Learn More at www.rootstock.io and www.kuladao.io and invest.modemobile.com

Issue Summary: Welcome back to Coinstack, the weekly newsletter for institutional crypto investors and industry insiders. We review the top news, stats, and reports in the digital asset ecosystem for our 320k weekly subscribers. This week, Robinhood acquired WonderFi, Celsius CEO sentenced to 12 years in prison, BlackRock meet with SEC Crypto Task Force, and big new venture rounds from Camp Network ($30M) and T-Rex ($17M).

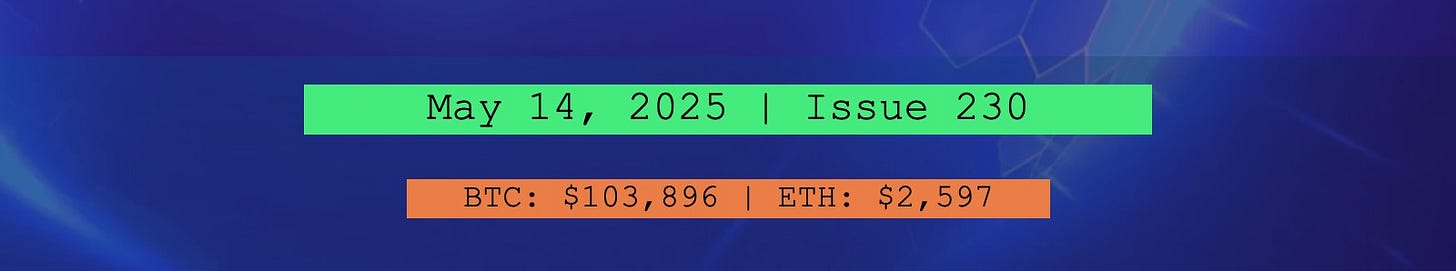

Price performance since we began writing Coinstack in January 2021

Published by Coinstack Partners

Coinstack Partners helps crypto/web3 companies raise funding from crypto venture capital firms and family offices for Series Seed/A/B/C rounds of $1M to $50M. The firm has relationships across many of the top 300 crypto venture capital firms across North America, Asia, and Europe. To discuss venture capital fundraising services for your company, please review our deck and schedule a free consultation.

Thanks to Our 2025 Coinstack Sponsors…

Tap into the $1.3tn Bitcoin DeFi opportunity this bull market with Rootstock, the longest running and leading Bitcoin sidechain. The most secure and decentralised way to stake, lend, borrow or trade your Bitcoin. Secured by 60%+ of Bitcoin’s hash rate, supported by the world’s leading DeFi protocols and 100% uptime since launch in 2018. Learn more: www.rootstock.io

Kula is a decentralised impact investment firm that transforms overlooked assets into shared prosperity and thriving communities by re-shaping how value and opportunity are recognised worldwide. By tokenising real-world assets, we provide opportunity, transparency, and financial sovereignty to historically excluded communities. Our model aligns economic growth with sustainable development, ensuring that wealth is not extracted but reinvested into the communities that generate it.

This tech company grew 32,481%...

No, it’s not Nvidia—it’s Mode Mobile, 2023’s fastest-growing software company according to Deloitte. Their EarnPhone and EarnOS helped +45M users earn $325M+, driving $60M+ in revenue. Mode just secured its Nasdaq ticker $MODE, and you can still invest in their pre-IPO offering for a limited time.

Become a Coinstack Sponsor

To reach our weekly audience of 320,000 crypto insiders, view our sponsor deck and schedule a call to discuss sponsoring Coinstack.

💵 Weekly Crypto Fundraises & Deals

Here are all the crypto fundraises we heard about this week, ranked by size…

🗞️ Crypto News Recap: The Top 5 Stories

Welcome back to This Week in Crypto… everything you need to know in one scannable format. Here are the top 5 stories of the week…

💰Robinhood woos Canadian crypto users with nearly $180 million WonderFi purchase: Robinhood, opens new tab said on Tuesday it will buy Canadian crypto firm WonderFi, opens new tab for C$250 million ($178.98 million), as the popular commission-free brokerage looks to expand its international footprint. The all-cash deal values WonderFi at 36 Canadian cents per share, a 41% premium to its previous close.

⚖️ Former Celsius CEO sentenced to 12 years in prison for crypto related fraud: Inner City Press: Former Celsius CEO Alex Mashinsky was sentenced to 12 years in prison, Inner City Press reported on Thursday. Prosecutors previously said Mashinksy "orchestrated one of the biggest frauds in the crypto industry."People lost their life savings and suffered psychologically, said Judge for the U.S. District Court for the Southern District of New York John George Koeltl, according to Inner City Press.

