Learn More at www.amphibiancapital.com and www.plutus.it and www.usefundex.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We reviewed the top news, stats, and reports in the digital asset ecosystem for our 350k weekly subscribers. This week, Ripple, Circle, and BitGo secured conditional approval for U.S. banking charters, Terraform Labs founder Do Kwon was sentenced to 15 years in prison over the $40 billion Terra-Luna collapse, and the UK financial authority announced plans to prioritize stablecoin payments by 2026. Meanwhile, Visa launched stablecoin settlement in the U.S. using Circle’s USDC on Solana, and MetaMask rolled out native Bitcoin support as part of its continued multi-chain expansion. On the fundraising front, RedotPay raised $107M in a Series B led by Pantera Capital, while METYA secured $50M in a strategic round led by Century United Holdings Group.

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our Coinstack Sponsors…

Award-winning Amphibian Capital, managing $145MM+ AUM, is a fund of the world’s leading hedge funds. *+20.4% net 2024 approx with their USD fund, *+14.1% net BTC on BTC in 2024 (*+152% in USD terms), and *+17.3% net ETH on ETH in 2024 (*+71.2% in USD terms). They target consistent risk-adjusted returns for long-term BTC & ETH holders. Learn more: www.amphibiancapital.com.

Plutus is a Web3 rewards platform where everyday spending earns PLUS, a merchant-funded reward token with a guaranteed £/$/€10 in-app value. Redeem PLUS for gift cards, cashback, travel rewards, or miles across 400+ global brands. With 250k sign ups and powering $40M+ in monthly spend, Plutus brings real utility to digital rewards.

Fundex helps founders run a disciplined, data-driven fundraise. We combine investor intelligence, structured outreach, and hands-on execution so you can stay focused on building while fundraising runs in parallel. Coinstack readers get 25% off with code COINSTACK25 — monthly pricing drops from $2,500 to $2,000 for a limited time.

Become a Coinstack Sponsor

To reach our weekly audience of 350,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

🚀 Ripple, Circle and BitGo secure conditional approval for US banking charters: Ripple, Circle, BitGo, Fidelity Digital Assets and Paxos have won conditional regulatory approvals that could clear a path for the crypto firms to operate as federally regulated trust banks in the United States.

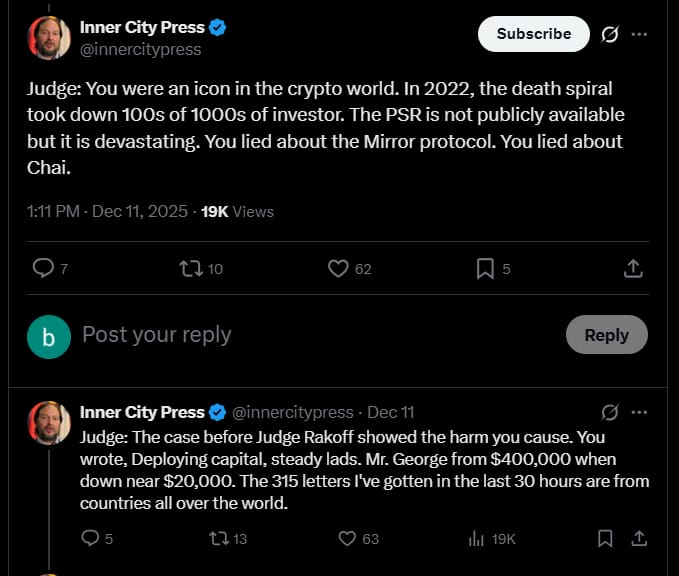

⚖️ Terraform Labs founder Do Kwon sentenced to 15 years over $40 billion Terra-Luna collapse:Terraform Labs founder Do Kwon was sentenced to 15 years in prison for his role in the collapse of the and Luna tokens — an implosion that wiped out $40 billion in 2022.

🏛️ UK financial authority to prioritize stablecoin payments in 2026:The Financial Conduct Authority, the UK’s primary financial regulator, announced Wednesday that enabling local firms to experiment with stablecoin payments will be a top priority for 2026.

