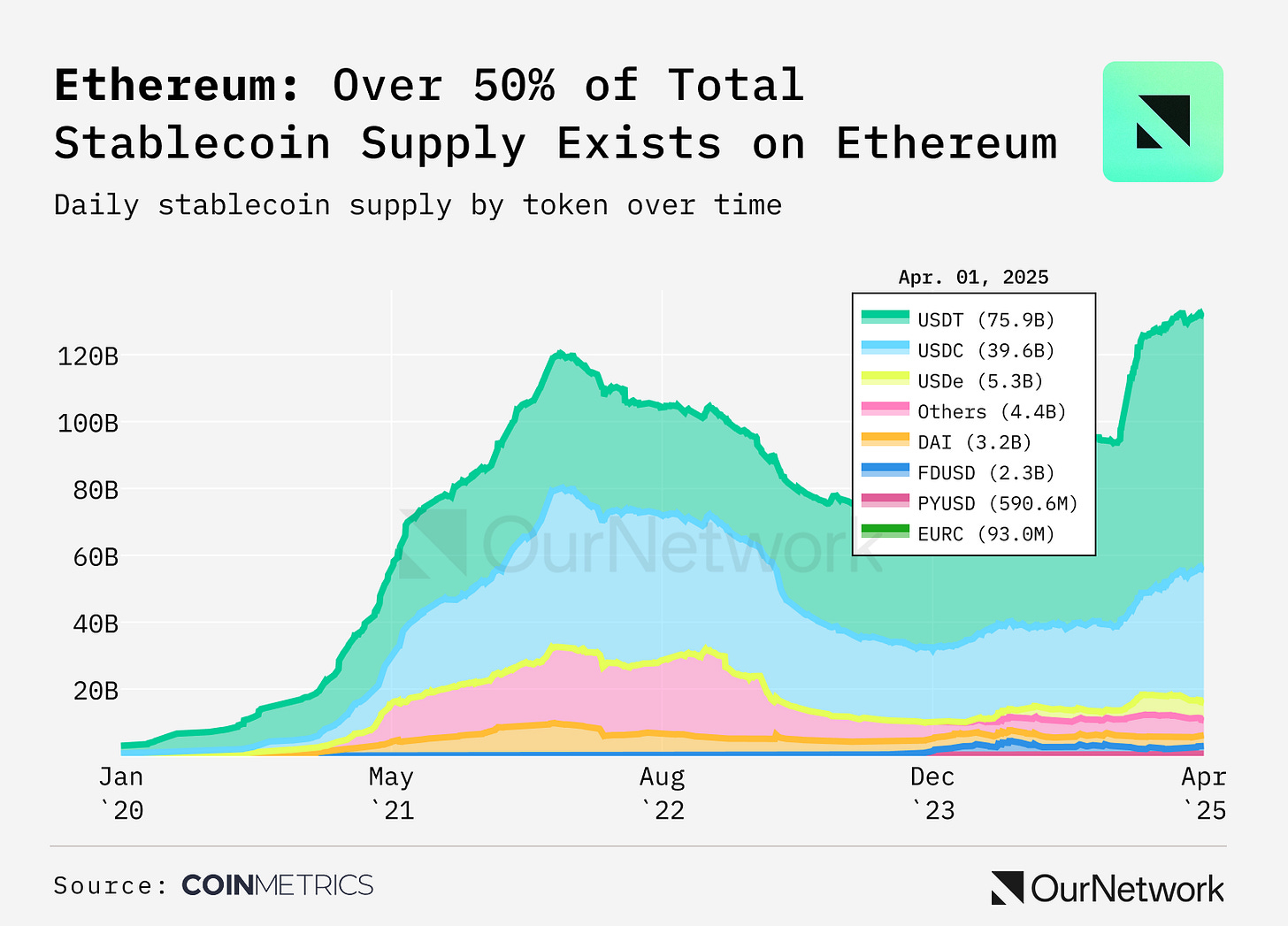

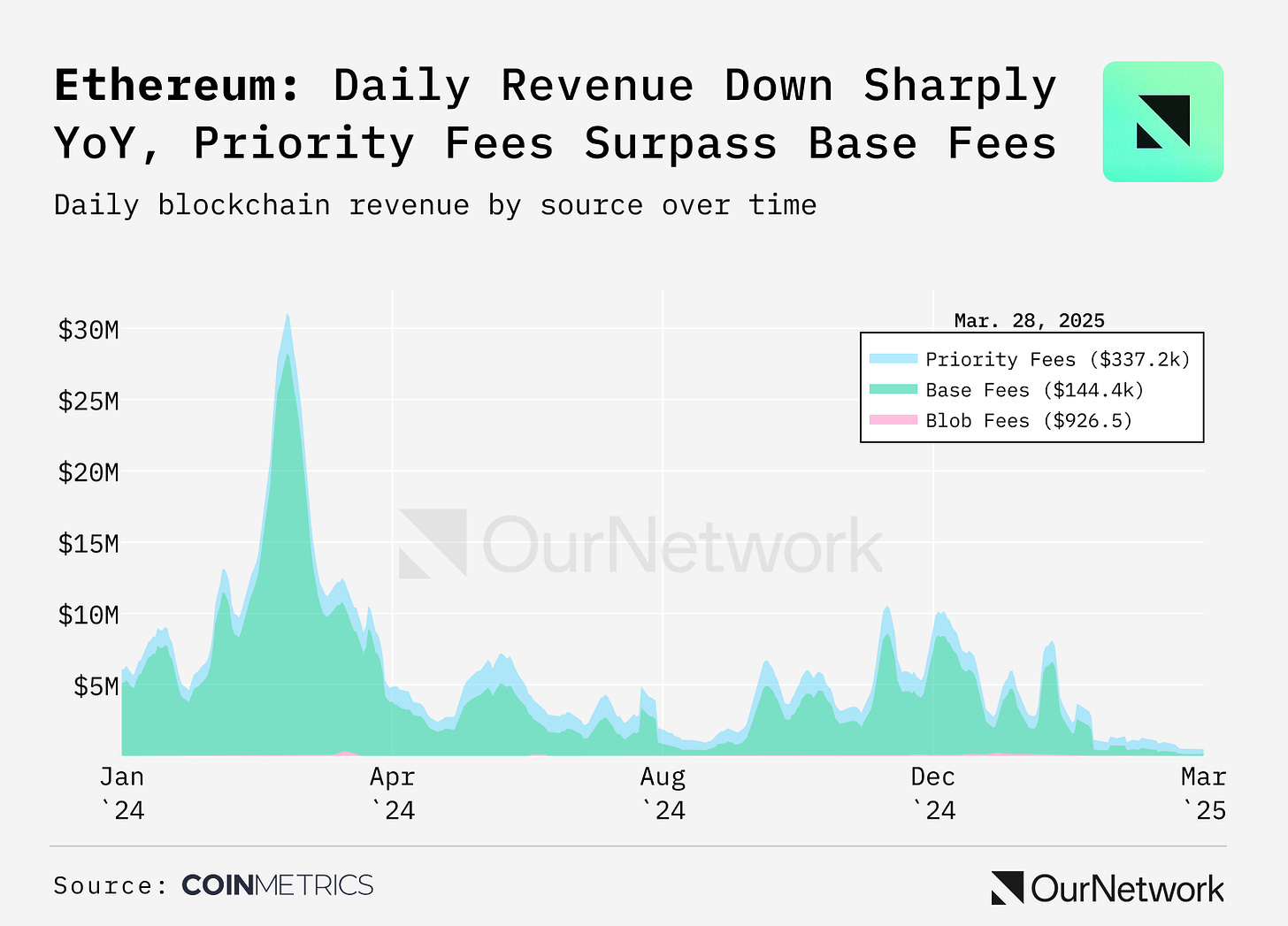

📈 Ethereum Stablecoin Supply Reaches All-Time High of $130B, Up 53% Year-over-Year as ETH Value Capture Has Lagged as Total Fees and Burn Decline.

With the stablecoin sector heating up, total supply has surpassed $230B. Of this, 56%—or $130B—resides on Ethereum, up 53% year-over-year. That’s two times more than Tron and ten times more than Solana. Ethereum’s stablecoin dominance highlights its role as the backbone for digital dollar liquidity, powering DeFi and an expanding base for tokenized real world asset settlement, from U.S. Treasuries to private credit. However, onchain activity has declined as Ethereum moves through a transitory phase, impacting value accrual of ETH the asset.