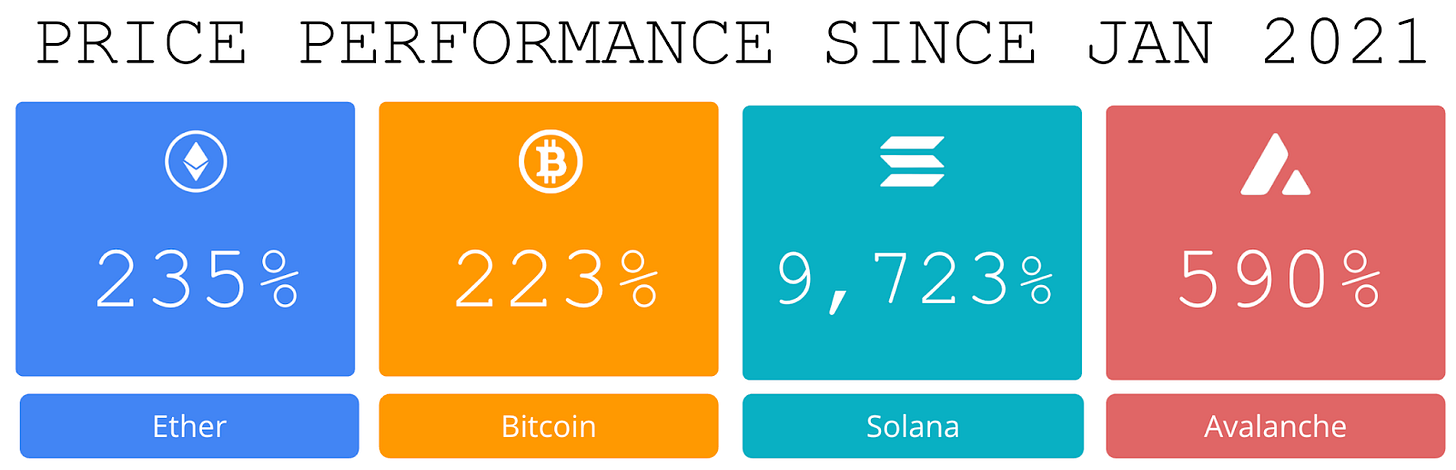

⚖️ BlackRock meets with SEC Crypto Task Force to discuss staking and options on crypto ETFs:Representatives at the world's largest asset management firm, BlackRock, met with U.S. Securities and Exchange Commission staff to discuss staking and options on cryptocurrency exchange-traded funds.The firm's representatives met with members of the SEC's crypto task force on Friday, according to a memorandum.

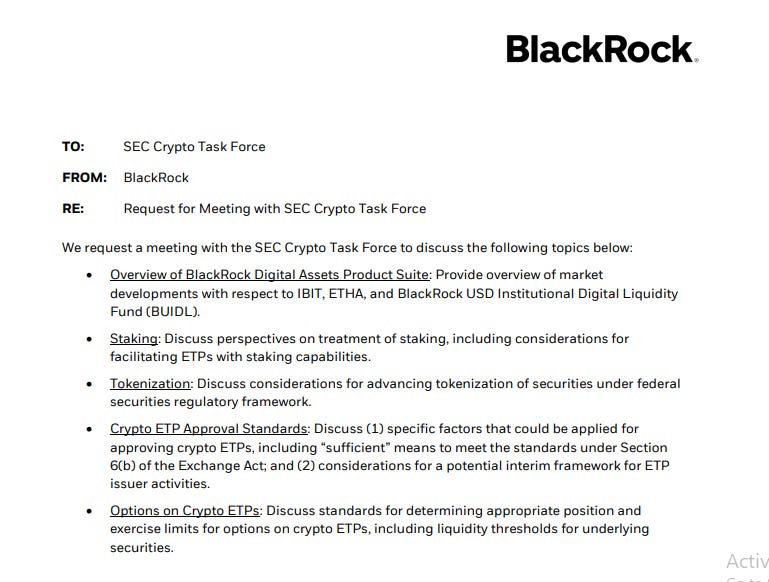

🚀 Spot Bitcoin ETFs set lifetime flow record at $40.3B as price recovers:Spot Bitcoin (BTC) exchange-traded funds (ETFs) traded in the US reached a new all-time high of $40.3 billion in lifetime flows on May 8, according to Bloomberg data.Bloomberg senior ETF analyst Eric Balchunas said lifetime net flows are the most critical metric related to ETFs to watch. He explained that this metric is “very hard to grow” and represents the “pure truth.”

⚖️ SEC Files for $50 Million Settlement With Ripple Over XRP Lawsuit:The Securities and Exchange Commission and Ripple Labs have officially settled a long-running lawsuit—over four years after the regulator went after the fintech firm. Wall Street's top regulator the SEC announced the settlement Thursday, after Ripple execs said in March that the agency was backing off. Ripple and two of its executives, CEO Brad Garlinghouse and Executive Chairman Chris Larsen, will pay a total of $50 million to the SEC to settle the case, the announcement said. Ripple had previously disclosed the $50 million agreement in March.