🎉 Visa launches stablecoin settlement in US via Circle’s USDC on Solana:Visa is launching a stablecoin settlement service in the U.S., underscoring growing institutional interest in blockchain-based payment rails.The payments giant said Tuesday it will allow U.S. financial institutions to use Circle’s for back-end payment flows over Solana, with Cross River Bank and a16z-backed Lead Bank among the first to participate.

🥳 MetaMask rolls out Bitcoin support, continuing multi-chain expansion:MetaMask has added native support for Bitcoin,as the largest Ethereum wallet continues its multi-chain expansion.According to an announcement on Monday, MetaMask users will now be able to buy bitcoin directly with fiat, make onchain Bitcoin network transfers, and swap to and from BTC using EVM-native assets and SOL.

💬 Tweet of the Week

Source: @StaniKulechov

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Solana’s Breakout Year: Record Activity, Expanding Capital Markets, Surging Stablecoins and Peer-to-Peer Adoption

Source: @OurNetwork

2. Sei is Dominating Gaming with Non Crypto-Native Games Joining the Chain

Source: @OurNetwork

3. Competition within the perp space has accelerated throughout 2025, with year-over-year volume surging more than $1T (+580%).

And while newer entrants like Lighter (28%) and Aster (19%) have eaten into market share, Hyperliquid still owns the core of the market: 80% of all perp DEX users and 52% of open interest remain on Hyperliquid.

Source: @DavidShuttleworth

4. You have to discount the value of Bitcoin by 34% today. There’s a 34% chance Quantum breaks Bitcoin in the next 3 years. Given a 2-3 yr timeline to deploy fix, this is the current discount rate. And it is growing. Every. Single. Day.

Source: @caprioleio

5. A lot of people have been asking for an update on this chart, so I’ll just leave this here for anyone who needs to see it.

This shows the average BTC trajectory following an oversold RSI reading, with RSI falling below 30 at t=0.

So far, it’s been pretty bang on.

Source: @BittelJulien

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

Welcome back to OurNetwork’s latest.

In this issue, we’re covering Layer 1s, a crucial sector in crypto which has reentered the conversation thanks to recent high profile entrants like Monad and Tempo.

Layer 1s matter because they’re the crown jewels of crypto — the platforms on which large hubs of financial and consumer activity have, or possibly will, develop.

In terms of TVL, Ethereum leads all chains with $113B of value stored in its smart contracts. Solana is second with $18B. Still, there is no consensus on how to value Layer 1s, which has led to furious online debates. The issue below examines some non-TVL aspects of Layer 1s, like app revenue, monthly transactions, and active smart contracts.

With contributions from the growthepie team, Surf Query, and SSaadmanM, let’s get into the weeds a bit.

– ON Editorial Team

📈 Ethereum Already Dominates Many Metrics, from Stablecoins to Uptime but Is Now Turning its Attention to Scaling The L1 in Particular

Recently renewed efforts to scale Ethereum L1 are accelerating: Transactions per second roughly doubled in 2025 alone, from ~12.5 to ~24.6. Ethereum has enjoyed 10+ years of decentralized uptime while scaling TPS by 34.6x. Yet for over two years (2022-2024), L1 TPS flatlined at ~12.4 while L2s increased by 15x. The new roadmap targets ~3x annual L1 TPS growth alongside L2 scaling.

Ethereum is currently generating $29M in daily app revenue fueled by its majority share in stablecoin supply. Zooming out, a clear upward trend can be seen with the next leg up likely to reach new all-time highs. Note: growthepie.com includes weighted stablecoin revenue in app revenue - many platforms do not.

In the past 180 days 40.88% of Ethereum’s gas fees came from DeFi/finance (58% of labeled activity). When compared to all-time this is up from 30.26%, a significant increase. Ethereum blockspace still commands a premium but it is getting cheaper and this is affecting how it is used.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.amphibiancapital.com and www.plutus.it and www.usefundex.com