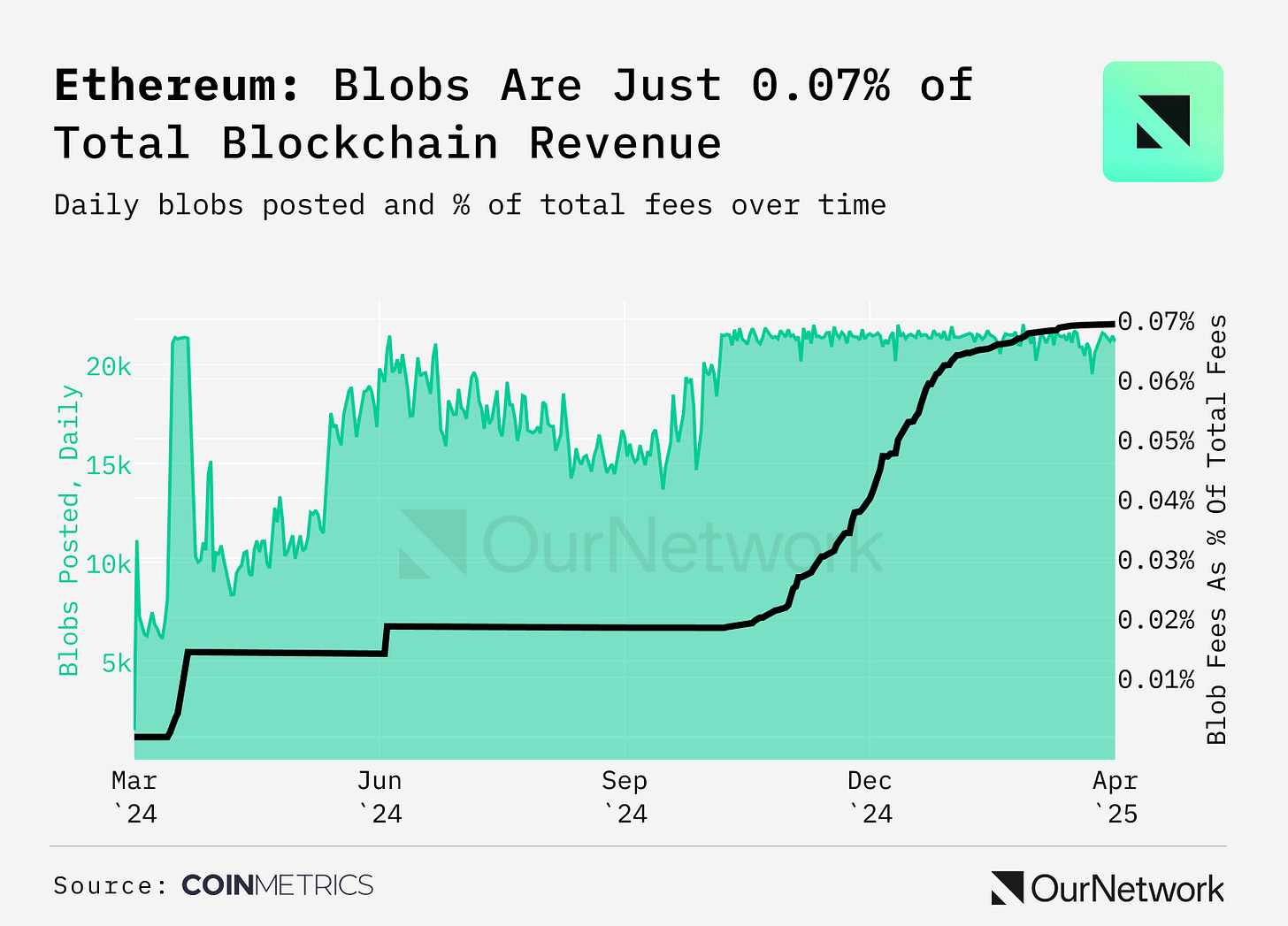

Total fees, ~$30M a year ago when EIP-4844 launched, now sit near $500K. Blob fees make up just 0.07%, with only ~70 ETH burned on average daily, pushing annual inflation to 0.78%. Developers aim to incrementally scale blob capacity, lower costs, and boost blob usage and ultimately, fee revenue.

Layer 2s (L2s) have consistently been hitting the target of 3 blobs per block (21K blobs daily). If demand continues to match capacity, the proliferation of L2s and renewed L1 activity through sectors like stablecoins, DeFi, and tokenization, could offer a viable path to restore value accrual to ETH.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.rootstock.io and www.crowdcreate.us