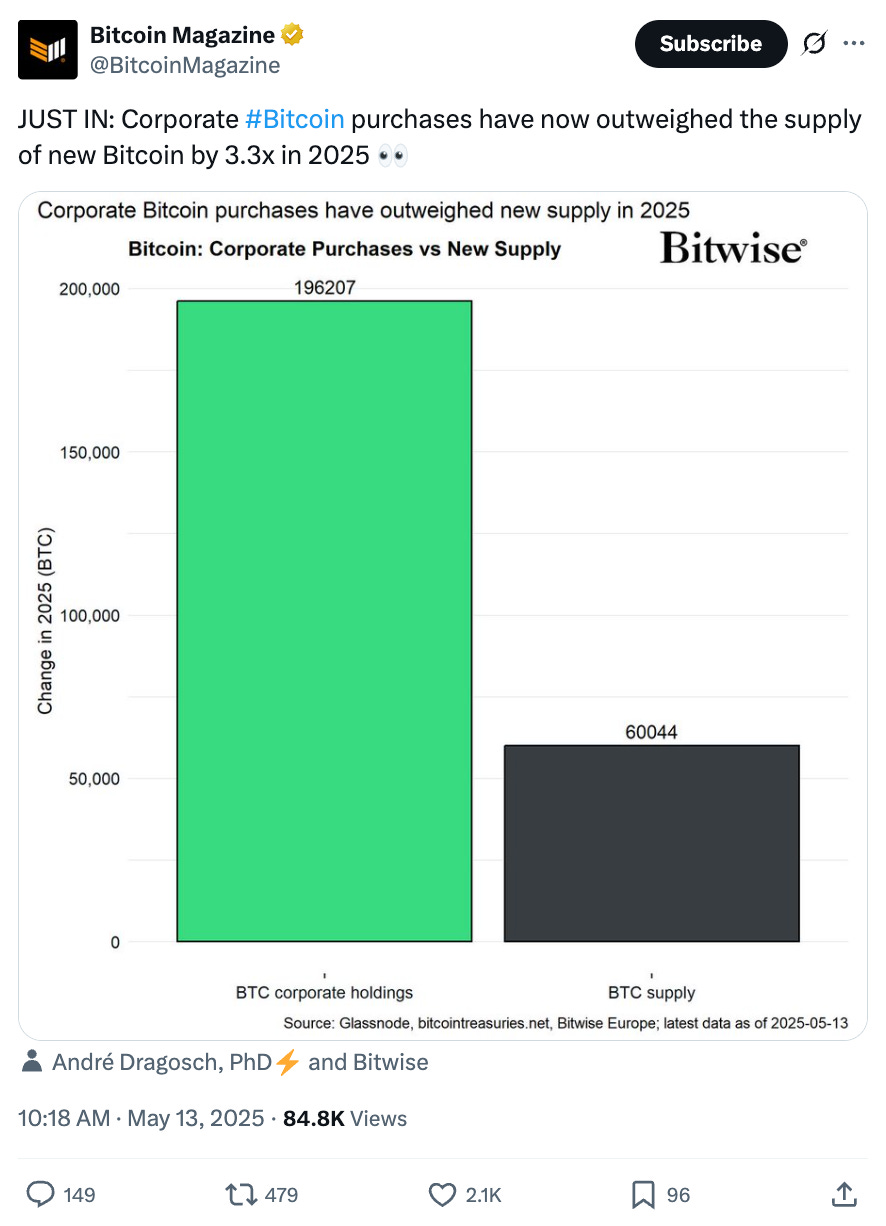

💬 Tweet of the Week

Source: @BitcoinMagazine

📊 Key Stats of the Week

Here are the most important and interesting stats in crypto this week...

1. Since the Pectra ugrade went live on May 7th, open interest on ETH futures has surged by $10B (46%), pushing total OI above $30B for the first time since January. Meanwhile, ETH itself is up 42% over the same period.

Interestingly, total open interest is now up by $19B (167%) YTD (red) compared to last May when the price of ETH was around $3,000 and open interest was just $11.5B (blue).

Nevertheless, favorable macro conditions will help continue to drive this momentum.

Source: @DavidShuttleworth

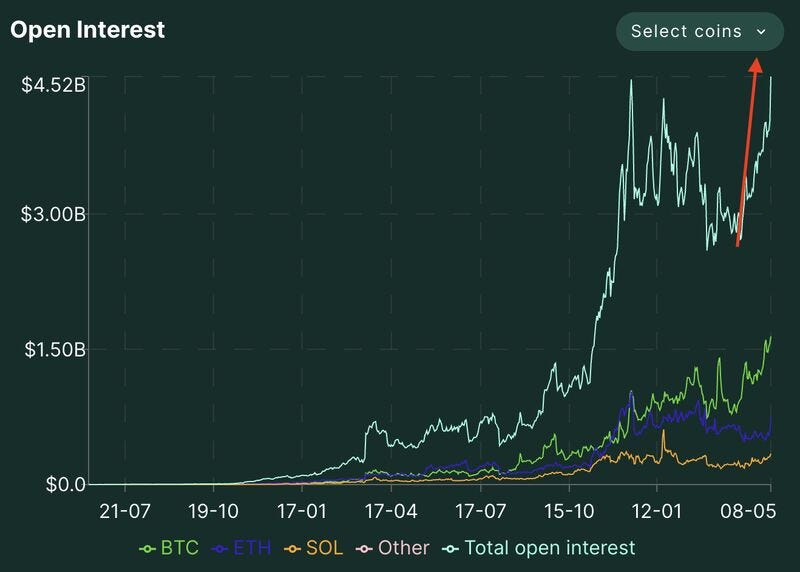

2. A glimpse of positive macro and open interest on Hyperliquid is at a new all-time high of $4.5B and is up 68% month-over-month.

The protocol also experienced the highest level of daily deposits ever this week, with over $200M pouring in.

Source: @DavidShuttleworth

3. And there we have it: at the first hint of improving macro conditions, we witness the largest daily volume of short liquidations all year and one of the highest levels since September. $829M and counting, with $393M in BTC shorts and $257M in ETH.

Macro leads, crypto follows.

Source: @DavidShuttleworth

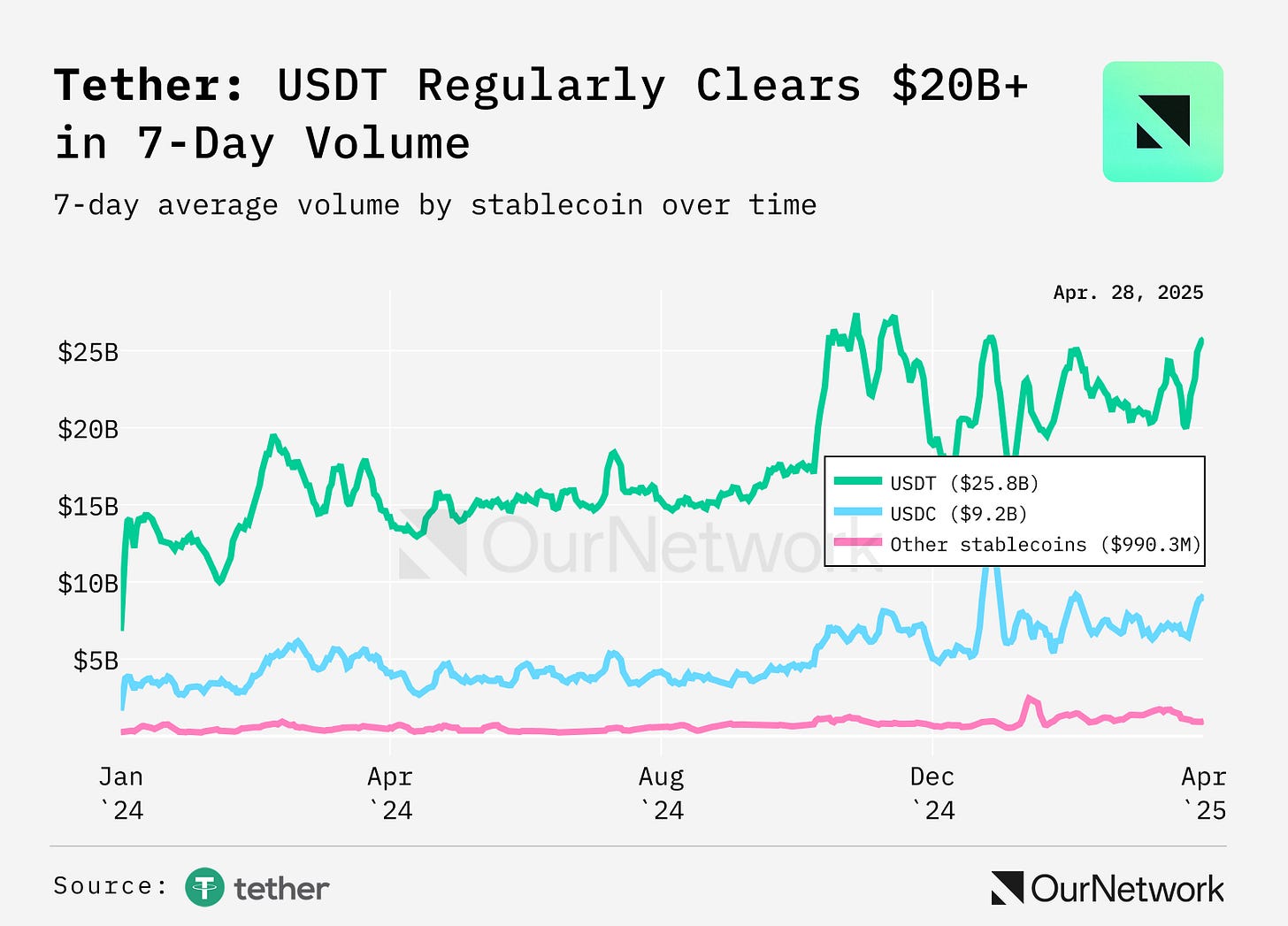

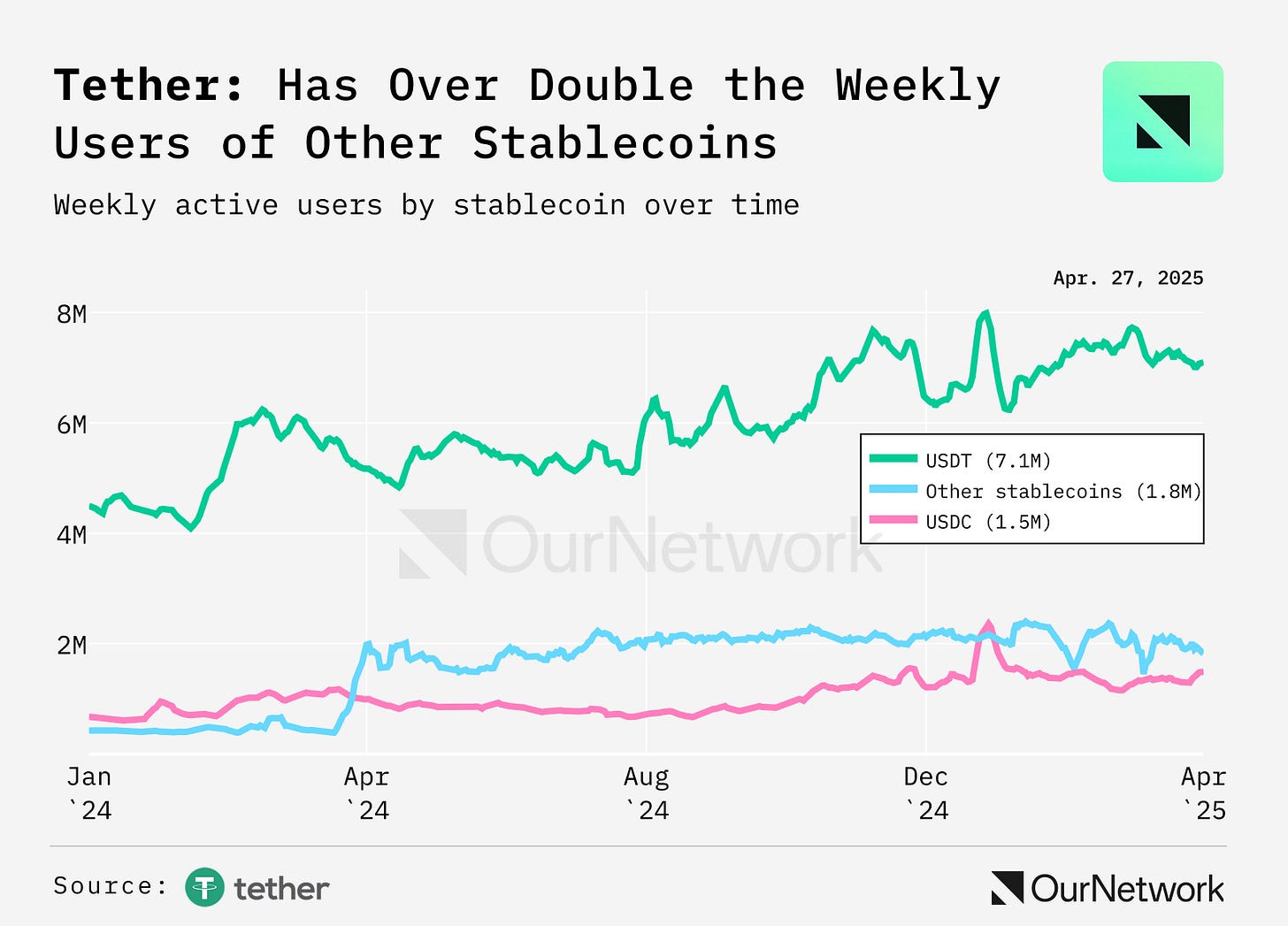

4. USDT Continues Upward Trajectory with $25B+ Volume Days and 7M+ Weekly Users

Tether's volume is over double all other stablecoins combined and is routinely clearing $20B in volume daily in 2025.

Source: @OurNetwork

5. Weekly active users of USDT have steadily grown from 4M early 2024 to 7M today.

Source: @OurNetwork

📝 Highlights from the Top Crypto Reports

Here are the top highlights from the best crypto research reports this week…

About the Author: OurNetwork, aims to help you understand crypto like never before by harnessing the power of onchain data & analytics. This is an excerpt from the full article, which you can find here.

📝 Editor’s Note:

On a red hot week for crypto prices, welcome to part one of a two-part series covering stablecoins. While most stablecoin holders likely wished they were holding non-pegged tokens, this was arguably a good week for the less-volatile digital assets as well.

Case in point, the payments giant Stripe announced Stablecoin Financial Accounts, which allows people in over 100 countries to easily set up an account which sends and receives stablecoins. News also hit that Meta, is exploring integrating stablecoins into its platforms.

It wasn't all positive this week for stablecoins however — in the U.S. the GENIUS act, a bipartisan bill which would clarify the law surrounding dollar-pegged assets, did not pass the Senate.

Still, according to the onchain data, stablecoin supply is marching slowly upward, now moving well-past a collective $230B market capitalization, according to CoinGecko. For context, that's just over 1% of the $21T current M2 supply of dollars, according to FRED.

99% to go. Let's get into it.

– ON Editorial Team

📈 Stablecoins' Growth Continues to Accrue to the Benefit of Leading Issuers and Networks

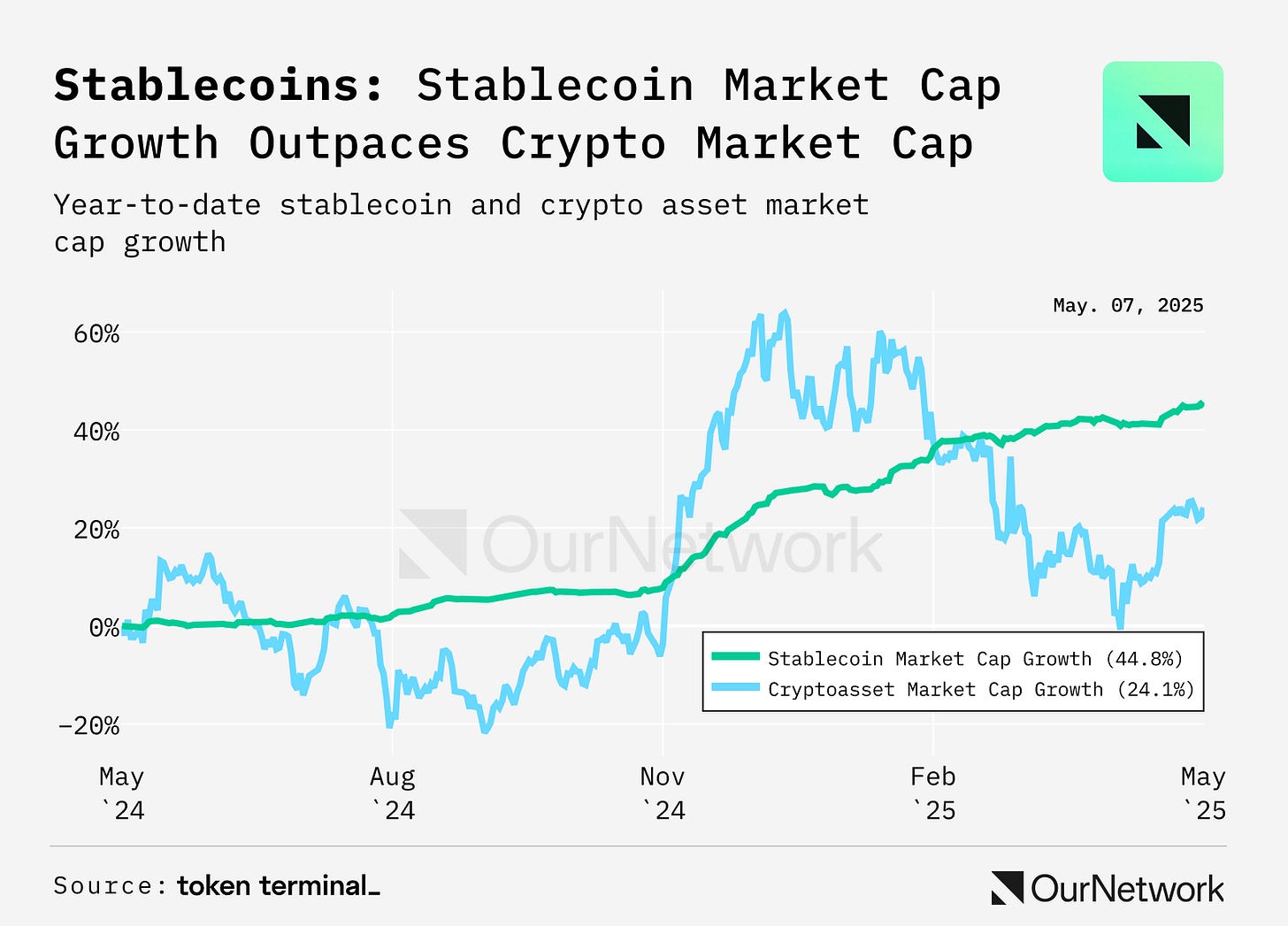

As an asset class, stablecoins outgrew cryptoassets over the past year. The stablecoin market cap is up 44.76%, while the cryptoasset market cap is up 24.13% from a year ago. Further, the chart below shows that the stablecoin market cap growth was achieved with meaningfully lower volatility compared cryptoassets.

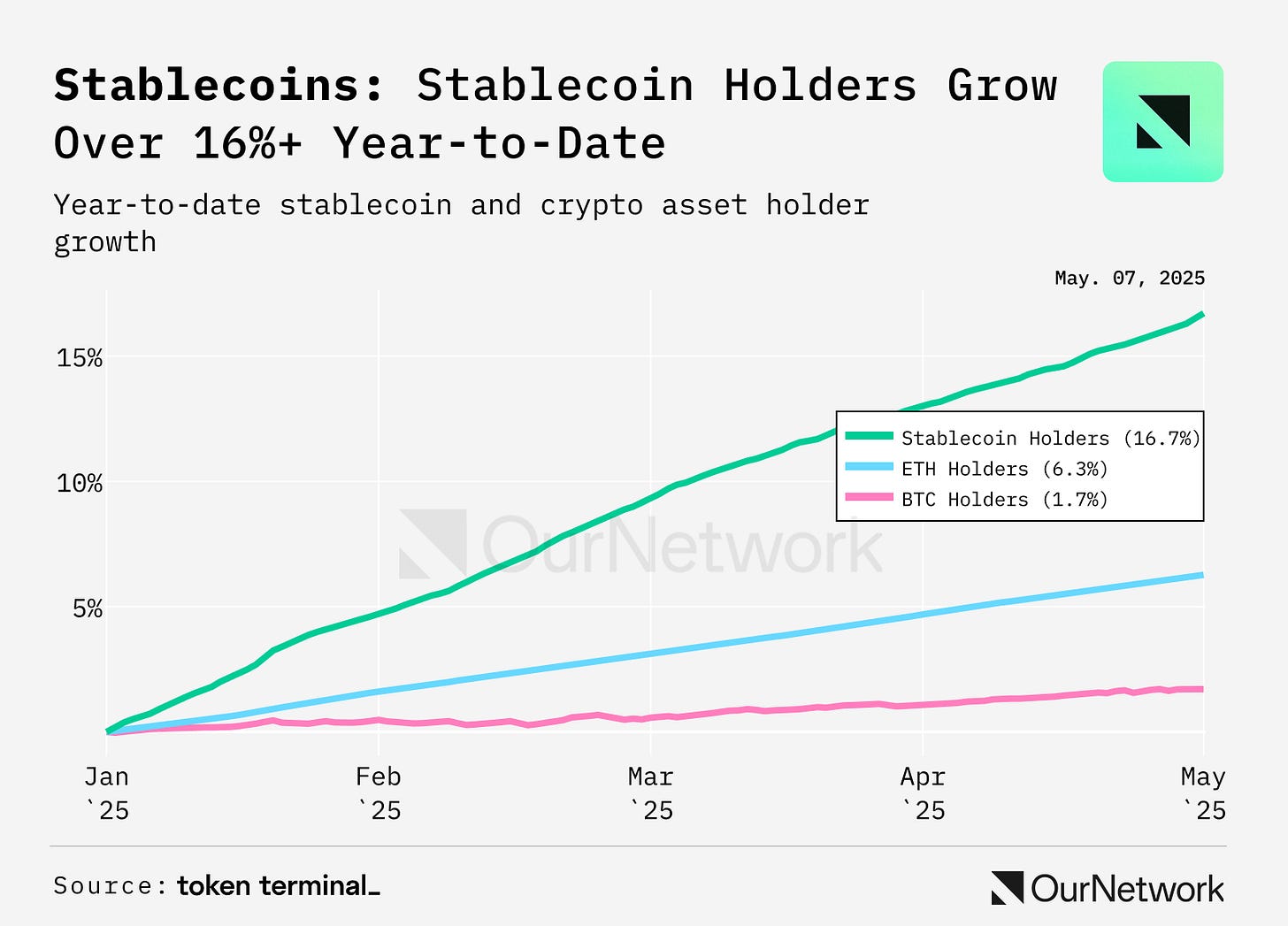

As a category, stablecoin holders have grown the most in the $100B+ asset peer group since the start of the year. The stablecoin holder count is up 16.71%, while ETH and BTC holder counts are up 6.27% and 1.71%, respectively, since the start of the year.

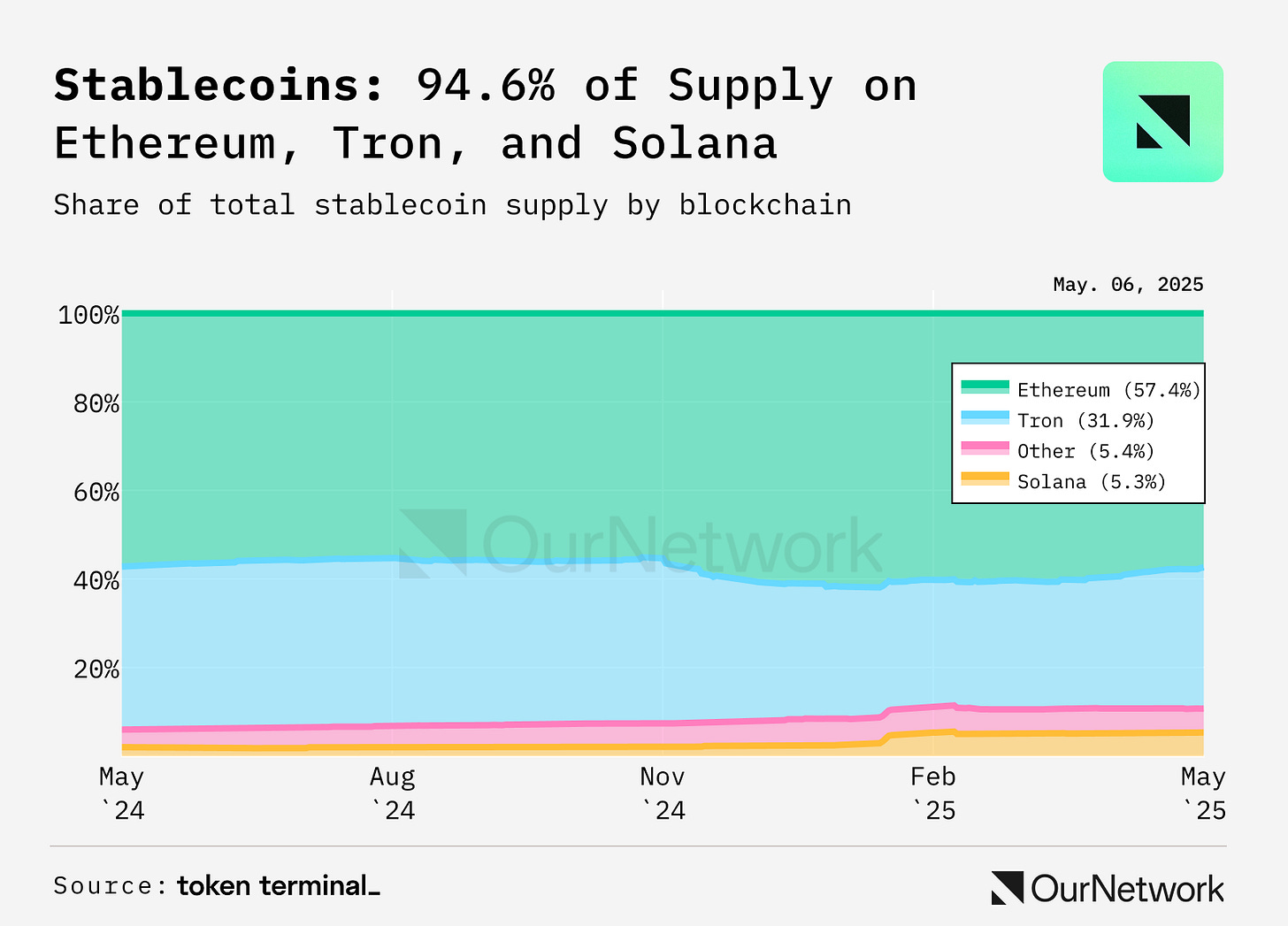

Stablecoin growth continues to accrue the benefit of major chains. The top three chains – Ethereum, TRON, and Solana – control over 90% of all natively minted stablecoins. Of the top three, Solana was the only one that was able to increase its market share over the past year, growing from 2.0% to 5.3%.

🎧 Top Crypto Podcasts of The Week

Here are the crypto podcasts that are worth listening to this week...

Additional Coinstack Sponsors

Hive Digital is a leader in providing SEO and PPC services for blockchain, DeFi, Web3, and crypto companies. If you want to expand your organic presence and paid leads from Google and Facebook, get a proposal from Hive Digital at www.hivedigital.com.

💬 Join The Coinstack Telegram Community

Join our Telegram Channel here to chat with our community, ask questions, and learn more about the future of money as we move to a decentralized internet and the creation of a new open global monetary system that works for everyone.

💬 The People We’re Following Closely on Twitter

📚 How To Get Started With Crypto Learning

Crypto: Explain It Like I’m 5 (Article)

Bankless - The DeFi community (Substack + Podcast + Discord)

Blockgeeks Video Tutorials (Video)

The Coinstack Website (Website)

2008 Bitcoin Whitepaper (PDF)

2013 Ethereum Whitepaper (PDF)

Tracking the most important blockchain stories of the 2020s, including a decentralized internet and the creation of a new open global monetary system that works for everyone. As always, published for informational purposes only. Please do your own research. Just our opinions. Not intended as financial advice as we are not financial advisors. We may own some of the digital assets we write about as we believe strongly in the sector. Please do your own research. Published and written weekly by Ryan Allis and Mike Gavela.

Coinstack is a news and analysis newsletter for the digital asset industry. None of the information here is a recommendation to invest in any securities or other types of investments. Past performance is no guarantee of future results. Any historical returns, expected returns, or probability projections may not reflect actual future performance. All investments involve risk and may result in loss.

Comments and thoughts are welcome on our Telegram channel:

Website at Coinstack.co

Substack at Coinstack.substack.com

Twitter at twitter.com/coinstackcrypto

Telegram channel at t.me/thecoinstack

Sponsors: See our Coinstack sponsor deck

Please share with your friends and colleagues.

Learn More at www.rootstock.io and www.kuladao.io and invest.modemobile.com